Professional Documents

Culture Documents

Tax Reduction Plan

Uploaded by

Kachua SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Reduction Plan

Uploaded by

Kachua SinghCopyright:

Available Formats

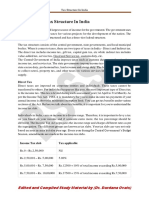

Section 80C

As per income tax act, under Section 80C up to a maximum of Rs. 1,00,000 is deductible from your annual income. This means that your annual income gets reduced by Rs. 1,00,000 and you end up paying no tax on it at all. This benefit is available to everyone, irrespective of their income levels. You can invest in any of the investment options but the tax benefit is limited to Rs 1,00,000. List of eligible investments are as follows

Employee Provident Fund (EPF) Voluntary Provident Fund (VPF) Public Provident Fund (PPF) Principal repayment of housing loan installments Equity linked saving scheme (ELSS) National savings certificates (NSC) Post office term deposits Life insurance premiums paid Tax Saving Fixed Deposit Senior Citizens Savings Scheme

But the limit for section 80C deductions is Rs. 1 Lakh so the maximum income tax that you can save is Rs. 30,000 if you fall in the highest tax bracket of 30%. In addition to the limit of Rs 1 Lakh for the fiscal year 2010 11, an investment of Rs 20,000 in infrastructure bonds will qualify for income tax deductions. If you have invested Rs 1 Lakh in the list of eligible investments and Rs 20,000 in infrastructure bonds, you can save tax on Rs 1, 20,000.

Reduce Income Tax Buy a house/flat with a home loan

Buying a house/flat by taking a home loan can help you reduce tax. You can save upto Rs 1.5 Lakh on the interest component of home loan and Rs 1 lakh on the principal component of home loan. The principal portion falls under Section 80C of income tax act.

Reduce Income Tax Medical Insurance premium

If you have do not have a medical insurance, opt for it immediately. A medical insurance is a must for all in terms of insuring you and your family for any medical emergencies and also in saving tax. Any Premium which is paid for medical insurance that has been taken on the health of the assessee, his spouse, dependent children, is allowed as a deduction, subject to a ceiling of Rs 15,000 per annum. A further deduction of Rs. 15,000 is also allowed for buying an insurance policy in respect of dependent parents.

Reduce Income Tax House Rent

Ensure to deposit the house rent receipts with your employer. You can save tax on house rent, if you are staying in a rented property. If you have a home loan and you staying in a rented property, you can benefit from both fonts saving tax on house rent as well as saving tax on home loan interest and principal payment.

Reduce Income Tax Tuition Fees for your kids

According to the Income Tax Act, deduction under this section is available for tuition fees/ school fees paid on two childrens education. Deduction is available for any two children only.

Reduce Income Tax Loss in stock market

Have you incurred any loss on your stock investments? If yes, book your loss by selling the stock and show the loss in your income tax filing. This will help you in reducing income tax.

Reduce Income Tax Save tax on your vacation (LTA)

You are eligible for a deduction under Leave Travel Allowance (LTA), if you have applied for leave from your company and have actually traveled. The total travel expenses incurred are covered. Under LTA, you and your family are covered. Family includes your, parents, dependent siblings, spouse and children. You can avail LTA once in two years. Check the LTA component of your salary and if you have plans to travel, make sure you submit your travel cost receipts.

Reduce Income Tax Food Coupons

You can save a maximum tax on Rs 3000 per month by opting for food coupons. Food Coupons are very common these days and majority of the retail food stores/ restaurants accept Food Coupons. You can even reduce the food coupons limit based on your tax bracket and your monthly expenditure on food.

Reduce Income Tax Conclusion

One rupee saved is a rupee earned. Saving tax on your income is highly recommended to all salaried employees. It is your money, so try to save as much income tax as you can by investing and declaring the accepted expenses (example LTA).

