Professional Documents

Culture Documents

Making Conditions

Uploaded by

NinaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Making Conditions

Uploaded by

NinaCopyright:

Available Formats

Decision-making conditions: Decision is made under three conditions: certainty, risk and uncertainty.

Certainty: When we have a feeling of complete belief or complete confidence in a single answer to the question is called certainty e.g. Decisions such as deciding on a new carpet for the office or installing a new piece of equipment or promoting an employee to a supervisory position are made with a high level of certainty. While there is always some degree of uncertainty about the eventual outcome of such decisions but there is enough clarity about the problem, the situation and the alternatives to consider the conditions to be certain. Risk: A state of uncertainty where some possible outcomes have an undesired effect or significant loss. Measurement of risk: A set of measured uncertainties where some possible outcomes are losses, and the magnitudes of those losses - this also includes loss functions over continuous variables. Uncertainty: The lack of certainty, A state of having limited knowledge where it is impossible to exactly describe existing state or future outcome, more than one possible outcome. Measurement of uncertainty: A set of possible states or outcomes where probabilities are assigned to each possible state or outcome - this also includes the application of a probability density function to continuous variables.

Example: Political Systems Inc. (PSI), a newly formed computer service firm specializing in information services such as surveys and data analysis for individuals running for political office. PSI is in the final stage of selecting a computer system for its Midwest branch located in Chicago .While the firm has decided on a computer manufacturer, it is currently attempting to determine the size of the computer system that would be the most economical to lease. Solution by using Payoff Tables: The first step is to identify the alternatives. For PSI, the final decision will be lease one of the three computer systems which differ in size and capacity. The three different alternatives denoted by d1, d2 and d3. D1=lease the large computer systems D2= lease the medium sized computer systems D3= lease the small computer systems Thus the PSI states of nature denoted S1 and S2, are as follows: S1= high customer acceptance of PSI services. S2= low customer acceptance of PSI services. For example, what profit would PSI experience if the firm has decided to lease the large computer system D1 and market acceptance was high S1? What profit would PSI experience if the firm has decided to lease the large computer system D1 and market acceptance was low S2? And so on. Payoff Table for the PSI Computer Leasing Problem Decision Alternatives Large System Medium System Small System d1 d2 d3 States of Nature High Acceptance Low Acceptance S1 S2 200000 -20000 150000 20000 100000 60000

Criteria for Decision Making under Uncertainty without using Probabilities: Three of the most popular criteria available for this case is maximin, maximax, minimax (regret). Maximin: The Maximin decision criterion is a pessimistic or conservative approach to arriving at a decision. In this approach the decision maker attempts to maximize the minimum possible profits; hence the term maximin. PSI minimum payoff ($) for each decision alternatives Minimum Payoff Large System Medium System Small System Maximax: Maximax provides an optimistic approach. Using this approach for maximization problems the decision maker selects the decision that maximizes the maximum payoff; hence the name maximax. PSI maximum payoff ($) for each decision alternative Maximum Payoff Large System Medium System Small System d1 d2 d3 200000 150000 100000 d1 d2 d3 -20000 20000 60000

Minimax Regret: The difference between the optimal payoff ($200,000) and the payoff experience ($100,000) is referred to as the opportunity loss or regret associated with our decision d3 when state s1 occurs i.e. 200,000-100,000=$100,000 and so on. Regret or opportunity loss for the PSI problem States of Nature Decision Alternatives Large System d1 High Acceptance S1 0 50000 100000 Low Acceptance S2 80000 40000 0

Medium System d2 Small System d3

The next step in applying the minimax regret criterion requires the decision analysis to identify the maximum regret for each decision alternative. The final decision is made by selecting the alternative corresponding to the minimum of the maximum regret values; hence the name minimax regret. For the PSI problem the decision to lease a medium size computer system with a corresponding regret of $50,000, is the recommended minimax regret decision. PSI maximum regret for each decision alternative

Decision Alternatives Large System Medium System Small System d1 d2 d3

Maximum Regret or Opportunity Loss 80000 50000 100000

Example 2:

Allison Tate runs a small company that manufacturers low-cost ergonomic chairs, sold via the Internet. Her firm has several popular models, each with annual sales of $200,000 to $450,000. She has an opportunity to invest in a new technology of manufacturing chairs. Tate knows that a new facility will cost $300,000 and is unsure whether there will be sufficient demand for the chair to cover this large investment. If the market is good, she thinks sell 8,000 chairs at a profit of $100 each, generating a cash flow with present value of $800,000. On the other hand, if the market is poor, she thinks she might sell only 1,000 chairs, generating a cash flow with present value of $100,000.How should she make decision?

