Professional Documents

Culture Documents

Britannia Balance Sheet

Britannia Balance Sheet

Uploaded by

man_mohini218Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Britannia Balance Sheet

Britannia Balance Sheet

Uploaded by

man_mohini218Copyright:

Available Formats

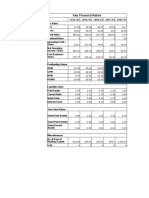

Britannia

Balance sheet

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07

Sources of funds

Owner's Iund

Equity share capital 23.89 23.89 23.89 23.89 23.89

Share application money - - - - -

PreIerence share capital - - - - -

Reserves & surplus 427.41 372.36 800.65 731.92 590.93

Loan funds

Secured loans 407.76 408.10 2.20 1.94 1.53

Unsecured loans 23.68 21.51 22.97 104.16 3.25

Total 882.75 825.87 849.70 861.91 619.60

Uses of funds

Fixed assets

Gross block 593.56 547.83 511.50 453.18 392.12

Less : revaluation reserve - - - - -

Less : accumulated depreciation 289.86 266.33 233.67 212.19 193.75

Net block 303.70 281.50 277.84 240.99 198.37

Capital work-in-progress 11.69 11.64 6.02 9.69 16.03

Investments 545.00 490.64 423.10 380.83 320.05

Net current assets

Current assets, loans & advances 648.32 552.19 553.66 577.48 382.61

Less : current liabilities & provisions 625.97 510.10 437.55 370.31 323.03

Total net current assets 22.36 42.09 116.11 207.17 59.58

Miscellaneous expenses not written - - 26.64 23.23 25.58

Total 882.75 825.87 849.70 861.91 619.60

Notes:

