Professional Documents

Culture Documents

Status of Micro Finance 2009-10 Eng

Status of Micro Finance 2009-10 Eng

Uploaded by

Asim WaghuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Status of Micro Finance 2009-10 Eng

Status of Micro Finance 2009-10 Eng

Uploaded by

Asim WaghuCopyright:

Available Formats

Status of Micro Finance in India 2009-2010

Yeejle ceW met#ce efJee keer efmLeefle - 2009-10

Status of Micro Finance in India 2009-10

veeyee[&

NABARD

Commited to Rural Prosperity

Head Office: C-24, G Block, Bandra-Kurla Complex, Bandra (E), Mumbai 400 051 - INDIA

Tel.: +91 222653 0084 / Fax: +91 22 2652 8141

www.nabard.org e-mail: mcid@nabard.org

Status of Micro Finance in India 2009-2010

Status of Micro Finance in India 2009-2010

Preface

The Self Help Group (SHG)-Bank Linkage Programme, in the past eighteen years, has become

a well known tool for bankers, developmental agencies and even for corporate houses. SHGs,

in many ways, have gone beyond the means of delivering the financial services as a channel

and turned out to be focal point for purveying various services to the poor. The programme, over

a period, has become the common vehicle in the development process, converging important

development programmes. With the small beginning as Pilot Programme launched by NABARD

by linking 255 SHGs with banks in 1992, the programme has reached to linking of 69.5 lakh

saving-linked SHGs and 48.5 lakh credit-linked SHGs and thus about 9.7 crore households are

covered under the programme, envisaging synthesis of formal financial system and informal

sector.

In view of the large outreach and pre-dominant position of the microFinance programme, it is

important to keep a continuous track of the status, progress, trends, qualitative and quantitative

performance comprehensively. To achieve this objective, Reserve Bank of India and NABARD

issued guidelines in the year 2006-07 to Commercial Banks, Regional Rural Banks and

Cooperative Banks to furnish data on progress under microFinance. The data so collected

covers various parameters like savings of SHGs with banks, bank loan disbursed to SHGs, bank

loan outstanding against SHGs, gross non performing assets of bank loans to SHGs, recovery

performance of loans to SHGs. Further, the banks also furnished the data regarding bank loans

provided to Micro Finance Institutions (MFIs). NABARD, has been bringing out the consolidated

document annually.

This booklet presents the consolidated data obtained from the banks along with preliminary

analysis of the various trends and progress under microfinance sector under the two models viz.,

SHG Bank Linkage model and MFI Bank Linkage model. The data furnished by the banks

have been analysed on a region-wise, state-wise, agency-wise, bank-wise and also for SHGs

exclusively under Swarnajayanti Gram Swarojgar Yojana and exclusive women SHGs data in the

booklet.

The trend in submitting the Management Information System by banks has shown improvement.

This year all 27 Public Sector Commercial Banks, 19 private sector Commercial Banks, 81

Regional Rural Banks and 318 Co-operative Banks have submitted the MIS. We thank all the

banks for furnishing the data and expected that in the coming years all the remaining banks will

co-operate in timely and accurate submission of data to us.

The major support provided by NABARD under Micro Finance Development and Equity Fund

relates to promotion and nurturing of SHGs by Self Help Promoting Institutions and training and

capacity building of the stakeholders in the Sector. NABARD is also experimenting innovative

projects for further developing the microFinance through Joint Liability Groups. The details in this

regard are also included in this booklet.

We hope that all the stakeholders under microfinance sector would use the information as

input and feedback relating to the sector for bringing about policy changes and improvement

in operational strategies. More analysis than what is given in the book is expected from all the

microfinance players. NABARD would welcome suggestions and comments on this booklet for

making it more informative and useful at all levels in microfinance sector.

Status of Micro Finance in India 2009-2010

Status of Micro Finance in India 2009-2010

Contents

PARtiCulARs

Highlights SHG Bank Linkage Programme 2009-10

Micro Finance in India

statement No.

I

I

I

I

I

-A

-B

-C

-D

-E

II - A

II - B

II - C

II - D

III - A (i)

III - A (ii)

III - B

III - C

IV - A (i)

IV - A (ii)

IV - B

IV - C

V - A (i)

V - A (ii)

V-B

VI - A (i)

VI - A (ii)

VI - B

VI - C

VII

VIII

IX - A

IX - B

IX - C

IX - D

IX - E

X-A

X-B

X-C

XI - A

XI - B

XI - C

Page No.

i-ii

iii-xxii

statements

Savings of SHGs with Banks Agency-wise position as on 31 March 2010

Bank loans disbursed to SHGs Agency-wise loans disbursed during 2009-10

Bank loans outstanding against SHGs Agency-wise position as on 31 March 2010

Non Performing Assets of Banks against SHGs Agency-wise position as on 31 March 2010

Agency wise Bank Loans provided to MFIs during 2009-10 and loans outstanding

as on 31 March 2010

Savings of SHGs with Banks Region-wise / State-wise / Agency-wise position as on

31 March 2010

Bank Loans disbursed during the year Region-wise / State-wise / Agency-wise Loans

disbursed during 2009 - 2010

Bank Loans Outstanding against SHGs Region-wise / State-wise / Agency-wise Loans

Oustanding as on 31 March 2010

Non Performing Assets (NPAs) against Bank loans to SHGs Region-wise / State-wise /

Agency-wise position of NPAs as on 31 March 2010

Savings of SHGs with Public Sector Commercial Banks as on 31 March 2010

Savings of SHGs with Private Sector Commercial Banks as on 31 March 2010

Savings of SHGs with Regional Rural Banks as on 31 March 2010

Savings of SHGs with Co-operative Banks as on 31 March 2010

Bank loans disbursed by Public Sector Commercial Banks to SHGs during 2009-10

Bank loans disbursed by Private Sector Commercial Banks to SHGs during 2009-10

Bank loans disbursed by Regional Rural Banks to SHGs during 2009-10

Bank loans disbursed by Co-operative Banks to SHGs during 2009-10

Bank Loans outstanding against SHGs as on 31 March 2010 Public Sector

Commercial Banks

Bank Loans outstanding against SHGs as on 31 March 2010 Private Sector

Commercial Banks

Bank Loans outstanding against SHGs as on 31 March 2010 Regional Rural Banks

NPAs against Bank loans to SHGs and Recovery Performance of Public Sector

Commercial Banks as on 31 March 2010

NPAs against Bank loans to SHGs and Recovery Performance of Private Sector

Commercial Banks as on 31 March 2010

NPAs against Bank loans to SHGs and Recovery Performance of Regional Rural Banks

as on 31 March 2010

NPAs against Bank loans to SHGs and Recovery Performance of Co-operative Banks

as on 31 March 2010

Bank Loans provided to MFIs and their Non Performing Assets (NPAs) and

Recovery Performance 2009-10

NABARD Support for Training and Capacity Buliding under Microfinance Sector 2009-10

Support to NGOs functioning as SHPIs

Support to RRBs functioning as SHPI

Support to Co-operative Banks Functioning as SHPI

Support to IRVs for Promoting SHGs

Support to Farmers Clubs Functioning as SHPI

Agencies having outstanding Revolving Fund Assistance as on 31 March 2010

Agencies having outstanding Capital Support as on 31 March 2010

MFIs assisted with grant support for rating during the year 2009-2010

Special focus on the Resource Poor Regions Savings Linked SHGs in the 13 Priority States

Special focus on the Resource Poor Regions Loans Disbursed to SHGs in the 13 Priority States

Special focus on the Resource Poor Regions Loans Outstanding against SHGs in the 13 Priority States

