Professional Documents

Culture Documents

Yale University Investments Office

Uploaded by

EddyNg0%(1)0% found this document useful (1 vote)

290 views1 pageFor changing: Shift to emerging economies to take advantage of inefficiencies +pe market is becoming overheated Reduce due to contrarian view DonPt change: Stay invested for long term as when you pull out its hard to come back in when the market is better.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFor changing: Shift to emerging economies to take advantage of inefficiencies +pe market is becoming overheated Reduce due to contrarian view DonPt change: Stay invested for long term as when you pull out its hard to come back in when the market is better.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

290 views1 pageYale University Investments Office

Uploaded by

EddyNgFor changing: Shift to emerging economies to take advantage of inefficiencies +pe market is becoming overheated Reduce due to contrarian view DonPt change: Stay invested for long term as when you pull out its hard to come back in when the market is better.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Yale University Investments Office: For changing: Shift to emerging economies to take advantage of inefficiencies Dont chase the

market pe market is becoming overheated Reduce due to contrarian view

Dont change: Stay invested for long term as when you pull your money out its hard to come back in when the market is better PE industry is based on relations Too much money chasing too little firms no longer valid as more supply of good portfolio firms

Diversification benefit Asset class allocations Asset class that give abnormal returns driven by inefficiencies (information asymmetry) Calculated risks Incentive alignment agency costs and moral hazards

You might also like

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Stuvia 1130557 Finance Iia NotesDocument154 pagesStuvia 1130557 Finance Iia Notessandisiwemtintsilana03No ratings yet

- Financial Mathematics NotesDocument3 pagesFinancial Mathematics NotesJackNo ratings yet

- Value Premium and Value InvestingDocument41 pagesValue Premium and Value InvestingSreyas SudarsanNo ratings yet

- Risk & Return of Selected Company Securities Traded in BSE SensexDocument58 pagesRisk & Return of Selected Company Securities Traded in BSE SensexSrinivasulu Ch89% (18)

- The Future For Investors - Siegel - Group 4Document58 pagesThe Future For Investors - Siegel - Group 4SrilakshmiNo ratings yet

- Issues With EMH: EMH Does Not Arise Enthusiasm in The Community of Professional Portfolio ManagersDocument8 pagesIssues With EMH: EMH Does Not Arise Enthusiasm in The Community of Professional Portfolio Managersosg01No ratings yet

- Invest in Mutual Funds for Long Term Growth (40 charactersDocument20 pagesInvest in Mutual Funds for Long Term Growth (40 charactersAshish SrivastavaNo ratings yet

- How To Invest in The Stock Market For Beginners in 2021Document33 pagesHow To Invest in The Stock Market For Beginners in 2021orvinwankeNo ratings yet

- Winton Yerramilli JFE2008Document29 pagesWinton Yerramilli JFE2008dineshjain11No ratings yet

- Jurnal IDocument4 pagesJurnal IAgung PrasetyoNo ratings yet

- Journal of Economics and Business: Minh T. VoDocument15 pagesJournal of Economics and Business: Minh T. VoUsama NawazNo ratings yet

- Private Equity ExplainedDocument27 pagesPrivate Equity Explainedleonnox100% (2)

- DP 2 3Document10 pagesDP 2 3khayyumNo ratings yet

- Stocks PDFDocument4 pagesStocks PDFifiokNo ratings yet

- FINA3324 MSE Potential QuestionsDocument10 pagesFINA3324 MSE Potential QuestionsrcrmNo ratings yet

- FIN701 Finance AS1744Document17 pagesFIN701 Finance AS1744anurag soniNo ratings yet

- RiskDocument15 pagesRiskNiraj Arun ThakkarNo ratings yet

- What Is The PriceDocument5 pagesWhat Is The PriceClaud NineNo ratings yet

- Drivers of Shareholder ValueDocument19 pagesDrivers of Shareholder Valueadbad100% (1)

- Capital Structure TheoriesDocument13 pagesCapital Structure TheoriesMoaaz AhmedNo ratings yet

