Professional Documents

Culture Documents

10000003172

Uploaded by

Chapter 11 Dockets0 ratings0% found this document useful (0 votes)

7 views8 pagesEToys Direct 1, LLC, et al., filed a voluntary petition for relief under chapter 11 of Title 11 of the Bankruptcy Code on December 28,2008. On January 16,2009, pursuant to a motion filed by The Debtors. Etoys subsequently filed a petition with the United States Bankruptcy Court for the district of delaware.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEToys Direct 1, LLC, et al., filed a voluntary petition for relief under chapter 11 of Title 11 of the Bankruptcy Code on December 28,2008. On January 16,2009, pursuant to a motion filed by The Debtors. Etoys subsequently filed a petition with the United States Bankruptcy Court for the district of delaware.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views8 pages10000003172

Uploaded by

Chapter 11 DocketsEToys Direct 1, LLC, et al., filed a voluntary petition for relief under chapter 11 of Title 11 of the Bankruptcy Code on December 28,2008. On January 16,2009, pursuant to a motion filed by The Debtors. Etoys subsequently filed a petition with the United States Bankruptcy Court for the district of delaware.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re:

eTOYS DIRECT 1, LLC, et al.,

1

) Chapter 11

)

) Case No. 08-13412-BS

) (Jointly Administered)

) Debtors.

) Re: Docket No. 143

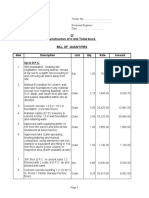

General Objections to Approval of Sale: January 30, 2009, at 5:00p.m. (EST)

Deadline for Submitting Bids: February 2, 2009, at 5:00p.m. (EST)

Deadline for Objections to Cure Costs: February 3, 2009, at 4:00p.m. (EST)

Auction Date: February 4, 2009, at 10:00 a.m. (EST)

Deadline for Objections to Debtors' Auction Conduct: February 5, 2009, at 12:00 noon (EST)

Deadline for Objections to Assumption and Assignment: February 5, 2009, at 4:00p.m. (EST)

Hearing Date on Approval of Sale: February 6, 2009, at 9:00a.m. (EST)

NOTICE OF AUCTION AND SALE HEARING PURSUANT TO ORDER

(A) APPROVING SALE PROCEDURES AND BID PROTECTIONS, INCLUDING

BREAK-UP FEE(S), IN CONNECTION WITH SALE OF SUBSTANTIALLY ALL

ASSETS; (B) SCHEDULING AN AUCTION FOR AND HEARING TO APPROVE ONE

OR MORE SALES; (C) APPROVING NOTICE OF RESPECTIVE DATE, TIME AND

PLACE FOR AUCTION AND FOR HEARING ON APPROVAL OF SALE(S)

PLEASE TAKE NOTICE THAT on December 28,2008, eToys Direct 1, LLC, et al.,

the above-captioned debtors and debtors-in-possession (collectively, the "Debtors"), each filed a

voluntary petition for relief under chapter 11 of Title 11 of the Bankruptcy Code.

PLEASE TAKE FURTHER NOTICE THAT on January 16,2009, pursuant to a

motion filed by the Debtors dated January 2, 2009 (the "Motion"),

2

the United States Bankruptcy

Court for the District of Delaware (the "Bankruptcy Court") entered an Order (A) Approving

Sale Procedures and Bid Protections, Including Break-Up Fee(s), in Connection With Sale of

Substantially All Assets; (B) Scheduling an Auction for and Hearing to Approve One or More

Sales; (C) Approving Notice of Respective Date, Time and Place For Auction and for Hearing on

Approval OfSale(s) (the "Sale Procedures Order") approving the Sale Procedures annexed

hereto as Exhibit 1.

