Professional Documents

Culture Documents

2001 Taxes Receivable

2001 Taxes Receivable

Uploaded by

Ewing Township, NJOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2001 Taxes Receivable

2001 Taxes Receivable

Uploaded by

Ewing Township, NJCopyright:

Available Formats

A-3

TOWNSHIP OF EWING

COUNTY OF MERCER

CURRENT FUND

SCHEDULE OF TAXES RECEIVABLE AND ANALYSIS OF PROPERTY TAX LEVY

FISCAL YEAR ENDED JUNE 30, 2001

Due From

FY2001 Levy and State of N.J. Transferred

Balance Added Taxes FY 2001 Senior Citizens to Tax Title Balance

Year June 30, 2000 Adjustment to Levies Collections And Veterans Cancelled Liens June 30, 2001

$ $ $ $ $ $ $

FY 1996 2,723.58 2,723.58 0.00 0.00

FY 1997 8,359.03 8,359.03 0.00 0.00

FY 1998 11,697.20 10,955.61 741.59 0.00 0.00

FY 1999 28,953.31 16,080.21 200.00 2,711.26 9,961.84

FY 2000 1,756,360.40 1,590,506.08 31,506.28 76,141.01 58,207.03

FY 2001 53,980,665.59 51,441,544.26 421,492.60 188,488.79 20,045.26 1,909,094.68

$ 1,808,093.52 $ 53,980,665.59 $ 53,070,168.77 $ 421,492.60 $ 220,936.66 $ 98,897.53 $ 1,977,263.55

Analysis of FY 2001 Property Tax Levy

Tax Yield

General Purpose $ 53,419,427.51

Added Taxes (N.J.S.A. 54:4-63.1 et seq.) 561,238.08

$ 53,980,665.59

Tax Levy

$

Local School District Tax and County Taxes 45,972,247.41

County Added Taxes 117,319.33 46,089,566.74

Local Purpose 7,891,098.85

$ 53,980,665.59

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Annex A. ChecklistDocument2 pagesAnnex A. ChecklistroseannurakNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Living TrustDocument7 pagesLiving TrustRocketLawyer100% (32)

- Bills List For 11-9-10Document7 pagesBills List For 11-9-10Ewing Township, NJNo ratings yet

- Regular Session: Wing Ownship OuncilDocument4 pagesRegular Session: Wing Ownship OuncilEwing Township, NJNo ratings yet

- Agenda Session: Wing Ownship OuncilDocument4 pagesAgenda Session: Wing Ownship OuncilEwing Township, NJNo ratings yet

- 11-9-10 AFSCME - Public Works Sanitation DivisionDocument1 page11-9-10 AFSCME - Public Works Sanitation DivisionEwing Township, NJNo ratings yet

- TrunkDocument1 pageTrunkEwing Township, NJNo ratings yet

- 2010 Trunk Treat Reg FormDocument3 pages2010 Trunk Treat Reg FormEwing Township, NJNo ratings yet

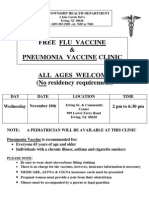

- 2011-10-10 Flu Pneumonia AnnouncementDocument1 page2011-10-10 Flu Pneumonia AnnouncementEwing Township, NJNo ratings yet

- 10-21-10 Notice of MTG Re Change of Date and TimeDocument1 page10-21-10 Notice of MTG Re Change of Date and TimeEwing Township, NJNo ratings yet

- Regular Session 5-25-10Document3 pagesRegular Session 5-25-10Ewing Township, NJNo ratings yet

- Special Meeting Minutes MAY 3, 2010Document2 pagesSpecial Meeting Minutes MAY 3, 2010Ewing Township, NJNo ratings yet

- Regular Session 6-15-10Document5 pagesRegular Session 6-15-10Ewing Township, NJNo ratings yet

- Regular Session 5-11-10Document2 pagesRegular Session 5-11-10Ewing Township, NJNo ratings yet

- Regular Session 4-13-10Document4 pagesRegular Session 4-13-10Ewing Township, NJNo ratings yet

- Regular Session 4-27-10Document5 pagesRegular Session 4-27-10Ewing Township, NJNo ratings yet

- Agenda Session 6-21-10Document3 pagesAgenda Session 6-21-10Ewing Township, NJNo ratings yet

- Mr. Cox - Present Mr. Steinmann - Absent Mr. Summiel - Present Ms. Wollert - PresentDocument5 pagesMr. Cox - Present Mr. Steinmann - Absent Mr. Summiel - Present Ms. Wollert - PresentEwing Township, NJNo ratings yet

