Professional Documents

Culture Documents

Excel File Suzuki

Uploaded by

Mahnoor AfzalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel File Suzuki

Uploaded by

Mahnoor AfzalCopyright:

Available Formats

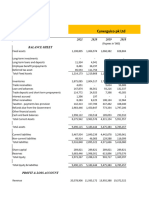

Statement

RS in 000 RS in 000

2018 2017

Assets:-

Non-Current Asset

Property, plant and equipment 15,654,827 8,800,002

Intangible assets 113,297 185,333

Long-term investments 329,274 208,086

Long-term

Long-term loans

deposits, prepayments and 4,203 2,361

other receivables 456,208 327,319

Long-term installment sales receivables 118,318 144,779

Deferred taxation 1,151,888 236,500

Total Non-current Asset 17,828,015 9,904,380

Current Assets

Stores, spares and loose tools 146,878 114,789

Stock-in-trade 29,397,056 23,946,058

Trade debts 237,538 211,358

Loans and advances 40,627 37,481

Trade

Currentdeposits

portionand short terminstallment

of long-term prepayment 1,357,271 965,722

sales receivables 549,627 320,996

Other receivables 268,622 176,474

Taxation - net 5,798,056 4,899,972

Sales tax and excise duty adjustable 4,369,996 1,143,685

Cash and bank balances 1,516,163 9,189,552

Accrued profit on bank accounts 0 0

Total Current Asset 43,681,834 41,006,087

Total Assets 61,509,849 50,910,467

Equity and Liabilities

Share capital and reserves

150,000,000 (2017: 150,000,000) ordinary shares of Rs. 10/-1,500,000

each 1,500,000

issued, subscribed and paid-up share capita 822,999 822,999

Capital reserve 844,596 844,596

Revenue reserves 27,565,270 27,882,121

Total Equity 29,232,865 29,549,716

Liabilities

Trade and other payables 14,409,566 11,377,815

Short-term finance/Acrrued Borrowing 11,310,497 0

Advance from customers 2,276,078 5,331,948

Security deposits 4,222,249 4,600,552

Provision for custom duties and sales tax 36,299 36,299

Unclaimed dividends 22,295 14,137

Total Liabiities 32,276,984 21,360,751

Total Equity & Liabilities 61,509,849 50,910,467

Statement Of Financial position

RS in 000 RS in 000 RS in 000 RS in 000

2016 2015 2014 2013

6,672,057 4,510,789 4,790,506 4,892,675

72,619 83,288 205,287 182,638

0 0 351 2,194

1,160 1,053 9,597 6,264

258,103 33,324 22,788 36,977

96,033 113,627 162,260 170,252

233,750 194,500 55,797 147,912

7,333,722 4,936,581 5,246,586 5,438,912

111,006 98,801 82,030 66,279

16,288,608 13,084,447 14,976,001 10,726,457

1,205,269 1,561,823 1,352,310 983,273

163,019 194,932 514,845 411,623

77,129 70,862 53,110 62,935

291,254 347,976 387,608 330,504

167,306 89,446 134,260 114,144

1,894,297 1,589,882 2,747,340 2,896,998

1,651,301 277,801 1,002,345 802,777

8,548,293 15,006,007 1,841,384 1,964,359

120,761 193,429 16,340 13,016

30,518,243 32,515,406 23,107,573 18,372,365