Section 10(13A) : House Rent Allowance

Every salaried employee is eligible for Rent tax deduction under the Income Tax Act. What is House Rent Allowance? House rent allowance (HRA) is an allowance provided by the employer to the employee to meet the expenses incurred of renting a house. Every employer as a part of the salary component, have house rent allowance. Every employee can avail rent tax deduction for the rent paid on their accommodation House Rent Allowance Calculation Deductions on House Rent Allowance (HRA) are eligible under Section 10(13A) of the Income Tax Act. House Rent Allowance Calculation can be calculated by any individual himself if the individual fulfills the following three conditions An HRA allowance is received as part of the salary package. If one is staying in a rented accommodation and paying rent for it. The rent exceeds 10% of the salary. Lets calculate house rent allowance

Select the minimum of the following three options 1. Actual house rent allowance received from your employer 2. Actual house rent paid by you minus 10% of your basic salary 3. 50% of your basic salary if you live in a metro or 40% of your basic salary if you live in a non-metro Taxable HRA = House Rent Allowance Minimum of the following 3 options. Taxable HRA is the amount on which you have to pay tax.

Claim income tax deduction for rent paid to your parents

For most of us House Rent Allowance is an important component of our salary and the government, realizing the importance of accommodation as a basic need, has been granting various tax exemptions for the amount spent on it. What is HRA? The House Rent Allowance (HRA) is the amount paid by the employer to the employee to compensate for the house rent paid by the employee for his accommodation. You are eligible for HRA even if you have given your own house on rent and staying in a rented house yourself in the same city or if you have a house in one city and you are working in another city. The Income Tax department grants you some exemption on the HRA received by you or rent paid by you for your accommodation. Your Parents Can be Your Landlords You are entitled for a deduction of rent paid from your income tax even if you are paying rent to your parents treating them as your landlord. For this purpose, the house should be in the name of your parents and your parents should issue a receipt for the rent received by them. But the rental

income received by your parents are taxable and they have to declare this income in their annual tax return. How To Claim Deductions On HRA Exemptions on HRA comes under Section 10(13-A) of IT Act and there are certain conditions under which the deduction is granted. First of all, you should have received House Rent Allowance as a component of your salary. Secondly, you should be staying in a rented accommodation. The third condition is that the rent paid should exceed 10 per cent of your salary. Other Conditions In order to get the benefit of deduction of HRA, one has to submit the receipts of rent paid to the Income Tax department. The maximum deduction allowed is 40 per cent of your salary for all cities in India except for metros like Mumbai, Delhi, Kolkata and Chennai where the deduction allowed is 50 per cent. As you know, the income tax benefits on home loan is different from the deductions allowed on HRA as both are totally different. But in both the cases, you have to fulfill certain conditions as laid down in the IT Act. For claiming deductions under HRA, you should be staying in rented accommodation. If you are staying in your own house without paying any rent or in a rent-free accommodation provided by your company, you are not eligible for any deduction. One more condition is that if the HRA drawn by you is up to Rs.3000 per month, you are not required to produce any rent receipt. As mentioned earlier, if you are paying rent to your parents for which you are getting rent receipts, you are eligible for a deduction from Income Tax. However, the same is not possible if you are paying rent to your spouse even if your spouse is issuing rent receipts. The reason behind this rule is that there cannot be a commercial relationship between spouses as they are believed to be staying together.

Section 24: Interest paid on housing loan

You can save a good amount of money in tax, if you have taken a home loan. A home loan monthly installment like any other loan installment has two components Principal and Interest.

Tax Savings on home loans Interest repayment According to Sec 24 of the Income Tax Act, 1961 a deduction up to Rs. 150,000 can be claimed. This deduction is claimed towards the total interest you pay on the home loan towards purchase or construction of house. Tax Savings on home loan Principal repayment of home loan installments The principal repayment up to Rs. 100,000 on your home loan will be allowed as a deduction under section 80C of income tax act. On home loan, you can save upto Rs 2,50,000 per annum ( Rs 1,50,000 Interest repayment and Rs 1,00,000 Principal repayment). That means you can do a tax savings on home loan for more than Rs 20,000 per month.

