Professional Documents

Culture Documents

District of Delaware: 20-2349869 1600 Manor Drive, Suite 110 Chalfont, PA

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

District of Delaware: 20-2349869 1600 Manor Drive, Suite 110 Chalfont, PA

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

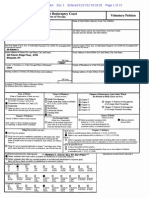

UNITED STATES BANKRUPTCY COURT

District of Delaware

(if more than one, state all):

20-2349869

1600 Manor Drive, Suite 110

Chalfont, PA

Easton, PA

Location

Type of Debtor

(Form of Organization)

(Check one box.)

0 Individual (includes Joint Debtors)

See Exhibit Don page 2 ofthisform.

Ill Corporation (includes LLC and LLP)

D Partnership

D Other (If debtor is not one of the above entities,

check this box. and state tYPe of entity below.)

Ill Full Filing Fee attached.

0

0

0

0

0

~

(include married, maiden, and trade names):

(if more than one, state all):

Nature of Business

(Check one box..)

Health Care Business

Single Asset Real Estate as defined in

11 u.s.c 101(51B)

Railroad

Stockbroker

Commodity Broker

Clearing Bank

Other

Tax-Exempt Entity

(Check box, if applicable.)

0

0

b2l

0

0

Chapter of Bankruptcy Code

the Petition is Filed (Check one box..)

Chapter?

Chapter9

Chapter 11

Chapter 12

Chapter 13

0 Chapter 15 Petition for

Recognition of a Foreign

Main Proceeding

0 Chapter 15 Petition for

Recognition of a Foreign

Nonmain Proceeding

Nature of Debts

(Check one box.)

0 Debts are primarily consumer

debts, defined in 11 U.S.C.

li!} Debts are primarily

business debts.

0 Debtor is a tax.-exempt organization

under Title 26 of the United States

Code (the Internal Revenue Code).

101(8) as "incurred by an

individual primarily for a

personal, family, or house-

hold "

11 Debtors

Check one box:

0 Debtor is a small business debtor as defined in 11 U.S.C. lOl(SlD),

[!1 Debtor is not a small business debtor as defined in 11 U.S.C. lOl(SID).

0 Filing Fee to be paid in installments (applicable to individuals only). Must attach

signed application for the court's consideration certifying that the debtor is

unable to pay fee except in installments. Rule 1006(b). See Official Form 3A.

Check if:

0 Debtor's aggregate noncontingcnt liquidated debt.<: (excluding debts owed to

insiders or affiliates) are less than $2,343,300 (amount subject to adJustment

on 4101/13 and every three years thereafter). 0 Filing Fee waiver requested (applicable to chapter 7 individuals only). Must

attach signed application for the court's consideration. See Official Form 3B.

Check all applicable boxes:

0 A plan is being filed with this petition.

0 .of the plan w e r ~ solicited prepetition from one or more classes

Statisticai/Adm inistrative Information THISSPACEJS FOR

COURT USE ONLY

0

Debtor estimates that funds will be available for distribution to unsecured creditors.

lilJ

Debtor estimates that, exempt property is excluded and administrative expenses paid, there will be no funds available for

0 0 0 0 0 0 0 0

l-49 50-99 200-999 1,000- 5,001- 10,001- 25,001- 50,001- Over

5,000 10,000 25,000 50,000 100,000 100,000

Assets

0 0 0 0 lilJ 0 0 0 0 0

$0 to $50,001 to $100,001 to $500,001 $1,000,001 $10,000,001 $50,000,001 $100,000,001 $500,000,001 More than

$50,000 $100,000 $500,000 to $1 to $10 to $50 to $100 to $500 to $1 billion $1 billion

million million million million

0 0 0 0 0 ~ 0 0 0 0

SO to $50,001 to $100,001 to $500,001 $1,000,001 $10,000,001 $50,000,001 $100,000,001 $500,000,001 More than

$50,000 $100,000 $500,000 to $1 to $10 to $50 to $100 to $500 to $1 billion $1 billion

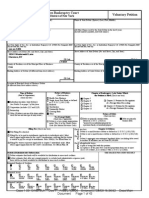

Bl (OfficialFonn 1) (4/10) Page2

Voluntary Petition

Name ofDebtor(s):

(This paf!.e must be completed and filed in every case.)

ClearPoint Resources, Inc.

All Prior Bankruptcy Cases Filed Within Last 8 Years Of more than two, attach additional sheet.

Location Case Number: Dale Filed:

Where Filed:

.

Location Case Number: Date Filed:

Where Filed:

Pending Bankruptcy Case Filed by any Spouse, Partner, or Affiliate of this Debtor Of more than one, attach additional sheet.)

Name of Debtor: Case Number: Date Filed:

ClearPoint Business Resources, Inc.

District:

District of Delaware

Relationship: Judge:

Exhibit A Exhibit B

(To be completed if debtor is an individual

(To be completed if debtor is required to file periodic report<; (e.g., forms IOK and IOQ) whose debts are primarily consumer debts.)

with the Securities and Exchange Commission pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 and is requesting relief nuder chapter 11.) I, the attorney for the petitioner named in the foregoing petition, declare that I

have it1fonned the petitioner that [he or she] may proceed under chapter 7, 11, 12,

or 13 of title 11, United States Code, and have explained the relief available under

each such chapter. I further certify that I have delivered to the debtor the notice

required by 11 U.S.C. 342(b).

D

Exhibit A is attached and made a patt of this petition. X

Siguature of Attorney for Debtor(s) (Date

Exhibit C

Does the debtor own or have possession of any propctty that poses or is alleged to pose a threat of immin.ent and identifiable hann to public health or safety?

D

Yes, and ExhibitC is attached and made a part of this petition.

l!i No.

