Professional Documents

Culture Documents

Luxury Goods Pitch

Uploaded by

nickbuchCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Luxury Goods Pitch

Uploaded by

nickbuchCopyright:

Available Formats

TheFederalReservesstaunchlydovishstanceoninterestratessincethefinancialmeltdown

andensuingglobaldebtcrisishasdonelittletospur(small)businessdemandforloanable

funds,whichwould,accordingtoclassiceconomics,encouragebusinessestotakeoutcheap

loans.Thesecheaploanswouldideallybespentonrampingupproductionandthusincreasing

employment.This,however,hasnotbeenthecase,duetothestatus-quoliquiditytrap,which

hasameliorateddomesticdemandforloanablefundsasaresultofalackoftrustintheFedand

pessimismoverthenear-termaggregatedemandparadigm.

Theseextremelylowinterestrateshavealsodiscouragedhouseholdsfromkeepingcash,as

theyseeverylittlebenefit(nearlyzeropercentinterestrates)fromputtingtheirmoneyinto

bankaccounts.Individualconsumershavedecidedtospendtheirincomethroughoutthis

recession,ratherthansaveit,whichistheconverseofhowUSbusinesshavedecidedtotreat

thetrillionsthattheycurrentlysiton.

Quarter-on-quarter,seasonallyadjustedPersonalConsumptionExpenditurequotedinmillionsof

USdollars.Source:BureauofEconomicAnalysis.

TotalPersonalConsumptionExpenditures(PCE)hasincreasedbyabout3.7%fromthefirst

quarterof2009tothefirstquarterof2011,whereasconsumptionofClothingandFootwear,a

subsetofthetotal,increasedby8.6%.ExpenditureonServicesincreased1.4%,andFood&

Beverageexpenditureincreasedby5.4%.ExpenditureonGasolinedecreasedby3.8%.

Thesequarter-onquarterexpenditurechangesrevealsomeinterestinganomalieswhen

comparedtothequarter-on-quarterpercentagechangeinprices:

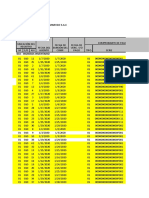

Line Series Name

2009 2009 2009 2009 2010 2010 2010 2010 2011

I II III IV I II III IV I

Personal consumption expenditures by major

type of product (From NIPA table 2.3.6):

BLANK

1 Personal consumption expenditures (PCE) DPCERX 9,040,884 8,998,541 9,050,293 9,060,177 9,121,193 9,186,916 9,247,087 9,328,389 9,376,739

2 Goods DGDSRX 3,082,584 3,064,334 3,120,715 3,124,564 3,173,307 3,202,864 3,240,813 3,306,005 3,344,410

3 Durable goods DDURRX 1,094,568 1,083,358 1,134,512 1,120,769 1,147,466 1,169,260 1,194,057 1,242,425 1,277,358

4 Motor vehicles and parts DMOTRX 316,237 312,420 344,549 316,728 315,923 321,353 328,031 354,925 368,217

5 Furnishings and durable household equipment DFDHRX 241,229 236,916 239,803 244,468 252,645 259,241 261,415 267,038 269,349

6 Recreational goods and vehicles DREQRX 401,609 396,670 411,816 426,856 441,985 452,142 465,838 478,543 495,861

7 Other durable goods DODGRX 144,599 145,824 147,168 146,367 152,166 152,886 156,414 158,141 161,413

8 Nondurable goods DNDGRX 1,980,332 1,972,821 1,982,657 1,997,673 2,021,125 2,030,761 2,045,835 2,067,432 2,075,433

9

Food and beverages purchased Ior oII-premises

consumption

DFXARX 646,989 654,751 660,817 666,806 671,628 667,219 672,810 680,772 682,090

10 Clothing and Iootwear DCLORX 324,334 318,385 321,619 325,126 334,334 339,643 339,982 350,058 352,753

11 Gasoline and other energy goods DGOERX 284,861 281,189 279,291 279,076 281,768 282,119 282,683 278,442 274,167

12 Other nondurable goods DONGRX 728,391 721,375 723,752 729,745 737,284 746,360 754,812 764,506 774,427

13 Services DSERRX 5,953,477 5,928,637 5,926,827 5,932,878 5,947,430 5,984,292 6,008,121 6,027,469 6,039,087

14

Household consumption expenditures (Ior

services)

DHCERX 5,676,346 5,657,048 5,653,532 5,655,164 5,668,116 5,702,586 5,730,617 5,754,730 5,765,938

15 Housing and utilities DHUTRX 1,649,999 1,651,323 1,656,634 1,661,529 1,663,578 1,665,707 1,675,297 1,672,213 1,666,045

