Professional Documents

Culture Documents

Chapter 13: Real Options, Investment Strategy and Process: d SE r t t 2 = + + ln / / σ σ

Uploaded by

Abhishek ChopraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 13: Real Options, Investment Strategy and Process: d SE r t t 2 = + + ln / / σ σ

Uploaded by

Abhishek ChopraCopyright:

Available Formats

Chapter 13: Real Options, Investment Strategy and Process Problem 1 Ptoject cost (Rs crore) PV of project's cash

flows (Rs crore) NPV (Rs crore) Cost of expansion (Rs crore) PV of cash flows of expansion (Rs crore) Time period (years) Standard deviation Risk-free rate

d1 = ln(S / E ) + r f + 2 / 2 t t

800 700 -100 2,000 2,100 3 32% 7.50%

E S0 t rf

0.7711

d2 = d t 1

N(d1) N(d2)

C = SN

0.2168 0.7797 0.5858

(d 1 )

Ee

rf t

N (d

701.72 601.72

Value of the project with option to expand (Rs crore): -100 + 701.72 Problem 2 Cost of development (Rs crore) PV of cash flows (Rs crore) NPV (Rs crore) Abandonment price (Rs crore) Time period (years) Standard deviation Risk-free rate Dividend yield: 1/30 ln(S / E ) + rf + 2 / 2 t d1 = t

1,200 1,000 -200 450 7 0.35 7.80% 0.0333

S0 E t rf y

1.9149 0.9889 0.9722 0.8387

d2 = d t 1

N(d1) N(d2)

The Black-Scholes call value will have to be adjusted for the assumed dividend yield. The adjustment will be made in the value of S0

C = Se

yt

N (d 1

Ee

rf t

N (d

551.31

Problem 3 Cost (Rs crore) Annual cash flows (Rs crore) Cost of capital PV of cash flows (Rs crore): 24/0.10 NPV (S crore): -185 + 24/0.10 Standard deviation Time period (years) Ris-free rate Using Balck-Schloes formula, we obtain: 185 24 10% 240 55 0.25 25 5%

d1 d2 N (d1 N (d2) Value of call Value of put Problem 4 Cost (Rs crore) Life (years) Annual cash flow (Rs crore) Cost of capital Risk-free rate Cash flow volatility (variance) Cash flow volatility (standard deviation) PV of cash flows (Rs crore) NPV (Rs crore) Suppose cash flows after one year (Rs crore) PV at the end of year 1 (Rs crore) Expected payoff after one year One-year return Suppose cash flows after one year (Rs crore) PV at the end of year 1 (Rs crore) One-year return Probability of high returns Probability of low returns Expected payoff (Rs crore) PV of expected payoff Problem 5 Patent life (years) Cost (Rs crore) PV (Rs crore) Volatility (standard deviation) Risk-free rate Expected cost of delay: y = 1/15 Using Balck-Schloes formula, we obtain: d1 d2 N (d1 N (d2) Value of call Value of put

1.4168 0.1668 0.92173 0.56623 131.58 15.35

50 15 7.5 15% 8% 0.0676 0.26 43.86 -6.14 9.45 63.55 4.10 44.9% 5.55 37.32 -14.9% 38.3% 61.7% 1.57 1.45

15 250 150 0.5 7% 0.0667 1.2467 -0.6898 0.89374 0.24515 27.87 60.17

E S0 rf y

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Real Options, Investment Strategy and Process: Problem 1Document4 pagesReal Options, Investment Strategy and Process: Problem 1Mukul KadyanNo ratings yet

- Tajikistan: Promoting Export Diversification and GrowthFrom EverandTajikistan: Promoting Export Diversification and GrowthNo ratings yet

- Capital Exp DecisionsDocument24 pagesCapital Exp DecisionsGourav PandeyNo ratings yet

- External Capital Rationing Internal Capital RationingDocument10 pagesExternal Capital Rationing Internal Capital RationingSiva SubramaniamNo ratings yet

- CH 01 Bond Pricing - Ready-To-BuildDocument19 pagesCH 01 Bond Pricing - Ready-To-BuildShruti SankarNo ratings yet

- Discounted Dividend ValuationDocument59 pagesDiscounted Dividend Valuationazzie3No ratings yet

- FNCE Cheat Sheet Midterm 1Document1 pageFNCE Cheat Sheet Midterm 1carmenng1990No ratings yet

- Chapter 10 - Profitability AnalysisDocument41 pagesChapter 10 - Profitability AnalysisSyafiq IzzuddinNo ratings yet

- Project Concept and FormulationDocument56 pagesProject Concept and FormulationWP 2-1-PR Katubedda-CESLNo ratings yet

- Basic Concepts in Project AppraisalDocument56 pagesBasic Concepts in Project AppraisalSubhanie RasanthiNo ratings yet

- General 4-Stage Model: Model 10-05A (Revenue Growth Model)Document2 pagesGeneral 4-Stage Model: Model 10-05A (Revenue Growth Model)JNNo ratings yet

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Cash Flow Estimation and Risk AnalysisDocument63 pagesCash Flow Estimation and Risk AnalysisAli JumaniNo ratings yet

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Valuation of Bonds and Shares: Problem 1Document29 pagesValuation of Bonds and Shares: Problem 1Sourav Kumar DasNo ratings yet

