Professional Documents

Culture Documents

Semi

Uploaded by

Markus DanielOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Semi

Uploaded by

Markus DanielCopyright:

Available Formats

Union Investment Endowed Chair of Asset Management

Prof. Dr. Roland Fss

Topic: The Validity of Company Valuation Using Discounted Cash Flow Methods

Tutor: Zeno Adams (zeno.adams@ebs.edu) You may either write in English or German

Discounted Cash Flow (DCF) methods are an important part in fundamental company valuation. In the typical two phase formula the companys future expected Free Cash Flows are discounted individually for the first few periods, and aggregated to a terminal value for the more distant future periods:

FVt %

!1 # r "

FCFt #1

# 1

!1 # r "

FCFt #2

2

# ... #

!1 # r "

FCFt # n

n

FCFt # n $ !1 # g "

!r & g "

!1 # r "

It turns out that in most practical situations the terminal value contributes the largest part to the firm value (FV). However, this term is an approximation that incorporates mainly uncertainty of future free cash flows. Small changes in the FCF forecast for time t+n, changes in the expected growth rate of future free cash flows g, as well as the discount rate r allow for a wide range of possible firm values. The aim of this seminar topic is to show how the firm value reacts to changes in one of these fundamental factors and to discuss possibly reasonable ranges for the firm value as well as for the determining factors of the model.

Literature: !

Brealey, R.A., Myers, S.C., and Allen, F. (2006), Corporate Finance, 8th ed

Bodie, Z., Kane, A., and Marcus, A.J. (2005), Investments, 6th ed, Ch. 18. Stephen, H.P., and Sougiannis, T. (1996), A Comparison of Dividend, Cash Flow, and Earnings Approaches to Equity Valuation, SSRN: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=15043

You might also like

- Risk in Capital Structure Arbitrage 2006Document46 pagesRisk in Capital Structure Arbitrage 2006jinwei2011No ratings yet

- Project Management Key Performance IndicatorsDocument28 pagesProject Management Key Performance IndicatorsEbrenonNo ratings yet

- Mark M Pollitt - Cyber Terrorism - Fact or FancyDocument5 pagesMark M Pollitt - Cyber Terrorism - Fact or FancyJohn SutherlandNo ratings yet

- Author's Accepted Manuscript: Journal of Financial EconomicsDocument51 pagesAuthor's Accepted Manuscript: Journal of Financial EconomicsMuhammad Idhwar Dzikir RNo ratings yet

- Karapandza (2016) Stock Returns and Future Tense Language in 10-K ReportsDocument12 pagesKarapandza (2016) Stock Returns and Future Tense Language in 10-K Reportsflareon08082016No ratings yet

- Fama French (2015) - International Tests of A Five-Factor Asset Pricing ModelDocument23 pagesFama French (2015) - International Tests of A Five-Factor Asset Pricing ModelBayu D. PutraNo ratings yet

- Li Feng MD&A 2009Document54 pagesLi Feng MD&A 2009Kirsten StricklerNo ratings yet

- Kraft Schwartz 11 WPDocument43 pagesKraft Schwartz 11 WPSalah AyoubiNo ratings yet

- Investment and The Weighted Average Cost of Capital: Murray Z. Frank and Tao ShenDocument51 pagesInvestment and The Weighted Average Cost of Capital: Murray Z. Frank and Tao ShenViorel AdirvaNo ratings yet

- Uncertainty, Major Investments, and Capital Structure DynamicsDocument56 pagesUncertainty, Major Investments, and Capital Structure Dynamicsaaditya01No ratings yet

- Piotroski Latest PaperDocument47 pagesPiotroski Latest PaperGeetha SajjaNo ratings yet

- Haugen BakerDocument39 pagesHaugen Bakerjared46No ratings yet

- Equity Fincing RiskDocument62 pagesEquity Fincing RiskBrian HughesNo ratings yet

- Dissertation On Determinants of Capital StructureDocument8 pagesDissertation On Determinants of Capital StructureCollegePaperServiceUK100% (1)

