Professional Documents

Culture Documents

Credit-Linked Notes

Uploaded by

tonyslamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit-Linked Notes

Uploaded by

tonyslamCopyright:

Available Formats

1

Credit-linked Notes

1. Repackaging 2. Asset swap repackaging 3. Credit-linked notes: structure and mechanism 4. Motivations of the parties 5. Valuing a credit-linked note

Kay Giesecke, June 2002

Credit-linked Notes

1-1

Repackaging

Repackaging involves placing securities in an Special Purpose Vehicle (SPV), which then issues customized notes that are backed by the instruments in the SPV. The goal is to take securities with attractive features that are nevertheless unappealing/inaccessible to many investors and repackage them to create viable investments that are not otherwise available to the investor. A security may be unappealing/inaccessible because it is denominated in an foreign currency, does not trade locally, or because of onerous tax features.

Kay Giesecke, June 2002

Credit-linked Notes

1-2

Repackaging vs. Securitization

While repackaging is based on re-structuring securities, securitization involves the re-structuring of non-security nancial assets, for example loan paper or accounts receivable originated by banks, credit card companies, or other providers of credit. Repackaging is often less complex. Because of higher xed costs, securitizations are typically larger than repackaging programs. While in repackaging programs the notes are available in a variety of documentation forms (medium-term notes, Schuldschein, commercial paper, loans) to meet investors needs, in a securitization the notes are less customized (many investors typically participate).

Kay Giesecke, June 2002

Credit-linked Notes

1-3

Asset Swap Repackaging

Due to regulatory/investment policy restrictions, some investors cannot enter into an interest rate swap. Solution: Fixed-rate bonds are placed in an SPV SPV enters into an interest rate swap to exchange xed for oating (LIBOR+credit spread) over the remaining term of the bonds SPV issues FRN to investor, who earns LIBOR+spread (lower than on comparable straight asset swap) In case of default, the transaction terminates, including the interest rate swap. Note investors receive any recoveries.

Kay Giesecke, June 2002

Credit-linked Notes

1-4

Credit-linked Notes

A credit-linked note (CLN) is a special form of repackaging that is often directly issued by a corporate issuer. Typical underlyings are individual debt instruments (loans, bonds, etc.), portfolios of debt instruments, or bond or emerging market indices. The principal/coupon on the note is paid contingent on the occurrence of a credit event. A CLN is a funded (i.e. on-balance sheet) alternative to a default swap (DS). Compared with a straight DS, the credit investment is de-leverd. The reference credit is usually not aware of the transaction.

Kay Giesecke, June 2002

Credit-linked Notes

1-5

Mechanism of a CLN

A CLN is a structured note with an embedded DS, in which Issuer/SPV issues notes to investors which are backed by the reference assets, and receives the proceeds Issuer/SPV sells protection on the reference asset in a DS with a third party (bank), and receives the swap rate Issuer/SPV pays an enhanced coupon to the note investors Instead of a DS, the CLN may also embed a rst-to-default swap or a spread option.

Kay Giesecke, June 2002

Credit-linked Notes

1-6

Payos to Note Investors

The CLN terminates at default of the reference asset or the maturity, whichever is rst. If there is no default, the DS terminates and the note investors receive the full note principal (like a straight bond position with enhanced coupon) In case of default, the SPV pays the default losses to the DS protection buyer. Note investors receive not the full principal repayment, but loose an amount equal to the default losses. A (less-risky) principal-protected CLN is not terminated at default, but interest payments to the notes cease. At maturity, the full principal is returned to the note investors.

Kay Giesecke, June 2002

Credit-linked Notes

1-7

CLN Spreads

Note investors bear the potential losses due to default of the reference asset. In return, they pick up some yield. In essence, the position of the note investors is if they had sold default protection on the reference asset via a DS to the CLN issuer/SPV. Thus, the spread picked up by the CLN investor must roughly equal the DS rate paid by the SPV. In practice, the CLN spread is somewhat higher than the DS spread, since the accrued swap rate is normally not paid in a CLN.

Kay Giesecke, June 2002

Credit-linked Notes

1-8

Protection Buyer in CLN

Usually, the SPV puts the proceeds of the note issuance in collateral. If the reference entity defaults, the SPV liquidates the collateral and simply pays less principal back to the note investors. This spared amount is directly passed through to the protection buyer (a bank) in the DS. Since the SPV has a very high rating (usually AAA), the bank is not exposed to a signicant counterparty default risk in the DS (it were exposed if it had contracted the DS with the investors directly).