Book value oI unquoted investments 407.25 566.76 423.07 380.81 352.55

Market value oI quoted investments 143.42 4.29 2.15 2.93 2.12

Contingent liabilities 359.63 318.67 329.05 169.55 102.63

Number oI equity sharesoutstanding (Lacs) 1194.51 238.90 238.90 238.90 238.90

!rofit loss account

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07

Income

Operating income 4,217.53 3,401.31 3,112.38 2,587.86 2,199.32

Expenses

Material consumed 2,771.01 2,176.29 1,917.22 1,563.79 1,404.58

ManuIacturing expenses 370.42 327.24 302.83 244.96 212.30

Personnel expenses 118.48 99.52 96.02 90.53 76.71

Selling expenses 593.16 510.36 434.73 363.20 303.67

Adminstrative expenses 134.10 83.84 137.40 93.06 73.37

Expenses capitalised - - - - -

Cost oI sales 3,987.17 3,197.25 2,888.20 2,355.54 2,070.62

Operating proIit 230.37 204.06 224.18 232.32 128.70

Other recurring income 26.67 37.26 24.23 24.07 15.67

Adjusted PBDIT 257.04 241.32 248.41 256.39 144.37

Financial expenses 40.08 8.21 16.01 9.73 8.90

Depreciation 44.59 37.54 33.46 29.08 25.27

Other write oIIs - - - - -

Adjusted PBT 172.37 195.57 198.95 217.57 110.20

Tax charges 40.50 4.27 52.12 41.26 10.76

Adjusted PAT 131.87 191.31 146.83 176.31 99.44

Non recurring items 21.10 -81.45 7.15 -3.95 5.89

Other non cash adjustments -7.68 6.65 26.42 18.64 2.32

Reported net proIit 145.29 116.51 180.40 191.00 107.65

Earnigs beIore appropriation 290.06 226.11 240.40 251.00 157.65

Equity dividend 77.64 59.73 95.56 43.00 35.84

PreIerence dividend - - - - -

Dividend tax 12.60 9.92 16.24 7.31 6.09

Retained earnings 199.82 156.46 128.60 200.69 115.73

#atios

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07

!er share ratios

Adjusted EPS (Rs) 11.04 80.08 61.46 73.80 41.62

Adjusted cash EPS (Rs) 14.77 95.79 75.46 85.98 52.20

Reported EPS (Rs) 12.16 48.77 75.51 79.95 45.06

Reported cash EPS (Rs) 15.90 64.48 89.52 92.12 55.64

Dividend per share 6.50 25.00 40.00 18.00 15.00

Operating proIit per share (Rs) 19.29 85.42 93.84 97.24 53.87

Book value (excl rev res) per share (Rs) 37.78 165.86 333.99 306.65 246.65

Book value (incl rev res) per share (Rs.) 37.78 165.86 333.99 306.65 246.65

Net operating income per share (Rs) 353.08 1,423.73 1,302.79 1,083.23 920.60

Free reserves per share (Rs) 35.41 154.03 322.15 294.86 234.99

!rofitability ratios

Operating margin () 5.46 5.99 7.20 8.97 5.85

Gross proIit margin () 4.40 4.89 6.12 7.85 4.70

Net proIit margin () 3.42 3.38 5.75 7.31 4.86

Adjusted cash margin () 4.15 6.65 5.74 7.86 5.63

Adjusted return on net worth () 29.21 48.27 18.40 24.06 16.87

Reported return on net worth () 32.19 29.40 22.60 26.07 18.26

Return on long term Iunds () 24.06 24.67 25.29 29.99 19.32

Leverage ratios

Long term debt / Equity 0.95 1.08 0.03 - -

Total debt/equity 0.95 1.08 0.03 0.14 0.01

Owners Iund as oI total source 51.12 47.98 97.03 87.69 99.22

Fixed assets turnover ratio 7.20 6.27 6.14 5.73 5.63

Liquidity ratios

Current ratio 1.04 1.08 1.27 1.56 1.18

Current ratio (inc. st loans) 1.04 1.08 1.27 1.22 1.17

Quick ratio 0.50 0.49 0.65 0.67 0.51

Inventory turnover ratio 16.68 15.06 14.54 9.98 12.88

!ayout ratios

Dividend payout ratio (net proIit) 62.10 59.77 61.97 26.34 38.94

Dividend payout ratio (cash proIit) 47.52 45.20 52.27 22.85 31.54

Earning retention ratio 31.57 63.60 23.86 71.47 57.84

Cash earnings retention ratio 48.86 69.57 37.99 75.51 66.39

Coverage ratios

Adjusted cash Ilow time total debt 2.44 1.88 0.13 0.51 0.03

Financial charges coverage ratio 6.41 29.41 15.52 26.34 16.22

Mar ' 11 Mar ' 10 Mar ' 09 Mar ' 08 Mar ' 07

Fin. charges cov.ratio (post tax) 5.74 19.77 14.36 23.61 15.94

Component ratios

Material cost component ( earnings) 66.13 64.61 62.22 59.76 65.41

Selling cost Component 14.06 15.00 13.96 14.03 13.80

Exports as percent oI total sales 1.22 1.20 2.22 0.44 0.66

Import comp. in raw mat. consumed 7.01 2.43 0.04 0.09 0.20

Long term assets / total Assets 0.56 0.58 0.55 0.52 0.58

Bonus component in equity capital () 91.82 91.82 91.82 91.82 91.82

You might also like

- Syndicate BankDocument5 pagesSyndicate BankpratikNo ratings yet

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeeNo ratings yet

- Balance Sheet: Hindalco IndustriesDocument20 pagesBalance Sheet: Hindalco Industriesparinay202No ratings yet

- Ratio Analysis: Balance Sheet of HPCLDocument8 pagesRatio Analysis: Balance Sheet of HPCLrajat_singlaNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Balance Sheet: Sources of FundsDocument14 pagesBalance Sheet: Sources of FundsJayesh RodeNo ratings yet

- Atlas Copco (India) LTD Balance Sheet: Sources of FundsDocument19 pagesAtlas Copco (India) LTD Balance Sheet: Sources of FundsnehaNo ratings yet

- Colgate PamoliveDocument5 pagesColgate Pamoliveprats00007No ratings yet

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Document6 pagesKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNo ratings yet

- Balance Sheet: Sources of FundsDocument8 pagesBalance Sheet: Sources of Fundssushilb_20No ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of Fundssumit_pNo ratings yet

- Ratio Analysis Ratio AnalysisDocument20 pagesRatio Analysis Ratio AnalysisHeena VermaNo ratings yet

- Tata Motors Ratio Analysis 1235110826059887 1Document14 pagesTata Motors Ratio Analysis 1235110826059887 1Saurabh PathakNo ratings yet

- Tata Motors - Ratio AnalysisDocument13 pagesTata Motors - Ratio Analysisshriji89No ratings yet

- 1 - Abhinav - Raymond Ltd.Document5 pages1 - Abhinav - Raymond Ltd.rajat_singlaNo ratings yet

- Tata Motors Ratio AnalysisDocument12 pagesTata Motors Ratio Analysispurval1611100% (2)

- Asian PaintsDocument2 pagesAsian Paints3989poojaNo ratings yet

- Renuka Sugars P and L AccntDocument13 pagesRenuka Sugars P and L AccntDivya NadarajanNo ratings yet

