Professional Documents

Culture Documents

Lesson 34: Issue Management: Issue Related Activities and Sebi Guidelines

Lesson 34: Issue Management: Issue Related Activities and Sebi Guidelines

Uploaded by

Mahesh SuriCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Giovanni Arrighi-The Long Twentieth Century - Money, Power and The Origins of Our Time-Verso Books (2009)Document432 pagesGiovanni Arrighi-The Long Twentieth Century - Money, Power and The Origins of Our Time-Verso Books (2009)Georgette Issa100% (5)

- Sun Bio DSC LetterDocument1 pageSun Bio DSC LetterArun KumarNo ratings yet

- Taxation - Real EstateDocument9 pagesTaxation - Real EstateArun KumarNo ratings yet

- Barber Shop ProjectDocument2 pagesBarber Shop ProjectArun KumarNo ratings yet

- Loan Amortization ScheduleDocument28 pagesLoan Amortization ScheduleArun KumarNo ratings yet

- WatchData ProxKey Brochure PDFDocument2 pagesWatchData ProxKey Brochure PDFArun KumarNo ratings yet

- FEDEX AgreementDocument12 pagesFEDEX AgreementArun KumarNo ratings yet

- Rental AgreementDocument3 pagesRental AgreementArun KumarNo ratings yet

- Packaged Drinking WaterDocument1 pagePackaged Drinking WaterArun KumarNo ratings yet

- Issue by Book BuildingDocument21 pagesIssue by Book BuildingArun KumarNo ratings yet

- Hard Disk PartitionDocument6 pagesHard Disk PartitionArun KumarNo ratings yet

- Chapter 10 - An Overview of Inter Corporate Loans, Investments, Guarantees and Security, Related Party Transactions Company LawDocument3 pagesChapter 10 - An Overview of Inter Corporate Loans, Investments, Guarantees and Security, Related Party Transactions Company Lawanubhaw sinhaNo ratings yet

- Philip Marmina CVDocument3 pagesPhilip Marmina CVPhilipMarminaNo ratings yet

- Executive Program in Applied Finance Batch 07: IIM CalcuttaDocument31 pagesExecutive Program in Applied Finance Batch 07: IIM CalcuttahussainkapdaNo ratings yet

- Normative Analyses of Investment Incentive in EthiopiaDocument6 pagesNormative Analyses of Investment Incentive in EthiopiaBelay MekuanintNo ratings yet

- TDS NotificationDocument24 pagesTDS NotificationSeemaNaikNo ratings yet

- Guna Fiber LTDDocument5 pagesGuna Fiber LTDKshitishNo ratings yet

- Madagascar - Integrated Growth Poles Project (World Bank - 2005)Document149 pagesMadagascar - Integrated Growth Poles Project (World Bank - 2005)HayZara MadagascarNo ratings yet

- May BankDocument19 pagesMay BankNazihah LiyanaNo ratings yet

- Consumer FinanceDocument18 pagesConsumer FinanceRavneet Kaur100% (1)

- 9706 Accounts Nov 08 p4Document8 pages9706 Accounts Nov 08 p4hiraashrafNo ratings yet

- Tata Tea WebsiteDocument59 pagesTata Tea WebsiteVikram KoradeNo ratings yet

- S-Corp 1120S Tax Filing Checklist - 2014Document3 pagesS-Corp 1120S Tax Filing Checklist - 2014Anonymous ruUxJt7lxNo ratings yet

- GK and Current Affairs - Finance - Minakshi TodiDocument5 pagesGK and Current Affairs - Finance - Minakshi TodiMinakshiNo ratings yet

- Home Loans Project ReportDocument105 pagesHome Loans Project Reportkaushal2442No ratings yet

- Capital Structure AnalysisDocument63 pagesCapital Structure AnalysisSameer HussainNo ratings yet

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 ReDocument13 pagesTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 Recrees25No ratings yet

- 4 Financial ManagementDocument5 pages4 Financial ManagementBizness Zenius Hant100% (1)

- Essay Writing 2Document5 pagesEssay Writing 2Khyati DhabaliaNo ratings yet

- Assignent 1 BF NewDocument19 pagesAssignent 1 BF NewDessiree ChenNo ratings yet

