Professional Documents

Culture Documents

Spending and Saving Workbook

Spending and Saving Workbook

Uploaded by

Arumugam ManickamCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Spending and Saving Workbook

Spending and Saving Workbook

Uploaded by

Arumugam ManickamCopyright:

Available Formats

IGCSE ECONOMICS

WORK, EARNINGS, SPENDING AND SAVINGS

WORKBOOK

Name

IGCSE ECONOMICS

Introduction In this workbook we will be examining the different factors that affect how people earn money through work and what they do with it once they have it. Specifically we will be looking at: The factors which affect a persons choice of job Why some jobs pay their workers more than others Why some people spend more money than others Why some people buy different goods and services than others Why some people save money and others dont

1)

What factors affect a persons choice of occupation?

Think about the jobs you would like to do when you leave education. Write them down in the table below: Features of the job i.e. qualifications/training required, make important decisions etc Rewards for doing the job i.e. job satisfaction, good salary

Job Id like to do

Are there any common features of the jobs you have described? Do they all pay high salaries? Write the common features below.

Now fill in the table on the next page with jobs you COULD DO but dont think you would like to do (being sensible obviously not many people could be a trapeze artist!)

IGCSE ECONOMICS

Jobs I WOULD NOT like to do

Features of the job i.e. qualifications/training required, make important decisions etc

Reason for not wanting to do that job

Are there any common features of the jobs you have described? Are they all repetitive? Or dangerous? Write the common features below.

Just as you have reasons why there are some jobs you would like to do and others that you wouldnt, so everyone else has reasons for choosing a certain job or occupation too. Here are the most common (you might have identified some of them already). Reason Level of wages/salary Other benefits/perks Promotion prospects Job satisfaction Social status Historical reasons Explanation and/or examples

IGCSE ECONOMICS

2)

Why do some occupations gain bigger financial rewards than others?

As we saw earlier, people would like to be employed in certain occupations more than others. This was for several reasons one of which was because they paid better wages or salaries. But why is this? Why should one person working hard all day get paid more (or less) than someone working equally as hard? Make notes from your textbook to explain each of the following reasons: Reason for difference in earnings Different abilities and qualifications Dirty jobs and unsociable hours Explanation

Job satisfaction

Lack of information about jobs and wages

Immobility

Fringe benefits

Even people doing the same jobs can earn different amount of money! This could be because of the amount of experience they have in that job, because there is a shortage of workers in their area to do a particular job or, the cost of living might be higher where they live i.e. it costs more to live in central London than it does to live in the highlands of Scotland therefore you get paid more.

Draw a supply and demand diagram in the box to represent a drop in supply of workers. Show that this pushes up the price of employing workers (or the wages they earn). Make sure you label it correctly.

IGCSE ECONOMICS

3)

What do people spend their incomes on?

When trying to decide if one person spends more of less money than someone else, it is difficult to get a clear picture from simply looking at the actual AMOUNT that they spend. Obviously, someone with a well-paid job will spend more than someone who is unemployed. What it would be more useful to do would be to analyse their PATTERN of spending money OVER TIME to see if it changes. In the table below, give 4 items on which teenagers might spend their money and 4 items or occasions for which they might save. In the same table, give 4 items on which adults might spend their money and 4 items or occasions for which they might save. Teenagers Spending Saving Spending Adults Saving

You probably found that teenagers spent their money in smaller amounts, on such as going to the cinema, buying a new computer game, or eating at McDonalds. However, you are likely to have found that adults probably spent larger amounts of money and on different things, such as paying the gas bill, doing the weekly shopping etc. You might also have found that teenagers saved money to buy things for themselves (a new bike, game console etc) whereas adults would save for bigger things and not necessarily just for themselves (buying a house or car, going on holiday, paying school fees in the future). As we grow older, our pattern of spending and saving changes. We should be saving more as we get older as we might have to provide for a family and we will probably need some money to live off when we retire (a pension). But we also need to spend more because there may be more people to provide for in our family. We have to make a choice as to what proportion of our income is spent and what proportion is saved.

IGCSE ECONOMICS

4)

What other factors determine how we spend or save our money?

