Professional Documents

Culture Documents

IGB Corporation Berhad Interim Financial Report for H1 2009

Uploaded by

James WarrenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IGB Corporation Berhad Interim Financial Report for H1 2009

Uploaded by

James WarrenCopyright:

Available Formats

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

Interim Financial Report for the six months ended 30 June 2009

Contents Page Condensed Consolidated Income Statements Condensed Consolidated Balance Sheets Condensed Consolidated Statements of Changes in Equity Condensed Consolidated Cash Flow Statements Explanatory Notes to the Interim Financial Statements: M1 Basis of preparation M2 - Qualification M3 Seasonality or cyclicality M4 Significant unusual items M5 Material changes in estimates M6 Debt and equity securities M7 Dividends paid M8 Segment reporting M9 Valuations M10 Material events subsequent to the end of the interim period M11 Changes in the composition of the Group M12 Contingent liabilities and contingent assets K1 Review of performance K2 Comparison with immediate preceding quarter K3 Prospects for 2009 K4 Profit forecast/profit guarantee K5 Tax K6 Unquoted investments K7 Marketable securities K8 Corporate proposals K9 Group borrowings and debt securities K10 Financial instruments K11 Material litigation K12 Proposed dividends K13 Earnings per share 6 6 6 6 6 6 7 7 8 8 9 9 9 9 9 9 10 10 10 10 11 11 11 11 12 1 2 3-4 5

Note: M1 to M12 are explanatory notes in accordance with FRS134. K1 to K13 are explanatory notes in accordance with paragraph 9.22 of the Bursa Malaysia Securities Berhad Listing Requirements.

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

Condensed Consolidated Income Statements

(The figures have not been audited)

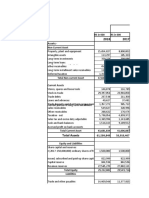

Current Year Quarter 30.06.2009 RM' 000 Revenue Cost of sales Gross profit Other operating income Administrative expenses Other operating expenses Profit from operations Finance costs Share of after-tax results of associates Profit before tax Less tax: Company and subsidiaries Profit for the period Attributable to: Equity holders of the Company Minority interests 43,320 5,185 48,505 Earnings per share (sen) - basic - diluted Dividends per ordinary share (sen) na

1

Preceding Year Quarter 30.06.2008 RM' 000 211,155 (111,918) 99,237 6,509 (29,188) (10,735) 65,823 (13,273) 4,643 57,193 (8,812) 48,381

Current Year To Date 30.06.2009 RM' 000 321,438 (145,045) 176,393 35,828 (71,517) (7,692) 133,012 (30,577) 9,969 112,404 (24,646) 87,758

Preceding Year To Date 30.06.2008 RM' 000 373,162 (195,190) 177,972 19,813 (64,502) (16,876) 116,407 (24,375) 13,908 105,940 (17,954) 87,986

155,876 (72,385) 83,491 25,229 (36,061) (3,551) 69,108 (15,960) 5,241 58,389 (9,884) 48,505

42,948 5,433 48,381

77,222 10,536 87,758

79,649 8,337 87,986

2.95

2.91 2.91 na

1

5.26

5.39 5.39

2.50

2.50

Note 1: Computation of diluted earnings per share is not applicable as there are no outstanding shares to be issued.

-1-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

Condensed Consolidated Balance Sheets

(The figures have not been audited)

30.06.2009 RM '000 Capital and reserves attributable to the Company's equity holders 745,148 Share capital Share premium 427,221 Treasury shares (36,427) 356,076 Revaluation and other reserves Retained earnings 1,296,033 2,788,051 102,029 Minority interests TOTAL EQUITY 2,890,080 Represented by: Non current assets Property, plant and equipment Long term prepaid lease Investment property Land held for property development Associates Other investments Deferred tax assets Current assets Property development costs Inventories Marketable securities Receivables Amount owing by associates Amount owing by a jointly controlled entity Tax recoverable Deposits with licensed banks Cash and bank balances

31.12.2008 RM '000 745,148 427,221 (35,005) 332,206 1,218,811 2,688,381 90,616 2,778,997

791,349 205,749 1,496,792 257,623 557,436 6,512 10,263 3,325,724 90,143 66,765 48,632 130,699 122,210 7,170 10,900 577,604 109,627 1,163,750