Kay Giesecke, June 2002

Credit-linked Notes

1-9

CLN Investor

An investor (e.g. an investment management fund) may be prohibited from buying bonds rated below AAA. The SPVs rating is AAA, which refers to its ability to pay , but not its obligation to pay. So the fund is allowed to invest into the CLN, although it is essentially investing into the riskier reference asset (it bears the losses associated with them). Thus a CLN can be used to circumvent certain investment constraints in order to enhance yields.

Kay Giesecke, June 2002

Credit-linked Notes

1 - 10

Why are CLNs Attractive?

Provides a funded credit derivative investment opportunity which is used by real-money DS investors such as mutual funds, investment departments of insurance companies, pension plans, which are not authorized to invest directly into credit derivatives Provides a yield pickup to other securities issued by the reference entity Provides customized maturity structures and credit features that are not otherwise available in the cash market If used by banks to lay o loan credit risks, a CLN provides access to funded credit opportunities that are not otherwise available

Kay Giesecke, June 2002

Credit-linked Notes

1 - 11

Mexican Default/Inconvertibility Structure

In 1995 following the nancial crisis in Mexico, a short-term CLN was designed to allow investors to capitalize on their bullish view on Mexico (continue to meet obligations and to convert the Peso): A1+ issuer/SPV Up to USD 20 million notional Between 30 and 90 days maturity Issued at a discount (zero-coupon like structure) Credit event: any default on any reference security or inconvertibility of the Peso to USD

Kay Giesecke, June 2002

Credit-linked Notes

1 - 12

Mexican Default/Inconvertibility Structure

Reference entity: Government of Mexico Reference securities: any issued or guaranteed by the reference entity Redemption: if there is no credit event, at par; if there is a credit event, delivery of any of the reference securities or its cash equivalent The spread on the notes was around 350-450bp, depending on market conditions. Investors secured this yield enhancement for their willingness to risk principal repayment with a deterioration of the credit quality of Mexico.

Kay Giesecke, June 2002

Credit-linked Notes

1 - 13

Valuing a CLN

Suppose the CLN pays coupons at dates t1 < t2 < < tn = T , where T is the maturity and the annual coupon rate is c. The notional is 1. The value of the notes is CLN = CLNN + CLND , the sum of the PVs of no-default payments and default payments. We have

n

CLNN = E[

i=1 n

t T (ti1 , ti )cB0i 1{ >ti } + B0 1{ >T } ] t T (ti1 , ti )cB0i (1 p(ti )) + B0 (1 p(T ))

=

i=1

PV of coupons

PV of principal

where p(t) = P [ t] is the risk-neutral default probability.

Kay Giesecke, June 2002

Credit-linked Notes

1 - 14

Valuing a CLN (2)

Suppose the recovery rate is a constant R [0, 1]. Then CLND = E[B0 R1{ T } ]

T

=R

0 m

u B0 P [ du] t P [tj1 < tj ]B0j

R

j=1 m

=R

j=1

t [p(tj ) p(tj1 )]B0j

Letting m the approximation is exact (in practice, one usually sets tj tj1 = 1 day).

Kay Giesecke, June 2002

Credit-linked Notes

1 - 15

Pre-paid Default Swap

A pre-paid DS is another funded DS alternative. It is structured like a DS with the dierence that the protection seller pays at inception the notional of the underlying to the protection buyer, who pays a periodic fee, composed of funding costs and the swap rate, to the seller. The structure terminates at maturity or the credit event, whichever is rst. If there is no default, the notional is returned to the seller. In case of a default, only the recovered amount on the reference asset is returned, so that the seller sustains the default losses on the underlying.