- Hufschmid, Eric - Painful QuestionsDocument14 pagesHufschmid, Eric - Painful QuestionsRicardo100% (1)

- Case StudyDocument14 pagesCase StudyPradnya Salve100% (1)

- Ap A1Document23 pagesAp A1Liên ĐỗNo ratings yet

- AFSIC Marketing Brochure 2023Document17 pagesAFSIC Marketing Brochure 2023Memory Shonge RutsitoNo ratings yet

- Statistical Foundations and Dealing With Data: Introductory Econometrics For Finance' © Chris Brooks 2019 1Document54 pagesStatistical Foundations and Dealing With Data: Introductory Econometrics For Finance' © Chris Brooks 2019 1nuttawatvNo ratings yet

- GHL INDIA - BrochureDocument12 pagesGHL INDIA - BrochureVIKRAM BHATINo ratings yet

- CFA Level III Mock Exam 4 - Questions (PM)Document34 pagesCFA Level III Mock Exam 4 - Questions (PM)Munkhbaatar SanjaasurenNo ratings yet

- The Global CityDocument5 pagesThe Global CityLeona AngelaNo ratings yet

- THHE Unit Reactivates PETRONAS LicenceDocument2 pagesTHHE Unit Reactivates PETRONAS Licencekamarularifin_azmanNo ratings yet

- COMESA Investment OpportunitiesDocument398 pagesCOMESA Investment OpportunitiesAhmed KorraNo ratings yet

Lesson 34: Issue Management: Issue Related Activities and Sebi Guidelines

Lesson 34: Issue Management: Issue Related Activities and Sebi Guidelines

Uploaded by

Mahesh SuriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 34: Issue Management: Issue Related Activities and Sebi Guidelines

Lesson 34: Issue Management: Issue Related Activities and Sebi Guidelines

Uploaded by

Mahesh SuriCopyright:

Available Formats

LESSON 34: ISSUE MANAGEMENT: ISSUE RELATED ACTIVITIES AND SEBI GUIDELINES

Lesson Objectives

UNIT IV FEE-BASED FINANCIAL SERVICES

To understand the process of issue management and SEBI guidelines related to issue management activity.

Introduction

Issue management, now days, is one of the very important fee based services provided by the financial institutions. In recent past various companies have entered into issue management activities. Still there are very few large scale and specialized issue management agencies in the country. With the growth of stock market and opening up of economy, the scope for issue management activity is widening day by day. To protect the investors interest and for orderly growth and development of market, SEBI has put in place guidelines as ground rules relating to new issue management activities. These guidelines are in addition to the company law requirements in relation to issues of capital / securities. Financial instruments can be classified into two main groups share capital and debt capital. There are various other classifications in each of the two categories. Also, there are various types of companys i.e. listed, unlisted, public, private etc. For each of them SEBI has issued comprehensive guidelines, related to issue of financial instruments. Let us discuss all these issue management activities in detail, one by one.

date if it has in three out of preceding five years (a) a pre issue net worth of Rs. 1 crore (b) a track record of distributable profit in terms of Sec. 205 of the Companies Act. The size of the issue should not exceed five times of the pre-issue net worth as per last available audited accounts either at the time of filing of offer or at the time of opening of issue. There are separate norms for companies in the information technology sector and partnership firms converted into companies or companies formed out of a division on an existing company. If the unlisted company does not comply with the aforesaid requirement of minimum pre-issue net worth and track record of distributable profits or its proposed size exceeds five times its pre-issue net worth, it can issue shares / convertible security only through book building process on the condition that 60% of the issue size would be allotted to qualified institutional buyers (QIB) failing which the full subscription should be refunded. Public issue by listed companies: All listed companies are eligible to make a public issue of equity shares/ convertible securities if the issue size does not exceed five times its preissue net worth as per the last available audited accounts at the time of either filing of documents with SEBI or opening of the issue. A listed company which does not satisfy this condition would be eligible to make issue only through book building process on the condition that 60% of the issue size would be allotted to QIBs, failing which full subscription money would be refunded. Exemption: The eligibility norms specified above are not applicable in the following cases:

