Professional Documents

Culture Documents

Novena Shirts Limited

Uploaded by

Andrea SalazarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Novena Shirts Limited

Uploaded by

Andrea SalazarCopyright:

Available Formats

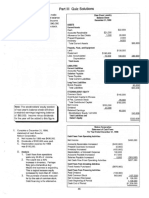

The balances below have been extracted from the accounting records of Novena Shirts Limited at 31 December 20X3:

SALDOS AJUSTES SALDO AJUSTADO

DETALLE

DEUDOR ACREEDOR DEBE HABER DEUDOR ACREEDOR

REVALUATION RESERVE $ 55,000

RETAINED PROFITS AT 1.1.13 $ 26,200

SHARE CAPITAL:

SHARE CAPITAL: 200.000 ORDINARY SHARES OF 10C EACH $ 20,000

10.000 8% CUMULATIVE $1 PREFERENCE SHARES $ 10,000

LAND & BUILDING: AT VALUATION $ 140,000

LAND & BUILDING: ACCUMULATED DEPRECIATION $ 18,000

SHARE PREMIUM $ 22,000

6% DEBENTURE LOAN 2020 $ 80,000

PROVISION FOR DOUBTFUL DEBTS $ 1,800

PLANT & MACHINERY: COST $ 320,000

PLANT & MACHINERY: ACCUMULATED DEPRECIATION $ 210,000

INTERIM DIVIDEND PAID ON ORDINARY SHARES $ 4,000

INTERIM DIVIDEND PAID ON PREFERENCE SHARES $ 400

CORPORATION TAX $ 2,200

DEBENTURE INTEREST $ 2,400

INVENTORY AT 1.1.13 $ 35,000

TRADE RECEIVABLES $ 65,000

BANK ACCOUNT $ 14,100

PREPAID INSURANCE AT 1.1.13 $ 1,400

ACRUED ELECTRICTY AT 1.1.13 $ 6,000

TRADE PAYABLES $ 17,000

NON- CURRENT ASSET DISPOSAL PROCEEDS $ 2,200

SALES $ 928,800

PURCHASES $ 396,000

WAGES AND SALARIES $ 367,000

INSURANCE $ 13,200

TRAVEL AND ENTERTAINMENT $ 21,000

PROFESSIONAL FEES $ 14,500

ELECTRICITY $ 29,000

$ 1,411,100 $ 1,411,100

You are given the following information:

1. Inventory at 31 December 20X3 cost $47,000. Included in this inventory are items that cost $1,400 and which are now obsolete and

are expected to be sold for $200.

2. The land and buildings, at valuation, comprise: land $80,000, buildings $60,000. The land is to be revalued to $250,000.

3. Prepaid insurance at 31 December 20X3 is $1,700 and accrued electricity, at that date, is $5,500.

4. An item of plant and machinery, the cost of which had been $5,000 and whose net book value was $2,300, had been sold in the year

for $2,200. No accounting entries relating to the disposal have been made in the company’s books of account other than in relation to

the disposal proceeds.

5. Depreciation on fixed assets is to be charged as follows: Freehold land: No depreciation is charged. Buildings: 1 per cent per annum

on a straight-line basis Plant and machinery: 30 per cent per annum on a reducing balance basis

6. A bad debt of $3,000 is to be written off.

7. The provision for bad debts is to be revised to 4 per cent of trade receivables.

8. A final dividend of 3c per ordinary share is to be proposed by the directors.

9. The dividend on the cumulative preference shares, due to be paid on 1 January 20X4, is to be provided.

10. Corporation tax of $20,000 on the current year’s profits is to be provided.

11. Interest on the debentures due to be paid on 1 January 20X4 is to be provided.

Required

An income statement for the year ended 31 December 20X3, a statement of financial position at that date, and a statement of

movements in equity note for 20X3, all in good style, for the directors.