758,007 206,857 1,527,263 256,641 542,348 6,212 10,522 3,307,850 93,565 67,625 37,556 158,504 118,920 5,869 4,067 528,954 127,184 1,142,244

Less: Current liabilities Payables Amount owing to associates Borrowings Tax Net current assets Less: Non current liabilities Borrowings Deferred taxation

395,376 24,386 121,531 24,192 565,485 598,265

473,328 24,386 122,781 14,751 635,246 506,998

953,531 80,378 1,033,909 2,890,080

954,305 81,546 1,035,851 2,778,997

-2

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

Condensed Consolidated Statement of Changes in Equity for the six months ended 30 June 2009

Minority Interests

(The figures have not been audited)

Issued and fully paid ordinary shares of RM0.50 each Distributable Retained earnings RM '000 1,218,811 77,222 Number of shares '000 1,490,296 (1,010) (1,422) 745,148 (22,257) (35,005) 427,221 332,206 Nominal Number of value shares RM '000 '000 Nominal value RM '000 Share premium RM '000 Revaluation and other reserves RM '000

Attributable to equity holders Treasury Shares ordinary shares of Non-distributable RM0.50 each

RM '000 90,616 10,536 8,271 416

Total RM '000 2,778,997 87,758 (1,422) 8,271 416

At 1 January 2009

Profit for the period

Purchase of treasury shares Conversion of warrants to ordinary shares Issuance of redeemable preference shares in a subsidiary

Currency translation differences 23,870 (122) (2,461) 1,490,296 745,148 (23,267) (36,427) 427,221 23,870 356,076 1,296,033 (2,583) (5,227) 102,029 23,748 (2,461) 21,287 (5,227) 2,890,080

from foreign associates

Dilution of shares in a subsidiary

Net gain not recognised in income statement

Dividends

At 30 June 2009

-3-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

Condensed Consolidated Statement of Changes in Equity for the six months ended 30 June 2008

Minority Interests

(The figures have not been audited)

Issued and fully paid ordinary shares of RM0.50 each Distributable Retained earnings RM '000 1,218,626 (25,000) 427,221 179 295 23,025 23,499 289,732 79,649 (295) (23,025) (23,320) (32,200) 1,242,755 Number of shares '000 1,489,724 572 1,490,296 745,148 (14,206) 286 247 (5,297) (7,906) 744,862 (8,909) (17,094) 426,974 266,233 Nominal Number of value shares RM '000 '000 Nominal value RM '000 Share premium RM '000 Revaluation and other reserves RM '000

Attributable to equity holders Treasury Shares ordinary shares of Non-distributable RM0.50 each

RM '000 89,384 8,337 (200) 93 128 221 (9,198) 88,544

Total RM '000 2,728,985 87,986 (200) (7,906) 533 272 128 400 (41,398) 2,768,400

At 1 January 2008

Profit for the period Acquisition of additional shares in subsidiary Purchase of treasury shares Issue of shares: Employees' Share Options

Currency translation differences Dilution of shares in a subsidiary Creation of capital redemption reserve in a subsidiary Net gain not recognised in income statement Dividends

At 30 June 2008

-4-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

Condensed Consolidated Cash Flow Statements

(The figures have not been audited)

30.06.2009 RM '000 Operating activities Receipts from customers Payments to contractors, suppliers and employees Cash flow from operations Interest paid Income taxes paid Net cash generated from operating activities Investing activities Dividends received from associates Dividends received from investments Interest received Proceeds from sale of investments Proceeds from disposal of property, plant and equipment Purchase of property, plant and equipment Repayments/(advances) from/(to) associates Net cash used in investing activities Financing activities Proceeds from shares issued by the Company Purchase of treasury shares Dividends paid Repayment of bank borrowings, net of receipts Net cash generated from/(used in) financing activities Foreign currencies exchange difference Net decrease in cash and cash equivalents Cash and cash equivalents at beginning of financial year Cash and cash equivalents at end of period (2,646) (4,068) 3,497 31,093 656,138 687,231 (1,422) 18,449 231 4,738 114 (54,057) (4,591) (35,116) 368,660 (250,528) 118,132 (29,719) (21,633) 66,780