Exhibit D

(To be completed by every in.dividual debtor. If a joittt petition is filed, each spouse must complete and attach a separate Exhibit D.)

D

Exhibit D completed and signed by the debtor is attached and made a part of this petition.

If this is a joint petition:

D

Exhibit D also completed and signed by the joint debtor is attached and made a part of this petition.

Information Regarding the Debtor- Venue

~

(Check any applicable box.)

Debtor has been. domiciled or has had a residence, principal place of business, or principal assets in this District for 180 days immediately

preceding the date of this petition or for a longer part of such 180 days than in any other District

D

There is a bankruptcy case concerning debtor's affiliate, gen.eral partner, or partnership pending in this District

D

Debtor is a debtor in a foreign proceeding and has its principal place of business or principal assets in. the United States in. this District, or has

no principal place of business or assets in the United States but is a defendant in an action or proceeding {in a federal or state court] in this

District, or the interests of the parties will be served in regard to the relief sought in this District

Certification by a Debtor Who Resides as a Tenant of Residential Property

(Check all applicable boxes.)

D

Landlord has a judgment against the debtor for possession of debtor's residence. (If box checked, complete the following.)

(Name of landlord that obtained judgment)

(Add""''"""'"'"!

D

Debtor claims that under applicable nonbankruptcy law, there are circumstances under which the debtor would be permitted to cure the

entire monetary default that gave rise to the judgment for possession, after the judgment for possession was entered, and

D

Debtor has included with this petition the deposit with the court of any rent that would become due during the 30-day period after the filing

of the petition.

D

Debtor certifies that he/she has served the Landlord with thi<; certification. (11 u.s. c. 362(1)).

B1 (Official Form) 1 (4/10) Page3

Voluntary Petition

o1Ji'"''rW'

(This paze mU%t be completed and filed in every crue.)

ear o1n esources, !nc.

Signatures

Signature(s) ofDcbtor(s) (IndividualfJoint) Signature of a Foreign Representative

I declare under penalty of perjury that tlte information provided in this petition is true

I declare under penalty of perjury that the information provided in this petition is

and correct.

true and correct, that I am the foreign representative of a debtor itt a foreign

[If petitioner is an individual whose debts are primarily consumer debts and has

proceeding, and that I am authorized to file this petition.

chosen to file lmder chapter 7} I am aware that I may proceed under chapter 7, 11, 12

(Check only one box..)

or 13 of title 11, United States Code, understand the relief available under each such

chapter, and choose to proceed under chapter 7.

D

I request relief in accordance with chapter 15 of title 11, United States Code.

[If no attorney represents me and no bankruptcy petition preparer signs the petition] I

Certified copies of the documents required by II U.S.C. 1515 are attached.

have obtained and read the notice required by 11 U.S.C. 342(b).

D

Pursuant to 11 U.S.C. 1511, I request relief in accordance with the

I request relief in accordance with the chapter of title 11, United States Code,

chapter of title 11 specified in this petition. A certified copy of the

specified in this petition. order granting recognition of the foreign main proceeding is attached.

X X

Signature of Debtor (Signature ofForeign Representative)

X

Signature of Joint Debtor (Printed Name of Foreign Representative)

Telephone Number (if not represented by attorney)

Dte

Dte

Signature of Bankruptcy Petition Preparer

X I declare under penalty of perjury that: (1) I am a banlcruptcy petition preparer as

4247)

defmed in II U.S.C. 110; (2) I prepared this document for compemation and have

provided the debtor with a copy of this document and the notices and information

Pfinted for Debtor(s)

required under 11 u.s.c. l!O(b), llO(h), and 342(b); and, (3) if rules or

ayar , ..

guidelines have been promulgated pursuant to 11 U.S.C. llO(h) setting a

Firm Name maximum fee for services chargeable by bankruptcy petition preparers, I have given

222 Dp'awgre Aven'le, Suite goo

the debtor notice of the maximum amount before preparing any docwnent for filing

VVilmiAteFJ, DE 19801

for a debtor or accepting any fee from the debtor, as required in that section.

Official Form 19 is attached.

655-5000 Fax: (302) 658-6395

Telephone Number Printed Name and title, if any, of Bankruptcy Petition Preparer

Dte number (If the banla-uptcy petition preparer

;,

not n

individual, 'tate the number of the officer, principal,

*In a case in which 707(b)(4)(D) applies, this signature also constitutes a

responsible person or partner of the bankruptcy petition preparer.) (Required

certification that the attorney has no knowledge after an inquiry that the information

by 11 u.s.c. 110.)

in the schedules is incorrect.

Signature of Debtor (Corporation/Partnership)

I declare under penalty of pctjury that the U1formatio11 provided in this petition is true

Address

and correct, and that I have been authorized to file this petition on behalf of the

X

debtor.

The debtor requests the relief in accordance with the chapter of title 11, United States

Date

Code, specified in this petition.

X

Signature of bankruptcy petition preparer or officer, principal, responsible person,

of Individual

or partner whose number is provided above.

nshne oe p

Names and nwnbers of all other individuals who prepared or

Ppinted.Uaml of Authorized Individual

res1 en

assisted in preparing this document unless the banla-uptcy petition preparer is not an

Title of Authorized Individual

individual.

Dte

If more than one person prepared this document, attach additional sheets

conforming to the appropriate official fonn for each person.

A bankruptcy petition preparer's failure to comply with the proVISions of title 11

and the Federal Rules of Bankruptcy Procedure may result in fines or imprisonment

or both. 11 U.S.C. 110; /8 U.S. C. /56.

8l (Qfftciai Form) 1 (4/10)

Voluntary PUUon

Inc.

