Professional Documents

Culture Documents

FXOPM

FXOPM

Uploaded by

Sailor Saturne0 ratings0% found this document useful (0 votes)

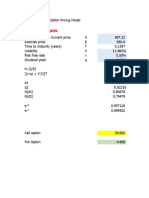

7 views1 pageThis document provides pricing information for a European FX option with a spot rate of 122, an exercise price of 122, and 108 days to expiration. It lists the interest rates in the U.S. and foreign markets, an option volatility of 15.985%, and calculates values for d1, d2, N(d1), N(d2) to derive a call option premium of 4.50 and put option premium of 3.97.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides pricing information for a European FX option with a spot rate of 122, an exercise price of 122, and 108 days to expiration. It lists the interest rates in the U.S. and foreign markets, an option volatility of 15.985%, and calculates values for d1, d2, N(d1), N(d2) to derive a call option premium of 4.50 and put option premium of 3.97.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageFXOPM

FXOPM

Uploaded by

Sailor SaturneThis document provides pricing information for a European FX option with a spot rate of 122, an exercise price of 122, and 108 days to expiration. It lists the interest rates in the U.S. and foreign markets, an option volatility of 15.985%, and calculates values for d1, d2, N(d1), N(d2) to derive a call option premium of 4.50 and put option premium of 3.97.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

EUROPEAN FX OPTION PRICING MODEL

Spot Rate(D) =

122.00

Forward Rate(D) =

122.53

Spot Rate(F)=

81.97

Forward Rate (F) =

81.61

U.S. Interest Rate =

Exercise Price =

Days to Expiration =

0.5375%

122.00

108

Foreign Interest Rate =

Option Volatility =

-0.93%

15.985%

Years to Expiration (T) =

0.2959

d1 =

0.0933

N(d1) =

0.5372

d2 =

0.0064

N(d2) =

0.5025

Call Option Premium =

4.50

Put Option Premium =

3.97

You might also like

- 2012 04 MLC Exam SolDocument20 pages2012 04 MLC Exam SolAki TsukiyomiNo ratings yet

- Week 3 Solutions To ExercisesDocument6 pagesWeek 3 Solutions To ExercisesBerend van RoozendaalNo ratings yet

- Bond Dur ConvexityDocument2 pagesBond Dur Convexityanon_346682430No ratings yet

- Test 3 Forum UlaDocument1 pageTest 3 Forum UlaSOPHIANo ratings yet

- Assingnment: Ch#4 (Options Market and Contracts)Document10 pagesAssingnment: Ch#4 (Options Market and Contracts)Mahnoor ShahbazNo ratings yet

- Trip Logistics CaseDocument20 pagesTrip Logistics CaseLingamurthy BNo ratings yet

- SOA MFE 76 Practice Ques SolsDocument70 pagesSOA MFE 76 Practice Ques SolsGracia DongNo ratings yet

- Market and Financial RisksDocument5 pagesMarket and Financial RisksTimothy NdegeNo ratings yet

- B - S ModelDocument3 pagesB - S ModelMos MasNo ratings yet

- Midsem SolutionDocument4 pagesMidsem SolutionEklavyaNo ratings yet

- Chapter 9 - FormulaDocument2 pagesChapter 9 - Formula2023607226No ratings yet

- Option PricingDocument13 pagesOption PricingAbhishek NatarajNo ratings yet

- FINS 2624 Tutorial Week 3 SlidesDocument12 pagesFINS 2624 Tutorial Week 3 SlidesWahaaj RanaNo ratings yet

- Cost of Capital: - Example: Tax Rate 40%Document3 pagesCost of Capital: - Example: Tax Rate 40%Alex NievaNo ratings yet

- SR No Security-Name Days Left To Maturity (Years) Last Traded Price Discount Factor (DF)Document1 pageSR No Security-Name Days Left To Maturity (Years) Last Traded Price Discount Factor (DF)Jasmeet S BindraNo ratings yet

- 04 Utility Decision MakingDocument25 pages04 Utility Decision MakingIman SatriaNo ratings yet

- DM and PCMDocument2 pagesDM and PCMSharev Singh Mehrok100% (1)

- COA - Unit2 Floating Point Arithmetic 2Document67 pagesCOA - Unit2 Floating Point Arithmetic 2Devika csbsNo ratings yet

- Option Valuation: Numerical ExampleDocument15 pagesOption Valuation: Numerical ExampleMarwa HassanNo ratings yet

- Problem Set 5 Solution-2 CopieDocument5 pagesProblem Set 5 Solution-2 CopieCarol VarelaNo ratings yet

- Workshop 7 Suggested SolutionsDocument42 pagesWorkshop 7 Suggested SolutionsDweep KapadiaNo ratings yet

