Professional Documents

Culture Documents

Indian Steel Industry

Uploaded by

Vimalan ParivallalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Steel Industry

Uploaded by

Vimalan ParivallalCopyright:

Available Formats

BUSINESS ENVIRONMENT 2011

2010-

1. INTRODUCTION

Steel is crucial to the development of any modern economy and is considered to be the backbone of the human civilization. The level of per capita consumption of steel is treated as one of the important indicators of socio-economic development and living standard of the people in any country Joint Plan Commission (2010). The Indian steel industry comprises producers of finished steel, semi-finished steel, stainless steel & pig iron. The major areas where steel is used are Construction Industry, Automobile industry, Infrastructure Industry, Oil and Gas Industry, and Container Industry. The Indian steel market is one of the fastest growing markets. The steel industry in India plays such a significant role that it has its own Ministry of Steel (MoS). According to World Steel Association (WSA) Crude Steel Production, as on October 2010 is 1165,116 metric tonne. Steel production across 66 countries around the world accounts 98% of global steel products. China had contributed 525 095 Metric tonne and India followed 55 764 Metric tonne According to MoS the Indian steel industry has emerged as the 5thlargest in the world following China, Japan, Russia, and United States, ahead of South Korea The Indian steel industry is expected to become the 2nd largest steel producing country by 2012 and 2ndlargest producer of crude steel by 2015-16. The Indian steel production grew with 8% in 2009-10 to 56.3 million tones and is expected to reach 124 million tonne by 2012; 8-10% of this will be exported. And Indian steel production is expected to reach around 275 million tonne by 2020. The steel products of India are in form of finished steel, semi-finished steel, stainless steel & pig iron. The private sector controls almost 2/3rd of the steel market while the remaining is held by the public sector like SAIL and RINL

ID No: 1013043

Page:1

BUSINESS ENVIRONMENT 2011

2010-

2. EXTERNAL ENVIRONMENT THE INDIAN STEEL

INDUSTRY.

The external environment of the Indian steel industry mainly comprises the factors influenced by the government interventions, developing economy, climatic conditions and Socio effects which intern affect the steel industry. 2.1. Political Factors

Recommendations on Captive Mines: The captive coal mines of various steel manufactures is facing trouble from the Coal Ministry due to improper usage while captive iron ore mines had being increased in capacity by the Government order. National Steel Policy to Remove Bottlenecks: The Cabinet Committee on Economic Affairs (CCEA) has given its approval to the National Steel Policy (NSP), apart from steel production, also aims to remove the bottlenecks in the availability of inputs like iron and coal. It wants to enhance iron ore production from the current capacity of 172 MT to 290 MT in 2019-20. The Economic Times (2010) Economic Factors

2.2.

GDP Growth Rate: According to MoS, Production for sale was at 43.849 million tonne (mt), a growth of 3.2 per cent Steel exports decreased by 36 per cent as it reached an estimated 2.099 million tonne while steel imports were at an estimated 5.21 million tonne, a growth of 16.6 per cent. India remained a net importer of steel. Domestic steel consumption was at 40.997 million tonne and increased by 7.8 per cent. Low Domestic Consumption The Domestic consumption of steel remains lower, as the per capita consumption of steel in India, at around 46 kg, is well below the world average (150 kg) and that of developed countries (400 kg).

ID No: 1013043

Page:2

BUSINESS ENVIRONMENT 2011 2.3. SOCIAL FACTORS:

2010-

Problem in setting up steel plants: There is always a general protest mode in the locals and the firms when it comes to setting up new steel plants. For Example, May 17: Over 2,000 tribal from 14 villages in Jharkhand's Jamshedpur District stage a protest against an upcoming steel plant in the area of Bhushan Power and Steel Plant project and claimed that they were being displaced in the name of development. Life style trends: Growing middle clause and urban-rural development has a wide effect on the steel industry as they demand more infrastructure like of roads, railways, airports & power. The Eleventh five year plan (2007-12) has lined up massive investment in all the related sectors. As per the reports of the Indian Steel Alliance, the projected investment towards the infrastructure sector during the Eleventh Plan is likely to be Rs.20,27,000 crores. This is an increase of 180% over the Tenth Plan which will ultimately lead to an increase in the demand of steel. 2.4. TECHNOLOGICAL FACTORS:

Maturity of technology: R&D has not limited itself only towards improvement in production process or capacity. It also aims at sustainable development and incorporates the following factors: a) Reducing the CO2 intensity of steel b) Enabling transfer of technology to revamp and improve the energy efficiency of out-dated steel plants c) Investing in breakthrough technologies for long-term solutions 2.5. Environmental Factors

Carbon dioxide Emission (CO2): Steel industry emits more carbon into the atmosphere during the process of smelting. According to the Intergovernmental Panel on Climate Change (IPCC), the steel industry accounts for between 3-4% of total world greenhouse gas emissions. On average, 1.9 tonne of carbon dioxide are emitted for every tonne of steel produced. Over 90% of steel industry emissions come from iron production in nine countries or regions: Brazil, China, EU-27, India, Japan, Korea, Russia, Ukraine and the USA, while India emits about 16%. Steel industry is one of the energy influence industry it uses almost 30-40% of overall energy of the country while the energy account about 25% of the finished steel. This energy consumption intern contributes in greenhouse effect.

ID No: 1013043

Page:3

BUSINESS ENVIRONMENT 2011 From 1. 2. 3. 4.

2010-

the above PESTE analysis the major key issues can be grouped as: Problems in procuring raw materials GDP influencing steel industry Resistance by locals for building power plants Carbon dioxide emission

The Steel industrys major raw materials are coal and iron ore. The main problem with raw material was getting iron ore supply since most of the high quality ore is being exported to China. And India is still lacking in high quality coke and is importing for other countries for higher price ($200 and $225 per metric ton) which leads to unused of given captive coal To address these issues the Ministry of Coal had taken few initiatives. According to Coal Mines (Nationalisation) Act, 1976, the Steel companies were allocated a mine each, and together these mines have coal and lignite reserves of 49 billion tonne. According to the Ministry of Coal, only 30 million tonne of coal was extracted from captive blocks in 2009-10 against a target of 81 million tonne. Hence ministry is in a plan to void the act and divert the coal reserves for power production which will be a serious setback for steel manufactures. And Ministry of Steel and mines passed an order to the Karnataka Government had giving a push back by providing access for two major blocks of iron ore in the state. The department of mines has identified 2,560 hectares of iron ore mines in which is rich in iron ore reserves. It is estimated that this block of mines contains over 300 million tonne of iron ore (Business Standard. Sep 2010), which will help the steel manufactures for gain control over there captive iron ore. As the GDP of the nation is growing there is a need for the nation to concentrate in infrastructure development. Growing population and changing life style of people demands more luxury in form of automobiles and house wares and other commodities where steel is either directly or indirectly linked. But the steel consumed in India is not only in flat or non-flat products but also in other forms which the Indian industry are not manufacturing and hence India had now become a net importer of steel even though it is 5tth largest steel producer in the world. And though there is a healthy GDP growth the per capita steel consumption is around 46 kg, is well below the world average (150 kg) and that of developed countries (400 kg). Hence there is a huge chance in the domestic market when the industry trys to concentrate in these fields which can tap the import. While the above said being the factor which may help out the industry the other two factors hinders the growth of the industry. India had seen a wide range of protest from the past to present when it comes to setting up new plants especially in case of chemical and metal industries. The major reason behind this is most of the ore is in undeveloped areas where tribe and locals reside there ID No: 1013043 Page:4

BUSINESS ENVIRONMENT 2011

2010-

from decades and the plants falling in this area have seen high resistance since there cultivation land is being abducted, their homes are being displaced and the environmental constraints like effluences from the furnace and fear of any industrial accidents. The CO2 emission is other factor which raises topics in Global climate change. The Ministry had come down hard on the industry to cut down energy consumption from 6.45- 8.5 Giga.Cal to 4.5-5 Giga.Cal per tonne of Crude Steel and to reduce CO2 emission from 2.7 tonne to 1.5-1.8 tonne of CO2 /tcs (Eleventh Five Year Plan,2007-12) by introducing new technologies and by optimising or replacing older technologies. A steel industry to run successfully needs raw materials, power, site for plant, and demand when all the above are addressed positively the industry can run smoothly also keeping the environmental constraints in mind.