37,851,965 37,451,987 28,354,159 23,811,277

1,500,000 1,500,000 1,500,000 1,500,000

822,999 822,999 822,999 822,999

0 0 0 0

25,393,908 23,856,239 18,413,683 16,822,159

26,216,907 24,679,238 19,236,682 17,645,158

6,300,123 6,441,748 4,945,271 3,695,675

0 0 8,982 0

1,625,472 4,226,341 2,159,487 629,275

3,673,164 2,068,361 1,917,414 1,702,694

36,299 36,299 86,323 138,475

0 0 0 0

11,635,058 12,772,749 9,117,477 6,166,119

37,851,965 37,451,987 28,354,159 23,811,277

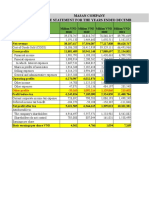

Statement Of profit and Loss

Rs in 000 Rs in 000 Rs in 000 Rs in 000 Rs in 000

2019 2018 2017 2016 2015

Sales 119,853,898 101,811,611 76,516,040 84,548,757 53,664,947

Cost of Sales 112,809,033 92,159,038 69,167,463 73,061,309 49,481,248

Gross profit 7,044,865 9,652,573 7,348,577 11,487,448 4,183,699 Purchases

Distribution and selling costs 2,706,853 2,804,256 2,004,285 1,945,832 746,304

Administrative expenses 2,301,080 15,998,150 1,539,590 1,230,819 1,101,650

Other Expenses 154,204 413,997 333,542 653,212 195,850

Other Income 595,943 864,711 1,039,851 1,058,426 510,208

Finance Cost 362,523 68,088 95,775 30,840 26,709

4,958,717 4,021,445 2,933,341 2,802,277 1,560,306

EBIT 2,086,148 5,631,128 4,415,236 8,685,171 2,623,393

Share of loss of equity acco 3,212 11,914 0 0 0

Profit before taxation 2,082,936 5,619,214 4,415,236 8,685,171 2,623,393

Taxation 784,828 1,793,393 1,642,601 2,842,500 701,500

Net Income 1,298,108 3,825,821 2,772,635 5,842,671 1,921,893

Ratio Anaylsis 201

Ratios

Name 2018 2017

1 Current Ratio 1.353 1.920

2 Quick ratio 0.438 0.793

3 Inventory turnover 3.818 3.830

Inventory turnover in

4 days 95.591 95.294

Account recievable

5 turnover 446.180 0.008

6 A/R turnover in days 162855.882 3.069

Average payment

7 period 46.623 45.062

8 Asset turnover 1.949 2.000

9 Fixed asset turnover 6.723 10.279

10 Debt Ratio 0.525 0.420

11 Debt to equity ratio 1.104 0.723

12 Coverage ratio 4.75 81.70

13 Gross profit Margin 5.9% 9.5%

14 Operating profit Margin 1.74% 5.53%

15 Net profit Margin 1.08% 3.76%

16 ROA 2.11% 7.51%

17 ROE 4.44% 12.95%

18 Cash conversion cycle 162904.850 53.300

19 Earning per share 15.77 46.49

o Anaylsis 2013-2018

2016 2015 2014 2013

2.623 2.546 2.534 2.980

1.213 1.514 0.883 1.229

4.218 5.542 3.286 #NAME?

86.542 65.861 111.076 #NAME?

0.023 0.025 0.038 #NAME?

8.401 9.126 13.916 #NAME?

33.246 32.182 36.479 #NAME?

2.021 2.258 1.893 #NAME?

10.433 17.127 10.229 #NAME?

0.307 0.341 0.322 0.259

0.444 0.518 0.474 0.349

45.10 280.62 97.22 #NAME?

9.6% 13.6% 7.8% #NAME?

5.77% 10.27% 4.89% #NAME?

3.62% 6.91% 3.58% #NAME?

7.32% 15.60% 6.78% #NAME?

10.58% 23.67% 9.99% #NAME?

61.696 42.805 88.513 #NAME?