30.06.2008 RM '000 345,967 (341,943) 4,024 (22,392) (22,557) (40,925)

12,261 5,826 17,941 1,363 (104,088) 2,961 (63,736)

533 (7,906) (32,199) 144,475 104,903 (1,256) (1,014) 453,234 452,220

-5-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

Explanatory notes to the Interim Financial Statements for the six months ended 30 June 2009

M1

Basis of preparation This Interim Report is unaudited and has been prepared in accordance with the requirements of Financial Reporting Standard 134 Interim Financial Reporting issued by the Malaysian Accounting Standards Board and paragraph 9.22 together with Part A, Appendix 9B of Bursa Malaysia Securities Berhad (Bursa Malaysia) Listing Requirements, and should be read in conjunction with the Groups audited financial statements for the financial year ended 31 December 2008. This interim financial report has been prepared based on accounting policies and methods of computation which are consistent with those adopted for the annual audited financial statements for the year financial ended 31 December 2008.

M2

Qualification The Audit Report of the Groups annual financial statements for the financial year ended 31 December 2008 was not subject to any audit qualification.

M3

Seasonality or cyclicality The Groups operations were not materially affected by seasonal or cyclical factors.

M4

Significant unusual items There were no significant unusual items that affect the assets, liabilities, equity, net income or cash flows other than those disclosed elsewhere in these notes.

M5

Material changes in estimates Not applicable.

M6

Debt and equity securities Shares repurchased during the current financial year to-date were as follows:

No. of shares 1,000,000 10,000 Lowest Price RM 1.40 1.67 Highest Price RM 1.40 1.67

Date 27.03.09 02.06.09

Cost RM 1,404,820.00 16,822.21

The number of treasury shares held as at 30 June 2009 was 23,266,100 ordinary shares of RM0.50 each. Other than the above, there were no issuances, cancellations, resale or repayments of debt and equity securities for the current financial year to-date.

-6-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

M7

Dividends paid No dividends have been paid during the current financial year to-date.

M8

Segment Reporting

Business segments 6 months ended 30 June 2009 Revenue Total revenue Intersegment revenue External revenue Results Segment results (external) Unallocated income Unallocated expense Profit from operations Finance costs Share of after-tax results of associates

Property development RM '000

Property investment RM '000

Hotel RM '000

Construction RM '000

Others RM '000

Group RM '000

46,154 46,154

206,420 (3,847) 202,573

69,404 (1,679) 67,725

34,895 (34,895) -

15,661 (10,675) 4,986

372,534 (51,096) 321,438

19,276

91,607

17,419

(144)

13,051

141,209 4,738 (12,935) 133,012 (30,577) 9,969 112,404 (24,646) 87,758

2,378

363

7,100

128

Profit from ordinary activities before tax Tax-Company and subsidiaries Profit for the period Attributable to: Equity holders of the Company Minority interests

77,222 10,536 87,758

Unallocated income represents interest income while unallocated expenses relates to head-office general administrative expenses that arise at the Group level and relate to the Group as a whole.

-7-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

M8

Segment Reporting (continued..)

Business segments 6 months ended 30 June 2008 Revenue Total revenue Intersegment revenue External revenue Results Segment results (external) Unallocated income Unallocated expense Profit from operations Finance costs Share of after-tax results of associates Profit from ordinary activities before tax

Property development RM '000

Property investment and holding RM '000

Hotel RM '000

Construction RM '000

Others RM '000

Group RM '000

172,955 (39,717) 133,238

179,825 (2,164) 177,661

71,997 (12,457) 59,540

81,667 (81,667) -

11,573 (8,850) 2,723

518,017 (144,855) 373,162

19,097

86,120

12,943

(11)

3,914

122,063 5,826 (11,482) 116,407 (24,375)

1,219

(972)

13,727

(66)

13,908 105,940 (17,954) 87,986

Tax-Company and subsidiaries Profit for the period Attributable to: Equity holders of the Company Minority interests

79,649 8,337 87,986

Unallocated income represents interest income while unallocated expenses relates to head-office general administrative expenses that arise at the Group level and relate to the Group as a whole. M9 Valuations Valuations of property, plant and equipment have been brought forward without amendment from the previous annual financial statements.