It is not just our age that determines what proportion of our money we spend or save. There are other factors too. These could relate to the type of work you do and what sector you work in. Complete the blanks in the table below. Factor Why does this affect our spending/saving patterns? Examples

Gender

We tend not to take luxury holidays or buy new cars when we are unemployed. We might use up some of our savings

Employed/unemployed

Skilled/unskilled job

Workers in the public sector get paid less than those in the private sector. This may mean that they do not save a big proportion of their income (see next section). Also, they are less likely to buy luxuries on a regular basis.

Private/public sector job

Primary/secondary/tertiary sector job Your findings from the above table bring us nicely onto the last topic in the workbook. 5) Why do different income groups have different patterns of spending, saving and borrowing?

Basically, it all depends upon what demands you have upon your income. We can split income up into different categories: GROSS PAY NET PAY or DISPOSABLE INCOME the money you earn from work before any deductions have been taken out. the money you receive after tax, national insurance and other items have been deducted from your gross pay. This happens AT SOURCE (i.e. before you get your pay), so you dont have a choice whether to pay them or not. In the UK at the moment, your at source deductions will typically be 35% of your gross pay.

DISCRETINARY the amount of money you have left over after you have paid for your immediate INCOME needs such as food, housing etc. In theory can spend this on whatever you want it is at your discretion.

IGCSE ECONOMICS

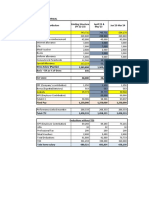

So, you can see that, by the time you have paid your taxes to the government, your rent and for food and the basic needs of everyday life there may not be much of your wages left for you to spend as you would like! Calculate the discretionary income of the three people below. Mr. Toff earns 16,000 a month as an investment banker in the City. He pays on average 45% tax on that income. He has a mortgage to pay each month of 1000 and spends approximately 500 a month on food. His net pay per month is? His discretionary income per month is?

Mr. Middleman earns 2000 a month as a computer consultant. He pays on average 35% tax on that income. He has a mortgage to pay each month of 450 and spends approximately 250 a month on food. His net pay per month is? His discretionary income per month is?

Mr. Small earns 900 a month as a fork lift truck driver. He pays on average 30% tax on that income. He has rent to pay each month of 225 and spends approximately 160 a month on food. His net pay per month is? His discretionary income per month is?

It is difficult to tell anything meaningful from these figures so lets put them into percentages so that we can compare them. Calculate the percentage of the monthly income for each person that they receive as discretionary income. The first one is part done for you. Name Mr. Toff Mr. Middleman Mr. Small So, from these figures you can see that even though those people on higher incomes pay more tax and spend more money on housing and food, they still end up with a higher proportion of their incomes as discretionary income. This means that they can spend a bigger percentage of their salary on luxury goods. It also means that they can save a bigger percentage of their salary. Gross monthly income 16,000 Discretionary income 7,300 Calculation (7,300/16,000 ) x 100 Answer?

IGCSE ECONOMICS

PAST PAPER QUESTION JUNE 1989

a) b) c) d) e) f)

Does this information cover the majority of households?

[1] [1]

What is the connection between expenditure on Transport and vehicles and income? Can it be concluded from these figures that the poorer household must eat more than the richer household? Explain your answer. (ii) Would you regard this item as a necessity or a luxury? Explain your answer. [4] [3] [4] If the low income group received a 10% increase in their income, how do you think their pattern of expenditure would change? Explain your answer. [6] (i) Identify one item on which the proportion spent increases as income increases. [1] How might expenditure on other goods and services differ for the two income groups?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ZAV - How Do I Apply For A JobDocument53 pagesZAV - How Do I Apply For A JobValère Richu Fokou TchemebeNo ratings yet

- FINAL FM-PS-313-01 Employee Clearance Form 2.1Document2 pagesFINAL FM-PS-313-01 Employee Clearance Form 2.1Karyl GargantillaNo ratings yet

- Anurag Revised Salary Breakup FY23-24Document2 pagesAnurag Revised Salary Breakup FY23-24SathyanarayanaAmbatiNo ratings yet

- Digested Case in Social LegislationDocument7 pagesDigested Case in Social LegislationJoan PabloNo ratings yet

- Importance of Soft Skills Training in Ethiopia1 PDFDocument5 pagesImportance of Soft Skills Training in Ethiopia1 PDFIjcemJournalNo ratings yet

