Professional Documents

Culture Documents

Service Tax Penalties

Uploaded by

Giridhar BhandiwadOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Tax Penalties

Uploaded by

Giridhar BhandiwadCopyright:

Available Formats

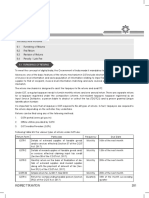

Service tax offences committed and penalty imposed.

Sl No. 1. Violation of Section in Finance Act Section 69 of Finance Act Violation Quantum of Penalty imposed under Section /Rule Section under which penalty imposed.

Under Sec 77(1)(a) of the Act.

Non registration or delayed registration Non-payment or delayed payment of service tax

An amount which may extend to Rs. 10,000/- or Rs.200/- for every day during which such failure continues, whichever is higher could be imposed as penalty A mandatory penalty, not less than Rs.100/- for every day during which such failure continues or @1% of such tax per month, whichever is higher, provided the total amount of penalty payable in terms of this section shall not exceed 50% of the service tax payable. Under Rule 7C of the finance Act, the person liable for the period of delay of(i) fifteen days from the date prescribed for submission of such return, an amount of five hundred rupees; (ii) beyond fifteen days but not later than thirty days from the date prescribed for submission of such return, an amount of one thousand rupees; and (iii) beyond thirty days from the date prescribed for submission of such return an amount of one thousand rupees plus one hundred rupees for every day from the thirty first day till the date of furnishing the said return: Provided that the total amount payable in terms of this rule, for delayed submission of return, shall not exceed the amount specified in section 70 of the Act which is Rs 20,000/- per return. An amount which may extend to Rs.5000/- shall be liable to be imposed as penalty

2.

Section 68 of Finance Act.

Section 76 of the Act

3.

Section 70 of Finance Act.

Non-filing / delayed filing of returns:

Rule 7C of the finance Act read with section 70 of the Act.

4.

any of the provisions of the Finance Act, 1994 or the Rules

Contravention of any of the provisions of the Finance Act, 1994 or the Rules made thereunder Failure to keep, maintain or retain books of account and other documents as required in accordance with the provisions of the Finance Act, 1994

under Sec.77(2) of the Act.

An amount which may extend to five thousand rupees shall be liable to be imposed as penalty. [Section 77(1)(b) of the Act]

You might also like

- The County Government of Kiambu Finance Bill.Document71 pagesThe County Government of Kiambu Finance Bill.Kiambu County Government -Kenya.No ratings yet

- Penal Provisions STDocument8 pagesPenal Provisions STKunalKumarNo ratings yet

- Expenses Regarding Service Tax Return Submited by Babai in The Month of June - 09Document13 pagesExpenses Regarding Service Tax Return Submited by Babai in The Month of June - 09mdbalajeeNo ratings yet

- Income Tax Amendments for Individuals, HUF, Companies and Charitable TrustsDocument13 pagesIncome Tax Amendments for Individuals, HUF, Companies and Charitable TrustsRashi ViRdiNo ratings yet

- Labour Law Assigmnent 27-3-19Document8 pagesLabour Law Assigmnent 27-3-19shubham chauhanNo ratings yet

- Income Tax ProjectDocument22 pagesIncome Tax ProjectGargi UpadhyayaNo ratings yet

- Service Tax PaneltyDocument16 pagesService Tax PaneltyHarish KapoorNo ratings yet

- Notification No. 33 of 2012 Service TaxDocument3 pagesNotification No. 33 of 2012 Service TaxAntyoday IndiaNo ratings yet

- Siaya County Finance Bill SummaryDocument89 pagesSiaya County Finance Bill SummaryinyasiNo ratings yet

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Directors Liabilities Under Various LawsDocument2 pagesDirectors Liabilities Under Various LawsrockyrrNo ratings yet

- Analysis of tax determination and demand procedures under CGST LawDocument9 pagesAnalysis of tax determination and demand procedures under CGST LawMohsin7226No ratings yet

- GST Demands & Recovery FAQsDocument12 pagesGST Demands & Recovery FAQspooja rajputNo ratings yet

- Cir 185 17 2022 CGSTDocument5 pagesCir 185 17 2022 CGSTAmritesh RaiNo ratings yet

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralNo ratings yet

- Determination of Tax & Adjudication of Demand by Proper Officer – Section 74 of CGST Act, 2017 - Taxguru - inDocument11 pagesDetermination of Tax & Adjudication of Demand by Proper Officer – Section 74 of CGST Act, 2017 - Taxguru - inAdarsh TripathiNo ratings yet

- Makati Revenue CodeDocument12 pagesMakati Revenue CodeMica de GuzmanNo ratings yet

- 09 Penalty NWDocument3 pages09 Penalty NWDippak GuptaNo ratings yet

- Merely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfDocument5 pagesMerely Signing The Statement During Investigation Under Coercion and Admitting Tax Liability Not Amounts To Self-Assessment or SelfShrey SharmaNo ratings yet

- Demand and RecoveryDocument9 pagesDemand and RecoverySaumya AllapartiNo ratings yet

- Service Tax Default or EvasionDocument6 pagesService Tax Default or EvasionTaxmann PublicationNo ratings yet

- Powers of Audit, Search and Seizure Under GST: By: Pratha KhannaDocument21 pagesPowers of Audit, Search and Seizure Under GST: By: Pratha KhannaLaiba FatimaNo ratings yet

- Professional Tax RulesDocument8 pagesProfessional Tax RulesSundasNo ratings yet

- Article On Assessment and AuditDocument33 pagesArticle On Assessment and Auditmks895525No ratings yet