1

1

1

2

2

3

4

5

6

7

20

23

27

36

49

51

55

63

76

79

90

102

104

108

117

118

120

169

175

179

182

183

184

185

186

187

188

Status of Micro Finance in India 2009-2010

Status of Micro Finance in India 2009-2010

SHG Bank Linkage Programme 2009-10

Highlights

Physical

Total number of SHGs savings linked with banks

69.53 lakh

Out of total [of which] exclusive Women SHGs

53.10 lakh

Out of total [of which] -SGSY SHGs

16.94 lakh

Total number of SHGs credit linked during 2009-10

15.87 lakh

Out of total [of which] exclusive Women SHGs credit linked

12.94 lakh

Out of total [of which]-SGSY SHGs credit linked

2.67 lakh

Total number of SHGs having loans outstanding as on

31 March 2010

48.51 lakh

Of which exclusive Women SHGs

38.98 lakh

Of which-SGSY SHGs

12.45 lakh

Estimated number of of families covered upto 31 March 2010

97 million

Financial

Total savings amount of SHGs with banks as on 31 March 2010

` 6198.71 crore

Out of total savings of exclusive Women SHGs

` 4498.66 crore

Out of total savings of SGSY SHGs

` 1292.62 crore

Total amount of loans disbursed to SHGs during 2009-10

` 14453.30 crore

Out of total loans disbursed to Women SHGs

` 12429.37 crore

Out of total loans disbursed to SGSY SHGs

` 2198.00 crore

Total amount of loans outstanding against SHGs

as on 31 March 2010

` 28038.28 crore

Out of total loans o/s against Women SHGs

` 23030.36 crore

Out of total loans o/s against SGSY SHGs

` 6251.08 crore

Average loan amount outstanding per SHG as on March 2010

` 57795

Average loan amount outstanding per member

as on 31 March 2010

` 4128

Status of Micro Finance in India 2009-2010

Participating banks

total number of banks submitted Mis

Commercial banks [public]

27

Foreign banks + Private banks

19

Regional Rural Banks

81

Cooperative Banks

318

Small Industries Development Bank of India

support from NABARD

Capacity building of partner institutions

Number of programmes conducted during 2009-10

6804

Number of participants covered during 2009-10

2.54 lakh

Cumulative number of participants Trained upto March 2010

24.55 lakh

Grant support during the year 2009-10

` 9.93 crore

Cumulative fund support upto March 2010

` 45.02 crore

Refinance support

Refinance to banks during 2009-10

` 3173.56 crore

Cumulative refinance released upto 31.3.2010

` 12861.65 crore

Revolving Fund Assistance [RFA] to MFis

RFA released to MFIs during the year

` 22.55 crore

Cumulative RFA released to MFIs upto 31 March 2010

Capital Support [CS] to MFIs

` 55.49 crore

CS released to MFIs during the year

` 7.87 crore

Cumulative CS released to MFIs upto 31 March 2010

` 24.86 crore

Grant Assistance to sHPis for Promotion of sHGs

Grant assistance sanctioned during 2009-10

` 28.78 crore

Cumulative sanctions upto 31 March 2010

` 107.66 crore

Grant assistance for Rating of MFIs during 2009-10

` 15.83 lakh

ii

Status of Micro Finance in India 2009-2010

Micro Finance in India

1. introduction

Microfinance sector has traversed a long

journey from micro savings to micro credit and

then to micro enterprises and now entered the

field of micro insurance, micro remittance and

micro pension. This gradual and evolutionary

growth process has given a great opportunity

to the rural poor in India to attain reasonable

economic, social and cultural empowerment,

leading to better living standard and quality

of life for participating households. Financial

institutions in the country continued to play a

leading role in the microfinance programme

for nearly two decades now. They have joined

hands proactively with informal delivery channels to give microfinance sector the necessary

momentum. During the current year too, microfinance has registered an impressive

expansion at the grass root level. This booklet aims to provide a snapshot of the progress in

the microfinance sector.

Since 2006-07, NABARD has been compiling and analysing the data on progress made in

microfinance sector, based on the returns furnished by Commercial Banks (CBs), Regional

Rural Banks (RRBs) and Cooperative Banks operating in the country. The banks operating,

presently, in the formal financial system comprises Public Sector CBs (27), Private Sector

CBs (22), RRBs (82), State Cooperative Banks (31) and District Central Cooperative Banks

(370). Most of the banks participating in the process of microfinance have reported the

progress made under the programme.

The data presented in this booklet covers information relating to savings of Self Help

Groups (SHGs) with banks as on 31 March 2010, loans disbursed by banks to SHGs during

the year 2009-10, loans outstanding of the banking system against the SHGs and the

details of Non-Performing Assets (NPAs) and recovery percentage in respect of bank loans

provided to SHGs as on 31 March 2010. The data have been compiled region-wise, Statewise and agency-wise. The booklet also provides details relating to SHGs coming under

Swarnjayanti Gram Swarojgar Yojna (SGSY) and exclusive women groups. In addition,

the information relating to bulk lending provided by Banks and Financial Institutions to

Micro Finance Institutions (MFIs) for on lending to groups and individuals have also been

provided. Based on these data and information, this booklet attempts an assessment of

progress on varied dimensions of the microfinance sector.

NABARD has been instrumental in facilitating

various activities under microfinance sector,

involving all possible partners at the ground

level in the field. NABARD has been

encouraging voluntary agencies, bankers,

socially spirited individuals, other formal

and informal entities and also government

functionaries to promote and nurture SHGs.

The focus in this direction has been on training

and capacity building of partners, promotional

grant assistance to Self Help Promoting

iii

Status of Micro Finance in India 2009-2010

Institutions (SHPIs), Revolving Fund Assistance (RFA) to MFIs, equity/ capital support to

MFIs to supplement their financial resources and provision of 100 per cent refinance against

bank loans provided by various banks for microfinance activities. Financial support and

promotional efforts of NABARD towards development of the microfinance sector have also

been outlined in this booklet.

2.

Progress under Microfinance - Highlights

2.1 Different Models of Microfinance

In this section, the data for the year 2009-10 alongwith a few preceding years have

been presented and reviewed under two models of microfinance involving credit

linkage with banks :

(i)

SHG - Bank Linkage Model : This

model involves the SHGs financed

directly by the banks viz., CBs (Public

Sector and Private Sector), RRBs and

Cooperative Banks.

(ii)

MFI - Bank Linkage Model : This

model covers financing of Micro

Finance Institutions (MFIs) by banking

agencies for on-lending to SHGs and

other small borrowers.

Milch animals purchased by JLGs / Bagavali PACS.

2.2 status of Micro-finance

The overall progress under these two models is depicted in Table -1:

table : 1- Overall Progress under Micro-finance during the last three years

(` in crore)

Particulars

A.

2007-08

No. of

sHGs

2008-09

% Growth (2008-09)

2009-10

% Growth (2009-10)

Amount

No. of

sHGs

Amount

No. of

sHGs

Amount

No. of

sHGs

Amount

No. of

sHGs

Amount

sHG-Bank linkage Model

Savings

of SHGs

with Bank

as on

31 March

Total

SHGs

Out of

which

SGSY

5009794

3785.39

6121147

5545.62

22.2

46.5

6953250

6198.71

13.6

11.8

1203070

809.51

1505581

1563.38

25.1

93.1

1693910

1292.62

12.5

(17.3)

Bank Loans

disbursed

to SHGs

during

the year

Total

SHGs

Out of

which

SGSY

1227770

8849.26

1609586 12253.51

31.1

38.5

1586822 14453.30

(1.4)

17.9

246649

1857.74

2015.22

7.3

8.5

2198.00

1.0

9.1

Bank Loans

outstanding

with SHGs

as on

31 March

Total

SHGs

Out of

which

SGSY

3625941 16999.91

4224338 22679.84

16.5

33.4

4851356 28038.28

14.8

23.6

6.5

21.7

1245394

27.5

6.6

916978

4816.87

264653

976887

5861.72

267403

6251.08

B.(1) MFi-Bank linkage Model

Particulars

Bank Loans disbursed

to MFIs during the year

Bank Loans outstanding

with MFIs as on

31 March

(` in crore)

2007-08

2008-09

Growth during

2008-09 (%)

2009-10

Growth during

2009-10 (%)

No. of

MFis

Amount

No. of

MFis

Amount

No. of

MFis

Amount

No. of

MFis

Amount

No. of

MFis

Amount

518

1970.15

581

3732.33

12.2%

89.4%

691

8062.74

18.9%

116.0%

1109

2748.84

1915

5009.09

72.7%

82.2%

1513 10147.54

(21%)

102.6%

Note : Actual number of MFIs provided with bank loans would be less as several MFIs could have availed loans from more than one bank.

iv

Status of Micro Finance in India 2009-2010

In addition, to the SHG-Bank linkage model and MFI-Bank linkage model, Small Industries

Development Bank of India (SIDBI) has also supported MFIs. The details for the year 200910 are presented below:

B.(2) MFIs supported by SIDBI

(` in crore)

No. of MFIs

Amount

Loans disbursed to MFIs during 2009-10

88

2665.75

Loans outstanding against MFIs as on 31 March 2010

146

3808.20

2.3 Coverage of Women SHGs

The details of total number of women SHGs saving linked, credit linked and loans

outstanding for the last two years are given in table 2 :

Table : 2 Position of Women SHGs

(` in crore)

Particulars

Year Total SHGs

Saving linked SHGs

Loans disbursed

Loans Outstanding

No.