Kay Giesecke, June 2002

You might also like

- George Soros & The CommoditiesDocument20 pagesGeorge Soros & The CommoditiesIwan Siauw100% (1)

- Earnest Money, Security Deosit and Retention MoneyDocument8 pagesEarnest Money, Security Deosit and Retention MoneyRushabh Ajmera100% (3)

- Cast Study - GM MotorsDocument9 pagesCast Study - GM MotorsAbdullahIsmailNo ratings yet

- AuditingDocument13 pagesAuditingVenilyn Valencia75% (4)

- Anatomy of Credit CPPI: Nomura Fixed Income ResearchDocument15 pagesAnatomy of Credit CPPI: Nomura Fixed Income ResearchAlviNo ratings yet

- Markit Credit Indices PrimerDocument63 pagesMarkit Credit Indices Primersa.vivek1522No ratings yet

- The Exponencial Yield Curve ModelDocument6 pagesThe Exponencial Yield Curve Modelleao414No ratings yet

- Modeling Autocallable Structured ProductsDocument21 pagesModeling Autocallable Structured Productsjohan oldmanNo ratings yet

- CMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Document21 pagesCMBS Trading - ACES IO Strategy Overview (07!19!16 Plain)Darren WolbergNo ratings yet

- Forgery Defenses; Bank LiabilitiesDocument24 pagesForgery Defenses; Bank LiabilitiesbrendamanganaanNo ratings yet

- 04 - The Credit Spread Puzzle (Opinion)Document4 pages04 - The Credit Spread Puzzle (Opinion)amitnp7373No ratings yet

- Fabozzi CH 32 CDS HW AnswersDocument19 pagesFabozzi CH 32 CDS HW AnswersTrish Jumbo100% (1)

- Callable BrochureDocument37 pagesCallable BrochurePratik MhatreNo ratings yet

- Fabozzi Bmas7 Ch11 ImDocument28 pagesFabozzi Bmas7 Ch11 ImEd williamsonNo ratings yet

- CMS Inverse FloatersDocument8 pagesCMS Inverse FloaterszdfgbsfdzcgbvdfcNo ratings yet

- Fabozzi Fofmi4 Ch11 ImDocument12 pagesFabozzi Fofmi4 Ch11 ImYasir ArafatNo ratings yet

- Bonds with Embedded Options ValuationDocument52 pagesBonds with Embedded Options ValuationkalyanshreeNo ratings yet

- Class 23: Fixed Income, Interest Rate SwapsDocument21 pagesClass 23: Fixed Income, Interest Rate SwapsKarya BangunanNo ratings yet

- 2018A QE Financial Accounting and Reporting FinalDocument6 pages2018A QE Financial Accounting and Reporting FinalJoy Dhemple LambacoNo ratings yet

- Securities Lending Times Issue 223Document44 pagesSecurities Lending Times Issue 223Securities Lending TimesNo ratings yet

- Intermediate Financial Accounting Part 1b by Zeus MillanDocument174 pagesIntermediate Financial Accounting Part 1b by Zeus MillanRheu Reyes73% (75)

- (Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesDocument13 pages(Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesrlindseyNo ratings yet

- A primer on whole business securitization financing structureDocument13 pagesA primer on whole business securitization financing structureSam TickerNo ratings yet

- (Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement DisasterDocument9 pages(Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement Disaster00aaNo ratings yet

- Mortgage Options: Valuation, Risk Management, & Relative ValueDocument31 pagesMortgage Options: Valuation, Risk Management, & Relative Value4sainadhNo ratings yet

- CDS Valuation 2011Document15 pagesCDS Valuation 2011Saúl García AcostaNo ratings yet

- Swaptions & Interest Rate ModelingDocument24 pagesSwaptions & Interest Rate ModelingRanit BanerjeeNo ratings yet

- Agencies JPMDocument18 pagesAgencies JPMbonefish212No ratings yet

- Structured Product - Credit Linked NoteDocument8 pagesStructured Product - Credit Linked Notelaila22222lailaNo ratings yet

- TradeDocument6 pagesTradekyleleefakeNo ratings yet

- Hull White Prepay OASDocument24 pagesHull White Prepay OASwoodstick98No ratings yet

- BASIC BOOKKEEPING COMPETENCIES HANDOUTDocument8 pagesBASIC BOOKKEEPING COMPETENCIES HANDOUTraquelNo ratings yet

- Convexity Adjustment: A User's Guide: Yan Zeng Version 1.0.1, Last Revised On 2015-02-14Document31 pagesConvexity Adjustment: A User's Guide: Yan Zeng Version 1.0.1, Last Revised On 2015-02-14TonyNo ratings yet

- Constructing A Liability Hedging Portfolio PDFDocument24 pagesConstructing A Liability Hedging Portfolio PDFtachyon007_mechNo ratings yet