1

The Debtors in these cases, along with the last four digits of each Debtors' federal tax identification number, if

applicable, are: eToys Direct 1, LLC (N/A); The Parent Company (7093); BabyUniverse, Inc. (7990); Dreamtime

Baby, Inc. (8047); eToys Direct, Inc. (7296); PoshTots, Inc. (8660); eToys Direct 2, LLC (N/A); eToys Direct 3,

LLC (N/A); Gift Acquisition, L.L.C. (0297); and My Twinn, Inc. (1842). The address for each of the Debtors is 717

17th Street, Suite 1300, Denver, CO 80202, with the exception of Posh Tots, Inc., the address for which is 5500 Cox

Road, Suite M, Glenn Allen, VA 23060. Unless otherwise defined, capitalized terms used herein have the meaning

ascribed to them in the Motion.

2

Capitalized terms used in this Notice but not defined shall have the meanings given to them in the Motion.

68781-001\DOCS_DE: 144013.7

PLEASE TAKE FURTHER NOTICE that the Debtors will deliver a copy of the Sale

Procedures Order and/or the Motion to you by facsimile, e-mail, or overnight delivery if you fax

a written request for such delivery to Michael R. Seidl, Esquire, at Pachulski Stang Ziehl &

Jones LLP, 919 North Market Street, 1 th Floor, Wilmington, Delaware 19801, facsimile number

302-652-4400 or request a copy by e-mail to mseidl@pszilaw.com. Such request must specify

how the information is to be transmitted.

PLEASE TAKE FURTHER NOTICE that the Debtors will seek entry of a second

order (the "Sale Order") at a hearing to be held on February 6, 2009, at 9:00a.m. (EST) (the

"Sale Hearing") to, among other things, (a) authorize the Debtors to sell substantially all Assets,

free and clear of liens, claims, and encumbrances, (b) consider and approve the transaction(s)

contemplated by the Successful Bid(s) selected by the Debtors at the Auction, and (c) assume

and assign executory contracts and unexpired leases of nonresidential real property. The Sale

Hearing may be adjourned from time to time without further notice except by

announcement of the adjourned date or dates at the hearing or any adjournment thereof.

PLEASE TAKE FURTHER NOTICE THAT, in accordance with the Sale

Procedures, among other things, (a) interested parties will have the opportunity to make

competing offers to either purchase, or consummate some other transaction with respect to all

or a portion of the assets of the Debtors or to serve as the Debtors' liquidation agent, and

(b) the Debtors will select the highest or best bid(s) and seek approval from the Bankruptcy

Court of the entity submitting such bid(s). The Sale Procedures should be reviewed

carefully as they contain detailed requirements for the submission of all bids and the

conduct of the Auction.

PLEASE TAKE FURTHER NOTICE THAT, pursuant to the Sale Procedures, the

Auction will be conducted at the offices ofPachulski Stang Ziehl & Jones LLP, 919 North

Market Street, 17th Floor, Wilmington, DE 19899, commencing on February 4, 2009, at

10:00 a.m. (EST). The Auction may be adjourned from time to time without further

notice except by announcement of the adjourned date or dates at the Auction or any

adjournment thereof.

PLEASE TAKE FURTHER NOTICE THAT objections to the sale of the Assets

on the terms requested in the Motion shall be set forth in writing and shall specify with

particularity the grounds for such objections or other statements of position and shall be

electronically filed with the Court on or before January 30, 2009, at 5:00p.m. (EST), and

shall be served so as to be received by that same date and time on ((a) counsel to the Debtors

- (i) Pachulski Stang Ziehl & Jones LLP, 10100 Santa Monica Blvd., Suite 1100, Los

Angeles, CA 90067, Attn: Jeffrey W. Dulberg, Esq., fax (310) 201-0760, e-mail:

jdulberg@pszjlaw.com, and (ii) Pachulski Stang Ziehl & Jones LLP, 919 North Market

Street, 1 ih Floor, P.O. Box 8705, Wilmington, DE 19899-8705, Attn: Laura Davis Jones,

Esq., fax (302) 652-4400, e-mail: ljones@pszjlaw.com; (b) counsel to the Lender- (i) Klee,

Tuchin, Bogdanoff & Stem LLP, 1999 Avenue of the Stars, 39th Floor, Los Angeles, CA

