Professional Documents

Culture Documents

POWER SECTOR Industry Analytics

POWER SECTOR Industry Analytics

Uploaded by

Vaibhav MittalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

POWER SECTOR Industry Analytics

POWER SECTOR Industry Analytics

Uploaded by

Vaibhav MittalCopyright:

Available Formats

ALLIANCE BUSINESS SCHOOL INDUSTRIAL ANALYTICS

PGP-I

Power sector

SUBMITTED TO : DATE SECTION : : PROF. SAMIK SHOME 6/4/2009 C

SUBMITTED BY:

GROUP NO: 2

(08PG136) (08PG156) (08PG168) (08PG179) (08PG192) (08PG204)

ADITHYA RAJ ARVIND KUMAR SHARMA LOKESH MAHAJAN POONAM RATHI SAUMYA SAURABH SWATI AGARWAL

Power Sector Report (Apr - 2009)

CONTENT

TOPIC

EXECUTIVE SUMMARY Chapter 1 OVERVIEW OF POWER SECTOR 1.1 Introduction 1.2 Global Overview Chapter 2 REVIEW OF LITERATURE Chapter 3 POWER SECTOR IN INDIA 3.1 Power Sector in India 3.1.1 Emergence of regional Power systems 3.1.2 Generation 3.1.3 Transmission 3.1.4 Power for All by 2012 3.1.5 Distribution Chapter 4 SEGMENTS IN POWER GENERATION 4.1 Thermal Power 4.2 Hydro Power 4.3 Nuclear Power 4.4 Solar 4.5 Wind 4.6 Small Hydro Chapter 5 REFORMS IN POWER SECTOR 5.1.1 Pre Reform Stage 5.1.2 Electricity Act 2003 5.1.3 Electricity Act 2007 Chapter 6 IMPACT OF POWER SECTOR 52 55 60 41 45 47 48 49 50 22 23 23 26 31 33 10 11 16

PAGE NO.

7

Power Sector Report ABS, Bangalore

2 | Page

Power Sector Report (Apr - 2009)

6.1 Impact of Power Sector 6.1.1 Local Impact 6.1.2 Regional Impact 6.1.3 Global Impact 6.2 National Environmental Legislation Affecting the Sector 6.3 National Environmental Policies Relevant to Sector Chapter 7 STUDY OF SELECTED COMPANIES 7.1 NTPC Ltd. 7.2 Reliance Infrastructure 7.3 Tata Power Ltd. 7.4 Power Grid Corporation 7.5 Torrent Power Ltd. 7.6 JP Hydropower 7.7 Energy Develop 7.8 KSK Energy 7.9 GVK Power 7.10 Indowind Energy Chapter 8 ANALYSIS OF POWER SECTOR 8.1 Ratio Analysis 8.2 Regression Analysis 8.3 Trend Analysis 8.4 Judgemental Analysis 8.5 Experts Opinion 8.6 Porters Five Force Model 8.7 SWOT Analysis Chapter 9 ISSUES AND CHALLENGES Chapter 10 CONCLUSION AND FINDINGS REFERENCES APPENDIX 140 143 147

3 | Page

64 64 65 66 66 67 70 75 78 82 85 87 89 90 92 95 99 120 124 128 129 131 133 137

Power Sector Report ABS, Bangalore

Power Sector Report (Apr - 2009)

LIST OF TABLES

TOPIC

1.

PAGE NO. 13 24 28 29 35 52 103 104 105 106 107 108 109 110 111 112 113 116 123 130

OECD Multinational Electricity companies Growth of Transmission Details of Sub-stations region Details of Funds released under APDRP Power Sector Reforms

2. Gap between demand and supply of power

3. 4. 5. 6.

7. Ratio Analysis of NTPC 8. Ratio Analysis of Power Grid Corp. 9. Ratio Analysis of Reliance Infra 10.Ratio Analysis of Tata Power 11.Ratio Analysis of Torrent Power 12.Ratio Analysis of Indowind Energy 13.Ratio Analysis of Energy Develop 14.Ratio Analysis of GVK Power 15.Ratio Analysis of JP Hydro 16.Ratio Analysis of KSK Energy

17. Comparative 18. Comparative

Ratio Analysis (Top 5 Companies) Ratio Analysis(Bottom 5 Companies)

19.Trend Analysis

20. Porters

Five Forces analysis

Power Sector Report ABS, Bangalore

4 | Page

Power Sector Report (Apr - 2009)

LIST OF FIGURES

TOPIC

1.

PAGE NO. 12 14 44 46 73 74 124 125 129 131 Framework 132

World Marketed Energy Consumption,1980-2030

2. Comparative Per Capita Consumption of Electricity 3. Comparison of Energy Intensity

4. 5. 6. 7. 8. 9.

State-wise hydro-power generation Growth of NTPC NTPC Performance Output of trend Analysis Exponential method Output of trend Analysis Moving Average method Porters Five Force Model

10. SWOT Analysis 11. SWOT Analysis

Power Sector Report ABS, Bangalore

5 | Page

Power Sector Report (Apr - 2009)

POWER SECTOR

Power Sector Report ABS, Bangalore

6 | Page

Power Sector Report (Apr - 2009)

EXECUTIVE SUMMARY

Availability of power is one of the important ingredients for industrial growth. It is an important infrastructure facility without which no industrial activity can be thought of in modern times. Increasing automation of Indian industries has created huge demand of power in India. This huge demand has resulted into demand supply gap in India in recent times. This report is based on the extensive study of the power sector in India. Both global and domestic perspectives of power sector focusing more on Indian players have been looked upon in this report. It includes the literature review by scholars which has analyzed the subject of power sector more extensively. The objective of this report is to get a comprehensive and apparent knowledge of the power sector, and to study the changes in power sector over a period of time there by analyzing various aspects of the power sector. In the report the power generation companies of the industry chosen, are the top five and bottom five companies of the power sector in India, based on the sales turnover. The trends in the demand, supply and generation in the power sector is discussed through the trend analysis. Before 2001, Indias electricity-supply was mainly owned and operated by public sector. It was running under the risk of bankruptcy. This created a serious impediment to investments in the sector at the time when India desperately needed them. This led to the emergence of Private players in the power sector. The NTPC, Reliance Infra, Tata Power, Power Grid, & Torrent Power are the market leaders in the power sector and have high Cumulative Annual Growth Rate (CAGR). This is because of the government support, inflow of foreign investment, growing demand and use of latest technology for power generation and transmission. The best management policies are adopted by these companies. The small players GVK power, Indowind Energy, Energy Development, JP Hydro, and KSK energy are also imparting new technology, and management policies to survive the competition and meet the demand of power sector.

Power Sector Report ABS, Bangalore

7 | Page

Power Sector Report (Apr - 2009)

The methodology used in report includes comparative analysis of the top 5 and bottom 5 companies of the sector. The Potters five forces analysis, SWOT analysis, Trend analysis & Ratio analysis are used to analyze the industry of power sector. The various analysis shows that there has been a continuous growth in generation and consumption of power in India. Thermal, hydro and nuclear are three major source of power generation From the installed capacity of only 1,362mw in 1947, has increased to 97000 MW as on March 2000 which has since crossed 100,000 MW mark India has become sixth largest producer and consumer of electricity in the world equaling the capacities of UK and France combined. The number of consumers connected to the Indian power grid exceeds is 75 million. Rural electrification is one significant initiative of the industry to trigger economic development and generate employment by providing electricity as an input for productive uses in agriculture and rural industries, and improve the quality of life of the rural people. The International Energy Outlook 2006 (IEO2006) projects strong growth for worldwide energy demand over the 27-year projection period from 2003 to 2030. Much of the growth in energy demand is among the developing countries in Asia, which includes China and India; demand in the region nearly triples over the projection period. Total primary energy consumption in the developing countries grows at an average annual rate of 3.0 percent between 2003 and 2030. In contrast, for the developed countrieswith its more mature energy-consuming nationsenergy use grows at a much slower average rate of 1.0 percent per year over the same period. This huge increase in projected demand of energy in India and China makes analysis of energy sector of these countries very important. World electricity generation rose at an average annual rate of 3.7% from 1971 to 2004, greater than the 2.1% growth in total primary energy supply. Total world consumption of marketed energy is projected to increase by 50 percent from 2005 to 2030.