- An International Analysis of Earnings, Stock Prices and Bond YieldsDocument30 pagesAn International Analysis of Earnings, Stock Prices and Bond YieldsMatteo MarcantogniniNo ratings yet

- CFAR Time Variation in The Equity Risk PremiumDocument16 pagesCFAR Time Variation in The Equity Risk Premiumpby5145No ratings yet

- Value and Growth Investing: A Review and Update: Louis K. C. Chan and Josef LakonishokDocument27 pagesValue and Growth Investing: A Review and Update: Louis K. C. Chan and Josef LakonishokNilesh AgarwalNo ratings yet

- 1 s2.0 S0304405X06001164 Main 2 PDFDocument28 pages1 s2.0 S0304405X06001164 Main 2 PDFAmmi JulianNo ratings yet

- Accounting Anomalies and Fundamental Analysis An Alternative ViewDocument12 pagesAccounting Anomalies and Fundamental Analysis An Alternative ViewZhang PeilinNo ratings yet

- Risk-Return Relationship in The Finnish Stock Market in The Light of Capital Asset Pricing Model (CAPM)Document19 pagesRisk-Return Relationship in The Finnish Stock Market in The Light of Capital Asset Pricing Model (CAPM)gitaNo ratings yet

- SSRN Id1873234Document70 pagesSSRN Id1873234Ayer MañanaNo ratings yet

- Cushman (2007) - A Portfolio Balance Approach To The CanadianU.S. Exchange RateDocument16 pagesCushman (2007) - A Portfolio Balance Approach To The CanadianU.S. Exchange RateLucero jimenezNo ratings yet

- Equity Investment IntangiblesDocument51 pagesEquity Investment Intangiblesgj409gj548jNo ratings yet

- Master Dissertation TraductionDocument8 pagesMaster Dissertation TraductionGhostWriterCollegePapersHartford100% (1)

- Finance FeaturesDocument7 pagesFinance FeaturesBlackBunny103No ratings yet

- Haugen 1996Document39 pagesHaugen 1996Roland Adi NugrahaNo ratings yet

- Betting Against Beta - Frazzini and PedersenDocument25 pagesBetting Against Beta - Frazzini and PedersenGustavo Barbeito LacerdaNo ratings yet

- The Journal of Finance - 2007 - LETTAU - Why Is Long Horizon Equity Less Risky A Duration Based Explanation of The ValueDocument38 pagesThe Journal of Finance - 2007 - LETTAU - Why Is Long Horizon Equity Less Risky A Duration Based Explanation of The Value1527351362No ratings yet

- Fama and French 2015JFEDocument53 pagesFama and French 2015JFEbhutorn3916100% (1)

- Belo 2011Document43 pagesBelo 2011Bariq AnugrahNo ratings yet

- Cash Flow Growth and Stock ReturnsDocument32 pagesCash Flow Growth and Stock ReturnsPierre-Alexis DelavaultNo ratings yet

- 10.1016/j.jcorpfin.2016.01.011: Journal of Corporate FinanceDocument76 pages10.1016/j.jcorpfin.2016.01.011: Journal of Corporate FinanceVương Trần AnhNo ratings yet

- Review of LiteratureDocument7 pagesReview of LiteratureAshish KumarNo ratings yet

- Firm Size and Capital StructureDocument41 pagesFirm Size and Capital StructureVectorNo ratings yet

- Contrarian Factor Timing Is Deceptively DifficultDocument29 pagesContrarian Factor Timing Is Deceptively DifficultgreyistariNo ratings yet

- Factor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertDocument16 pagesFactor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertJuan Manuel VeronNo ratings yet

- Betting Against BetaDocument25 pagesBetting Against BetamNo ratings yet

- Distress Risk Jun 05Document46 pagesDistress Risk Jun 05ragothbaNo ratings yet

- Project Proposal Evaluating Performance and Strategy of Mutual FundsDocument6 pagesProject Proposal Evaluating Performance and Strategy of Mutual FundsVignesh SuryaNo ratings yet

