Professional Documents

Culture Documents

Exim Requirement2

Uploaded by

sadasalimOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exim Requirement2

Uploaded by

sadasalimCopyright:

Available Formats

Registration-Cum-Membership Certificate (RCMC)

RCMC means the certificate of registration and membership granted by an Export Promotion Council/ Commodity Board/ Development Authority or other competent authority as prescribed in the Foreign Trade Policy or Handbook (Vol.1). An exporter desiring to obtain a Registration-cum-Membership Certificate shall declare his main line of business in the application, which shall be made to the Export Promotion Council (EPC) relating to that line of business. However, a status holder has the option to obtain RCMC from Federation of Indian Exporters Organization (FIEO). The service exporters (except software service exporters) shall be required to obtain RCMC from FIEO.

List of few EPCs/Commodity Boards

Agricultural and Processed Food Products Export Development Authority (APEDA) Basic Chemicals, Pharmaceuticals & Cosmetics Export Promotion Council Chemicals and Allied Products Export Promotion Council (CAPEXIL) Coffee Board Coir Board Electronics and Computer Software Export Promotion Council (ESC) Engineering Export Promotion Council Export Promotion Council for EOUs and SEZ Units Federation of Indian Export Organisations (FIEO)

List of few EPCs/Commodity Boards

The Gem & Jewellery Export Promotion Council Export Promotion Council for Handicrafts The Handloom Export Promotion Council The Indian Silk Export Promotion Council Pharmaceutical Export Promotion Council The Rubber Board Spices Board Tea Board Tobacco Board Wool & Woollens Export Promotion Council

Registration with various Agencies

i. Registration for legal identity :Exporter has to get his organization registered under respective acts/authorities such as: A sole proprietor - The Shops and Establishments Act or take permission from local authorities, such as Municipal Corporation, if required. A partnership firm - Indian Partnership Act, 1932. A Joint stock company - Indian Companies Act, 1956 A Co-operative Society - The Co-operative Societies Act, 1912. A Trust - Indian Trust Act, 1882

Registration with various Agencies

ii. Registration for manufacturing activities a. Small Scale Industry b. Industrial Licensing c. Tiny Sector/Enterprises d. Khadi Village Industries Commission

Registration with various Agencies

iii. Registration with Central Excise Authorities:Goods meant for exports are exempt from Central Excise duty. To avail exemption from payment of excise duty on export goods, exporter has to obtain C.Excise Registration. There are two options to avail such benefit: a. Export under Rebate claim - Exporter has to pay excise duty at the time of clearance and on exportation can claim rebate of excise duty paid. b. Export under Bond - In this case goods are cleared under Bond and there is no need of payment of excise duty.

Registration with various Agencies

iv. Registration with the Customs Authorities (BIN) Exporters have to obtain PAN based Business Identification Number (BIN) from the DGFT prior to filing of shipping bill for clearance of export goods. Under the EDI System, PAN based BIN is received by the Customs System from the DGFT online. v. Registration with VAT Authorities Goods which are to be shipped out of the country for export are eligible for exemption from both VAT and Central Sales Tax for this registration with VAT Authorities is required.

Registration with various Agencies

vi. Registration with Service Tax Authorities Service tax is an indirect tax levied under the Finance Act, 1994. At present, there are approximately 96 categories of services taxable under the service tax net. Service Tax is levied at a uniform rate of 12% + 2% Education Cess + 1% Secondary and Higher Education Cess on services liable to service tax under Finance Bill 2007.

vi. How to quickly respond to overseas enquiries and how to project image? Strategy in Export and Import Correspondence When to reply Means of reply vii. Electronic Data Interchange (EDI) EDI is the modern mode of transfer of documents. It is direct electronic transmission, computer to computer of standard business forms such as purchase order, advance, shipping notices, invoices and the like between two organizations. Contd.

The five key elements of EDI are 1. Electronic Transmission, 2. Standards Business Documents, 3. Predefined format, 4. Business application and 5. Trading partner. It increases the profits by lowering the cost of the business process and increases the marketing share by providing an improved service to customers. The Indian Government has also fallen in line with the requirements of International Trade and has introduced computerized processing of documents in various matters relating to international trade. Contd.

EDI applications can help with their wide range of business application systems for different industries, which include: Application for trade permits from government agencies. Bidding for export quotas from regulatory bodies. Filing of corporate returns with relevant authorities. Submission of claims to insurance companies. Bill payment and collection with banks and financial institutions. Order placement and invoicing with trading partners.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- American Express Summer Internship ReportDocument56 pagesAmerican Express Summer Internship Reportsadasalim0% (1)

- Hi! Please Type TheDocument1 pageHi! Please Type ThesadasalimNo ratings yet

- ITR RefundDocument1 pageITR RefundsadasalimNo ratings yet

- Q3 1213Document4 pagesQ3 1213sadasalimNo ratings yet

- Best HR Practices - Great Place To WorkDocument4 pagesBest HR Practices - Great Place To WorkRCOOL_D13No ratings yet

- Hi! Please Type TheDocument1 pageHi! Please Type ThesadasalimNo ratings yet

- Ethical HackingDocument10 pagesEthical HackingRicardoZapataNo ratings yet

- Container SizesDocument1 pageContainer SizessadasalimNo ratings yet

- Holistic MarketingDocument24 pagesHolistic MarketingmyraNo ratings yet

- Hi! Please Type TheDocument1 pageHi! Please Type ThesadasalimNo ratings yet

- Hi! Please Type TheDocument1 pageHi! Please Type ThesadasalimNo ratings yet

- Brief History of Deposit Insurance in IndiaDocument6 pagesBrief History of Deposit Insurance in IndiasadasalimNo ratings yet