- Agenda Session 7-26-10Document3 pagesAgenda Session 7-26-10Ewing Township, NJNo ratings yet

- Agenda Session 9-13-10Document5 pagesAgenda Session 9-13-10Ewing Township, NJNo ratings yet

- Agenda Session 4-26-10Document3 pagesAgenda Session 4-26-10Ewing Township, NJNo ratings yet

- Agenda Session 5-10-10Document2 pagesAgenda Session 5-10-10Ewing Township, NJNo ratings yet

- Bills List For 10-12-10Document4 pagesBills List For 10-12-10Ewing Township, NJNo ratings yet

- Agenda Session 4-12-10Document3 pagesAgenda Session 4-12-10Ewing Township, NJNo ratings yet

- Worksheet 1Document2 pagesWorksheet 1Smoked PeanutNo ratings yet

- VINOYA v. NLRCDocument3 pagesVINOYA v. NLRCninaNo ratings yet

- A Revelation of The Father - S LoveDocument10 pagesA Revelation of The Father - S LovesantipraNo ratings yet

- List of Finance Job TitlesDocument8 pagesList of Finance Job Titlesgoodabhi_99100% (2)

- Davao Norte Police Provincial Office: Original SignedDocument4 pagesDavao Norte Police Provincial Office: Original SignedCarol JacintoNo ratings yet

- Struggle of Shia in IndonesiaDocument328 pagesStruggle of Shia in IndonesiaAdit OkayNo ratings yet

- Book ReviewDocument2 pagesBook ReviewEricko MarvinNo ratings yet

- TCS Finance AssignmentDocument19 pagesTCS Finance AssignmentNILOTPAL SARKAR (RA2152001010046)No ratings yet

- 2012-2013 PNHA Tables - 2Document9 pages2012-2013 PNHA Tables - 2Juan CarlosNo ratings yet

- KoreanDocument32 pagesKoreanSaid RodríguezNo ratings yet

- House Rental ApplicationDocument3 pagesHouse Rental Applicationsadafsuleimani51No ratings yet

- Tender Doc For StationaryDocument22 pagesTender Doc For StationaryvishalchhatriNo ratings yet

- Case Digest - Ting vs. TingDocument2 pagesCase Digest - Ting vs. TingValencia and Valencia OfficeNo ratings yet

- Syndicate Bank Saves Its Way To SuccessDocument2 pagesSyndicate Bank Saves Its Way To SuccessPriyanka Kumari0% (1)

- 1987 - Williams - Fantasy Theme Analysis - Theory and PracticeDocument11 pages1987 - Williams - Fantasy Theme Analysis - Theory and Practicejakebobb7084No ratings yet

- Criminal Law-2 - 4th SemesterDocument36 pagesCriminal Law-2 - 4th SemesterVijay Srinivas KukkalaNo ratings yet

- Manpower PlanningDocument18 pagesManpower Planningtamim947No ratings yet

- Apples To Apples Gamespdf 3 PDF FreeDocument19 pagesApples To Apples Gamespdf 3 PDF FreeLiss SánchezNo ratings yet

- Anacleto vs. CADocument8 pagesAnacleto vs. CAPaulineNo ratings yet

- Canterbury Tales Vocabulary Words. To Show Proficiency in The Reading Learning Targets, Read "TheDocument9 pagesCanterbury Tales Vocabulary Words. To Show Proficiency in The Reading Learning Targets, Read "TheVon AlexisNo ratings yet

- Lufthansa Finished EssayDocument27 pagesLufthansa Finished EssayKhaled Dakakni100% (1)

- At Aud001Document4 pagesAt Aud001KathleenNo ratings yet

- Beach-Reflective EssayDocument8 pagesBeach-Reflective Essayapi-340847248No ratings yet

- Petition To Make SpecialDocument8 pagesPetition To Make SpecialErik PeltonNo ratings yet

- Challenges To Translate IdiomsDocument9 pagesChallenges To Translate IdiomsOrsi SimonNo ratings yet

- Sermon Notes First Ecumenical Church Service Palm Sunday April 1, 2012Document3 pagesSermon Notes First Ecumenical Church Service Palm Sunday April 1, 2012api-180169039No ratings yet

- RADWIN PortfolioDocument35 pagesRADWIN Portfoliorafaelrodgar_7642429No ratings yet

- CERTIFICATE OF INDIGENCY - WITH PARENT (Small Edition)Document6 pagesCERTIFICATE OF INDIGENCY - WITH PARENT (Small Edition)Kimberly BringNo ratings yet