Professional Documents

Culture Documents

Print/Copy To Excel:: Previous Years

Uploaded by

sharmavikram876Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Print/Copy To Excel:: Previous Years

Uploaded by

sharmavikram876Copyright:

Available Formats

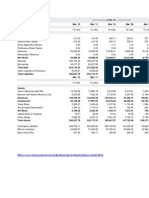

Financial Ratios

Print/Copy to Excel :

Previous Year

Mar '11

Mar '10

Mar '09

Mar '08

Mar '07

5.00

5.00

5.00

5.00

5.00

Investment Valuation Ratios

Face Value

Dividend Per Share

7.50

6.00

3.50

5.00

4.50

115.72

129.38

65.89

88.31

76.30

1,014.77

717.50

625.34

512.49

403.82

318.45

286.28

231.89

--

--

--

--

--

Operating Profit Margin(%)

9.14

12.74

9.18

14.12

14.88

Profit Before Interest And Tax Margin(%)

6.24

9.73

5.62

10.70

12.74

Gross Profit Margin(%)

6.37

9.93

5.77

10.97

16.66

Cash Profit Margin(%)

8.69

10.78

9.13

11.79

12.08

Adjusted Cash Margin(%)

8.69

10.78

9.13

11.79

12.01

Net Profit Margin(%)

6.13

8.34

5.72

9.34

10.29

Adjusted Net Profit Margin(%)

6.13

8.34

5.72

9.34

10.22

Return On Capital Employed(%)

21.69

27.89

17.37

26.18

30.65

Return On Net Worth(%)

16.50

21.10

13.04

20.56

22.79

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

1,265.5

0

474.32

Profitability Ratios

Adjusted Return on Net Worth(%)

16.08

20.29

13.23

19.20

22.63

Return on Assets Excluding Revaluations

479.99

409.65

323.45

291.28

237.23

Return on Assets Including Revaluations

479.99

409.65

323.45

291.28

237.23

21.74

28.80

17.48

27.35

30.74

Current Ratio

1.47

0.91

1.51

0.91

1.40

Quick Ratio

1.14

0.68

1.26

0.66

1.13

Debt Equity Ratio

0.02

0.07

0.07

0.11

0.09

Long Term Debt Equity Ratio

0.02

0.04

0.07

0.06

0.09

126.04

105.39

34.21

40.93

61.01

0.02

0.07

0.07

0.11

0.09

Financial Charges Coverage Ratio

167.58

130.02

48.06

50.46

68.23

Financial Charges Coverage Ratio Post Tax

136.33

100.18

38.75

39.57

49.76

Inventory Turnover Ratio

33.33

30.47

30.46

22.93

21.27

Debtors Turnover Ratio

42.93

33.92

26.33

25.76

21.12

Investments Turnover Ratio

33.33

30.47

30.46

22.93

28.76

Fixed Assets Turnover Ratio

3.13

2.82

2.38

2.48

6.32

Total Assets Turnover Ratio

2.59

2.32

2.06

1.94

1.98

Asset Turnover Ratio

3.13

2.82

2.38

2.48

2.41

Average Raw Material Holding

10.01

10.66

13.21

9.33

12.36

Average Finished Goods Held

4.56

5.35

3.17

12.49

6.52

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Debt Coverage Ratios

Interest Cover

Total Debt to Owners Fund

Management Efficiency Ratios

Key Financial Ratios of Maruti Suzuki India

You might also like

- Key Financial Ratios Over 5 YearsDocument4 pagesKey Financial Ratios Over 5 YearsMadani MaddyNo ratings yet

- Reliance Industries Key Financial Ratios Over 5 YearsDocument13 pagesReliance Industries Key Financial Ratios Over 5 YearsAditya KumarNo ratings yet

- Sun TV Networks FinancialsDocument11 pagesSun TV Networks FinancialsVikas SarangalNo ratings yet

- All Bank of RajasthanDocument7 pagesAll Bank of RajasthanAnonymous 6TyOtlNo ratings yet

- Previous Years: Tata Motor S - in Rs. Cr.Document28 pagesPrevious Years: Tata Motor S - in Rs. Cr.priya4112No ratings yet

- Analysis of key financial ratios for major Indian fertilizer companiesDocument8 pagesAnalysis of key financial ratios for major Indian fertilizer companiesYash ShahNo ratings yet

- Kotak Mahindra Bank Balance Sheet of Last 5 YearsDocument10 pagesKotak Mahindra Bank Balance Sheet of Last 5 YearsManish MahajanNo ratings yet

- Profit LossDocument9 pagesProfit LossAnshika AgarwalNo ratings yet

- Bajaj Auto Financial Analysis: Presented byDocument20 pagesBajaj Auto Financial Analysis: Presented byMayank_Gupta_1995No ratings yet

- Ratios ExampleDocument2 pagesRatios ExampleDakshesh RawatNo ratings yet

- Key Financial Ratios of Ultratech Cement: Next Years Previous YearsDocument6 pagesKey Financial Ratios of Ultratech Cement: Next Years Previous YearsRamana VaitlaNo ratings yet

- Key Ratios of NTPCDocument2 pagesKey Ratios of NTPCManinder BaggaNo ratings yet

- Excel financial ratios Canara BankDocument12 pagesExcel financial ratios Canara Bankkapish1014No ratings yet

- Idea Cellular: Previous YearsDocument8 pagesIdea Cellular: Previous YearsParvez AnsariNo ratings yet

- Previous Years: Larse N and Toubr o - in Rs. Cr.Document12 pagesPrevious Years: Larse N and Toubr o - in Rs. Cr.Parveen BabuNo ratings yet