- FM Practice Sheet Booklet SOLUTIONS - Nov 2022Document135 pagesFM Practice Sheet Booklet SOLUTIONS - Nov 2022Dhruvi VachhaniNo ratings yet

- 073 - C5 Equity ValuationDocument77 pages073 - C5 Equity ValuationRazvan Dan0% (1)

- 76 OvalleDocument17 pages76 OvalleAsset KanatovNo ratings yet

- GDBA505 Formula Sheet For ExamDocument3 pagesGDBA505 Formula Sheet For ExamFLOREAROMEONo ratings yet

- CFA Level 3 FormulaDocument6 pagesCFA Level 3 FormulaRishabh SardaNo ratings yet

- Solution For Numerical Review QuestionDocument85 pagesSolution For Numerical Review QuestionAparajith GuhaNo ratings yet

- 02 LCC, WaccDocument20 pages02 LCC, Waccx23siddharthnaNo ratings yet

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDocument25 pagesChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanNo ratings yet

- Issues For Discussion Issues For DiscussionDocument19 pagesIssues For Discussion Issues For DiscussionNaveen SehrawatNo ratings yet

- Formulae SheetDocument4 pagesFormulae SheetSameer SharmaNo ratings yet

- Chapter II Methods of Comparing Alternative ProposalsDocument17 pagesChapter II Methods of Comparing Alternative ProposalsJOHN100% (1)

- Risk Free Rate + Beta× (Expected Market Return Risk Free Rate)Document4 pagesRisk Free Rate + Beta× (Expected Market Return Risk Free Rate)Sadiya Sweeto0% (1)

- An Introduction To Security Valuation: Dr. Amir RafiqueDocument34 pagesAn Introduction To Security Valuation: Dr. Amir RafiqueUsman MahmoodNo ratings yet

- R) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVDocument9 pagesR) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVAgnes LoNo ratings yet

- CFA Formula Cheat SheetDocument9 pagesCFA Formula Cheat SheetChingWa ChanNo ratings yet

- IAPMDocument26 pagesIAPMNeelesh ReddyNo ratings yet

- Formula Sheet FIMDocument4 pagesFormula Sheet FIMYNo ratings yet

- AFM. Resources. Useful FormulasDocument4 pagesAFM. Resources. Useful FormulasAnonymous MeNo ratings yet

- Capital BudgetingDocument48 pagesCapital BudgetingVIVEK JAISWAL100% (1)

- Capital Exp Decisions1Document24 pagesCapital Exp Decisions1Kanchan GuptaNo ratings yet

- Corporate FinanceDocument19 pagesCorporate FinanceBilal Shahid100% (4)

- Time Value of MoneyDocument27 pagesTime Value of MoneyRishab KapurNo ratings yet

- Chap 4 - Other DCF ModelsDocument35 pagesChap 4 - Other DCF Modelsrafat.jalladNo ratings yet

- Busn 233 CH 08 EeeeDocument102 pagesBusn 233 CH 08 EeeeDavid IoanaNo ratings yet

- Questionnaire For IMDDocument3 pagesQuestionnaire For IMDAnonymous iCFJ73OMpDNo ratings yet

- CHAPTER 9 - Investment AppraisalDocument37 pagesCHAPTER 9 - Investment AppraisalnaurahimanNo ratings yet

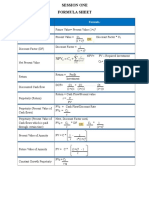

- Session One FormulasDocument1 pageSession One FormulasSalarAliMemonNo ratings yet

- EXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Document16 pagesEXCEL Modeli Upravljanja Troškovima - HP - XI - 2013Ana MarkovićNo ratings yet

- Slides367 Investment Mangemnt Must PrintDocument454 pagesSlides367 Investment Mangemnt Must PrintneveenNo ratings yet

- 11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoDocument38 pages11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoRachel PalosNo ratings yet

- Advanced Capital Budgeting-RawDocument34 pagesAdvanced Capital Budgeting-Rawjohn3dNo ratings yet

- How To Calculate Present Values: Fixed Income SecuritiesDocument52 pagesHow To Calculate Present Values: Fixed Income Securitiesmohitaggarwal123No ratings yet

- Ch11 ShowDocument63 pagesCh11 ShowMahmoud AbdullahNo ratings yet

- Chapter 3 Prob SolutionsDocument33 pagesChapter 3 Prob SolutionsMehak Ayoub100% (1)

- Formulas and ConceptsDocument7 pagesFormulas and Conceptscolen.anneNo ratings yet

- FM FormulasDocument9 pagesFM FormulasrafishogunNo ratings yet

- FINS3630 Finals Formula SheetDocument3 pagesFINS3630 Finals Formula SheetElaineKongNo ratings yet

- PA - Chapter 7Document32 pagesPA - Chapter 7Mai Lâm LêNo ratings yet

- Valuation of SecuritiesDocument71 pagesValuation of Securitieskuruvillaj2217No ratings yet

- International Capital Budgeting or Evaluation of International ProjectDocument18 pagesInternational Capital Budgeting or Evaluation of International ProjectAvayant Kumar SinghNo ratings yet

- 19DM511, Fixed Income SecuritiesDocument4 pages19DM511, Fixed Income SecuritiesSIDDHARTHA VERMA 20DM210No ratings yet