MANAGEMENT OF FINANCIAL SERVICES

Eligibility Norms

To make an issue, the company must fulfill the eligibility norms specified by SEBI and Companies Act. The companies issuing securities through an offer document, that is (a) prospectus in case of public issue or offer for sale and (b) letter of offer in case of right issue, should satisfy the eligibility norms as specified by SEBI, below: Filing of Offer Document: In the case of a public issue of securities, as well as any issue of security, by a listed company through rights issue in excess of Rs. 50 lakh, a draft prospectus should be filed with SEBI through an eligible registered merchant banker at least 21 days prior to filing it with ROC. Companies prohibited by SEBI, under any order/direction, from accessing the capital market cannot issue any security. The companies intending to issue securities to public should apply for listing them in recognized stock exchange(s). Also, all the issuing companies must (a) enter into an agreement with a depository registered with SEBI for dematerialization of securities already issued / proposed to be issued and (b) give an option to subscribers / shareholder / investors to receive security certificates or hold securities in a dematerialized form with a depository. Public issue / Offer for sale by Unlisted Companies: An unlisted company can make a public issue / offer for sale of equity shares / security convertible into equity shares on a late

Private sector banks Infrastructure companies, wholly engaged in the business of developing, maintaining and operating infrastructure facility within the meaning of Sec. 10(23-G) of the Income Tax Act (a) whose project has been appraised by a public financial institution / IDFC/ILFS and (b) not less than 5% of the project cost has been financed by any of the appraising institutions jointly / severally by way of loan / subscription to equity or combination of both and Rights issue by a listed company.

Credit Rating for Debt Instruments: A debt instrument means an instrument / security which creates / acknowledges indebtedness and includes debentures, bonds and such other securities of a company whether constituting charge on its assets or not. For issue, both public and rights, of a debt instrument, including convertibles, credit rating irrespective of the maturity or conversion period is mandatory and should be disclosed. The disclosure should also include the unaccepted credit rating. Two ratings from two different credit rating

250

Copy Right: Rai University

11.671.3

agencies registered with SEBI should be obtained in case of public/rights issue of Rs.100 crore and more. All credit ratings obtained during the three years preceding the public/rights issue for any listed security of the issuing company should also be disclosed in the offer document. Outstanding Warrants / Financial Instruments: An unlisted company is prohibited from making a public issue of shares / convertible securities in case there are any outstanding financial instruments / any other rights entitling the existing promoters / shareholders any option to receive equity share capital after the initial public offering. Partly Paid-up Shares: Before making a public / rights issued of equity shares / convertible securities, all the existing partly paid up shares should be made fully paid up or forfeited if the investor fails to pay call money within 12 months.

13(4) of the Companies Act and in compliance with norms specified by SEBI from time to time. The companies which have already issued shares in the denominations of Rs. 10 or Rs. 100 may change their standard denomination by splitting / consolidating them.

MANAGEMENT OF FINANCIAL SERVICES

Promoters Contribution and Lock-in Requirements

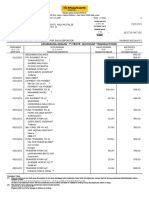

Regulations regarding promoters contribution are discussed as under: Public issue by unlisted companies: The promoters should contribute at least 20% and 50% of the post issue capital in public issue at par and premium respectively. In case the issue size exceeds Rs. 100 crores, their contribution would be computed on the basis of total equity to be issued, including premium at present and in the future, upon conversion of optionally convertible instruments, including warrants. Such contribution may be computed by applying the slab rated mentioned below: Size of Capital Issue (including premium) On first Rs. 100 crores On next Rs. 200 crores On next Rs. 300 crores On balance Percentage of contribution 50 40 30 15