Power Sector Report ABS, Bangalore

8 | Page

Power Sector Report (Apr - 2009)

CHAPTER 1 OVERVIEW OF POWER SECTOR

Power Sector Report ABS, Bangalore

9 | Page

Power Sector Report (Apr - 2009)

1.1. INTRODUCTION

An economys growth, development, ability to handle global competition is all dependent on the availability, reliability and quality of the power sector. As the Indian economy continues to surge ahead, electrification and electricity services have been expanding concurrently to support the growth rate. The demand for power is growing exponentially and the scope of growth of this sector is immense. Existing generation suffers from several recurrent problems. The efficiency and the availability of the coal power plants are low by international standards. A majority of the plants use low-heat-content and high-ash unwashed coal. This leads to a high number of airborne pollutants per unit of power produced. Moreover, past investments have skewed generation toward coal-fired power plants at the expense of peak-load capacity. In the context of fast-growing demand, large T&D losses and poor pooling of loads at the national level exacerbate the lack of generating capacity. India is one of the main manufacturers and users of energy. Globally, India is presently positioned as the 11th largest manufacturers of energy. It is also the worlds 6th largest energy users. In spite of its extensive yearly energy output, Indian power sector is a regular importer of energy because of huge disparity. Global and Indian economy have decelerated, but power is one of the few commodities in short supply in India. So, despite the sluggishness in production and demand for manufactured products, India remains power hungry, both in terms of normal and peak power demand. Power is derived from various sources in India. These include thermal power, hydropower or hydroelectricity, solar power, biogas energy, wind power etc. The distribution of the power generated is undertaken by Rural Electrification Corporation for electricity power supply.

Power Sector Report ABS, Bangalore

10 | P a g e

Power Sector Report (Apr - 2009)

1.2. GLOBAL OVERVIEW

The energy required to support our economies and lifestyles provides tremendous convenience and benefits. Energy consumption is reportedly higher in countries where less than 5 % of the population lives below the poverty line than it is in countries where most people live in poverty -- four times higher. For example, Americans make up less than 5 % of the worlds population yet consume 26 % of the worlds energy. World electricity generation rose at an average annual rate of 3.7% from 1971 to 2004, greater than the 2.1% growth in total primary energy supply. This increase was largely due to more electrical appliances, development of electrical heating in several developed countries and rural electrification programmes in developing countries. De-regulation in areas of the global energy markets has led to fierce competition. Now more than ever electricity has to be produced at a lower cost with many countries imposing ever tightening environmental legislation to reduce the impact power generation has on the environment. The enormous challenges are recognised in providing electricity as efficiently as possible and strive to develop technology to meet your needs. Collectively, developing countries use 30% of the world's energy, but with projected population and economic growth in those markets, energy demands are expected to rise 95 %. Overall global consumption is expected to rise 50 % from 2005 to 2030. World energy consumption is projected to expand by 50% from 2005 to 2030 in the IEO2008 reference case projection. Although high prices for oil and natural gas, which are expected to continue throughout the period, are likely to slow the growth of energy demand in the long term, world energy consumption is projected to continue increasing strongly as a result of robust economic growth and expanding populations in the worlds developing countries. Energy demand in the OECD economies is expected to grow slowly over the projection period, at an average annual rate of 0.7%, whereas energy consumption in the emerging economies of non-OECD countries is expected to expand by an average of 2.5 % per year.

Power Sector Report ABS, Bangalore

11 | P a g e

Power Sector Report (Apr - 2009)

China and Indiathe fastest growing non-OECD economieswill be key contributors to world energy consumption in the future. Over the past decades, their energy consumption as a share of total world energy use has increased significantly. In 1980, China and India together accounted for less than 8 % of the worlds total energy consumption. In 2005 their share had grown to 18 %. Even stronger growth is projected over the next 25 years, with their combined energy use more than doubling and their share increasing to one-quarter of world energy consumption in 2030 in the IEO2008 reference case. In contrast, the U.S. share of total world energy consumption is projected to contract from 22 % in 2005 to about 17 % in 2030. Energy consumption in other non-OECD regions also is expected to grow strongly from 2005 to 2030, with increases of around 60 % projected for the Middle East, Africa, and Central and South America. A smaller increase, about 36 %, is expected for non-OECD Europe and Eurasia (including Russia and the other former Soviet Republics), as substantial gains in energy efficiency result from the replacement of inefficient Soviet-era capital stock and population growth rates decline. Fig .1: World Marketed Energy Consumption, 1980 - 2030

Source: EIA International Energy Annual 2005(June-October 2007)

Power Sector Report ABS, Bangalore

12 | P a g e

Power Sector Report (Apr - 2009)

Oil for power generation has been displaced in particular by dramatic growth in nuclear electricity generation, which rose from 2.1% in 1971 to 15.7% in 2004. The share of coal remained stable, at 40% while that of natural gas increased from 13.3% to 19.6%. The share of hydro-electricity decreased from 23.0% to 16.1%. Due to large programmes to develop wind and solar energy in several OECD countries, the share of new and renewable energies, such as solar, wind, geothermal, biomass and waste increased. However, these energy forms remain limited: in 2004, they accounted for only 2.1% of total electricity production. The share of electricity production from fossil fuels has gradually fallen, from just under 75% in 1971 to 66% in 2004. This decrease was due to a progressive move away from oil, which fell from 20.9% to 6.7%.

Company

AES EDF Tractebel Enron Intergen Mirant Transalta IP CDC

Table 1: OECD Multinational Electricity Companies Activity Assets Countries Active

Generation Generation Generation & supply Generation Generation Generation Generation Generation Generation 1666MW 1684MW 848MW 204MW 1830MW 2261MW 280MW 3817MW 810MW China, India, Pakistan, Sri Lanka China, Laos, Vietnam China, Thailand, Laos Philippines, Guam China, Philippines, Singapore, Australia Philippines Australia Australia, Pakistan, Thailand, Malaysia Bangladesh

Source: http://www.tni.org/books/yearb05corporations.pdf.

As per the recent survery, the global electrical & electronics market is worth $1,038.8 billion, which is forecasted to grow to $ 1,216.8 billion at the end of the year 2008. If electrical & electronics production statistics are considered, the industry accounted for $1,025.8 billion in 2006, which is forcasted to reach $1,051.5 billion in future.

Power Sector Report ABS, Bangalore

13 | P a g e

Power Sector Report (Apr - 2009)

Fig.2: Comparative Per Capita Consumption Of Electricity (Kwh)

The per capita consumption is seen to be far behind from the world average and very less when compared to other countries. So there is a need to improve it. Though India has achieved many milestones in generation still the there is a wide gap between demand and supply of power. This is the most important issue to be concerned.

Power Sector Report ABS, Bangalore

14 | P a g e

Power Sector Report (Apr - 2009)

CHAPTER 2 LITERATURE REVIEW

Power Sector Report ABS, Bangalore

15 | P a g e

Power Sector Report (Apr - 2009)

2.1 REVIEW OF LITERATURE

Schwartz (2008), Studies the business of NAILD distributor through this article. The NAILD is an organisation supporting lighting distributors in the US with publications, training, and conferences. According to him, recent changes and trends in the lighting market provide new opportunities. The keys to taking advantage of the opportunities is to understand the market, know where to get more information, provide updates to your customers, and turn information into active marketing and promotional efforts. The Energy Independence and Security Act of 2007 add to the programs and efforts introduced in EPACT 2005. A key component of the ENERGY STAR qualified light fixtures program is the Advanced Lighting Package (ALP). As market trends and legislation move purchasers away from inefficient technologies and towards energy-efficient products, NAILD distributors that become ENERGY STAR Partners have an opportunity to increase sales and profits.

Sreekumar (2008) reviews the market-oriented power sector reforms initiated in India in the early 1990s. It brings out a public interest oriented critique of the three phases of the reforms firstly, privatization of generation, secondly, state sector restructuring and finally, the ongoing reforms since the passage of the Electricity Act 2003. Reforms were taken up as a response to the crisis in the sector. The article questions the success of the process in solving the crisis. While acknowledging positive elements like increase in transparency and participation, it criticizes the process for neglect of development issues like rural electrification and energy efficiency. The article concludes with some thoughts on developing an alternate reform approach.

