Professional Documents

Culture Documents

FM Butler Grup 2

FM Butler Grup 2

Uploaded by

iranchoiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Butler Grup 2

FM Butler Grup 2

Uploaded by

iranchoiCopyright:

Available Formats

Butler Lumber Company

Finance Management

xx xx xx Nanda Pujiputranto 10K16008 Yuliyanti 10K16016

MAGISTER OF BUSINESS ADMINISTRATION GADJAH MADA UNIVERSITY 2010

Butler Lumber Company

Case Study of Financial Management WE-16 Group II

INTRODUCTION

Butler Lumber Company was a growth company in the late 1980. This Company faced tremendous sales growth since it had been founded in 1981 by Mr. Butler and his brother-in-law, Henry Stark.In 1988, Mr. Butler bought Mr. Stark s share for $105,000 that would be paid off in 1989. For this payment, Mr. Butler has been loan of $70,000 in late 1988. This loan was secure by Butler s land and buildings, carried an interest rate of 11% and was repayable in quarterly installments at the rate of $7,000 a year over the next 10 years. Mr. Butler was also mortgaged his house for $38,000. Besides that, Mr. Butler held a $70,000 life insurance policy, payable to Mrs. Butler. Mr. Butler as the owner waslooking for new source of funding by extends his current unsecure bank loan because the company had shown a significant decrease in cash and increase in liabilities over the last three years.The maximum loan that the Butler Lumber Company could obtain from Suburban National was $250,000 in which his property would be used to secure the loan. George Dodge, an officer of a much larger bank, the Northrup National Bank. He offered Butler Lumber Company a line of credit of up to $465,000. The interest on the new loan would be prime 2%. Butler Lumber Company would have to sever ties with Suburban National if they were to have this LOC extended to them.

MAIN ISSUES

Was Butler Lumner Company a profitable business? Why Mr. Butler has to borrow so much many to support his company? Butler Lumber Company had a problem with a shortage of cash that was not allowing them to expand the business. For this reason, thecompany needed a larger unsecured loan that would allow them to expand the bussiness. The company expected larger sales figures in the near future. Therefore ButerLumber Company needed to determine if it wanted to grow the business or not. Northrup National Bank offered Butler Lumber Company a line of credit of up to $465,000. Was the bank s offer of $465,000 revolving credit enough (assume a 1991 sales volume of 3.5 million)?Could the cash flows of Butler Lumber support additional debt or stay with Suburban National s loan? A quick glance at Butler Lumber s Operating Statements and Balance Sheets might seem positive because the company was seeing a steady increase in Net Sales.After closer examination, Butler Lumber Company was not as might expect with such robust growth in sales.One main question begs to be asked, why was sales growth so robust, but net income growth anemic at best?

ANALYSIS PROFORMA

Pro forma Income Statement and Balance Sheet for period ending December 31, 1991 is prepared to determine how much Butler Lumber Company will need to borrow if it expands as planned.

1|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II

INCOME STATEMENT

Table 1 Projected Income Statement for 1991 of Butler Lumber Company

BUTLER LUMBER COMPANY

Projected Income Statement for December 31, 1991 (thousands of dollars) 1991 Net sales Cost of good sales Beginning Inventory Purchases $ $ $ $ Ending Inventory Total cost of goods sold Gross Profit Operating expense Operating Profit Purchases Discount Interest expense Net income before income tax Provision for income tax Net income $ $ 3,500 418 2,646 3,064 (546) 2,517 71.93% Computed value (total COGS - beg inv purchases) Historical % of sales based on prior 3 years Value $ 3,500 $ 418 Assumptions Explanation Given in case From Exhibit 2 1990 Historical % of sales based on prior 3 years

75.61%

$ $ $ $ $ $ $ $

983 (876) 107 40 (45) 101 (22) 78 34% 2% 10.50% Assume purchase discounts of 2% taken on all purchases after April 1, 1991. Given in case 25.02% Historical % of sales based on prior 3 years

Beginning inventory was pulled from the previous year s ending inventory. Purchases were projected from a trend of 75.61% of sales for the previous 3 years. The total cost of goods sold assumed the previous 3-year average of 71.93% of sales would continue. Provision for income taxes was calculated as 15% for the first $50 income, 25% for the second $25 income, and 34% for above $75 income.