- 29 - Tej Inder - Bharti AirtelDocument14 pages29 - Tej Inder - Bharti Airtelrajat_singlaNo ratings yet

- 21 - Rajat Singla - Reliance Industries Ltd.Document51 pages21 - Rajat Singla - Reliance Industries Ltd.rajat_singlaNo ratings yet

- Appl Ication Mon EyDocument14 pagesAppl Ication Mon EyDevesh PantNo ratings yet

- Profit and Loss Account of GodrejDocument4 pagesProfit and Loss Account of GodrejDeepak PatelNo ratings yet

- Balance Sheet: Sources of FundsDocument3 pagesBalance Sheet: Sources of FundsJay MogradiaNo ratings yet

- Dokumen - Tips Wipro Ratio Analysis 55849d8e50235Document20 pagesDokumen - Tips Wipro Ratio Analysis 55849d8e50235zomaan mirzaNo ratings yet

- Britannia Industries LTDDocument4 pagesBritannia Industries LTDMEENU MARY MATHEWS RCBSNo ratings yet

- Shinansh TiwariDocument11 pagesShinansh TiwariAnuj VermaNo ratings yet

- Excel Brittaniya 2Document3 pagesExcel Brittaniya 2Adnan LakdawalaNo ratings yet

- Previous Years: Canar A Bank - in Rs. Cr.Document12 pagesPrevious Years: Canar A Bank - in Rs. Cr.kapish1014No ratings yet

- Asian PaintsDocument10 pagesAsian PaintsNeer YadavNo ratings yet

- Adani Port P&L, BS, CF - IIMKDocument6 pagesAdani Port P&L, BS, CF - IIMKabcdefNo ratings yet

- Trent LTD Ratio Analysis Excel Shivam JhaDocument6 pagesTrent LTD Ratio Analysis Excel Shivam JhaVandit BatlaNo ratings yet

- Apollo TyresDocument4 pagesApollo TyresGokulKumarNo ratings yet

- Nerolec Balance Sheet: Sources of FundsDocument3 pagesNerolec Balance Sheet: Sources of Funds3989poojaNo ratings yet

- UltraTech Financial Statement - Ratio AnalysisDocument11 pagesUltraTech Financial Statement - Ratio AnalysisYen HoangNo ratings yet

- Balance Sheet: Sources of FundsDocument5 pagesBalance Sheet: Sources of FundsTarun VijaykarNo ratings yet

- Balance Sheet & Ratio AnalysisDocument24 pagesBalance Sheet & Ratio AnalysisPayal PatnaikNo ratings yet

- HindalcoDocument13 pagesHindalcosanjana jainNo ratings yet

- Annextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015Document3 pagesAnnextures Balance Sheet of Larsen & Toubro From The Year 2011 To The Year 2015vandv printsNo ratings yet

- 17 - Manoj Batra - Hero Honda MotorsDocument13 pages17 - Manoj Batra - Hero Honda Motorsrajat_singlaNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of FundsAbhisek SarkarNo ratings yet

- FM Varsity Main-Model Chapter-4Document8 pagesFM Varsity Main-Model Chapter-4AnasNo ratings yet

- Company Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Document14 pagesCompany Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Sujay SinghviNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- Case Study of Tata MotorsDocument6 pagesCase Study of Tata MotorsSoumendra RoyNo ratings yet

- Infosys Technologies LTD RatioDocument4 pagesInfosys Technologies LTD Ratioron1436No ratings yet

- Balance Sheet of Grasim Industries LimitedDocument5 pagesBalance Sheet of Grasim Industries LimitedDaniel Mathew VibyNo ratings yet

- Annual Accounts 2021Document11 pagesAnnual Accounts 2021Shehzad QureshiNo ratings yet

- Enginee Rs India: Previous YearsDocument9 pagesEnginee Rs India: Previous YearsArun KanadeNo ratings yet

- Balance Sheet: Sources of FundsDocument4 pagesBalance Sheet: Sources of FundsYogesh GuwalaniNo ratings yet

- Key Financial RatiosDocument16 pagesKey Financial Ratioskriss2coolNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Mar '05 Mar '06 12 Mths 12 Mths Sources ofDocument13 pagesMar '05 Mar '06 12 Mths 12 Mths Sources ofJack and Master of AllNo ratings yet

- M Book 1Document2 pagesM Book 1marianmadhurNo ratings yet

- Summery of RatiosDocument8 pagesSummery of RatiosAmreen KhanNo ratings yet

- Project 3 - Ratio AnalysisDocument2 pagesProject 3 - Ratio AnalysisATANU GANGULYNo ratings yet