Professional Documents

Culture Documents

07 Hedging

Uploaded by

khushinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Hedging

Uploaded by

khushinCopyright:

Available Formats

Price Risk Management

and

the Futures Market

Hedging

Market Risk

W Economic vs. Product Risk

product deterioration in value ; product destruction

W Risk is a Marketing Function (Facilitative

function)

W Risk as Cost; Risk Taking for Profit

W Farmers Have Unavoidable Price Risk

W Risk Transfer May Be Desirable, Profitable

Examples of Your Risk

Management

W Plant Now, Price Now by Contract

W College Tuition (Pay in 1uly for Year)

W College Study (Protect Against Low Pay

1ob)

W Magazine Subscription: Pay for copies in

advance

W Home rental contract ; Insurance

rain Farmers` Market Risk

W Plant in Spring Without Knowing Fall

Harvest Price

W Sell in Spring Without Knowing Fall

Yield

W Sell in Fall Without Knowing Spring

Price

W Store in Fall Without Knowing Spring

Price

Farmer Tools For Managing

Price Risk

W Cash Sale (at Harvest or From Storage)

W Forward Pricing:

Forward Contracts: Cash and Basis

contracts

Hedging using Futures

Options

W Minimum Price Contract

Futures Markets

W Futures Exchanges : CBOT, CME,

KCBT etc.,

W Futures price is today`s price for

products to be delivered in the future.

Contract specifications

Order execution process (open outcry)

Margin requirements

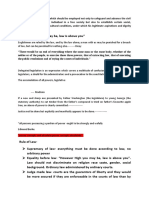

Date Price per Bushel Action Margin Action Account Balance

nitial margin = $500

Maintenance margin = $350

17-Jan $2.50 Sell July corn Deposit $500 $500

18-Jan $2.52 $400

19-Jan $2.54 $300

Margin Call $200 $500

20-Jan $2.53 $550

21-Jan $2.60 $200

Margin Call $300 $500

24-Jan $2.57 $650

25-Jan $2.55 $750

26-Jan $2.51 $950

Withdraw $450 $500

27-Jan $2.49 $600

28-Jan $2.44 Buy July corn $800

Futures Market Participants

W Speculators:

Risk Takers

Profit From

Correctly

Anticipating Price

Changes

Could Not Deliver or

Take Delivery of

Futures Commodities

W edgers:

Have Inherent

Price Risk

Wish to Reduce or

Manage Risk

Could Deliver

Against Futures

Contract

Hedge: Definitions

W Using the Futures or Options Markets To

Manage Price Risks

W A Temporary Substitution of A Futures

Market Transaction for a Planned Cash

Market Transaction

W Taking Equal and Opposite Positions on the

Cash and Futures Markets

Hedging Decisions

W What is my attitude toward price risk?

W What do I expect price to do?

W What are my costs?

W When should I set the hedge? When to

lift it?

W What are my alternatives to hedging?

Hedging uidelines

W Decide on a definite hedging objective -

reasons, month

W Discuss hedging plan with those involved; e.g.

bankers

W Know how to calculate your productions costs -

FC, VC, BEP

W Follow basis patterns

W Hedge reasonable amounts of commodity

W Keep adequate records

Production and Marketing

Periods

Spring

Planting

Fall

Harvest

Spring/

Summer

Pre-Harvest Period Storage Period

#sk: Plant wthout

knowng Fall Prce

#sk: Store wthout

knowng Sprng Prce

The Perfect Hedge

Fallng Prce Perod)

Cash

Price

Futures

Price

Bass

Nov.

Dec.

Buy $.

Sell $. $.

Sell $.9

Buy $. $.

Cash sale $.9

Futures ain .

Return to Hedge $.

cent gain

Perfect Hedge Returns

For a Perfect edge Bass Constant), 1he

#eturn 1o 1he edge Cash Prce + Futures)

Wll Always Be the Same.

The Perfect Hedge

#sng Prce Perod)

Cash

Price

Futures

Price

Bass

Nov.

Dec.

Buy $.

Sell $. $.

Sell $.

Buy $. $.

Cash sale $.

- Futures Loss .

Return to Hedge $.

cent loss

The Slightly Imperfect

Hedge

Cash

Price

Futures

Price

Bass

Nov.

Dec.

Buy $.

Sell $. $.

Sell $.9

Buy $. $.

Cash sale $.9

Futures ain .

Return to Hedge $.9

$.9 is better

than $.9

But not $.