90067, Attn: Michael L. Tuchin, Esq., fax (310) 407-9090, e-mail: mtuchin@ktbslaw.com,

and (ii) Richards, Layton & Finger, P.A., One Rodney Square, 920 North King Street,

Wilmington, DE 19801, Attn: Daniel J. DeFranceschi, Esq., fax (302) 651-7701, e-mail:

68781-00I\DOCS_DE:l44013.7 2

defranceschi@RLF.com; (c) counsel to the Committee, (i) Arent Fox LLP, 1675 Broadway,

New York, NY 10019, Attn: Schuyler G. Carroll, Esq., fax (212) 484-3990, e-mail:

carroll.schuyler@arentfox.com, and (ii) Elliott Greenleaf, 1000 West Street, Suite 1440,

Wilmington, DE 19801, Attn: Rafael X. Zahralddin-Aravena, Esq., fax (302) 384-9399, e-

mail: rxza@elliottgreenleaf.com; and (d) the Office ofthe United States Trustee, J. Caleb

Boggs Federal Building, 844 King Street, Suite 2207, Wilmington, DE 19801, Attn: David

Buchbinder, Esq., fax (302) 573-6497, e-mail: David.L.Buchbinder@usdoj.gov; provided,

however, that parties may file and serve objections to any matters relating to the conducting

of the Auction, including, but not limited to, the Debtors' determinations of which bid was a

Qualified Bid, which bid was the Successful Bid or the manner in which the Auction was

conducted, on or before 12:00 noon (EST) on February 5, 2009.

PLEASE TAKE FURTHER NOTICE that the failure of any person or entity, other

than the Lender and the Debtors' pre-petition lenders, to timely file its objection shall be a

bar to the assertion at the Sale Hearing or thereafter, of any objection to approval of the sale

to the Successful Bidder(s) on such terms, or consummation and performance of the purchase

agreement with the Successful Bidder(s), including the transfer of the Assets free and clear of

all Interests pursuant to section 365(f) of the Bankruptcy Code, any good faith finding with

respect to the Successful Bidder(s) under section 363(m), and the sale of the Assignable

Contracts and Leases and the Intellectual Property, and the exercise of those rights by the

Successful Bidder(s) under section 365 ofthe Bankruptcy Code, and shall be deemed a

consent to such transfer, if authorized by the Court.

PLEASE TAKE FURTHER NOTICE that this Auction and Sale Hearing Notice is

subject to the full terms and conditions of the Motion, Sale Procedures Order and Sale

Procedures which shall control in the event of any conflict and the Debtors encourage parties in

interest to review such documents in their entirety, which are available upon written request from

undersigned counsel.

Dated: January 2Q., 2009

68781-001\DOCS_DE: 144013.7

~

~

Jeffrey W. Dulberg (CA Bar No. 181200)

Michael R. Seidl (Bar No. 3889)

919 N. Market Street, 17th Floor

Wilmington, DE 19801

Telephone: 302/652-4100

Facsimile: 302/652-4400

Email: ljones@pszjlaw.com

jdulberg@pszjlaw.com

mseidl@pszjlaw.com

[Proposed] Counsel for eToys Direct 1, LLC, et al.,

Debtors and Debtors in Possession

3

EXHIBIT 1

Sale And Bid Procedures*

a. The Assets shall be sold free and clear of all liens, claims and encumbrances,

other than any liabilities for future performance under Assignable Contracts and Leases, in

accordance with section 363(b) & (t) and section 365 of the Bankruptcy Code, with all then-

existing liens, claims, and encumbrances (collectively "Interests") (i) to attach to the net

proceeds of the sale of the Assets with the same validity and priority as existed prior to the sale

(the Lender to be paid in cash at closing) or (ii) to be paid in full.

b. The Debtors will provide parties interested in acquiring the Assets ("Potential

Purchasers") with reasonable access to their books, records, facilities, key personnel, officers,

independent accoWltants and legal COWlsel for the purpose of conducting due diligence. The