33.69 70.99 23.35 22.47

Vertical Anaylsis of Statem

Financial Position 2013

2018 2017 2016

Assets:-

Non-Current Asset

Property, plant and equipment 25% 17% 18%

Intangible assets 0.184% 0.36% 0.19%

Long-term investments 1% 0.41% 0.000%

Long-term

prepaymentsloans

and other 0.007% 0.005% 0.003%

receivables 1% 1% 1%

Long-term installment sales receiv 0% 0.28% 0.25%

Deferred taxation 2% 0.46% 1%

Total Non-current Asset 29% 19% 19%

Current Assets

Stores, spares and loose tools 0.24% 0.23% 0.29%

Stock-in-trade 48% 47% 43%

Trade debts 0.39% 0.42% 3%

Loans and advances 0.07% 0.07% 0.43%

Trade

Currentdeposits

portionand short term pr

of long-term 2% 2% 0.20%

installment sales receivables 1% 1% 1%

Other receivables 0.44% 0.35% 0.44%

Taxation - net 9% 10% 5%

Sales tax and excise duty adjustab 7% 2% 4%

Cash and bank balances 2% 18% 23%

Accrued profit on bank accounts 0.00% 0.00% 0.32%

Total Current Asset 71% 81% 81%

Total Assets 100.0% 100.0% 100.0%

Equity and Liabilities

Share capital and reserves

150,000,000 (2017: 150,000,000) o

issued, subscribed and paid-up sha 1% 2% 2.2%

Capital reserve 1% 2% 0.0%

Revenue reserves 45% 55% 67.1%

Total Equity 48% 58% 69.3%

Liabilities

Trade and other payables 23% 22% 16.6%

Short-term finance/Acrrued Borr 18% 0% 0.0%

Advance from customers 4% 10% 4.3%

Security deposits 7% 9% 9.7%

Provision for custom duties and sa 0% 0% 0.1%

Unclaimed dividends 0% 0% 0.0%

Total Liabiities 52% 42% 30.7%

Total Equity & Liabilities 100.00% 100.00% 100.00%

sis of Statement Of

osition 2013-18

2015 2014 2013

12% 17% 21%

0% 0.72% 0.77%

0.00% 0.0012% 0.009%

0.00% 0.03% 0.03%

0.09% 0.08% 0.16%

0.30% 1% 1%

1% 0.20% 1%

13% 19% 23%

0.26% 0.29% 0.28%

35% 53% 45%

4% 5% 4%

1% 2% 2%

0.19% 0.19% 0.26%

1% 1% 1%

0.24% 0.47% 0.48%

4% 10% 12%

1% 4% 3%

40% 6% 8%

1% 0.06% 0.05%

87% 81% 77%

100.0% 100.0% 100.0%

2.20% 3% 3%

0.00% 0% 0%

63.70% 65% 71%

65.90% 68% 74%

17.20% 17% 16%

0.00% 0% 0%

11.28% 8% 3%

5.52% 7% 7%

0.10% 0% 1%

0.00% 0% 0%

34.10% 32% 26%

100.00% 100.00% 100.00%

Vertical Anaylsis of Statement Of profit and loss

2013-18

2018 2017 2016 2015 2014 2013

Sales 100.00% 100.00% 100.00% 100.00% 100.00% #NAME?

Cost of Sales 94.12% 90.52% 90.40% 86.41% 92.20% #NAME?

Gross profit 5.88% 9.48% 9.60% 13.59% 7.80% #NAME?

Distribution and sellin 2.26% 2.75% 2.62% 2.30% 1.39% #NAME?

Administrative expen 1.92% 15.71% 2.01% 1.46% 2.05% #NAME?

Other Expenses 0.13% 0.41% 0.44% 0.77% 0.36% #NAME?

Other Income 0.50% 0.85% 1.36% 1.25% 0.95% #NAME?

Finance Cost 0.30% 0.07% 0.13% 0.04% 0.05% #NAME?

3.95% 3.83% 3.31% 2.91% #NAME?

EBIT 1.74% 5.53% 5.77% 10.27% 4.89% #NAME?

Share of loss of equit 0.0027% 0.0117% 0.00% 0.00% 0.00% #NAME?

Profit before taxation 1.74% 5.52% 5.77% 10.27% 4.89% #NAME?