Characteristics of a Successful

Hedge

W Equal and Opposite Positions on Cash and

Futures Markets

W Cash and Futures Markets Move In Same

Direction

W Predictable Basis Pattern

W Nullify Futures Position, Sell on Cash Market

W Loss on One Market ain on Other Market

W Transfer of Risk from Hedgers to Speculators

W No Tears, No Regrets

9

Types of Hedges

W Short Hedge (Protects Against Falling Prices)

Long Cash, Short Futures

Sell Cash, Buy Back Futures

W Long Hedge (Protects Against Rising Prices)

Short Cash, Long Futures

Buy Cash, Sell Futures

W Texas ~Hedge (Not a True Hedge)

Same Position on Cash and Futures Markets

Doubles the Risk

Three Farmer Hedges

W Perfect Hedge

Useful for Learning; Rare in Practice

W Storage Hedge

Set During Storage; Oct. to May

Protects Against Falling Prices

Helps Earn Storage Returns

W Pre-Harvest Hedge

Set in Spring

Protects Fall Harvest Price

Storage Hedges

W Harvest-to-Sale Period (Storage Season)

W Risk of Price Decline, Inventory Loss

W Will Price Rise Cover Storage Costs?

W Carrying Charges:

Storage Costs

Handling Charges

Insurance and Interest Costs

W Key to Success: Narrowing Basis Pattern

The Storage Hedge

Cash

Price

Futures

Price

Bass

Nov.

1une

Buy/Store $. Sell $.

$.

Sell $. Buy $. $.

Cash sale $.

Futures ain .

Return to Hedge $.

- Original Cost $.

Storage Return $.

- $.

Storage Hedge Rule

The Storage Hedger`s Carrying Charge

(Return to Storage) Will Always Equal

The Change in Basis Over the Storage Period

The Storage Hedge Transfers the Basis

Change From the Speculators to Hedgers

Hedging Principle

1he Bass Determnes

the Success

of A edge

Date Cash Market Futures

Market

October Harvest Price $. Sell 1uly Fut. $.

Est. 1une Bass $.1

Storage Cost $.3

Forward Price $.-. $.

Storage Profit $. -. - . $.

1une Cash Sale $. Buy Back Fut. $.

Return to Hedge: $. $. $ .

Corn Storage Hedge

Pre-Harvest Hedge

W Set During Planting or rowing Period

W Protects Against Harvest Price Risk

Wll arvest Prce Cover Producton Costs?

W Locks-In Fall Harvest Target Price

W Key to Success: Requires Accurate

Harvest Basis Prediction

The PreHarvest Hedge

Cash

Price

Futures

Price

Bass

May

Planting

Nov.

Harvest

Plant at 1arget

Prce:

$.-.$.

Sell $.

Sell $.

Buy $.

Expected

$.

Cash Sale $.

Futures ain .

Return to Hedge $. Spring Target

Date Cash Market Futures

Market

May Sell Dec Fut. $.

Cost of Producton $2.1

Forward Price $.-. basis $.

Expected Profit $. -. $.

Oct. Cash Sale $. Buy Back Fut. $.

Net Return to Hedge: $. $.- $. $ .

Corn Pre-Harvest Hedge

Expected bass $.3

9

Calculating the Return

To a Hedge

1oday: Current Futures Price...$.

Less: Expected Basis at Sale Time .. .

Equals: Lock-In Forward Price..$.

Future Sale: Cash Price..$.

Plus/Minus Futures Transaction $.

Equals: Total Return to Hedge... $.

Less: Costs (Prodn. Or Storage).$.

Equals: Net Return To Hedge...$.

Combination Pre-Harvest

and Storage Hedge

May 99 Target $. Sell$.

$.-. Est. Spr.

$. basis$.

Cash Dec. 98 1une 99

Market Futures Futures

May 999 $. xxxx Buy$.

Return to Hedge: $. .9 $.

Why Don`t More Farmers

Hedge?

W Lack of Understanding of Hedging

W Mistrust of Futures Market

W Prefer Ease of Forward Contracts

W Like Risk; Prefer to Speculate on Cash

Market

W Dislike Margin Calls

W Other????