Amt

Exclusive

% age of women

Women SHGs SHGs to total SHGs

No.

Amt

No

31.03.2009

6121147

5545.62

4863921

4434.03

79.5

Amt.

80.0

31.03.2010

6953250

6198.71

5310436

4498.66

76.4

72.6

2008-09

1609586

12253.51

1374579

10527.38

85.4

85.9

2009-10

86.0

1586822

14453.30

1294476

12429.37

81.6

31.03.2009

4224338

22679.84

3277355

18583.54

77.6

81.9

31.03.2010

4851356

28038.28

3897797

23030.36

80.3

82.1

It may be seen that of the total number of saving linked and credit linked SHGs, exclusive

women SHGs with banks were 76.4 per cent and 81.6 per cent, respectively. Further, the

percentage of loans outstanding of exclusive women SHGs to loans outstanding of total

SHGs which was 81.9 per cent as on 31 March 2009 has increased to 82.1 per cent as on

31 March 2010.

3. SHG - Bank Linkage

This section provides disaggregated picture of the progress achieved under SHG Bank

linkage programme.

v

Status of Micro Finance in India 2009-2010

3.1 savings of sHGs with Banks

As on 31 March 2010, a total of 69.53 lakh SHGs were having saving bank accounts

with the banking sector with outstanding savings of ` 6198.71 crore as against 61.21

lakh SHGs with savings of ` 5545.62 crore as on 31 March 2009, thereby showing a

growth rate of 13.6 per cent and 11.8 per cent, respectively. Thus, more than 97 million

poor households were associated with banking agencies under SHG-Bank Linkage

Programme. As on 31 March 2010, the CBs lead with savings accounts of 40.53 lakh

SHGs (58.3%) with savings amount of ` 3673.89 crore (59.3 %) followed by RRBs

having savings bank accounts of 18.21 lakh SHGs (26.2% ) with savings amount of

` 1299.37 crore (21.0%) and Cooperative Banks having savings bank accounts of

10.79 lakh SHGs (15.5 %) with savings amount of ` 1225.44 crore (19.8%).

The share under SGSY was 16.94 lakh SHGs with savings of ` 1,292.62 crore forming

24.4 per cent of the total SHGs having savings accounts with the banks and 20.8 per

cent of their total savings amount.

The agency-wise savings of SHGs with banks as on 31 March 2009 and 31 March

2010 are given in Table - 3:

table : 3 savings of sHGs with Banks Agency-wise Position

(` in crore)

Agency

Position

as on

total sHGs savings with the banks as on

31 March 2009 / 2010

No. of

sHGs

%

share

Amount

%

share

Per sHG

savings

(Rupees)

Out of total : sHGs

savings with banks

under sGsY

No. of

sHGs

Amount

Commercial Banks

(Public & Private

Sector)

31.03.09

31.03.10

% growth

3549509

4052915

14.2

58.0

58.3

2772.99

3673.89

32.5

50.0

59.3

7812

9065

16.0

931422

1088160

16.8

681.60

831.48

21.9

Regional Rural Banks

31.03.09

31.03.10

% growth

1628588

1820870

11.8

26.6

26.2

1989.75

1299.37

(34.7)

35.9

21.0

12218

7136

(41.6)

433912

462370

6.5

774.55

268.50

(65.3)

Cooperative Banks

31.03.09

31.03.10

% growth

943050

1079465

14.5

15.4

15.5

782.88

1225.44

56.5

14.1

19.8

8302

11352

36.7

140247

143380

2.2

107.24

192.64

79.6

31.03.09

6121147

100.0

5545.62

100.0

9060

1505581

1,563.39

31.03.10

% growth

6953250

13.6

100.0

6198.71

11.8

100.0

8915

(1.6)

1693910

12.5

1292.62

(17.3)

tOtAl

vi

Status of Micro Finance in India 2009-2010

During the year under review, the average savings per SHG with all banks had

marginally decreased from ` 9,060 as on 31 March 2009 to ` 8,915 as on 31 March

2010. The decrease may be due to proper utilization of saving amount by SHGs for

internal lending. It varied from ` 11,352 per SHG with co-operative banks to ` 7,136

per SHG with RRBs.

As on 31 March 2010, the share of women SHGs in the total SHGs with saving bank

accounts was 53.10 lakh SHGs forming 76.4 per cent as compared to the previous

years share of 79.5 per cent. The actual share of women SHGs would be more as all

RRBs from Uttar Pradesh, Gujarat and Jammu & Kashmir and all Co-operative Banks

from Uttar Pradesh, Gujarat, Jammu & Kashmir, Goa, Assam, Nagaland, Tripura,

Mizoram, and Manipur have not reported data for women SHGs. In addition, some of

RRBs viz., Marathwada Gramin Bank from Maharashtra, Assam Gramin Vikas Bank,

Bihar Kshetriya Gramin Bank, Madhya Bihar Gramin Bank, Nainital Almora Kshetriya

Gramin Bank and some of the Central Cooperative Banks have also not reported

women SHGs data.

The State-wise and bank-wise position of savings of SHGs with banks as on 31 March

2010 is indicated at Statement III-A (i) (Public sector CBs), III-A (ii) (Private sector

CBs), III-B (RRBs) and III-C (Cooperative Banks).

3.2 Bank loans Disbursed to sHGs

During 2009-10, banks have financed 15.87 lakh SHGs, including repeat loan to the

existing SHGs, with bank loans of ` 14,453.30 crore as against 16.10 SHGs with bank

loans of ` 12,253.51 crore during 2008-09, registering a decline of 1.4 per cent of

SHGs but a growth of 17.9 per cent in bank loans disbursed. Out of the total loans

disbursed during 2009-10, SHGs financed under SGSY accounted for 2.67 lakh

(16.9%) with bank loan of ` 2198.00 crore (15.2%) as against 2.65 lakh SHGs (16.4%)

with bank loan of ` 2015.22 crore (16.4%) during 2008-09.

The agency-wise details of loans disbursed by banks to SHGs during the years 200809 and 2009-10 are given in Table 4.

table 4 : Bank loans disbursed to sHGs Agency-wise Position

Agency

During the

year

total loans disbursed by Banks to

sHGs during the year

No. of

sHGs

%

share

Amount

%

share

Per sHG

loan

disbursed

(Rupees)

(` in crore)

Out of total : Bank

loan disbursed to

sHGs under sGsY

No. of

sHGs

Amount

Commercial Banks

(Public & Private

Sector)

2008-09

2009-10

% growth

1004587

977521

(2.7)

62.4

61.6

8060.53

9780.18

21.3

65.8

67.7

80237

100050

24.7

133117

157560

18.4

1102.38

1215.50

10.3

Regional Rural Banks

2008-09

2009-10

% growth

405569

376797

(7.1)

25.2

23.7

3193.49

3333.20

4.4

26.1

23.1

78741

88461

12.3

81662

67531

(17.3)

655.27

682.41

4.1

Cooperative Banks

2008-09

2009-10

% growth

199430

232504

16.6

12.4

14.7

999.49

1339.92

34.1

8.2

9.3

50117

57629

15.0

49874

42312

(15.2)

257.57

300.09

16.5

tOtAl

2008-09

2009-10

% growth

1609586

1586822

(1.4)

100.0

100.0

12253.51

14453.30

17.9

100.0

100.0

76128

91083

19.6

264653

267403

1.0

2015.22

2198.00

9.1

It may be observed from Table-4 that as always, CBs led in disbursement of loans to

SHGs during 2009-10 with 61.6 per cent share followed by RRBs with a share of 23.7

per cent and Cooperative Banks with a share of 14.7 per cent.

vii

Status of Micro Finance in India 2009-2010

During 2009-10, average bank loan disbursed per SHG was ` 91,083 as against

` 76,128 during 2008-09. The average loan per SHG ranged from of ` 1,00,050 per

SHG by CBs to ` 57,629 per SHG by Cooperative Banks.

