Professional Documents

Culture Documents

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Uploaded by

Chapter 11 DocketsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In The United States Bankruptcy Court Eastern District of Michigan Southern Division

Uploaded by

Chapter 11 DocketsCopyright:

Available Formats

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION,

et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

THE COLLINS & AIKMAN POST-CONSUMMATION TRUSTS FIRST OMNIBUS OBJECTION TO CLAIMS (DUPLICATE CLAIMS) The Collins & Aikman Post-Consummation Trust (the Trust), as successor to the above-captioned Debtors (collectively, the Debtors) pursuant to the First Amended Joint Plan of Reorganization of Collins & Aikman Corporation and its Debtor Subsidiaries as confirmed by order of the Bankruptcy Court, hereby files this omnibus objection (the First Omnibus Objection) to the claims listed on Exhibit B as Duplicate Claims and request the entry of an order, substantially in the form of Exhibit A, disallowing the Duplicate Claims that are listed on

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

0W[;(!1

0555927080117000000000002

"J

Exhibit B.

Pursuant to Rule 3007(e)(1) of the Federal Rules of Bankruptcy Procedure,

Claimants receiving this First Omnibus Objection should locate their names and claims in the objection and the attached exhibits. In support of the First Omnibus Objection, the Trust respectfully represents as follows: Jurisdiction 1. The Court has subject matter jurisdiction to consider and determine the First

Omnibus Objection pursuant to Paragraph 41(a) of the Order Confirming First Amended Joint Plan Of Collins & Aikman Corporation And Its Debtor Subsidiaries (the Order). 2. 3. Venue is proper before the Court pursuant to 28 U.S.C. 1408 and 1409. The statutory basis for the relief requested by the First Omnibus Objection is

section 502 of the Bankruptcy Code, 11 U.S.C. 101-1330 and Rule 3007 of the Federal Rules of Bankruptcy Procedure. Background 4. On July 9, 2007, Debtors filed the First Amended Joint Plan of Collins & Aikman

Corporation and Its Debtor Subsidiaries (the Plan). 5. On July 18, 2007, the Court entered the Order confirming the Plan. The Order

provided the mechanism by which claimants would submit claims and the process by which the Trust would File, settle, compromise, withdraw or litigate to judgment objections to Claims. (Order at 38.) Thus, consistent with the Orders directive regarding disposition of the Claims, this First Omnibus Objection is timely filed. (Order at 49.) Objection to Duplicate Claims 6. The Debtors are in the process of reviewing and evaluating the claims that have

been filed against them. In that process, a number of duplicate claims have been identified. (Ex.

B.)

Debtors have concluded that each such proof of claim is an exact duplicate of the

corresponding proof of claim identified as a surviving claim on Exhibit B. The Duplicate Claims were filed against the same Debtors for the same dollar amount on account of the same obligation. Thus, it appears that the claimant inadvertently filed the same proof of claim more than once or the clerk may have inadvertently docketed both the originals and copies as separate claims. To adjust the claims database to reflect the correct liabilities to the claimants, the Debtors request that the Court disallow the duplicate claims. Because this objection to the duplicate claims does not constitute an objection to the surviving claims indicated on Exhibit B, the Debtors reserve the right to object to such surviving claims on any grounds whatsoever. Notice 7. Pursuant to Article VII.A.1 of the Plan, the First Omnibus Objection (with

exhibits) and a notice thereof will be served upon the Holders of such Claims and the United States Trustee.2 A copy of the First Omnibus Objection has also been filed with the CM/ECF system which will serve a copy of this pleading on all attorneys registered to receive such filings. 8. No prior request for the relief sought in the First Omnibus Objection has been

made to this or any other Court.

2 Capitalized terms used in this paragraph not otherwise defined herein shall have the meanings set forth in the Plan and the Order.

WHEREFORE, the Trust respectfully requests entry of an order, substantially in the form attached hereto as Exhibit A, (a) disallowing the Duplicate Claims identified on Exhibit B; and (b) granting such other and further relief as is just and proper. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Post Consummation Trust

Dated: January 17, 2008

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

NOTICE AND OPPORTUNITY TO RESPOND TO THE COLLINS & AIKMAN POST-CONSUMMATION TRUSTS FIRST OMNIBUS OBJECTION TO CLAIMS (DUPLICATE CLAIMS) PLEASE TAKE NOTICE THAT the Collins & Aikman Post-Consummation Trust (the Trust), as successor to the above-captioned Debtors (collectively, the Debtors) pursuant to the First Amended Joint Plan of Reorganization of Collins & Aikman Corporation and its Debtor Subsidiaries as confirmed by the order of the Bankruptcy Court, have filed its First Omnibus Objection to Claims (Duplicate Claims) (the First Omnibus Objection).