Tax Savings ||| Section 80D: Health Insurance Premium

Any Premium which is paid for medical insurance that has been taken on the health of the assessee, his spouse, dependent children, is allowed as a deduction, subject to a ceiling of Rs 15,000 per annum. A further deduction of Rs. 15,000 is also allowed for buying an insurance policy in respect of dependent parents. For Senior Citizens, a deduction of Rs 20,000 is allowed under section 80D. Who are eligible under Section 80D (a) In case of an individual Insurance on the health (health insurance) of the assessee, or wife or husband, or [dependent] parents or dependent children. (b) In case of an H.U.F.- Insurance on the health of any member of the family.

You might also like

- Eight Tax Saving Secrets You Should KnowDocument4 pagesEight Tax Saving Secrets You Should KnowSharma AiplNo ratings yet

- Budget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaDocument79 pagesBudget 2016 - 6 Ways To Pay Less Tax, Legally - Times of IndiaLukkana VaraprasadNo ratings yet

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaNo ratings yet

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLDocument7 pagesTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiNo ratings yet

- 8 SMART Ways To Lower Your Tax LiabilityDocument6 pages8 SMART Ways To Lower Your Tax LiabilityansplanetNo ratings yet

- 10 Lesser Known Income Tax DeductionsDocument3 pages10 Lesser Known Income Tax DeductionsPrakash GuruswamiNo ratings yet

- Tax PlaningDocument9 pagesTax PlaningGaurav Singh JadaunNo ratings yet

- Income Tax ProjectDocument6 pagesIncome Tax Projectdipmoip2210No ratings yet

- Income From Salary: Explain Fully On What Basis Income Is Taxed Under The Head SalaryDocument4 pagesIncome From Salary: Explain Fully On What Basis Income Is Taxed Under The Head SalaryDeepika BhopaleNo ratings yet

- Deduction ListDocument5 pagesDeduction ListsupportNo ratings yet

- Tax GuideDocument27 pagesTax GuideanjaliNo ratings yet

- Heads of Income TaxDocument6 pagesHeads of Income Taxkanchan100% (1)

- Unit 3Document7 pagesUnit 3piyush.birru25No ratings yet

- Income Tax KnowledgeDocument5 pagesIncome Tax KnowledgeAbhishekNo ratings yet

- Income Tax RulesDocument4 pagesIncome Tax RulesvenkatanagachandraNo ratings yet

- How To Use Infra BondsDocument3 pagesHow To Use Infra Bondsvshrika21No ratings yet

- VFN Tax and Tax Saving Session 2015Document27 pagesVFN Tax and Tax Saving Session 2015Sumit BawejaNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Basics of Personal FinanceDocument15 pagesBasics of Personal FinanceAnjali TejaniNo ratings yet

- Indian Income Tax DeductionsDocument4 pagesIndian Income Tax DeductionsDivyanshu ShekharNo ratings yet

- Assignment of Economic and Business Legislature: Submitted To-Submitted byDocument7 pagesAssignment of Economic and Business Legislature: Submitted To-Submitted byMohit SahniNo ratings yet

- How To Save Tax For FY 2017-18Document14 pagesHow To Save Tax For FY 2017-18Srinivas Pavan KumarNo ratings yet

- House Rent AllowanceDocument2 pagesHouse Rent AllowanceyagayNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Instruments of Tax SavingDocument10 pagesInstruments of Tax Savinganilpipaliya117No ratings yet

- Making The Best of Tax Saving OptionsDocument12 pagesMaking The Best of Tax Saving Optionssumit_shindeNo ratings yet

- Taxation Law Question Bank BALLBDocument49 pagesTaxation Law Question Bank BALLBaazamrazamaqsoodiNo ratings yet

- How To Save Income Tax in IndiaDocument6 pagesHow To Save Income Tax in IndiaSameerNo ratings yet

- Impact On Direct Tax Code On Various Products: Tax Rules in IndiaDocument6 pagesImpact On Direct Tax Code On Various Products: Tax Rules in IndiamerijannatNo ratings yet

- DGM Annexure B Know Your Pay ComponentsDocument3 pagesDGM Annexure B Know Your Pay ComponentsaakritishellNo ratings yet