- RR 1-98Document9 pagesRR 1-98Crnc NavidadNo ratings yet

- Multiple Curve Disocunt PDFDocument82 pagesMultiple Curve Disocunt PDFKishlay Kumar100% (1)

- Credit Derivatives: An Overview: David MengleDocument24 pagesCredit Derivatives: An Overview: David MengleMonica HoffmanNo ratings yet

- Taylor & Francis, Ltd. Financial Analysts JournalDocument16 pagesTaylor & Francis, Ltd. Financial Analysts JournalJean Pierre BetancourthNo ratings yet

- Pricing Zero-Coupon Bonds Under Stochastic RatesDocument15 pagesPricing Zero-Coupon Bonds Under Stochastic RatesKofi Appiah-DanquahNo ratings yet

- Valuation and Hedging of Inv Floaters PDFDocument4 pagesValuation and Hedging of Inv Floaters PDFtiwariaradNo ratings yet

- Hedge Fund Risk Management: September 2009Document18 pagesHedge Fund Risk Management: September 2009Alan LaubschNo ratings yet

- Hedge Fund Collapse Due to Rising Interest RatesDocument1 pageHedge Fund Collapse Due to Rising Interest RatesPoorvaNo ratings yet

- Collateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and VadmsDocument5 pagesCollateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and Vadmsddelis77No ratings yet

- Goldman Sachs Presentationppt409Document25 pagesGoldman Sachs Presentationppt409Swati AryaNo ratings yet

- Expected Returns On Stocks and BondsDocument21 pagesExpected Returns On Stocks and BondshussankaNo ratings yet

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketFrom EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo ratings yet

- Currency OverlayDocument6 pagesCurrency OverlayprankyaquariusNo ratings yet

- Life Settlements and Longevity Structures: Pricing and Risk ManagementFrom EverandLife Settlements and Longevity Structures: Pricing and Risk ManagementNo ratings yet

- CDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsDocument26 pagesCDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsSimran AroraNo ratings yet

- Edhec Publication Dynamic Ldi Strategies 0Document124 pagesEdhec Publication Dynamic Ldi Strategies 0John ManciaNo ratings yet

- 26 Structured RepoDocument4 pages26 Structured RepoJasvinder JosenNo ratings yet

- Duration Times SpreadDocument24 pagesDuration Times SpreadfrolloosNo ratings yet

- YTM at Time of Issuance (At Par)Document8 pagesYTM at Time of Issuance (At Par)tech& GamingNo ratings yet

- Convert Arb1Document18 pagesConvert Arb1JustinNo ratings yet

- Interest Rate Swaps: Pre-2008 CrisisDocument1 pageInterest Rate Swaps: Pre-2008 CrisisJasvinder JosenNo ratings yet

- Wai Lee - Regimes - Nonparametric Identification and ForecastingDocument16 pagesWai Lee - Regimes - Nonparametric Identification and ForecastingramdabomNo ratings yet

- (Andrew Davidson & Co) An Implied Prepayment Model For MBSDocument13 pages(Andrew Davidson & Co) An Implied Prepayment Model For MBSgatzarNo ratings yet

- Fabozzi Ch06Document26 pagesFabozzi Ch06cmb463No ratings yet

- Interest RatesDocument54 pagesInterest RatesAmeen ShaikhNo ratings yet

- CdosDocument53 pagesCdosapi-3742111No ratings yet

- Derivatives and Risk Management JP Morgan ReportDocument24 pagesDerivatives and Risk Management JP Morgan Reportanirbanccim8493No ratings yet

- Lehman Brothers ABS Credit Default Swaps - A Primer - December 9, 2005Document21 pagesLehman Brothers ABS Credit Default Swaps - A Primer - December 9, 2005AC123123No ratings yet

- Fabozzi Bmas7 Ch03 ImDocument27 pagesFabozzi Bmas7 Ch03 ImWakas KhalidNo ratings yet

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsFrom EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo ratings yet

- Libor Market Model Specification and CalibrationDocument29 pagesLibor Market Model Specification and CalibrationGeorge LiuNo ratings yet

- Structured Financial Product A Complete Guide - 2020 EditionFrom EverandStructured Financial Product A Complete Guide - 2020 EditionNo ratings yet

- Longrich - Classy Style - Pi Cup - DetailsDocument2 pagesLongrich - Classy Style - Pi Cup - DetailstonyslamNo ratings yet