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

PLEASE TAKE FURTHER NOTICE THAT your rights may be affected. Pursuant to Rule 3007(e)(1) of the Federal Rules of Bankruptcy Procedure, Claimants receiving this First Omnibus Objection should locate their names and claims in the objection and the attached exhibits. You may wish to review the Objection and discuss it with your attorney, if you have one in these cases. If you do not have an attorney, you may wish to consult one. PLEASE TAKE FURTHER NOTICE THAT if you wish to object to the Court granting the relief sought in the First Omnibus Objection, or if you want the Court to otherwise consider your views on the Objection, no later than February 1, 2008, or such shorter time as the Court may order and of which you may receive subsequent notices, you or your attorney must file with the Court a written response explaining your position at: United States Bankruptcy Court 211 West Fort Street, Suite 2100 Detroit, Michigan 48226 PLEASE TAKE FURTHER NOTICE THAT if you mail your response to the Court for filing, you must mail it early enough so the Court will receive it on or before the date above. PLEASE TAKE FURTHER NOTICE THAT you must also serve your response so that it is received on or before February 1, 2008 by the undersigned attorney.

PLEASE TAKE FURTHER NOTICE THAT if no response to the Objection is timely filed and served, the Court may grant the Objection and enter the order without a hearing as set forth in Rule 9014-1 of the Local Rules for the United States Bankruptcy Court for the Eastern District of Michigan. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Post Consummation Trust

Dated: January 17, 2008

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

NOTICE OF HEARING PLEASE TAKE NOTICE that a hearing on The Collins & Aikman Post-Consummation Trusts (the Trust) First Omnibus Objection to Claims (the First Omnibus Objection) is scheduled to be heard before the Honorable Steven W. Rhodes on February 21, 2008 at 2:00 p.m., or as soon thereafter as counsel may be heard, in his courtroom in the United States Bankruptcy Court, 211 West Fort Street, Detroit, Michigan 48226. PLEASE TAKE FURTHER NOTICE that the February 21, 2008 hearing (the Hearing) may be adjourned thereafter from time to time without further notice to claimants and other

1

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

parties in interest other than the announcement of the adjourned date at the Hearing or any other hearing thereafter. PLEASE TAKE FURTHER NOTICE that you need not appear at the Hearing if you do not object to the relief requested in the First Omnibus Objection. PLEASE TAKE FURTHER NOTICE that if no responses to the First Omnibus Objection are timely filed and served, the Court may grant the First Omnibus Objection and enter the order without a hearing as set forth in Rule 9014-1 of the Local Rules for the United States Bankruptcy Court for the Eastern District of Michigan. Respectfully submitted, BOYLE BURDETT By:s/H. William Burdett, Jr. Eugene H. Boyle, Jr. (P42023) H. William Burdett, Jr. (P63185) 14950 East Jefferson, Suite 200 Grosse Pointe Park, Michigan 48230 (313) 344-4000 (313) 344-4001 (facsimile) burdett@boyleburdett.com Attorneys for the Collins & Aikman Post Consummation Trust

Dated: January 17, 2008

EXHIBIT A

IN THE UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) ) COLLINS & AIKMAN CORPORATION, et al.1 ) ) Debtors. ) ) ) ) ) ) _________________________________________) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) (Tax Identification #13-3489233) Honorable Steven W. Rhodes

ORDER GRANTING THE COLLINS & AIKMAN POST-CONSUMMATION TRUSTS FIRST OMNIBUS OBJECTION TO CLAIMS (DUPLICATE CLAIMS) Upon the Collins & Aikman Post-Consummation Trusts (the Trust) First Omnibus Objection, dated January 17, 2008; and upon consideration of the supporting papers and the files and records in these cases and upon the arguments and testimony presented at a hearing before the Court; and any responses to the First Omnibus Objection having been withdrawn or overruled on the merits; and it appearing that the Court has jurisdiction over the subject matter of the First Omnibus Objection and the relief requested therein; and it appearing that notice of the