M10 Material events subsequent to the end of the interim period There were no material events subsequent to the end of the interim period up to the date of this report other than as disclosed elsewhere in this report.

-8-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

M11 Changes in the composition of the Group On 21 May 2009, the Company announced to Bursa Malaysia that Mid Valley City Developments Sdn Bhd, a wholly-owned subsidiary of the Company had acquired 100% of the issued and paid-up share capital of Original Advisory Sdn Bhd comprising two ordinary shares of RM1.00 each fully paid at par. On 27 July 2009, the Company announced to Bursa Malaysia that the Company had acquired 100% of the issued and paid-up share capital of Crest Corridor Sdn Bhd comprising two ordinary shares of RM1.00 each fully paid at par.

M12 Contingent liabilities and contingent assets There were no contingent liabilities or contingent assets since 31 December 2008.

K1

Review of performance For the three months ended 30 June 2009, Group revenue achieved decreased by 26% to RM155.9 million when compared to the corresponding period in 2008 of RM211.2 million due mainly to lower contribution from the Property Development division. However, Group pre-tax profit increased marginally by 2% to RM58.4 million when compared to pre-tax profit of RM57.2 million achieved in the corresponding period in 2008 mainly attributable to write-backs in provision for diminution in investments in the current quarter.

K2

Comparison with immediate preceding quarter Group revenue achieved for the three months ended 30 June 2009 decreased by 6% to RM155.9 million when compared to RM165.6 million achieved for the three months ended 31 March 2009 due mainly to lower contribution from the Property Development division. However, Group pre-tax profit achieved increased by 8% to RM58.4 million when compared to the RM54.0 million reported in the immediate preceding quarter mainly due to improved contribution from the Hotel division as well as higher write-backs in provision for diminution in investments in the current quarter.

K3

Prospects for 2009 As the global economic situation seems to be improving, the Board is cautiously optimistic that the Groups operational results for the current financial year will be satisfactory.

K4

Profit forecast/profit guarantee The Group did not issue any profit forecast or profit guarantee.

-9-

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

K5

Tax

Current quarter ended 30.06.2009 RM '000 Malaysian income tax - Company and subsidiaries Transferred to deferred tax Overseas tax - Company and subsidiaries 22 9,884 10,726 (864) 9,862

Cumulative current Year-To-Date ended 30.06.2009 RM '000 24,194 405 24,599 47 24,646

The effective tax rate of the Group for the current quarter and for the financial year to-date was lower than the statutory tax rate as certain income were not subjected to tax.

K6

Unquoted investments There was no sale of unquoted investments for the current quarter and financial year to-date.

K7

Marketable securities Total investments in marketable securities as at 30 June 2009 were as follows: RM 000 Total investments at cost Total investments at carrying value/book value (after provision for diminution in value) Total investments at market value at 30 June 2009 61,382 48,630 48,848

K8

Corporate proposals No corporate proposals have been announced during the financial quarter under review up to the date of this report.

- 10 -

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

K9

Group borrowings and debt securities Group borrowings as at 30 June 2009 were as follows:

RM '000 Long term borrowings: Secured Term Loan Redeemable Bonds Unsecured Term Loan Short term borrowings: Secured Current portion of Redeemable Bonds Unsecured Current portion of term loan Short term loan TOTAL Total equity as at 30 June 2009

300,000 448,144 205,387 953,531

40,000 52,781 28,750 121,531 1,075,062 2,890,080

K10 Financial instruments The Group does not have any financial instruments with off balance sheet risk.

K11 Material litigation There was no pending material litigation as at the date of this report which exceeds 5% of the net assets of the Group.

K12 Proposed dividends No interim dividend is declared or proposed in respect of the financial year ending 31 December 2009.

- 11 -

IGB Corporation Berhad (5745-A)

(Incorporated in Malaysia)

K13 Earnings per share Current Preceding Quarter Year ended Quarter ended 30.06.2009 30.06.2008 Profit for the period Weighted average number of ordinary shares in issue Basic earnings per share Profit for the period Weighted average number of ordinary shares in issue Adjustments for share options Weighted average number of ordinary shares for diluted earnings per share Diluted earnings per share '000 sen 1,467,508 na 1,478,370 2.91 1,467,508 na 1,478,370 5.39 '000 '000 1,467,508 1,478,282 88 1,467,508 1,478,282 88 '000 sen RM '000 1,467,508 2.95 43,320 1,478,282 2.91 42,948 1,467,508 5.26 43,320 1,478,282 5.39 79,649 RM '000 43,320 42,948 Current Year To Date ended 30.06.2009 77,222 Preceding Year To Date ended 30.06.2008 79,649

Computation of diluted earnings per share is not applicable as there are no outstanding shares to be issued.