16 Health care DHLCRX 1,409,109 1,421,574 1,429,062 1,432,828 1,424,063 1,438,150 1,446,910 1,462,284 1,464,348

17 Transportation services DTRSRX 251,846 248,460 246,186 245,894 247,624 249,904 251,557 251,643 251,353

18 Recreation services DRCARX 338,027 335,240 332,276 333,812 335,923 339,391 345,759 344,705 342,962

19 Food services and accommodations DFSARX 538,636 533,395 532,323 532,706 543,512 549,201 553,240 558,155 567,593

20 Financial services and insurance DIFSRX 693,105 679,744 670,561 660,965 667,046 670,773 665,922 667,581 674,683

21 Other services DOTSRX 796,063 787,644 786,688 787,619 786,565 789,607 792,389 798,327 798,804

22

Final consumption expenditures oI nonproIit

institutions serving households (NPISHs)

1

DNPIRX 279,283 273,365 275,340 280,311 282,045 284,554 279,526 273,928 274,324

23 Gross output oI nonproIit institutions

2

DNPERX 965,953 967,761 971,948 977,076 974,328 988,219 992,801 1,001,600 997,242

24

Less: Receipts Irom sales oI goods and services

by nonproIit institutions

3

DNPSRX 688,305 695,418 697,785 698,433 694,311 705,495 714,117 727,295 722,777

Addenda: BLANK

1 oI 5

Bureau of Economic Analysis

Table 2.3.6U. Real Personal Consumption Expenditures by Major Type of Product and by Major Function

|Millions oI chained (2005) dollars; quarters and months are seasonally adjusted at annual rates|

Last Revised on: November 23, 2011 - Next Release Date December 23, 2011

Quarter-on-quarterpercentagechangeinConsumerPriceIndex(CPI).Source:Bureauof

EconomicAnalysis.

Theexpendituresonmanygoodsincluding:gasoline,food&beverages,andpersonal

computershaveincreasedevenasquarter-on-quarterpricesofthosegoodswasfalling.Wecan

concludethatconsumer(discretionary)expenditurehasincreasedoverthepasttenquarters,

asthepricesofthegoodsbeingpurchasedasfallen,inmanycases,butalsointhecaseof

clothingandfootwear,wheretheincreasingcoreCPIstandsasapriceindicator.Thetakeaway

fromthisisthatconsumersarespendingrobustly,eventhoughtheeconomyremainslaggard.

Thisisevidentthroughrecentcorporateearnings,especiallythoseofthesummerof2010,

whereitbecamethenormforcompaniestoannounceexpectation-shatteringsalesnumbers.

RetailerslikeMacys($M),Costco($COST),andJCPenny($JCP)haveseensolidsalesfigures

andhavemovedintandemwiththemarketthroughout2009and2010,untiltheypulledaway

fromotherindustriesandbecameahigherbetaplayinthesummerof2010.Thiswasall

predictabletosomedegree,butlesspredictablehasbeenthemeteoricmovementinluxury

goodstockprices.

Lowinterestrateshavebeenthesparkforthenation-wideincreaseinexpenditure(savings

aversion),butsomethinglessconsideredbyWallStreethasbeentheaftermathoftheover-

leveragingoftheGreenspanEraintothepresenttime.

Inthepost-Techbubbleenvironmentofthe2000s,manyhouseholdsover-leveragedtheir

wealthwithcheaphomeloans.Aportionofthoseloansweredefaulteduponduring2007,after

itbecameclearthattherecipientswereterriblyundeservingofsuchcheapcredit,whichwere

primarilylowandmiddleincomehomes.Numeroushomeloans,though,weretoupperclassor

borderline-upper-classhomesthathoppedonthecheapcreditbandwagon.Theseupperclass

loanrecipientshavenotdefaultedontheirloans,butstillhavethebenefitofhavingover-

leveragedtheirsavingsandincomeastrongcasefortheincreaseddemandofluxurygoods.

Anotherdriverforluxurygoodshasbeenhealthyinternationaldemand.Countriessuchas

ChinaandIndiahavebeenhotsince2009(somewouldsayonfire)andhaveseenhighlevelsof

consumption-driveninflation.Luxurygoodsbeingnon-denominationalinnaturemeansthat

theyaredemandedbythewealthyworldwideandarenotdependentononeparticular

economyorsubjecttocountry-specificsubstitutes.