Pricing of Issues

A listed company can freely price shares/convertible securities through a public/ rights issue. An unlisted company eligible to make a public issue and desirous of getting its securities listed on a recognized stock exchange can also freely price shares and convertible securities. The free pricing of equity shares by an infrastructure company is subject to the compliance with disclosure norms as specified by SEBI from time to time. While freely pricing their initial public issue of shares/ convertible, all banks require approval by the RBI. Differential Pricing: Listed/unlisted companies may issue shares/convertible securities to applicants in the firm allotment category at a price different from the price at which the net offer to the public is made, provided the price at which the securities are offered to public. A listed company making a composite issue of capital may issue securities at differential prices in its public and rights issue. In the public issue, which is a part of a composite issue, differential pricing in firm allotment category vis--vis the net offer to the public is also permissible. However, justification for the price differential should be given in the offer document in case of firm allotment category as well as in all composite issues. Price Band: The issuer / issuing company can mention a price band of 20% (cap in the price band should not exceed 20% of the floor price) in the offer document filed with SEBI and the actual price can be determined at a later date before filing it with the ROC. If the BOD of the issuing company has been authorized to determine the offer price within a specified price band, a resolution would have to be passed by them to determine such a price. The lead merchant banker should ensure that in case of listed companies, a 48 hours notice of the meeting of BOD for passing the resolution for determination of price is given to the regional stock exchange. The final offer document should contain only one price and one set of financial projections, if applicable. Payment of Discount / Commissions: Any direct or indirect payment in the nature of discount / commission / allowance or otherwise cannot be made by the issuer company / promoter to any firm allottee in a public issue. Denomination of Shares: Public / rights issue of equity shares can be made in any denomination in accordance with Sec.

11.671.3

While computing the extent of contribution, the amount against the last slab should be so adjusted that on an average the promoters contribution is not less than 20% of post issue capital after conversion. Offer for sale by unlisted companies: The promoters shareholding, after offer for sale, should at least 20% of the post issue capital. Public issue by listed companies: The participation of the promoters should either be (i) to the extent of 20% of the proposed issue or (ii) to ensure shareholding to the extent of 20% of the post-issue capital. Composite issue by Listed Companies: At the option of the promoters, the contribution would be either 20% of the proposed public issue or 20% of the post-issue capital, excluding rights issue component of the composite issue. Public Issue by unlisted infrastructure companies at premium: The promoters contribution, including contribution by equipment suppliers and other strategic investors, should be at least 50% of the post-issue capital at the same or a price higher than the one at which the securities are being offered to public. Securities Ineligible for computation of promoters contribution: The securities specified below acquired by / allotted to promoters would not be considered for computation of promoters contribution:

Where before filing the offer document with SEBI, equity shares were acquired during the preceding three years (a) for consideration other than cash and revaluation of assets / capitalization of intangible assets is involved in such transactions and (b) from a bonus issue out of revaluation reserves or reserves without accrual of cash revenues;

251

Copy Right: Rai University

In the case of a public issue by unlisted companies, securities issued to promoters during the preceding one year at a price lower than the price at which equity is offered to the public. The shares allotted to promoters during the previous year out of funds brought in during that period in respect of companies formed by conversion of partnership firms where the partners of the firm and the promoters of the converted company are the same and there is no change in management unless such shares have been issued at the same price at which the public offer is made. However, if partners capital existed in the firm for a period exceeding one year on a continuous basis, the shares allotted to promoters against such capital would be eligible. The ineligible shares specified in the above three categories would, be eligible for computation of promoters contribution if they are acquired in pursuance of a scheme of merger/ amalgamation approved by a high court. c.

issue capital, the excess contribution would attract pricing guidelines on preferential issues if the issue price is lower than the price as determined on the basis of the guidelines on preferential issue. b. Where no identifiable promoter / promoter group exists. Rights issue. Lock-in requirements of Promoters contribution: Promoters contribution is subject to a lock-in period as detailed below: Lock-n of Minimum Required Contribution: In case of any (all) issues of capital to the public, the minimum promoters contribution would be locked in for a period of three years. The lock-in period would start from the date of allotment in the proposed issue and the last date of the lock-in period would be reckoned as three years from the date of commencement of commercial production or the date of allotment in the public issue, or whichever is later. Lock-in excess promoters contribution: In the case of public issue by an unlisted company, excess promoters contribution would be locked in for a period of one year. The excess contribution in a public issue by a listed company would also be locked in for a period of one year as per the lock-in provisions. Securities issued last to be locked in first: The securities, forming part of the promoters contribution issued last to them, would be locked in first for the specified period. However, if securities were issued last to financial institutions as promoters, these would not be locked in before the shares allotted to other promoters. Lock-in of Pre-issue share capital of an unlisted company: The entire pre-issue share capital, other than locked in as promoters contribution, would be locked-in for one year from the date of commencement of commercial production or the date of allotment in the public offer whichever is later. Lock-in of securities issued on firm allotment basis: Securities issued on firm allotment basis would be locked in for one year from the date of commencement of commercial production, or date of allotment in public issue, whichever is later. Other requirements in respect of Lock-in: The other requirements relating to the lock-in of promoters contribution is discussed hereunder: Pledge of securities: Locked-in securities held by the promoters may be pledged only with banks/financial institutions, as collateral security for loans granted by them provided the pledge of shares is one the terms of the sanction of the loan. Inter-se transfer of Securities: Transfer of locked in securities amongst promoters as named in the offer document can be made subject to lock-in being applicable to the transferees for the remaining lock-in period. Inscription of Non-transferability: The securities, which are subject to a lock-in period, should carry inscription nontransferable, along with duration of specified non-transferable period mentioned in the face of the security certificate.