Solution of Example 2 using Decision Tree

320,000 Mkt. Favor 320,000 0.4 Mkt. Un Favor 800,000

0.6 120,000

200,000

You might also like

- Return and Risk of A Single AssetDocument11 pagesReturn and Risk of A Single AssetSuharsh HarshaNo ratings yet

- Chapter 2 Time Value of MoneyDocument47 pagesChapter 2 Time Value of Moneymarketing bbs 2nd year pdfNo ratings yet

- Principles of FinanceDocument1 pagePrinciples of FinanceSaiful Islam100% (1)

- Drury 2017 Ma12 Decision-Making Under Conditions of Risk and UncertaintyDocument23 pagesDrury 2017 Ma12 Decision-Making Under Conditions of Risk and UncertaintyKoolest Moni100% (1)

- Important Definations - Risk ManagmentDocument11 pagesImportant Definations - Risk ManagmentomerNo ratings yet

- Contemporary Management - NotesDocument6 pagesContemporary Management - NotesMahmoud NassefNo ratings yet

- Impact of Dividend PolicyDocument12 pagesImpact of Dividend PolicyGarimaNo ratings yet

- Management ConceptDocument12 pagesManagement ConceptMurugesa PandianNo ratings yet

- Nature and Significance of Management (Hot Q&A)Document158 pagesNature and Significance of Management (Hot Q&A)Zulfikar ShishirNo ratings yet

- Session 6 Meaning and Nature of RiskDocument20 pagesSession 6 Meaning and Nature of RiskPranit ShahNo ratings yet

- Corporate, Business and Functional Level StrategyDocument12 pagesCorporate, Business and Functional Level StrategyASK ME ANYTHING SMARTPHONENo ratings yet

- Financial ManagementDocument26 pagesFinancial ManagementbassramiNo ratings yet

- Organization Behaviour NotesDocument35 pagesOrganization Behaviour Notesjansami22100% (1)

- OBJECTIVE 1: "What Is A Price?" and Discuss The Importance of Pricing in Today's Fast Changing EnvironmentDocument4 pagesOBJECTIVE 1: "What Is A Price?" and Discuss The Importance of Pricing in Today's Fast Changing EnvironmentRaphaela ArciagaNo ratings yet

- Yield To Maturity Yield To CallDocument14 pagesYield To Maturity Yield To CallAdamNo ratings yet

- Goleb Transport: Value (EMV)Document3 pagesGoleb Transport: Value (EMV)cutie4everrNo ratings yet

- Case On Industrial ConflictDocument4 pagesCase On Industrial ConflictshwetabatraNo ratings yet

- Challenges and Opportunities of Organisational BehaviourDocument11 pagesChallenges and Opportunities of Organisational Behaviourarjun SinghNo ratings yet

- Capital MarketDocument16 pagesCapital MarketAnand SinghNo ratings yet

- Intr MGT 112 HandoutDocument113 pagesIntr MGT 112 HandoutAraarsaa GazmuuNo ratings yet

- Types of Portfolio ManagementDocument3 pagesTypes of Portfolio ManagementaartiNo ratings yet

- Pyramid Diagram of Organizational Levels and Information RequirementsDocument5 pagesPyramid Diagram of Organizational Levels and Information RequirementsMohan William Sharma100% (1)

- Types of Financial Decisions in Financial ManagementDocument20 pagesTypes of Financial Decisions in Financial ManagementRahul Upadhayaya100% (1)

- Insurance & Risk ManagementDocument43 pagesInsurance & Risk Managementsibananda patra100% (1)

- Global Outsourcing NotesDocument8 pagesGlobal Outsourcing NotesAnubhav Kapoor100% (1)

- Module 2 Time Value of MoneyDocument42 pagesModule 2 Time Value of MoneyNani MadhavNo ratings yet

- Risk Uncertainty and Decision MakingDocument14 pagesRisk Uncertainty and Decision Makingkevior2No ratings yet

- Chapter 6 Long - Term FinancingDocument8 pagesChapter 6 Long - Term Financinganteneh hailieNo ratings yet

- Text Book: Organizational Behaviour by Stephen RobbinsDocument20 pagesText Book: Organizational Behaviour by Stephen Robbinscooldude690No ratings yet

- Qutitative Assignmente 3 AnsewreDocument8 pagesQutitative Assignmente 3 Ansewreabebe amare100% (2)

- Assignment On Strategic Evaluation & ControlDocument13 pagesAssignment On Strategic Evaluation & ControlShubhamNo ratings yet

- Defination of Total Quality ManagementDocument4 pagesDefination of Total Quality ManagementAinnur ArifahNo ratings yet

- OB NotesDocument93 pagesOB NotesSwastik Jamadar100% (1)

- Financial Risk Management Course OutlineDocument3 pagesFinancial Risk Management Course OutlineFarooqChaudharyNo ratings yet