- Lazy PricesDocument45 pagesLazy PricesHe LiNo ratings yet

- Exchange Rate ThesisDocument8 pagesExchange Rate ThesisWritingPaperHelpSiouxFalls100% (2)

- A Panel Data Analysis of Working Capital Management PoliciesDocument15 pagesA Panel Data Analysis of Working Capital Management PoliciesMirza Zain Ul AbideenNo ratings yet

- Gomes2001 FinancingInvestmentDocument24 pagesGomes2001 FinancingInvestmenthannesreiNo ratings yet

- Earning Response Coefficients and The Financial Risks of China Commercial BanksDocument11 pagesEarning Response Coefficients and The Financial Risks of China Commercial BanksShelly ImoNo ratings yet

- Volatility Forecasting For Mutual Fund PortfoliosDocument10 pagesVolatility Forecasting For Mutual Fund PortfoliosRai_Esthu_NalendraNo ratings yet

- Factor Investing in The Corporate Bond Market: Patrick HouwelingDocument49 pagesFactor Investing in The Corporate Bond Market: Patrick HouwelingAndrew FuNo ratings yet

- Value Versus Growth: Australian EvidenceDocument36 pagesValue Versus Growth: Australian Evidenceberean9878No ratings yet

- Zarraree PDFDocument8 pagesZarraree PDFkshitijsaxenaNo ratings yet

- The Impact of Free Cash Flow On Market Value of Firm: Abdul Nafea Al Zararee and Abdulrahman Al-AzzawiDocument8 pagesThe Impact of Free Cash Flow On Market Value of Firm: Abdul Nafea Al Zararee and Abdulrahman Al-AzzawibagusNo ratings yet

- 1 s2.0 S0378426616301091 MainDocument14 pages1 s2.0 S0378426616301091 Maindarcy whiteNo ratings yet

- Models of Future Currency PricesDocument29 pagesModels of Future Currency Pricesjluste3No ratings yet

- Adaptive Asset AllocationDocument24 pagesAdaptive Asset Allocationchalimac100% (2)

- Ilmanen Kizer 2012 Death of Diversification ExaggeratedDocument14 pagesIlmanen Kizer 2012 Death of Diversification Exaggeratedroblee1No ratings yet

- 10 Chapter 2Document63 pages10 Chapter 2Nikhil DhawanNo ratings yet

- Thesis Exchange RateDocument5 pagesThesis Exchange Ratetheresasinghseattle100% (2)

- Optimal Leverage and Firm Performance: An Endogenous Threshold AnalysisDocument34 pagesOptimal Leverage and Firm Performance: An Endogenous Threshold AnalysisNguyễnVũNhậtLinhNo ratings yet

- Report 1Document13 pagesReport 1Ranjusha AshokNo ratings yet

- Downside Risk Aversion Fixed Income ExpoDocument48 pagesDownside Risk Aversion Fixed Income ExpoDGLNo ratings yet

- Capital Structure Dissertation TopicsDocument5 pagesCapital Structure Dissertation TopicsCustomWritingPaperServiceCanada100% (1)

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- EIB Working Papers 2019/11 - Macro-based asset allocation: An empirical analysisFrom EverandEIB Working Papers 2019/11 - Macro-based asset allocation: An empirical analysisNo ratings yet

- (Johann Mouton, H. C. Marais) Basic Concepts in TH (BookFi)Document285 pages(Johann Mouton, H. C. Marais) Basic Concepts in TH (BookFi)Irfan AllatifNo ratings yet

- LHB675 Spec SheetDocument1 pageLHB675 Spec SheetVenkatesh ChakravarthyNo ratings yet

- Opemtqm Module 1Document23 pagesOpemtqm Module 1Zera DelafuenteNo ratings yet

- 209 FullDocument23 pages209 FullMarta MontesinosNo ratings yet

- Financial Ratio - Wikipedia, The Free EncyclopediaDocument8 pagesFinancial Ratio - Wikipedia, The Free EncyclopediaSai Kiran CNo ratings yet

