Professional Documents

Culture Documents

Finance Presentation 1

Finance Presentation 1

Uploaded by

baamrani80 ratings0% found this document useful (0 votes)

5 views3 pagesRebalancing an investment portfolio involves adjusting the allocation of assets to maintain the original risk profile over time. This is done by selling assets that have performed well and buying those that have not to restore the intended percentage allocation in each asset class. It is recommended that investors rebalance their portfolio at least once per year to account for shifts in asset values and ensure the portfolio continues to align with their risk tolerance.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRebalancing an investment portfolio involves adjusting the allocation of assets to maintain the original risk profile over time. This is done by selling assets that have performed well and buying those that have not to restore the intended percentage allocation in each asset class. It is recommended that investors rebalance their portfolio at least once per year to account for shifts in asset values and ensure the portfolio continues to align with their risk tolerance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesFinance Presentation 1

Finance Presentation 1

Uploaded by

baamrani8Rebalancing an investment portfolio involves adjusting the allocation of assets to maintain the original risk profile over time. This is done by selling assets that have performed well and buying those that have not to restore the intended percentage allocation in each asset class. It is recommended that investors rebalance their portfolio at least once per year to account for shifts in asset values and ensure the portfolio continues to align with their risk tolerance.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 3

Rebalancing Investment Portfolio

Rebalancing of portfolio is a strategy used by investors to maintain their risk profile by adjusting the allocation of portfolios assets trough time.

It takes place by selling assets that have good performance and buying the ones that have not done so well.

It is recommended that investors should rebalance their portfolio at least once a year.

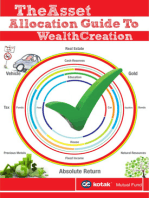

Diversification & The Portfolio Pyramid

The asset allocation should match to the investors risk profile.

Diversification & The Portfolio Pyramid

Market capitalization / Style / Sector Small cap stocks are usually riskier than the large cap ones but they also tend to have higher return. Holding many stocks of the same sector can be very risky. Industry / Geography Although a sector may perform well, not all the industries inside the sector will have the same performance. The markets of different countries are not affected by the same factors and they do not have the same growth rates. Manager Stock

You might also like

- CRM Pine Street CapitalDocument12 pagesCRM Pine Street CapitalMuhammad Daniala Syuhada50% (2)

- Hedge Fund StrategiesDocument3 pagesHedge Fund StrategiesJack Jacinto100% (1)

- Portfolio RevisionDocument10 pagesPortfolio RevisionJack RayonNo ratings yet

- Portfolio Revision: By-Sagar Sree Mouli Manasa Pranavi AbhilashDocument11 pagesPortfolio Revision: By-Sagar Sree Mouli Manasa Pranavi AbhilashchinchpureNo ratings yet

- Chapter 19 Equity Portfolio ManagementDocument32 pagesChapter 19 Equity Portfolio ManagementkegnataNo ratings yet

- 6205 LectureDocument27 pages6205 Lectureapi-3699305No ratings yet

- The Intelligent Investor Chapter 9Document3 pagesThe Intelligent Investor Chapter 9Michael Pullman100% (1)

- 2module 7 - Investment and Porfolio ManagementDocument26 pages2module 7 - Investment and Porfolio ManagementFelix Dichoso UngcoNo ratings yet

- Module 5 - Portfolio ManagementDocument7 pagesModule 5 - Portfolio ManagementAyush kashyapNo ratings yet

- Presenting: Equity ManagementDocument44 pagesPresenting: Equity ManagementMohamed HammadNo ratings yet

- Portfolio MGTDocument13 pagesPortfolio MGTmaddy_muksNo ratings yet

- Chapter 9. Portfolio Revisionand EvaluationDocument21 pagesChapter 9. Portfolio Revisionand Evaluationnguyen tungNo ratings yet

- Portfolio ManagementDocument33 pagesPortfolio ManagementNigus AberaNo ratings yet

- Portfolio Management: ROLL NUMBER: 112-128Document18 pagesPortfolio Management: ROLL NUMBER: 112-128Kadam 2019No ratings yet

- Portfolio Revision TechniquesDocument28 pagesPortfolio Revision Techniquesspssimran50% (6)

- Portfolio Management 2023 Students' VersionDocument40 pagesPortfolio Management 2023 Students' VersionAram Shaban FATTAHNo ratings yet

- Asset Allocation: Management Style and Performance Measurement by William F SharpeDocument42 pagesAsset Allocation: Management Style and Performance Measurement by William F SharpeAdnan KamalNo ratings yet

- Types of Portfolios in FinanceDocument16 pagesTypes of Portfolios in FinanceMichelle LoboNo ratings yet

- Portfolio RevisionDocument9 pagesPortfolio RevisionShweta ShrivastavaNo ratings yet