You might also like

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Chapter-2 Solution For 27 and 28Document6 pagesChapter-2 Solution For 27 and 28Tarif IslamNo ratings yet

- Ch2 TB Moodle 20201030Document6 pagesCh2 TB Moodle 20201030Wang JukNo ratings yet

- Stranger Things Episode Script 2 05 Chapter Five Dig DugDocument67 pagesStranger Things Episode Script 2 05 Chapter Five Dig Dugyonas123No ratings yet

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- Soal Kombinasi Bisnis 1Document4 pagesSoal Kombinasi Bisnis 1Melati Sepsa100% (1)

- 704Document3 pages704Bhoomi GhariwalaNo ratings yet

- Consolidated Cash Flow StatementDocument4 pagesConsolidated Cash Flow Statementlaale dijaanNo ratings yet

- Ken Scott - Metal BoatsDocument208 pagesKen Scott - Metal BoatsMaxi Sie100% (3)

- Big 'J'S Supermarket Income Statement 2022Document2 pagesBig 'J'S Supermarket Income Statement 2022Stephen Francis100% (1)

- Tugas 4-11-2023Document2 pagesTugas 4-11-2023Anita InaNo ratings yet

- Akm. P10Document5 pagesAkm. P10Diandra MurtiNo ratings yet

- Unadjusted Trial Balance and Financial StatementsDocument15 pagesUnadjusted Trial Balance and Financial Statementspatel avaniNo ratings yet

- Principles of Accounting: Name: Muhammad Hasnain Shakir Enrolment No: 01-111192-145 Section: BBA4 - 2ADocument3 pagesPrinciples of Accounting: Name: Muhammad Hasnain Shakir Enrolment No: 01-111192-145 Section: BBA4 - 2AOsman Bin SaifNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Service Business Accounting CycleDocument6 pagesService Business Accounting CycleMarie Kairish Damag Vivar100% (1)

- Accounting RemedialDocument40 pagesAccounting Remedialwhyme_bNo ratings yet

- Current Liabilities and Warranties p2Document4 pagesCurrent Liabilities and Warranties p2James AngklaNo ratings yet

- Marion Boats Case Solution CompressDocument16 pagesMarion Boats Case Solution CompressashishNo ratings yet

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocument4 pagesQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNo ratings yet

- D'Leon Inc. financial analysisDocument10 pagesD'Leon Inc. financial analysisLeia Nada MarohombsarNo ratings yet

- AkunDocument9 pagesAkunmorinNo ratings yet

- FA TableDocument8 pagesFA TableVy Duong TrieuNo ratings yet

- 13 Single Entry and Incomplete Records Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records Additional ExercisesAditya Hemani100% (1)

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Final Exam - AccountingDocument5 pagesFinal Exam - Accountingtanvi virmaniNo ratings yet

- Fischer10h Ch21 TBDocument2 pagesFischer10h Ch21 TBLouiza Kyla AridaNo ratings yet

- Date Particulars Dr. CR.: Answer 01Document7 pagesDate Particulars Dr. CR.: Answer 01Mursalin RabbiNo ratings yet

- Drill Corporate LiquidationDocument3 pagesDrill Corporate LiquidationElizabeth DumawalNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/32caiexpertcontactNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- 2 - A. Problems - Property Plant and EquipmentDocument59 pages2 - A. Problems - Property Plant and EquipmentsbibandiganNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- Chintia Novrianti 3c Lat 12 RevDocument6 pagesChintia Novrianti 3c Lat 12 RevShintia NovriantiNo ratings yet

- Latihan AJEDocument13 pagesLatihan AJEkhalzhrni17No ratings yet

- Materi Lab 5 - Consolidated Techniques and ProceduresDocument7 pagesMateri Lab 5 - Consolidated Techniques and ProceduresrahayuNo ratings yet

- ACC723 TUTORIAL 5 SOLUTIONSDocument3 pagesACC723 TUTORIAL 5 SOLUTIONSJohn TomNo ratings yet