- of Behavioral Corporate FinanceDocument19 pagesof Behavioral Corporate Financejanak0609No ratings yet

- PEVC Club - 101Document26 pagesPEVC Club - 101tevfik_erenNo ratings yet

- Part I - Investing in StocksDocument97 pagesPart I - Investing in StocksPJ DavisNo ratings yet

- Venture Capital NotesDocument7 pagesVenture Capital NotesRaj VidalNo ratings yet

- Week 1 - Introduction To Venture Capital: VerviewDocument19 pagesWeek 1 - Introduction To Venture Capital: VerviewBluesinhaNo ratings yet

- GMO - Profits For The LongRun - Affirming The Case For QualityDocument7 pagesGMO - Profits For The LongRun - Affirming The Case For QualityHelio KwonNo ratings yet

- PVT Equity Vs VC: Private Equity Venture CapitalDocument3 pagesPVT Equity Vs VC: Private Equity Venture Capitalsurya_rathiNo ratings yet

- Hybrid Finance - EssayDocument6 pagesHybrid Finance - EssayMalina TatarovaNo ratings yet

- Dark Side of Valuation NotesDocument11 pagesDark Side of Valuation Notesad9292No ratings yet

- YaleDocument2 pagesYaleSumedha ChakrabortyNo ratings yet

- CFP NotesDocument19 pagesCFP Notesdaksh.aggarwal26No ratings yet

- Capital Structure Policy /ebit Eps AnalysisDocument9 pagesCapital Structure Policy /ebit Eps AnalysisUma NNo ratings yet

- Portfolio Performance EvaluationDocument11 pagesPortfolio Performance EvaluationjoannamanngoNo ratings yet

- Quality, Value and Growth Framework - Excellent Section Chapter 8Document8 pagesQuality, Value and Growth Framework - Excellent Section Chapter 8Roshan PriyadarshiNo ratings yet

- Mutual Funds and Other Investment Companies: Session 5Document43 pagesMutual Funds and Other Investment Companies: Session 5Niyanthesh ReddyNo ratings yet

- 2018 03 10 Screening Jaclyn McclellanDocument52 pages2018 03 10 Screening Jaclyn McclellanYudhi GendutNo ratings yet

- Topic 3-Capital Structure and LeverageDocument24 pagesTopic 3-Capital Structure and LeverageAshraful IslamNo ratings yet

- The Intelligent Investor NotesDocument13 pagesThe Intelligent Investor NotesAjay AtwalNo ratings yet

- Task 3 - Investment AppraisalDocument12 pagesTask 3 - Investment AppraisalYashmi BhanderiNo ratings yet

- Resumen Valuation MckinseyDocument11 pagesResumen Valuation MckinseycarlosvallejoNo ratings yet

- What Kinds of Stocks Are There?Document4 pagesWhat Kinds of Stocks Are There?Gilner PomarNo ratings yet

- Ba323 - Exam 1 Study GuideDocument1 pageBa323 - Exam 1 Study Guideemily kleitschNo ratings yet

- Capital Structure and LeverageDocument23 pagesCapital Structure and Leveragequeen montanoNo ratings yet

- Different Types of Investments: What Is An 'Investment'Document8 pagesDifferent Types of Investments: What Is An 'Investment'Anonymous oLTidvNo ratings yet

- Stein Chapter 2-Agency, Information and Corporate InvestmentDocument4 pagesStein Chapter 2-Agency, Information and Corporate InvestmentIndji TanNo ratings yet

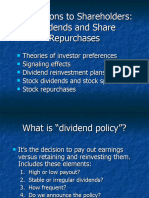

- Dividend Policy: Firm Has 2 ChoicesDocument18 pagesDividend Policy: Firm Has 2 ChoicesRajat LoyaNo ratings yet

- Interest Rate and Risk PremiumDocument15 pagesInterest Rate and Risk PremiumAlfonso Joel GonzalesNo ratings yet

- Investment and Financial ConceptsDocument24 pagesInvestment and Financial ConceptsSarjeel Ahsan NiloyNo ratings yet