- Tax Planning: Ideal Home LoanDocument5 pagesTax Planning: Ideal Home Loanrns116No ratings yet

- The Payments That You Make To Your PF Are Counted Towards Sec 80CDocument4 pagesThe Payments That You Make To Your PF Are Counted Towards Sec 80CManu VermaNo ratings yet

- When You Are in The Highest Tax BracketDocument3 pagesWhen You Are in The Highest Tax Bracketjaycee68No ratings yet

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- SalariesDocument6 pagesSalariesrichaNo ratings yet

- Tax Touch Up: Which Is That Amt DepositedDocument5 pagesTax Touch Up: Which Is That Amt DepositedVelayudham ThiyagarajanNo ratings yet

- First Home Super Saver SchemeDocument5 pagesFirst Home Super Saver Schemeishtee894No ratings yet

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNo ratings yet

- Know Your Taxation Sec 1Document20 pagesKnow Your Taxation Sec 1Nagarajan PeriyasamyNo ratings yet

- Project Report On Corporate Tax Plannin1Document16 pagesProject Report On Corporate Tax Plannin1Rutu Patel0% (1)

- Session 3Document14 pagesSession 3Arun JaiswalNo ratings yet

- Tax Planning DefinitionDocument7 pagesTax Planning DefinitionAlex MasonNo ratings yet

- Interest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very SoonDocument3 pagesInterest On PPF Is Proposed To Increase To 8.60% and Investment Limit Is Also Expected To Increase To Rs. 1,00,000/-Very Soonanshushah_144850168No ratings yet

- Sraheja Tax Saving TipsDocument4 pagesSraheja Tax Saving TipsSRaheja id8No ratings yet

- House Rent Allowance and Indian Income Tax ActDocument2 pagesHouse Rent Allowance and Indian Income Tax ActMUTHUSAMY RNo ratings yet

- HRA - House Rent Allowance - Exemption Rules & Tax DeductionsDocument4 pagesHRA - House Rent Allowance - Exemption Rules & Tax DeductionsKrishna SwainNo ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- Untangling NPS Taxation: Your ContributionsDocument5 pagesUntangling NPS Taxation: Your ContributionsNItishNo ratings yet

- Taxation-Direct-and-Indirect - AssignmentDocument8 pagesTaxation-Direct-and-Indirect - AssignmentAkshatNo ratings yet

- Assignment Accounting and Finance For Engineers: Prof. AVVS SubbalakshmiDocument8 pagesAssignment Accounting and Finance For Engineers: Prof. AVVS SubbalakshmiNarasimha naidu ThotaNo ratings yet

- 5 Tax InstrumentsDocument3 pages5 Tax InstrumentsktsnlNo ratings yet

- Santosh and Dipak PFP PresentationDocument8 pagesSantosh and Dipak PFP PresentationKaira EventsNo ratings yet

- Investment Alternatives For Tax Savings For Salaried EmployeesDocument10 pagesInvestment Alternatives For Tax Savings For Salaried Employeessanjaymenon94No ratings yet

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Document5 pagesTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNo ratings yet

- Print Tax On Savings Interest - How Much Tax You Pay - GOV - UKDocument5 pagesPrint Tax On Savings Interest - How Much Tax You Pay - GOV - UKscribd.peworNo ratings yet

- Shreha Shah (Ba LLB Vii)Document7 pagesShreha Shah (Ba LLB Vii)Shreha VlogsNo ratings yet

- Tugas - Group - 7 - Transfer - Pricing MeriskaDocument4 pagesTugas - Group - 7 - Transfer - Pricing MeriskaMeriskaNo ratings yet

- Case: Ii: Lecturer: Mr. Shakeel BaigDocument2 pagesCase: Ii: Lecturer: Mr. Shakeel BaigKathleen De JesusNo ratings yet

- Absorption and Variable Costing - Illustrative Example - PagaddutDocument4 pagesAbsorption and Variable Costing - Illustrative Example - PagaddutLovely Rose GuinilingNo ratings yet

- Corporate Restructuring at TATADocument25 pagesCorporate Restructuring at TATAVaibhav Gupta100% (1)