- Investment Management of BanksDocument28 pagesInvestment Management of BanksGragnor PrideNo ratings yet

- Capital Market FinalsDocument8 pagesCapital Market FinalsJ15 Clothing ApparelNo ratings yet

- Chapter 15 (Equity Portfolio Management Strategies)Document24 pagesChapter 15 (Equity Portfolio Management Strategies)Abuzafar Abdullah100% (1)

- Portfolio RevisionDocument13 pagesPortfolio Revisionaqsamumtaz812No ratings yet

- Investment Management - 9 - 07-Bond StrategyDocument64 pagesInvestment Management - 9 - 07-Bond StrategySaurabh TayalNo ratings yet

- A Project On Mutual Fund: Submitted By: Anurag Jena MBA FinanceDocument44 pagesA Project On Mutual Fund: Submitted By: Anurag Jena MBA FinanceANURAG JENANo ratings yet

- Fin 214 Mutual FundsDocument34 pagesFin 214 Mutual Fundsofficialrrk06No ratings yet

- Portfolio ManagementDocument36 pagesPortfolio Managementrajujaipur1234No ratings yet

- Portfolio RevisionDocument19 pagesPortfolio RevisionAneesh AsokanNo ratings yet

- Investment Management: Soumendra Roy NimsDocument25 pagesInvestment Management: Soumendra Roy NimsNitesh KumarNo ratings yet

- Introduction To Portfolio ManagementDocument39 pagesIntroduction To Portfolio Managementayaankhan2307sreNo ratings yet

- Hedge FundDocument46 pagesHedge Fundbboyvn100% (1)

- Chapter 19 - Bond Portfoilio Management StrategiesDocument20 pagesChapter 19 - Bond Portfoilio Management StrategiesJoseph LangitNo ratings yet

- Asset AllocationDocument27 pagesAsset AllocationLomyna YapNo ratings yet

- 3b. Managing InvestmentsDocument27 pages3b. Managing InvestmentsSasquarch VeinNo ratings yet

- Mutual FundsDocument48 pagesMutual FundsTony StarkNo ratings yet

- Moduel 3Document13 pagesModuel 3sarojkumardasbsetNo ratings yet

- Investment ManagementDocument20 pagesInvestment ManagementShubham Singh100% (1)

- Société FinancièreDocument133 pagesSociété Financièrekoxy2019No ratings yet

- Chapter 01.pptx-1Document22 pagesChapter 01.pptx-1Sadia HalimaNo ratings yet

- Mutual Funds in IndiaDocument26 pagesMutual Funds in IndiaAnjali RajNo ratings yet

- Changing The Existing Mix of SecuritiesDocument9 pagesChanging The Existing Mix of SecuritiesAni SinghNo ratings yet

- 4 Asset AllocationDocument51 pages4 Asset AllocationSHIVANSH BANSALNo ratings yet

- Chapter 17 - Equity Portfolio Management StrategiesDocument35 pagesChapter 17 - Equity Portfolio Management Strategieshajra1989100% (9)

- Hedge Fund StrategiesDocument3 pagesHedge Fund StrategiesKen BiiNo ratings yet

- Chap 11 Equity StrategiesDocument72 pagesChap 11 Equity StrategiesYibeltal AssefaNo ratings yet

- IA&M - Module 6 - 23 - 25Document22 pagesIA&M - Module 6 - 23 - 25Shalini HSNo ratings yet

- Unit IiDocument16 pagesUnit IiHeadhunter gameplayNo ratings yet

- 25.10.2021 Personal Finance (Shruti Ma'Am)Document13 pages25.10.2021 Personal Finance (Shruti Ma'Am)Shivam SinghNo ratings yet

- Inability To Create A Truly Diversified PortfolioDocument11 pagesInability To Create A Truly Diversified PortfolioMuhammad BilalNo ratings yet

- Investment Options Through Hedge FundDocument17 pagesInvestment Options Through Hedge FundMahesh KempegowdaNo ratings yet

- SapmDocument37 pagesSapmsinglamuskaan2002No ratings yet

- SAPM Portfolio RevisionDocument9 pagesSAPM Portfolio RevisionSpUnky RohitNo ratings yet

- Investment Options and CompaniesDocument15 pagesInvestment Options and Companiesshane.rweekesNo ratings yet

- Common Stocks: Analysis & StrategyDocument39 pagesCommon Stocks: Analysis & StrategyzeshanNo ratings yet

- Lecture Note 08 - Bond Portfolio ManagementDocument64 pagesLecture Note 08 - Bond Portfolio Managementben tenNo ratings yet

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingFrom EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingNo ratings yet

- The Asset Allocation Guide to Wealth CreationFrom EverandThe Asset Allocation Guide to Wealth CreationRating: 4 out of 5 stars4/5 (2)