Summary: Risk Management

Tools

W Hedging

W Options

W Forward Cash Contracts

W Basis Contracts

W Minimum Price Contracts

You might also like

- Excel AdvancedDocument19 pagesExcel Advancedpraba19No ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Rural Penetration of Coca - ColaDocument42 pagesRural Penetration of Coca - ColaMunsif HussainNo ratings yet

- Consumer SpendingDocument4 pagesConsumer SpendingkhushinNo ratings yet

- PriyankaDocument9 pagesPriyankakhushinNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sculi EMT enDocument1 pageSculi EMT enAndrei Bleoju100% (1)

- Spiritual RealityDocument3 pagesSpiritual RealityhysiokijNo ratings yet

- Digi Bill 13513651340.010360825015067633Document7 pagesDigi Bill 13513651340.010360825015067633DAVENDRAN A/L KALIAPPAN MoeNo ratings yet

- SUDAN A Country StudyDocument483 pagesSUDAN A Country StudyAlicia Torija López Carmona Verea100% (1)

- JAR66Document100 pagesJAR66Nae GabrielNo ratings yet

- If I Was The President of Uganda by Isaac Christopher LubogoDocument69 pagesIf I Was The President of Uganda by Isaac Christopher LubogolubogoNo ratings yet

- Quickstart V. 1.1: A Setting of Damned Souls and Unearthly Horrors For 5 EditionDocument35 pagesQuickstart V. 1.1: A Setting of Damned Souls and Unearthly Horrors For 5 EditionÁdám Markó100% (2)

- 2.1 Song of The Open RoadDocument10 pages2.1 Song of The Open RoadHariom yadavNo ratings yet

- Judgments of Adminstrative LawDocument22 pagesJudgments of Adminstrative Lawpunit gaurNo ratings yet

- Schedules of Shared Day Companies - MITCOEDocument1 pageSchedules of Shared Day Companies - MITCOEKalpak ShahaneNo ratings yet

- Accounting For Revenue and Other ReceiptsDocument4 pagesAccounting For Revenue and Other ReceiptsNelin BarandinoNo ratings yet

- Ingles Junio 17 CanariasDocument5 pagesIngles Junio 17 CanariaskinkirevolutionNo ratings yet

- Psychology Essay IntroductionDocument3 pagesPsychology Essay Introductionfesegizipej2100% (2)

- Supermarkets - UK - November 2015 - Executive SummaryDocument8 pagesSupermarkets - UK - November 2015 - Executive Summarymaxime78540No ratings yet

- Wrongful ForeclosureDocument8 pagesWrongful Foreclosurefaceoneoneoneone100% (2)

- AssignmentDocument25 pagesAssignmentPrashan Shaalin FernandoNo ratings yet

- Names of PartnerDocument7 pagesNames of PartnerDana-Zaza BajicNo ratings yet

- Buyer - Source To Contracts - English - 25 Apr - v4Document361 pagesBuyer - Source To Contracts - English - 25 Apr - v4ardiannikko0No ratings yet

- Commandos - Beyond The Call of Duty - Manual - PCDocument43 pagesCommandos - Beyond The Call of Duty - Manual - PCAlessandro AbrahaoNo ratings yet

- Republic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962Document2 pagesRepublic of The Philippines vs. Bagtas, 6 SCRA 262, 25 October 1962DAblue ReyNo ratings yet

- Roads of Enlightenment GuideDocument5 pagesRoads of Enlightenment GuideMicNo ratings yet

- Basic Fortigate Firewall Configuration: Content at A GlanceDocument17 pagesBasic Fortigate Firewall Configuration: Content at A GlanceDenisa PriftiNo ratings yet

- Acknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyDocument3 pagesAcknowledgment, Dedication, Curriculum Vitae - Lanie B. BatoyLanie BatoyNo ratings yet

- TolemicaDocument101 pagesTolemicaPrashanth KumarNo ratings yet

- Gerson Lehrman GroupDocument1 pageGerson Lehrman GroupEla ElaNo ratings yet

- Bangladesh Labor Law HandoutDocument18 pagesBangladesh Labor Law HandoutMd. Mainul Ahsan SwaadNo ratings yet

- Introduction To Paid Search Advertising - TranscriptDocument4 pagesIntroduction To Paid Search Advertising - TranscriptAnudeep KumarNo ratings yet

- Top 10 Busiest PortsDocument7 pagesTop 10 Busiest Portsaashish1507No ratings yet

- Can God Intervene$Document245 pagesCan God Intervene$cemoara100% (1)

- CIT Exercises - June 2020 - ACEDocument16 pagesCIT Exercises - June 2020 - ACEKHUÊ TRẦN ÁINo ratings yet