- Lbo Modeling Test Example: StreetofwallsDocument18 pagesLbo Modeling Test Example: StreetofwallsLesterNo ratings yet

- ACC210 SyllabusDocument10 pagesACC210 SyllabusGrantham University0% (1)

- Secrets of The Trading Pros - Techniques and Tips That Pros Use - Bouroudjian 2007Document223 pagesSecrets of The Trading Pros - Techniques and Tips That Pros Use - Bouroudjian 2007DeepSixitnow91% (43)

- North Adams Strategic Economic Development PlanDocument81 pagesNorth Adams Strategic Economic Development PlaniBerkshires.comNo ratings yet

- Construction Accounting and Financial ManagementDocument3 pagesConstruction Accounting and Financial ManagementSon Go HanNo ratings yet

- Quickfix Financial ManagementDocument7 pagesQuickfix Financial ManagementMiconNo ratings yet

- Tesla Short ThesisDocument10 pagesTesla Short ThesisBisto MasiloNo ratings yet

- Elasticity of Demand-3Document25 pagesElasticity of Demand-3vismayNo ratings yet

- MorningStar ES0143416115Document4 pagesMorningStar ES0143416115José J. Ruiz SorianoNo ratings yet

- Principle CH 8 Ed.23 Oxley Internal Control, and Cash)Document8 pagesPrinciple CH 8 Ed.23 Oxley Internal Control, and Cash)Heri SiringoringoNo ratings yet

- SCR Banking KMDDocument25 pagesSCR Banking KMDamitguptaujjNo ratings yet

- CBSE Boards Class 10 Maths Previous Years Question Papers 2007 2013Document258 pagesCBSE Boards Class 10 Maths Previous Years Question Papers 2007 2013harman1611No ratings yet

- Comparative Study On Ulips in The Indian Insurance Market For Tata Aig Life by Delnaaz ParvezDocument71 pagesComparative Study On Ulips in The Indian Insurance Market For Tata Aig Life by Delnaaz Parveznarayanamohan0% (2)

- PolicyBazaar.com PPTDocument10 pagesPolicyBazaar.com PPTdevendra singh67% (3)

- Pelizloy Realty Corp. V Province of Benguet FULL TEXTDocument8 pagesPelizloy Realty Corp. V Province of Benguet FULL TEXTFrances Ann TevesNo ratings yet

- EIN Letter From IRSDocument2 pagesEIN Letter From IRSAnnabelParkNo ratings yet

- DOF-BLGF Local Treasury Operations Manual (LTOM)Document609 pagesDOF-BLGF Local Treasury Operations Manual (LTOM)Carlo P. Caguimbal100% (21)

- The Following Is A Research Assignment Made by Harsh Vagal On Financial Management of The Copanies Tata Motors VS Maruti SuzukiDocument25 pagesThe Following Is A Research Assignment Made by Harsh Vagal On Financial Management of The Copanies Tata Motors VS Maruti SuzukiHarsh VagalNo ratings yet

- Caribbean Internet CafeDocument3 pagesCaribbean Internet Cafem.h.n.g67% (3)

- Business Analysis - MTHR BreweryDocument13 pagesBusiness Analysis - MTHR Brewerydimitris_tsagkosNo ratings yet

- EM Pracx 23& 24Document13 pagesEM Pracx 23& 24Camille LimNo ratings yet

- BPP Revision Kit Sample Answers 1Document8 pagesBPP Revision Kit Sample Answers 1Kian TuckNo ratings yet

- CTP SalariesDocument11 pagesCTP SalariesankushdeshmukhNo ratings yet

- CIR v. CLDCDocument7 pagesCIR v. CLDCFlorence UdaNo ratings yet

- CH 13 SM FAF5eDocument48 pagesCH 13 SM FAF5eSonora Nguyen100% (1)

- Performance Training Sales Management in Denver CO Resume Geoff LeopoldDocument1 pagePerformance Training Sales Management in Denver CO Resume Geoff LeopoldGeoffLeopoldNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerFrom EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesFrom EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNo ratings yet

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-2-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)