Professional Documents

Culture Documents

Customer 65 Documet

Uploaded by

Rohit GuptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer 65 Documet

Uploaded by

Rohit GuptaCopyright:

Available Formats

HIGH SEAS SALE AGREEMENT No.

Date

THIS HIGH SEAS SALE AGREEMENT is made this day at Chennai between M/s------------------------------------------------------------------------------------------------------------------------------------- a company incorporated under the provisions of the Companies Act 1956 (hereinafter referred to as the seller which expression unless it be repugnant to the meaning and context thereof be deemed to include their successors and assigns). AND M/s. -------------------------------------------------(hereinafter referred to as the Buyer, which expression shall unless they be repugnant to the meaning or context thereof, mean and include its successors and assigns). WHEREAS the seller has placed an order to buy certain goods from M/s. -------------------------------------------- hereinafter called the foreign supplier, hereby agrees to sell the said goods to M/s. -------------------------------- on high sea sales. NOW THEREFORE THIS AGREEMENT WITHNESSETH AND THE FOLLOWING TERMS AND CONDITIONS ARE HEREBY AGREED TO BY AND BETWEEN BOTH THE PARTIES HERETO. Details a) Name & Address of the seller b) IEC code of seller c) Name and address of the buyer d) IEC code of buyer : M/s.-----------------------------------------: : M/s. ----------------------------------------:

e) Name and address of the foreign supplier

f) Description of Goods g) Shipment details 2. PAYMENT The buyer agrees to make payment for the goods by the seller on High Sea through advance cheque. 3. DELIVERY The seller will transfer the rights & Title of the goods to the buyer by endorsing the AWB in favour the buyer after realization of the cheque. 4. FREIGHT & INSURANCE a) FREIGHT Considering the fact, that current shipment is on Ex-works terms, the seller shall be responsible for the payment of freight other related expenses with respect to this High Sea Sales. b) INSURANCE Considering the fact, that current shipment is on Ex-Works terms, the seller shall be responsible for the payment of insurance with respect to this high sea sales. 5. CUSTOMS CLEARANCE In view of disposal of goods on high sea sales basis and transfer of tittle by the seller in favour of the buyer, the buyer shall arrange clearance of goods from Customs at its sole risk and responsibilities. The buyer shall be responsible for payment of the customs duties, clearing of goods, port expenses, demurrage container charges, octroi, inland transportation and any other related expenses. 6. POST PROCEDURE The Buyer shall hand over to the seller the Original exchange control copy of he Bill of Entry, copy of Customs attested invoice and other documentary proof of having cleared the material from the Customs as are required by the Seller to the Bank and or RBI or any other State or Central Govt. Agency. 7. SALES TAX As the goods are being sold on high sea sales, no central sales tax will be charged under the provision of Central Sales Tax Act and rules thereof. However, in the event of any amendments, modifications, notifications to the contrary the liability if any shall be borne by the buyer. 8. CONSIDERATION In consideration of this sale, the buyer shall pay to the seller (as per payment terms enumerated above in clause) as detailed below. Sl. No. Particulars Amount : Shipped as per AWB No:

1. 2. 3. 4.

Cost of Materisl Feight Insurance Consideration

This amount shall present the entire amount payable by the buyer to the seller and shall include all cost of the seller. IN WITNESS WHEREOF BOTH THE PARTIES HERETO HAVE EXECUTED THIS AGREEMENT ON DAY AND DATE AS FIRST MENTIONED HEREIN ABOVE. SIGNED AND DELIVERED

Name of the Person Designation

In presence of Signed and Delivered

(Name & Address of Person) For Buyer

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- On Rs.100/-Stamp Paper To Be NotarisedDocument9 pagesOn Rs.100/-Stamp Paper To Be NotarisedSadique MominNo ratings yet

- A Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsFrom EverandA Short View of the Laws Now Subsisting with Respect to the Powers of the East India Company To Borrow Money under their Seal, and to Incur Debts in the Course of their Trade, by the Purchase of Goods on Credit, and by Freighting Ships or other Mercantile TransactionsRating: 3 out of 5 stars3/5 (1)

- On Rs.100/-Stamp Paper To Be NotarisedDocument9 pagesOn Rs.100/-Stamp Paper To Be NotarisedRohit GuptaNo ratings yet