The State-wise and bank-wise position of disbursement of bank loans to SHGs during

the year 2009-10 is indicated at Statement IV-A (i) (Public sector CBs), IV-A (ii) (Private

sector CBs), Statement IV-B (RRBs) and Statement IV-C (Cooperative Banks).

3.3 Bank loans Outstanding against sHGs

As on 31 March 2010, total number of 48.51 lakh SHGs were having outstanding bank

loans of ` 28,038.28 crore as against 42.24 lakh SHGs with bank loans of ` 22,679.85

crore as on 31 March 2009, representing a growth of 14.8 per cent in number of SHGs

and 23.6 per cent in bank loans outstanding against SHGs. The share of SHGs under

SGSY was 12.45 lakh SHGs (25.7%) with outstanding bank loans of ` 6,251.07 crore

(22.3%) as against 9.77 lakh SHGs (23.1%) with outstanding bank loans of ` 5,861.72

crore (25.8%) as on 31 March 2009.

The agency-wise position of outstanding bank loans to SHGs for the years 2008-09

and 2009-10 are given in Table 5.

table 5 : Bank loan outstanding against sHGs Agency-wise Position

(` in crore)

Agency

Position

as on

total Bank loan outstanding

against sHGs

No. of

sHGs

%

share

Amount

%

share

Per sHGbank

loan O/s

(Rupees)

Out of total: Bank loan

outstanding against

sHGs under sGsY

No. of

sHGs

Amount

CBs (Public &

Private Sector)

31.03.2009

31.03.2010

% growth

2831374

3237263

14.3

67.1

66.7

16149.43

20164.71

24.9

71.2

71.9

57,037

62,289

9.2

645145

798304

23.7

3961.53

4072.03

2.7

RRBs

31.03.2009

31.03.2010

% growth

977834

1103980

14.3

23.1

22.8

5224.42

6144.58

17.6

23.0

21.9

53,428

55,658

4.2

258890

368795

42.4

1508.10

1725.94

14.4

Cooperative Banks

31.03.2009

31.03.2010

% growth

415130

510113

22.9

9.8

10.5

1306.00

1728.99

32.4

5.8

6.2

31,460

33,894

7.7

72852

78295

7.5

392.09

453.11

15.6

tOtAl

31.03.2009

31.03.2010

% growth

4224338

4851356

14.8

100.0

100.0

22679.85

28038.28

23.6

100.0

100.0

53,689

57,795

7.6

976887

1245394

27.5

5861.72

6251.07

6.6

viii

Status of Micro Finance in India 2009-2010

It may be observed from Table 5, that following the highest disbursements, CBs also

had the maximum share of 66.7 per cent in outstanding bank loans to SHGs followed

by RRBs with a share of 22.8 per cent and Cooperative Banks with a share of 10.5 per

cent.

The average bank loan outstanding per SHG had increased from ` 53,689 as on 31

March 2009 to ` 57,795 as on 31 March 2010. It varied between ` 62,289 per SHG in

case of CBs and ` 33,894 per SHG in case of Co-operative Banks as on 31 March 2010.

The State-wise and bank-wise position of outstanding bank loans to SHGs as on 31

March 2010 is given in Statement V-A (i) (Public sector Commercial Banks), V-A (ii)

(Private sector Commercial Banks), V-B (RRBs) and V-C (Cooperative Banks).

3.4 Non-Performing Assets of Bank loans to sHGs

As on 31 March 2010, total 221 banks had reported data on Non Performing Assets

(NPAs). Based on these data, NPAs to total bank loans outstanding against SHGs as

on 31 March 2010 stood at 2.94 per cent, amounted to ` 823.04 crore, which showed

an increase from 2.90 per cent and ` 625.87 crore during 2008-09.

In case of SHGs under SGSY, NPAs to total bank loans outstanding against SHGs

were five per cent, amounting to ` 319.47 crore, as on 31 March 2010. The agencywise position of NPAs to total bank loans outstanding against SHGs as on 31 March

2010 is given in Table 6:

table : 6 Agency-wise NPAs of Bank loans to sHGs

Agency

(` in crore)

NPAs as on 31 March 2010

Outstanding loans

against sHGs

Amount of NPAs

CBs (Public Sector )

19724.42

513.53

2.60

CBs (Private Sector)

440.29

23.93

5.44

RRBs

6144.58

218.53

3.56

Cooperative Banks

1728.99

67.04

3.88

28038.28

823.04

2.94

tOtAl

% of NPAs to

outstanding bank loans

The State-wise and bank-wise position of NPAs of bank loans to SHGs as on 31

March 2010 are provided in Statement VI-A (i) (Public Sector Commercial Banks), VI-A

(ii) (Private Sector Commercial Banks), VI-B (RRBs) and VI-C (Cooperative Banks).

3.5 Recovery Performance of Bank

The recovery performance of banks varies from region to region and also as between

SHG-Bank linkage programme and SHGs financed under SGSY programme. On the

basis of data reported by banks, out of 302 banks which have reported the recovery

data, 203 banks (67.2%) had more than 80% recovery of SHG loans as on 31 March

2010 which remained about the same as on 31 March 2009. Agency-wise distribution

of banks according to recovery per centage of SHGs, is given in Table 7.

ix

Status of Micro Finance in India 2009-2010

table : 7 Recovery Performance Agency-wise (All sHGs)

Agency

No. of Banks

reported recovery

data

No. of banks based on percentage distribution of recovery

performance of bank loans to sHGs as on 31 March 2010

=/> 95%

Commercial Banks

(Public Sector)

Commercial Banks

(Private Sector)

Regional Rural Banks

24

80-94%

10

50-79%

6

< 50%

0

70

17

28

21

Cooperative Banks

199

72

59

43

25

tOtAl

302

103

100

70

29

34.1

33.1

23.2

9.6

Percentage of Banks

As regards recovery percentage of SHG loans by banks under SGSY, out of total 165

banks reported the recovery data of SHGs under SGSY, 86 banks (52.2%) had more

than 80% recovery of as on 31 March 2010 as against 58.9% as on 31 March 2009.

Agency-wise percentage distribution of banks according to recovery performance is

given in Table 8.

table : 8 Recovery Performance Agency-wise (Exclusive sGsY sHGs)

Agency

total no. of

Banks reported

recovery data

No. of banks, based on percentage distribution of recovery

performance of bank loans to sHGs as on 31 March 2010

=/> 95%

Commercial Banks

(Public Sector)

Commercial Banks

(Private Sector)

Regional Rural Banks

Cooperative Banks

tOtAl

Percentage of Banks

24

80-94%

50-79%

10

10

< 50%

0

56

19

23

10

77

26

17

20

14

165

39

47

55

24

23.6

28.6

33.3

14.5

The State-wise and bank-wise position of recovery percentage to demand of SHG

loans as on 31 March 2010 is indicated at Statement VI-A(i) (Public sector CBs), VIA(ii) (Private sector CBs), VI-B (RRBs) and VI-C (Cooperative Banks).

4.

Micro Credit by Micro Finance institutions

Micro Finance Institutions (MFIs) are playing an important role of financial intermediaries in

microfinance sector. The MFIs operate under various legal forms, viz.,

NGO MFIs Registered under Societies Registration Act, 1860 and / or Indian Trust

Act, 1880

Cooperative MFIs Registered under State Cooperative Societies Act or Mutually

Aided Cooperative Societies Act (MACS) or Multi- State Coop. Societies Act, 2002

NBFC MFIs incorporated under Section 25 of Companies Act, 1956 (not for profit)

NBFC MFIs incorporated under Companies Act, 1956 & registered with RBI

Following the RBI guidelines issued vide its circular dated 18 February 2000, to all

scheduled commercial banks including RRBs, MFIs have been availing bulk loans from

banks for on-lending to groups and other small borrowers. On the basis of returns received

from banks for the year 2009-10, SIDBI, 21 Public Sector Commercial Banks, 14 private

x

Status of Micro Finance in India 2009-2010

sector Commercial Banks, 04 foreign Commercial Banks, 7 RRBs and one Co-operative

Bank had reportedly financed MFIs for on-lending to groups and other small borrowers to

promote microfinance activities.

