Professional Documents

Culture Documents

Input Tax

Uploaded by

Amie Jane Miranda0 ratings0% found this document useful (0 votes)

1K views18 pagesfdxgfdgfg

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfdxgfdgfg

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views18 pagesInput Tax

Uploaded by

Amie Jane Mirandafdxgfdgfg

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 18

Input Tax

Sources of input tax

Transitional input tax

Presumptive input tax

Input tax on domestic purchases or importation

(VAT actually paid)

Transitional input tax

Persons who can avail:

› Persons who become liable to VAT

› Persons who elect to be VAT-registered

Basis of transitional input tax – Beginning inventory

of VAT-subject goods, materials and supplies.

Transitional input tax allowed – HIGHER between:

› 2% of the VAT-subject beginning inventory value for

income tax purposes; and

› Actual VAT paid on such beginning inventory

Presumptive input tax (Sa Ma Mi

Co Pa Re)

Persons or firms who can avail:

› Processor of Sardines, Mackerel and Milk

› Manufacturer of Cooking oil, Packed noodle-based

instant meal and Refined Sugar.

Basis of presumptive input tax – Gross value in

money of purchases of primary agricultural

products used as inputs in the processing or

manufacturing of SaMaMeCoPaRe.

Rate of presumptive input tax – 4%

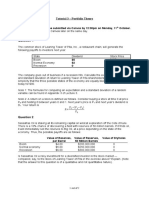

Example:

Sugary is a processor of refined sugar. It

purchases sugarcane from farmers for processing

into intermediaries stages until becomes refined

sugar. In a month it had the following sales and

purchases, no tax included:

Sales 880,000

Purchases of sugarcane 220,000

Purchases of containers and paper label 100,000

The value added tax payable is?

Input taxes on domestic purchases

or importation of:

Goods for sale

Goods for conversion into finished product (including

packaging materials)

Goods for use as supplies

Goods for use as materials supplied in the sale of services

Goods for use in trade or business for which depreciation

or amortization is allowed

Real properties for which VAT has actually been paid

Services for which VAT has actually been paid

Transactions deemed sale (CR WPD)

Illustration:

Virgin is a producer of cooking oil from coconut and corn. Previously exempt from the value

added tax, he became subject to the value-added tax on January 1, 2018. For January 2018, with

sales, value-added tax not included, of 700,000, he had the following other data for the month:

Inventory, January 1, 2018 NRV Cost

Corn and coconut purchased from farmers 120,000 100,000

Packaging materials purchased VAT suppliers 24,640 22,400

Supplies purchased from VAT suppliers 11,200 13,440

Purchases during the month of coconut and corn from farmers 330,000

Purchases during the month of coconut from VAT suppliers:

Packaging materials 56,000

Supplies 16,800

The transitional input tax is? Php 3,600

The presumptive input tax is? Php 13,200

The creditable input taxes are? Php 24,600

The value-added tax payable for the month is? Php 59,400

Lovely, had the following data on its operations for a month as VAT-registered

taxpayer:

Sales, total invoice price 592,480

Purchases of goods, VAT not included:

From VAT-registered persons 100,000

From non-VAT registered persons 80,000

Purchases of services, VAT not included:

From VAT-registered persons 20,000

From non-VAT registered persons 8,000

From persons subject to percentage taxes 10,000

Salaries of employees 60,000

Other operating expenses 12,000

This is the first month of being liable to the value-added tax. Data on inventories at

the beginning of the period bought from VAT registered persons follow:

Inventory, at cost 44,800

at net realizable value 49,000

Value-added tax paid on beginning inventory 4,800

Input taxes are? Php 19,200

The value added tax payable is? Php 44,280

Claim for input tax on depreciable

goods

Applies only to domestic purchase or importation

of capital goods subject to depreciation for

income tax purposes.

Where the aggregate acquisition cost (exclusive

of VAT) of depreciable capital goods during any

calendar month does not exceed P1,000,000, the

total input tax is creditable against output tax in

the month acquired.

Where the aggregate acquisition cost (exclusive

of VAT) of depreciable capital goods during any

calendar month exceeds P1,000,000, the total

input tax is creditable against output tax, as

follows:

› Spread evenly over 60 months (starting in the

calendar month acquired) the input tax, if the

estimated useful life of the depreciable capital goods

is 5 years or more.

› Spread evenly over the actual number of months of

estimated useful life (starting in the calendar month

acquired) the input tax, if the estimated useful life of

the depreciable capital good is less than 5 years.