BY ORDER OF THE BOARD TINA CHAN LAI YIN Secretary Kuala Lumpur 26 August 2009

- 12 -

You might also like

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- ConsolidatedReport08 (BAHL)Document87 pagesConsolidatedReport08 (BAHL)Muhammad UsmanNo ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Unaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009Document4 pagesUnaudited Condensed Consolidated Income Statements For The Second Quarter Ended 30 June 2009James WarrenNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- PTCL Accounts 2009 (Parent)Document48 pagesPTCL Accounts 2009 (Parent)Najam U SaharNo ratings yet

- Pakistan Synthetics Limited Condensed Interim Balance Sheet AnalysisDocument8 pagesPakistan Synthetics Limited Condensed Interim Balance Sheet AnalysismohammadtalhaNo ratings yet

- S P SETIA BERHAD Interim Financial Report for Period Ended 31 January 2004Document13 pagesS P SETIA BERHAD Interim Financial Report for Period Ended 31 January 2004Xavier YeohNo ratings yet

- FS Final March31 2009Document29 pagesFS Final March31 2009beehajiNo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- FY2011 ResultsDocument1 pageFY2011 ResultsSantosh VaishyaNo ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- P2int 2008 Dec QDocument8 pagesP2int 2008 Dec Qpkv12No ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Document36 pagesNational Bank of Pakistan: Standalone Financial Statements For The Quarter Ended September 30, 2010Ghulam AkbarNo ratings yet

- Genting Singapore PLCDocument22 pagesGenting Singapore PLCHQ Li Ying SoonNo ratings yet

- MCB Bank Limited Consolidated Financial Statements SummaryDocument93 pagesMCB Bank Limited Consolidated Financial Statements SummaryUmair NasirNo ratings yet

- DRB-HICOM Interim Report Mar10Document21 pagesDRB-HICOM Interim Report Mar10Jefrry AbdullahNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- Consolidated2010 FinalDocument79 pagesConsolidated2010 FinalHammna AshrafNo ratings yet

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- Aftab Automobiles Limited and Its SubsidiariesDocument4 pagesAftab Automobiles Limited and Its SubsidiariesNur Md Al HossainNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Analyze Dell's FinancialsDocument18 pagesAnalyze Dell's FinancialsSaema JessyNo ratings yet

- Results For The Year Ended 30 September 2010Document19 pagesResults For The Year Ended 30 September 2010Sissi ChiangNo ratings yet

- Financial Statements For The Year Ended 31 December 2009Document64 pagesFinancial Statements For The Year Ended 31 December 2009AyeshaJangdaNo ratings yet

- BMW Group reports net profit of €5.3 billionDocument8 pagesBMW Group reports net profit of €5.3 billionaudit202No ratings yet

- Interim Results June 2008Document12 pagesInterim Results June 2008Huseyin BozkinaNo ratings yet

- Interim Condensed: Sanofi-Aventis Pakistan LimitedDocument13 pagesInterim Condensed: Sanofi-Aventis Pakistan LimitedawaisleoNo ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- UBL Financial Statement AnalysisDocument17 pagesUBL Financial Statement AnalysisJamal GillNo ratings yet

- 2Q10 ITR Free Translation FIBRIADocument74 pages2Q10 ITR Free Translation FIBRIAFibriaRINo ratings yet

- Q4FY2013 Interim ResultsDocument13 pagesQ4FY2013 Interim ResultsrickysuNo ratings yet

- An adventure of enterprise: PPR's 2008 results and outlookDocument47 pagesAn adventure of enterprise: PPR's 2008 results and outlooksl7789No ratings yet

- TMP 14608-GAMUDA 260913B2126481517Document16 pagesTMP 14608-GAMUDA 260913B2126481517NurhalimDawiNo ratings yet