(This ""'""' must and filed in everv case. J

(Jltdiv(du:al!.Joiut) Sfinature uf a Foreign Rf.:pT1lE"ntstive

1 dedare under pem.lty ofpe!jury tb,al tbe infqnnation provided in this petition i& true l Qeclare under pexti!Jty of perjury that the information fX'OVideQ jn this petition tS

and correct.

true aDd correct, that I am 1he foreigt'l repres!illt?tiye of .a debtor in a tO;;eign

(lf petitioner i!l an individual .....-t..QM: del:rn; ;ore primarily debts. and hRs

proc::eOOUlg, and that I am authorized to fJe this pe>tition.

chosen to file under chap1e;' 7) \ atn.aw.;Jre thAtl may proce-ed under cllapn::r 7, I 1, 12

(Checl< only one box.)

or 13 of ll, Unitt::tl CQde, undemand the relief available und..;r eacl"J such

chapter, and cboQse to u,nder chapter 7.

D I request relief in accordance with cbapter )S of title 11. UMed Stllles Code.

(tfno attorney f(lpre:sems me aOO.!'lo. bankruptcy petition preparer signs fue petition] I

Certified copies of the docu:men!:s required by 11 U.S.C. 1515 a.rn attached.

have obtained and read the notice required by l f 'U.S.C. 34:Z(b),

D

Pwswmtto ll u.s.c. 1511, I request relief in. accordance witb me

I request rotiof lo w)th 1:heo chapttlot of title 11, Unit>ed Stat-<:s. Code,.

chapW1: o( tit).c 11. specified in this petition. A cl:rlifimi -of th.,

specified in this p.etiti{ln. order granting recognition of the foreign main proceeding is attacbed..

X X

Signa.twe of Dc:l;ltor (Signature offoO!'ign Representative)

X

Signarurc: of Joint Debtor (Printed Name off<m::ign

T elep..l-'Joo.e: Number ( lf not represented by attorney)

-.

.....

Dte

Date

of Atto()}ey"' ,Sigoab:lre of B9.l1Jt:nl.pu:.y J?'rep3XI!r

X I declare under penalty of paljury tha.t: (1) I am a banb"uptcy petition preparer as

r 424 7)

in ll t).S.C. 9 110; (2:) l prepared thi5 for wmptm<tUIJn

provided. tlle deOI:Qr with a copy of document and the notiws and \nfonnation

N.r.p?f(ttomey for De1>tor(s)

rc:quirc:d under 11 U.S.<.:. S UQ(b), llO(.Il), and 342(b); and, (3}if rules or

ayar , ..

guidelines have been pt"otnulgate<l purswmt to ll iJS.C. U O(h) :s.etting a

fjrmNs.me fee for services chargc:ab1c: by bankruptty petition preparers,l have gj""efl

222 Delaw<:Jm AvgOIIQ, sl ilc goo the debtor nQtice Qfthc ma;Js.\mum amcuot before preparing any document for filiJ\g

Wihniugtefl, DE 19801

for a debtor or accepting any fe-e from the debtor, required in that ::>ection.

Official Fonu 19 is attached.

Fax: (302) 658-395

Telephone Number Printc:d Name and tilie, if any, of Bankruptcy Petitiot'l Preparet

Oat< number (If the bankroptcy pst'ition preparer is not e.n

Individual,

-til'

SocislSecu.O.ty :uurobc:r of tbe offiter, principal,

l<(n.a case it) which 707(b)(4}(D) this signature als-o a

responsible person or p.artuer of the ban).:::ruptcy pe$ion preparer.) (RJ::quircd

certification that the attOrney has no I<;M..Yledge after an inqUiry <hat File mfonnst,ioo.

by 11 U.S.C. llO.)

in the schedules is incorroct.

Slgu8ture of Debtor

l declare unde-.r pemdty of perjury tl.wt the i;nfo1"11'1atioo provlded in this petiti011 i:;. tnl.e

and correct. and that I have been authorize<l to '!his on beh!!lf of the

X

debtor.

The deln:qr requests the rclief in ao.::ordance with the oftttle J Uu.itcd

Dare

Code, spes2:n thls petition.

Sjgnature of b<ll'lkruptt;y petition preparer or ofticer, pi!:rson,

X t ,ut;.14#

orpartnm- whose SociaJ.Socurity nu:m.OOr is providti!d a-bove,

Q(

nst1ne oe p

of Autlloriz! !ndMd""l

Names and Social-Securicy numb<;rs of all othr:r individuals who prepared or

assisted il1 preparing this document unless the bankruptcy petition preparet is not att

Title

individuttl.

.... . 6 '-1" l;bt!l. .

lf mQrt: thaD. QJ'I.e person prepa.red this docwneni, attach additional sheets

Dare

confor:ming tQ the official b:m ;for each person.

A baNkruptcy petiti<Jn '.:I' ,foifwp: tQ c;;;mply with th pr/7flisi;;;ns if titltt 11

and thfi Fruifiral ofBr:mkropt'f{"ot;GthP'Il mQy ..v,rnlt Qr i/rij)ris()htnt!nt

r}rQu(h, 11 U.SC. 110; JIH/.S.C. 156.

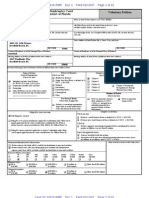

UNITED STATES BANKRUPTCY COURT

DISTRICT OF DELAWARE

Form 4. LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS

Form B4 (Official Form 4) - (12/07)

Case No. (If known) Debtor

ClearPoint Business Resources Inc.

Following is a list of the debtor's creditors holding the 20 largest unsecured claims. The list is prepared in accordance with Fed. R.