- Form6 Mock ExamDocument7 pagesForm6 Mock Examkya.pNo ratings yet

- AC101 Quiz 1Document2 pagesAC101 Quiz 1irene TogaraNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklBaiq Melaty Sepsa WindiNo ratings yet

- TIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yDocument9 pagesTIP: Transaction (A) Is Presented Below As An Example.: 1. Ejercicio E2-12 de La Página 85 yEstefanía ZavalaNo ratings yet

- Baiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklDocument13 pagesBaiq Melati Sepsa Windi Ar - A1c019041 - Tugas AklMelati SepsaNo ratings yet

- Afar 2Document7 pagesAfar 2Diana Faye CaduadaNo ratings yet

- Part 9 SCF Problem SolvingDocument16 pagesPart 9 SCF Problem SolvingEhrom SaidovNo ratings yet

- Impairment of LoanDocument4 pagesImpairment of LoanaleywaleyNo ratings yet

- September 22nd 2005 (KB)Document4 pagesSeptember 22nd 2005 (KB)nic tNo ratings yet

- Accounting for margin of safety, break-even pointDocument5 pagesAccounting for margin of safety, break-even pointRheu ReyesNo ratings yet

- Solution CH 2Document14 pagesSolution CH 2razaffd410No ratings yet

- XLSXDocument10 pagesXLSXezar zacharyNo ratings yet

- Nguyen Thu HuyenDocument8 pagesNguyen Thu Huyenhuyền nguyễnNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Required: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"Document2 pagesRequired: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"АннаNo ratings yet

- Acc 201 CH 9Document7 pagesAcc 201 CH 9Trickster TwelveNo ratings yet

- Revision Questions - CH 17 - SolutionsDocument4 pagesRevision Questions - CH 17 - SolutionsMinh ThưNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- CE Principles of Accounts 1998 PaperDocument8 pagesCE Principles of Accounts 1998 Paperapi-3747191No ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- MBF5207201004 Strategic Financial ManagementDocument5 pagesMBF5207201004 Strategic Financial ManagementtawandaNo ratings yet

- Vang Management Services Worksheet Year-End Trial Balance 2017Document1 pageVang Management Services Worksheet Year-End Trial Balance 2017Janice KusnandarNo ratings yet

- Tax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreFrom EverandTax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreNo ratings yet

- Cap 3 - MT-PerrigoDocument4 pagesCap 3 - MT-PerrigoAndrea SalazarNo ratings yet

- Charter - Time WarnerDocument3 pagesCharter - Time WarnerAndrea SalazarNo ratings yet

- Country Risk DeterminantsMeasures and Implications - The 2021 EditionDocument125 pagesCountry Risk DeterminantsMeasures and Implications - The 2021 EditionAndrea SalazarNo ratings yet

- Return On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and ImplicationsDocument69 pagesReturn On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and Implicationsbauh100% (1)

- Cost of CapitalDocument28 pagesCost of CapitalYawar Khan KhiljiNo ratings yet

- Equity Risk Premiums (ERP) Determinants, Estimation, and Implications - The 2021 EditionDocument144 pagesEquity Risk Premiums (ERP) Determinants, Estimation, and Implications - The 2021 EditionAndrea SalazarNo ratings yet

- Jagger y SidneyDocument1 pageJagger y SidneyAndrea SalazarNo ratings yet

- Jagger plc financial statements for year ended 31 March 2017Document1 pageJagger plc financial statements for year ended 31 March 2017Andrea SalazarNo ratings yet

- Ko-Furn Income StatementDocument1 pageKo-Furn Income StatementAndrea SalazarNo ratings yet

- Mozart S EffectDocument1 pageMozart S EffectAndrea SalazarNo ratings yet

- Invention of The InternetDocument1 pageInvention of The InternetAndrea SalazarNo ratings yet

- Bits and Pieces LTDDocument1 pageBits and Pieces LTDAndrea SalazarNo ratings yet

