Professional Documents

Culture Documents

Business Taxation

Uploaded by

Hannan UmerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Taxation

Uploaded by

Hannan UmerCopyright:

Available Formats

Business Taxation

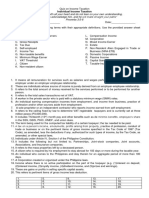

Attempt all question each question carry equal marks. Question no 1: What is provident Fund? Explain its types & different treatments. Question no 2: What are the functions performed by income tax authority CCIR. Question no 3: Briefly explain the legal provisions governing the filing of returns of total income under the income tax law. Question no 4: Mr. Mohsin is a registered manufacturer. Data regarding his business For the month of august 2010 is as follows: Taxable turnover to registered person Taxable turnover to non registered person Sales to retailer Exempted sales Supplies to DTRE registered person Supplies made for personel use (including the amount of sales tax) Zero rated supplies Taxable purchases from registered person Taxable purchases from non registered person Exempted purchases Imported goods Acquisition of fixed assets from registered person Purchases raw material (used taxable and exmept supplies) Sales tax debit Sales tax paid on telephones bills Sales tax paid on gas bills 35, 00,000 2, 50,000 20,00,000 6,00,000 4,00,000 5,00,000 2,00,000 2,50,000 1,00,000 5,00,000 3,00,000 1,00,000 3,00,000 5,000 20,000 30,000

Marks: 100

20 20 20

20

Carry forward Required :Calculate sales tax payable . (sales tax registration number is printed on bills) Question no 5: Mr .yasoob a senior citizen (61 years) .Following are the data avaliable on his record for the tax year ended june 30,2010. Salary Bonus Commision Over time payments Capital loss Interst free loan received by employer zakat Income from property Forfieted money Unadjustable advance Pay in lieu of leave Medical allowance Dividend income Capital gain on shares (dispose off after 12 months) Share from AOP Golden hand shake during the tax year Worker welfare fund Interst on security(net) Royality Incomefrom business 2,500 25,000 (48000 per month) (1000 per month)

2,000

20

2,000 10,000 2,000 1,00,000 20,000 3,00,000 5,000 1,00,000 5,000 80,000 20,000 80,000 25,000 10,000 5,000 6,300

Employer deductd tax (section 149) Approved peension fund Note : 20,000

2,000

1)Mr .yasoob has provided rent free accomadation which was not provided him. 2)He was also provided a car for his personal use Rs 1000000. 3)Donation to approved 4)Qualification pay Requried: Calculate his income tax payable. 30,000 2,000

You might also like

- 3.2 Business Profit TaxDocument53 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- TAX102 MIDTerm EXAMDocument12 pagesTAX102 MIDTerm EXAMYsabella ChenNo ratings yet

- Sales Tax Practice Questions With SolutionsDocument6 pagesSales Tax Practice Questions With Solutionshanif channa100% (1)

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- TaxDocument3 pagesTaxCess MelendezNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Synthesis - Problem Solving QuizDocument3 pagesSynthesis - Problem Solving QuizEren CuestaNo ratings yet

- TAXATION- KEY CONCEPTS AND CALCULATIONSDocument18 pagesTAXATION- KEY CONCEPTS AND CALCULATIONSbeverlyrtanNo ratings yet

- BAF 306 BAF 4 - VAT Payable or RefundableDocument16 pagesBAF 306 BAF 4 - VAT Payable or Refundableyudamwambafula30No ratings yet

- BuwisDocument23 pagesBuwisshineneigh00No ratings yet

- Ca Ipcc May 2011 Qustion Paper 5Document11 pagesCa Ipcc May 2011 Qustion Paper 5Asim DasNo ratings yet

- Income Tax, IndiaDocument11 pagesIncome Tax, Indiahimanshu_mathur88No ratings yet

- 3.2 Business Profit TaxDocument49 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Mock E Exam Pap ERDocument19 pagesMock E Exam Pap ERtim_rattanaNo ratings yet

- Input TaxDocument18 pagesInput TaxAmie Jane MirandaNo ratings yet

- Chapter 9 Percentage TaxDocument25 pagesChapter 9 Percentage TaxTrisha Mae BoholNo ratings yet