If the depreciable capital goods is sold or

transferred within a period of 5 years or prior to

the exhaustion of the amortizable input tax

thereon, the entire unamortized input tax on the

capital goods sold or transferred can be claimed

as input tax credit in the month/quarter when the

sale or transfer was made.

Amortization of the input VAT in C above shall

be allowed only until December 31, 2021, after

which any unutilized input VAT balance shall be

allowed to apply the same as scheduled until

fully utilized.

Illustration:

Pfizer Corporation sold its capital goods to Wyetth Company

on installment basis. It is agreed that the installment selling

price, including the VAT, shall be payable in 6 equal monthly

installments, commencing on the date of sale. The data

pertinent to the assets sold are as follows:

› Date of sale January 1, 2018

› Installment selling price6,000,000

› Passed-on VAT 720,000

› Original cost of assets 3,000,000

› Accumulated depreciation 1,000,000

› Unutilized input tax (Asset sold) 100,000

› Remaining useful life 5 years

The VAT payable on the sale by Pfizer Corporation and the monthly

creditable input tax that Wyetth Company can claim are, respectively?

620,000 and 12,000

Creditable input tax of a VAT-registered

person also engaged in VAT-exempt sales

A VAT-registered person is also engaged in transactions

not subject to VAT shall ne allowed tax credit as follows:

› Total input tax which can be directly attributed to transactions

subject to VAT, provided that input taxes attributable to VAT

taxable sale of goods and services to the Government or any of

its political subdivisions, instrumentalities or agencies

(including GOCC) shall not credited against output taxes

arising from sales to non-Government entities, and

› A ratable portion of any input tax which cannot be directly

attributed to either activity computed as follows:

VAT sales x Input tax

Total Sales

Withholding of VAT on Government

money payments and payments to non-

residents

Who are required to withhold?

› Government or any of its political subdivisions,

instrumentalities or agencies, including government-

owned or controlled corporations (GOCCs)

› Lessee of properties or property rights owned by non-

residents.

› Persons for services rendered in the Phil (including

services rendered to local insurance companies with

respect to reinsurance premiums payable) by non-

residents.

Percentage of withholding VAT:

› Government money payments – 5% final VAT

(starting 1/1/21, however, this VAT withholding

system shall shift from final to a creditable system)

› Payments to non-residents – 12% creditable VAT

What is done with the VAT withheld?

› Buyer or Lessee (withholding agent) – remitted to the

BIR within 10 days following the end of the month

the withholding was made.

Illustration:

Jargon Corporation has the following sales (VAT not included) during the month:

› Sale to private entities subject to 12 VAT 100,000

› Sale to private entities subject to 0% VAT 100,000

› Sale of exempt goods 100,000

› Sale to Government subject to

5% final VAT withholding 100,000

› Total sales for the month 400,000

› The following input taxes were passed-on by its VAT suppliers:

› Input tax on taxable goods (12%) 6,000

› Input tax on zero-rated sales 3,000

› Input tax on sale of exempt goods 2,000

› Input tax on sale to Government 4,000

› Input tax on depreciable capital goods

Not attributable to any specific activity

(monthly amortization for 60 months) 20,000

The allowable creditable input taxes for the month on sales to non-

Government and on sale to the Government are, respectively: 19,000 and 7,000

Determination of creditable input

taxes

Input taxes on domestic purchases or importations Xxx

Transitional input tax Xxx

Presumptive input tax Xxx

Input tax carried over from previous month/quarter xxx

Total input taxes Xxx

Less:

Input taxes claimed as refund Xxx

Input taxes claimed as tax credit for other NIRC taxes Xxx

Input taxes applicable to purchase returns and allow. Xxx

Input taxes attributable to sales subject to VAT withholding Xxx

Input taxes attributable to VAT-exempt sales xxx xxx

Net creditable input taxes xxx

Illustration:

Data for a trader with one line of business subject to the value-added tax and

another line of business not subject to the value-added tax:

› Sales, VAT business, VAT included 896,000

› Sales, non-VAT business 200,000

› Purchases of goods, VAT business, VAT included 224,000

› Purchases of goods, non-VAT business 33,600

› Purchase of depreciable asset,

For use in VAT and non-VAT business, VAT inc 112,000

› Purchase of supplies, for VAT and non-VAT

Business, VAT included 2,240

› Rental of premises, for VAT and non-VAT

Business, VAT included registered person 22,400

The Value added tax payable is? 62,208

You might also like

- Tax LawDocument8 pagesTax LawAmie Jane MirandaNo ratings yet

- The Professional CPA Review School - Auditing Problems First Preboard ExamDocument18 pagesThe Professional CPA Review School - Auditing Problems First Preboard ExamRodmae VersonNo ratings yet