- On The Value Relevance of Asymmetric Financial Reporting PoliciesDocument26 pagesOn The Value Relevance of Asymmetric Financial Reporting PoliciesApple Onlineshop PinkNo ratings yet

- Further Explanation of Agency Cost Problem by Eastbrook F.HDocument11 pagesFurther Explanation of Agency Cost Problem by Eastbrook F.Harchaudhry130No ratings yet

- FAME V Conference NotesDocument14 pagesFAME V Conference NotesdjmphdNo ratings yet

- DividendsPolicy 23Document20 pagesDividendsPolicy 23haymanotandualem2015No ratings yet

- Equity Portfolio ManagementDocument22 pagesEquity Portfolio ManagementMayur DaveNo ratings yet

- Jeremy Siegel - The Future For InvestorsDocument58 pagesJeremy Siegel - The Future For Investorsjj220% (1)

- Project Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Document20 pagesProject Report: "A Study On The Stock Performance of Higher Dividend Yielding Companies "Arun OusephNo ratings yet

- Ch01-The Investment SettingDocument27 pagesCh01-The Investment Settingmc limNo ratings yet

- Profi Ts For The Long Run: Affi Rming The Case For Quality: Hite AperDocument7 pagesProfi Ts For The Long Run: Affi Rming The Case For Quality: Hite AperLaurent MilletNo ratings yet

- Topic 5 (Overvaluation, High Growth and Start Up Business)Document4 pagesTopic 5 (Overvaluation, High Growth and Start Up Business)Lidia SamuelNo ratings yet

- VC and BuyoutsDocument60 pagesVC and BuyoutsEddyNgNo ratings yet

- Sample Formula Sheet For Midterm ExamDocument1 pageSample Formula Sheet For Midterm ExamEddyNgNo ratings yet

- Private EquityDocument2 pagesPrivate EquityEddyNgNo ratings yet

- Financial Institutions Management Solutions Chap009Document32 pagesFinancial Institutions Management Solutions Chap009EddyNgNo ratings yet

- A Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersFrom EverandA Joosr Guide to... What Color is Your Parachute? 2016 by Richard Bolles: A Practical Manual for Job-Hunters and Career-ChangersRating: 4 out of 5 stars4/5 (1)

- Job Interview: Outfits, Questions and Answers You Should Know aboutFrom EverandJob Interview: Outfits, Questions and Answers You Should Know aboutRating: 5 out of 5 stars5/5 (4)

- Speak With No Fear: Go from a nervous, nauseated, and sweaty speaker to an excited, energized, and passionate presenterFrom EverandSpeak With No Fear: Go from a nervous, nauseated, and sweaty speaker to an excited, energized, and passionate presenterRating: 4.5 out of 5 stars4.5/5 (78)

- Freight Dispatcher Training: How to Build and Run a Successful Truck Dispatching Business Without Owning a Single TruckFrom EverandFreight Dispatcher Training: How to Build and Run a Successful Truck Dispatching Business Without Owning a Single TruckRating: 4.5 out of 5 stars4.5/5 (2)

- How To Find Your Passion: 23 Questions That Can Change Your Entire LifeFrom EverandHow To Find Your Passion: 23 Questions That Can Change Your Entire LifeRating: 3.5 out of 5 stars3.5/5 (4)

- Designing Your Life - Summarized for Busy People: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life - Summarized for Busy People: How to Build a Well-Lived, Joyful LifeRating: 4 out of 5 stars4/5 (4)

- Promote Yourself: The New Rules for Career SuccessFrom EverandPromote Yourself: The New Rules for Career SuccessRating: 5 out of 5 stars5/5 (2)

- Be the Unicorn: 12 Data-Driven Habits that Separate the Best Leaders from the RestFrom EverandBe the Unicorn: 12 Data-Driven Habits that Separate the Best Leaders from the RestRating: 4.5 out of 5 stars4.5/5 (17)

- How to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpFrom EverandHow to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpRating: 4 out of 5 stars4/5 (74)