3. COMPETITIVE RIVALRY WITHIN THE INDUSTRY

ID No: 1013043

Page:5

BUSINESS ENVIRONMENT 2011

2010-

The competitive rivalry within the industry can be analysed with use of the Michael Porters Five Force Model. The steel industry is becoming more and more competitive. The firms inside the industry is looking for further in expansions, forwards and backward accusations. Larger companies of India like Tata and JSW are expanding their presence in global markets while companies like ArcelorMittal and POSCO are investing in India to gain advantage in the growing economy of the country. 3.1. The threat of the entry of new competitors

Economies of Scale are less in, R& D expenses and better bargaining power while sourcing raw materials for those steel companies, which are integrated, have their own mines for key raw materials such as iron ore and coal and this protects them for the potential threat for new entrants to a significant extent Steel has very low barriers in terms of product differentiation as it doesn't fall into the luxury or specialty goods and thus does not have any substantial price difference. Keeping the economic development the government polices helps both the existing and new entrants. The economic reforms initiated by the government in 1991 with polices like Licensing requirement for capacity creation has been abolished; Steel industry has been removed from the list of industries reserved for the state sector; Restrictions on external trade, both in import and export, have been removed; Import tariff reduced from 105% in 1992 to 1993, to 30% in 1996 to 1997; (Development of Indian Steel Sector Since 1991)

The government has a favourable policy for steel manufacturers. However, there are certain inconsistencies involved in allocation of iron ore mines and land acquisitions. Furthermore, the regulatory clearances and other issues are some of the major problems for the new entrants. The cost of major raw materials like iron ore, coking coal, and other raw materials are less about Rs 289/tonne in India with average global cost is about Rs 372/tonne. The labour cost is low about Rs 57/tonne when average global cost is about Rs 89/tonne, but it is neutralized by its low level of per capita productivity in India with. The financial cost and the cost of power, oil and some other materials are high. Energy accounts for about 35% to 40% of the cost of steel production. It is estimated that to set up 1 Mt/a capacity of integrated steel plant, it requires between Rs 25 bn to Rs 30 bn depending upon the location of the plant and technology used.(Strategy for Revival and Growth of Indian Steel Industry,2009) 3.2. The bargaining power of suppliers

ID No: 1013043

Page:6

BUSINESS ENVIRONMENT 2011

2010-

The bargaining power is low for the suppliers over the firms who have integrated plants with captive mines providing raw materials like coal, iron ore and limestone. But other firms which depend on the market for raw material supply is hit hard since they have very less power on the supplier. On an average the iron ore cost to the steel companies with total captive mining falls in the range of Rs.322 per tonne for Tata Steel to Rs.558 per tonne for SAIL for the year 200506. For a company dependent on partly captive resources (up to about 30%) such as JSW Steel, located in a mining area, the costs were Rs. 886 per tonne. For RINL, totally dependent on assured supply from NMDC at government determined prices, the costs were in excess of Rs. 1500 per tonne in 2005-06 and Rs.1100 per tonne in the previous year. As against this, a typical sponge iron unit dependent totally on the open market paid Rs. 2800per tonne. (Strategy for Revival and Growth of Indian Steel Industry,2009) 3.3. The bargaining power of customers (buyers)

The Buyers have fewer substitutes for steel and also there exists a lower product differentiation. But still they have a high bargaining power when they consume in higher quantity for example SAIL is long lasting and SAIL is the major supplier of rails for Indian railways. And the Indian railways joint venture with SAIL in producing 1,200 railway freight wagons. There are less chances of backward integration by buyers as it is not easy for them to acquire all the financial, technical and human resources needed for steel production. But with more firms expanding and foreign companies are interested in investing in Indian steel industry there are chances for variable in price and the differentiation in commodity in the form steel shaped. Also buyers are very much aware of rates at which all the major producers sell their steel products so their bargaining power automatically has increased. 3.4. The threat of substitute products or services