Debtors shall not be required to provide confidential or proprietary information to a Potential

Purchaser if the Debtors (after consultation with the Lender) reasonably believe that such

disclosure would be detrimental to the interests of the Debtors. Prior to being permitted to

conduct any due diligence, a Potential Purchaser may be required to execute a non-disclosure

agreement in fonn and substance satisfactory to the Debtors.

c. Bids will be accepted for the purchase of the Assets as a going concern, or other

transaction respecting the Assets, or to act as liquidation agent to the Debtors. Bids may be for

all or a portion of the Assets. Bids must be in writing and must be submitted so that they are

actua1ly received by (a) counsel to the Debtors- (i) Pachulski Stang Ziehl & Jones LLP, 10100

Santa Monica Blvd., Suite 1100, Los Angeles, CA 90067, Attn: Jeffrey W. Dulberg, Esq . fax

(310) 201-0760, e-mail: jdulberg@pszjlaw.com, and (ii) Pachulski Stang Ziehl & Jones LLP,

919 North Market Street, 17th Floor, P.O. Box 8705, Wilmington, DE 198998705, Attn: Laura

Davis Jones, Esq., fax (302) 652A400, e-mail: ljones@pszjlaw.com; (b) counsel to the Lender-

(i) Klee, Tuchin, Bogdanoff & Stern LLP, 1999 Avenue of the Stars, 39th Floor, Los Angeles,

CA 90067, Attn: Michael L. Tuchin, Esq., fax (310) 407-9090, e-mail: mtuchin@ktbslaw.com,

and (ii) Richards, Layton & Finger, P.A., One Rodney Square, 920 North King Street,

Wilmington, DE 19801, Attn: Daniel J. DeFranceschi, Esq., fax (302) 651-7701, e-mail:

defranceschi@RLF.com; and (c) counsel to the Committee- (i) Arent Fox LLP, 1675

Broadway, New York, NY 10019, Attn: Schuyler G. Carroll, Esq., fax (212) 484-3990, e-mail:

carroll.schuyler@arentfox.com, and (ii) Elliott Greenleaf, 1000 West Street, Suite 1440,

Wilmington, DE 19801, Attn: Rafael X. Zahralddin-Aravena, Esq., fax (302) 384-9399, e-mail:

rxza@elliottgreenleaf.com by no later than 5:00p.m. (EST), on February 2, 2009.

d. Bids shall

(1) include an executed purchase agreement (a "Purchase Agreement") and/or

an executed agency agreement standard tor use by liquidators in the

industry (an '"Agency Agreement");

Capitalized tenns used herein that are not otherwise defined have the meaning ascribed to them in the Debtors'

Sale Procedures I Sale Approval Motion filed January 2, 2009, and which will be made available upon written

request made to Debtors' counsel.

68781-001\DOCS_OE;\440\j,)

(2) provide that the bidding Potential Purchaser (each a "Bidder'') is prepared

to enter into and consummate the transaction upon the entry of the Sale

Order;

(3) not be subject to, or conditioned on, and not contain any material

contingencies to the validity, effectiveness, and/or binding nature of the

bid, including, without limitation, contingencies for financing, due

diligence, or

(4) state that such Bidder is prepared to abide by the Sale Procedures; and

(5) provide that the purchase price shall be paid in full in cash or immediately

available funds at closing.

(e) A bid shall also be accompanied by a deposit in the amount often percent (10%)

of the purchase price, in the fonn of a bank wire (instructions to be provided) or bank check

(made out to "Pachulski Stang Ziehl & Jones, LLP Trust Account for the benefit of The Parent

Co.'') (the "Deposit"). In addition, a bid must contain information, acceptable to the Debtors and

the Lender, in consultation with the Committee, which demonstrates that the Bidder (i) has

sufficient cash on hand or a binding financial commitment from an established and financially

sound financial institution to ensure such Bidder's ability to meet its commitments purSuant to its

bid and to close the transaction within the time frame established, and (ii) has the legal capacity

to complete the Sale.

