Professional Documents

Culture Documents

Hellenic Republic Public Debt Bulletin: December 2011

Hellenic Republic Public Debt Bulletin: December 2011

Uploaded by

Cüneyt TorosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hellenic Republic Public Debt Bulletin: December 2011

Hellenic Republic Public Debt Bulletin: December 2011

Uploaded by

Cüneyt TorosCopyright:

Available Formats

HELLENIC REPUBLIC PUBLIC DEBT BULLETIN

Inflation and Interest Rates of T-Bills for the period (Dec. 10 Dec. 11)

%

6 5 4 3 2 1 0

Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

%

3,5 3,0 2,5 2,0 1,5 1,0 0,5 0,0 -0,5 -1,0 -1,5 -2,0 -2,5 -3,0 T-Bills Interest Rate Inflation Real Interest Rate

64

December 2011

31/12/2011 367,978.00 62.0% 38.0% 74.7% 25.3% 97.5% 2.5%

Note: The monthly real interest rate is defined as the difference between the 6-month T-Bill interest rate (prevailing at the end of the month) and the inflation rate. The real interest rate is depicted on the right vertical axis, while the inflation rate and the T-bill interest rate on the left vertical axis.

A. Public Debt (Central Government)1

Composition of Central Government Debt (amounts in million euro)* 30/09/2011 Outstanding Central Government Debt . Fixed rate2 Floating rate2,3 . Tradable Non-Tradable C. Euro Non-euro zone currencies6 360,379.16 64.0% 36.0% 76.7% 23.3% 97.7% 2.3%

Cash Deposits of the H.R. (million euro)

3,558.7

3,629.4

1. Central Government Debt differs from General Government Debt (Maastricht definition) by the amount of intra-sectoral debt holdings and other ESA '95 adjustments. 2. Fixed/floating participation is calculated including Interest Rate Swap transactions. 3. Index-linked bonds are classified as floating rate bonds.

* Estimates MINISTRY OF FINANCE GENERAL DIRECTORATE OF THE TREASURY AND THE BUDGET PUBLIC DEBT DIRECTORATE CONTACT PERSON: G. FLORATOS DIRECTOR TEL.+30 210 33 38 451 +30 210 33 38 334 - +30 210 33 38 324 - FAX: +30 210 33 38 205 Internet address: http://www.minfin.gr, e-mail address: d23@glk.gr Reuters: GR/FINMIN01 Bloomberg: GRMF

. Central Government Debt by major categories** (amounts in million euro)*

Bonds and short-term notes Bonds issued domestically Bonds issued abroad Securitization issued abroad Short-term notes Loans Bank of Greece Other domestic loans Special purpose and bilateral loans Financial Support Mechanism loans Other external loans Short-term loans Total 30/09/2011 276,308.42 241,833.18 17,880.90 312.63 16,281.71 84,070.74 5,685.95 19.40 7,333.58 65,166.00 5,865.81 0.00 360,379.16 31/12/2011 274,832.81 240,940.37 18,521.18 312.63 15,058.63 93,145.19 5,683.99 836.71 7,257.46 73,210.36 6,156.67 0.00 367,978.00

*Since 31/12/2010 Public Debt has been categorized between bonds and loans, long-term and short-term, according to European System Accounts (ESA 95). ** Estimates

Outstanding volume of Greek State Guarantees (millions of euro) Outstanding guaranteed debt

* Estimates

30/09/2011* 22,968.7

31/12/2011* 20,632.5

C. New Borrowing (Jan. Dec. 2011) Composition of borrowing for the period Jan. Dec. 2011

EFSM Loans 47.5%

Composition of new borrowing by initial maturity

1Y 28.5%

EIB Loans 1,3%

T-Bills 44.7%

3Y 36.1 %

Special Issues 6.5%

5Y 35.4%

Weighted average maturity of new borrowing

2011 2010 2009 2008 2007 0 2 4 6 8 2,36 3,68 5,66 10,96 13,25 10 12 14 16 18 20

Borrowing activity in 2011, by month (amounts in million euro)

18000 16000 14000 12000 10000 8000 6000 4000 2000 0

Ja n Fe b M ar Ap r M ay Ju n Ju l Au g

-Bills Special Issues EFSM Loans EIB Loans

Se p O ct No v De c

Weighted average maturity in years

D. Primary and Secondary Market of Greek Government Securities 1. Issuance Calendar of Greek Government securities

A. Auction Calendar for January & February 2012 10/01/2012 17/01/2012 07/02/2012 15/02/2012 26-weeks T-Bill (ACT/360) 13-weeks T-Bill (ACT/360) 26-weeks T-Bill (ACT/360) 13-weeks T-Bill (ACT/360) 2. Auction Results (Oct. Dec. 11)