Aluminium is being treated as substitute for steel has been raising continuously in the automobile and consumer durables sectors, it still does not pose any significant threat to steel as the latter cannot be replaced completely and the cost differential is also very high 2472.00$/MT, while steel is priced at 545.00$/MT. (LME,2011) In the domestic steel industry, demand still exceeds the supply. India is a net importer of steel. However, a threat from dumping of cheaper products does exist. Plastics and composites pose a threat to Indian steel in one of its biggest markets automotive manufacture.

3.5.

The intensity of competitive rivalry

ID No: 1013043

Page:7

BUSINESS ENVIRONMENT 2011

2010-

Many of the governments policy such as the priority allocation of mineral resource assets to captive use, exports tax, tax sops to attract investment to specific regions, etc., have in-built non-competitive elements. They distort the market and resource allocation. Among all of them, captive and prioritization of mining leases to end user industries and export tax on steel and iron ore introduced recently have the most adverse implications on the market from the competition point of view. Laveesh Bhandari(2009). There are very few major players in the country which has immense raw materials and most of these raw materials are being enjoyed by very prominent players like SAIL and TATA which acts as monopoly over the Indian Steel Industry while other International players aims to produce steel at lower cost compared to other parts of the globe and they target different market instead of competing in the domestic market.

4. MARKET LEADING FIRMS IN THE INDIAN STEEL INDUSTRY

ID No: 1013043

Page:8

BUSINESS ENVIRONMENT 2011

2010-

The Indian steel industry comprises producers of finished steel, semi-finished steel, stainless steel and pig iron. The private sector controls almost two-thirds of the steel market with production (about 36.804 Million tonne), while the public sector producers have the remaining one-third market share producing (about 18.403 Million tonne of steel). The industry involves in exporting (about 2.009 Million tonne) and importing of steel (about 5.210 Million tonne).

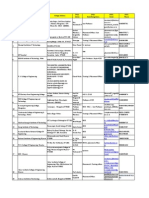

The three leading firms in the Steel industry are: Steel Authority of India Limited (SAIL) The Tata Iron and Steel Company (TISCO) Rashtriya Ispat Nigam Limited (Visakhapatnam Steel Plant) (RINL) The Matrices shows the edge of competitive advantage of SAIL Vs RNIL Vs TISCO against each. SAIL being the largest producer of steel in India has the advantage of its capacity and captive mines but usually imports high quality coke for a huge amount. It has a good brand image across the country but failed to showcase its global presence while RINL being the second largest producer in public sector is relatively smaller than SAIL and the raw materials are being supplied through NMDC. TISCO is the largest private player in the country which has integrated steel manufacturing units and huge iron ore reserve in the captive mines. The Brand image of TISCO is spread worldwide by establishing centres in 5 continents and carrying out overseas operations. TISCO is the only company which has more product differentiation in the Indian steel industry. Due to high iron ore reserve and effective usage of local available coke and with newer technologies and innovations TISCO had been the LOW COST producer of steel

Name of the Firm

SAIL (Public sector)

RINL (Public sector)

TISCO (Private Sector)

ID No: 1013043

Page:9

BUSINESS ENVIRONMENT 2011

Market Share Profit Before Tax 22% Rs 32046 Cr Structural, Bars, Rods & Rebars, HR Coils, Sheets & Skelp, Plates, Crane Rails, Wire Rods, CR Coils, Sheets, GP Sheets & Coils/ GC Sheets, Pipes, Electrical Steel, Tinplates, Semis, Wheels & Axles, Rails, Pig Iron, Wagons 6% Rs 12884 Cr Product Mix, Special Steels, Plain Wire Rods, In Coils,'VIZAG TMT', Rebars, VIZAG UKKU' Structurals, Plain Rounds,Pig Iron, Ship Building 9%

2010-

Rs 18,393.34 Cr Engineering, Construction, Aerospace, Automotive, Carriages, TMT, Consumer good, Energy and Power, Rails, Sheets, Consumer good, Agricultural tool, Packing, Ship building, Defence

Product Range

Production capacity Capacity expansion plans Production Captive Mines

18.2 million tonne 26 million tonne 13.9 million tonne 24.43 million tonne

6.3 million tonne 9 million tonne 3.8 million tonne Sourced by NMDC

6.8 million tonne. 10 million tonne.