- Problem 1Document6 pagesProblem 1novyNo ratings yet

- Dokumen - Tips - Auditing Problems by Cabrera Solution Key For Auditing 2009 Ed by Cabrera Audit PDFDocument3 pagesDokumen - Tips - Auditing Problems by Cabrera Solution Key For Auditing 2009 Ed by Cabrera Audit PDFJoffrey UrianNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Icare Far First Preboard Examinations Batch 3Document14 pagesIcare Far First Preboard Examinations Batch 3Merliza Jusayan100% (1)

- Batch 93 FAR First Preboard February 2023Document15 pagesBatch 93 FAR First Preboard February 2023Ameroden AbdullahNo ratings yet

- Construction Contracts-My NotesDocument3 pagesConstruction Contracts-My Notesjhaeus enajNo ratings yet

- Metro Manila College: College of Business and AccountancyDocument8 pagesMetro Manila College: College of Business and AccountancyJeric TorionNo ratings yet

- Cherry Company accounts receivable adjustmentsDocument6 pagesCherry Company accounts receivable adjustmentsEdemson NavalesNo ratings yet

- 019 CpaleDocument15 pages019 CpaleJohn DoeNo ratings yet

- Partnership Accounting Problems and Solutions #0010Document5 pagesPartnership Accounting Problems and Solutions #0010Jenny MendozaNo ratings yet

- Coursehero 12Document2 pagesCoursehero 12nhbNo ratings yet

- ReSA CPA Review Batch 41 Audit Problems Weeks 1-3Document4 pagesReSA CPA Review Batch 41 Audit Problems Weeks 1-3Angela AlejandroNo ratings yet

- Auditing Cup - 19 Rmyc Answer Key Final Round House StarkDocument13 pagesAuditing Cup - 19 Rmyc Answer Key Final Round House StarkCarl John PlacidoNo ratings yet

- Quiz - 5B 2Document3 pagesQuiz - 5B 2Jao FloresNo ratings yet

- Group Quiz On Documentary Stamp TaxDocument2 pagesGroup Quiz On Documentary Stamp TaxRowena RogadoNo ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- Chapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingDocument52 pagesChapter 3-Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable CostingMarienela Faye LungayNo ratings yet

- MGA DAMBIEEE!!!! Complete AnswerDocument12 pagesMGA DAMBIEEE!!!! Complete AnswerHannah Jane UmbayNo ratings yet

- TAX 1201 Answers Deductions From Gross IncomeDocument6 pagesTAX 1201 Answers Deductions From Gross IncomeCarlo Agravante100% (1)

- Other Percentage TaxesDocument5 pagesOther Percentage TaxesAlexandra Nicole IsaacNo ratings yet

- JOINT OPERATION FORMATIONDocument7 pagesJOINT OPERATION FORMATIONChristine Jane Abang100% (1)

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- AfarDocument3 pagesAfarDanielle Nicole MarquezNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- ReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDocument21 pagesReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Unit 1 Audit of Cash and Cash Equivalents Unit Activity Essay: ExistenceDocument32 pagesUnit 1 Audit of Cash and Cash Equivalents Unit Activity Essay: ExistenceIvan Anabo100% (1)

- MasDocument12 pagesMasKenneth RobledoNo ratings yet

- For A Vanishing DeductionDocument2 pagesFor A Vanishing DeductionJunho ChaNo ratings yet

- Business Law SurecpaDocument35 pagesBusiness Law SurecpaChessaAlenelLigutom100% (1)

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Corporate LiquidationDocument3 pagesCorporate LiquidationKrizia Mae Flores100% (1)

- Tax 3216Document5 pagesTax 3216Rich William PagaduanNo ratings yet

- MCQ Donorx27s TaxesDocument6 pagesMCQ Donorx27s TaxesMary Joyce GarciaNo ratings yet

- Part 10Document5 pagesPart 10chimchimcoliNo ratings yet

- VAT Calculation and TransactionsDocument11 pagesVAT Calculation and Transactionsishinoya keishiNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAnna TaylorNo ratings yet