- Next!: The Power of Reinvention in Life and WorkFrom EverandNext!: The Power of Reinvention in Life and WorkRating: 4 out of 5 stars4/5 (13)

- When to Jump: If the Job You Have Isn't the Life You WantFrom EverandWhen to Jump: If the Job You Have Isn't the Life You WantRating: 4.5 out of 5 stars4.5/5 (16)

- Jungian 16 Types Personality Test: Find Your 4 Letter Archetype to Guide Your Work, Relationships, & SuccessFrom EverandJungian 16 Types Personality Test: Find Your 4 Letter Archetype to Guide Your Work, Relationships, & SuccessRating: 4 out of 5 stars4/5 (12)

- HOW SUCCESSFUL PEOPLE THINK: CHANGE YOUR LIFEFrom EverandHOW SUCCESSFUL PEOPLE THINK: CHANGE YOUR LIFERating: 5 out of 5 stars5/5 (4)

- Job Interview: 81 Questions, Answers, and the Full Preparation for a Job InterviewFrom EverandJob Interview: 81 Questions, Answers, and the Full Preparation for a Job InterviewRating: 4.5 out of 5 stars4.5/5 (76)

- Get That Job! The Quick and Complete Guide to a Winning InterviewFrom EverandGet That Job! The Quick and Complete Guide to a Winning InterviewRating: 4.5 out of 5 stars4.5/5 (15)

- How to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpFrom EverandHow to Be Everything: A Guide for Those Who (Still) Don't Know What They Want to Be When They Grow UpRating: 4.5 out of 5 stars4.5/5 (231)

- 100 Ways to Motivate Yourself (EasyRead Large Edition): Change Your Life ForeverFrom Everand100 Ways to Motivate Yourself (EasyRead Large Edition): Change Your Life ForeverRating: 5 out of 5 stars5/5 (6)

- Find What You Love: 5 Tips to Uncover Your Passion Quickly and EasilyFrom EverandFind What You Love: 5 Tips to Uncover Your Passion Quickly and EasilyRating: 4 out of 5 stars4/5 (6)

- Your Talent Stack: How to Develop Your Skills and Talents, Stand Out, and Thrive in Your CareerFrom EverandYour Talent Stack: How to Develop Your Skills and Talents, Stand Out, and Thrive in Your CareerRating: 5 out of 5 stars5/5 (8)

- Virtual Assistant: Jobs, Companies, Services, Training, and SalaryFrom EverandVirtual Assistant: Jobs, Companies, Services, Training, and SalaryNo ratings yet

- Unbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredFrom EverandUnbeatable Resumes: America's Top Recruiter Reveals What REALLY Gets You HiredRating: 5 out of 5 stars5/5 (2)

- The 2-Hour Job Search: Using Technology to Get the Right Job FasterFrom EverandThe 2-Hour Job Search: Using Technology to Get the Right Job FasterRating: 4 out of 5 stars4/5 (23)

- The STAR Method Explained: Proven Technique to Succeed at InterviewFrom EverandThe STAR Method Explained: Proven Technique to Succeed at InterviewRating: 4 out of 5 stars4/5 (4)

- Your Talent Stack: How to Develop Your Skills and Talents, Stand Out, and Thrive in Your CareerFrom EverandYour Talent Stack: How to Develop Your Skills and Talents, Stand Out, and Thrive in Your CareerRating: 4 out of 5 stars4/5 (1)

- The Star Interview: The Ultimate Guide to a Successful Interview, Learn The Best Practices On How to Ace An Interview As Well As Crucial Mistakes You Need to Avoid In Order To Land the JobFrom EverandThe Star Interview: The Ultimate Guide to a Successful Interview, Learn The Best Practices On How to Ace An Interview As Well As Crucial Mistakes You Need to Avoid In Order To Land the JobRating: 5 out of 5 stars5/5 (31)

- Quitter: Closing the Gap Between Your Day Job and Your Dream JobFrom EverandQuitter: Closing the Gap Between Your Day Job and Your Dream JobRating: 4.5 out of 5 stars4.5/5 (31)

- The PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptFrom EverandThe PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptNo ratings yet