Professional Documents

Culture Documents

Rent V Buy Custom W-Jim Hamilton PDF

Uploaded by

Jim HamiltonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rent V Buy Custom W-Jim Hamilton PDF

Uploaded by

Jim HamiltonCopyright:

Available Formats

Is now the right time to buy a home?

Are you still paying your landlord's mortgage?.......why not buy and start building your own equity! With mortgage rates setting new all time low's, combined with real estate prices not seen since the mid '90's, right now might be the best time to make the switch from renting to owning!

Below is an example of how renting compares with home ownership, $1750 rent vs $350k purchase:

Amount of Equity gained in 10 years

Your Equity Gained-

$202,758

Amount of rent paid in 10 years

Home Purchase Comparison

Rent Monthly payment Taxes, Ins, etc. Total Payment Tax Benefit Principal Paid $1,750 $30 $1,780 $0 $0 $1,780 Buy $1,604 $740 $2,344 $444 $503 $1,397

Paid to Landlord-

$244,341

Net Monthly Payments

Based on a 120 month analysis

Comparison assumptions: 30 yr fixed FHA loan Purchase Price: $350k, 3.5% down, 3.875% rate, APR 4.125% Down Payment: $12,250, closing costs: $6500 Rental Assumption Increase: 3%/yr Ownership Assumption Appreciation: 2% Tax bracket: 25%

of home purchase

Total Equity Gained Cash Paid to Landlord

$0 $244,341

$202,758 $0

Jeff Marr Senior Mortgage Advisor MLO # 275846 Alpine Mortgage Planning 2281 Lava Ridge Ct Roseville CA 95630 jmarr@alpinemc.com Cell 916-947-1312

Jim Hamilton REALTOR DRE #01871309 Lyon Real Estate 150 Natoma Station Dr, ste 300 Folsom CA 95630 jhamilton@golyon.com Cell: 916-601-0500

Pinnacle Capital Mortgage Corporation NMLS 81395 | WA CL-81395 | ID-MBL-6950 | AZ-BK 910890 | UT-7033397-MLCO | NM-03710 Licensed by the Department of Corporations under the California Residential Mortgage Lending Act. This is not a commitment to lend. Rates, prices, home availability, and guidelines are subject to change without notice. Subject to review of credit and/or collateral. Not all applicants will qualify for financing

You might also like

- Lending PartnersDocument1 pageLending PartnersJim HamiltonNo ratings yet

- Short Sale Listing PresentationDocument14 pagesShort Sale Listing PresentationJim Hamilton100% (1)

- Fiscal Cliff EV Sept 12Document4 pagesFiscal Cliff EV Sept 12Jim HamiltonNo ratings yet

- The 3 8% TaxDocument11 pagesThe 3 8% Taxsanwest60No ratings yet

- DH GroupDocument10 pagesDH GroupJim HamiltonNo ratings yet

- Short Sale Listing PresentationDocument14 pagesShort Sale Listing PresentationJim Hamilton100% (1)

- NAR Housing - Sacramento (October 2012)Document29 pagesNAR Housing - Sacramento (October 2012)Jim HamiltonNo ratings yet

- Vendor ListDocument5 pagesVendor ListJim HamiltonNo ratings yet

- Distressed Homeowner GuideDocument9 pagesDistressed Homeowner GuideJim HamiltonNo ratings yet

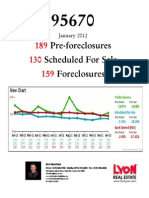

- Foreclosure Stats, FolsomDocument2 pagesForeclosure Stats, FolsomJim HamiltonNo ratings yet

- Foreclosure Stats, 95670Document2 pagesForeclosure Stats, 95670Jim HamiltonNo ratings yet

- Buyers Presentation, Jim Hamilton Real EstateDocument9 pagesBuyers Presentation, Jim Hamilton Real EstateJim HamiltonNo ratings yet

- Vendor ListDocument4 pagesVendor ListJim HamiltonNo ratings yet

- Online Presentation For SellersDocument28 pagesOnline Presentation For SellersJim HamiltonNo ratings yet

- UntitledDocument1 pageUntitledJim HamiltonNo ratings yet

- Jim Hamilton Real Estate, ProfileDocument2 pagesJim Hamilton Real Estate, ProfileJim HamiltonNo ratings yet

- LendersDocument1 pageLendersJim HamiltonNo ratings yet

- Welcome: Jim Hamilton Real EstateDocument28 pagesWelcome: Jim Hamilton Real EstateJim HamiltonNo ratings yet

- Folsom Trends Newsletter January 2012Document2 pagesFolsom Trends Newsletter January 2012Jim HamiltonNo ratings yet

- Folsom Bike Trail MapDocument2 pagesFolsom Bike Trail MapJim HamiltonNo ratings yet

- Hannaford Cross Newsletter Summer 2011Document2 pagesHannaford Cross Newsletter Summer 2011Jim HamiltonNo ratings yet

- Jim Hamilton Real Estate, ProfileDocument2 pagesJim Hamilton Real Estate, ProfileJim HamiltonNo ratings yet

- 10-04-11 Sacto AORDocument118 pages10-04-11 Sacto AORJimHamiltonNo ratings yet

- High School Maps SCUSDDocument1 pageHigh School Maps SCUSDJim HamiltonNo ratings yet

- Elementry Schools Map SCUSDDocument1 pageElementry Schools Map SCUSDJim HamiltonNo ratings yet

- Press Release June 2011, Lyon Real EstateDocument3 pagesPress Release June 2011, Lyon Real EstateJim HamiltonNo ratings yet

- Middle Schools Map SCUSDDocument1 pageMiddle Schools Map SCUSDJim HamiltonNo ratings yet

- EDC Schools and District MAPDocument1 pageEDC Schools and District MAPJim HamiltonNo ratings yet

- Folsom Area School Attendance BoundariesDocument1 pageFolsom Area School Attendance BoundariesJim HamiltonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)