Augustine (2007), tries to put forth a model pertaining to transportation because India is facing a huge increase in power consumption. The model is done with an aid of GAMS

Power Sector Report ABS, Bangalore

16 | P a g e

Power Sector Report (Apr - 2009)

(General Algebraic Modelling System). The power sector is represented in the model by production capacities, cost of production and transmission, demand for power and the distances between power plants and consumption centres. The author has considered major power generating areas of the country like Ranchi, Bhopal, bhubwaneshwar, dhanbad, Vishakhapatnam etc. The model described is very realistic, scalable and easy to implement, but has only considered coal, hydroelectric and natural gas technologies. It can be expanded to include other technologies and also can be made dynamic to provide solutions for different time periods representing the maturing of the power generation plants during the duration of the model.

Remes (2007) talks about Russia fourth largest user of electricity in the world, he talks about RAO UES which controls all the transmission, distribution and supply of electricity, it controls everything except nuclear power. Anatoly Chubais, The very core of the reform has been to separate competitive businesses from natural monopolies, both legally, functionally and regulatory. Consequently, competitive parts generation companies, supply/sales companies and service companies have been separated into legally different companies from natural monopolies from Transmission Company, distribution companies and system Operator Company. It is of utmost importance for the future, to prevent the creation of any monopoly structures on the markets. UES is suggesting a change in the law allowing the Antimonopoly Agency to interfere immediately when the share of any company in any regional free-flow markets. Finally, concluding it can be said that Russia is ahead of the EU in the reform of the power sector and power sector monopolies. Russia has been able to create very sophisticated markets, with new elements, and with rational elements to the regulations.

Yemula, Medhekar, Maheshwari, Khaparde, Joshi(2007) have put their opinion about Interoperability in the power sector. According to Wikipedia, Interoperability is a property referring to the ability of diverse systems and organizations to work together (inter-operate). The term is often used in a technical systems engineering sense, or alternatively in a broad sense, taking into account social, political, and organizational factors that impact system to

Power Sector Report ABS, Bangalore

17 | P a g e

Power Sector Report (Apr - 2009)

system performance. Basically they have considered organizational, application, information and technical level interoperability. They believe that organization interoperability is ensured by standard inter-organization protocol, which expresses the way in which organization share data. Application Interoperability is achieved by enforcement of inter-application protocol. Information interoperability is ensured at lower level by the compliance of standard information model. Technical Interoperability is the result of application of standard device level protocols.

Singh (2006) address the Power sector reforms in India. Reforms were initiated at a juncture when the sector was plagued with commercial losses and burgeoning subsidy burden. Investment in the sector was not able to keep pace with growing demand for electricity. This paper takes stock of pre-reform situation in Indian power sector and identifies key concerns that led to initiation of the process of reform. The paper discusses major policy and regulatory changes undertaken since the early 1990s. The paper also illustrates changes in the market structure as we move along the reform process. It also discuss some of the major provisions of the recently enacted Electricity Act 2003 that aims to replace the prevailing acts which govern the functioning of the power sector in the country. In this context, it discuss two issues arising out of it, namely open access and multi-year tariff that we think would have a significant bearing on the performance of the sector in the near future. The paper also evaluates the reform process in the light of some of the regulatory changes undertaken. Finally, the paper briefly discusses the issues involved in introduction of competition in the power sector primarily through development of a market for bulk power.

Kumar, Khetan & Thapa (2005) highlights that India has set itself an ambitious target of more than doubling per-capita electricity consumption by 2011. Indian power sector, with current electricity shortages of over 11% of peak and 7% of energy, will be one of the key determinants to future growth. The Indian government has worked steadily to liberalise the sector and initiated reforms that culminated in the Electricity Act 2003. The Act brought together structural and regulatory reforms designed to foster competitive markets, encourage private participation and transform the states role from service provider to regulator. The Act

Power Sector Report ABS, Bangalore

18 | P a g e

Power Sector Report (Apr - 2009)

afforded consumers the ability to directly source their electricity from suppliers using existing networks and recognised trading as a separate line of business. Despite the potential offered by the Indias power sector, investors have long been weary of the sectors bureaucracy and regulatory complexity. With a critical mass of progress in regulatory reforms and soaring economic growth, the Indian power sector is now primed for take off. How India deals with the remaining challenges of the restructuring process and emerging fuel shortages will dictate what happens in the years to come.

Newbery (2005) says that Modern infrastructure, particularly electricity, telecom and roads, is critical to economic development. Electricity provides light, the ability to use modern equipment, computers and access to ICT. Telecom facilitate information exchange and access to the rest of the world, while transport infrastructure is critical for trade, and by lowering transport costs extends the market and increases competition. If there is a surplus of infrastructure, more investment adds little to total output, but if there is a deficit, then shortages constrain total output, magnifying the impact, so that the return to reducing that deficit can be very high indeed.

Banerjee (2004) says that the earliest electric power systems were distributed generation (DG) systems intended to cater to the requirements of local areas. Subsequent technology developments driven by economies of scale resulted in the development of large centralized grids connecting up entire regions and countries. The design and operating philosophies of power systems have emerged with a focus on centralized generation. During the last decade, there has been renewed interest in DG. This paper reviews the different technological options available for DG, their current status and evaluates them based on the cost of generation and future potential. The relevance of these options for a developing country context is examined using data for India. Different definitions of DG have been proposed. Some have linked this to the size of the plant, suggesting that DG should be from a few kW to sizes less than 10 or 50MW. This provides a review of alternative definitions of DG and suggests that DG be defined as the

Power Sector Report ABS, Bangalore

19 | P a g e

Power Sector Report (Apr - 2009)

installation and operation of electric power generation units connected directly to the distribution network or connected to the network on the customer site of the meter. DG is also referred to as dispersed generation or embedded generation. DG options can be classified based on the prime movers usedengines, turbines, fuel cells or based on the fuel source as renewable or non-renewable. There are a large number of possible system configurations.

Swain, Singh and Kumar (2004) ,describes there were many inhibitors to growth in power sector but the main problem in the growth was Government Policy, which made it difficult for a private player to enter. This further created the problem that Indian entrepreneurs didnt have enough knowledge and experience in developing power projects. A whole new system was evolved where private players were invited to be an active participant. The system demanded financial, political and other major requirement in roads and communication. Some of the bold steps taken in the Act were moving generation and distribution out of License Raj, opening access to national grid and demolishing the Single Buyer model. The failure of the large structure and the changing global scenario has forced Government to think of ways to revive this fundamental infrastructure sector. Two ways that government can count on for future growth of this sector are Small Power Plants and Clean Development Mechanism.

Soronow, Pierce & Wang(2003), introduces FEA's Power Sector Model as the next step in derivatives pricing. Here the authors identified weather and marginal fuel prices as independent variables driving load levels and power prices. This is grounded in the understanding that, to a large extent, weather dictates load conditions, which, together with the marginal fuel price, determines the power price. The second step is to conduct a detailed empirical study of the nature and relationships among the various components under analysis. The goal of the study is twofold: to understand the relationship between the variables, as well as to determine the seasonal aspects inherent in each component. The approach is capable of capturing the essential power price characteristics such as seasonality in price and volatility, mean-reversion, price spikes, volatility clustering, and regional

Power Sector Report ABS, Bangalore

20 | P a g e

Power Sector Report (Apr - 2009)

correlations. The model is self-contained, and when fully calibrated, Monte Carlo simulation provides the basis for valuing power contracts and generation assets directly.

Tongia (2003), describes that Indias power sector is undergoing significant reforms, beginning in 1991, which are changing and diminishing the role of the government, which functioned earlier as the near monopoly integrated utility. Because of significant financial difficulties faced by the SEBs 1991 saw the enactment of legislation, the 1991 Electricity (Supply) Act, which opened up the sector to private participation, primarily in generation. The current thrust of reforms is on the distribution sector, reducing losses and increasing efficiency. This might just be a precursor to privatization, but there is a goal to full electrification by 2012. In the last few years, the T&D losses have stabilized somewhat, but there is only limited interest of private players into the sector, especially new players. Those who state that overall financial losses have increased after the reforms do not factor in the increase in costs due to generator price increases regardless of reforms, even from government generators and PSUs. Electricity Bill 2001 opens up the sector to private participation with limited approval obligations. This sector is vital to Indias growth and development. At the same time they have not sufficiently addressed structural changes for grid operation and discipline (dispatch), such as based on load duration curves, or access and penetration for the poor (especially how that affects financial performance). They are a step in the right direction, ending years of Government control and mindset.