4.86 million

tonne.

28.1 million tonne

* Sources:

1. JPC 2. MoS Annual Report 3. SAIL, TISCO, & RINL Annual reports 4. INDIAN STEEL INDUSTRY-Final Report, Prepared for the Competition Commission of India, January 2009

5. CONCLUSION

ID No: 1013043

Page:10

BUSINESS ENVIRONMENT 2011

2010-

India is expected to become the 2nd largest producer of crude steel in the world by 2015-16. 222 MoUs have been signed with various States for planned capacity of around 276 million tonne. A promotion of R&D in Iron and Steel Sector with an outlay of Rs. 118.00 crore has been approved by RINL & SAIL joint venture While Also NMDC and Tata steel have signed an MoU on 22nd January, 2010 to explore the possibility of entering into a joint venture. India is now the fastest growing economy and knowing the phase of its growth many foreign companies had managed to setup plants in India due to the favours like immense ore availability, low labour cost. And many Indian firms have made overseas accusations and joint ventures to reap maximum profit. The steel industry is in the growth phase. Indian steelmakers plan to increase annual steel production capacity to 81.4 million tonne by FY10, larger than the domestic consumption forecast of 65 million. And the forecast of next five years will be helped by the growing GDP that boost up infrastructure development which leads to steel demand. And the growing population, Rapid urban development, change in life style also plays vital role in usage of steel. The raw material price and availability, Energy shortage and CO2 emission are the major drawbacks which the industry is now facing. And there exists a strict resistance from locals in setting up new plants near their neighbourhood. The Government have made the policies of taxation, import and export in favourable of the industry since the steel industry provides major contribution in the countrys economy and employment for about million either direct or indirect. The mineral security ensures that the firms get adequate supply of raw materials while the companies are striving hard to come out with various innovations and R&D to reduce the impact of power and CO2 emission There is still a wide scope of domestic market due to low consumption of steel about 46kg per capita while the global average is about 150kg per capita. Even though India is 5th largest steel producer in the world it was net importer of steel in the year 2009-10. This is because there is a large demand in surface finishing products, Light weight products which is being dominated by the European Manufactures. Indian Steel industry lacks in R&D and technology of forming differentiation in the field. Thus further innovation will help the industry to penetrate into the local market.

6. REFERENCE

Joint Plan Commission (2010) ID No: 1013043 Page:11

BUSINESS ENVIRONMENT 2011 http://www.jpcindiansteel.nic.in/profile.asp

2010-

Ministry of Steel, Results framework Document (RFD) - Strategic Plan 2010-11 http://steel.nic.in/rfd/rfd_26022010.pdf World Steel Association (WSA) Crude Steel Production, http://www.jpcindiansteel.nic.in/Oct2010.pdf Businesses Standard,(2010) Karnataka readies to allot captive iron ore mines to steel majors http://www.business-standard.com/india/news/karnataka-readies-to-allotcaptive-iron-ore-mines-to-steel-majors/416946/ The Economic Times (2010) http://economictimes.indiatimes.com/News/News-By-Industry/Mining-industryOn-a-growth-trail/articleshow/4694631.cms Report of the Working Group on Steel Industry for the Eleventh Five-Year Plan (2007-2012) http://planningcommission.nic.in/plans/planrel/fiveyr/11th/11_v3/11th_vol3.pdf Fact Sheet-Energy- World Steel Association http://www.worldsteel.org/pictures/programfiles/Fact%20sheet_Energy.pdf Indias Iron and Steel Industry: Productivity, Energy Efficiency and Carbon Emissions, ERNEST ORLANDO LAWRENCE -BERKELEY NATIONAL LABORATORY Strategy for Revival and Growth of Indian Steel Industry, Institute of EngineersJournal Metals and metallurgical- Volume 91 October 2010 http://www.ieindia.org/publish/mm/mm.htm Development of Indian Steel Sector Since 1991 http://steel.nic.in/development.htm SAIL to set up railway wagon factory http://www.thehindubusinessline.com/2010/08/07/stories/20100 London Metal Exchange rate http://www.basemetals.com/ INDIAN STEEL INDUSTRY-Final Report, Prepared for the Competition Commission of India, January 2009