(f) A bid must also be accompanied by sufficient indicia that the person submitting

the bid is legally empoweredt by power of attorney or otherwise, and financially capable to

(i) bid on behalf of the Bidder, and (ii) complete and sign, on behalf of the Bidder, a binding and

enforceable asset purchase agreement.

(g) The Debtors and the Lender, in consultation with the Committee, shall detennine

whether a bid has satjsfied all the conditions set forth above. Any bid that satisfies such

conditions shall be deemed a "Qualified Bid" and the maker of such bid, a "Qualified Bidder,.,

(h) The Auction will be conducted at the offices of Pachulski Stang Ziehl & Jones

LLP, 919 N. Market Street, 17th Floor, Wilmington, DE 19899, or at another location as may be

timely disclosed by the Debtors to Qualified Bidders, on February 4, 2009, at 10:00 a.m. (EST)

(the "Auction Date"). Only Qualified Bidders, the Debtors, the Lender, and the Committee will

be permitted to participate in and/or make any statements on the record at the Auction. All

Qualified Bidders must appear in person at the Auction, or through a duly authorized

representative. If multiple Qualifying Bids satisfYing all Auction requirements are received,

each such Qualified Bidder shall have the right to continue to improve its bid at the Auction.

The Auction will be an 'open format' such that all participants are contemporaneously to be

made aware of the particulars of any Qualified Bids that are submitted. The Debtors reserve the

right, in consultation with the Lender and the Committee, to (i) auction the Assets in one or more

lots, (ii) impose additional tenns and conditions at or prior to the Auction, including, but not

limited to, extending the deadlines set forth in the Sale Procedures, (iii) adjourn or cancel the

Auction at any time without further notice and/or seek to move forward with a private sale, and

68781-00I\DOCS_OE;I44013.5 2

(iv) reject any or all Qualified Bids that, in the Debtors' reasonable business judgment, after

consultation with the Lender. are not for a fair and adequate price or the acceptance of which

would otherwise not be in the best interests of the estates.

(i) The Debtors may conduct the Auction in all respects in the manner that the

Debtors, in consultation with the Lender and the Committee. detennine will result in the highest,

best or otherwise financially superior offer(s) for the Assets provided that such manner is not

inconsistent with the provisions of the Bankruptcy Code. At the conclusion of the Auction, and

subject to Bankruptcy Court approval following the Auction, the successful Qualified Bid(s)

shall be selected by the Debtors in consultation with the Lender and the Committee (the

"Successful Bid(s)").

(j) Promptly following the conclusion of the Auction, the Successful Bidder(s),

consisting of the entity that made a Successful Bid(s), or the entities that together made the

Successful Bids, shall complete and sign all agreements, contracts, instruments or other

documents evidencing and containing the terms and conditions upon which such bid was made.

Promptly following the conclusion of the Auction, the Debtors shall cause to be posted upon the

web site of their claims agent, www.omnimgt.com/etoys, the results ofthe Auctiont the identity

of any Successful Bidder(s), and information provided by any Successful Bidder(s) as adequate

assurance of future performance within the meaning of 11 U.S.C. 365(f)(2)(B) of any

Assignable Contracts and Leases to be assumed and assigned to such Successful Bidder(s).

(k) The second highest bidder(s) for the Assets (including, if applicable, the high

bidder for any portion thereof) may be required by the Debtors to sign such agreements,

contracts, instruments or other docwnentsfor such bid(s) as back-up bid(s) open for 15 days

pending closing with the Successful Bidder(s). If closing with the Successful Bidder(s) is not

completed within 15 days of Bankruptcy Court approval of the Auction, then the Debtors, in

consultation with the Lender and the Committee, may elect to sell to such second hirest back-

up bidder(s), who will be obligated to complete the closing of its purchase by the 10 day

following its selection by the Debtors (with the consent of the Lender) as the new Successful

Bidder.