Power Sector Report ABS, Bangalore

21 | P a g e

Power Sector Report (Apr - 2009)

CHAPTER 3 POWER SECTOR IN INDIA

3.1. POWER SECTOR IN INDIA

The process of electrification commenced in India almost with the developed world, in the 1880s, with the establishment of a small hydroelectric power station in Darjeeling. However, commercial production and distribution started in 1889, in Calcutta (now Kolkata). In the year 1947, the country had a power generating capacity of 1,362 MW. Generation and distribution of electrical power was carried out primarily by private utility companies such as Calcutta Electric. Power was available only in a few urban centers; rural areas and villages did not have electricity. After 1947, all new power generation, transmission and distribution in the rural sector and the urban centers (which was not served by private utilities) came

Power Sector Report ABS, Bangalore

22 | P a g e

Power Sector Report (Apr - 2009)

under the purview of State and Central government agencies. State Electricity Boards (SEBs) were formed in all the states. Legal provisions to support and regulate the sector were put in place through the Indian Electricity Act, 1910. Shortly after independence, a second Act - The Electricity (Supply) Act, 1948 was formulated, paving the way for establishing Electricity Boards in the states of the Union. In 1960s and 70s, enormous impetus was given for the expansion of distribution of electricity in rural areas. It was thought by policy makers that as the private players were small and did not have required resources for the massive expansion drive, the production of power was reserved for the public sector in the Industrial Policy Resolution of 1956. Since then, almost all new investment in power generation, transmission and distribution has been made in the public sector. Most of the private players were bought out by state electricity boards. From the installed capacity of only 1,362mw in 1947, has increased to 97000 MW as on March 2000 which has since crossed 100,000 MW mark India has become sixth largest producer and consumer of electricity in the world equaling the capacities of UK and France combined. The number of consumers connected to the Indian power grid exceeds is 75 million. India's power system today with its extensive regional grids maturing in to an integrated national grid, has millions of kilometers of T & D lines criss-crossing diverse topography of the country. However, the achievements of India's power sector growth looks phony on the face of huge gaps in supply and demand on one side and antediluvian generation and distribution system on the verge of collapse having plagued by inefficiencies, mismanagement, political interference and corruption for decades, on the other. Indian power sector is at the cross road today. A paradigm shift is in escapable- for better or may be for worse.

3.1.1. EMERGENCE OF REGIONAL POWER SYSTEMS

Power Sector Report ABS, Bangalore

23 | P a g e

Power Sector Report (Apr - 2009)

In order to optimally utilise the dispersed sources for power generation it was decided right at the beginning of the 1960s that the country would be divided into 5 regions and the planning process would aim at achieving regional self sufficiency. The planning was so far based on a region as a unit for planning and accordingly the power systems have been developed and operated on regional basis. Today, strong integrated grids exist in all the five regions of the country and the energy resources developed are widely utilised within the regional grids. Presently, the Eastern & North-Eastern Regions are operating in parallel. With the proposed inter-regional links being developed it is envisaged that it would be possible for power to flow any where in the country with the concept of National Grid becoming a reality during 12th Plan Period.

3.1.2. GENERATION

India has installed power generation capacity of 1,41,079.84 MW as on January 31, 2008, which is about 100 times the installed capacity of 1362 MW in the year 1947. Power generation has showcased a robust growth rate which is steadily improving year after year. There has been significant improvement in the growth in actual generation over the last few years. As compared to annual growth rate of about 3.1% at the end of 9th Plan and initial years of 10th Plan, the growth in generation during 2006-07 and 2007-08 was of the order of 7.3% and 6.33% respectively. The electricity generation target for the year 2008-09 has been fixed at 744.344 BU comprising of 631.270 BU thermal; 118.450 BU hydro; 19.000 BU nuclear; and 5.624 BU import from Bhutan. Abbreviation:

SHP BG BP

= = =

Small Hydro Project Biomas Gasfier Biomass Power

Power Sector Report ABS, Bangalore

24 | P a g e

Power Sector Report (Apr - 2009)

U&I = RES =

Urban & Industrial Water Power Renewable Sources.

Table.2: Gap Between Demand And Supply Of Power

Source: http://www.indexmundi.com/India/electricity_production.html The table shows the average shortage of electricity in India every year to be approximately between 7-8%.

3.1.2.1. STRATEGIES

The various strategies followed to achieve the goal in power sector are, Power Generation Strategy with focus on low cost generation, optimization of capacity utilization, controlling the input cost, optimization of fuel mix, Technology up gradation and utilization of Nonconventional energy sources

Power Sector Report ABS, Bangalore

25 | P a g e

Power Sector Report (Apr - 2009)

Transmission Strategy with focus on development of National Grid including Interstate connections, Technology up gradation & optimization of transmission cost. Distribution strategy to achieve Distribution Reforms with focus on System up gradation, loss reduction, theft control, consumer service orientation, quality power supply commercialization, Decentralized distributed generation and supply for rural areas. Regulation Strategy aimed at protecting Consumer interests and making the sector commercially viable. Financing Strategy is to generate resources for required growth of the power sector. Conservation Strategy to optimize the utilization of electricity with focus on Demand Side management, Load management and Technology up gradation to provide energy efficient equipment gadgets. Communication Strategy for political consensus with media support to enhance the general public awareness. To achieve the above objectives National Electric Policy has been designed. To fulfill the objectives of the NEP, a capacity addition of 78,577 MW has been proposed for the 11th plan. This capacity addition is expected to provide a growth of 9.5 % to the power sector. The Tenth Plan for fiscal years 2002 to 2007 targeted a capacity addition of 41,110 MW, which was subsequently revised to 30,641 MW; however at the end of the Tenth Plan period, only 21,180 MW of capacity was added. This shows that India is not upto the mark in achieving the targets of generation. Our planning is perfect but our path to achieve the target is not perfect.

3.1.2.2. INVESTMENTS IN GENERATION Power Sector Report ABS, Bangalore

26 | P a g e

Power Sector Report (Apr - 2009)

The total fund requirement for generation projects, during the Eleventh Plan period is estimated at Rs. 4,108,960 million, with Rs. 2,020,670 million being required for the central sector, Rs. 1,237,920 million being required for the state sector and Rs. 850,370 million being required for the private sector. The total fund requirement includes the fund requirement estimated at Rs. 1,891,950 million for start-up generation projects benefiting in the Twelfth Plan.

3.1.3. TRANSMISSION

Transmission of electricity is defined as bulk transfer of power over a long distance at high voltage, generally of 132 kV. In India bulk transmission has increased from 3708 ckm in 1950 to more than 256,000 ckm today. The Government of India has an ambitious mission of POWER FOR ALL BY 2012. This mission would require that our installed generation capacity should be at least 2, 00,000 MW by 2012 from the present level of 1, 14,000 MW. To be able to reach this power to the entire country an expansion of the regional transmission network and inter regional capacity to transmit power would be essential. The latter is required because resources are unevenly distributed in the country and power needs to be carried great distances to areas where load centres exist. Ability of the power system to safely withstand a contingency without generation rescheduling or load-shedding was the main criteria for planning the transmission system. However, due to various reasons such as spatial development of load in the network, noncommissioning of load centre generating units originally planned and deficit in reactive compensation, certain pockets in the power system could not safely operate even under normal conditions. This had necessitated backing down of generation and operating at a lower load generation balance in the past. Transmission planning has therefore moved away from the earlier generation evacuation system planning to integrated system planning. While the predominant technology for electricity transmission and distribution has been Alternating Current (AC) technology, High Voltage Direct Current (HVDC) technology has

Power Sector Report ABS, Bangalore

27 | P a g e

Power Sector Report (Apr - 2009)

also been used for interconnection of all regional grids across the country and for bulk transmission of power over long distances. Certain provisions in the Electricity Act 2003 such as open access to the transmission and distribution network, recognition of power trading as a distinct activity, the liberal definition of a captive generating plant and provision for supply in rural areas are expected to introduce and encourage competition in the electricity sector. It is expected that all the above measures on the generation, transmission and distribution front would result in formation of a robust electricity grid in the country.