MANAGEMENT OF FINANCIAL SERVICES

Securities of any private placement made by solicitation of subscription from unrelated persons either directly or through an intermediary; and Securities for which a specific written consent has not been obtained from the respective shareholders for inclusion of their subscription in the minimum promoters contribution.

Issue of convertible security: In the case of issue of convertible security, promoters have an option to bring in their subscription by way of equity or subscription to the convertible security being offered so that their total contribution would not be less than the required minimum in cases of (a) par/ premium issue by unlisted companies (b) offer for sale, (c) issues/ composite issue by listed companies and (d) public issue at premium by infrastructure companies. Promoters Participation in Excess of Required Minimum: In a listed company participation by promoters in excess of the required minimum percentage in public/ composite issues would be subject to pricing of preferential allotment, if the issue price is lower than the price as determined on the basis of preferential allotment pricing. Promoters contribution before public issue: Promoters should bring in the full amount of their contribution, including premium, at least one day before the public issue opens/ issue opening date which would be kept in an escrow account with a bank and would be released to the company along with the public issue proceed. Exemption from Requirement of Promoters Contribution: The requirement of promoters contribution is not applicable in the following three cases, although in all the cases, the shareholders should disclose in the offer document their existing shareholding and the extent to which they are participating in the proposed issue: a. Public issue by a company listed on a stock exchange for at least three years and having a track record of dividend payment for at least three immediately preceding years. However, if the promoters participate in the proposed issue to the extent greater than higher of the two options available, namely, 20% of the issue or 20% of the post252

Issue Advertisement

The term advertisement is defined to include notices, brochures, pamphlets, circulars, show cards, catalogues, placards, posters,

11.671.3

Copy Right: Rai University

insertions in newspapers, pictures, films, cover pages of offer documents or any other print medium, radio, television programs through any electronic media. The lead merchant banker should ensure compliance with the guidelines on issue advertisement by the issuing companies.

comply with the requirements of SEBI in this regard. These are discussed here. 75% Book Building Process: The option of book-building is available to all body corporate which are eligible to make an issue of capital to the public as an alternative to and to the extent of the percentage of the issue, which can be reserved for firm allotment. The issuer company can either reserve the securities for firm allotment or issue them through bookbuilding process. The issue of securities though book-building route should be separately identified/indicated as placement portion category in the prospectus. The securities available to the public should be separately identified as net offer to the public. The requirement of minimum 25% of the securities to be offered to the public is also applicable. Underwriting is mandatory to the extent of the net offer to the public. The draft prospectus containing all the details except the price at which the securities are offered should be filed with SEBI. The issuer company should nominate one of the lead merchant bankers to the issue as book runner, and his name should be mentioned in the prospectus. The copy of the draft prospectus, filed with SEBI, should be circulated by the book runner to the institutional buyers, who are eligible for firm allotment, and to the intermediaries, eligible to act as underwriters inviting offers for subscription to the securities. 100% Book Building Process: In an issue of securities to the public through a prospectus, the option for 100% book building is available to any issuer company. The issue of capital should be Rs. 25 crore and above. Reservation for firm allotment to the extent of the percentage specified in the relevant SEBI guidelines can be made only to promoters, permanent employees of the issuer company and in the case of new company to the permanent employees of the promoting company. It can also be made to shareholders of the promoting companies, in the case of new company and shareholders of group companies in the case of existing company either on a competitive basis or on a firm allotment basis. The issuer company should appoint eligible merchant bankers as book runner(s) and their names should be mentioned in the draft prospectus. The lead merchant banker should act as the lead book runner and the other eligible merchant bankers are termed as co-book runner. The issuer company should compulsorily offer an additional 10% of the issue size offered to the public through the prospectus.