- Cloud ComputingDocument8 pagesCloud ComputingsadasalimNo ratings yet

- C. K Prahlad AchievemnetDocument1 pageC. K Prahlad AchievemnetsadasalimNo ratings yet

- Betu's DiaryDocument1 pageBetu's DiarysadasalimNo ratings yet

- C.K PrahladDocument14 pagesC.K PrahladsadasalimNo ratings yet

- NetworkingDocument6 pagesNetworkingsadasalimNo ratings yet

- TT Sem2Document3 pagesTT Sem2sadasalimNo ratings yet

- Name Number Email Name Number Email Sr. No. Company Name HR MarketingDocument3 pagesName Number Email Name Number Email Sr. No. Company Name HR MarketingsadasalimNo ratings yet

- Experimental Analysis 37 - 40Document6 pagesExperimental Analysis 37 - 40sadasalimNo ratings yet

- R20 International Trade and Capital Flows PDFDocument36 pagesR20 International Trade and Capital Flows PDFROSHNINo ratings yet

- To Be Printed On Letter Head (For CA / CC Account) : I) Export of Goods/ MaterialsDocument2 pagesTo Be Printed On Letter Head (For CA / CC Account) : I) Export of Goods/ Materialsrohanrajore00No ratings yet

- Chapter 12 - Customs Act 1962Document6 pagesChapter 12 - Customs Act 1962Abhay Sharma100% (1)

- DP World Internship ReportDocument40 pagesDP World Internship ReportSaurabh100% (1)

- Eco Essay On TheDocument12 pagesEco Essay On ThemasoodNo ratings yet

- Mms Semester-Iv Project On Functional Specialisation Synopsis Name: Roll NoDocument2 pagesMms Semester-Iv Project On Functional Specialisation Synopsis Name: Roll Noharish nayakNo ratings yet

- ECGCDocument22 pagesECGCabhi7oct1987No ratings yet

- 2 Trade or ProtectionDocument57 pages2 Trade or ProtectionKrishika JainNo ratings yet

- Certificate of Free Sale FlyerDocument1 pageCertificate of Free Sale FlyerzNo ratings yet

- MCQ FTPDocument7 pagesMCQ FTPNeha MittalNo ratings yet

- wts2016 e PDFDocument165 pageswts2016 e PDFMikiKikiNo ratings yet

- Arley A. Howard, New Mexico State University, Las Cruces, MN 88003 (505) 646-4901Document5 pagesArley A. Howard, New Mexico State University, Las Cruces, MN 88003 (505) 646-4901sushsush2kNo ratings yet

- Aci Csa Pip FastDocument53 pagesAci Csa Pip Fastapi-522706100% (2)

- Alfalfa BanDocument5 pagesAlfalfa BanhussamwaliNo ratings yet

- Introduction RiceDocument18 pagesIntroduction Riceharikrushn4499No ratings yet

- Chinese Fireworks IndustryDocument13 pagesChinese Fireworks IndustrySakshi GuptaNo ratings yet

- Purchasing Power ParityDocument5 pagesPurchasing Power ParityRahul Kumar AwadeNo ratings yet

- Designing and Implementing Trade Facilitation in Asia and The Pacific 2013 UpdateDocument231 pagesDesigning and Implementing Trade Facilitation in Asia and The Pacific 2013 UpdateAsian Development BankNo ratings yet

- Induction ReportDocument30 pagesInduction Reportpushpesh1984No ratings yet

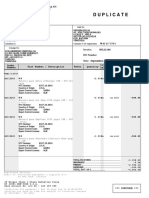

- Duplicate: Invoice: DO NumberDocument2 pagesDuplicate: Invoice: DO NumberLiau Zhan HongNo ratings yet

- MalawiDocument113 pagesMalawiAdam PaytonNo ratings yet

- Executive SummaryDocument12 pagesExecutive SummaryLalit BansalNo ratings yet

- Vietnam Wine - Final Report - 11.12.2014Document17 pagesVietnam Wine - Final Report - 11.12.2014kateanh2501100% (1)

- AP Economics Chapter 29 VocabularyDocument2 pagesAP Economics Chapter 29 VocabularyKevin WangNo ratings yet

- Hescom SolarDocument9 pagesHescom SolarSagar DarbarNo ratings yet

- Proposal For SAP Upgrade at Hindustan Motors: Deloitte & Touche Consulting India Pvt. LTDDocument49 pagesProposal For SAP Upgrade at Hindustan Motors: Deloitte & Touche Consulting India Pvt. LTDYogeshNo ratings yet

- Import ExportDocument16 pagesImport ExportYuvrajgreatNo ratings yet

- Industry Definition FootwareDocument40 pagesIndustry Definition FootwareJadavAshishNo ratings yet

- Economic Reforms and Micro, Small and Medium Enterprises: CommerceDocument11 pagesEconomic Reforms and Micro, Small and Medium Enterprises: CommerceIka Putri MurwadiNo ratings yet

- Rules of Origin (ROO) and Certificate of Hong Kong Origin - CEPA (CO (CEPA) )Document3 pagesRules of Origin (ROO) and Certificate of Hong Kong Origin - CEPA (CO (CEPA) )Phuc NguyenNo ratings yet