BALANCE SHEET

Table 2 Projected Balance Sheet for 1991 of Butler Lumber Company

BUTLER LUMBER COMPANY

Projected Balance Sheet for December 31, 1991 (thousands of dollars) 1991 Assets Cash Accounts receivable, net Inventory $ $ $ 53.27 411.84 546 Value 1.52% 11.77% Assumptions Explanation Recent % of sales Recent % of sales Computed value from above

2|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II Current assets Property, net Total assets Liabilities Notes payable, bank Accounts payable Accrued expenses Long-term debt, current position Current liabilities Long-term debt Total liabilities Net worth Total liabilities and net worth * Bank note $ 1,011.29 $ 203.97 5.83% Recent % of sales $ 1,215.26

$ $ $ $ $ $

616.28 72.50 50.78 7 746.56 43 Computed value $ 10 1.45% 7 Days of purchases Historical % of sales based on prior 3 years Constant amortization

$ 789.56 $ 426 $ 1,215.26 $ 616.28

The balance sheet was created with the assumption that Butler wouldn t take the additional loan. The trend that cash followed from the previous years was used to project the cash asset. Account receivable was based on % of sales previous year. Property was expected to increase by 5.83% based on the previous year s trends. Accounts payable stayed at 10 days of purchases. Accrued expenses were based on historical 3 years i.e. 1.45% of sales. The long-term debt for the purchase of the company would be paid down to $43,000. Net worth of Butler Lumber Company was net worth from the previous year and net income from the projected income statement for the last 1991. Based on the pro forma income statement and balance sheet, it was determined that Butler Lumber would need to increase their current debt to approximately $616.28 to continue their expansion as planned.

FINANCIAL CONDITION LIQUIDITY

Table 3 Liquidity Ratio of Butler Lumber Company

Liquidity Ratio

Current Ratio Quick Ratio Cash Ratio

Formula

Current Assets Current Liabilities Current Assets Inventory Current Liabilities Cash Current Liabilities

1988

1.80x 0.88x 0.22x

1989

1.59x 0.72x 0.13x

1990

1.45x 0.67x 0.08x

1991 Q1

1.35x 0.54x 0.04x

Comments

trend is getting worse trend is getting worse trend is getting worse

The current and quick ratios were designed to indicate the organization s ability to meet its short-term obligations such as payments and other short-term debts, which typically were paid for current assets. A current ratio aproaching one was desirable. A lower value could indicate that a company might be having difficulties meeting its short-term obligations, while a current ratio value higher than one could be indicative of poor or inefficient use of funds.

3|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II Butler Lumber Company s current ratio was quite high at 1.45, yet its quick ratio was only o.67 (in 1990). This indicate that Butler Lumber Company was not best use of the funds available to it. Mr. Butler choosed to purchase inventory in quantities large enough to quality for discount for promt payment, but he rarely was able to take advantage of that discount. All of the difference in the current and quick ratios was inventory. Liquidity ratios of Butler Lumber Company were decreased yearly.For its current ratios, the company still can pay off its current liabilities through its current assets even has decreased. The decreasing trend was worrisome especially given the low quick ratios. But Butler Lumber Company covers its interest expenses 2.61 times in 1990 although the trend for TIE was also worsening (shows in table of Financial Leverage). The notable trend in this section was toward reduced liquidity. Butler was experiencing a shortage of working capital that needs to be addressed to sustain growth in this profitable business.

FINANCIAL LEVERAGE

Table 4 Liquidity Ratio of Butler Lumber Company

Financial Leverage Ratio

Total Debt Ratio Debt-Equity Ratio Equity Multiplier Times Interest Earned Cash Coverage Number of Days Payable

Formula

Total Assets - Total Equity Total Assets Total Debt Total Equity Total Assets Total Equity EBIT Interest EBIT + Depreciation Interest Accounts Payable Annual Purchases/365

1988

55% 1.20x 2.20x 3.85x 3.85x 35 days

1989

59% 1.42x 2.42x 3.05x 3.05x 46 days

1990

63% 1.68x 2.68x 2.61x 2.61x 46 days

Comments

Trend towards increased leverage

Interest expense is increasing

Good position helping cash flow

In 1990, Total Debt Ratio of Butler Lumber Company was about 63%. This was high given the slow move in inventories and low liquidity ratio. The trend showed increase in the use of debt. The data showed that Butler was becoming more leveraged, primarily in terms of short term debt. It further showed that the interest expense was outpacing the earnings growth, which could be helped by securing the new loan at a more favorable interest rate.