The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 0555991; Collins & Aikman Automotive Exteriors, Inc. (f/k/a Textron Automotive Exteriors, Inc.), Case No. 05-55958; Collins & Aikman Automotive Interiors, Inc. (f/k/a Textron Automotive Interiors, Inc.), Case No. 05-55956; Collins & Aikman Automotive International, Inc., Case No. 05-55980; Collins & Aikman Automotive International Services, Inc. (f/k/a Textron Automotive International Services, Inc.), Case No. 05-55985; Collins & Aikman Automotive Mats, LLC, Case No. 05-55969; Collins & Aikman Automotive Overseas Investment, Inc. (f/k/a Textron Automotive Overseas Investment, Inc.), Case No. 05-55978; Collins & Aikman Automotive Services, LLC, Case No. 05-55981; Collins & Aikman Canada Domestic Holding Company, Case No. 05-55930; Collins & Aikman Carpet & Acoustics (MI), Inc., Case No. 05-55982; Collins & Aikman Carpet & Acoustics (TN), Inc., Case No. 05-55984; Collins & Aikman Development Company, Case No. 05-55943; Collins & Aikman Europe, Inc., Case No. 05-55971; Collins & Aikman Fabrics, Inc. (d/b/a Joan Automotive Industries, Inc.), Case No. 05-55963; Collins & Aikman Intellimold, Inc. (d/b/a M&C Advanced Processes, Inc.), Case No. 05-55976; Collins & Aikman Interiors, Inc., Case No. 05-55970; Collins & Aikman International Corporation, Case No. 05-55951; Collins & Aikman Plastics, Inc., Case No. 05-55960; Collins & Aikman Products Co., Case No. 05-55932; Collins & Aikman Properties, Inc., Case No. 0555964; Comet Acoustics, Inc., Case No. 05-55972; CW Management Corporation, Case No. 05-55979; Dura Convertible Systems, Inc., Case No. 05-55942; Gamble Development Company, Case No. 05-55974; JPS Automotive, Inc. (d/b/a PACJ, Inc.), Case No. 05-55935; New Baltimore Holdings, LLC, Case No. 05-55992; Owosso Thermal Forming, LLC, Case No. 05-55946; Southwest Laminates, Inc. (d/b/a Southwest Fabric Laminators Inc.), Case No. 05-55948; Wickes Asset Management, Inc., Case No. 05-55962; and Wickes Manufacturing Company, Case No. 05-55968.

First Omnibus Objection was sufficient and no other or further notice need be provided; and after due deliberation and sufficient cause appearing therefore, it is ORDERED: 1. 2. The First Omnibus Objection is granted in its entirety. The Duplicate Claims identified on Exhibit B to the First Omnibus Objection are

disallowed for all purposes. The Surviving Claims identified on Exhibit B to the First Omnibus Objection remain unaffected by this Order. This Order is without prejudice to the Trusts right to object to the Surviving Claims identified on Exhibit B to the First Omnibus Objection on any ground whatsoever. 3. 4. This Order is effective without further action of the Debtors and the claimants. The Debtors, the Trust, and Kurtzman Carson Consultants, LLC are authorized to

take all actions necessary to effectuate the relief granted pursuant to this Order in accordance with the First Omnibus Objection. 5. The terms and conditions of this Order shall be immediately effective and

enforceable upon its entry. 6. The Court retains jurisdiction with respect to all matters arising from or relating to

the implementation of this Order.

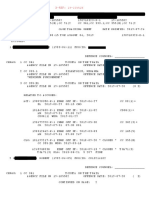

EXHIBIT B

Admin Claim Objections

Duplicative Claims

Reason for Disallowance Carolina Container Co 8822 Connell Equipment Leasing Co a Div of Connell Finance Co Inc Connell Equipment Leasing Co a Div of Connell Finance Co Inc 3162 Createc Corp 8814 Fischer America Inc 8821 Numatech Canada Inc 8818 SunGard Availability Svc LP 8724 SunGard Availability Svc LP Numatech Canada Inc Fischer America Inc $20,878.29 $20,878.29 $8,418.00 $8,418.00 $21,061.00 $21,061.00 Createc Corp $23,094.72 $23,094.72 Admin Admin Admin Admin Admin Admin Admin Admin Connell Equipment Leasing Co a Div of Connell Finance Co Inc $1,568.22 Admin $1,568.22 Admin $1,568.22 Admin Carolina Container Co $25,079.23 Admin $25,079.23 Admin

Claim # to be Claim # to disallowed survive Creditor Name Nature

Claim Amount

Debtor Name Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation Collins & Aikman Corporation

Duplicative Claim (Obj. at 2-3)

8811

Duplicative Claim (Obj. at 2-3)

2943

Duplicative Claim (Obj. at 2-3)

2733

Duplicative Claim (Obj. at 2-3)

8798

Duplicative Claim (Obj. at 2-3)

8779

Duplicative Claim (Obj. at 2-3)