MANAGEMENT OF FINANCIAL SERVICES

Issue of Debt Instruments

A company offering convertible/non-convertible debt instruments through an offer document should, in addition to the other relevant provisions of these guidelines, complies with the following provisions: Requirement of credit rating: A public or rights issue of debt instruments (including convertible instruments) in respect of their maturity or conversion period can be made only if the credit rating has been obtained and disclosed in the offer document. For all issues greater than or equal to Rs.100 crore, two ratings from two different credit rating agencies should be obtained. Requirements in Respect of Debenture Trustees: In the case of issue of debentures with maturity of more than 18 months, the issuer should appoint debenture trustees whose name must be stated in the offer document. The issuer company in favor of the debenture trustees should execute a trust deed within six months of the closure of the issue. Creation of Debenture Redemption Reserves (DRR): A company has to create DRR in the case of the issue of debentures with maturity of more than 18 months. Distribution of Dividends: In the case of new companies, distribution of dividends would require the approval of the trustees to the issue and the lead institution, if any. In case of existing companies, prior permission of the lead institution for declaring dividend, exceeding 20% as per the loan covenants, is necessary if the company does not comply with institutional condition regarding interest and debt service coverage ratio. Redemption: The issuer company should redeem the debentures as per the offer documents. Disclosure and Creation of Charge: The offer document should specifically state the assets on which the security would be created as also the ranking of the charge(s). In the case of second/residual charge or subordinated obligation, the risks associated with should clearly be stated. Filing of Letter of Option: A letter of option containing disclosures with regards to credit rating, debentures holders resolution, option for conversion, justification for conversion price and such other terms which SEBI may prescribe from time to time should be filed with SEBI through an eligible merchant banker, in case of a roll over of non-convertible portions of PCD/NCDs, etc.

IPO Through Stock Exchange On-line System (E-IPO)

In addition to other requirements for public issue as given in SEBI guidelines wherever applicable, a company proposing to issue capital to public through the on-line system of the stock exchange for offer of securities has to comply with the additional requirements in this regard. They are applicable to the fixed price issue as well as for the fixed price portion of the book-built issues. The issuing company would have the option to issue securities to public either through the on-line system of the stock-exchange or through the existing banking channel. For E-IPO the company should enter into agreement with the stock-exchange(s) and the stock-exchange would appoint SEBI registered stockbrokers of the stock exchange to accept applica-

Book Building

Book-building means a process by which a demand for the securities proposed to be issued by a body corporate is elicited and built up and the price for such securities is assessed for the determination of the quantum of such securities to be issued by means of notice/ circular / advertisement/ document or information memoranda or offer document. A company proposing to issue capital through book-building has to

11.671.3

Copy Right: Rai University

253

tions. The brokers and other intermediaries are required to maintain records of (a) orders received, (b) applications received, (c) details of allocation and allotment, (d) details of margin collected and refunded and (e) details of refund of application money.

either through conversion or otherwise, the currency of the instruments cannot exceed beyond 18 months from the date of issue of the relevant instruments. Non-transferability of Financial Instruments: The instruments allotted on a preferential basis to the promoters / promoter groups are subject to a lock-in period of three years from the date of allotment. In any case, not more than 20% of the total capital of the company, including the one brought in by way of preferential issue would be subject to a lock-in period of three years from the date of allotment. Currency of Shareholders Resolutions: Any allotment pursuant to any resolution passed at a meeting of shareholders of a company granting consent for preferential issues of any financial instrument, should be completed within a period of three months from the date of passing of the resolution. Certificate from Auditors: In case every issue of shares/ FCDs/PCDs/ or other financial instruments has the conversion option, the statutory auditors of the issuer company should certify that the issue of said instruments is being made in accordance with the requirements contained in these guidelines.