ASSET UTILIZATION

Table 5 Asset Utilization of Butler Lumber Company

Asset Utilization Ratio

Inventory Turnover Days Sales Inventory Receivables Turnover

Formula

Cost of Goods Sold Inventory 365 Days Inventory Turnover Sales Accounts Receivable

1988

5.11x 71 days 9.92x

1989

4.42x 83 days 9.07x

1990

4.67x 78 days 8.50x

Comments

Anticipated sales is increasing inventory on hand Taking longer to turn inventory

4|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II

Asset Utilization Ratio

Days Sales in A/R Average Collection Period Total Asset Turnover Capital Intensity

Formula

365 Days Receivables Turnover Accounts Receivable Sales/365 Days Sales Total Assets Total Assets Sales

1988

37 days 37 days 2.86x 0.35x

1989

40 days 40 days 2.74x 0.37x

1990

43 days 43 days 2.89x 0.35x Stable Stable

Comments

Taking longer to receive payment

Total asset turnover is slightly less than 3 for the three years under consideration. Butcomparison of the three years indicate deteriorating trend with respect to average collection period and inventory turnover ratios. Average collection period increased from 37 days in 1988 to 43 days in 1990 indicated the company takes longer days for taking payment. With increasing sales figures, as displayed in the previous years by the Butler Lumber Company, these long collection days have a greater effect on the business as the amount of outstanding proportional to the sales figures increase also. Inventory Turnover needs to be improved through better management of the inventory mix, and that increased effort is required to encourage customers to pay in a timelier manner. Done correctly these two actions should actually help reverse the downward trend in profit margin.

PROFITABILITY

Table 6 Profitability of Butler Lumber Company

Profitability Ratio

Profit Margin ROE ROA

Formula

I Sales I Total Equity I Total Assets

1988

1.83% 11.48% 5.22%

1989

1.69% 11.18% 4.62%

1990

1.63% 12.64% 4.72%

Comments

Decreasing trend is a concern

The Butler Lumber Company has positive Profit Margins and ROE, therefore it was a profitable business.However, the profit margin of company only had 1.83% in 1988 and always decline every year. Beside that, all of these ratios are trending in a negative direction, as a result of the analysis presented above.

SUGGESTION

Butler Lumber Company was on a growing path. It was evident from the case that the volume has been built due to successful price competition, careful control of operating expenses and purchases at substantial discounts. The data was tabulated below:

Table 7 % Increase in sales of Butler Lumber Company

% increase in sales of Butler Lumber Company

1988 Net Sales % Increase $ 1,697 NA 1989 $ 2,013 18.62% $ 1990 2,694 Expected 1991 $ 3,500 29.92%

33.83%

5|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II As Mr. Butler s financial advisor, we wouldn t advise him take the loan in an attempt to grow the business even though the business was profitable and growing. The revenue has been able to grow at a fast pace; 18.62% in 1989, 33.83% in 1990, 29.92% in 1991 but it was not recommended that Butler continue with their expansion plans. Although sales are high, the company was still relying heavily on borrowed funds to finance its daily activities. Increasing the loan amount would drive the company closer to bankruptcy, if the funds were used for expansion. Butler could however use the money to pay his account payable As a banker, we would not grant Butler Lumber Company a LOC for $465,000. This was too much for a company like this size, and with such little equity. The Days Sales A/R ratio was trending in the wrong direction, and more effort needs to be spent on collecting receivables in a timely manner. Additionally, the Inventory Turnover was decreasing, tying up too much cash, and exacerbating the shortage of working capital. More effort needed to be spent on inventory management, making sure there was not a growing amount of stagnant inventory, and that the mix was correct for the intended market.In addition to the conditions stipulated in the text, the bank should put require that these two ratios (Days Sales A/R and Inventory Turnover) return to their 1988 levels, and that Mark Butler s compensation be tied to these objectives.

CONCLUSION

Based on its profitability ratios, Butler Lumber Company was a profitable business. Butler Lumber Company has borrowed increasing amounts despite its profitability because the net income was growing at a slower rate than operating expenses. Between the years of 1988-1990 the net income only rose from 31, 34, 44 thousand repectively. The operating costs for the 3 years rose from 425, 515, 658 thousand repectively. Mr. Butler needed to take out loan so he could increase the purchasing power of goods. This would be accomplished by Mr. Butler has liquid cash to use for prompt payment, which would lead to acquiring trade discounts and then Mr. Butler would have a competitive advantage in terms of buying power.