Line

2009 2009 2009 2009 2010 2010 2010 2010 2011 2011

I II III IV I II III IV I II

1 PCE Chain-type price index (percent change) -1.7 1.9 3.0 2.8 1.9 0.3 1.0 1.9 3.9 3.3

2 Less: Formula effect (percentage points) -0.02 -0.26 -0.36 -0.31 -0.05 -0.07 -0.08 -0.12 -0.24 -0.22

3 Gasoline and other motor Iuel 0.10 -0.05 -0.16 -0.06 0.00 0.01 0.00 -0.04 -0.10 -0.05

4 Personal computers and peripheral equipment -0.02 -0.02 -0.04 -0.01 -0.01 -0.01 0.00 -0.01 -0.03 -0.02

5 Video and audio equipment -0.07 -0.07 -0.09 -0.11 -0.05 -0.04 -0.04 -0.04 -0.03 -0.05

6 Tobacco -0.02 -0.09 -0.02 -0.01 0.00 0.00 -0.01 0.00 0.00 0.00

7 Health care 0.04 0.02 0.02 0.03 0.02 0.02 0.01 0.00 0.01 0.01

8

Electricity, gas, Iuel oil, and other household

Iuels

0.01 0.00 0.00 -0.01 0.01 0.00 0.00 0.00 -0.01 0.00

9 Housing 0.01 0.01 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

10

Food and beverages purchased Ior oII-premises

consumption

-0.01 0.00 0.00 -0.01 0.01 0.01 0.00 0.00 0.00 0.00

11 Other -0.06 -0.06 -0.08 -0.13 -0.02 -0.05 -0.03 -0.03 -0.08 -0.12

12

Equals: PCE fixed-weight price index (percent

change)

-1.65 2.15 3.37 3.09 1.90 0.40 1.06 2.07 4.14 3.52

13 Less: Weight effect (percentage points) 0.98 0.06 -0.74 -0.59 -0.50 0.36 -0.28 -0.70 -1.33 -0.89

14 Rent oI shelter -0.32 -0.25 -0.05 0.07 0.09 0.02 -0.09 -0.16 -0.23 -0.18

15

Imputed rental oI owner-occupied nonIarm

housing

-0.25 -0.20 -0.04 0.05 0.08 0.03 -0.07 -0.12 -0.17 -0.15

16 Rental oI tenant-occupied nonIarm housing -0.07 -0.04 -0.01 0.01 0.00 -0.01 -0.02 -0.04 -0.06 -0.04

17 Hotels and motels 0.22 0.14 0.08 -0.03 0.00 0.00 0.00 0.00 0.00 0.00

18 Gasoline and other motor Iuel 0.75 -0.28 -0.73 -0.25 -0.26 0.38 -0.15 -0.54 -0.85 -0.31

19

Electricity, gas, Iuel oil, and other household

Iuels

0.13 0.32 0.12 -0.11 -0.07 0.02 0.02 0.02 -0.03 -0.07

20 Other 0.20 0.11 -0.15 -0.26 -0.25 -0.06 -0.07 -0.01 -0.22 -0.33

21

Less: Scope effect - PCE price index items

out-of-scope of the CPI (percentage points)

-0.20 0.44 0.75 1.28 0.82 0.77 0.11 0.46 0.50 0.42

22 Physician services 0.11 0.10 0.09 0.09 0.08 0.10 0.12 0.06 -0.01 0.07

23 Hospital and nursing home services 0.29 0.26 0.27 0.35 0.21 0.21 0.12 0.08 0.17 0.22

24 Financial services Iurnished without payment -0.17 0.14 0.15 0.56 0.39 0.38 -0.31 -0.02 0.10 -0.08

1 oI 7

Bureau of Economic Analysis

Reconciliation of Percent Change in the CPI with Percent Change in the PCE Price Index

|Quarterly change is seasonally adjusted at annual rates; monthly change is seasonally adjusted at monthly rates|

Last Revised on: November 23, 2011 - Next Release Date December 23, 2011

TwoyearchartofTiffany($TIF),Coach($COH),Costco($COST),Gold&Silver($XAU),andthe

Dow,S&P500,&Nasdaq.

Thechartclearlyshowstheaforementionedoutperformanceofluxurygoodsasembodiedby

TiffanyandCoach.Thistrendwillprovetobeastellarplayin2012and/orwheneverwesee

anendtothefinancialrutinwhichwehavefoundourselves.TheFedhaspromisedtokeep

rateslowuntil2012,and,saveanear-termpullback,thereexistnoeminentthreatstothis

playunlessweactuallyseeaglobaldepression.