Bankr. P. 1007(d) for filing in this chapter 11 [or chapter 9] case. The list does not include (1) persons who come within the definition of

insider set forth in 11 U.S.C. 101, or (2) secured creditors unless the value of the collateral is such that the unsecured deficiency places

the creditor among the holders of the 20 largest unsecured claims. If a minor child is one of the creditors holding the 20 largest unsecured

claims, state the child's initials and the name and address of the child's parent or guardian, such as A.B., a minor child, by John Doe,

guardian. Do not disclose the childs name. See 11 U.S.C. 112 and Fed. R. Bankr. P. 1007(m).

Name of creditor and

complete mailing address,

including zip code.

Name, telephone number and

complete mailing address,

including zip code, of employee,

agent, or department of creditor

familiar with claim who may be

contacted

Nature of claim

(trade debt, bank

loan, government

contract, etc.)

AMOUNT OF

CLAIM (if secured

also state value of

security)

C

O

N

T

I

N

G

E

N

T

U

N

L

I

Q

U

I

D

A

T

E

D

D

I

S

P

U

T

E

D

$4,710,061.33 NOTES PAYABLE

1ST PRIORITY

M&T BANK

601 DRESHER ROAD

HORSHAM , PA 19044

M&T BANK

601 DRESHER ROAD

HORSHAM , PA 19044

TEL: 215-956-7138

FAX: 215-956-7139

1

$1,685,851.44 NOTES PAYABLE ALS,LLC

4074 SCARLET IRIS PLACE

WINTER PARK, FL 32792

ALS,LLC

4074 SCARLET IRIS PLACE

WINTER PARK, FL 32792

TEL: 407-677-0400

FAX: 407-677-7757

2

$795,094.94 CONTRACT OBLIGATIONS OPTOS CAPITAL PARTNERS, LLC

1866 LEITHSVILLE RD

SUITE 225

HELLERTOWN, PA 18055

OPTOS CAPITAL PARTNERS, LLC

1866 LEITHSVILLE RD

SUITE 225

HELLERTOWN, PA 18055

TEL: 215-820-9299

FAX: 610-672-9999

3

$496,262.00 NOTES PAYABLE BANK DIRECT

CAPITAL FINANCE

TWO CONWAY PARK

LAKE FOREST, IL 60045

BANK DIRECT

CAPITAL FINANCE

TWO CONWAY PARK

LAKE FOREST, IL 60045

TEL: 877-226-5456

FAX: 877-226-5297

4

$339,000.00 NOTES PAYABLE FERGO BROTHERS

P.O. BOX 42

PHILLIPSBURG, NJ 08865

FERGO BROTHERS

P.O. BOX 42

PHILLIPSBURG, NJ 08865

TEL: 215-820-9299

FAX: 610-672-9999

5

Page 1 of 4

(Continuation Sheet)

Form 4. LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS

Form B4 (Official Form 4) - (12/07)

Case No. (If known) Debtor

ClearPoint Business Resources Inc.

Name of creditor and

complete mailing address,

including zip code.

Name, telephone number and

complete mailing address,

including zip code, of employee,

agent, or department of creditor

familiar with claim who may be

contacted

Nature of claim

(trade debt, bank

loan, government

contract, etc.)

AMOUNT OF

CLAIM (if secured

also state value of

security)

C

O

N

T

I

N

G

E

N

T

U

N

L

I

Q

U

I

D

A

T

E

D

D

I

S

P

U

T

E

D

$300,000.00 LITIGATION SETTLEMENT ALLIANCE CONSULTING

SIX TOWER BRIDGE

181 WASHINGTON STREET STE 350

CONSHOHOCKEN, PA 19428

ALLIANCE CONSULTING

SIX TOWER BRIDGE

181 WASHINGTON STREET STE 350

CONSHOHOCKEN, PA 19428

TEL: 610-234-4301

FAX: 610 234 4302

6

$256,709.00 CONTRACT OBLIGATIONS CHRISTOPHER FERGUSON

2060 QUAIL COURT

BETHLEHEM, PA 18015

CHRISTOPHER FERGUSON

2060 QUAIL COURT

BETHLEHEM, PA 18015

TEL: 215-820-9299

FAX: 610-672-9999

7

$250,000.00 LITIGATION SETTLEMENT AICCO INC.

NORRIS MCLAUGHLIN & MARCUS, P.A.

P.O. BOX 5933

BRIDGEWATER, NJ 08807-5933

AICCO INC.

NORRIS MCLAUGHLIN & MARCUS, P.A.

P.O. BOX 5933

BRIDGEWATER, NJ 08807-5933

TEL: 908-722-0700

FAX: 908- 722-0755

8

$192,896.50 NOTES PAYABLE NIGEL LUI - SCOTT NIEH

133-47 SANFORD AVE

#5E

FLUSHING, NY 11355

NIGEL LUI - SCOTT NIEH

133-47 SANFORD AVE

#5E

FLUSHING, NY 11355

TEL: 917-885-5713

9

$126,158.24 TRADE PAYABLE GRAY ROBINSON

P.O. BOX 3068

ORLANDO, FL 32802-3068

GRAY ROBINSON

P.O. BOX 3068

ORLANDO, FL 32802-3068

TEL: 407-843-8880

FAX: 407-244-5690

10

$113,000.00 NOTES PAYABLE ALYSON P. DREW

59 WOODLANDS ROAD

HARRISON, NY 10528

ALYSON P. DREW

59 WOODLANDS ROAD

HARRISON, NY 10528

TEL: 914-582-1966

11

Page 2 of 4

(Continuation Sheet)

Form 4. LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS

Form B4 (Official Form 4) - (12/07)

Case No. (If known) Debtor

ClearPoint Business Resources Inc.

Name of creditor and

complete mailing address,

including zip code.

Name, telephone number and

complete mailing address,

including zip code, of employee,

agent, or department of creditor

familiar with claim who may be

contacted

Nature of claim

(trade debt, bank

loan, government

contract, etc.)