- Transfer and Business Taxation: Module WritersDocument129 pagesTransfer and Business Taxation: Module WritersPaulita GomezNo ratings yet

- MBA Taxation Assignment on Objectives of Tax Planning and Factors to ConsiderDocument8 pagesMBA Taxation Assignment on Objectives of Tax Planning and Factors to Considersambha86No ratings yet

- Advanced II - Chapter 0 TaxDocument79 pagesAdvanced II - Chapter 0 TaxHawultu AsresieNo ratings yet

- TAX MGT PPT 1Document28 pagesTAX MGT PPT 1Rahul DesaiNo ratings yet

- Assignment IDocument3 pagesAssignment IAparna RajasekharanNo ratings yet

- Week 11 Dealings in Property 1Document45 pagesWeek 11 Dealings in Property 1Arellano Rhovic R.No ratings yet

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- Dealings in PropertiesDocument6 pagesDealings in PropertieserespemaychisagangNo ratings yet

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- U 5 TaxDocument23 pagesU 5 TaxfsafwfNo ratings yet

- 07 - Excise For Dealers PDFDocument57 pages07 - Excise For Dealers PDFsanku guptaNo ratings yet

- Module 7 Business TaxationDocument6 pagesModule 7 Business Taxationfranz mallari0% (1)

- Ethiopian Tax SystemDocument75 pagesEthiopian Tax Systemyared100% (1)

- Deductions From Gross IncomeDocument30 pagesDeductions From Gross IncomeKatherine Ederosas50% (4)

- Enrichment Class Tax On CorporationDocument4 pagesEnrichment Class Tax On CorporationEmersonNo ratings yet

- Output VatDocument16 pagesOutput VatLica Dapitilla Perin100% (1)

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Tax IllustrationsDocument7 pagesTax IllustrationsMsema KweliNo ratings yet

- BUSINESS TAX CALCULATIONSDocument13 pagesBUSINESS TAX CALCULATIONSKathleen AgustinNo ratings yet

- Cash flow statement problemsDocument12 pagesCash flow statement problemsAnjali Mehta100% (1)

- Self Employed: TRN Requirements For Sole ProprietorsDocument14 pagesSelf Employed: TRN Requirements For Sole ProprietorsAnonymous imWQ1y63No ratings yet

- Long Question of Financial AcDocument20 pagesLong Question of Financial AcQasim AliNo ratings yet

- Tax Consideration in Project FinancesDocument18 pagesTax Consideration in Project FinancesMukesh Kumar SharmaNo ratings yet

- Illustration For CITDocument3 pagesIllustration For CITBảo BờmNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- TaxationDocument12 pagesTaxationjanahh.omNo ratings yet

- Annual Income Form for Professional PartnershipsDocument2 pagesAnnual Income Form for Professional PartnershipsAlvin Dela CruzNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Quiz on Income TaxationDocument2 pagesQuiz on Income TaxationVergel Martinez100% (1)

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- Tax Deductions Under Section 80 GGBDocument8 pagesTax Deductions Under Section 80 GGBAnamika VatsaNo ratings yet

- Tax Note No. 6 (Tax On Commercial - Part1)Document10 pagesTax Note No. 6 (Tax On Commercial - Part1)Eman AbasiryNo ratings yet

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoNo ratings yet

- Goa VAT LawDocument23 pagesGoa VAT LawSiddesh ChimulkerNo ratings yet

- VatDocument9 pagesVatmayurgharatNo ratings yet

- Income Tax On Individuals (Part 3)Document13 pagesIncome Tax On Individuals (Part 3)Jamielene TanNo ratings yet

- Minimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)Document57 pagesMinimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)kyleramosNo ratings yet

- Taxation of CompaniesDocument3 pagesTaxation of CompaniesJEBET RUTH KIPLAGATNo ratings yet

- Indirect Taxes-May 2011: FIRST OF ALL Read CarefullyDocument8 pagesIndirect Taxes-May 2011: FIRST OF ALL Read Carefully9811702789No ratings yet

- VAT QuizzerDocument16 pagesVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)