3.1.3.1. GROWTH OF TRANSMISSION

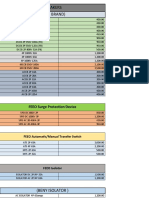

Table.3: CUMLATIVE GROWTH IN TRANSMISSION SECTOR & PROGRAMME FOR 11th PLAN

Power Sector Report ABS, Bangalore

28 | P a g e

Power Sector Report (Apr - 2009)

Unit At the end of VIII Plan ie March 1997 At the end of IX Plan ie March 2002 At the end of X Plan ie March 2007 At the end of XI Plan ie March 2012

TRANSMISSION LINES 765 kV HVDC +/- 500kV HVDC 200kV Monopole 400kV 230kV/220Kv Total Transmission Line SUBSTATIONS HVDC BTB HVDC Bipole+Monopole Total-HVDC Terminal Capacity 765kV 400Kv 230/220Kv Total-AC Subtation Capacity ckm ckm ckm ckm ckm ckm VIII Plan 409 3138 0 36142 79601 119290 IX Plan 971 3138 162 49378 96993 150642 X Plan 1704 58728 162 75772 114629 198089 XI Plan 7132 11078 162 125000 150000 293372

MW MW MW MVA MVA MVA MVA

VIII Plan 1500 1500 3000 0 40865 84177 125042

IX Plan 2000 3200 5200 0 60380 116363 176743

X Plan 3000 5200 8200 2000 92942 156497 251439

XI Plan 3000 11200 14200 53000 145000 230000 428000

Source: National Electricity Plan (vol-II) Transmission

3.1.3.2. TRANSMISSION NETWORK

Table.4: Details of Existing Lines and Sub-Stations Region Details of Existing Lines and Sub-Stations Region HVDC 1 400KV 220KV 132KV (MVA)

Northern Region

29 | P a g e

Power Sector Report ABS, Bangalore

Power Sector Report (Apr - 2009)

J&K HP Delhi Haryana Punjab Rajasthan UP Total NR 2 MP Maharashtra Gujarat Total WR 3 AP Karnataka Kerala Tamil Nadu Total SR 4 Bihar Orissa West Bengal 817 817 300 572 397 1789 1170 791 2933 7952 Western Region 5791 1127 1195 8113 Southern Region 2762 965 260 1647 5634 Eastern Region 1057 1034 1287 82 872 333 1860 2520 2025 156 64 220 0 3150 NIL 630 1575 5355 852 852 0 945 NIL 630 1575 687 192 66 401 1032 870 3248 0 1260 1575 2025 1130 630 6620

Power Sector Report ABS, Bangalore

30 | P a g e

Power Sector Report (Apr - 2009)

DVC Total ER 5 Assam Maghalaya Nagaland Manipur Mizoram Tripura Arunachal Pradesh Total NER Total All India 817 344 3722 N.E.Region 1978 333 2311 27732 171 320 491 5763 79 67 189 443 178 147 42 1145 1478 1015 100 6.3 5 1126 21711 952 333 630 7035

Source: http://cercind.gov.in/powergrid.htm

According to this table about 2.5% of Indian villages still remain unelectrified. In addition to state boards Power Grid Corporation of India Limited has a major role in transmission Power Grid Corporation of India limited (POWERGRID) was incorporated on October 23, 1989 with an authorized share capital of Rs. 5,000 Crore as a public limited company, wholly owned by the Government of India. POWERGRID started functioning on management basis with effect from August, 1991 and it took over transmission assets from NTPC, NHPC, NEEPCO and other Central/Joint Sector Organizations during 1992-93 in a phased manner. In addition to this, it also took over the operation of existing Regional Load Dispatch Centers from CEA, in a phased manner, which has been upgraded with State of-the-art Unified Load Dispatch and Communication (ULDC) schemes. According to its mandate, the Corporation,

Power Sector Report ABS, Bangalore

31 | P a g e

Power Sector Report (Apr - 2009)

apart from providing transmission system for evacuation of central sector power, is also responsible for Establishment and Operation of Regional and National Power Grids to facilitate transfer of power within and across the Regions with Reliability, Security and Economy on sound commercial principles. Based on its performance POWERGRID was recognized as a Mini-ratna company by the Government of India in October 1998.

POWERGRID, notified as the Central Transmission Utility of the country, is playing a major role in Indian Power Sector and is also providing Open Access on its inter-State transmission system.

3.1.4. FUTURE PLANS FOR POWER FOR ALL BY 2012

The countrys transmission perspective plan for eleventh plan focuses on the strengthening of National Power Grid through addition of over 60,000 ckm of Transmission Network by 2012. Such an integrated grid shall carry 60% of the power generated in the country. The existing inter-regional power transfer capacity is 17,000 MW, which is to be further enhanced to 37,000 MW by 2012 through creation of Transmission Super Highways. Based on the expected generation capacity addition in XI plan, an investment of about 75,000 Crore is envisaged in Central Sector and Rs. 65,000 Crore is envisaged in the State Sector. POWERGRID is working towards achieving its mission of Establishment and Operation of Regional and National Power Grids to facilitate transfer of power within and across the regions with reliability, security and economy, on sound commercial principles". The exploitable energy resources in our country are unevenly distributed, like Coal resources are abundant in Bihar/Jharkhand, Orissa, West Bengal and Hydro Resources are mainly concentrated in Northern and North-Eastern Regions. As a result, some regions do not have adequate natural resources for setting power plants to meet their future requirements whereas others have abundant natural resources. Demand for power continues to grow unabated. This calls for optimal utilization of generating resources for sustainable development. Thus, formation of National Power Grid is an effective tool to achieve this as various countries

Power Sector Report ABS, Bangalore

32 | P a g e

Power Sector Report (Apr - 2009)

have adopted the model of interconnecting power grid not only at national level but also at international level. Further, acquiring Right of Way (ROW) for constructing transmission lines is getting increasingly difficult, especially in eco-sensitive areas like North-Eastern Region, Chicken neck area, hilly areas in Jammu & Kashmir and Himachal Pradesh. At the same time, these areas are also endowed with major hydro potential of the country. This necessitates creation of Transmission Super Highways, so that in future, constraints in ROW do not cause bottleneck in harnessing generating resources. Inter-connection of these highways from different part of the country would ultimately lead to formation of a high capacity National Power Grid. Thus, developments in power sector emphasize the need for accelerated implementation of National Power Grid on priority to enable scheduled/unscheduled exchange of power as well as for providing open access to encourage competition in power market. Formation of such a National Power Grid has been envisaged in a phased manner. Initially, considering wide variations in electrical parameters in the regional grids, primarily HVDC interconnections were established between the regions. This was completed in the year 2002, thereby achieving inter-regional power transfer capacity of 5000 MW. In the next phase, inter-regional connectivity is planned to be strengthened with hybrid system consisting of high capacity EHV/UHV AC and HVDC links. Such a National Power Grid is envisaged to disperse power not only from Mega sized generation projects but also to enable transfer of bulk power from one part of the country to another in different operational scenarios say, in varying climatic conditions across the country: Summer, Winter, Monsoon etc. Commissioning of links under this phase has already begun with the commissioning of 2000 MW Talcher-II HVDC Bipole, Raipur Rourkela 400kV D/C AC transmission line having Series Compensation, augmentation of Gazuwaka HVDC (500MW) back to back link and Tala transmission system. The inter-regional transfer capacity of 16,200 MW is available as on date. Further strengthening of National Power Grid is envisaged through high capacity AC EHV lines, 765 kV UHV AC lines/ HVDC lines. This phase is planned to be implemented by 2012 when inter-regional power transfer capacity will be enhanced to about 37,700 MW by the end of XI Plan, depending upon planned growth of generation capacity.