AMOUNT OF

CLAIM (if secured

also state value of

security)

C

O

N

T

I

N

G

E

N

T

U

N

L

I

Q

U

I

D

A

T

E

D

D

I

S

P

U

T

E

D

$113,000.00 NOTES PAYABLE B & N ASSOCIATES

1207 BELVEDERE ROAD

PHILLIPSBURG, NJ 08865

B & N ASSOCIATES

1207 BELVEDERE ROAD

PHILLIPSBURG, NJ 08865

TEL: 212-341-9790

12

$73,150.55 TRADE PAYABLE MICHAEL L JANDA

853 WEST RANDOLPH STREET

CHICAGO, IL 60607

MICHAEL L JANDA

853 WEST RANDOLPH STREET

CHICAGO, IL 60607

TEL: 312-226-4447

13

$73,150.55 THE 1997 SALTZMAN TRUST

CO MICHAEL JANDA

853 WEST RANDOLPH STREET

CHICAGO, IL 60607

THE 1997 SALTZMAN TRUST

CO MICHAEL JANDA

853 WEST RANDOLPH STREET

CHICAGO, IL 60607

TEL: 312-226-4447

14

$58,179.81 TAXES COMMONWEALTH OF PENNSYLVANIA

DEPARTMENT OF BUSINESS TRUST FUND

TAXES

PO BOX 280904

HARRISBURG, PA 17128-0904

COMMONWEALTH OF PENNSYLVANIA

DEPARTMENT OF BUSINESS TRUST FUND

TAXES

PO BOX 280904

HARRISBURG, PA 17128-0904

TEL: 717-783-5271

15

$56,500.00 NOTES PAYABLE MATTHEW KINGFIELD

123 S MAIN STREET

PHILLIPSBURG, NJ 08865

MATTHEW KINGFIELD

123 S MAIN STREET

PHILLIPSBURG, NJ 08865

TEL: 908-674-0010

16

$49,424.79 TRADE PAYABLE RR DONNELLEY RECEIVABLES, INC.

A.G. ADJUSTMENTS LTD

P.O. BOX 9090

MELVILLE, NY 11747-9090

RR DONNELLEY RECEIVABLES, INC.

A.G. ADJUSTMENTS LTD

P.O. BOX 9090

MELVILLE, NY 11747-9090

TEL: 215-564-3220

FAX: 631-425-8808

17

Page 3 of 4

(Continuation Sheet)

Form 4. LIST OF CREDITORS HOLDING 20 LARGEST UNSECURED CLAIMS

Form B4 (Official Form 4) - (12/07)

Case No. (If known) Debtor

ClearPoint Business Resources Inc.

Name of creditor and

complete mailing address,

including zip code.

Name, telephone number and

complete mailing address,

including zip code, of employee,

agent, or department of creditor

familiar with claim who may be

contacted

Nature of claim

(trade debt, bank

loan, government

contract, etc.)

AMOUNT OF

CLAIM (if secured

also state value of

security)

C

O

N

T

I

N

G

E

N

T

U

N

L

I

Q

U

I

D

A

T

E

D

D

I

S

P

U

T

E

D

$40,447.00 TAXES RICHLAND COUNTY JUDICIAL CENTER

1701 MAIN STREET

PO BOX 2766

COLUMBUS, SC 29202

RICHLAND COUNTY JUDICIAL CENTER

1701 MAIN STREET

PO BOX 2766

COLUMBUS, SC 29202

TEL: 803-576-1950

FAX: 803-576-1785

18

$40,135.00 TRADE PAYABLE CROWE HORWATH LLP

PO BOX 145415

CINCINNATTI, OH 45250

CROWE HORWATH LLP

PO BOX 145415

CINCINNATTI, OH 45250

TEL: 520-290-0206

FAX: 480-287-8911

19

$40,045.60 TRADE PAYABLE MORGAN, LEWIS & BOCKIUS LLP

1701 MARKET STREET

PHILADELPHIA, PA 19103-2921

MORGAN, LEWIS & BOCKIUS LLP

1701 MARKET STREET

PHILADELPHIA, PA 19103-2921

TEL: 215.963.5000

FAX: 215.963.5001

20

Page 4 of 4

DECLARATION UNDER PENALTY OF PERJURY

ON BEHALF OF A CORPORATION OR PARTNERSHIP

I, the President and Secretary of the Debtors in these chapter 11 cases, declare

under penalty of perjury that I have read the foregoing Consolidated List of Top 20

Unsecured Creditors and that it is true and correct to the best of my information and

belief.

Date; June 23,, 2010

r3aeiSTwrf Dcxrc.P /iefiPdl-f"

(Print Name and Title)

Penalty for making a false statement r concealing property: Fine up to $500,000 or imprisonment for

up to 5 years or both 18 U.S.C. 152 and 3571.

WRITTEN CONSENT OF THE BOARD OF DIRECTORS OF

CLEARPOINT RESOURCES, INC., ADELA WARE CORPORATION

The undersigned, being the sole member of the Board of Directors (the "Board") of

Clearpoint Resources, Inc (the "Company"), does hereby consent, pursuant to Section 141 of the

General Corporation Law of the State of Delaware, to the adoption of the following Resolutions

with the same force and effect as though adopted at a meeting duly called and held:

WHEREAS, the Board has held extensive discussions during the course of several

months regarding the current circumstances of the financial liquidity and business prospects of

the Company and its subsidiaries with the Company's executive officers and financial and legal

advisors; and

WHEREAS, the Board has evaluated and considered the information provided by and

the recommendations of the Company's executive officers and financial and legal advisors and

has had the opportunity to ask questions of the same and independently to verify and diligence

all such information; and

WHEREAS, the Board evaluated and considered the circumstances and consequences of

filing a petition relative to the Company (the "Petition") seeking relief under the provisions of