TheFedandtheIMF(will)haveprintedtrillionsbytheendofthisdebacle,andthoughweare

battlingdeflationrightnow,inflationwillbesuretorunrampantlyin2012andbeyondonce

saidmonetarypolicyworksthroughtheglobaleconomy.But,asaforementioned,consumers

expendituredoesnotseemtobeaffectedbyprices,solongasthereexistsnobetterwaytoget

abangfortheirbuck.

Keeponspendin

njb

You might also like

- Monthly Portfolio September 2019Document30 pagesMonthly Portfolio September 2019TunirNo ratings yet

- AppendixDocument11 pagesAppendixyousufalkaiumNo ratings yet

- Index: PPLTVF PPLF PPTSFDocument29 pagesIndex: PPLTVF PPLF PPTSFTunirNo ratings yet

- Country Ranking Analysis TemplateDocument12 pagesCountry Ranking Analysis Templatesendano 0No ratings yet

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Document4 pagesCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsNo ratings yet

- Fundamental Analyzis of WiproDocument15 pagesFundamental Analyzis of WiproAthira K. ANo ratings yet

- January 24 Supporting Docs 2Document1 pageJanuary 24 Supporting Docs 2Chris NorthcraftNo ratings yet

- 61 02 Charge Offs Recoveries AfterDocument3 pages61 02 Charge Offs Recoveries Aftermerag76668No ratings yet

- 2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDocument8 pages2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDougNo ratings yet

- B - Avle InfoDocument21 pagesB - Avle InfoQuofi SeliNo ratings yet

- 2013 Jollibee's Consolidated Statement of Financial PositionDocument86 pages2013 Jollibee's Consolidated Statement of Financial PositionRose Jean Raniel Oropa63% (16)

- EoDR 30 08 2006Document2 pagesEoDR 30 08 2006api-3818152No ratings yet

- ICICI Prudential Life InsuranceDocument3 pagesICICI Prudential Life InsuranceArjun BhatnagarNo ratings yet

- 61 01 Overview Loan Projections AfterDocument2 pages61 01 Overview Loan Projections Aftermerag76668No ratings yet

- Preference Shares BangladeshDocument5 pagesPreference Shares BangladeshBangladesh Foreign Investment PolicyNo ratings yet

- Helios Flexi Cap Fund Monthly Portfolio As On 30th November 2023Document8 pagesHelios Flexi Cap Fund Monthly Portfolio As On 30th November 2023shubham KumbharNo ratings yet

- Asses Ments 2Document2 pagesAsses Ments 2brian mochez01No ratings yet

- Book 1Document8 pagesBook 1Jerome NgNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- SBI-MultiCap-Fund 2Document9 pagesSBI-MultiCap-Fund 2garvitaneja477No ratings yet

- Project Report PDFDocument13 pagesProject Report PDFMan KumaNo ratings yet

- May 22Document1 pageMay 22Jesus TorresNo ratings yet

- Implications For City FinancesDocument11 pagesImplications For City FinancesAnonymous Pb39klJNo ratings yet

- Coronavirus Relief Fund Reprioritization - October 2020Document39 pagesCoronavirus Relief Fund Reprioritization - October 2020Tyler AxnessNo ratings yet

- Cases&Exercises - Chapter 1Document5 pagesCases&Exercises - Chapter 1Barbara AraujoNo ratings yet

- Real Estate Investment AnalysisDocument1 pageReal Estate Investment AnalysisJoelleCabasaNo ratings yet

- Teuer Furniture A Case Solution PPT (Group-04)Document13 pagesTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- 01 Levelized Cost EnergyDocument6 pages01 Levelized Cost EnergySopanghadgeNo ratings yet

- It Dic 13 Eng - NDocument11 pagesIt Dic 13 Eng - NcoccobillerNo ratings yet

- Particulars Jan Feb Mar Apr May Jun Jul: (Version 2)Document2 pagesParticulars Jan Feb Mar Apr May Jun Jul: (Version 2)Rubelyn Quimat RepasaNo ratings yet

- Compras Holding EneroDocument10 pagesCompras Holding EneroPINTADO INDUSTRIANo ratings yet

- UntitledDocument8 pagesUntitledShubham SarafNo ratings yet

- Glenmark BalanceSheet CashflowDocument3 pagesGlenmark BalanceSheet CashflowRaina RajNo ratings yet

- AFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Document3 pagesAFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Judith CastroNo ratings yet

- Strama MJC EfeDocument7 pagesStrama MJC EfeBriand DaydayNo ratings yet

- HR3 TitleI&II MemoDocument16 pagesHR3 TitleI&II MemoPeter SullivanNo ratings yet

- AFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Document3 pagesAFS 2016 - Towncall Rural Bank, Inc. Page 28 of 42Judith CastroNo ratings yet