Power Sector Report ABS, Bangalore

33 | P a g e

Power Sector Report (Apr - 2009)

3.1.5. DISTRIBUTION

The total installed generating capacity in the country is over 1, 35,000 MW and the total number of consumers is over 144 million. A vast network of sub transmission in distribution system has also come up for the utilization of power by the ultimate consumer. However, due to lack of adequate investment on T&D works, the T&D losses have been consistently on higher side, and reached to the level of 32.86% in the year 2000-01.The reduction of these losses was essential to bring economic viability to the State Utilities. As the T&D loss was not able to capture all the losses in the net work, concept of Aggregate Technical and Commercial (AT&C) loss was introduced. AT&C loss captures technical as well as commercial losses in the network and is a true indicator of total losses in the system. High technical losses in the system are primarily due to inadequate investments over the years for system improvement works, which has resulted in unplanned extensions of the distribution lines, overloading of the system elements like transformers and conductors, and lack of adequate reactive power support. The commercial losses are mainly due to low metering efficiency, theft & pilferages. This may be eliminated by improving metering efficiency, proper energy accounting & auditing and improved billing & collection efficiency. Fixing of accountability of the personnel / feeder managers may help considerably in reduction of AT&C loss. With the initiative of the Government of India and of the States, the Accelerated Power Development & Reform Programme (APDRP) was launched in 2001, for the strengthening of Sub Transmission and Distribution network and reduction in AT&C losses. The main objective of the programme was to bring Aggregate Technical & Commercial (AT&C) losses below 15% in five years in urban and in high-density areas. The programme, along with other initiatives of the Government of India and of the States, has led to reduction in the overall AT&C loss from 38.86% in 2001-02 to 34.54% in 2005-06. The commercial loss of the State Power Utilities reduced significantly during this period from Rs. 29331 Crore to Rs. 19546 Crore. The loss as %age of turnover was reduced from 33% in 2000-01 to 16.60% in 2005-06.

Power Sector Report ABS, Bangalore

34 | P a g e

Power Sector Report (Apr - 2009)

The APDRP programme is being restructured by the Government of India, so that the desired level of 15% AT&C loss could be achieved by the end of 11th plan. Since incentive financing is proposed to be integrated with the existing investment program to achieve commercial viability of SEBs / Utilities and link it to the reform process, the original APDP was rechristened to Accelerated Power Development & Reforms Programme (APDRP) during 2002-03 for 10th five year plan. The objectives of APDRP are: Improving financial viability of State Power Utilities Reduction of AT & C losses Improving customer satisfaction Increasing reliability &quality of power supply The scheme has two components as below:

a. Investment component Government of India provides Additional Central

Assistance for strengthening and up gradation of sub-transmission and distribution network. 25% of the project cost is provided as Additional central plan assistance in form of Grant to the state utilities. To begin with the Govt. also provided loan to the tune of 25% of the project cost. However in accordance with the recommendation of 12th finance commission, the loan component has been discontinued from FY 200506. Now utilities have to arrange remaining 75% of the project cost from FIs like PFC/REC or their resources. Special category state (like NE states, J&K, H.P, Uttaranchal and Sikkim) are entitled for 90% assistance in form of grant and balance 10% fund.

b. Incentive component - An incentive equivalent to 50% of the actual cash loss

reduction by SEBs/ Utilities, is provided as grant. The year 2000-01 is the base year for the calculation of loss reduction, in subsequent years. The cash losses are calculated net of subsidy and receivables.

Power Sector Report ABS, Bangalore

35 | P a g e

Power Sector Report (Apr - 2009)

Funds Released: Table.5: The details of the cash loss reduction and incentives released to various states under APDRP (As on 31 March 2008) Sl. No. 1 2 3 4 5 6 7 8 9 Incentive Amount Recommended for released to MoF 265.11 236.38 148.08 366.82 288.03 105.49 64.94 82.99 297.61 137.89 137.71 73 302.76 5.88 115.1 251.94 2879.63 Amount Released by MoF 265.11 236.38 148.08 366.82 288.03 105.49 64.94 82.99 297.61 137.89 137.71 73 302.76 5.88 115.1 251.94 2879.63

State Andhra Pradesh Gujarat Haryana Kerala Madhya Pradesh Maharashtra Rajasthan West Bengal Punjab Total

Claim Year 2002-03 2001-02 2002-03 2003-04 2004-05 2001-02 2002-03 2004-05 2002-03 2001-02 2001-02 2002-03 2003-04 2004-05 2005-06 2003-04

Source: http://www.powermin.nic.in/distribution/apdrp/projects/about_apdrp.htm Schemes undertaken under APDRP are for renovation and modernization of sub-stations, transmission lines & distribution transformers, augmentation of feeders & transformers, feeder and consumer meters, high voltage distribution system (HVDS), consumer indexing, SCADA, computerized billing etc.

1. Project Formulation The State utilities to prepare for each of the high-density areas in order of priority, Detail Project Reports (DPRs), based on the Technical Manual prepared by the Expert Committee on Distribution, constituted by the Ministry of Power. These DPRs are to be vetted by NTPC or PGCIL and put up to MOP for sanction. The different project components shall include:

Power Sector Report ABS, Bangalore

36 | P a g e

Power Sector Report (Apr - 2009)

2. Energy meters on Feeders Static meters on 11 kV out-going feeders and HT consumers have been contemplated. Though the Chief Ministers conference held in March 2001 decided to complete the implementation of the feeder meters by December 2002, due to various reasons their procurement and installation is yet to be completed. Since these feeders provide the metering at the points of bulk deliveries in the distribution system, these are of paramount importance for carrying out energy audits. Actions for procurement & installation of these are being pursued vigorously. It is also necessary that the meters be provided with on-line communication facility so that reliable, continuous data from all the substations are made available without manual intervention. 3. Energy meters on DTs & Consumers and energy accounting In many areas it has been planned to install suitable energy meters at distribution transformers to facilitate detailed accounting of energy flows and these have to be planned with suitable data transmission / collection facilities convenient to the utilities. Such meters can also help in keeping track of the distribution transformer loading and thereby reduce their outages apart from providing useful information on consumption patterns for demand side management. 4. 11 kV Feeder as Profit Centre Administrative measures are considered a powerful tool in our overall reform strategy because of the tremendous benefits it can provide in a short time span and with least burden to the SEB's. Recently, Andhra Pradesh has planned to entrust the distribution in selected 11 kV feeders and below levels to selected agencies with the requisite capabilities and have invited tenders for such tasks. Karnataka has come out with the program of Grama Vidyut Pradhinidhis for distribution in selected 11kv feeder areas. Success of such endeavors would go a long way in finding a solution to the issues of the Indian power sector. 5. Technical Loss reduction measures Measures for technical loss reduction include Installation of capacitors at all levels;

Re-conductoring of over loaded sections Re-configuration of feeder lines & distribution transformers so as to reduce the length

of LT lines

Power Sector Report ABS, Bangalore

37 | P a g e

Power Sector Report (Apr - 2009)

Make the system less LT oriented by installation of smaller size energy efficient

distribution transformers so that each transformer supplies power to 10 to 15 households only

Development of digital mapping of the entire assets of distribution system

Computerized load flow studies so that investments could be undertaken for long-term strengthening of the distribution system. 6. Improving customer satisfaction Customer satisfaction can be improved through providing better quality power in terms of voltage fluctuations and reliability by reducing outages. These necessarily call for technical intervention in firstly ensuring that the assets already created are maintained in proper working condition and secondly through augmenting the system. Further, customer complaint redressal mechanisms are to be made more responsive and proactive through building transparent and reliable system with the help of computerization. The system should be capable enough to meet the growing demand of information conscious customers. 7. Computerization Creation of comprehensive, up to date consumer index and system databases on computerized platforms are essential for creation of platforms for efficient commercial and technical operation and management of any distribution system. The APDRP program has laid emphasis on this basic need and actions are on in many areas for creation of such databases. The energy accounting, billing and revenue management platforms are also planned under the APDRP program for realizing the objectives outlined above and provide better services to the customers. Implementations for these are under various stages in different areas. In addition provisions of computerized automatic data acquisition at the substations are planned. Based on the needs these would be hooked up to suitable Supervisory Control and Data Acquisition systems. 8. Turnkey Implementation The schemes proposed under APDRP have to be implemented in a very short time frame so that benefits of the investments are perceived and confidence is generated in the FIs that investments in the distribution sector can be bankable. Execution of the scheme adopting