Auction T-Bills 11-10-11 18-10-11 08-11-11 15-11-11 13-12-11 20-12-11 GR0002088517 GR0000089897 GR0002089523 GR0000090903 GR0002090539 GR0000091919 17-04-12 20-01-12 11-05-12 17-02-12 15-06-12 23-03-12 1,000 1,250 1,000 1,000 1,250 1,000 2,725 3,580 2,910 2,940 3,660 2,910 1,600 2,000 1,600 1,600 2,000 1,600 97.550% 98.848% 97.588% 98.843% 97.558% 98.830% 4.86% 4.61% 4.89% 4.63% 4.95% 4.68% ISIN Matutity Auction Amount ( mln) Offered Amount ( mln) Amount Issued ( mln) Price Yield

3. Special Purpose Bonds & Other Issues (Oct. Dec. 11) Bonds Record date ISIN Tenor Maturity

Amount Issued

( mln) 0.07 1,496.90 2,097.65

Coupon 1.00% 6 Euribor + 1.3%

07-11-11 GR0106003792 1Y 30/06/2012 30-12-11 GR0514017145 5Y 21/05/2014 Undertaking loans of OASA, TRAM (L.3920/2011, article 3) Loans Disbursement Organization Tenor

Maturity

Amount in

( mln)

Interest Rate

4. Financial Support Mechanism Loans (Oct. - Dec. 11)

Tranche 6th Organi zation I.M.F Disbursem ent 07/12/2011 Maturity From 07/03/2015 untill 07/12/2016 (quarterly) From 13/03/2015 untill 15/12/2016 (quarterly) Ccy SDR Amount in (mln.) 2,231.7 Interest Rate Step up: - 3 SDR - 3M SDR + spread 2% - 3M SDR + spread 3% 3M Euribor + spread 3% for the first three years and 4% for the remaining years until maturity.

6th

.U.

14/12/2011

EUR

5,800.0

5. Central Government Debt by residual maturity (amounts in million euro)

30/09/2011 Total volume of which: 360,379.16 52,041.48 166,535.09 141,802.59 % 100.0% 14.5% 46.2% 39.3% 31/12/2011 367,978.00 50,521.70 175,261.00 142,195.30 % 100.0% 13.7% 47.6% 38.7%

short-term (up to 1 year) medium-term (1to 5 years) long-term (more than 5 years)

Weighted average residual maturity of Central Government Debt on 31/12/11: 6.30 years 3

6. Redemption schedule of Central Government Debt on 31/12/2011 (amounts in billion euro)

60 62.6 49.5

50 15.1 37.9 40 35.5 30 20

25.3 24.0 25.6 11.3 9.9 6.2 1.5 11.39.6 1.0

10 0

7.7 1.5 0.6 0.4

8.6

9.3 7.9 0.3 0.3 0.3 2.3 0.3 0.3 1.8

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 40 57

Years

Bonds & Loans

Notes:

Short-term notes

1. Buy-backs are scheduled for the smoothening of redemptions.

7. Monthly volume of transactions on Greek Government securities in the Electronic Secondary Market (HDAT) (Jan. 09 Dec. 11) (amounts in billion euro)

2009 2010 2011

60

50

40

30

20

10

0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Source: Bank of Greece, HDAT Note: Public Debt data for each quarter will be announced no later than 50 days after the end of the reference quarter.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Project Management of World Bank ProjectsDocument25 pagesProject Management of World Bank ProjectsDenisa PopescuNo ratings yet

- ACTG 2011 - Midterm Package - 2012-2013Document44 pagesACTG 2011 - Midterm Package - 2012-2013waysNo ratings yet

- ΝΟΜΙΣΜΑΤΙΚΗ ΠΟΛΙΤΙΚΗ - ΕΝΔΙΑΜΕΣΗ ΕΚΘΕΣΗ - ΝΟΕ.2012 - ΤΡΑΠΕΖΑ ΤΗΣ ΕΛΛΑΔΟΣDocument234 pagesΝΟΜΙΣΜΑΤΙΚΗ ΠΟΛΙΤΙΚΗ - ΕΝΔΙΑΜΕΣΗ ΕΚΘΕΣΗ - ΝΟΕ.2012 - ΤΡΑΠΕΖΑ ΤΗΣ ΕΛΛΑΔΟΣTheoTheodoridesNo ratings yet

- Puncturing Greece's Dream For Sharing Its Pain - NYTimesDocument5 pagesPuncturing Greece's Dream For Sharing Its Pain - NYTimesTheoTheodoridesNo ratings yet

- Issues of Secession and Expulsion From The EU and EMUDocument50 pagesIssues of Secession and Expulsion From The EU and EMUTheoTheodoridesNo ratings yet