- Brean Capital Expecting Positive Panel in June Reiterates PGNX With A BUY and $11PTDocument4 pagesBrean Capital Expecting Positive Panel in June Reiterates PGNX With A BUY and $11PTMayTepper100% (1)

- EoDR 03 09 2006Document2 pagesEoDR 03 09 2006api-3818152No ratings yet

- Session ModelDocument6 pagesSession ModelGanesh TiwariNo ratings yet

- Ondo East 2022 Finalt BudgetDocument182 pagesOndo East 2022 Finalt Budgetojo bamideleNo ratings yet

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Document19 pagesNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNo ratings yet

- End Game: VariableDocument18 pagesEnd Game: VariableArun KumarNo ratings yet

- Rockwell Land CorporationDocument15 pagesRockwell Land CorporationaravillarinoNo ratings yet

- Variable How It Is MeasuredDocument11 pagesVariable How It Is MeasuredJosé Manuel EstebanNo ratings yet

- Delta State Approved 2019 BudgetDocument122 pagesDelta State Approved 2019 BudgetGeorge AniborNo ratings yet

- NBDocument6 pagesNBVijay S PatilNo ratings yet

- Q4 2020 Revenue PerformanceDocument11 pagesQ4 2020 Revenue PerformanceVoiture GermanNo ratings yet

- Note 1 - Agency ProfileDocument9 pagesNote 1 - Agency Profilerhonnah Mie BeltranNo ratings yet

- BDO-Roxas-Cruz-Tagle ABI 2018 Year-End Report - FinalDocument28 pagesBDO-Roxas-Cruz-Tagle ABI 2018 Year-End Report - FinalAnonymous gV9BmXXHNo ratings yet

- Budget 2012-2013Document43 pagesBudget 2012-2013Cruz Crasborn FernandoNo ratings yet

- Sapm Stock AnalysisDocument23 pagesSapm Stock AnalysisAthira K. ANo ratings yet

- Asian CorporationDocument10 pagesAsian CorporationpriyankaNo ratings yet

- Financial AccountingDocument18 pagesFinancial AccountingBhargavi RathodNo ratings yet

- FM Group 03Document25 pagesFM Group 03Mohammad IslamNo ratings yet

- V!s!t!l!ty Statement of Financial Performance Table 1Document15 pagesV!s!t!l!ty Statement of Financial Performance Table 1Carl Toks Bien InocetoNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Surviving the Aftermath of Covid-19:How Business Can Survive in the New EraFrom EverandSurviving the Aftermath of Covid-19:How Business Can Survive in the New EraNo ratings yet

- US Equity TechnicalsDocument2 pagesUS Equity TechnicalsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument14 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Fiscal Cliff ContingenciesDocument34 pagesFiscal Cliff ContingenciesnickbuchNo ratings yet

- Fiscal Cliff ContingenciesDocument34 pagesFiscal Cliff ContingenciesnickbuchNo ratings yet

- Fiscal Cliff ContingenciesDocument34 pagesFiscal Cliff ContingenciesnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument14 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument14 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument11 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument14 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument13 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument11 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument11 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument11 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument11 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument11 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Introductory DerivativesDocument2 pagesIntroductory DerivativesnickbuchNo ratings yet

- Boom-and-Bust: Evolution of MarketsDocument10 pagesBoom-and-Bust: Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument7 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument11 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom and Bust-Evolution of MarketsDocument8 pagesBoom and Bust-Evolution of MarketsnickbuchNo ratings yet

- Boom-and-Bust: Evolution of MarketsDocument10 pagesBoom-and-Bust: Evolution of MarketsnickbuchNo ratings yet

- Luxury Goods PitchDocument3 pagesLuxury Goods PitchnickbuchNo ratings yet

- Nicholas Bucheleres & Matthew BinderDocument25 pagesNicholas Bucheleres & Matthew BindernickbuchNo ratings yet

- Intra - Day Chart of Coach ($COH), Tiffany ($TIF), Gold & Silver ($XAU), and The Three US IndicesDocument1 pageIntra - Day Chart of Coach ($COH), Tiffany ($TIF), Gold & Silver ($XAU), and The Three US IndicesnickbuchNo ratings yet

- Luxury Goods PitchDocument3 pagesLuxury Goods PitchnickbuchNo ratings yet

- EWMA CalculationDocument1 pageEWMA CalculationnickbuchNo ratings yet

- EWMA CalculationDocument1 pageEWMA CalculationnickbuchNo ratings yet

- EWMA CalculationDocument1 pageEWMA CalculationnickbuchNo ratings yet