Table 8 Spread of Butler Lumber Company for 1988-1990

1988

ROIC ROE D/R Spread 12,29% 11,48% 54,55% -1,47%

1989

13,52% 11,18% 58,70% -3,98%

1990

17,63% 12,64% 62,70% -7,95%

The table above shows the spread of butler lumber company from 1988 to 1990. From the table it can be seen that the spread continues to show negative results. This is due to its ROIC value greater than the value of its ROE. ROE was the result of the advantage if using internal and external funds, while ROIC only use internal funds only. Value of negative spreads continued to show that the company could not grow anymore. Thus Butler Lumber Company wasn t recomend to continue their expansion plan. Increasing their loan made the company become bankruptcy.

Table 9 Spread of Butler Lumber Company for projected 1991

projected 1991

ROIC ROE D/R Spread 17,43% 18,30% 64,90% 1,33%

6|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II On the prediction of financial statements for the year 1991, the company would increaseits spread. This only happened if the company has 3,5 million for volume sales in 1991. If sales volume of Butler Lumber Company assumed in 1991 was 3,5 million so the company has to increase its debt until 616.28 thousands. The Northrup National Bank s offer of 465 thousand revolving credit was not enough.

Table 10 % Inventory to total assets of Butler Lumber Company

1988

% Inventory to total assets 40.24%

1989

44.16%

1990

44.80%

Based on the table, Butler was short on funds due to their inventory. In 1990, inventory was almost 45% (i.e 44.80%) of their total assets. Better inventory management might increase the cash fund as well as free up space in the warehouses.

ATTACHMENT

Table 11 Exhibit 1 of Butler Lumber Company

BUTLER LUMBER COMPANY EXHIBIT 1

Operating Expenses for Years Ending December 31, 1988-1990, and for First Quarter 1991 (thousands of dollars) 1st Qtr. 1988 Net sales Cost of good sales Beginning Inventory Purchases $ 183 $ 1,278 $ 1,461 $ (239) $ 1,222 $ 475 $ (425) $ (13) $ 37 $ (6) $ 31 $ 239 $ 1,524 $ 1,763 $ (325) $ 1,438 $ 576 $ (515) $ (20) $ 41 $ (7) $ 34 $ 326 $ 2,042 $ 2,368 $ (418) $ 1,950 $ 744 $ (658) $ (33) $ 53 $ (9) $ 44 $ $ $ $ $ 418 660 1,078 (556) 522 1989 $ 2,013 1990 $ 2,694 $ 1991 718 (1) $ 1,697

Ending Inventory Total cost of goods sold

Gross Profit Operating expense(2) Interest expense Net income before income tax Provision for income tax Net income

$ $ $ $ $ $

196 (175) (10) 11 (2) 9

7|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II PS: (1) In the first quarter of 1990 sales were $698,000 and net income was $7,000 (2) Operating expenses include a cash salary for Mr. Butler of $75,000 in 1988, $85,000 in 1989, $95,000 in 1990, and $22,000 in the first quarter of 1991. Mr. Butler also received some of the perquisites commonly taken by owners of privately held business

Table 12Memo Items for Exhibit 1 of Butler Lumber Company

Memo Items

1 2 3 4 5 Purchase to sales Cost of good sales to sales Operating expense to sales Growth (sales) Growth (assets)

1988

75.31% 72.01% 25.04% -

1989

75.71% 71.44% 25.58% 18.62% 19.29%

1990

75.80% 72.38% 24.42% 33.83% 21.11%

Average

75.61% 71.94% 25.02%

Table 13 Exhibit 2 of Butler Lumber Company

BUTLER LUMBER COMPANY EXHIBIT 2

Balance Sheets at December 31, 1988--1990, and March 31,1991 (thousands of dollars) 1988 Assets Cash Accounts receivable, net Inventory Current assets Property, net Total assets Liabilities Note payable, bank Notes payable, Mr. Stark Notes payable, trade Accounts payable Accrued expenses Long-term debt, current position Current liabilities Long-term debt Total liabilities Net worth Total liabilities and net worth $ $ $ $ $ $ $ $ $ $ $ 105 124 24 7 260 64 324 270 594 $ $ $ $ $ $ $ $ $ $ $ 146 192 30 7 375 57 432 304 736 $ $ $ $ $ $ $ $ $ $ $ 233 256 39 7 535 50 585 348 933 $ $ $ $ $ $ $ $ $ $ 247 157 243 36 7 690 47 737 357 $ $ $ $ $ $ 58 171 239 468 126 594 $ $ $ $ $ $ 49 222 325 596 140 736 $ $ $ $ $ $ 41 317 418 776 157 933 $ $ $ $ $ 31 345 556 932 162 1989 1990 1st Qtr 1991