- DR Reddy RatiosDocument6 pagesDR Reddy RatiosRezwan KhanNo ratings yet

- United Engineers - CIMBDocument7 pagesUnited Engineers - CIMBTheng RogerNo ratings yet

- Eicher RatiosDocument2 pagesEicher RatiosKetanDesiiDesadia100% (1)

- Burton Sensors SheetDocument128 pagesBurton Sensors Sheetchirag shah17% (6)

- Balance Sheet of Axis BankDocument8 pagesBalance Sheet of Axis BankKushal GuptaNo ratings yet

- Cost of capital, financial ratios, and cash flow analysis of power generation optionsDocument22 pagesCost of capital, financial ratios, and cash flow analysis of power generation optionsmaazwasifNo ratings yet

- Yes Bank: Key Financial RatiosDocument8 pagesYes Bank: Key Financial Ratiosrky1992No ratings yet

- Financial Statement Analysis of HDFC BankDocument58 pagesFinancial Statement Analysis of HDFC BankArup SarkarNo ratings yet

- Tata Motors RatiosDocument2 pagesTata Motors RatiosRahul GargNo ratings yet

- 3 - Akhil Kohli - ITC Ltd.Document24 pages3 - Akhil Kohli - ITC Ltd.rajat_singlaNo ratings yet

- Trend Analysis of Ice Cream FirmDocument16 pagesTrend Analysis of Ice Cream FirmAnkitesh Kumar TiwariNo ratings yet

- Horizontal Analysis Balance Sheet Profit & Loss Key RatiosDocument18 pagesHorizontal Analysis Balance Sheet Profit & Loss Key Ratiosvinayjain221No ratings yet

- Cipla Profit & Loss Account - in Rs. Cr.Document3 pagesCipla Profit & Loss Account - in Rs. Cr.Daniel ShettyNo ratings yet

- Ratio Analysis: Investor Liquidity RatiosDocument11 pagesRatio Analysis: Investor Liquidity RatiosjayRNo ratings yet

- Lab 1Document7 pagesLab 1Sharifah AYNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- Apollo TyresDocument4 pagesApollo TyresGokulKumarNo ratings yet

- Dabur India key financial ratios and profit & loss data for 5 yearsDocument5 pagesDabur India key financial ratios and profit & loss data for 5 yearsHiren ShahNo ratings yet

- Essar SteelDocument10 pagesEssar Steelchin2dabgarNo ratings yet

- Capital and Liabilities:: ApplicationDocument6 pagesCapital and Liabilities:: ApplicationKeshav GoyalNo ratings yet

- Chettinad Cement Balance Sheet and Financial Ratios Over 5 YearsDocument10 pagesChettinad Cement Balance Sheet and Financial Ratios Over 5 YearsvmktptNo ratings yet

- Bajaj AutoDocument8 pagesBajaj Autorpandey0607No ratings yet

- Profit and loss analysis of 5 yearsDocument5 pagesProfit and loss analysis of 5 yearspratikNo ratings yet

- Balance Sheet AnalysisDocument25 pagesBalance Sheet Analysissinger0% (1)

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- Harley DavidsonDocument5 pagesHarley DavidsonpagalinsanNo ratings yet

- Disney (DIS) GAAP Highlights FY 2012-2015Document40 pagesDisney (DIS) GAAP Highlights FY 2012-2015Rahil VermaNo ratings yet

- Nandan Denim Financial AnalysisDocument14 pagesNandan Denim Financial AnalysisAnkit SainiNo ratings yet

- Trend Analysis of TCLDocument1 pageTrend Analysis of TCLRaviShankarSharmaNo ratings yet

- HDFCDocument1 pageHDFCAjith KumarNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Audited Financial Results March 2009Document40 pagesAudited Financial Results March 2009Ashwin SwamiNo ratings yet

- Pancha MDocument1 pagePancha MGirish NayakNo ratings yet

- Gujarat Apollo Industries LimitedDocument30 pagesGujarat Apollo Industries LimitedChitsimran NarangNo ratings yet

- Financial Decision Making: AssignmentDocument19 pagesFinancial Decision Making: AssignmentMutasem AmrNo ratings yet

- Archies Financial StatmentsDocument5 pagesArchies Financial StatmentsShitiz JainNo ratings yet

- Profit Loss Analysis of 5 YearsDocument5 pagesProfit Loss Analysis of 5 YearsPunit KariaNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- LBO Test - 75Document84 pagesLBO Test - 75conc880% (1)

- Balance Sheet of RaymondDocument5 pagesBalance Sheet of RaymondRachana Yashwant PatneNo ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- Six Yrs Per OGDCLDocument2 pagesSix Yrs Per OGDCLMAk KhanNo ratings yet

- Key Financial Ratios of ACCDocument2 pagesKey Financial Ratios of ACCcool_mani11No ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Organizing Presentation BenefitsDocument9 pagesOrganizing Presentation Benefitssharmavikram876No ratings yet

- Managing Talent Through Competency Assessment & DevelopmentDocument14 pagesManaging Talent Through Competency Assessment & Developmentsharmavikram876No ratings yet

- Summer Internship Project On Wealth ManagementDocument63 pagesSummer Internship Project On Wealth Managementsharmavikram87667% (3)

- Summer Internship Project On Wealth ManagementDocument63 pagesSummer Internship Project On Wealth Managementsharmavikram87667% (3)

- Stock Portfolio For EQUITY RESEARCHDocument4 pagesStock Portfolio For EQUITY RESEARCHsharmavikram876No ratings yet

- Camels Model of Allahabad BankDocument12 pagesCamels Model of Allahabad BankVikram SharmaNo ratings yet