MANAGEMENT OF FINANCIAL SERVICES

Issue of Capital by Designated Financial Institutions

Designated financial institutions (DFI), approaching the capital market for fund though an offer document, have to follow following guidelines. Promoters contributions: There is no requirement of minimum promoters contribution in the case of any issue by DFIs. If any DFI proposes to make a reservation for promoters, such contribution should come only from actual promoters and not from directors, friends, relatives and associates, etc. Reservation for employees: The DFIs may reserve out of the proposed issues for allotment only to their permanent employees, including their MD or any fulltime director. Such reservations should be restricted to Rs. 2000 per employee, subject to five percent of the issue size. The shares allotted under the reserved category are subject to a lock-in for a period of three years. Pricing of the issue: The DFIs, may freely price the issues in consultation with the lead managers, if the DFIs have a three years track record of consistent profitability out of immediately preceding five years, with profit during last two years prior to the issue.

OTCEI Issues

A company making an initial public offer of equity shares / convertible securities and proposing to list them on the Over The Counter Exchange of India (OTCEI) has to comply with following requirements: Eligibility Norms: Such a company is exempted from the eligibility norms applicable to unlisted companies, provided (i) it is sponsored by a member of the OTCEI and (ii) has appointed at least two market makers. Any offer of sale of equity shares / convertible securities resulting from a bought out deal registered with OTCEI is also exempted from the eligibility norms subject to the fulfillment of the listing criteria laid down by the OTCEI. Pricing norms: Any offer for sale of equity shares or any other convertible security resulting from a bought out deal registered with OTCEI is exempted from the pricing norms specified for unlisted companies, subject to following conditions: (a) The promoters after such issue would retain at least 20% of the total issued capital with a lock-in of three years from the date of the allotment of securities in the proposed issue and (b) at least two market makers are appointed in accordance with the market making guidelines stipulated by the OTCEI. Projection: In case of securities proposed to be listed on the OTCEI, projections based on the appraisal done by the sponsor who undertakes to do market-making activity can be included in the offer document subject to compliance with the other conditions relating to the contents of offer documents.

Preferential Issue

The preferential issue of equity shares/ fully convertible debentures (FCD)/ partly convertible debentures (PCDs) or any other financial instruments, which would be converted into or exchanged with equity shares at a later date by listed companies to any select group of persons under section 81(1A) of the Companies Act, 1956 on a private placement basis, are governed by the following guidelines: Pricing of issue: The issue of shares on a preferential basis can be made at a price not less than the higher of the following: (i) The average of the weekly high and low of the closing prices of the related shares quoted on the stock exchange and (ii) The average of the weekly high and low of the closing prices of the related shares quoted on a stock exchange during the two weeks preceding the relevant date. Pricing of Shares arising out of warrants: Where warrants are issued on a preferential basis with an option to apply for and be allotted shares, the issuer company should determine the price of the resultant shares in accordance with the provisions discussed in the above point. Pricing of shares on Conversion: Where PCDs/FCDs/ other convertible instruments are issued on a preferential basis, providing for the issuer to allot shares at a future date, the issuer should determine the price at which the shares could be allotted in the same manner as specified for pricing of shares allotted in lieu of warrants. Currency of Financial Instruments: In the case of warrants / PCDs / FCDs / or any other financial instruments with a provision for the allotment of equity shares at a future date,

254

Copy Right: Rai University

11.671.3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Giovanni Arrighi-The Long Twentieth Century - Money, Power and The Origins of Our Time-Verso Books (2009)Document432 pagesGiovanni Arrighi-The Long Twentieth Century - Money, Power and The Origins of Our Time-Verso Books (2009)Georgette Issa100% (5)

- Sun Bio DSC LetterDocument1 pageSun Bio DSC LetterArun KumarNo ratings yet

- Taxation - Real EstateDocument9 pagesTaxation - Real EstateArun KumarNo ratings yet

- Barber Shop ProjectDocument2 pagesBarber Shop ProjectArun KumarNo ratings yet

- Loan Amortization ScheduleDocument28 pagesLoan Amortization ScheduleArun KumarNo ratings yet

- WatchData ProxKey Brochure PDFDocument2 pagesWatchData ProxKey Brochure PDFArun KumarNo ratings yet

- FEDEX AgreementDocument12 pagesFEDEX AgreementArun KumarNo ratings yet

- Rental AgreementDocument3 pagesRental AgreementArun KumarNo ratings yet

- Packaged Drinking WaterDocument1 pagePackaged Drinking WaterArun KumarNo ratings yet