Chapter 11 of Title 11 of the United States Code (the "Bankruptcy Code"), and which petition is

attached to this resolution as an exhibit; and

NOW, THEREFORE, the Board hereby adopts the following Resolutions:

RESOLVED, in the judgment of the Board, it is in the best interests of the Company and

its subsidiaries, creditors of the Company and its subsidiaries, the employees of the Company,

the shareholders of the Company, and other interested parties, for the Company to file the

Petition on behalf of itself seeking relief under the Bankruptcy Code; and it is

FURTHER RESOLVED, that the Petition substantially in the form distributed to the

undersigned and attached hereto is adopted in all respects, and that the officers of the Company

(the "Authorized Persons") be, and they hereby are, authorized and directed, on behalf of the

Company, to execute the Petition or authorize the execution of a filing of the Petition by the

Company with such changes thereto as an Authorized Person executing the same shall approve,

the execution thereof, by such Authorized Person to be deemed conclusive evidence of such

approval, and to cause the same to be filed (the "Chapter 11 Proceeding") with the United States

Bankruptcy Court for the District of Delaware (the "Bankruptcy Court") at such time as the

Authorized Persons consider appropriate; and it is

FURTHER RESOLVED, that the Authorized Persons be, and they hereby are,

authorized to retain on behalf of the Company the law firm of Gersten Savage LLP, upon such

terms and conditions as the Authorized Persons shall approve, to render legal services to and

represent the Company in connection with the Chapter 11 Proceedings; and it is

FURTHER RESOLVED, that the Authorized Persons be, and they hereby are,

authorized to retain on behalf of the Company the law firm of Bayard, P.A., as Delaware co-

counsel, upon such terms and conditions as the Authorized Persons shall approve, to render legal

services to and represent the Company in connection with the Chapter 11 Proceedings; and it is

FURTHER RESOLVED, that the Authorized Persons be, and they hereby are,

authorized to retain on behalf of the Company a balloting, servicing, and claims agent to be

identified by the Authorized Persons, upon such terms and conditions as the Authorized Persons

shall approve, to render certain administrative services in connection with the Chapter 11

Proceedings; and it is

FURTHER RESOLVED, that each Authorized Person, and such other officers of the

Company as the Authorized Persons shall from time to time designate, and any employees

or agents (including counsel) designated by or directed by any such officers, be, and each hereby

is, authorized, empowered and directed, in the name and on behalf of the Company and its

subsidiaries, to execute and file all petitions, schedules, motions, lists, applications, pleadings

and other papers, and to take and perform any and all further acts and deeds which he or she

deems necessary, proper or desirable in connection with the Chapter 11 case, including without

limitation, negotiating and obtaining debtor-in-possession financing, exit financing, and/or the

use of cash collateral, and executing, delivering and performing any and all documents,

agreements, certificates and/or instruments in connection with such debtor-in-possession

financing, exit financing, and/or use of cash collateral, with a view to the successful prosecution

of such case; and it is

FURTHER RESOLVED, that each Authorized Person, and such other officers of

the Company and its subsidiaries as the Authorized Persons shall from time to time designate,

be, and each hereby is, authorized, empowered and directed, in the name and on behalf of

the Company and its subsidiaries, as the case may be, to: (a) negotiate, execute, deliver and/or

file any and all of the agreements, documents and instruments referenced herein, and such

other agreements, documents and instruments and assignments thereof as may be required or as

such Authorized Person or designated officer deems appropriate or advisable, or to cause the

negotiation, execution and delivery thereof, in the name and on behalf of the Company and

its subsidiaries, as the case may be, in such form and substance as such Authorized Person or

designated officer may approve, together with such changes and amendments to any of the

terms and conditions thereof as such Authorized Person or designated officer may approve, with

the execution and delivery thereof on behalf of the Company and its subsidiaries by or at the

direction of such Authorized Person or designated officer to constitute evidence of such approval,

(b) negotiate, execute, deliver and/or file, in the name and on behalf of the Company and its

subsidiaries any and all agreements, documents, certificates, consents, filings and

applications relating to the resolutions adopted and matters ratified or approved herein and the

transactions contemplated thereby, and amendments and supplements to any of the foregoing,

and to take such other actions as may be required or as such Authorized Person or designated

officer deems appropriate or advisable in connection therewith, and (c) do such other things as

may be required, or as may in their judgment be appropriate or advisable, in order to effectuate

fully the resolutions adopted and matters ratified or approved herein and the consummation of

the transactions contemplated thereby; and it is

FURTHER RESOLVED, that all acts lawfully done or actions lawfully taken by any

Authorized Person to file the voluntary petition for relief under Chapter 11 of the Bankruptcy

Code or in any other connection with the Chapter 11 Proceedings, or any manger related thereto,

or by virtue of these resolutions be, and hereby are, in all respects ratified, confirmed and

approved.

This Written Consent may be executed by facsimile signature, or electronic mail

signature if attached to such electronic mail message in a commonly readable format.

IN WITNESS WHEREOF, the undersigned, being all of the directors of the Company,

consent hereto in writing as of June 21, 2010, and direct that this instrument be filed with the

minutes,;) of th; Board of Directors of the Company.