- Abduselam Aliyi Project ProposalDocument67 pagesAbduselam Aliyi Project ProposalAbduselam AliyiNo ratings yet

- Middlesex University Coursework 1: 2020/21 CST2330 Data Analysis For Enterprise ModellingDocument8 pagesMiddlesex University Coursework 1: 2020/21 CST2330 Data Analysis For Enterprise ModellingZulqarnain KhanNo ratings yet

- AWS Tutorial - Google SearchDocument3 pagesAWS Tutorial - Google Searchsai vishnu vardhanNo ratings yet

- Contribution Margin Is The Amount of Earnings Remaining After All Variable Costs Have Been Subtracted From RevenueDocument2 pagesContribution Margin Is The Amount of Earnings Remaining After All Variable Costs Have Been Subtracted From RevenueKonanRogerKouakouNo ratings yet

- How To Crack The Case OliverWyman LSEDocument27 pagesHow To Crack The Case OliverWyman LSEjohncenaasdf0% (1)

- Stabilization of A Model Rocket PDFDocument5 pagesStabilization of A Model Rocket PDFRiddhijit ChattopadhyayNo ratings yet

- EC Safety Data Sheet: 1. Name of Product, Characterization and Company NameDocument3 pagesEC Safety Data Sheet: 1. Name of Product, Characterization and Company NamemitramgopalNo ratings yet

- Discoverer 10g InstallationDocument8 pagesDiscoverer 10g Installationmanish nashikkrNo ratings yet

- Villegas vs. CaDocument2 pagesVillegas vs. CaJohn NambatacNo ratings yet

- Schematic DiagramDocument19 pagesSchematic DiagramtggfvguhjNo ratings yet

- Prediction Using NAVCADDocument2 pagesPrediction Using NAVCADspeedydogNo ratings yet

- (Don ChristianDocument37 pages(Don ChristianAmin RoisNo ratings yet

- 09 - 20 - 21 - Brochure - Handique College - v2Document1 page09 - 20 - 21 - Brochure - Handique College - v2Nilimoy BuragohainNo ratings yet

- Hiral Thakkar (107350592100) Mitali Wadhwani (107350592074)Document31 pagesHiral Thakkar (107350592100) Mitali Wadhwani (107350592074)Hiral ThakkarNo ratings yet

- Contribution of Aluminium To The Multi-Material Light-Weight BIW Design of SLCDocument12 pagesContribution of Aluminium To The Multi-Material Light-Weight BIW Design of SLCKivanc SengozNo ratings yet

- ORiN2SDK UsersGuide enDocument59 pagesORiN2SDK UsersGuide enWilliamNo ratings yet

- CMP Products Cable Gland Accessory CatalogueDocument3 pagesCMP Products Cable Gland Accessory CatalogueAlanBertinSouzaNo ratings yet

- DCC MPDocument21 pagesDCC MP556-Harsh TandelNo ratings yet

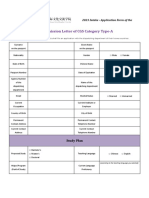

- Pre-Admission Letter of CGS Category Type-A: 2023 Intake - Application Form of TheDocument3 pagesPre-Admission Letter of CGS Category Type-A: 2023 Intake - Application Form of TheTạ Phương LinhNo ratings yet

- Training Ebsilon EnglDocument49 pagesTraining Ebsilon EnglUsama Jawaid100% (1)

- Hindrances and Prospects of Ceramic Technology Development in NigeriaDocument9 pagesHindrances and Prospects of Ceramic Technology Development in NigeriaijsidonlineinfoNo ratings yet

- Brand Plan For Sip Mineral Water: Presented byDocument18 pagesBrand Plan For Sip Mineral Water: Presented bysaiham saiemNo ratings yet

- New Cannabis Dispensary Retail Display Solutions Now AvailableDocument3 pagesNew Cannabis Dispensary Retail Display Solutions Now AvailablePR.comNo ratings yet