- Guidelines For Foreign Exchange Derivatives in The Nigerian Financial MarketsDocument6 pagesGuidelines For Foreign Exchange Derivatives in The Nigerian Financial MarketstonyslamNo ratings yet

- Statement of Financial Accounting Standards No. 52: Foreign Currency TranslationDocument54 pagesStatement of Financial Accounting Standards No. 52: Foreign Currency TranslationJuan Alejandro AguirreNo ratings yet

- Private Equity GuideDocument10 pagesPrivate Equity GuidetonyslamNo ratings yet

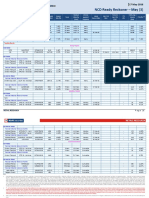

- Thomson Reuters Bond Zero Curve RatesDocument2 pagesThomson Reuters Bond Zero Curve RatestonyslamNo ratings yet

- MACRO BETA (Portfolio Returns)Document150 pagesMACRO BETA (Portfolio Returns)tonyslamNo ratings yet

- Guidelines For Foreign Exchange Derivatives in The Nigerian Financial MarketsDocument6 pagesGuidelines For Foreign Exchange Derivatives in The Nigerian Financial MarketstonyslamNo ratings yet

- Steve Eisman - Ira Sohn Conference - May 2010Document47 pagesSteve Eisman - Ira Sohn Conference - May 2010Terry Tate Buffett100% (2)

- Fundamental Analysis IntroDocument25 pagesFundamental Analysis IntrotonyslamNo ratings yet

- Pro Forma Financial StatementsDocument13 pagesPro Forma Financial StatementsAlex liaoNo ratings yet

- 1-The Following Table Shows The Sex of The Respondents Sex Respondents PercentageDocument36 pages1-The Following Table Shows The Sex of The Respondents Sex Respondents Percentageletter2lalNo ratings yet

- Keown 23 RP3Document24 pagesKeown 23 RP3ausantNo ratings yet

- CySEC English Basic Exam WorkbookDocument220 pagesCySEC English Basic Exam WorkbookARavindaNo ratings yet

- Performance of Mutual Fund Schemes in IndiaDocument8 pagesPerformance of Mutual Fund Schemes in IndiaPankaj GuravNo ratings yet

- Pricing Asian and Basket Options Via Taylor ExpansionDocument35 pagesPricing Asian and Basket Options Via Taylor ExpansionSorasit LimpipolpaibulNo ratings yet

- AEC 213 Course OutlineDocument2 pagesAEC 213 Course Outlinechie syNo ratings yet

- Conservatism in Accounting - Ross L WattsDocument39 pagesConservatism in Accounting - Ross L WattsDekri FirmansyahNo ratings yet

- HW2Document6 pagesHW2LiamNo ratings yet

- Indah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014Document3 pagesIndah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014btishidbNo ratings yet

- Case StudyDocument7 pagesCase StudyPatricia TabalonNo ratings yet

- Annual Report 2015 16Document193 pagesAnnual Report 2015 16Rahul KumarNo ratings yet

- Bank Strategic Planning and Budgeting ProcessDocument18 pagesBank Strategic Planning and Budgeting ProcessBaby KhorNo ratings yet

- Top AA+ rated tax-free bonds under 15 yearsDocument3 pagesTop AA+ rated tax-free bonds under 15 yearsumaganNo ratings yet

- SRC Supplement 1-Registered Debt CompaniesDocument2 pagesSRC Supplement 1-Registered Debt CompaniesMae Richelle Dizon DacaraNo ratings yet

- 91 SA Institutional Cautious Managed Fund Factsheet enDocument1 page91 SA Institutional Cautious Managed Fund Factsheet enXola Xhayimpi JwaraNo ratings yet

- 1 Financial MarketDocument35 pages1 Financial MarketSachinGoelNo ratings yet

- Negotiated Acquisitions of Companies Subsidiaries and Divisions CH 11 + 12Document82 pagesNegotiated Acquisitions of Companies Subsidiaries and Divisions CH 11 + 12Tinn ApNo ratings yet

- A Study On People Perception Towards Stock Market PROJECT MANAGMENTDocument43 pagesA Study On People Perception Towards Stock Market PROJECT MANAGMENTChinmaya MohantyNo ratings yet

- Five Tic ForexDocument25 pagesFive Tic ForexNeagu TeodorNo ratings yet