- Jiang Et Al - 2009 - Total Reward Strategy - A Human Resources Management Strategy Going With The Trend of The TimesDocument7 pagesJiang Et Al - 2009 - Total Reward Strategy - A Human Resources Management Strategy Going With The Trend of The TimesJoaquínMartínezMiño100% (1)

- Bond & Stock ValuationDocument37 pagesBond & Stock ValuationSara KarenNo ratings yet

- Need or Importance of Business EthicsDocument4 pagesNeed or Importance of Business Ethicskhandelwalsukriti50% (2)

- Ch-5 Policies in Functional AreasDocument4 pagesCh-5 Policies in Functional AreasTanya MadraNo ratings yet

- Quantitative Business Analysis Practice Exercises Chapter 3 - SolutionsDocument7 pagesQuantitative Business Analysis Practice Exercises Chapter 3 - SolutionstableroofNo ratings yet

- Decision AnalysisDocument45 pagesDecision AnalysisHussien AliyiNo ratings yet

- Chapter 3 PlanningDocument29 pagesChapter 3 PlanningDagm alemayehuNo ratings yet

- Capital Structure TheoriesDocument47 pagesCapital Structure Theoriesamol_more37No ratings yet

- Chapter One Entrepreneurship and Free EnterpriseDocument10 pagesChapter One Entrepreneurship and Free EnterpriseBethelhem Yetwale100% (1)

- Decision Analysis ExerciseDocument5 pagesDecision Analysis Exercisescm390% (1)

- CSR Case Study AssignmentDocument3 pagesCSR Case Study AssignmentMoazzam AleeNo ratings yet

- Chapter01 Managers, Profits, and MarketsDocument47 pagesChapter01 Managers, Profits, and MarketsMohammad Raihanul HasanNo ratings yet

- ACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyDocument3 pagesACCN09B Strategic Cost Management 1: For Use As Instructional Materials OnlyAdrienne Nicole MercadoNo ratings yet

- Breakeven AnalysisDocument30 pagesBreakeven Analysisrameshpersonal2000No ratings yet

- Pecking Order TheoryDocument4 pagesPecking Order TheoryThunder CatNo ratings yet

- Louis Simms Case Study: Section B - Group 7Document2 pagesLouis Simms Case Study: Section B - Group 7Manguirish NadkarniNo ratings yet

- 10 Qualities of A Successful EntrepreneurDocument3 pages10 Qualities of A Successful EntrepreneurTewodros Kassa Ye EtalemahuNo ratings yet

- Bonuses CanBackFireDocument16 pagesBonuses CanBackFireGarimaAsthaNo ratings yet

- Module 6 Gathering Performance InformationDocument14 pagesModule 6 Gathering Performance Informationmitashi jainNo ratings yet

- Case Application 2Document8 pagesCase Application 2ehsanul150% (2)

- Features and Objectives of Human Resources ManagementDocument3 pagesFeatures and Objectives of Human Resources ManagementRashmi Ranjan PanigrahiNo ratings yet

- Formation of Different Forms of Business OrganizationDocument29 pagesFormation of Different Forms of Business OrganizationMiggy BambaNo ratings yet

- Classroom Notes Business EthicsDocument22 pagesClassroom Notes Business Ethicsewan koNo ratings yet

- Organizational Culture and Environment: The ConstraintsDocument35 pagesOrganizational Culture and Environment: The ConstraintsSuno AliNo ratings yet

- 3a) - Decision Analysis PDFDocument67 pages3a) - Decision Analysis PDFyukideenaNo ratings yet

- W 9 & 11 (Introduction To Decision Analysis)Document55 pagesW 9 & 11 (Introduction To Decision Analysis)asadNo ratings yet

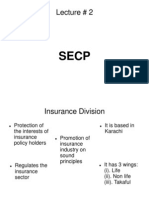

- manualCG SECPDocument88 pagesmanualCG SECPmustafaNo ratings yet

- Career Development of Women Executives in BanksDocument3 pagesCareer Development of Women Executives in BankssorryhasanNo ratings yet

- SECPDocument16 pagesSECPsorryhasanNo ratings yet

- Project Base On Study of Telecomm SectorDocument10 pagesProject Base On Study of Telecomm SectorcryoffalconNo ratings yet

- Ufone FinalDocument53 pagesUfone FinalsorryhasanNo ratings yet

- Integrative NegoDocument8 pagesIntegrative NegosorryhasanNo ratings yet

- Various Compensation Issues in Aviation IndustryDocument7 pagesVarious Compensation Issues in Aviation IndustrysorryhasanNo ratings yet

- Family in Transition 21ST CenturyDocument11 pagesFamily in Transition 21ST CenturysorryhasanNo ratings yet

- The Role of Significance Tests1: D. R. CoxDocument22 pagesThe Role of Significance Tests1: D. R. CoxMusiur Raza AbidiNo ratings yet