Taxation 0.65% 1.76% 2.15% 3.36% 1.31% #NAME?

Net Income 1.08% 3.76% 3.62% 6.91% 3.58% #NAME?

Horizontal Anaylsi

2013-18

2018 2017

Assets:-

Non-Current Asset

Property, plant and equipment 319.96% 179.86%

Intangible assets 62.03% 101.48%

Long-term investments 15007.93% 9484.32%

Long-term loans 67.10% 37.69%

Long-term deposits, prepayments and other 1233.76% 885.20%

Long-term installment sales receivables 69.50% 85.04%

Deferred taxation 778.77% 159.89%

Total Non-current Asset 327.79% 182.10%

Current Assets

Stores, spares and loose tools 222% 173%

Stock-in-trade 274% 223%

Trade debts 24% 21%

Loans and advances 10% 9%

Trade deposits and short term prepayment 2157% 1534%

Current portion of long-term installment sa 166% 97%

Other receivables 235% 155%

Taxation - net 200% 169%

Sales tax and excise duty adjustable 544% 142%

Cash and bank balances 77% 468%

Accrued profit on bank accounts 0% 0%

Total Current Asset 238% 223%

Total Assets 258% 214%

Equity and Liabilities

Share capital and reserves

150,000,000 (2017: 150,000,000) ordinary s

issued, subscribed and paid-up share capit 100.0% 100.0%

Capital reserve N/A N/A

Revenue reserves 163.9% 165.7%

Liabilities

Trade and other payables 389.9% 307.9%

Short-term finance/Acrrued Borrowing #DIV/0! #DIV/0!

Advance from customers 361.7% 847.3%

Security deposits 248.0% 270.2%

Provision for custom duties and sales tax 26.2% 26.2%

Unclaimed dividends #DIV/0! #DIV/0!

Total Liabiities 523.5% 346.4%

Total Equity & Liabilities 258% 214%

ontal Anaylsis OF SOFP

2013-18

2016 2015 2014 2013

136.37% 92.19% 97.91% 100.00%

39.76% 45.60% 112.40% 100.00%

0.00% 0.00% 16.00% 100.00%

18.52% 16.81% 153.21% 100.00%

698.01% 90.12% 61.63% 100.00%

56.41% 66.74% 95.31% 100.00%

158.03% 131.50% 37.72% 100.00%

134.84% 90.76% 96.46% 100.00%

167% 149% 124% 100%

152% 122% 140% 100%

123% 159% 138% 100%

40% 47% 125% 100%

123% 113% 84% 100%

88% 105% 117% 100%

147% 78% 118% 100%

65% 55% 95% 100%

206% 35% 125% 100%

435% 764% 94% 100%

928% 1486% 126% 100%

166% 177% 126% 100%

159% 157% 119% 100%

100.0% 100.0% 100.0% 100.0%

N/A N/A N/A N/A

151.0% 141.8% 109.5% 100.0%

170.5% 174.3% 133.8% 100.0%

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

258.3% 671.6% 343.2% 100.0%

215.7% 121.5% 112.6% 100.0%

26.2% 26.2% 62.3% 100.0%

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

188.7% 207.1% 147.9% 100.0%

159% 157% 119% 100.0%

Horizental Anaylsis Of SOP/L

2013-18

2018 2017 2016 2015

Sales #NAME? #NAME? #NAME? #NAME?

Cost of Sales #NAME? #NAME? #NAME? #NAME?

Gross profit #NAME? #NAME? #NAME? #NAME?

Distribution and sellin #NAME? #NAME? #NAME? #NAME?

Administrative expen #NAME? #NAME? #NAME? #NAME?

Other Expenses #NAME? #NAME? #NAME? #NAME?

Other Income #NAME? #NAME? #NAME? #NAME?

Finance Cost #NAME? #NAME? #NAME? #NAME?

EBIT #NAME? #NAME? #NAME? #NAME?