Based on the MIS, banks have financed to 691 MFIs with bank loans of ` 8062.74 crore as

against 581 MFIs with bank loans of ` 3,732.33 crore during 2008-09, representing growth

rate of 116.5 per cent in bank loans disbursed. As on 31 March 2010, the outstanding bank

loans to 1513 MFIs was ` 10147.54 crore as against ` 5009.09 crore to 1915 MFIs as on

31 March 2009, showing doubling of bank loan over the previous year.

Further, during the year 2009-10, SIDBI had financed to 88 MFIs with financial assistance

of ` 2665.75 crore and the loan outstanding against 146 MFIs as on 31 March 2010 was

` 3808.20 crore. As such the total exposure of banks and financial institutions to MFIs as

on 31 March 2010 was to the tune of ` 13955.74 crore.

The progress under MFI-bank Linkage programme, for the year 2008-09 and 2009-10, is

given in Table 9.

table 9 : Bank loan provided to MFis

Agency

Years

Amount of loan

disbursed to

NGOs/ MFis

No. of MFis

CBs (Public, Private and Foreign)

RRBs

Coop. Banks

total All Banks

(` in crore)

loan Outstanding

against NGOs/ MFis

as on 31 March

Amount

No. of MFis

Percentage

Recovery of

loans range

Amount

2008-09

522

3,718.93

1,762

4,977.89

70-100

2009-10

645

8,038.61

1407

10,095.32

80-100

% growth

23.5

116.2

(20.1)

102.8

2008-09

59

13.40

153

31.20

87-100

100

2009-10

46

24.14

103

52.22

% growth

(22)

80.1

(32.7)

67.4

2008-09

0.00

0.00

NA

2009-10

0.00

0.007

90

NA

% growth

NA

NA

NA

NA

2008-09

581

3,732.33

1,915

5,009.09

2009-10

691

8062.74

1,513

10,147.54

% growth

18.9

116.5

(21.0)

102.6

SIDBI

2009-10

88

2665.75

146

3808.20

total of all Banks and

siDBi to MFis

2009-10

779

10728.49

1659

13955.74

NA

Note: Actual no. of MFIs provided with bank loans would be less as several MFIs had availed loans from more than one bank.

NA Not Applicable/Not available.

Bank-wise details of MFIs financed by banks during the year 2009-10 are furnished in

Statement VII.

5. Financial support and Promotional Efforts by NABARD

5.1 NABARD Refinance support to Banks

NABARD provides refinance support to banks to the extent of 100 per cent of the bank

loans disbursed to SHGs. The total refinance disbursed to banks against banks loans

to SHGs during 2009-10 was ` 3173.56 crore, registered a growth of 21.1 per cent

from ` 2620.03 crore in 2008-09. Further, the cumulative refinance disbursed under

SHG bank linkage programme by NABARD to Banks upto 31 March 2010 stood at

` 12861.65 crore.

xi

Status of Micro Finance in India 2009-2010

5.2 Promotional support - sHG-Bank linkage

(i)

Micro Finance Development and Equity Fund

To strengthen the efforts of NABARD towards promotional support for micro

finance, the Government of India in the Union Budget for 2010-11 had further

increased the corpus of Micro Finance Development and Equity Fund (MFDEF) to

` 400 crore. Recognising the need for upscaling the micro-Finance interventions

in the country, the Honble Union Finance Minister, while presenting the budget

for the year 2000-01, had created Micro Finance Development Fund (mFDF) with

an initial contribution of ` 100 crore, to be funded by Reserve Bank of India,

NABARD and commercial Banks in the ratio of 40:40:20. In the Union Budget

for 2005-06, the Government of India had decided to re-designate the mFDF

into mFDEF and raised its corpus from ` 100 crore to ` 200 crore. The mFDEF

is managed and administered by NABARD under the guidance of an mFDEF

Advisory Board. The objective of mFDEF is to facilitate and support the orderly

growth of the microfinance sector through diverse modalities for enlarging the flow

of financial services to the poor, particularly for women and vulnerable sections of

society consistent with sustainability.

The Fund is utilised to support interventions to eligible institutions and

stakeholders. The major components of the assistance include promotional

grant assistance to Self-Help Promoting Agencies, training and capacity building

for microfinance clients and stakeholders of SHG - Bank Linkage Programme,

funding support to MFIs, Management Information System (MIS) for microfinance,

research, studies and publications.

(ii) training and Capacity building

NABARD

continued

to

organize / sponsor training

programmes and exposure

visits for the benefit of officials

of banks, NGOs, SHGs and

government

agencies

to

enhance their effectiveness

in the field of microfinance.

Training supplements and

materials were supplied to

banks and other agencies.

Best practices and innovations

of partner agencies were

widely

circulated

among

government

agencies,

banks and NGOs. During the year 2009-10, fund support of ` 9.93 crore was

provided for capacity building, exposure visits and awareness-building as against

` 6.10 crore during 2008-09. The cumulative fund support for the purpose

as on 31 March 2010 stood at ` 45.02 crore. During 2009-10, 6,804 training/

capacity building programmes were conducted covering 2,53,868 participants. The

progress under training and capacity building during the year 2009-10 is given in

Table -10.

xii

Status of Micro Finance in India 2009-2010

table : 10 training and Capacity Building Programmes 2009-10

sr.

No.

Programme Particulars / categories

No. of

Programmes

conducted

No. of

Participants

Awareness creation and capacity building programmes organised for

SHG members in association with identified resource NGOs, covering

participants to inculcate skills for managing thrift and credit

1991

83131

Awareness-cum-refresher programmes conducted for NGOs, including CEOs

1130

35648

Training programmes conducted for bankers covering officials of Commercial banks,

RRBs and Co-operative Banks

462

14945

Exposure visits for bank officials / NGOs to agencies pioneering in Microfinance

(MF) initiatives

14

387

Field visits of Block Level Bankers' Committee (BLBC) members to nearby SHGs

227

5880

Programmes for the elected members of Panchayati Raj Institutions (PRIs) to create

awareness among them about the MF initiatives

80

2799

Training & exposure programmes for government officials

79

3385

Other training programmes for microfinance sector

1181

65029

1530

38313

36

1000

Micro Enterprises Development Programme (MEDP)

10

Micro Enterprise Promotional Agency

11

Meetings and Seminars (Bankers, NGO officials, etc.)

total

74

3351

6804

253868

The Region/State-wise position of support provided by NABARD for training and capacity

building during the year 2009-10 is given in Statement VIII.

(iii) Joint liability Groups:

Based on the studies conducted by

NABARD, it was found that financing

of Joint Liability Groups (JLGs) is a

good business proposition. It needs

simplified

documentation,

group

dynamics, timely repayment culture

and prospects of credit enhancement

to quality clients. Keeping in view

the need and findings of the studies,

NABARD has issued comprehensive

JLG of Bagavali PACS with the leafy vegetable.

guidelines on JLGs to Banks focusing

on small and marginal farmers, oral

lessees, tenant farmers engaged in farm sector and other clients under nonfarm activities. NABARD supports banks for nurturing and financing of JLGs for

the initial three years. Banks may use the services of JLG-promoting agencies.

In addition, NABARD would also extend support for training, exposure visits,

experience-sharing, etc., for banks staff. The details of the scheme are given in

Exhibit.

(iv) Micro Enterprise Development Programme for skill Development

The Micro Enterprise Development Programme (MEDP) was launched by

NABARD in March 2006 with the basic objective to enhance the capacities of the

members of matured SHGs to take up micro enterprises through appropriate skill

upgradation / development in the existing or new livelihood activities both in farm

and non-farm sectors by way of enriching knowledge of participants on enterprise

management, business dynamics and rural markets. It is tailor-made and focused

on skill building training programme. The duration of training programme ranged

xiii

Status of Micro Finance in India 2009-2010

between 3 and 13 days, depending

upon the objective and nature of

training. The training budget has

been revised to ` 39,000/- per

programme for imparting training to

30 participants upto 13 days.

In 2009-10, a total of 1530 MEDPs,

both under Farm and Non-farm

activities, were conducted across the

country covering 38313 members

of the matured SHGs. Cumulatively,

total 2837 MEDPs have been

conducted so far covering 93777

participants. The dominant activities in agriculture and allied sector covered

under MEDPs were animal husbandry, bee-keeping, mushroom cultivation, vermicompost/ organic manure, horticulture, floriculture, etc. whereas predominant

non-farm activities taken up under MEDPs were readymade garments, Agarbattimaking, embroidery, bamboo-craft, beauty parlours, etc.