- Dore Bars Gold Spa Cif From EtsDocument17 pagesDore Bars Gold Spa Cif From EtsFarhan Sheikh100% (1)

- Asset Purchase AgreementDocument22 pagesAsset Purchase Agreementtom304467% (3)

- Sale Agreement - Arul - 1Document3 pagesSale Agreement - Arul - 1Muthumeena VimalanNo ratings yet

- 65 Main St. ContractDocument12 pages65 Main St. ContractThe Valley IndyNo ratings yet

- High Seas AgreementDocument2 pagesHigh Seas AgreementTharangini VNo ratings yet

- What It Is and How It WorksDocument3 pagesWhat It Is and How It WorksThiyagarajanSivaramanNo ratings yet

- Purchase Agreement Template SBLCDocument21 pagesPurchase Agreement Template SBLCJonathan David WilliamNo ratings yet

- Deed of Absolute SaleDocument7 pagesDeed of Absolute Salemmabbun00180% (10)

- S&P Agreement - SA708DDocument5 pagesS&P Agreement - SA708DJojo Al-hami Zurairi Y.MNo ratings yet

- FCODocument3 pagesFCOSani Bismar100% (3)

- Full Corporate Offer Fco PDFDocument5 pagesFull Corporate Offer Fco PDFVikesh Chaudhary100% (1)

- Sale Purchase Contract of Lift: Document1Document8 pagesSale Purchase Contract of Lift: Document1Rajarshi SinghNo ratings yet

- Agreement With VendorDocument2 pagesAgreement With VendorTeja RNo ratings yet

- 1.1 Commercial Contract - April 3 2020 - For Quimimport ReviewDocument16 pages1.1 Commercial Contract - April 3 2020 - For Quimimport Reviewevelyn martinez moralesNo ratings yet

- The Risk Involved in Documentary Bills Credit in Case of ExportDocument8 pagesThe Risk Involved in Documentary Bills Credit in Case of Exportcool4330No ratings yet

- JexCO OTPDocument12 pagesJexCO OTPCosmasNo ratings yet

- Agreement For The Sale of ScrapDocument4 pagesAgreement For The Sale of ScrapMhilet57% (23)

- COINS - ESCROW-AGRMT - FOR SPA - VII.1-1b-BTC-EIBACCT-EACHAD-XXBUYEROEG-XXSELLANT-040523Document7 pagesCOINS - ESCROW-AGRMT - FOR SPA - VII.1-1b-BTC-EIBACCT-EACHAD-XXBUYEROEG-XXSELLANT-040523semih karakuşNo ratings yet

- General Purchase Agreement For Delivery of JET A1 2017Document14 pagesGeneral Purchase Agreement For Delivery of JET A1 2017marcell ribeiroNo ratings yet

- Purchase and Sale Agreement: Attachment 1Document26 pagesPurchase and Sale Agreement: Attachment 1emmettoconnellNo ratings yet

- Gold ContractDocument26 pagesGold ContractMM100% (1)

- Draft Escrow Agreement 2020Document11 pagesDraft Escrow Agreement 2020radelca52No ratings yet

- Contract To Sell SampleDocument9 pagesContract To Sell SampleJasmin Regis Sy80% (5)

- Contract EngDocument20 pagesContract EngEllaine ZoicanNo ratings yet

- Draft ContractDocument12 pagesDraft Contracthazem abidNo ratings yet

- Eastgate SPA IR64 RICE Ramesh.Document7 pagesEastgate SPA IR64 RICE Ramesh.srinivasareddyNo ratings yet

- Sale and Purchase Agreement Contract Code: 11012022Document8 pagesSale and Purchase Agreement Contract Code: 11012022Moustapha KouyateNo ratings yet

- SPA FH (General) (2021-11-04 15.43.17)Document24 pagesSPA FH (General) (2021-11-04 15.43.17)azilaNo ratings yet

- Spaqicbuyer 2Document12 pagesSpaqicbuyer 2JOURNEY 01No ratings yet

- Dubai Brinks To Brinks H & B - Fco - DraftDocument8 pagesDubai Brinks To Brinks H & B - Fco - DraftNevila Kakeli100% (2)

