Professional Documents

Culture Documents

Accounting for margin of safety, break-even point

Uploaded by

Rheu ReyesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting for margin of safety, break-even point

Uploaded by

Rheu ReyesCopyright:

Available Formats

GENERAL ACCOUNTING 2 - “ Four random questions w/ answers”

QUESTION No. 1

Margin of safety - is the difference between the amount of expected profitability and the break-even

point. The margin of safety formula is equal to current sales minus the breakeven point, divided by

current sales.

Margin of safety = Actual Sales - Breakeven point sales

Break Even Point - is the necessary level of output for a company’s revenue to be equal to its total costs

– or said differently, the inflection point at which a company begins to generate a profit.

Break-Even point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit) or Fixed

Cost ÷ CM/unit

Break-Even point (sales dollars) = Fixed Costs ÷ Contribution Margin.

Contribution margin - is a business’ sales revenue less its variable costs. The resulting contribution

dollars can be used to cover fixed costs (such as rent), and once those are covered, any excess is

considered earnings.

Contribution Margin (units) = Selling price per unit – Variable cost per unit

Contribution Margin (dollars) = Total Sales Revenue – Total Variable Costs

Given:

Selling price per unit = 42 kr/stk

Variable Cost per unit = 14kr/stk

Fixed Costs = 42.000 kr

Sold pieces in June/Actual sales = 4.000 stykki

All sales revenue that a company collects over and above its break-even point represents the margin

of safety.

Contribution Margin (units) = SP per unit – VC per unit

= (42kr/stk - 14kr/stk )

= 28 kr/stk per unit

Break-Even point (units) = Fixed cost ÷ CM/unit

= 42.000 kr/28

= 1.500 pieces or stykki

Margin of safety = (Actual sales - BEP Sales)

Margin of Safety (pieces) = (4.000 – 1.500)

= 2.500 pieces

Margin of safety (value) = 2.500 × 42 kr/stk

= 105.000 kr

QUESTION No. 2

Juniper Company uses a perpetual inventory system and the gross method of accounting for purchases.

The company purchased $9,750 of merchandise on August 7 with terms 1/10, n/30. On August 11, it

returned $1,500 worth of merchandise. On August 16, it paid the full amount due. The correct journal

entry to record the payment on August 16 is:

Multiple Choice

a.) Debit Merchandise Inventory $8,250; credit Cash $8,250.

b.) Debit Cash $8,250; credit Accounts Payable $8,250.

c.) Debit Accounts Payable $8,250; credit Merchandise Inventory $82.50; credit Cash $8,167.50.

d.) Debit Accounts Payable $9,750; credit Merchandise Inventory $97.50; credit Cash $9,652.50.

e.) Debit Accounts Payable $8,167.50; credit Cash $8,167.50.

Merchandise inventory - the cost of finished goods (COGS) that a retailer or wholesaler has available to

sell to its customers during a given accounting period. For a bookstore, merchandise inventory would

include the cost of the books or magazines it has for sale.

Date Journal Entry Debit Credit

Aug. 7 Merchandise Inventory $ 9,750

Accounts Payable $ 9,750

(To record purchase of MI on account)

Aug. 11 Accounts Payable $ 1,500

Merchandise Inventory $ 1,500

(To record any returned MI )

16.Aug Accounts Payable (MI + Cash) $8,250

Merchandise Inventory

(purchased cost - returned MI) x terms

$82.50

percentage " 1/10, n/30" (e.g 1%)

(9,750 - 1,500) x 1%

Cash

(purchased cost - returned MI) x (100% -

$8,167.5

terms percentage) " 1/10, n/30" (e.g

0

100%-1% = 99%)

(9,750 - 1,500) x 99%

(To record payment of MI purchased due)

QUESTION No. 3

Question No. 3.1: The adjusted account balances of Hobby Centre at July 31 are as follows: Accounts

Account Balances Account Balances $25,000 Cash $203,000 Accounts receivable 39,000 22,000 18,000

41.000 Supplies Prepaid insurance Accounts Service revenue Interest revenue Depreciation expense

Insurance expense Salary expense Supplies expense Utilities expense 22.000 20,000 Buildings 314,000

44,000 Accumulated depreciation-Buildings 134,000 23,000 Accounts payable 33,000 26,000 D. Fortier,

Capital 209.000 D. Fortier, Drawings 29,000 Prepare the end of the period closing entries for Hobby

Centre. (Credit account titles are automatically indented when the dmount is entered. Do not indent

manually. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Credit

July 31 (To close revenue accounts to income summary.) July 31 (To close expense accounts to income

summary.) July 31 (To close income summary account to capital.) July 31 (To close drawings to capital.)