$ 1,094

$ 1,094

8|P a ge

Butler Lumber Company

Case Study of Financial Management WE-16 Group II

Table 14 Memo Items for Exhibit 2 of Butler Lumber Company

Memo Items

1 2 3 4 5 6 7 Networking capital Networking operating capital Cash to sales Account receivable to sales Net property to sales Accrued expenses to sales Account payable to sales $ $

1988

208 320 3.42% 10.08% 7.42% 1.41% 7.31% $ $

1989

221 374 2.43% 11.03% 6.95% 1.49% 9.54% $ $

1990

241 481 1.52% 11.77% 5.83% 1.45% 9.50%

1st Qtr.1991

$ $ 242 653

Average

$ $ 228 457 2.46% 10.96% 6.74% 1.45%

9|P a ge

You might also like

- Group B&D - Case 19 - Fonderia PresentationDocument24 pagesGroup B&D - Case 19 - Fonderia PresentationVinithi Thongkampala100% (2)

- Case of Dorchester LTD (Assignment)Document7 pagesCase of Dorchester LTD (Assignment)ShahedNo ratings yet

- Butler Lumber - Pro Forma - Balance and Income StatementDocument4 pagesButler Lumber - Pro Forma - Balance and Income StatementJack Benjamin83% (6)

- Case 26 Rockboro Group ADocument27 pagesCase 26 Rockboro Group AKanoknad KalaphakdeeNo ratings yet

- Rockboro Machine Tools Corporation Case QuestionsDocument1 pageRockboro Machine Tools Corporation Case QuestionsMasumiNo ratings yet

- Butler Lumber CaseDocument7 pagesButler Lumber CaseSam Rosenbaum100% (1)

- Butler Lumber 1Document6 pagesButler Lumber 1Bhavna Singh33% (3)

- FM SolutionDocument11 pagesFM SolutionBilal Naseer100% (4)

- Oblicon Project Bar Review QuestionsDocument35 pagesOblicon Project Bar Review QuestionsSarah Cadiogan88% (8)

- Butler Lumber Case Study SolutionDocument8 pagesButler Lumber Case Study SolutionBagus Be WeNo ratings yet

- Act 8Document6 pagesAct 8Carlos MartinezNo ratings yet

- Grennell Farm SolutionDocument6 pagesGrennell Farm SolutionMichael TorresNo ratings yet

- Butler Lumber Company Case SolutionDocument18 pagesButler Lumber Company Case SolutionNabab Shirajuddoula75% (8)

- Butler Lumber Company: Following Questions Are Answered in This Case Study SolutionDocument3 pagesButler Lumber Company: Following Questions Are Answered in This Case Study SolutionTalha SiddiquiNo ratings yet

- Butler Lumber CompanyDocument8 pagesButler Lumber CompanyAnmol ChopraNo ratings yet

- Sabya BhaiDocument6 pagesSabya BhaiamanNo ratings yet

- Butler Lumber Case SolutionDocument4 pagesButler Lumber Case SolutionCharleneNo ratings yet

- Blaine SolutionDocument4 pagesBlaine Solutionchintan MehtaNo ratings yet

- Rockboro Machine Tools Corporation: Source: Author EstimatesDocument10 pagesRockboro Machine Tools Corporation: Source: Author EstimatesMasumi0% (2)

- Case 3: Rockboro Machine Tools Corporation Executive SummaryDocument1 pageCase 3: Rockboro Machine Tools Corporation Executive SummaryMaricel GuarinoNo ratings yet

- Sure CutDocument1 pageSure Cutchch917No ratings yet

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Super ProjectDocument2 pagesSuper ProjectAnkit MehtaNo ratings yet

- Butler Lumber CaseDocument14 pagesButler Lumber CaseSangeet SaritaNo ratings yet