Power Sector Report ABS, Bangalore

38 | P a g e

Power Sector Report (Apr - 2009)

conventional arrangement of ordering each of the components separately would be time consuming and delay in arranging any one component could lead to overall time delays. With the present day manpower position in most of the SEBs it would also not be practical to coordinate the efforts of multiple agencies. By awarding the works under a turnkey contract the scheduling of equipment would be the responsibility of the contractor and shall keep in adhering to the time schedules. Hence turnkey packaging concept would be adopted for execution of works preferably through empanelled turnkey contractors to expedite project implementation schedule. Performance Guarantee Mechanism having adopted a turnkey concept for execution it would be possible to bind the contractor in terms of - Work completion schedule - Overall costs - Equipment performance. A scheme of incentives for early completion and penalties for delays or failure to meet performance guarantees can also be worked out in the turnkey contracts. If required performance guarantee contract mechanisms will be introduced whereby the turnkey companies would implement projects with guaranteed AT&C loss reduction with their own investments. The returns are expected from the guaranteed incremental loss reduction. Implementation of various activities / interventions will be prioritized to ensure quick improvements in reliability and quality of power supply, reduction in AT&C losses, increase in revenues and reduction in outages. The focus will be on 11 KV feeders, Distribution transformers and the Consumers. Therefore, the SEBs/State Utilities shall be urged to implement projects sanctioned under this programme on turnkey basis through pre-qualified turnkey contractors selected on a competitive basis to ensure quality and expeditious implementation.

9. Technical Specification & Standardization The Expert Committee has also recommended standardization of technical specifications of equipment used in the distribution sector. Specifications are being drawn up for energy efficient and standardized equipments like electronic and static meters, transformers,

Power Sector Report ABS, Bangalore

39 | P a g e

Power Sector Report (Apr - 2009)

capacitors, conductors, insulators etc., with the assistance of the Indian Electrical and Equipment Manufacturing Association, the Confederation of Indian Industry and the Bureau of Indian Standards etc. Appropriate Expert Committees have been set up for this purpose. NTPC and PGCIL have also prepared model bidding documents which are available for use by the utilities. 10. Accreditation Project formulation for up gradation of distribution network is a highly specialized job that involves detailed energy balancing and network reconfiguration necessary for a high voltage or low voltage distribution system. The SEBs may or may not have adequate skills in the area and, therefore, may like to acquire the expertise and skills on an outsourcing basis. In order to cover a large number of urban & industrial areas in the country, within the next 4 to 5 years, it is essential to make available a number of accredited specialized agencies for the purposes of energy audit & accounting, project formulation, turnkey implementation, project monitoring and project evaluation. SEBs / Utilities, if they so desire, would be able to outsource the implementation to accredited agencies for quick formulation of quality projects and their implementation. A Committee with members from NTPC, PGCIL, PFC, CEA, SEBs /Utilities, credit rating agencies, FIs etc. will be constituted to accredit reputed agencies for the above purpose. This would require engagement of agencies that are specialists in the fields of work given below in assisting the states which lack internal capabilities or manpower, and oversee the proposals & implementation by the states who are well equipped:

Engineering Agencies: To formulate and appraise the DPRs for augmentation of sub-

transmission and distribution system and oversee implementation including quality checks.

Project Monitoring Agencies: To review the physical and financial progress of the

project and bring out concern areas to the notice of the MOP for immediate resolution to avoid time and cost over - runs.

Turnkey Contractors: To undertake design, manufacture, supply, erection, testing &

commissioning and provide maintenance facilities and performance warranty for the various components involved in the sub-transmission and distribution system. Project Evaluators: To conduct concurrent and post execution evaluation of the anticipated and actual benefits accrued consequent upon execution of the project.

Power Sector Report ABS, Bangalore

40 | P a g e

Power Sector Report (Apr - 2009)

Energy Accounting & Audit Agencies: The key success of distribution sector lies in

bridging the gap between the energy drawn from the system and the metered energy supplied to the customers. The MOU with the States has a provision for conducting energy audit on each feeder. But the results of the audit have shown that a fair amount of energy accounted for as supplied is based on assessment. For success of the program and improving revenue realization it is essential that all energy transactions are adequately metered and properly accounted. Just as any business would have to get its accounts audited it is necessary that this energy accounting is audited by eminent third parties so that the programme can sustain on its own strength in the coming years. For carrying out the detailed activities at field level agencies with sufficient experience in the respective areas of work are proposed to be identified and accredited. Any SEB can invite quotations from the accredited parties for the specific work and immediately place an award thereby saving considerable time and effort. This would facilitate in reduction of bidding time, bring in uniformity of terms of reference and work content. For the other activities especially those involving HR initiatives at SEB level and DSM and distributed generation concepts, discussions are being held with international financing agencies to support the programme. 11. Application of Information Technology Information technology and computer aided tools for revenue increase, outage reduction, monitoring and control, play a vital role in distribution management. It is, therefore, proposed to have a technology mission for customizing / development of cost effective and relevant solutions for consumer and control point data communications, remote monitoring, operation and control, etc. for the distribution network. Involvement of IT industries in this effort is envisaged. IT applications will be used in such processes in the distribution sector to ensure higher revenues as a result of segregation of T&D losses, and controlling commercial losses, especially for metering, meter reading, billing, collection and outage reduction. 12. Management Information System (MIS) Operational efficiency improvement and customer servicing also need to be addressed at various levels in the organization. In this regard, an effective Management Information System (MIS) is required to ensure effective flow of information to facilitate quick decision-

Power Sector Report ABS, Bangalore

41 | P a g e

Power Sector Report (Apr - 2009)

making at various levels of organization and to improve the operation and management of the distribution system. This is proposed to be achieved through computerization and networking. Management Information System for the SEBs/ Utilities should provide relevant information at each level of the organization in timely and accurate manner. The timeliness and accuracy of information improves decision-making. For MIS, information flow is required from lower level to higher levels with some information in real time and some in batch mode. For real time information flow, networking within the organization is needed. In addition to this, information management required for monitoring and decision-making will be different at various levels in hierarchy. MIS should be able to take care of different needs at various levels. Otherwise huge data generated from MIS will not be of any significant use. The structure of MIS should be SEB specific because of difference in their organizational structures and responsibilities at various levels across the organization. A generalized framework of MIS is presented which may be tailored to suit the needs of a specific SEB/utilities. 13. Capacity Building within SEBs/Utilities Even though SEBs have expertise in different fields, strengthening of sub-transmission & distribution network on a scientific basis using computer aided tools requires an integrated knowledge. Most SEBs, during the regional meetings held in April and then later in June, 2001 expressed their inability to take up such work with their own manpower. It was considered necessary to promote capacity building exercise in the SEBs/State Power Utilities to enable SEB personnel to prepare detailed project reports for each of the districts/ circles and implement the project using APDRP funds at a later stage. Capacity building exercise is to cover: Training the manpower Energy audit & accounting studies Making the SEB officials collect relevant data from each 11 KV feeder in the identified circle. Analysis of the data using computer tools to prepare feeder wise computer aided least cost project report.

Power Sector Report ABS, Bangalore

42 | P a g e

Power Sector Report (Apr - 2009)

Supervision of implementation Several training programmes were organized by the training institutions such as Power Management Institute (NTPC), National Power Training Institute, PGCIL etc., and several working level officers from the various SEBs benefited from such programmes. It is planned to further strengthen our efforts in imparting quality training to bring about changes in business perspective crucial to the success of our power reform programme. It is proposed to provide extensive training to the staff of SEBs / Utilities at all levels to so as enable them to develop bankable project reports covering techno-commercial activities for each circle and manage electricity distribution with a commercial orientation. Capacity building is envisaged as a continuous exercise to ensure that the latest developments are internalized. Distribution reforms require a structural change in the existing set up of the SEBs. In order to enable them to manage distribution on a profit centre approach and to improve their performance on the basis of certain benchmarks, funds under APDRP will be provided only to those State Govts. /SEBs which agree to certain precedent conditions through an Agreement The SEBs / State Distribution Utilities will execute a SEB/Utilityspecific Memorandum of Agreement [MOA] with the Ministry of Power. The Ministry of Power will also monitor implementation of the precedent conditions before releasing funds. The efficiency gains on account of APDRP investments shall be intimated to the regulatory commission to ensure that the benefits and reliefs are passed on to the customer by the private utilities.