- Compliance by LLPDocument2 pagesCompliance by LLPSavoir PenNo ratings yet

- Levy and Collection of Tax and PenaltiesDocument6 pagesLevy and Collection of Tax and PenaltiesNitin KatariaNo ratings yet

- Service Tax 1Document18 pagesService Tax 1sudhiryadav7586No ratings yet

- Refund Under GST Regime Up To Date 12-03-2021 Detailed AnalysisDocument17 pagesRefund Under GST Regime Up To Date 12-03-2021 Detailed AnalysisChaithanya RajuNo ratings yet

- Corporate Law Workbook SectionsDocument9 pagesCorporate Law Workbook SectionsPushkar PriyamNo ratings yet

- 64 Amendmntnotes 10 18 PDFDocument9 pages64 Amendmntnotes 10 18 PDFkhusbu jainNo ratings yet

- Composition Scheme For Sarafa and JewellersDocument6 pagesComposition Scheme For Sarafa and JewellersVirender ChaudharyNo ratings yet

- Presented By: Anish GuptaDocument14 pagesPresented By: Anish Guptagupta_ani04No ratings yet

- Law of TaxationDocument13 pagesLaw of TaxationRameshNadarNo ratings yet

- Excerpts From EPF Scheme of 1995Document4 pagesExcerpts From EPF Scheme of 1995askarnabNo ratings yet

- Withholding On Wages SEC. 78. Definitions. - As Used in This ChapterDocument5 pagesWithholding On Wages SEC. 78. Definitions. - As Used in This ChaptershakiraNo ratings yet

- Understanding AirDocument5 pagesUnderstanding AirakashNo ratings yet

- Tax Ordinance Sub Section 114 and 115Document4 pagesTax Ordinance Sub Section 114 and 115faiz kamranNo ratings yet

- Offences N ProsecutionsDocument12 pagesOffences N ProsecutionsIndu Shekhar PoddarNo ratings yet

- Chapter 7Document4 pagesChapter 7api-345893311No ratings yet

- Meaning of Payment of Bonus ActDocument16 pagesMeaning of Payment of Bonus ActDaljeet KaurNo ratings yet

- Office of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001Document5 pagesOffice of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001jitendraktNo ratings yet

- Refund & Refund AuditDocument80 pagesRefund & Refund AuditSujeet KothawaleNo ratings yet

- Law of TaxationDocument3 pagesLaw of TaxationmangalagowrirudrappaNo ratings yet

- The Companies (Profits) Surtax Act, 1964Document16 pagesThe Companies (Profits) Surtax Act, 1964Mrigendra MishraNo ratings yet

- Tax Rates, Exemptions and AmendmentsDocument25 pagesTax Rates, Exemptions and Amendmentsanshulagarwal62No ratings yet

- Tax ReportDocument8 pagesTax ReportRubal JalanNo ratings yet

- Banking Law Case AnalysisDocument4 pagesBanking Law Case Analysis1982024No ratings yet

- Online license application for contractorsDocument5 pagesOnline license application for contractorsPalani KumarNo ratings yet

- Rmo 1-90Document14 pagesRmo 1-90cmv mendoza100% (2)

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- DownloadDocument3 pagesDownloadVansh AroraNo ratings yet

- Service Tax1Document8 pagesService Tax1Suman pendharkarNo ratings yet

- Brief Notes Compliance Checklist Under Labour LawsDocument39 pagesBrief Notes Compliance Checklist Under Labour LawsJitendra Nagvekar100% (1)

- Fundamentals of TaxationDocument17 pagesFundamentals of TaxationPetersonNo ratings yet

- Things To RemeberDocument19 pagesThings To Remebermammas collectionNo ratings yet

- Statutory Updates For Nov-21 ExamsDocument50 pagesStatutory Updates For Nov-21 ExamsShodasakshari VidyaNo ratings yet

- The Goa Panchayat Raj (Application of Panchayat and Zilla Panchayat Funds) (Conditions and Limitations) Rules, 2006Document6 pagesThe Goa Panchayat Raj (Application of Panchayat and Zilla Panchayat Funds) (Conditions and Limitations) Rules, 2006Sanjiv KubalNo ratings yet

- Chapter-5 Advanced Payment of TaxesDocument25 pagesChapter-5 Advanced Payment of TaxesSumon iqbalNo ratings yet

- Service Tax Procedures: HapterDocument25 pagesService Tax Procedures: HaptertimirkantaNo ratings yet

- E1 QuestionDocument18 pagesE1 QuestionHarish G R GowdaNo ratings yet

- Computer Science Project On Address BookDocument19 pagesComputer Science Project On Address BookGiridhar BhandiwadNo ratings yet

- RTI Application FormatDocument1 pageRTI Application FormatGiridhar BhandiwadNo ratings yet

- NtseDocument2 pagesNtseGiridhar BhandiwadNo ratings yet

- Fire ExtinguisherDocument1 pageFire ExtinguisherGiridhar BhandiwadNo ratings yet

- 8 Science Synthetic FibresDocument4 pages8 Science Synthetic FibresHarun VenkatNo ratings yet

- Science PPT PresentationDocument38 pagesScience PPT PresentationGiridhar BhandiwadNo ratings yet

- BiologyDocument3 pagesBiologyGiridhar BhandiwadNo ratings yet

- Ntse 2010 Stage 2 Mat SolDocument26 pagesNtse 2010 Stage 2 Mat SolGiridhar BhandiwadNo ratings yet

- Nso 4Document4 pagesNso 4Mohini BajajNo ratings yet