(v) Grant support to Partner Agencies for Promotion and Nurture of sHGs

NABARD continued its efforts in the formation and nurturing of quality SHGs by

means of promotional grant support to NGOs, RRBs, DCCBs, Farmers' Clubs and

Individual Rural Volunteers (IRVs) and by facilitating capacity building of various

partners, which has brought impressive results in the promotion and credit linkage

of SHGs. Further, the number of partner institutions/individuals functioning as

Self-Help Promoting Institutions (SHPIs) over the years has increased to 2911

which has resulted in the expansion of the programme throughout the country.

During the year 2009-10, the financial support provided by NABARD to its

partner institutions and their progress in SHGs promotion / linkage are indicated in

Table - 11.

table : 11 Grant support to Partner Agencies - 2009-10

(` in lakh)

Grant Assistance Extended to various Partners under sHG-Bank linkage Programme

Agency

sanctions during the Year

Cumulative sanctions

Cumulative Progress

No.

Amount

No. of

sHGs

No.

Amount

No. of

sHGs

Amount

released

sHG

formed

sHGs

linked

NGOs

306

2620.10

53393

2624

9025.81

345173

3469.69

244367

157831

RRBs

40.14

3395

117

429.44

47975

189.23

54271

36155

Co-operatives

63.23

5230

102

626.36

59105

252.95

44618

29075

IRVs (2023)

154.70

9250

68

684.46

40483

63.91

9991

5636

Farmers Clubs

61.96

14858

7986

319

2,878.17

71268

2911

10766.07

492746

4037.74

368105

236683

total

The SHPI-wise details of the promotional grant provided by NABARD during the

year 2009-10 are given in Statement No. IX-A (NGOs- SHPI), IX-B (RRBs- SHPI),

IX-C (Coop. Banks- SHPI), IX-D (IRVs- SHPI) and IX-E (Farmers Clubs-SHPI).

(vi) Pilot Project on sHG-Post Office linkage Programme

The Pilot Project for SHG-Post Office Linkage programme was initially launched

in five select districts of Tamil Nadu, viz., Sivaganga, Pudukottai, Tiruvannamalai,

Thanjavur and Tiruvarur. The initial results have been encouraging. Thus,

xiv

Status of Micro Finance in India 2009-2010

NABARD has sanctioned an additional Revolving Fund Assistance (RFA) of ` 200

lakh to India Post for on-lending to the SHGs, taking the total RFA sanctioned to

` 500 lakh.

As on 31 March 2010, 2,828 SHGs have opened zero interest savings accounts

with select Post Offices in Tamil Nadu and 1195 SHGs have been credit linked

with loans amounting to ` 321.25 lakh.

NABARD has sanctioned RFA of ` 5 lakh to Post Offices in Meghalaya for onlending to 50 SHGs in East Khasi Hills.

(vii) support to Activity-Based Groups

NABARD introduced a scheme for supporting small-scale activity based groups

(ABGs) in 2008-09, wherein capacity building, production and investment credit

and market-related support would be extended. The scheme focuses on forming

and nurturing the groups engaged

in similar economic activities, such

as farmers, handloom weavers,

craftsmen, fishermen, etc., to improve

efficiency of their production and

realise better terms from the market

through economies of aggregation

and scale. The scheme drew upon

NABARDs

existing

modes

of

support and has both grant and loan

components. While grant support

would cover expenditure on SHGs

formation and training, extension services, establishing market linkages, etc.,

bank loan/s would cover investment activities and working capital needs of the

SHGs. Banks would be eligible to draw refinance for the loans provided to ActivityBased Groups on the same terms as applicable for SHGs financing. In select

cases, NABARD may also provide loans directly to registered SHGs or through

the agencies promoting SHGs to establish few initial projects where none exists.

(viii) support to sHGs Federations

Recognising the emerging role of the SHGs Federations in nurturing of

SHGs, enhancing the bargaining powers of group members and livelihood

promotion, NABARD introduced during 2007-08, a flexible scheme to support

such Federations, irrespective of their model. The broad norms prescribed for

supporting SHG Federations stipulate that the federations should be need-based,

member-owned/driven, democratically managed with members at liberty to join,

become self-managed over three years, etc. NABARD extends grant support

to the Federation for training, capacity building, and exposure visits of SHG

members, etc., as also under all of NABARDs existing promotional schemes. So

far grant assistance of ` 22.02 lakh has been sanctioned to SHG Federations.

(ix) special initiative for scaling up sHGs/ sHG Federations

NABARD has been associated with Rajiv Gandhi Charitable Trust (RGCT) for

promotion, credit linkage and formation of SHG Federations in select districts

of Uttar Pradesh. The project envisages promotion and credit linkage of 22,000

SHGs, 1,100 cluster-level associations and 44 block-level associations in

collaboration with participating banks and implementing NGOs. The project would

xv

Status of Micro Finance in India 2009-2010

cover 15 and 29 blocks under Phase I and II respectively in 12 districts of Uttar

Pradesh viz. Sultanpur, Rae Bareli, Barabanki, Pratapgarh, Lucknow, Unnao,

Fatehpur, Jhansi, Lalitpur, Bahraich, Shravasti and Banda. NABARD and RGCT

have designed the project with technical assistance from Society for Elimination of

Rural Poverty (SERP), Government of Andhra Pradesh. As at the end of 31 March

2010, 21,868 SHGs have been promoted, of which 12,749 SHGs have been credit

linked. In addition, 676 Village Level and 15 Block Level SHG Federations were

formed under Phase I and Phase II.

(x) state specific support in North Eastern Region

(a) Arunachal Pradesh: During 2008-09, an amount of ` 39.15 lakh was

sanctioned by NABARD for implementing the project Micro Finance Vision

2011 by the Govt. of Arunachal Pradesh. Further, an amount of ` 33.66 lakh

was sanctioned to the Essom Foundation Trust for setting up a Resource

Centre at Itanagar for providing policy, operational inputs, capacity building

support and marketing linkages among the groups. NABARD has released `

5.452 lakh to the trust upto 31 March 2010.

(b) Tripura: NABARD continued to provide technical support to the State support

project on SHGs being implemented by the Government of Tripura for credit

linkage of 11,500 existing SHGs, forming and credit linking 35,000 new SHGs

and promoting livelihood activities among the 3 lakh members upto 2012.

5.3 Promotional support - MFi Bank linkage

NABARD has taken three major initiatives to support Micro Finance Institutions (MFIs)

to strengthen them as detailed in the following paragraphs:

(i)

Capital support to MFis

(a) the scheme:

As mentioned earlier, the Micro Finance Development Fund (mFDF) was set

up with NABARD by Government of India in 2000-01 with the initial corpus

of ` 100 crore to be contributed by Reserve Bank of India (40%), NABARD

(40%) and Commercial Banks (20%). The mFDF was redesignated to

Micro Finance Development and Equity Fund (mFDEF) in 2005-06 and the

corpus was increased to ` 200 crore and same has been further increased

to ` 400 crore during 2010-11. Accordingly, NABARD formulated a scheme

called Capital/Equity Support to MFIs in 2007-08 for providing Capital/equity

support to various types of MFIs to enable them to leverage commercial and

other funds from banks. This would help MFIs in providing financial services

at an affordable cost to the poor.

During 2009-10, NABARD introduced a new scheme for "Capital Support

to start-up MFIs" having potential to scale-up their activities but lacking

in capital, infrastructural facilities and managerial skills. Micro-Finance

Organisations (MFOs) and MFI-NBFCs, identified as Start ups on the basis

of area of operation, client outreach, lending model, borrowing history, etc.,

are eligible for support under the scheme. Financial support will be in the

form of subordinated debt which shall be sub-ordinate to the claims of

all other creditors. The quantum of support will be commensurate with the

business plan of the MFO / MFI-NBFC but not exceeding ` 50 lakh in any

case. The rate of interest has been fixed at 3.5 per cent to be repaid over a

period of 7 years including moratorium of 2 years.

xvi

Status of Micro Finance in India 2009-2010

(b) Progress under scheme:

During 2009-10, under Capital Support Scheme, 10 proposals amounting to

` 6.87 crore were sanctioned to 10 MFIs and disbursed ` 7.87 crore. The

outstanding under Capital support as on 31 March 2010 was ` 24.17 crore

against 31 MFIs. The agency-wise outstanding is given in Statement No. X(B).