/.t7j1'2

// i/ t/

/

Gary E Jaggard

You might also like

- CIT Bankruptcy PetitionDocument30 pagesCIT Bankruptcy PetitionDealBook100% (1)

- Citadel Broadcasting's Bankruptcy PetitionDocument23 pagesCitadel Broadcasting's Bankruptcy PetitionDealBook100% (1)

- Borders' Bankruptcy PetitionDocument21 pagesBorders' Bankruptcy PetitionDealBook100% (1)

- United States Bankruptcy Court Southern District of New York Voluntary PetitionDocument18 pagesUnited States Bankruptcy Court Southern District of New York Voluntary PetitionChapter 11 DocketsNo ratings yet

- 10000001843Document110 pages10000001843Chapter 11 DocketsNo ratings yet

- Bart Coffee KiosksDocument28 pagesBart Coffee KioskskatherinestechNo ratings yet

- Legacy Construction (Hardy) BankruptcyDocument13 pagesLegacy Construction (Hardy) BankruptcyLas Vegas Review-JournalNo ratings yet

- 10000019287Document165 pages10000019287Chapter 11 DocketsNo ratings yet

- MOONGABSOOBKFORMDocument3 pagesMOONGABSOOBKFORMJames KimNo ratings yet

- Fisker Automotive Holdings IncDocument4 pagesFisker Automotive Holdings IncChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of New York AmendedChapter 11 DocketsNo ratings yet

- Riiitzaiit6F5T-L I: R1 Official Form 1) (12/11Document41 pagesRiiitzaiit6F5T-L I: R1 Official Form 1) (12/11Chapter 11 DocketsNo ratings yet

- Conway BankruptcyDocument43 pagesConway Bankruptcyhurricanesmith2No ratings yet

- Senator Sean Nienow Minnesota Bankruptcy FilingsDocument58 pagesSenator Sean Nienow Minnesota Bankruptcy FilingsghostgripNo ratings yet

- Peticion Quiebra TelexfreeDocument19 pagesPeticion Quiebra TelexfreelordmiguelNo ratings yet

- 001 NYC Opera PetitionDocument10 pages001 NYC Opera Petitionahawkins8223No ratings yet

- 10000000597Document5,120 pages10000000597Chapter 11 Dockets0% (1)

- U S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtDocument19 pagesU S B C Southern District of New York Voluntary Petition: Nited Tates Ankruptcy OurtMelanie CohenNo ratings yet

- Sinbad's BankruptcyDocument3 pagesSinbad's BankruptcyGeri KoeppelNo ratings yet

- Solavei Bankruptcy14 14505 TWD 1Document249 pagesSolavei Bankruptcy14 14505 TWD 1John CookNo ratings yet

- Loehmann's Petition For Chapter 11Document20 pagesLoehmann's Petition For Chapter 11DealBookNo ratings yet

- James R. Rosendall Jr.'s Bankruptcy Filing.Document50 pagesJames R. Rosendall Jr.'s Bankruptcy Filing.rob_snell_1No ratings yet

- United States Bankruptcy Court Voluntary Petition: District of DelawareDocument16 pagesUnited States Bankruptcy Court Voluntary Petition: District of DelawareChapter 11 DocketsNo ratings yet

- Michigan Brewing Company Bankruptcy FilingDocument171 pagesMichigan Brewing Company Bankruptcy FilingLansingStateJournalNo ratings yet

- Southern Florida: United States Bankruptcy CourtDocument38 pagesSouthern Florida: United States Bankruptcy CourtMy-Acts Of-SeditionNo ratings yet

- Marlene Davis Bankruptcy FilingDocument51 pagesMarlene Davis Bankruptcy Filingacsamaha100% (1)

- Affinity First Day SchedulesDocument101 pagesAffinity First Day SchedulesjaxxstrawNo ratings yet

- Hargreaves Ch. 11 Bankruptcy FilingDocument24 pagesHargreaves Ch. 11 Bankruptcy FilingNick HalterNo ratings yet

- Southern District of New YorkDocument17 pagesSouthern District of New YorkChapter 11 DocketsNo ratings yet

- Palomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoDocument10 pagesPalomar Hangar, LLC Chapter 11 Bankruptcy - MacalusoSpoiledMomNo ratings yet

- Transdel First Day PetitionsDocument122 pagesTransdel First Day PetitionsjaxxstrawNo ratings yet

- Braswell BankruptcyDocument58 pagesBraswell BankruptcyMatt DixonNo ratings yet

- Illuzzi Chap 7 BankruptcyDocument46 pagesIlluzzi Chap 7 BankruptcyAlan BedenkoNo ratings yet

- Far East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15Document15 pagesFar East Energy Corporation - Bankruptcy Petition 15-35970 Doc 1 Filed 10 Nov 15scion.scionNo ratings yet

- Full Details SugarmanDocument40 pagesFull Details SugarmanBecket AdamsNo ratings yet

- 10000021291Document490 pages10000021291Chapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Southern District of Florida Voluntary PetitionDocument55 pagesUnited States Bankruptcy Court Southern District of Florida Voluntary Petitional_crespo100% (1)

- United States Bankruptcy Court Voluntary Petition: Central District of California - Santa AnaDocument12 pagesUnited States Bankruptcy Court Voluntary Petition: Central District of California - Santa AnaChapter 11 DocketsNo ratings yet

- Earl Gaudio & Son PetitionDocument11 pagesEarl Gaudio & Son PetitionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition Western District of Texas San Antonio Division Atled, LTDDocument9 pagesUnited States Bankruptcy Court Voluntary Petition Western District of Texas San Antonio Division Atled, LTDChapter 11 DocketsNo ratings yet

- Daffys 1Document18 pagesDaffys 1Chapter 11 DocketsNo ratings yet

- Dahl's Bankruptcy PetitionDocument116 pagesDahl's Bankruptcy PetitiondmronlineNo ratings yet

- Dahl's FilingDocument116 pagesDahl's FilingwhohdNo ratings yet

- United States Bankruptcy Court District of Colorado Voluntary PetitionDocument64 pagesUnited States Bankruptcy Court District of Colorado Voluntary Petitionspacecat007No ratings yet

- 10000005743Document48 pages10000005743Chapter 11 DocketsNo ratings yet

- Circle Family Healthcare Network Voluntary PetitionDocument108 pagesCircle Family Healthcare Network Voluntary PetitionEllyn FortinoNo ratings yet