- Issue by Book BuildingDocument21 pagesIssue by Book BuildingArun KumarNo ratings yet

- Hard Disk PartitionDocument6 pagesHard Disk PartitionArun KumarNo ratings yet

- Chapter 10 - An Overview of Inter Corporate Loans, Investments, Guarantees and Security, Related Party Transactions Company LawDocument3 pagesChapter 10 - An Overview of Inter Corporate Loans, Investments, Guarantees and Security, Related Party Transactions Company Lawanubhaw sinhaNo ratings yet

- Philip Marmina CVDocument3 pagesPhilip Marmina CVPhilipMarminaNo ratings yet

- Executive Program in Applied Finance Batch 07: IIM CalcuttaDocument31 pagesExecutive Program in Applied Finance Batch 07: IIM CalcuttahussainkapdaNo ratings yet

- Normative Analyses of Investment Incentive in EthiopiaDocument6 pagesNormative Analyses of Investment Incentive in EthiopiaBelay MekuanintNo ratings yet

- TDS NotificationDocument24 pagesTDS NotificationSeemaNaikNo ratings yet

- Guna Fiber LTDDocument5 pagesGuna Fiber LTDKshitishNo ratings yet

- Madagascar - Integrated Growth Poles Project (World Bank - 2005)Document149 pagesMadagascar - Integrated Growth Poles Project (World Bank - 2005)HayZara MadagascarNo ratings yet

- May BankDocument19 pagesMay BankNazihah LiyanaNo ratings yet

- Consumer FinanceDocument18 pagesConsumer FinanceRavneet Kaur100% (1)

- 9706 Accounts Nov 08 p4Document8 pages9706 Accounts Nov 08 p4hiraashrafNo ratings yet

- Tata Tea WebsiteDocument59 pagesTata Tea WebsiteVikram KoradeNo ratings yet

- S-Corp 1120S Tax Filing Checklist - 2014Document3 pagesS-Corp 1120S Tax Filing Checklist - 2014Anonymous ruUxJt7lxNo ratings yet

- GK and Current Affairs - Finance - Minakshi TodiDocument5 pagesGK and Current Affairs - Finance - Minakshi TodiMinakshiNo ratings yet

- Home Loans Project ReportDocument105 pagesHome Loans Project Reportkaushal2442No ratings yet

- Capital Structure AnalysisDocument63 pagesCapital Structure AnalysisSameer HussainNo ratings yet

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 ReDocument13 pagesTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: July 16, 2012 Recrees25No ratings yet

- 4 Financial ManagementDocument5 pages4 Financial ManagementBizness Zenius Hant100% (1)

- Essay Writing 2Document5 pagesEssay Writing 2Khyati DhabaliaNo ratings yet

- Assignent 1 BF NewDocument19 pagesAssignent 1 BF NewDessiree ChenNo ratings yet

- Hufschmid, Eric - Painful QuestionsDocument14 pagesHufschmid, Eric - Painful QuestionsRicardo100% (1)

- Case StudyDocument14 pagesCase StudyPradnya Salve100% (1)

- Ap A1Document23 pagesAp A1Liên ĐỗNo ratings yet

- AFSIC Marketing Brochure 2023Document17 pagesAFSIC Marketing Brochure 2023Memory Shonge RutsitoNo ratings yet

- Statistical Foundations and Dealing With Data: Introductory Econometrics For Finance' © Chris Brooks 2019 1Document54 pagesStatistical Foundations and Dealing With Data: Introductory Econometrics For Finance' © Chris Brooks 2019 1nuttawatvNo ratings yet

- GHL INDIA - BrochureDocument12 pagesGHL INDIA - BrochureVIKRAM BHATINo ratings yet

- CFA Level III Mock Exam 4 - Questions (PM)Document34 pagesCFA Level III Mock Exam 4 - Questions (PM)Munkhbaatar SanjaasurenNo ratings yet

- The Global CityDocument5 pagesThe Global CityLeona AngelaNo ratings yet

- THHE Unit Reactivates PETRONAS LicenceDocument2 pagesTHHE Unit Reactivates PETRONAS Licencekamarularifin_azmanNo ratings yet

- COMESA Investment OpportunitiesDocument398 pagesCOMESA Investment OpportunitiesAhmed KorraNo ratings yet