(ii) Revolving Fund Assistance to MFis

(a) the scheme:

NABARD provides loan funds in the form of Revolving Fund Assistance

(RFA), on a selective basis, to MFIs. The RFA provided to these agencies is

necessarily to be used for on-lending to SHGs or individuals and the amount

is to be repaid along with the service charge between 3.5 per cent and 9.5

per cent within a stipulated period of 5 to 7 years with one to two years of

moratorium period. This enables them to build a credit history, which would

help them to access credit facilities through the regular banking channels.

(b) Progress under scheme:

During 2009-10, RFA of ` 23 crore was sanctioned to 13 MFIs taking

cumulative RFA sanction to ` 65.98 crore to 51 agencies. The disbursements

made during 2009-10 were at ` 22.55 crore and the cumulative disbursement

reached to ` 55.49 crore. As on 31 March 2010, the total RFA outstanding

was ` 33.27 crore against 22 MFIs. The details of agencies-wise outstanding

RFA are given in Statement - X(A).

Besides Capital Support and RFA from MFDEF, refinance assistance of ` 30

crore was also released during 2009-10 of which outstanding as on 31 March

2010 was Rs.28.33 crore.

(iii) Rating of MFis

In order to identify, classify and rate Micro Finance Institutions (MFIs) and

empower them to function as intermediaries between the lending banks and their

clients, NABARD had introduced a scheme for providing financial assistance by

way of grant to CBs, RRBs and Co-operative Banks to avail of the services of

accredited rating agencies for rating of MFIs. Banks can avail the services of

credit rating agencies viz. CRISIL, M-CRIL, ICRA, CARE and Planet Finance for

rating of MFIs and also avail financial assistance by way of grant to the extent of

100 per cent of the professional fees of the credit rating agency.

During 2009-10, the scheme has been refined and the grant support has been

increased to a maximum of ` 3.00 lakh. The facility is available for the first rating

of an MFI with a minimum loan outstanding of ` 50.00 lakh and maximum loan

outstanding of ` 10 crore. Duirng 2009-10, NABARD has provided grant support

of ` 15.83 lakh for rating of 13 MFIs to Banks or MFIs. The MFI-wise details of

the grant support provided by NABARD for rating of the MFIs duirng the year are

given in Statement No. X (C).

6. Quality And sustainability of sHGs

NABARD had entrusted a study to, Institute for Social and Economic Change (ISEC),

Bagalore for studying the quality and sustainability of SHGs in Karnataka. For study

purpose, three representative districts viz. Mysore (well developed), Tumkur (medium), and

Bagalkot (less developed) and the major finding are as follows:

xvii

Status of Micro Finance in India 2009-2010

96 per cent of the SHGs constituted women's group with an average of 17 members

per SHG.

90 per cent of the members were owning less than two acres of land.

Around 40 per cent SHGs were credit linked to RRBs; 30 per cent to CBs and thirty

per cent to Co-operatives.

In developed district of Mysore 22 per cent the members lost interest in attending

meetings and meetings were held less frequently.

Government department promoted groups expected subsidised loans and depended on

Anganwadi workers for maintenance of accounts and further guidance.

NGOs and govt departments provided better opportunities for training for taking up

income generating activities than the banks whose role in the area appeared to be low.

Training imparted by NGOs / Government agencies, however, was not of substantial

help and useful as training imparted did not match the needs of the members.

Training on routine activities like papad and pickle making etc., were not preferred by

the members.

Average loan amount increased from ` 56,307 in the first linkage to ` 2,13,333 in the

fifth dose in all the districts covered under study. Maximum loan availed amounted to

` 45 lakh for a group based activity.

Nearly 57 per cent SHGs availed loan less than three times of their savings, 24 per

cent between three and five times.

Certain problems encountered by the groups were

s

inadequate loans: 97 percent of the SHGs in Bagalkot district, 81 percent in

Mysore district and 70 per cent in Tumkur district reported getting inadequate

loans.

delay in getting loans with the need for frequent visits by the members to the

banks,

SGSY loans being made available in installments which were equally divided

among the members

different interest rates charged by the banks: while commercial banks and RRBs

charged 12 per cent whereas the DCCBs charged at the rate of 4.5 per cent

(subsidised by the State Govt).

Dependency on money lenders was reduced as about 96 per cent of the SHGs

stopped going to money lenders.

Repayment of loans was made regularly on monthly basis.

The SHG BLP has led to social and economic empowerment of the rural poor, such as:

Ninety two per cent of the SHG members came out of the four walls of the their houses

and 76 per cent of the them were able to interact with officials/ give speeches and 28 per

cent of the members were able to save in banks; the result were seen in decision making in

household matter, sending children to school, changing undesirable habits of their spouse,

participating in Gram Panchayat election, access to bank credit after joining SHG (98%) as

compared to mere two per cent before joining, increase in income by undertaking incomegenerating activities, etc.

xviii

Status of Micro Finance in India 2009-2010

7. Centre for Micro Finance Research

With the funding support from MFDEF, a Centre for Micro finance Research (CMR) has

been setup in Bankers Institute of Rural Development, Lucknow to take up research studies

in the field of microfinance with the mission of strengthening microfinance sector through

supply of research inputs to facilitate policy initiatives and improvements in design and

delivery system that provide poor with sustainable access to quality financial services.

The CMR along with four sub-centres viz., Indian Institute of Bank Management (IIBM),

Guwahati, Institute of Financial Management and Research (IFMR), Chennai, Institute

of Development Studies (IDS), Jaipur and Chadragupta Institute of Management, Patna

(CIMP) had initiated several studies on critical issues of microfinance. Grant assistance

of ` 375.00 lakh was sanctioned to CMR from MFDEF to pursue the above-envisaged

activities.

8. NABARD GtZ technical Collaboration in Rural Finance

institutions Programme

Under the purview of technical collaboration in Rural Finance Institutions Programme

between GTZ and NABARD, technical assistance continued to be extended to NABARD

during the year for, interalia, promotion and

development of microfinance as well as

improvement in the quality and viability of

financial services under SHG-Bank Linkage

Programme. Exposure-cum-studies, capacity

building interventions and documentation, etc.,

were undertaken in collaborative process for

furtherance of the sector.

The report of the 'Committee on Financial

Inclusion' has indicated the need for

addressing the remittance needs of the poor

and NABARD has to play an important role in

this. Keeping in view, NABARD with GTZ has

undertaken a quick study on present practices

of remittance and the team leader was Dr.

Y.S.P.Thorat (ex-chairman, NABARD). Based

on the findings of the study report, a joint

appraisal mission on remittance discussed

the issue with various partners viz., Ministry

of Finance, GoI, Reserve Bank of India,

State Bank of India, India Post, Mr Nandan

Nilekani (Unique ID), etc. On the basis of the

discussions of the appraisal team, NABARD

and GTZ signed 'Agreed Minutes on the Joint Appraisal of the Programme on 19 January

2010. The NABARD and GTZ have now commissioned a detailed study on "Remittance

needs of the poor" in different corridors (Eastern Uttar Pradesh and Mumbai, Intra State

between various parts of Maharashtra and Mumbai and Orissa and Kolkata).

Findings of the study will be presented before Government of India and Reserve Bank

of India for policy changes, if required, for financial inclusion of poor migrant workers

particularly rural women.

xix

Status of Micro Finance in India 2009-2010

Exhibit

Joint Liability Group

1. introduction

SHG-Bank linkage programme has proved to be successful in providing financial services

from the formal banking sector to the poor. However, the issue of linking the small /marginal

farmers, tenant farmers / oral lessees, share croppers and the rural non-farm entrepreneurs

with the formal banking sector was concern for NABARD as their demand were not met

through the SHG as in SHGs, loan amount is linked to savings.

NABARD had piloted Joint Liability Groups (JLGs) programme during 2004-05 in eight states

of the country with the help of 13 RRBs through the mechanism of joint liability approach.

The JLGs promoted in 2004-05 were 285 with bank finance of ` 4.48 crores and to 488 JLGs

with bank loan of ` 6.79 crores in 2005-06. Besides the above pilot project, the Government

of Andhra Pradesh through its Agriculture Department primarily designed the initiative by

promoting Rythu Mithra Groups (RMGs) on the SHG model. During 2005-06, banks extended

finance of ` 131.78 crore to 12,468 RMGs. RMGs are also expected to serve as a conduit for

technology transfer, facilitate access to market information and assist in carrying out activities

like soil testing, training, health camps, assess input requirements, etc., to its members.