Share of loss of equit #NAME? #NAME? #NAME? #NAME?

Profit before taxation #NAME? #NAME? #NAME? #NAME?

Taxation #NAME? #NAME? #NAME? #NAME?

Net Income #NAME? #NAME? #NAME? #NAME?

ylsis Of SOP/L

3-18

2014 2013

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

#NAME? #NAME?

You might also like

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- Berger Paints Excel SheetDocument27 pagesBerger Paints Excel SheetHamza100% (1)

- Berger Paints: Statement of Financial PositionDocument6 pagesBerger Paints: Statement of Financial PositionMuhammad Hamza ZahidNo ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- Atlas Honda - Balance SheetDocument1 pageAtlas Honda - Balance SheetMail MergeNo ratings yet

- Finance NFL & MitchelsDocument10 pagesFinance NFL & Mitchelsrimshaanwar617No ratings yet

- Term Peper Group G FIN201Document16 pagesTerm Peper Group G FIN201Fahim XubayerNo ratings yet

- Balance Sheet Comparison 2017-2015Document9 pagesBalance Sheet Comparison 2017-2015sumeer shafiqNo ratings yet

- AssetsDocument3 pagesAssetsyasrab abbasNo ratings yet

- Sir Safdar Project (Autosaved) (1) - 5Document30 pagesSir Safdar Project (Autosaved) (1) - 5M.TalhaNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- NCC Bank RatiosDocument20 pagesNCC Bank RatiosRahnoma Bilkis NavaidNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet

- Quiz RatiosDocument4 pagesQuiz RatiosAmmar AsifNo ratings yet

- Restaurant BusinessDocument14 pagesRestaurant BusinessSAKIBNo ratings yet

- Buxly Paint: Balance SheetDocument33 pagesBuxly Paint: Balance SheetJarhan AzeemNo ratings yet

- Balance Sheet: AssetsDocument19 pagesBalance Sheet: Assetssumeer shafiqNo ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Abbott IbfDocument16 pagesAbbott IbfRutaba TahirNo ratings yet

- Beximco Pharmaceuticals LimitedDocument4 pagesBeximco Pharmaceuticals Limitedsamia0akter-228864No ratings yet

- KPJ Financial Comparison 1Document15 pagesKPJ Financial Comparison 1MaryamKhalilahNo ratings yet

- Term Peper Group G FIN201Document16 pagesTerm Peper Group G FIN201Fahim XubayerNo ratings yet

- Balance Sheet: AssetsDocument6 pagesBalance Sheet: Assetskashif aliNo ratings yet

- FMOD PROJECT WeefervDocument13 pagesFMOD PROJECT WeefervOmer CrestianiNo ratings yet

- Rak Ceramics: Income StatementDocument27 pagesRak Ceramics: Income StatementRafsan JahangirNo ratings yet

- Filinvest Land 2006-2010Document18 pagesFilinvest Land 2006-2010Christian VillarNo ratings yet

- Assessment WorkbookDocument7 pagesAssessment WorkbookMiguel Pacheco ChicaNo ratings yet

- Analysis of Balance Sheet Trends 2017-2015Document8 pagesAnalysis of Balance Sheet Trends 2017-2015sumeer shafiqNo ratings yet

- Atlas Honda Motor Company LimitedDocument10 pagesAtlas Honda Motor Company LimitedAyesha RazzaqNo ratings yet

- Maple Leaf Cement Factory Limited.Document17 pagesMaple Leaf Cement Factory Limited.MubasharNo ratings yet

- 2017 Financial Analysis VNMDocument23 pages2017 Financial Analysis VNMDương Thảo NhiNo ratings yet

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- BHEL Valuation FinalDocument33 pagesBHEL Valuation FinalragulNo ratings yet

- HUBCO Financial Statements Analysis 2015-2020Document97 pagesHUBCO Financial Statements Analysis 2015-2020Omer CrestianiNo ratings yet