- Valuing An Option To Abandon A Project: Inputs Relating The Underlying AssetDocument3 pagesValuing An Option To Abandon A Project: Inputs Relating The Underlying AssetPro ResourcesNo ratings yet

- BKM, Chap 16Document16 pagesBKM, Chap 16rob_jiangNo ratings yet

- p4 j13 FormulaeDocument5 pagesp4 j13 FormulaeaamirNo ratings yet

- Black Scholes Continous DividendDocument4 pagesBlack Scholes Continous DividendSyahrizkaNo ratings yet

- Hedging Risk With DerivativesDocument36 pagesHedging Risk With DerivativesSoumyadeep RoyNo ratings yet

- Trees SimpleDocument9 pagesTrees SimpleSatyadeep RoatNo ratings yet

- Corporate Finance II Problem Set 4Document11 pagesCorporate Finance II Problem Set 4Joana Azevedo PereiraNo ratings yet

- All AllDocument2 pagesAll AllFemilya Sri ZulfaNo ratings yet

- حل السؤال السابعDocument1 pageحل السؤال السابعhussein alkhafagiNo ratings yet

- Assignment 1Document3 pagesAssignment 1Oni SundayNo ratings yet

- Institute of Actuaries of India: November 2010 ExaminationsDocument9 pagesInstitute of Actuaries of India: November 2010 ExaminationsdasNo ratings yet

- Eco No Metrics Assignment 3Document6 pagesEco No Metrics Assignment 3Arpit_Lal_1267No ratings yet

- 06 Floating PointDocument53 pages06 Floating Pointgoogle gmailNo ratings yet

- Black Scholes WorkingDocument15 pagesBlack Scholes WorkingChRehanAliNo ratings yet

- Anuj Jagannath Said Me21b172 Tut 09Document2 pagesAnuj Jagannath Said Me21b172 Tut 09Anuj SaidNo ratings yet

- Chap 11 IBFDocument6 pagesChap 11 IBFSamra EjazNo ratings yet

- Introductory DerivativesDocument2 pagesIntroductory DerivativesnickbuchNo ratings yet

- FBL4Document15 pagesFBL4FaleeNo ratings yet

- Pricing American Options: Dilip Madan Department of Finance Robert H. Smith School of BusinessDocument25 pagesPricing American Options: Dilip Madan Department of Finance Robert H. Smith School of BusinessHhsfdksdfkk4No ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management Formulasrera zeoNo ratings yet

- Jawaban 80%Document2 pagesJawaban 80%Nabilatul InayahNo ratings yet

- ACCA F9 Financial Management Complete Text Errata Sheet 210909Document4 pagesACCA F9 Financial Management Complete Text Errata Sheet 210909kcp123No ratings yet

- 1676811564189vedic Math Multiplication MastryDocument46 pages1676811564189vedic Math Multiplication MastryvetriNo ratings yet

- Dot Net FormattingDocument1 pageDot Net Formattingandrear77No ratings yet

- UntitledDocument1 pageUntitledMuruga DasNo ratings yet

- Z ScoreDocument2 pagesZ ScorevivekasriNo ratings yet

- Ex: Treasury Bond Provide A Return (KN) of 9% and The Inflation (I) Is 4%Document3 pagesEx: Treasury Bond Provide A Return (KN) of 9% and The Inflation (I) Is 4%MostakNo ratings yet

- Investment and Portfolio Management Session 3 SolutionsDocument3 pagesInvestment and Portfolio Management Session 3 Solutions李佳南No ratings yet

- Derivatives: Forward ContractsDocument4 pagesDerivatives: Forward ContractsSAITEJA DASARINo ratings yet

- Tutorial 4 Bond AnswerDocument4 pagesTutorial 4 Bond AnswerConnie OngNo ratings yet

- Test 18 SolutionDocument11 pagesTest 18 SolutionshaitoNo ratings yet

- Siddharth Gala Project Part 1Document8 pagesSiddharth Gala Project Part 1Niyati ShahNo ratings yet

- HW 11 SolutionDocument5 pagesHW 11 SolutionPepe BufordNo ratings yet

- Answer 4.1Document22 pagesAnswer 4.1Ankit AgarwalNo ratings yet

- INV3703 Past Paper 3Document28 pagesINV3703 Past Paper 3SilenceNo ratings yet

- After Studying Iris Hamson's Credit Analysis, George Davies Is Considering Whether He Can Increase The Holding Period ReturnDocument3 pagesAfter Studying Iris Hamson's Credit Analysis, George Davies Is Considering Whether He Can Increase The Holding Period ReturnpriyaNo ratings yet

- Options PricingDocument17 pagesOptions Pricingvodakaa100% (1)

- Future Cash Flows-Compounding-Even FlowsDocument4 pagesFuture Cash Flows-Compounding-Even FlowsfacefarawayNo ratings yet