(1) The Debtors intend to solicit "stalking horse" bids for the Assets prior to the

Auction. Recognizing a Stalking Horse Bidder's expenditure of time, energy and resources, and

that the stalking horse provides a floor bid with respect to the Assets that it offers to purchase,

the Debtors propose to provide certain bidding protections to those Potential Purchasers, if any,

selected as stalking horse bidders (each a "Stalking Horse Bidder") by the Debtors in their sole

discretion, in consultation with the Lender and the Committee, subject to further approval and

order of the Bankruptcy Court.

(m) The Debtors may agree to pay a Stalking Horse Bidder a break-up fee in the

amount ofup to 3.0% of the purchase price offered by such Stalking Horse Bidder, in cash or

other immediately available good funds in the event that: (i). the Stalking Horse Bidder is not

approved by the Bankruptcy Court as the purchaser of the Assets on which it bid (ii) the Stalking

Horse Bidder is not in default of its obligations under the purchase agreement with it and (iii) the

Assets on which it bid are thereafter sold to a Successful Bidder(s) at the Auction for

68781 ..QOI\DOCS_DE:l44()JJ.S 3

consideration in excess of the purchase price provided for in the purchase agreement with the

Stalking Horse Bidder notwithstanding the Stalking Horse willingness and ability to

consummate the transactions contemplated by the purchase agreement, which payment shall be

made to the Stalking Horse Bidder promptly following closing with the Successful Purchaser(s)

of the Assets on which the Stalking Horse Bidder bid (the "Break-Up Fee"); provided that in no

event shall any Break-Up Fee be paid to any Stalking Horse Bidder absent further order of the

Bankruptcy Court.

(n) In the event a Stalking Horse Bidder is designated and approved by the

Bankruptcy Court, any bid(s) submitted by a party or parties other than the Stalking Horse

Bidder must be in an amount that is sufficient to pay the Break-Up Fee and result in additional

consideration to the Debtors' estates (as compared to the purchase price offered by such Stalking

Horse Bidder), after payment of the Break-Up Fee, in an amount determined by the Debtors, in

consultation with the Lender and the Committee. in their sole and absolute discretion. Such

amount may include an initial minimum bid increment and the Debtors may require subsequent

minimum bid increments for any further bids.

(o) The Sale Hearing will be held before the Honorable Brendan L. Shannon, United

States Bankruptcy Judge, on February 6, 2009, at 9:00a.m. (EST) or at such time thereafter as

counsel may be heard. The Sale(s) of the Assets will be subject to, among other things, the entry

of the Sale Order by the Bankruptcy Court approving the Sale(s). The Sale Hearing may be

adjourned from time to time without further notice to creditors or parties in interest other than by

announcement of the adjoununent in open court or on the Bankruptcy Court's calendar on the

date scheduled for the Sale Hearing or any adjourned date.

(p) Deposits of all Qualified Bidders shall be held until the third day after the Sale

Order is entered, after which time the Deposits of the non-Successful Bidder(s) other than those

of the back-up bidder(s) shall be returned. If the Successful Bidder(s) fail to consummate a

Bankruptcy Court-approved Sale because of a material breach or failure to perfonn on the part of

such Successful Bidder(s), the Debtors shall be entitled to retain the Deposit(s) of each

Successful Bidder, in addition to any other legal or equitable remedies that may be available

under applicable law.

(q) The closing shall take place at the offices ofPachulski Stang Ziehl & Jones, LLP,

919 N. Market Street, 17th Floor, Wilmington, DEl 9899 on or before February 13, 2009 (the

uoutside Date"). In the event the conditions to closing set forth in any Agreement executed by

the Debtors and a Successful Bidder have not been satisfied or waived by the Outside Date, then

any party who is not in default may terminate the Agreement. Alternatively, the parties may,

subject to the consent of the Lender, mutually agree to an extended Closing Date. Until any

Agrer:ment is either terminated or the parties have agreed upon an extended Closing the

parties shall diligently continue to work to satisfy ali- conditions to Closing and the transaction

contemplated therein shall close as soon as such conditions are satisfied or waived.