- Pyramid Analysis Solution: Strictly ConfidentialDocument3 pagesPyramid Analysis Solution: Strictly ConfidentialEmnet AbNo ratings yet

- Pyramid Analysis Solution: Strictly ConfidentialDocument3 pagesPyramid Analysis Solution: Strictly ConfidentialSueetYeingNo ratings yet

- Final Pyramid of Ratios: Strictly ConfidentialDocument3 pagesFinal Pyramid of Ratios: Strictly ConfidentialaeqlehczeNo ratings yet

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Crescent Textile Mills LTD AnalysisDocument23 pagesCrescent Textile Mills LTD AnalysisMuhammad Noman MehboobNo ratings yet

- Financial AnalysisDocument29 pagesFinancial AnalysisAn NguyễnNo ratings yet

- Annual of City BankDocument13 pagesAnnual of City BankAnonymous yu9A5ShBNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisAlina Binte EjazNo ratings yet

- Netflix Spreadsheet - SMG ToolsDocument9 pagesNetflix Spreadsheet - SMG ToolsJohn AngNo ratings yet

- Accounting ProjectDocument16 pagesAccounting Projectnawal jamshaidNo ratings yet

- Revenue 6% Other Oper 30%Document9 pagesRevenue 6% Other Oper 30%Amit Kumar SinghNo ratings yet

- Ab Bank RatiosDocument12 pagesAb Bank RatiosRahnoma Bilkis NavaidNo ratings yet

- Agriauto industry financial ratios and trendsDocument5 pagesAgriauto industry financial ratios and trendsSader AzamNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Renata LimitedDocument18 pagesRenata LimitedSaqeef RayhanNo ratings yet

- Pragathi Infra - Financial StatementDocument3 pagesPragathi Infra - Financial StatementAnurag ShuklaNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Ali Asghar Report ..Document7 pagesAli Asghar Report ..Ali AzgarNo ratings yet

- Crescent Steel and Allied Products LTD.: Balance SheetDocument14 pagesCrescent Steel and Allied Products LTD.: Balance SheetAsadvirkNo ratings yet

- BF Project (2011 To 2013)Document6 pagesBF Project (2011 To 2013)Syed Zeeshan ArshadNo ratings yet

- Spreadsheet-Company A - Quiz 2Document6 pagesSpreadsheet-Company A - Quiz 2BinsiboiNo ratings yet

- Ratio AnalysisDocument35 pagesRatio AnalysisMd. Sakib HossainNo ratings yet

- Balance Sheet, Income Statement, and Cash Flow Data by YearDocument4 pagesBalance Sheet, Income Statement, and Cash Flow Data by YearOthman Alaoui Mdaghri BenNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 5689 13076 1 SMDocument15 pages5689 13076 1 SMMahnoor AfzalNo ratings yet

- Spring 2020Document7 pagesSpring 2020Mahnoor AfzalNo ratings yet

- Demand / Term Finance Abc Enterprises (PVT) LTD Limit 24 Million Marup Rate TermDocument2 pagesDemand / Term Finance Abc Enterprises (PVT) LTD Limit 24 Million Marup Rate TermMahnoor AfzalNo ratings yet

- Commercial Lending Fund Based Non-Fund BasedDocument10 pagesCommercial Lending Fund Based Non-Fund BasedMahnoor AfzalNo ratings yet

- Revised - Business Ethics - Class Project - Guidlines - April 12, 2020Document3 pagesRevised - Business Ethics - Class Project - Guidlines - April 12, 2020Mahnoor AfzalNo ratings yet

- OTL Exam E Answer Key NewDocument16 pagesOTL Exam E Answer Key Newpatrick Muyaya100% (1)

- BRIGHT AIGBE Mortgage Underwriter Conventional 3Document3 pagesBRIGHT AIGBE Mortgage Underwriter Conventional 3Santhi NNo ratings yet