- Cpar - Ap 09.15.13Document18 pagesCpar - Ap 09.15.13KamilleNo ratings yet

- Perez Long Quiz Auditing and Assurance Concepts and ApplicationDocument7 pagesPerez Long Quiz Auditing and Assurance Concepts and ApplicationMitch MinglanaNo ratings yet

- Vat On Importation: Presumptive Input TaxDocument13 pagesVat On Importation: Presumptive Input TaxNerish PlazaNo ratings yet

- Auditing Problems Internal Control Measures and Substantive Audit Procedures for CashDocument8 pagesAuditing Problems Internal Control Measures and Substantive Audit Procedures for CashMa Yra YmataNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- 17002Document2 pages17002Alvin YercNo ratings yet

- AST FinalsDocument20 pagesAST FinalsMica Ella San DiegoNo ratings yet

- Chap 1 - 3 TestbankDocument9 pagesChap 1 - 3 TestbankDiane CabiscuelasNo ratings yet

- TB 5Document2 pagesTB 5Louiza Kyla AridaNo ratings yet

- The Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. AuditorDocument2 pagesThe Responsibility For The Detection and Prevention of Errors, Fraud and Noncompliance With Laws and Regulations Rests With A. Auditoraccounts 3 lifeNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- Core Review TopicsDocument87 pagesCore Review TopicsPeter BanjaoNo ratings yet

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- Answer Key Quizzes (5,6,7,8,9)Document10 pagesAnswer Key Quizzes (5,6,7,8,9)Justine PaulinoNo ratings yet

- Quiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDocument25 pagesQuiz Foreign Currency Transaction, Hedging & Translation: U AnsweredDenise Jane RoqueNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- MS B45 First PB With AnswersDocument13 pagesMS B45 First PB With AnswersSophia RabacalNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- Chapter 9 Input VatDocument10 pagesChapter 9 Input VatHazel Jane EsclamadaNo ratings yet

- BL 2Document6 pagesBL 2Amie Jane MirandaNo ratings yet

- Examining accounting standards and conceptual frameworkDocument8 pagesExamining accounting standards and conceptual frameworkAmie Jane MirandaNo ratings yet

- ACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityDocument7 pagesACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- L-NU AA-23-02-01-18 Finals Exam ReviewDocument10 pagesL-NU AA-23-02-01-18 Finals Exam ReviewAmie Jane MirandaNo ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Lyceum-Northwestern UniversityDocument7 pagesLyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- AdvacDocument13 pagesAdvacAmie Jane MirandaNo ratings yet

- FINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsDocument11 pagesFINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsAmie Jane MirandaNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document8 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- FIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityDocument7 pagesFIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- LAW FinalsDocument11 pagesLAW FinalsAmie Jane MirandaNo ratings yet

- LNU-AA-23-02-01-18 ExamDocument13 pagesLNU-AA-23-02-01-18 ExamAmie Jane MirandaNo ratings yet

- Assurance FinalsDocument11 pagesAssurance FinalsAmie Jane MirandaNo ratings yet

- AFAR FinalsDocument13 pagesAFAR FinalsAmie Jane MirandaNo ratings yet

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- Lyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditDocument12 pagesLyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditAmie Jane Miranda0% (1)

- Acctg 24 Agency, Sales, Labor and Other Commercial Laws: Lyceum-Northwestern UniversityDocument4 pagesAcctg 24 Agency, Sales, Labor and Other Commercial Laws: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- ACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityDocument4 pagesACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- CAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityDocument15 pagesCAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- LNU AA-23-02-01-18 Midterm Exam ReviewDocument4 pagesLNU AA-23-02-01-18 Midterm Exam ReviewAmie Jane MirandaNo ratings yet

- ACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityDocument7 pagesACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- CAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityDocument7 pagesCAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- tAX FINALSDocument8 pagestAX FINALSAmie Jane MirandaNo ratings yet

- ACCTG 5 Financial Accounting Theory and Practice III: Lyceum-Northwestern UniversityDocument5 pagesACCTG 5 Financial Accounting Theory and Practice III: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Risk & Return Simplified PDFDocument292 pagesRisk & Return Simplified PDFDevikaNo ratings yet

- ACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityDocument4 pagesACCTG 25 Negotiable Instruments Law: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Investment Analysis and Portfolio Management 2010Document166 pagesInvestment Analysis and Portfolio Management 2010johnsm2010No ratings yet

- CAE 10 CG Strategic Cost ManagementDocument23 pagesCAE 10 CG Strategic Cost ManagementAmie Jane MirandaNo ratings yet