Over the last few years NABARD has been propagating the idea of JLGs at various

fora. Based on the experience gained in implementation of the pilot project, a scheme

for financing JLGs by the Commercial Banks, RRBs and Cooperative Banks has been

formulated and circulated to RRBs and Co-operative Banks by NABARD and to Commercial

Banks through Reserve Bank of India/Indian Banks Association. The salient features of the

scheme are as given below:-

2. Objectives: the scheme aims at the following objectives

i)

To augment flow of credit to tenant farmers1 cultivating land either as oral lessees or

sharecroppers and small farmers who do not have proper title of their land holding,

through formation and financing of JLGs.

ii)

To extend collateral free loans to target clients, including rural micro entrepreneurs

through JLGs

iii)

To build mutual trust and confidence between banks, tenant farmers, entrepreneurs, etc.

3. General features of JlG

(i)

JLG is an informal group of preferably 4 to10 individuals but can be upto 20 members

as in the case of SHG

(ii)

The JLG members would offer a joint undertaking for bank loans.

(iii) The JLG members are expected to engage in similar type of economic activities like

crop production.

1.

Tenant - Any person who holds land under another person's name and pays rent to such other person on

account of the use of land is called a tenant i.e. Tenant is a person who has taken the lease and is liable to pay

rent for the piece of land.

Oral lessees - The term refers to tenancy without legal sanction and permission or without any written

agreement.

Sharecroppers - Tenants who pay rent to landlords by way of sharing crops grown (in lieu of rent by cash) may

be called sharecroppers.

xx

Status of Micro Finance in India 2009-2010

4. Criteria for selection of JlG members

JLGs can be formed primarily consisting of tenant farmers and small farmers cultivating

land without possessing proper title of their land / rural entrepreneurs engaged in non-farm

activities.

(i) Members should be of similar socio-economic status and background carrying out

farming activities / non-farm activities and who agree to function as a joint liability

group.

(ii) The members should be residing in the same village/ area and trust each other to take

up joint liability for group/ individual loans.

(iii) The members should be engaged in agricultural activity for a continuous period of not

less than one year within the area of operations of the bank branch.

(iv) The group members should not be a defaulter to any other formal financial institution.

(v) There should not be more than one person from the same family in the JLG.

5. security

The group would extend mutual guarantee for the group or individual loan.

6. Formation of JlGs

Banks may initially form JLGs by using their

own staff wherever feasible. Banks may also

engage business facilitators like NGOs and

other individual rural volunteers to assist banks

in promoting the concept and formation of

groups.

7. savings by JlG

JLG Farmer spraying pesticide.

The JLG is intended primarily to be a credit

group. Therefore, savings by the JLG members

is voluntary and not compulsory as in the case of SHG. All the JLG members may be

encouraged to open an individual "no frills" account. However, if the JLG chooses to

undertake savings as well as credit operations through the group mechanism, such groups

should open a savings account in the name of JLG with atleast two members being

authorised to operate the account on behalf of the group.

8. JlG Models

Banks can finance JLG by adopting any one of the following two models;

Model A Financing Individuals in the Group: The group would be eligible for accessing

separate individual loans from the financing bank. All members would jointly execute

one inter-se document (making each one jointly and severally liable for repayment of all

loans taken by all individuals in the group). The financing bank could assess the credit

requirement, depending on the activities being undertaken and credit absorption capacity

of the individual. However, there has to be mutual agreement and consensus among all

members about the amount of individual debt liability that will be created.

Model B Financing the Group: The JLG would consist preferably of 4 to 10 individuals

and function as one borrowing unit. The group would be eligible for accessing one loan,

which could be combined credit requirement of all its members. In case of crop loan, the

credit assessment of the group could be based on crop/s to be grown and the available

cultivable area by each member of the JLG. All members would jointly execute the

document and own the debt liability jointly and severally.

xxi

Status of Micro Finance in India 2009-2010

9. type of loan

Banks may consider cash credit, short-term loan or term loan or composite loan (working

capital with term loan) depending upon the purpose of loan.

10. Margin and security Norms

No collaterals may be insisted upon by the banks against their loans to JLGs. It may

however, be ensured that the mutual guarantees offered by the JLG members are kept on

record. Margin as per the norms prescribed by RBI, may be applied.

11. Documents

Model A:

The documents to be obtained include Introduction form, application-cum-appraisal form,

mutual guarantee & DPN.

Model B:

Documents as applicable to SHGs may be adopted.

12. Financing to JlGs

Financing to JLGs by bank will form part of priority sector lending and banks may include

lending to JLGs in their corporate plan and also in the training schedule of officers/staff.

13 support extended by NABARD:

(i)

Grant support for of JlGs:

To facilitate promotion of JLGs, NABARD provides grant assistance to Banks and other

institutions involved in promotion and nurturing of JLGs. JLG promoting institute is

expected to formulate a plan for a minimum of 20 JLGs. Grant assistance of ` 2000

per JLG will be extended to banks for formation, nurturing and financing of JLGs over

a period of three years. The first instalment of ` 1000/- would be released to the Bank/

other institutions after sanction of loan by the bank. The second instalment may be

released after commencement of repayment. The third instalment may be released

in third year subject to certification of bank with regard to satisfactory repayment.

However, the grant to other institutions would be released, based on the certification by

the banks as indicated above.

(ii)

Refinance: NABARD will provide 100% refinance assistance to all banks in respect of

their lending to JLGs under investment credit and the procedure for claiming refinance

from NABARD would be similar to that under SHG-Bank Linkage Programme.

14. Capacity Building :

Banks may undertake capacity building measures like conduct of training programmes for

stakeholders, awareness and sensitization of JLG concept both for banks own staff as well

as the target group. The banks operating staff should be familiar with the concept, benefits

for the banks and clients under the programme. NABARD would consider supporting

capacity building programmes for Banks staff and other publicity measures, such as

publication of pamphlets/ leaflets, use of media (print as well as others), etc. for greater

awareness and orientation.

Note: For further details banks/NGOs may contact nearest NABARD office.

xxii

Status of Micro Finance in India 2009-2010

Statements

Status of Micro Finance in India 2009-2010

Status of Micro Finance in India 2009-2010

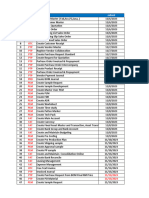

STATEMENT I - A

Progress under Microfinance Savings of SHGs with Banks

Agency-wise position as on 31 March 2010

(Amount ` lakh)

Sr.

No.

Name of the Agency

Total Savings of SHGs with

Banks as on 31 march 2010

Out of Total Under SGSY

Out of Total Exclusive

Women SHGs

No. of SHGs

Saving Amount

No. of SHGs

Saving Amount

No. of SHGs

Saving Amount

Commercial Banks

4052915

367389.24

1088160

83147.57

3350054

290057.64

Regional Rural Bank

1820870

129937.49

462370

26850.40

1240342

99686.25

Cooperative Bank

1079465

122544.16

143380

19264.25

720040

60121.86

Total

6953250

619870.89

1693910

129262.22

5310436

449865.75

STATEMENT I - B

Progress under Microfinance Bank loans disbursed to SHGs

Agency-wise loans disbursed during 2009-10

(Amount ` lakh)

Sr.

No.

Name of the Agency

Loans disbursed to SHGs by

Banks during the year

Out of Total Under SGSY

Out of Total Exclusive

Women SHGs

No. of SHGs

Loans disbused

No. of SHGs

Loans disbused

No. of SHGs

Loans disbused

Commercial Banks

977521

978018.55

157560

121549.57

889177

904331.26

Regional Rural Bank

376797

333320.06

67531

68241.02

284120

273912.79

Cooperative Bank

232504

133991.75

42312

30009.47

121179

64692.75

1586822

1445330.36

267403

219800.06

1294476

1242936.80

Total

STATEMENT I - C

Progress under Microfinance Bank loans outstanding against SHGs

Agency-wise position as on 31 March 2010

(Amount ` lakh)

Sr.

No.

Name of the Agency

Total Outstanding Bank

Loans against SHGs

No. of

SHGs

Out of Total Under SGSY

Out of Total Exclusive

Women SHGs

Loan

Outstanding

No. of

SHGs

Loan

Outstanding

No. of

SHGs

Loan

Outstanding

Commercial Banks

3237263

2016471.21

798304

407203.07

2706634

1730867.35

Regional Rural Bank

1103980

614458.24

368795

172593.66

843697

467992.52

Cooperative Bank

510113

172898.62

78295