- HKSE Announcement of 2011 ResultsDocument29 pagesHKSE Announcement of 2011 ResultsHenry KwongNo ratings yet

- Consolidated Financial Results and Segment DataDocument88 pagesConsolidated Financial Results and Segment Datathaituan2808No ratings yet

- ICI Pakistan Limited: Balance SheetDocument28 pagesICI Pakistan Limited: Balance SheetArsalan KhanNo ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Al-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Document6 pagesAl-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Umair KhanNo ratings yet

- Standalone Accounts 2008Document87 pagesStandalone Accounts 2008Noore NayabNo ratings yet

- Financial Statements PDFDocument91 pagesFinancial Statements PDFHolmes MusclesFanNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- India Infoline Q2 Results 2005Document6 pagesIndia Infoline Q2 Results 2005Shatheesh LingamNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- 1st Quarterly Report 2009Document38 pages1st Quarterly Report 2009Muhammad Salman ShahNo ratings yet

- Oldtown QRDocument26 pagesOldtown QRfieya91No ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniNo ratings yet

- Profit & Loss Account NewDocument2 pagesProfit & Loss Account NewPatel SagarNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- Company Financial StatementsDocument49 pagesCompany Financial StatementsStar ShinnerNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Padini Msia AR 2020 PDFDocument126 pagesPadini Msia AR 2020 PDFJames WarrenNo ratings yet

- Prolexus PDFDocument146 pagesProlexus PDFJames WarrenNo ratings yet

- Prolexus PDFDocument146 pagesProlexus PDFJames WarrenNo ratings yet

- Supermax 2021Document122 pagesSupermax 2021James WarrenNo ratings yet

- Asia accounts for two-thirds of global patent, trademark and design filingsDocument2 pagesAsia accounts for two-thirds of global patent, trademark and design filingsJames WarrenNo ratings yet

- Data Visualisation For Reporting: Using Microsoft Excel DashboardDocument2 pagesData Visualisation For Reporting: Using Microsoft Excel DashboardJames WarrenNo ratings yet

- Martin Armstrong ArticleDocument28 pagesMartin Armstrong ArticleJames WarrenNo ratings yet

- Cancer Cell Math Modelling PDFDocument104 pagesCancer Cell Math Modelling PDFJames WarrenNo ratings yet

- Court upholds qualified privilege defense in defamation suitDocument7 pagesCourt upholds qualified privilege defense in defamation suitJames WarrenNo ratings yet

- Impairment in The Football Team's Financial ReportsDocument10 pagesImpairment in The Football Team's Financial ReportsJames WarrenNo ratings yet

- En CIMB-Principal Malaysia Equity Fund AR PDFDocument54 pagesEn CIMB-Principal Malaysia Equity Fund AR PDFJames WarrenNo ratings yet

- Mao Timeline PDFDocument6 pagesMao Timeline PDFsuudfiinNo ratings yet

- Math - Taylor Series DiscussionDocument3 pagesMath - Taylor Series DiscussionJames WarrenNo ratings yet

- Case 3 - TransmileDocument16 pagesCase 3 - TransmileSumirah Maktar100% (1)

- Turing's Theory of Morphogenesis: Where We Started, Where We Are and Where We Want To GoDocument17 pagesTuring's Theory of Morphogenesis: Where We Started, Where We Are and Where We Want To GoLEONARDO RAMÍREZNo ratings yet

- (Adam Schlecter) BookDocument55 pages(Adam Schlecter) BookJames Warren50% (2)

- Hotel Budget 8mths Forecast 09Document1 pageHotel Budget 8mths Forecast 09James WarrenNo ratings yet

- Brochure-Er Jan 2016Document17 pagesBrochure-Er Jan 2016James WarrenNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- JY The School of FormsDocument3 pagesJY The School of FormsJames Warren100% (2)

- All Religions Are Not The SameDocument3 pagesAll Religions Are Not The SameJames Warren100% (1)

- Zipf, Law Pareto - A Ranking TutorialDocument5 pagesZipf, Law Pareto - A Ranking Tutorialapi-3850725No ratings yet

- 007.the Value of Not Being SureDocument2 pages007.the Value of Not Being SureJames WarrenNo ratings yet