- Sales in Course of Import and High Seas Sales Under CST ActDocument23 pagesSales in Course of Import and High Seas Sales Under CST ActAMIT GUPTANo ratings yet

- Sale and Purchase AgreementDocument7 pagesSale and Purchase Agreementoliver twistNo ratings yet

- Business Sale AgreementDocument8 pagesBusiness Sale AgreementRocketLawyer100% (4)

- Sales LC - Petroleum Products and Crude OilDocument17 pagesSales LC - Petroleum Products and Crude OilAli Al SaadyNo ratings yet

- Noor Dib Salam Contract TCDocument22 pagesNoor Dib Salam Contract TCAnas AnsariNo ratings yet

- Contract For International Sale of Goods: Seller Cataclysm Equipment LTDDocument6 pagesContract For International Sale of Goods: Seller Cataclysm Equipment LTDK59 Ngo Thi Tra LyNo ratings yet

- Canicosa Contract To SellDocument5 pagesCanicosa Contract To SellMick VelandresNo ratings yet

- Contract SampleDocument33 pagesContract SampleRadea MardiatnaNo ratings yet

- Sample Deed of Absolute SaleDocument6 pagesSample Deed of Absolute SaleChika Tolentino100% (2)

- International Sale ContractDocument0 pagesInternational Sale ContractshybleNo ratings yet

- Asset Purchase Agreement BankruptcyDocument8 pagesAsset Purchase Agreement BankruptcytempczarNo ratings yet

- Spa First DraftDocument6 pagesSpa First Draft_scribd7No ratings yet

- Spa - Ul and CMT 100KG SDocument11 pagesSpa - Ul and CMT 100KG SFadelousNo ratings yet

- Sales Agreement-2Document3 pagesSales Agreement-2erickNo ratings yet

- COntract Wood CoalDocument5 pagesCOntract Wood CoalMinh KentNo ratings yet

- YEM Gold Sale ProcedureDocument12 pagesYEM Gold Sale ProcedureSaumyadeepa DharNo ratings yet

- Vehicle Sales Agreement: BackgroundDocument4 pagesVehicle Sales Agreement: Backgroundbetsy gadianNo ratings yet

- SPA - TemplateDocument49 pagesSPA - TemplatejrcurielNo ratings yet

- Asset Purchase Agreement Retail StoreDocument34 pagesAsset Purchase Agreement Retail StoreamanNo ratings yet

- Export Sales ContractDocument6 pagesExport Sales ContractNithin KuniyilNo ratings yet

- Contract To Sell SampleDocument8 pagesContract To Sell SampleHoney Bona LanzuelaNo ratings yet

- AGREEMENT FOR SALE DAVID AND CAROLINE 105346 AmendedDocument10 pagesAGREEMENT FOR SALE DAVID AND CAROLINE 105346 Amendedwakili cathyNo ratings yet

- AND (P O G .) : Ower IL AND ASDocument10 pagesAND (P O G .) : Ower IL AND ASEricson Trokon KemoonNo ratings yet

- Day Wise ScheduleDocument4 pagesDay Wise ScheduleadiNo ratings yet

- SMART Train ScheduleDocument1 pageSMART Train ScheduleDave AllenNo ratings yet

- Service Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsDocument3 pagesService Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsSriram SridharNo ratings yet

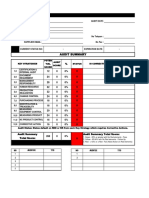

- Form Audit QAV 1&2 Supplier 2020 PDFDocument1 pageForm Audit QAV 1&2 Supplier 2020 PDFovanNo ratings yet

- MPERSDocument1 pageMPERSKen ChiaNo ratings yet

- Glories of Srimad Bhagavatam - Bhaktivedanta VidyapithaDocument7 pagesGlories of Srimad Bhagavatam - Bhaktivedanta VidyapithaPrajot NairNo ratings yet

- Business Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketDocument13 pagesBusiness Enterprise Simulation Quarter 3 - Module 2 - Lesson 1: Analyzing The MarketJtm GarciaNo ratings yet

- Vayigash BookletDocument35 pagesVayigash BookletSalvador Orihuela ReyesNo ratings yet

- Civil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Document6 pagesCivil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Ronald MedinaNo ratings yet