Power Sector Report ABS, Bangalore

43 | P a g e

Power Sector Report (Apr - 2009)

CHAPTER 4 SEGMENTS IN POWER GENERATION

Power Sector Report ABS, Bangalore

44 | P a g e

Power Sector Report (Apr - 2009)

SEGMENTS IN POWER GENERATION 4.1. THERMAL

Current installed capacity of Thermal Power (as of 12/2008) is 93392.64 MW which is 63.3% of total installed capacity. Current installed base of coal based thermal power is 77458.88MW which comes to 53.3% of total installed base. Current installed base of gas based thermal power is 14734.01MW which is 10.5% of total installed base. Current installed base of oil based thermal power is 1199.75 which is .09% of total installed base. Maharashtra is the largest producer of thermal power in the country. Fig. 3: Comparison of Energy Intensity

Power Sector Report ABS, Bangalore

45 | P a g e

Power Sector Report (Apr - 2009)

Source: chmn@dae.gov.in

4.2. HYDRO POWER

India is blessed with a rich hydro power potential. In the exploitable potential terms, India ranks fifth in the world. Less than 25% of the potential has been developed as of now. A large hydro has four main advantages. It is a source of green energy. It has low variable cost. It is grid friendly. It can also can sub serve other purposes by irrigation, flood control, etc.

India has 3 major rivers: the Indus, the Brahmaputra, and the Ganga. It also has three major river systems? Central Indian, west flowing rivers of south India, and east flowing rivers of south India with a total of 48 river basins. The total potential from these river basins is 600TWh (Terawatt Hours) of electricity.

Power Sector Report ABS, Bangalore

46 | P a g e

Power Sector Report (Apr - 2009)

Hydroelectric projects can be classified on the basis of purpose, hydraulic features, capacity, head, constructional features, mode of operation, etc. The main types are

ROR (Run of River) There are not large reservoirs; a part of water flow is diverted to

the plant which is adjacent to the river. After generation the flow is diverted back to the main flow through the tail race. This type of hydro plants requires a diversion dam and has unregulated water flow.

Dam Storage In these types of hydro plants, large reservoirs are created by the

construction a sizeable dam across the river and the plants is situated at the toe of the dam. Here, water could be regulated to generate electricity depending upon the demand

Pumped Storage These types of plants have two reservoirs, one at the upstream of the

power plant and one at the downstream. When there is low peak demand, the water from the reservoir situated downstream is pumped0020back to the upstream reservoir. As of today, the total identified hydro potential is 1 48 701 MW (mega watt). According to the list of hydro electric projects in the country, a total of 29 572 MW,19.9% of the total? Has been harnessed and 13 286 MW is under construction. A total of 3 660 MW of pumped storage schemes have also been developed. Various initiatives for accelerated development have been taken up by the central government to harness the hydro potential in India. Some of these are Hydro Power Policy (1998) 50 000 MW initiative Preparation of viable models for private sector participation Ranking of projects R&M up gradation and life extension programmes Facilitation for trading and co-operation with other countries Execution of projects with interstate aspects by Central Public Sector Units

Fig.4: State wise Hydro-power generation

Power Sector Report ABS, Bangalore

47 | P a g e

Power Sector Report (Apr - 2009)

Source: http://www.marketresearch.com/product/display.asp?productid=1695991

4.3. NUCLEAR POWER GENERATION

In India, out of total installed capacity of 126993.97 MW (as on 31 August 2006); the share of nuclear power is 3% at 3900 MW. From the electricity generation point of view, nuclear power plants contributed 17 238.89 GWh out of total electricity generation of 6 17 510.44 GWh during April 2005 - March 2006, amounting to 2.79% of total generation. However, with exponential growth in energy demand coupled with a finite availability of coal, oil, and gas; there is a renewed emphasis on nuclear energy. Moreover, nuclear energy is considered to be an environmentally benign source of energy. Department of Atomic Energy is carrying out nuclear energy programme in India. The Indian Nuclear Power Programme has the following three stages.

Power Sector Report ABS, Bangalore

48 | P a g e

Power Sector Report (Apr - 2009)

The first stage, already commercial now, comprised setting up of PHWRs (pressurised heavy water reactors) and associated fuel cycle facilities. PHWRs use natural uranium as fuel and heavy water as moderator and coolant. The design, construction, and operation of these reactors is undertaken by public sector undertaking the NPCIL (Nuclear Power Corporation of India Ltd). The company operates 16 reactors (2 Boiling Water Reactors and 14 PHWRs) with a total capacity of 3900 MWe. In the second stage, it was envisaged to set up FBRs (fast breeder reactors) along with reprocessing plants and plutonium-based fuel fabrication plants. Plutonium is produced by irradiation of Uranium-238. The Fast Breeder Programme is in the technology demonstration stage. Under this stage, the IGCAR (Indira Gandhi Centre for Atomic Research) has completed design of a 500 MWe PFBR (prototype fast breeder reactor) being implemented by BHAVINI (Bharatiya Nabhikiya Vidyut Nigam). The third stage of the Indian Nuclear Power Programme is based on the thoriumuranium-233 cycle. Uranium-233 is obtained by irradiation of thorium. Presently this stage is in technology development phase. The ongoing development of 300 MWe AHWR (advanced heavy water reactor) at BARC (Bhabha Atomic Research Centre) concerns thorium utilization and its demonstration.

4.4. SOLAR India is endowed with rich solar energy resource. The average intensity of solar radiation received on India is 200 MW/km square (megawatt per kilometer square). With a geographical area of 3.287 million km square, this amounts to 657.4 million MW. However, 87.5% of the land is used for agriculture, forests, fallow lands, etc., 6.7% for housing, industry, etc., and 5.8% is either barren, snow bound, or generally inhabitable. Thus, only 12.5% of the land area amounting to 0.413 million km square can, in theory, be used for solar energy installations. Even if 10% of this area can be used, the available solar energy would be 8 million MW, which is equivalent to 5 909 mtoe (million tons of oil equivalent) per year.

Power Sector Report ABS, Bangalore

49 | P a g e

Power Sector Report (Apr - 2009)

However, solar energy is a dilute source. The energy collected by 1 m square of a solar collector in a day is approximately equal to that released by burning 1 kg of coal or 1/2 litre of kerosene. Thus, large areas are needed for collection. Besides, the efficiency of conversion of solar energy to useful energy is low. Therefore, the energy actually available would be order of magnitude lower than the aforementioned estimates. Nonetheless, it is obvious that solar energy can be a good source of meeting energy demands. On the applications side, the range of solar energy is very large. While at the high end there are megawatt level solar thermal power plants, at the lower end there are domestic appliances such as solar cooker, solar water heater, and PV lanterns. Then, in between, there are applications such as industrial process heat, desalination, refrigeration and air-conditioning, drying, large scale cooking, water pumping, domestic power systems, and passive solar architecture. Solar energy can be harnessed to supply thermal as well as electrical energy. Those technologies that use solar energy resource to generate energy are known as solar energy technologies. Solar energy technologies consists of

Solar thermal technologies, which utilize sun's thermal energy and Solar photovoltaic technology, which convert solar energy directly in to electricity.

Solar energy resource: Since the accurate information about solar energy resource at a specific location is crucial for designing appropriate solar system. Solar energy resource assessment becomes an essential activity of any solar energy programme.

4.5. WIND

The suns energy falling on the earth produces large-scale motions of the atmosphere causing winds, which are also influenced by small scale flows caused by local conditions such as nature of terrain, buildings, water bodies, etc. Wind energy is extracted by turbines to convert the energy into electricity. A small-scale and large-scale wind industry exists globally. The small-scale wind industry caters for urban settings where a wind farm is not feasible and also where there is a need for

Power Sector Report ABS, Bangalore

50 | P a g e

Power Sector Report (Apr - 2009)