- Economics Project 2021-2022: Name: Jhalak Gupta Class: Xi S ID: 3090 Submitted To: Ms. Manasvi Singh TanwarDocument32 pagesEconomics Project 2021-2022: Name: Jhalak Gupta Class: Xi S ID: 3090 Submitted To: Ms. Manasvi Singh TanwarJhalak GuptaNo ratings yet

- Consti CasesDocument48 pagesConsti CasesMark Anthony Javellana SicadNo ratings yet

- Karim DKK (2019)Document9 pagesKarim DKK (2019)Khairuman NawawiNo ratings yet

- Dorman Long Newsletter MAY 15...Document26 pagesDorman Long Newsletter MAY 15...jesusgameboyNo ratings yet

- Price FloorDocument6 pagesPrice FloorUgly DucklingNo ratings yet

- Grievance SystemDocument13 pagesGrievance SystemAbhishek MisraNo ratings yet

- Daniel J. Ursu For Richmond Heights MayorDocument2 pagesDaniel J. Ursu For Richmond Heights MayorThe News-HeraldNo ratings yet

- TejalSujeeth (13 0)Document4 pagesTejalSujeeth (13 0)bhavnaNo ratings yet

- 2019 NTB Specificatons For The Supply of Schwing Pump PartsDocument23 pages2019 NTB Specificatons For The Supply of Schwing Pump PartsSamehNo ratings yet

- 2018-NAPEO Whitepaper - Economic Analysis of PEO IndustryDocument10 pages2018-NAPEO Whitepaper - Economic Analysis of PEO IndustryVk VirataNo ratings yet

- EVELYN CHIA-QUA Vs CLAVE AND TAY TUNG HIGH SCHOOLDocument2 pagesEVELYN CHIA-QUA Vs CLAVE AND TAY TUNG HIGH SCHOOLFer Grace AniñonAcabalcuid Cataylo100% (1)

- Labour Law ProjectDocument15 pagesLabour Law ProjectShubh Dixit100% (1)

- FAMILY MEMBER Notice of Eligibility Rights & Resp Template (WH-381 Exp 6.2023)Document4 pagesFAMILY MEMBER Notice of Eligibility Rights & Resp Template (WH-381 Exp 6.2023)Alex DanielNo ratings yet

- CompensationDocument20 pagesCompensationKashif AnwerNo ratings yet

- Labor Standard ReviewerDocument80 pagesLabor Standard ReviewerJoksmer MajorNo ratings yet

- Eco C12 MacroEconomicsDocument110 pagesEco C12 MacroEconomicskane2123287450% (2)

- The Results of Stewardship: EssonDocument7 pagesThe Results of Stewardship: EssonMitochiNo ratings yet

- Matias Gacia Cortez - Virtual Class N°8 Job - ProfessionsDocument2 pagesMatias Gacia Cortez - Virtual Class N°8 Job - ProfessionsFlorencia GNo ratings yet

- Sample Enrollment ProposalDocument16 pagesSample Enrollment ProposalFidelRomasantaNo ratings yet

- Professional Indemnity Insurance Proposal Form Architects and Consulting Engineers Project CoverDocument5 pagesProfessional Indemnity Insurance Proposal Form Architects and Consulting Engineers Project CoverNasser Issa Abu HalimehNo ratings yet

- A Project On Labour in Unorganised SectorDocument17 pagesA Project On Labour in Unorganised SectorRishabh SinghNo ratings yet

- 206643-2017-De Ocampo Memorial Schools Inc. v. Bigkis20180320-6791-8qpzw7 PDFDocument7 pages206643-2017-De Ocampo Memorial Schools Inc. v. Bigkis20180320-6791-8qpzw7 PDFIsay YasonNo ratings yet

- Nidhish Balaga - Confronting Youth Unemployment in South AfricaDocument8 pagesNidhish Balaga - Confronting Youth Unemployment in South Africanidhish101No ratings yet

- MR Sachin Rewale: No.153/2 M.R.B. Arcade Bagalur Main Road Dwarakanagar IAF Post Yelahanka - Bangalore-53Document1 pageMR Sachin Rewale: No.153/2 M.R.B. Arcade Bagalur Main Road Dwarakanagar IAF Post Yelahanka - Bangalore-53Sachin RNo ratings yet

- Colegio de Montalban: Presentation, Analysis and Interpretation of DataDocument15 pagesColegio de Montalban: Presentation, Analysis and Interpretation of DataViñas, Diana L.No ratings yet