REQUIREMENT NO. 1: CULLUMBER CENTRE

Date Account Titles and Explanation Debit Credit

July 31 Service Revenue $ 203,000

Interest Revenue $ 22,000

Income Summary ( $ 203K + $ 22K) $ 225,000

(To close revenue accounts to income summary)

July 31 Income Summary $ 154,000

Depreciation Expense $ 41,000

Insurance Expense $ 20,000

Salary expense $ 44,000

Supllies Expense $ 23,000

Utilities Expense $ 26,000

(To close expense accounts to income summary)

July 31 Income Summary ($ 225K - $ 154K) $ 71,000

D. Harris, Capital $ 71,000

(To close income summary to capital)

July 31 Income Summary $ 29,000

D. Harris, Drawings $ 29,000

(To close drawings to capital)

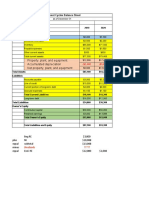

Question No. 3.2: The adjusted trial balance for Mosley Brown Tiles at December 31, 2024, is as follows:

REQUIREMENT NO. 2: MOSLEY BROWN TILES

Mosley Brown Tiles

Balance sheet

December 31,2024

ASSETS

Current Assets

Cash $ 32,200

Accounts Receivable 26,300

Prepaid Insurance 2,450

Prepaid Rent 5,180

Supplies 3,950

Total Current Asset 70,080

Fixed Asset

Equipment 18,100

Accumulated Depreciation-Equipment - 5,400

Furniture 25,300

Accumulated Depreciation-Furniture - 4,320

Total Non-current assets 33,680

Total Assets $ 103,760

LIABILITIES AND EQUITY

Current Liabilities

Accounts Payable $ 8,350

Salary Payable 13,000

Unearned revenue 6,340

Total current liabilities 27,690

Long-term Liabilities

Mortgage Payable 37,900

Total Non-current liabilities 37,900

Total Liabilities 65,590

Shareholder's Equity

M.Brown, Capital 57,350

M.Brown, Drawings - 16,300

Retained Earnings/Profit&Loss - 2,880

Total Equity 38,170

Total Liabilities and Equity $ 103,760

Mosley Brown Tiles

Profit and Loss Statement

December 31,2024

Service revenue $ 35,000

Less: Expenses

Salary Expense 23,600

Depreciation expense 4,940

Rent expense 5,750

Insurance expense 2,000

Supplies expense 740

Advertising expense 850 37,880

Net Income/ (Loss) - 2,880

Question No. 4

Calculation of percentage

= Increase or decrease amount / Base year amount (2021) x 100

= [(Current year amount – Previous year amount) / Previous year amount] x 100

Increase or (Decrease)

2022 2021 Amount Percentage

Assets

Current assets $ 123,400 $ 100,000 $ 23,400 23.4%

Plant assets (net) 394,350 330,000 64,350 19.5%

Total assets $ 517,750 $ 430,000 $ 87,750 20.4%

Liabilities

Current liabilities 86,328 72,000 14,328 19.9%

Long-term liabilities 133,280 85,000 48,280 56.8%

Total liabilities 219,608 157,000 62,608 39.9%

Stockholders' Equity

Common stock, $1 par 166,440 120,000 46,440 38.7%

Retained earnings 131,702 153,000 (21,298) (13.9%)

Total stockholders' equity 298,142 273,000 25,142 9.2%

Total liabilities and Stockholders'

$ 517,750 $ 430,000 $ 87,750 20.4%

equity

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Mid term examDocument6 pagesMid term examWaizin KyawNo ratings yet

- Assignment #1 BADM 1050 Emily KiaraDocument5 pagesAssignment #1 BADM 1050 Emily Kiaraemilynelson1429No ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- Use The Above Information To Answer The Following Questions From A To e (Use Direct Method and Show All Calculations)Document2 pagesUse The Above Information To Answer The Following Questions From A To e (Use Direct Method and Show All Calculations)karunakar vNo ratings yet

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDocument12 pages3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- Final Exam - AccountingDocument5 pagesFinal Exam - Accountingtanvi virmaniNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Tugas 11Document4 pagesTugas 11ahmad shinigamiNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Cast 77 Service Company financial statementsDocument10 pagesCast 77 Service Company financial statementsJohn Kenneth Bohol50% (2)

- CH23 - Transactional Approach and CFExercises and SolutionsDocument6 pagesCH23 - Transactional Approach and CFExercises and SolutionsHossein ParvardehNo ratings yet

- Lecture Practice QuestionsDocument5 pagesLecture Practice QuestionsMariøn Lemonnier BruelNo ratings yet

- Financial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesDocument7 pagesFinancial Accounting Review (Week 1) : Income Statement and Balance Sheet Depreciation Gains and LossesAndy MoralesNo ratings yet

- Intermediate Accounting ExamDocument6 pagesIntermediate Accounting ExamPISONANTA KRISETIANo ratings yet

- Intro to Accounting Adjusting EntriesDocument3 pagesIntro to Accounting Adjusting EntriesAISYAH FARAH YASIRA FITRINo ratings yet

- Financial Problems Jan 19Document17 pagesFinancial Problems Jan 19ledmabaya23No ratings yet

- Assignment LDocument6 pagesAssignment Lphprcffj2rNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Professor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsDocument3 pagesProfessor Office Beach Cabana 2014-2013 Balance Sheets and Income StatementsPrecious Uminga100% (1)

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Chapter-2 Solution For 27 and 28Document6 pagesChapter-2 Solution For 27 and 28Tarif IslamNo ratings yet