- Soal AnalitikDocument3 pagesSoal AnalitikNurlaeli NaelulmunaMajdiyah0% (1)

- Engineering Council Exam Mathematics C101 Solutions To Exam Paper 2004Document2 pagesEngineering Council Exam Mathematics C101 Solutions To Exam Paper 2004cataiceNo ratings yet

- Skoog - Solucionário Capítulo 10 PDFDocument20 pagesSkoog - Solucionário Capítulo 10 PDFThais Dos SantosNo ratings yet

- Effort Estimation Template - PERTDocument7 pagesEffort Estimation Template - PERTrkc1980No ratings yet

- Viscoelasticity 05 LaplaceDocument7 pagesViscoelasticity 05 LaplacealirezakhadirNo ratings yet

- Lectures 04Document117 pagesLectures 04salman8102No ratings yet

- Penggunaan Assosiation Rule Mining Dalam Penetapan Harga Promosi, Stok, Dan Penataan Produk Pada EtalaseDocument11 pagesPenggunaan Assosiation Rule Mining Dalam Penetapan Harga Promosi, Stok, Dan Penataan Produk Pada EtalaseifaNo ratings yet

- SSRN Id3373116 PDFDocument39 pagesSSRN Id3373116 PDFRavi RanjanNo ratings yet

- 03 - Inverse Circulae Function - A DAS GUPTADocument6 pages03 - Inverse Circulae Function - A DAS GUPTAJoseNo ratings yet

- Tarea 2 - Solución de Modelos de Programación Lineal de DecisiónDocument9 pagesTarea 2 - Solución de Modelos de Programación Lineal de DecisiónMaria OrozcoNo ratings yet

- Welcome To This Presentation On Tata Steel's Journey Towards Business ExcellenceDocument30 pagesWelcome To This Presentation On Tata Steel's Journey Towards Business ExcellenceAnand DubeyNo ratings yet

- Session 1Document8 pagesSession 1JonathanNo ratings yet

- Group 7 - Hypothesis Testing - 1Document25 pagesGroup 7 - Hypothesis Testing - 1John Christopher GozunNo ratings yet

- PFP RubricsDocument2 pagesPFP RubricsKim SejeongNo ratings yet

- 6420 PHENOLS 6420 A. Introduction: 1. Sources and SignificanceDocument6 pages6420 PHENOLS 6420 A. Introduction: 1. Sources and SignificanceNguyen Hien Duc HienNo ratings yet

- Imp Methods 2Document11 pagesImp Methods 2anilpharma1022No ratings yet

- OR ReportDocument49 pagesOR ReportAnkit SharmaNo ratings yet

- Mixed Research MethodologyDocument7 pagesMixed Research MethodologyDr. Nisanth.P.MNo ratings yet

- Forgot Your Username? Create An Account: LoginDocument13 pagesForgot Your Username? Create An Account: LoginAnonymous gUjimJKNo ratings yet

- WEEK 6 Numerical Differentiation and Integration For Chem EngDocument111 pagesWEEK 6 Numerical Differentiation and Integration For Chem EngEmy LinZi CimanjuntackNo ratings yet

- Bartle Sherbert Real Analysis Solution Manual PDFDocument2 pagesBartle Sherbert Real Analysis Solution Manual PDFchuptong38% (40)

- (DPP-4) - (JEE 2.0) - Basic Mathematics - Inverse Trigonometric Functions - 18th MayDocument47 pages(DPP-4) - (JEE 2.0) - Basic Mathematics - Inverse Trigonometric Functions - 18th MayAmit TimalsinaNo ratings yet

- Advance Engineering MathematicsDocument62 pagesAdvance Engineering MathematicsAngelo Lirio InsigneNo ratings yet

- (N.P. Bali, Manish Goyal) A Textbook of Engineerin PDFDocument590 pages(N.P. Bali, Manish Goyal) A Textbook of Engineerin PDFPoorna Chandar67% (9)

- The Importance of Educational Technology of Oral Speech in Secondary School StudentsDocument4 pagesThe Importance of Educational Technology of Oral Speech in Secondary School StudentsOpen Access JournalNo ratings yet

- Matrix Equation in Multivariable ControlDocument22 pagesMatrix Equation in Multivariable ControlReta JibatNo ratings yet

- Data Analytics Certificate: Who Should Enroll Inside The ProgramDocument2 pagesData Analytics Certificate: Who Should Enroll Inside The ProgramkhalilNo ratings yet

- Identitas RamanujamDocument18 pagesIdentitas RamanujamJuwandaNo ratings yet

- Unit 2 Lecture 4 Transportation & Assignment ModelsDocument33 pagesUnit 2 Lecture 4 Transportation & Assignment ModelslevyNo ratings yet