- Arctic TundraDocument1 pageArctic TundraAndrea SalazarNo ratings yet

- Van ThunenDocument1 pageVan ThunenAndrea SalazarNo ratings yet

- Impressionism and Expressionism ArtDocument1 pageImpressionism and Expressionism ArtAndrea SalazarNo ratings yet

- Speidel, M. O. (1981) - Stress Corrosion Cracking of Stainless Steels in NaCl Solutions.Document11 pagesSpeidel, M. O. (1981) - Stress Corrosion Cracking of Stainless Steels in NaCl Solutions.oozdemirNo ratings yet

- Read Me 22222222222222Document2 pagesRead Me 22222222222222sancakemreNo ratings yet

- MalayoDocument39 pagesMalayoRoxanne Datuin UsonNo ratings yet

- Calculating parameters for a basic modern transistor amplifierDocument189 pagesCalculating parameters for a basic modern transistor amplifierionioni2000No ratings yet

- Nelson Olmos introduces himself and familyDocument4 pagesNelson Olmos introduces himself and familyNelson Olmos QuimbayoNo ratings yet

- 2009 Bar Exam Criminal Law QuestionsDocument25 pages2009 Bar Exam Criminal Law QuestionsJonny Duppses100% (2)

- Essay 2Document13 pagesEssay 2Monarch ParmarNo ratings yet

- 1 Vkip 113Document595 pages1 Vkip 113flopo72No ratings yet

- Manage Vitamin B12 DeficiencyDocument5 pagesManage Vitamin B12 DeficiencyAnca CucuNo ratings yet

- Maceda Vs Energy Reg BoardDocument4 pagesMaceda Vs Energy Reg BoardJay Mark Esconde100% (1)

- Caren 4TH Q Finals MapehDocument3 pagesCaren 4TH Q Finals MapehDexter Lloyd Chavez CatiagNo ratings yet

- Awards and Honors 2018Document79 pagesAwards and Honors 2018rajinder345No ratings yet

- 2023 SPMS Indicators As of MarchDocument22 pages2023 SPMS Indicators As of Marchcds documentNo ratings yet

- Economics I Course Manual 2022Document13 pagesEconomics I Course Manual 2022Mridula BansalNo ratings yet

- Grievance Officer West ZoneDocument1 pageGrievance Officer West ZoneAshish SrivastavaNo ratings yet

- BBL CVDocument13 pagesBBL CVkuashask2No ratings yet

- Decision Criteria For Ethical ReasoningDocument14 pagesDecision Criteria For Ethical ReasoningZara ImranNo ratings yet

- Salman Sahuri - Identification of Deforestation in Protected Forest AreasDocument9 pagesSalman Sahuri - Identification of Deforestation in Protected Forest AreaseditorseajaetNo ratings yet

- Magh Bihu or Maghar DomahiDocument8 pagesMagh Bihu or Maghar Domahihackdarenot4No ratings yet

- Design Portfolio (Priyal)Document30 pagesDesign Portfolio (Priyal)PRIYAL SINGHALNo ratings yet

- M 003927Document78 pagesM 003927Eder RinasNo ratings yet

- BS 07579-1992 (1999) Iso 2194-1991Document10 pagesBS 07579-1992 (1999) Iso 2194-1991matteo_1234No ratings yet

- Work, Energy and Power ExplainedDocument34 pagesWork, Energy and Power ExplainedncmzcnmzzNo ratings yet

- Grade 1 Mother Tongue SyllabusDocument3 pagesGrade 1 Mother Tongue SyllabusDorz EDNo ratings yet

- Embedded SQL Into RPGDocument8 pagesEmbedded SQL Into RPGMaran GanapathyNo ratings yet

- Mental Health and Mental Disorder ReportDocument6 pagesMental Health and Mental Disorder ReportBonJovi Mojica ArtistaNo ratings yet

- Importance of Education: March 2015Document4 pagesImportance of Education: March 2015AswiniieNo ratings yet

- Statistical PhysicsDocument4 pagesStatistical PhysicsRenan ZortéaNo ratings yet