- The Best Chess BooksDocument3 pagesThe Best Chess BooksJames Warren100% (1)

- Construction CompanyDocument111 pagesConstruction CompanyJames Warren0% (1)

- Financial Statements Quiz ReviewDocument11 pagesFinancial Statements Quiz ReviewErika YastoNo ratings yet

- Holt Notes CfroeDocument3 pagesHolt Notes CfroewmthomsonNo ratings yet

- MBA Project On Financial RatiosDocument67 pagesMBA Project On Financial Ratioskamdica86% (21)

- 102B - Business Organisation & Office ManagementDocument22 pages102B - Business Organisation & Office ManagementAnonymous WtjVcZCgNo ratings yet

- FPWM - Long cases 23-24_240205_123906Document8 pagesFPWM - Long cases 23-24_240205_123906juheel.sejpal054No ratings yet

- Financial Statement Analysis: Mr. Christopher B. CauanDocument63 pagesFinancial Statement Analysis: Mr. Christopher B. CauanChristopher Beltran CauanNo ratings yet

- Week 8: Financial Statement Analysis & PerformanceDocument41 pagesWeek 8: Financial Statement Analysis & Performanceyow jing peiNo ratings yet

- PWC Guide Foreign Currency 2014Document168 pagesPWC Guide Foreign Currency 2014Vikalp Awasthi100% (2)

- C. FIG Analyst Training - Partie IIDocument136 pagesC. FIG Analyst Training - Partie IIFabrizioNo ratings yet

- 0d354cf1-781e-48d0-bf53-a637b1e60960Document3 pages0d354cf1-781e-48d0-bf53-a637b1e60960Zubair AhmedNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- Comprehensive stockholders' equity transactionsDocument14 pagesComprehensive stockholders' equity transactionsAnne Clarisse ConsuntoNo ratings yet

- Cutie PIE Statement of Financial PositionDocument7 pagesCutie PIE Statement of Financial PositionJeffrey CardonaNo ratings yet

- Chapter 5 - Financial StatementDocument31 pagesChapter 5 - Financial StatementQUYÊN VŨ THỊ THUNo ratings yet

- Deloitte CombinacionDocument236 pagesDeloitte CombinacionEliecer Campos CárdenasNo ratings yet

- Fin440 ApexFoods and GHAILDocument22 pagesFin440 ApexFoods and GHAILAbid KhanNo ratings yet

- Entreprunership Chapter-3 PDFDocument12 pagesEntreprunership Chapter-3 PDFfitsumNo ratings yet

- Qualifying Examination: Financial Accounting 2Document11 pagesQualifying Examination: Financial Accounting 2Patricia ByunNo ratings yet

- FS Analysis Ratios and Cash Flow StatementDocument4 pagesFS Analysis Ratios and Cash Flow StatementBrian Christian VillaluzNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test BankDocument24 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bankmrsbrianajonesmdkgzxyiatoq100% (26)

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- 31 - Term Sheets For Private Equity InvestmentsDocument3 pages31 - Term Sheets For Private Equity InvestmentsshakibalamNo ratings yet

- Examination: Certificate in Practical Financial EconomicsDocument63 pagesExamination: Certificate in Practical Financial Economicschan chadoNo ratings yet

- OffGrid and Investors Company-Profiles - UpdatedDocument51 pagesOffGrid and Investors Company-Profiles - UpdatedkulukundunguNo ratings yet

- BDL Management Trainee FinanceDocument31 pagesBDL Management Trainee FinanceravinderNo ratings yet

- Dwnload Full Corporate Finance 3rd Edition Berk Test Bank PDFDocument35 pagesDwnload Full Corporate Finance 3rd Edition Berk Test Bank PDFlief.tanrec.culjd100% (12)

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Bikaji Foods International LTD Ipo Date, PriceDocument1 pageBikaji Foods International LTD Ipo Date, PriceJatin JainNo ratings yet

- AP 004 D.1 Audit If Investments Prob. 1Document1 pageAP 004 D.1 Audit If Investments Prob. 1Loid Gumera LenchicoNo ratings yet

- Journalize the above transactions in the general journal of Bert PhotographyDocument24 pagesJournalize the above transactions in the general journal of Bert PhotographyManuel Panotes Reantazo50% (2)