ID No: 1013043

Page:12

BUSINESS ENVIRONMENT 2011 www.cci.gov.in/images/media/.../Indicussteel_20090420151842.pdf

2010-

ID No: 1013043

Page:13

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Primavera ConceptsDocument56 pagesPrimavera ConceptsVimalan ParivallalNo ratings yet

- Model of Fire Water Line of Petrochemical PlantDocument1 pageModel of Fire Water Line of Petrochemical PlantVimalan ParivallalNo ratings yet

- Mechnical Oriented CompaniesDocument21 pagesMechnical Oriented CompaniesVimalan ParivallalNo ratings yet

- Primavera P6 PM Course MaterialDocument75 pagesPrimavera P6 PM Course Materialsunilas21840896% (27)

- Epracto Product Booklet PDFDocument6 pagesEpracto Product Booklet PDFVimalan ParivallalNo ratings yet

- Drilling FloorDocument1 pageDrilling FloorVimalan ParivallalNo ratings yet

- Hard QuestionDocument183 pagesHard QuestionWidodo Muis100% (1)

- Formac Industry Readiness ProgramDocument7 pagesFormac Industry Readiness ProgramVimalan ParivallalNo ratings yet

- Sample WBSfor Oil, Gasand Petrochemical ProjectDocument3 pagesSample WBSfor Oil, Gasand Petrochemical Projectmohammed_1401No ratings yet

- College SPOC Contact ListDocument5 pagesCollege SPOC Contact ListVimalan Parivallal88% (26)

- ISRO Interview TipsDocument10 pagesISRO Interview TipsVimalan ParivallalNo ratings yet

- Isac OverviewDocument47 pagesIsac OverviewVimalan ParivallalNo ratings yet

- Zero Based Budgeting in ISRODocument100 pagesZero Based Budgeting in ISROVimalan Parivallal100% (1)

- JP Morgan Interview For Financial AnalystDocument10 pagesJP Morgan Interview For Financial AnalystVimalan Parivallal100% (3)

- ISRO Questions Personal DetailsDocument21 pagesISRO Questions Personal DetailsVimalan Parivallal0% (1)

- An Insight of Growth and Development of United States of AmericaDocument14 pagesAn Insight of Growth and Development of United States of AmericaVimalan ParivallalNo ratings yet

- 13-Secrets - Napoleon HillDocument14 pages13-Secrets - Napoleon HillGastoreNo ratings yet

- Ecw 2Document14 pagesEcw 2Vimalan ParivallalNo ratings yet

- Women's Clothing Buying During RecessionDocument109 pagesWomen's Clothing Buying During RecessionVimalan Parivallal100% (1)

- Evaluation of Ebusiness Systems of Screwfix ComDocument18 pagesEvaluation of Ebusiness Systems of Screwfix ComVimalan ParivallalNo ratings yet

- Durai STMDocument14 pagesDurai STMVimalan ParivallalNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Retail AssignmentDocument35 pagesRetail Assignmentapi-316655900No ratings yet

- Sme Group 21Document9 pagesSme Group 21Sudir SinghNo ratings yet

- Role of Microfinance Institutions in Achieving Nigeria's Economic Self-RelianceDocument95 pagesRole of Microfinance Institutions in Achieving Nigeria's Economic Self-RelianceFaith MoneyNo ratings yet

- Chapter 5 - Macroeconomic Policy DebatesDocument37 pagesChapter 5 - Macroeconomic Policy DebatesbashatigabuNo ratings yet

- Edexcel As Econ Unit 2 FullDocument198 pagesEdexcel As Econ Unit 2 Fullloca_sanamNo ratings yet