- Case Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, IncDocument3 pagesCase Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, Inchelsamra0% (2)

- Al-Ghazi Tractors - Final ProjectDocument27 pagesAl-Ghazi Tractors - Final ProjectAwais MasoodNo ratings yet

- Butler Lumber Company Case ProblemDocument2 pagesButler Lumber Company Case ProblemJem JemNo ratings yet

- Butler Lumber CaseDocument14 pagesButler Lumber CaseSamarth Mewada83% (6)

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421No ratings yet

- ButlerDocument8 pagesButlerHadi Khawaja100% (1)

- Butler Excel Sheets (Group 2)Document11 pagesButler Excel Sheets (Group 2)Nathan ClarkinNo ratings yet

- Hill CountryDocument8 pagesHill CountryAtif Raza AkbarNo ratings yet

- (S3) Butler Lumber - EnGDocument11 pages(S3) Butler Lumber - EnGdavidinmexicoNo ratings yet

- West Jet AirlinesDocument2 pagesWest Jet AirlinesPraeen Kc100% (1)

- Case: Blaine Kitchenware, IncDocument5 pagesCase: Blaine Kitchenware, IncWilliam NgNo ratings yet

- Clarkson TemplateDocument7 pagesClarkson TemplateJeffery KaoNo ratings yet

- Hill Country CaseDocument5 pagesHill Country CaseDeepansh Kakkar100% (1)

- Mid Term ExamDocument4 pagesMid Term ExamChris Rosbeck0% (1)

- Cred&coll Reviewer MidtermsDocument24 pagesCred&coll Reviewer MidtermsElla Marie LopezNo ratings yet

- Walmart Case 150Document38 pagesWalmart Case 150Phakpoom Naji100% (2)

- Butler Lumber CaseDocument4 pagesButler Lumber CaseLovin SeeNo ratings yet

- Butler Lumber SuggestionsDocument2 pagesButler Lumber Suggestionsmannu.abhimanyu3098No ratings yet

- The Butler Lumber Company - AH1Document6 pagesThe Butler Lumber Company - AH1shaluxlriNo ratings yet

- Butler Lumber Final First DraftDocument12 pagesButler Lumber Final First DraftAdit Swarup100% (3)

- Case #7 Butler LumberDocument2 pagesCase #7 Butler LumberBianca UcheNo ratings yet

- Butler Lumber Case DiscussionDocument3 pagesButler Lumber Case DiscussionJayzie Li100% (1)

- Butler CaseDocument16 pagesButler Casea_14sNo ratings yet

- Bulter Lumber CaseDocument3 pagesBulter Lumber CaseSwarna RSNo ratings yet

- Butler Lumber Case AnalysisDocument2 pagesButler Lumber Case AnalysisDucNo ratings yet

- Analysis Butler Lumber CompanyDocument3 pagesAnalysis Butler Lumber CompanyRoberto LlerenaNo ratings yet

- Joneja Bright Steels: The Cash Discount DecisionDocument13 pagesJoneja Bright Steels: The Cash Discount DecisionDiv_nNo ratings yet

- Hill Country Snack Food Co.Document7 pagesHill Country Snack Food Co.Anish NarulaNo ratings yet

- Sec6 Group13 SimulationDocument5 pagesSec6 Group13 SimulationAvinashDeshpande1989100% (1)

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Case QuestionsDocument6 pagesCase QuestionslddNo ratings yet

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDocument2 pagesM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현100% (1)

- BCB Case StudyDocument20 pagesBCB Case Studycarota89100% (1)

- Assignment 7 - Clarkson LumberDocument5 pagesAssignment 7 - Clarkson Lumbertesttest1No ratings yet

- Case Analysis - Toy WorldDocument11 pagesCase Analysis - Toy Worldvarjin71% (7)

- Blaine Kitchenware 3Document8 pagesBlaine Kitchenware 3Chris100% (1)

- LYons Bond Case SolutionDocument2 pagesLYons Bond Case SolutionGautam Sethi75% (4)

- FIN254 Assignment# 1Document2 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- Analysis: Operating ActivitiesDocument3 pagesAnalysis: Operating ActivitiesSammy Dalie Soto Bernaola0% (1)

- Financial Statements, Taxes, and Cash FlowDocument46 pagesFinancial Statements, Taxes, and Cash FlowgagafikNo ratings yet