8785

Duplicative Claim (Obj. at 2-3)

1196

In re Collins Aikman Corporation, et al. Case No. 05-55927 (SWR)

Page 1 of 1

1/17/2008 2:21 PM

You might also like

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument16 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument21 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument15 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument13 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument13 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument16 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument13 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument18 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument20 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument22 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument19 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionFrom EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- Core Values in Social WorkDocument5 pagesCore Values in Social Workjinnah kayNo ratings yet

- Batiquin vs. CADocument7 pagesBatiquin vs. CAWilfredNo ratings yet

- Annotated BibliographyDocument10 pagesAnnotated Bibliographyapi-269717223No ratings yet

- Back To Back ContractsDocument4 pagesBack To Back ContractshumaidjafriNo ratings yet

- 6 Sergio Products Inc. vs. Pci Leasing Case DigestDocument2 pages6 Sergio Products Inc. vs. Pci Leasing Case DigestElaine BercenioNo ratings yet

- Anti-Torture Act of 2009 RA 9745Document42 pagesAnti-Torture Act of 2009 RA 9745Lakan Bugtali100% (2)

- De OcampoDocument3 pagesDe Ocampovmanalo16No ratings yet

- Ra 4670 Magna Carta For Public School TeachersDocument8 pagesRa 4670 Magna Carta For Public School TeachersMary Claire De GuzmanNo ratings yet

- Alawi v. Alauya 268 SCRA 629Document1 pageAlawi v. Alauya 268 SCRA 629Mary Ann AntenorNo ratings yet

- NEGO Reviewer For Long QuizDocument7 pagesNEGO Reviewer For Long QuizJued CisnerosNo ratings yet

- Investigating The Existence and Effectiveness of Musical Copyright Law in LesothoDocument11 pagesInvestigating The Existence and Effectiveness of Musical Copyright Law in LesothoTakura BhilaNo ratings yet

- People V Mapan LeDocument2 pagesPeople V Mapan LeMaria Dariz AlbiolaNo ratings yet

- D READ This Understanding The Executor OfficeDocument27 pagesD READ This Understanding The Executor OfficeDean Golden100% (3)

- HOW TO WIN IN COURT & Corruption ExposedDocument15 pagesHOW TO WIN IN COURT & Corruption ExposedArlie Taylor100% (22)

- International Standby Practices: Institute of International Banking Law & Practice, IncDocument11 pagesInternational Standby Practices: Institute of International Banking Law & Practice, IncTran TungNo ratings yet

- Isc - Case 2 Androids Under Attack PresentationDocument7 pagesIsc - Case 2 Androids Under Attack PresentationPui Yan100% (1)

- Charges Upon and Obligations of The Conjugal PartnershipDocument13 pagesCharges Upon and Obligations of The Conjugal PartnershipSheie WiseNo ratings yet

- 190910323P1 Criminal Disclosure PackageDocument89 pages190910323P1 Criminal Disclosure PackageWes SwensonNo ratings yet

- Membership Reactivation FormDocument7 pagesMembership Reactivation Formrina0% (1)

- Orion Savings Bank V Suzuki 740 Scra 345Document10 pagesOrion Savings Bank V Suzuki 740 Scra 345Karen Joy MasapolNo ratings yet

- Plaintiffs Fail to Prove Authenticity of AllongesDocument14 pagesPlaintiffs Fail to Prove Authenticity of AllongesBeth Stoops Jacobson100% (1)

- 6 People vs. AcostaDocument13 pages6 People vs. AcostaJantzenNo ratings yet

- Fire Safety Certificate and Business Permit Year 2021Document2 pagesFire Safety Certificate and Business Permit Year 2021Janu MaglenteNo ratings yet

- Propertycases 476-501Document131 pagesPropertycases 476-501Ja VillaromanNo ratings yet

- People V LagonDocument8 pagesPeople V LagonKatrina Anne Layson Yeen100% (1)

- LaborDocument141 pagesLaborGian Paula MonghitNo ratings yet

- CTA upholds dismissal of VAT refund claimDocument11 pagesCTA upholds dismissal of VAT refund claimChennieNo ratings yet

- Export Agency Agreement 3Document5 pagesExport Agency Agreement 3roni_nr1415No ratings yet

- United States v. Hurtado, 10th Cir. (2016)Document3 pagesUnited States v. Hurtado, 10th Cir. (2016)Scribd Government DocsNo ratings yet

- Bolos v. Bolos GR 186400Document8 pagesBolos v. Bolos GR 186400AnonymousNo ratings yet