- ECO401 Latest PaPers - SolvedSubjective Mega FileDocument41 pagesECO401 Latest PaPers - SolvedSubjective Mega FileSamra BatoolNo ratings yet

- TVET As An Important Factor in Country's Economic DevelopmentDocument3 pagesTVET As An Important Factor in Country's Economic Developmentbizaisham bidinNo ratings yet

- Poverty and EducationDocument36 pagesPoverty and EducationMorneNo ratings yet

- AGM Notice and Annual Report for FY2018-19Document324 pagesAGM Notice and Annual Report for FY2018-19KALEEN BHAIYA KING OF MIRZAPURNo ratings yet

- Hanoi, Vietnam: School of Advanced Educational Programs National Economics UniversityDocument7 pagesHanoi, Vietnam: School of Advanced Educational Programs National Economics UniversityHồng NhungNo ratings yet

- Ethiopia Health Sector Transformation ProcessDocument184 pagesEthiopia Health Sector Transformation ProcessAbebe TilahunNo ratings yet

- Crisil List of SMEDocument72 pagesCrisil List of SMEGp MishraNo ratings yet

- JobfitDocument244 pagesJobfitjeemee0320No ratings yet

- China-US Trade IssuesDocument54 pagesChina-US Trade IssuesGabrielGaunyNo ratings yet

- Annual Report and Financial Statements: Kenya Roads BoardDocument100 pagesAnnual Report and Financial Statements: Kenya Roads BoardRonnie Kinyanjui0% (1)

- Make in IndiaDocument2 pagesMake in IndiaRadhika WaliaNo ratings yet

- Model UKMDocument17 pagesModel UKMFajar JuniarNo ratings yet

- Dry Bulk Full Report SMOO Q1 2024Document8 pagesDry Bulk Full Report SMOO Q1 2024bill duanNo ratings yet

- Co-op Movement's Role in Maharashtra Rural DevelopmentDocument54 pagesCo-op Movement's Role in Maharashtra Rural DevelopmentAbhiNo ratings yet

- DBA 5034 International Trade FinanceDocument241 pagesDBA 5034 International Trade FinanceShrividhyaNo ratings yet

- The India-Middle East-Europe Economic Corridor (IMEC)Document4 pagesThe India-Middle East-Europe Economic Corridor (IMEC)Nofil RazaNo ratings yet

- FOE - Promotion of A Venture - Unit-2Document8 pagesFOE - Promotion of A Venture - Unit-2Rashmi Ranjan PanigrahiNo ratings yet

- Economic Growth and Macroeconomic Dynamics - Recent Developments in Economic Theory (PDFDrive) PDFDocument201 pagesEconomic Growth and Macroeconomic Dynamics - Recent Developments in Economic Theory (PDFDrive) PDFdrparulkhanna07No ratings yet

- India's Economic Development 1950-1990Document13 pagesIndia's Economic Development 1950-1990Manya NagpalNo ratings yet

- Walton Bangladesh Report Analyzes Leading Electronics BrandDocument27 pagesWalton Bangladesh Report Analyzes Leading Electronics BrandAhmad Shubho0% (1)

- Structural Change and Economic Dynamics: Fabricio Missio, Ricardo Azevedo Araujo, Frederico G. Jayme JRDocument9 pagesStructural Change and Economic Dynamics: Fabricio Missio, Ricardo Azevedo Araujo, Frederico G. Jayme JRikhsan syahabNo ratings yet

- STS PPT Chapter 1 7 PDFDocument405 pagesSTS PPT Chapter 1 7 PDFearl beanscentNo ratings yet

- 2012 Mid Term Fiscal Policy ReviewDocument170 pages2012 Mid Term Fiscal Policy ReviewgizzarNo ratings yet

- Jammu & Kashmir IT PolicyDocument17 pagesJammu & Kashmir IT PolicyIndustrialpropertyinNo ratings yet

- A Broader-Based Economy - Inquirer OpinionDocument6 pagesA Broader-Based Economy - Inquirer OpinionRamon T. Conducto IINo ratings yet