- Exercises AllDocument9 pagesExercises AllLede Ann Calipus YapNo ratings yet

- Butler Lumber Company Income StatementDocument8 pagesButler Lumber Company Income StatementpuspemoltuNo ratings yet

- Assignment 1-Gideon Zoiku-R1810D6621 FMDocument16 pagesAssignment 1-Gideon Zoiku-R1810D6621 FMBrett ViceNo ratings yet

- Credit Guarantee Fund Trust For Micro & Small EnterprisesDocument19 pagesCredit Guarantee Fund Trust For Micro & Small EnterprisesAnand SinghNo ratings yet

- Marriott Corporation The Cost of Capital Case Study AnalysisDocument21 pagesMarriott Corporation The Cost of Capital Case Study AnalysisvasanthaNo ratings yet

- Investment Analysis and Portfolio Management-KRISTINA L PDFDocument166 pagesInvestment Analysis and Portfolio Management-KRISTINA L PDFWahyu S. Furqonnanto100% (2)

- Organized Crime in BulgariaDocument204 pagesOrganized Crime in BulgariahellasrocketmailNo ratings yet

- Real Estate Mortgage - SampleDocument3 pagesReal Estate Mortgage - SampleCharlotte GallegoNo ratings yet

- Chandan Project PDFDocument95 pagesChandan Project PDFChandan Kumar NNo ratings yet

- Problem Set-Leverage and Capital StructureDocument10 pagesProblem Set-Leverage and Capital StructuremaazNo ratings yet

- A Study On The Financial Analysis of Reliance Industries LimitedDocument13 pagesA Study On The Financial Analysis of Reliance Industries LimitedIJAR JOURNAL100% (1)

- Euro Currency MarketDocument33 pagesEuro Currency Marketsfkokane83% (6)

- A Comparative Analysis of Annual Report of "United Spirits LTD" Across IndustriesDocument12 pagesA Comparative Analysis of Annual Report of "United Spirits LTD" Across Industriesrishimahesh2005No ratings yet

- الأزمة المالية العالمية 2008 جذورها و تداعياتها ساعد مرابط PDFDocument15 pagesالأزمة المالية العالمية 2008 جذورها و تداعياتها ساعد مرابط PDFساعدNo ratings yet

- Tutorial 4 TVM ApplicationDocument4 pagesTutorial 4 TVM ApplicationTrần ThảoNo ratings yet

- Ifr 2019-11-02 PDFDocument96 pagesIfr 2019-11-02 PDFPiyushNo ratings yet

- JA Personal Finance - Blended - Answer Key - 19-20Document5 pagesJA Personal Finance - Blended - Answer Key - 19-20sheima siddigNo ratings yet

- Tan v. Rodil EnterprisesDocument3 pagesTan v. Rodil EnterprisesTootsie GuzmaNo ratings yet

- Public Debt and Its Sustainability at State Level-A Study of Kerala Literature ReviewDocument4 pagesPublic Debt and Its Sustainability at State Level-A Study of Kerala Literature ReviewM CharlesNo ratings yet

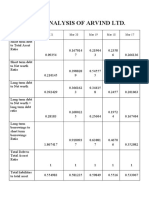

- Ratio Analysis of Arvind LTD.: Ratios Mar 21 Mar 20 Mar 19 Mar 18 Mar 17Document10 pagesRatio Analysis of Arvind LTD.: Ratios Mar 21 Mar 20 Mar 19 Mar 18 Mar 17simranNo ratings yet

- Penalties, Time Limit and Forms May 2023Document12 pagesPenalties, Time Limit and Forms May 2023VenkataRajuNo ratings yet

- In What Context Are Terms Pledge, Hypothecation and Mortgage UsedDocument2 pagesIn What Context Are Terms Pledge, Hypothecation and Mortgage Useddineshjain11100% (1)

- Grade Xi HOLIDAY HOMEWORK-2016-17 Commerce Stream AccountancyDocument36 pagesGrade Xi HOLIDAY HOMEWORK-2016-17 Commerce Stream AccountancysanjeevaniNo ratings yet

- Capital Structure: Meaning and Theories Presented by Namrata Deb 1 PGDBMDocument20 pagesCapital Structure: Meaning and Theories Presented by Namrata Deb 1 PGDBMDhiraj SharmaNo ratings yet

- Dominos ReportDocument20 pagesDominos ReportDisha HalderNo ratings yet