- Four Reasons Why The Euro Is Not CrashingDocument6 pagesFour Reasons Why The Euro Is Not CrashingTheoTheodoridesNo ratings yet

- Framework For Recovery and Resolution of Financial InstitutionsDocument171 pagesFramework For Recovery and Resolution of Financial InstitutionsEKAI CenterNo ratings yet

- Us Cons Job Architecture 041315Document11 pagesUs Cons Job Architecture 041315Karan Pratap Singh100% (1)

- DocumentDocument5 pagesDocumentmaxz100% (1)

- Backbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft EbookDocument35 pagesBackbase Winning Strategies To Jumpstart Your Digital Transformation Microsoft Ebooks4shivNo ratings yet

- BP-Make-to-Order Production Wo Variant ConfigurationDocument9 pagesBP-Make-to-Order Production Wo Variant ConfigurationMaxkNo ratings yet

- Africa Drive Project - Communication Strategy and Plan: Version 01: Created 31/08/2006 By: PCA (Pty) LTDDocument7 pagesAfrica Drive Project - Communication Strategy and Plan: Version 01: Created 31/08/2006 By: PCA (Pty) LTDJianjun RenNo ratings yet

- Busniness Maths Assignment (Time, Value and Money) by Haiqa Malik (2019-BBA-027) Group-ADocument7 pagesBusniness Maths Assignment (Time, Value and Money) by Haiqa Malik (2019-BBA-027) Group-Ahaiqa malik100% (1)

- PPT-10 - Ethics in Consumer Protection and Community RelationsDocument31 pagesPPT-10 - Ethics in Consumer Protection and Community RelationsMuhammad Ali AdnanNo ratings yet

- An Overall Financial Analysis of Tesla: Jingyuan FangDocument6 pagesAn Overall Financial Analysis of Tesla: Jingyuan FangShahmala PerabuNo ratings yet

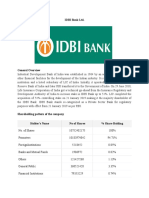

- IDBI Bank LTDDocument3 pagesIDBI Bank LTDSololoNo ratings yet

- SCM Chap-9 Group-4 PDFDocument5 pagesSCM Chap-9 Group-4 PDFHannah CapidosNo ratings yet

- Unit 12 Mergers and AcquisitionsDocument2 pagesUnit 12 Mergers and AcquisitionsNhựt Hồ QuangNo ratings yet

- Format of Noc To Be Obtained From SocietyDocument1 pageFormat of Noc To Be Obtained From SocietySushant Sawal78% (9)

- Amal Babu Seminar MergedDocument34 pagesAmal Babu Seminar MergedAjoy AnilNo ratings yet

- CH 20Document8 pagesCH 20Saleh RaoufNo ratings yet

- Telenor Case StudyDocument6 pagesTelenor Case StudyAas RaoNo ratings yet

- How To Calculate NPV (With Downloadable Calculator)Document7 pagesHow To Calculate NPV (With Downloadable Calculator)Richard Obeng KorantengNo ratings yet

- Transport New Version - ZIPDocument1,761 pagesTransport New Version - ZIPZafar MirzaNo ratings yet

- 1 Introduction To Industrial Policy and DevelopmentDocument13 pages1 Introduction To Industrial Policy and Development吴善统No ratings yet

- Existing CVR RulesDocument2 pagesExisting CVR Ruleskhaleel ofcNo ratings yet

- Lesson 23 Theories of Social Class and Stratification - IiDocument3 pagesLesson 23 Theories of Social Class and Stratification - IiAyesha JabeenNo ratings yet

- R&R 2014 AccountsDocument78 pagesR&R 2014 AccountsBadGandalfNo ratings yet

- Final Project Report - AIS - Group 5 - Payroll Udh RevisiDocument32 pagesFinal Project Report - AIS - Group 5 - Payroll Udh RevisiZakyaNo ratings yet

- Woven Bamboo Products Manufacturing UnitDocument9 pagesWoven Bamboo Products Manufacturing UnitKishor BiswasNo ratings yet

- Game of Thrones - Indian Telecom SectorDocument7 pagesGame of Thrones - Indian Telecom SectorAditya ToraneNo ratings yet

- Synopsis SampleDocument12 pagesSynopsis SampleSuniel0% (1)

- AOM LESSON 1 ModuleDocument4 pagesAOM LESSON 1 ModuleErlene LinsanganNo ratings yet

- Rabobank Groep N.VDocument29 pagesRabobank Groep N.Vkrisz_fanfic7132No ratings yet

- A Case StudyDocument7 pagesA Case Studyadarshrai9792No ratings yet