- Joy Taylor BK DocsDocument45 pagesJoy Taylor BK DocsStephen DibertNo ratings yet

- Voluntary Petition: United States Bankruptcy Court Central District of CaliforniaDocument21 pagesVoluntary Petition: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Central District of CaliforniaDocument65 pagesUnited States Bankruptcy Court Voluntary Petition: Central District of California11CV00233No ratings yet

- Mason Bankruptcy PetitionDocument195 pagesMason Bankruptcy PetitionLansingStateJournalNo ratings yet

- MMA's Bankruptcy PetitionDocument94 pagesMMA's Bankruptcy PetitionWilliam Wolfe-WylieNo ratings yet

- Court DocumentsDocument64 pagesCourt DocumentsAnonymous DeZm0ZLptONo ratings yet

- Voluntary Petition: United States Bankruptcy Court Central District of CaliforniaDocument47 pagesVoluntary Petition: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsNo ratings yet

- Atari Interactive's Bankruptcy FilingDocument12 pagesAtari Interactive's Bankruptcy FilingDealBookNo ratings yet

- Andrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012Document71 pagesAndrei Leon Gill SR Bankruptcy Petition 185 McCarrons BLVD PO Box 11683 06-05-2012CamdenCanaryNo ratings yet

- 05014834923Document41 pages05014834923My-Acts Of-SeditionNo ratings yet

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- First Conditional Exercises - Ies Nãºm. 1 - LibertasDocument2 pagesFirst Conditional Exercises - Ies Nãºm. 1 - LibertasdelfaescuderoNo ratings yet

- Raul Guerra Fdle ReportDocument84 pagesRaul Guerra Fdle Reportal_crespo_2No ratings yet

- Contract Ii Case Review (Doc Frustration) PDFDocument25 pagesContract Ii Case Review (Doc Frustration) PDFkhairiah tsamNo ratings yet

- Mulugeta AbrhaDocument104 pagesMulugeta Abrhafraol alemuNo ratings yet

- English Civil WarDocument48 pagesEnglish Civil WarsmrithiNo ratings yet

- Answers 6.3.2021Document9 pagesAnswers 6.3.2021rubby deanNo ratings yet

- In The Matter To Declare in Contempt of Court Hon. Simeon A. DatumanongDocument2 pagesIn The Matter To Declare in Contempt of Court Hon. Simeon A. DatumanongElyn ApiadoNo ratings yet

- Case Facts Issues and RatioDocument12 pagesCase Facts Issues and RatioKio Paulo Hernandez SanAndresNo ratings yet

- National Christian Council of India. Proceedings 1950 v11Document121 pagesNational Christian Council of India. Proceedings 1950 v11Shantanu Vaishnav100% (3)

- The Punjab Local Government Ordinance, 2001Document165 pagesThe Punjab Local Government Ordinance, 2001Rh_shakeelNo ratings yet

- MulanDocument1 pageMulanEnricNo ratings yet

- EE319 Lab 2Document3 pagesEE319 Lab 2Fathan NaufalNo ratings yet

- Report of The African Court On Human and Peoples Rights in The Protection of Human Rights in Africa FinalDocument10 pagesReport of The African Court On Human and Peoples Rights in The Protection of Human Rights in Africa FinalRANDAN SADIQNo ratings yet

- Upper-Intermediate TestsDocument3 pagesUpper-Intermediate Testsvsakareva0% (3)

- 1 Pp-3 Match Summary Dewa Cup 4Document4 pages1 Pp-3 Match Summary Dewa Cup 4Anak KentangNo ratings yet

- Islamic Studies: Quiz #1Document3 pagesIslamic Studies: Quiz #1Talha TariqNo ratings yet

- Usurpation of Real RightsDocument7 pagesUsurpation of Real RightsTukneNo ratings yet

- The Dark Side of Anwar Sadat WASHINGTON POSTDocument2 pagesThe Dark Side of Anwar Sadat WASHINGTON POSTKarim MerabetNo ratings yet

- Criminology ProfessionDocument26 pagesCriminology ProfessionKim Laurente-AlibNo ratings yet

- Trustee's Deed SuccessorDocument2 pagesTrustee's Deed SuccessorAdam SaadNo ratings yet

- Laporan KKI Ke POSI 2021Document5 pagesLaporan KKI Ke POSI 2021dheoakuNo ratings yet

- Popular Music For Bayan and Accordion - A4Document110 pagesPopular Music For Bayan and Accordion - A4nickr01100% (2)

- EM 8-Position PaperDocument2 pagesEM 8-Position PaperSTEVEN MENDEZNo ratings yet

- 2tado PP Vs TipayDocument2 pages2tado PP Vs TipayReginaNo ratings yet

- Immunizations MeningococcalDocument2 pagesImmunizations MeningococcalVarun ArvindNo ratings yet

- D171 TMA 01 - Psychodynamic Vs Person Centred CounsellingDocument5 pagesD171 TMA 01 - Psychodynamic Vs Person Centred CounsellingCaitlin NiChraith0% (1)

- 9.5.2.6 Packet Tracer - Configuring IPv6 ACLs Instructions PDFDocument2 pages9.5.2.6 Packet Tracer - Configuring IPv6 ACLs Instructions PDFEder MonteiroNo ratings yet

- Lanuza Vs CADocument3 pagesLanuza Vs CALiaa Aquino100% (1)

- 0 042010 Notes - Brandon AdamsDocument17 pages0 042010 Notes - Brandon AdamsCK in DC100% (5)

- 3.Hum-Controlling Drug Menace in India - MR - Sree KRISHNA BHARADWAJ HDocument6 pages3.Hum-Controlling Drug Menace in India - MR - Sree KRISHNA BHARADWAJ HImpact JournalsNo ratings yet