- C1 Level ExamDocument2 pagesC1 Level ExamEZ English WorkshopNo ratings yet

- Specpro.09.Salazar vs. Court of First Instance of Laguna and Rivera, 64 Phil. 785 (1937)Document12 pagesSpecpro.09.Salazar vs. Court of First Instance of Laguna and Rivera, 64 Phil. 785 (1937)John Paul VillaflorNo ratings yet

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDocument3 pagesFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliNo ratings yet

- Uniform Civil Code and Gender JusticeDocument13 pagesUniform Civil Code and Gender JusticeS.P. SINGHNo ratings yet

- General Concepts and Principles of ObligationsDocument61 pagesGeneral Concepts and Principles of ObligationsJoAiza DiazNo ratings yet

- Archbishop Averky Taushev - Stand Fast in The TruthDocument14 pagesArchbishop Averky Taushev - Stand Fast in The Truthdorin_jambaNo ratings yet

- Kesari Tours and Travel: A Service Project Report OnDocument15 pagesKesari Tours and Travel: A Service Project Report OnShivam Jadhav100% (3)

- Italian Budgeting Policy Between Punctuations and Incrementalism Alice Cavalieri Full ChapterDocument51 pagesItalian Budgeting Policy Between Punctuations and Incrementalism Alice Cavalieri Full Chapterjames.philson408No ratings yet

- Facts:: Topic: Serious Misconduct and Wilfull DisobedienceDocument3 pagesFacts:: Topic: Serious Misconduct and Wilfull DisobedienceRochelle Othin Odsinada MarquesesNo ratings yet

- Insura CoDocument151 pagesInsura CoSiyuan SunNo ratings yet

- JournalofHS Vol11Document136 pagesJournalofHS Vol11AleynaNo ratings yet

- Nef Elem Quicktest 04Document2 pagesNef Elem Quicktest 04manri3keteNo ratings yet

- Introduction To Anglo-Saxon LiteratureDocument20 pagesIntroduction To Anglo-Saxon LiteratureMariel EstrellaNo ratings yet

- 7wonders ZeusDocument18 pages7wonders ZeusIliana ParraNo ratings yet

- MAKAUT CIVIL Syllabus SEM 8Document9 pagesMAKAUT CIVIL Syllabus SEM 8u9830120786No ratings yet

- CHAPTER 1 - 3 Q Flashcards - QuizletDocument17 pagesCHAPTER 1 - 3 Q Flashcards - Quizletrochacold100% (1)

- Student Guidelines The School PoliciesDocument5 pagesStudent Guidelines The School PoliciesMaritessNo ratings yet

- Letter Regarding Neil Green To UHP, District AttorneyDocument4 pagesLetter Regarding Neil Green To UHP, District AttorneyWordofgreenNo ratings yet

- 11 January 2022 Dear Mohammed Rayyan,: TH TH RDDocument5 pages11 January 2022 Dear Mohammed Rayyan,: TH TH RDmrcopy xeroxNo ratings yet

- Ch.6 TariffsDocument59 pagesCh.6 TariffsDina SamirNo ratings yet

- Trifles Summary and Analysis of Part IDocument11 pagesTrifles Summary and Analysis of Part IJohn SmytheNo ratings yet

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseFrom EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNo ratings yet

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowFrom EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowRating: 1 out of 5 stars1/5 (1)

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreFrom EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreRating: 3.5 out of 5 stars3.5/5 (2)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersFrom EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersRating: 5 out of 5 stars5/5 (1)

- Law of Contract Made Simple for LaymenFrom EverandLaw of Contract Made Simple for LaymenRating: 4.5 out of 5 stars4.5/5 (9)

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterFrom EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNo ratings yet

- Contracts: The Essential Business Desk ReferenceFrom EverandContracts: The Essential Business Desk ReferenceRating: 4 out of 5 stars4/5 (15)

- How to Win Your Case in Small Claims Court Without a LawyerFrom EverandHow to Win Your Case in Small Claims Court Without a LawyerRating: 5 out of 5 stars5/5 (1)

- What Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreFrom EverandWhat Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreRating: 4 out of 5 stars4/5 (2)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityFrom EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNo ratings yet

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetFrom EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNo ratings yet

- Broadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessFrom EverandBroadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessNo ratings yet