- Mock Test 1Document7 pagesMock Test 1Toàn ĐứcNo ratings yet

- Loan Recovery Policy - StatebankoftravancoreDocument2 pagesLoan Recovery Policy - StatebankoftravancoreBhagyanath MenonNo ratings yet

- Working GroupDocument16 pagesWorking GrouppvaibhyNo ratings yet

- Report PT Bukit Uluwatu Villa 30 September 2019Document146 pagesReport PT Bukit Uluwatu Villa 30 September 2019Hanif RaihanNo ratings yet

- Gathering and Evaluating EvidenceDocument9 pagesGathering and Evaluating EvidenceLynne PetersNo ratings yet

- FINAL Ceilli English 20142015Document126 pagesFINAL Ceilli English 20142015Cheong Weng ChoyNo ratings yet

- Venue: Pioneer Campus & Leopards Hill.: - 15 DECEMBER, 2021Document3 pagesVenue: Pioneer Campus & Leopards Hill.: - 15 DECEMBER, 2021Twaambo PhiriNo ratings yet

- Razelle Ann B. Dapilaga 11 Abm, Peter DruckerDocument3 pagesRazelle Ann B. Dapilaga 11 Abm, Peter DruckerJasmine ActaNo ratings yet

- CH 7 SolutionsDocument12 pagesCH 7 SolutionsGabriel PanoNo ratings yet

- Bankera WhitepaperDocument29 pagesBankera Whitepaperkenfouet ouamba gabinNo ratings yet

- DD Form HDFCDocument1 pageDD Form HDFCVikas LokhandeNo ratings yet

- Apznza 1Document27 pagesApznza 1jason manalotoNo ratings yet

- DirectoryDocument94 pagesDirectoryShahzad ShaikhNo ratings yet

- Discussion QuestionsDocument22 pagesDiscussion QuestionsAndhikaa Nesansa NNo ratings yet

- Novena Shirts LimitedDocument1 pageNovena Shirts LimitedAndrea SalazarNo ratings yet

- Aamra Network LTD Ratio Analysis 2016 2020Document14 pagesAamra Network LTD Ratio Analysis 2016 2020israt jahanNo ratings yet

- Amardeep XI First TermDocument8 pagesAmardeep XI First TermAnahita GuptaNo ratings yet

- Situational banking problems and solutionsDocument7 pagesSituational banking problems and solutionsPranesh SharmaNo ratings yet

- Intangible Asset Sample ProblemsDocument3 pagesIntangible Asset Sample ProblemsJan Jan100% (1)

- Discount MarketDocument10 pagesDiscount MarketDheeraj ShriyanNo ratings yet

- Oil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Document3 pagesOil and Gas Sector Update: SOGT Finally Awarded? - 01/09/2010Rhb InvestNo ratings yet

- Review Engineering Economics Bsce 2022 Sem2Document11 pagesReview Engineering Economics Bsce 2022 Sem2Angelica PanganibanNo ratings yet

- Prepare Worksheet Hyun Bin ClinicDocument3 pagesPrepare Worksheet Hyun Bin ClinicChris Aruh BorsalinaNo ratings yet

- Mutual Fund PresentationDocument14 pagesMutual Fund PresentationHetal ShahNo ratings yet

- Advanced Financial Accounting - II CH 1-4Document24 pagesAdvanced Financial Accounting - II CH 1-4TAKELE NEDESANo ratings yet

- Indian Money MarketDocument20 pagesIndian Money Marketsubha_bkpNo ratings yet

- Amendments To Regulations On Electronic Banking Services and Other Electronic OperationsDocument13 pagesAmendments To Regulations On Electronic Banking Services and Other Electronic OperationsKat GuiangNo ratings yet

- Non Managed Customers Product Penetration HDFC Bank - NarsampetDocument21 pagesNon Managed Customers Product Penetration HDFC Bank - Narsampetdeepak100% (1)