- Advanced Part 2 Solman MillanDocument270 pagesAdvanced Part 2 Solman MillanVenz Lacre80% (25)

- Title X. - Appraisal RightDocument2 pagesTitle X. - Appraisal RightAlyn SimNo ratings yet

- Admission of A PartnerDocument21 pagesAdmission of A PartnerHarmohandeep singhNo ratings yet

- Tugas Akm Ii Pertemuan 13Document5 pagesTugas Akm Ii Pertemuan 13Alisya UmariNo ratings yet

- '7 Kansai: NerolacDocument228 pages'7 Kansai: NerolacSuprabhat SealNo ratings yet

- Inventory Valuation Special MethodsDocument30 pagesInventory Valuation Special Methodsyebegashet100% (1)

- Workshop Questions Chapter 5Document6 pagesWorkshop Questions Chapter 5Ng Peng LiangNo ratings yet

- BW ControversyDocument5 pagesBW ControversyJacquelyn RamosNo ratings yet

- Tell Me Why Co. Is Expected To Maintain A Constant...Document2 pagesTell Me Why Co. Is Expected To Maintain A Constant...awaisNo ratings yet

- ACTBFAR Work Text - Chapter 13. - 2T1920 - FormattedDocument7 pagesACTBFAR Work Text - Chapter 13. - 2T1920 - FormattednuggsNo ratings yet

- International Public Sector Accounting Standards (IPSAS) (A4)Document12 pagesInternational Public Sector Accounting Standards (IPSAS) (A4)Moses K. Wangaruro100% (1)

- Chairman & MD Brief Bio Data PDFDocument2 pagesChairman & MD Brief Bio Data PDFVivek PandeyNo ratings yet

- Midterms Sa2 FARDocument6 pagesMidterms Sa2 FAREloiNo ratings yet

- Financial Ratio Analysis Infosys PresentationDocument43 pagesFinancial Ratio Analysis Infosys PresentationSaurabh SharmaNo ratings yet

- Madeleine's Fund Leaving No Stone Unturned Limited Full Report 27.01.2010Document12 pagesMadeleine's Fund Leaving No Stone Unturned Limited Full Report 27.01.2010Joana MoraisNo ratings yet

- Limited Liability Partnership - The Way Forward ?Document8 pagesLimited Liability Partnership - The Way Forward ?vivek1119No ratings yet

- Corporate FinanceDocument42 pagesCorporate FinanceNguyễn Thụy Ngọc HânNo ratings yet

- Vertical Financial StatementsDocument3 pagesVertical Financial StatementsMANAN MEHTANo ratings yet

- Financial Analysis of Food IndustryDocument8 pagesFinancial Analysis of Food Industrysona0% (1)

- Republic Act No. 8799: The Securities Regulation CodeDocument50 pagesRepublic Act No. 8799: The Securities Regulation CodeWendyMayVillapaNo ratings yet

- ACCT-UB 3 - Financial Statement Analysis Module 3 HomeworkDocument2 pagesACCT-UB 3 - Financial Statement Analysis Module 3 HomeworkpratheekNo ratings yet

- F9 Past PapersDocument32 pagesF9 Past PapersBurhan MaqsoodNo ratings yet

- Portfolio Theory Tutorial 3 – Finance I, Autumn 2021Document2 pagesPortfolio Theory Tutorial 3 – Finance I, Autumn 2021VivienLamNo ratings yet

- Ama AssDocument3 pagesAma AssBaiju MonNo ratings yet

- BSIS ePA 313 - Preparation of Statement of Changes in EquityDocument6 pagesBSIS ePA 313 - Preparation of Statement of Changes in EquityKen ChanNo ratings yet

- Berkshire Hathaway Equity ResearchDocument2 pagesBerkshire Hathaway Equity ResearchInvestingSidekickNo ratings yet

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDocument34 pagesZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNo ratings yet

- Abusama Impairment of AssetsDocument1 pageAbusama Impairment of AssetsGarp BarrocaNo ratings yet

- Top Kolkata-based stock brokers and directorsDocument2 pagesTop Kolkata-based stock brokers and directorsswati_progNo ratings yet

- TaxDocument2 pagesTaxnomercykillingNo ratings yet

- Royal British rule: doctrine Bank v of Turquand constructive noticeDocument30 pagesRoyal British rule: doctrine Bank v of Turquand constructive noticedownloader10280% (5)