6878l..QOl\DOCS_DE:I440l3.5 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- scx4521f SeriesDocument173 pagesscx4521f SeriesVuleticJovanNo ratings yet

- How To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkDocument13 pagesHow To Unbrick Tp-Link Wifi Router Wr841Nd Using TFTP and WiresharkdanielNo ratings yet

- Global Review Solar Tower Technology PDFDocument43 pagesGlobal Review Solar Tower Technology PDFmohit tailorNo ratings yet

- Surge Arrester: Technical DataDocument5 pagesSurge Arrester: Technical Datamaruf048No ratings yet

- Stainless Steel 1.4404 316lDocument3 pagesStainless Steel 1.4404 316lDilipSinghNo ratings yet

- Change Language DynamicallyDocument3 pagesChange Language DynamicallySinan YıldızNo ratings yet

- DC0002A Lhires III Assembling Procedure EnglishDocument17 pagesDC0002A Lhires III Assembling Procedure EnglishНикола ЉубичићNo ratings yet

- Bondoc Vs PinedaDocument3 pagesBondoc Vs PinedaMa Gabriellen Quijada-TabuñagNo ratings yet

- Unit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARDocument9 pagesUnit 10-Maintain Knowledge of Improvements To Influence Health and Safety Practice ARAshraf EL WardajiNo ratings yet

- Supply Chain Risk Management: Resilience and Business ContinuityDocument27 pagesSupply Chain Risk Management: Resilience and Business ContinuityHope VillonNo ratings yet

- Sena BrochureDocument5 pagesSena BrochureNICOLAS GUERRERO ARANGONo ratings yet

- Yamaha F200 Maintenance ScheduleDocument2 pagesYamaha F200 Maintenance ScheduleGrady SandersNo ratings yet

- Consultancy Services For The Feasibility Study of A Second Runway at SSR International AirportDocument6 pagesConsultancy Services For The Feasibility Study of A Second Runway at SSR International AirportNitish RamdaworNo ratings yet

- 3.1 Radiation in Class Exercises IIDocument2 pages3.1 Radiation in Class Exercises IIPabloNo ratings yet

- Jainithesh - Docx CorrectedDocument54 pagesJainithesh - Docx CorrectedBala MuruganNo ratings yet

- Irrig in AfricaDocument64 pagesIrrig in Africaer viNo ratings yet

- Qa-St User and Service ManualDocument46 pagesQa-St User and Service ManualNelson Hurtado LopezNo ratings yet

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Document6 pagesType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheNo ratings yet

- Review Questions Financial Accounting and Reporting PART 1Document3 pagesReview Questions Financial Accounting and Reporting PART 1Claire BarbaNo ratings yet

- Relationship Between Principal Leadership Skills and Teachers' Organizational Citizenship BehaviourDocument16 pagesRelationship Between Principal Leadership Skills and Teachers' Organizational Citizenship BehaviourToe ToeNo ratings yet

- Computerized AccountingDocument14 pagesComputerized Accountinglayyah2013No ratings yet

- GSMDocument11 pagesGSMLinduxNo ratings yet

- A Varactor Tuned Indoor Loop AntennaDocument12 pagesA Varactor Tuned Indoor Loop Antennabayman66No ratings yet

- 19-2 Clericis LaicosDocument3 pages19-2 Clericis LaicosC C Bờm BờmNo ratings yet

- Lps - Config Doc of Fm-BcsDocument37 pagesLps - Config Doc of Fm-Bcsraj01072007No ratings yet

- Karmex 80df Diuron MsdsDocument9 pagesKarmex 80df Diuron MsdsSouth Santee Aquaculture100% (1)

- HW4 Fa17Document4 pagesHW4 Fa17mikeiscool133No ratings yet

- Vylto Seed DeckDocument17 pagesVylto Seed DeckBear MatthewsNo ratings yet

- Shares and Share CapitalDocument50 pagesShares and Share CapitalSteve Nteful100% (1)

- Database Management System and SQL CommandsDocument3 pagesDatabase Management System and SQL Commandsdev guptaNo ratings yet