- Reporting Financial Results: Practice Session and Revision LectureDocument53 pagesReporting Financial Results: Practice Session and Revision LectureNurt TurdNo ratings yet

- 9 Accounting HomeworkDocument18 pages9 Accounting HomeworkCharlie RNo ratings yet

- MC Worksheet-3 (DICKY IRAWAN - C1I017051)Document5 pagesMC Worksheet-3 (DICKY IRAWAN - C1I017051)DICKY IRAWAN 1No ratings yet

- Problems: Final Review Intermediate 1Document33 pagesProblems: Final Review Intermediate 1Nguyên NguyễnNo ratings yet

- Balance Sheet and Transactions Analysis for Charles CompanyDocument14 pagesBalance Sheet and Transactions Analysis for Charles CompanyArunesh SN100% (1)

- Klausur WS2021-22-1Document6 pagesKlausur WS2021-22-1marynayarmak.stNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Tugas Kelompok Akuntansi Ke 4Document10 pagesTugas Kelompok Akuntansi Ke 4grup apa iniNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- Accounting Homework AdjustmentsDocument5 pagesAccounting Homework AdjustmentsHasan NajiNo ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Financial Statement AdjustmentsDocument5 pagesFinancial Statement AdjustmentsHasan NajiNo ratings yet

- Chapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Document6 pagesChapter 11 Financial Statement Analysis: Accounting - What The Numbers Mean, 12e (Marshall)Jue WernNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Computer Project 1Document5 pagesComputer Project 1Alex SmallzNo ratings yet

- Soal Akuntansi OSN Ekonomi Dan PembahasaDocument6 pagesSoal Akuntansi OSN Ekonomi Dan PembahasaQurrotul AyuniNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Statement of Cash Flow - SolutionDocument8 pagesStatement of Cash Flow - SolutionHân NabiNo ratings yet

- CH 07 PPTsDocument30 pagesCH 07 PPTsAfifan Ahmad FaisalNo ratings yet

- (ASSIGNMENT 3) Eslam Mahmoud MohamedDocument4 pages(ASSIGNMENT 3) Eslam Mahmoud MohamedAmira OkashaNo ratings yet

- Acctg 102 Prelim Exam With SolutionsDocument12 pagesAcctg 102 Prelim Exam With SolutionsYsabel ApostolNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- Practice Set 2 SCFDocument10 pagesPractice Set 2 SCFAtul DarganNo ratings yet

- B02 Final Exam Review QuestionsDocument8 pagesB02 Final Exam Review QuestionsnigaroNo ratings yet

- Analyzing financial statements and expensesDocument5 pagesAnalyzing financial statements and expensesVallabhRemaniNo ratings yet

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Tarea Taller 1 FINA 503Document4 pagesTarea Taller 1 FINA 503Hugo LombardiNo ratings yet

- Answer 5 - " Modern Appliances Corporation"Document4 pagesAnswer 5 - " Modern Appliances Corporation"Rheu ReyesNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- General Accounting 3 - Express Handling and DeliveryDocument9 pagesGeneral Accounting 3 - Express Handling and DeliveryRheu ReyesNo ratings yet

- Answer 1 - Blue Bill CorporationDocument2 pagesAnswer 1 - Blue Bill CorporationRheu ReyesNo ratings yet

- Answer 2 - Answers Only For Crane Company, Swifty Company, Pharaoh Company, and Random Accounting QuestionsDocument10 pagesAnswer 2 - Answers Only For Crane Company, Swifty Company, Pharaoh Company, and Random Accounting QuestionsRheu ReyesNo ratings yet

- Chapter 19Document42 pagesChapter 19Karissa GaviolaNo ratings yet

- General Accounting 1 - Indianola Pharmaceutical CompanyDocument7 pagesGeneral Accounting 1 - Indianola Pharmaceutical CompanyRheu ReyesNo ratings yet

- Vaughn Co current liabilitiesDocument3 pagesVaughn Co current liabilitiesRheu ReyesNo ratings yet

- P2 105 Agency Home Office and Branch Accounting Key AnswersDocument6 pagesP2 105 Agency Home Office and Branch Accounting Key AnswersHikari100% (1)

- Answer 3 - "Different Random Answers To Various Accounting Questions"Document21 pagesAnswer 3 - "Different Random Answers To Various Accounting Questions"Rheu ReyesNo ratings yet

- Nationalized or Partly Nationalized Corporations 1. 100 % FilipinosDocument1 pageNationalized or Partly Nationalized Corporations 1. 100 % FilipinosRheu ReyesNo ratings yet

- Auditing Theory FinalsDocument17 pagesAuditing Theory FinalsRheu ReyesNo ratings yet

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- Activities On CIP and BAsket Value With AnswersDocument2 pagesActivities On CIP and BAsket Value With AnswersRheu ReyesNo ratings yet

- Business Plan ProposalDocument4 pagesBusiness Plan ProposalRheu ReyesNo ratings yet

- Form For Application For Acad ScholarshipDocument1 pageForm For Application For Acad ScholarshipRheu ReyesNo ratings yet

- TRAIN HighlightsDocument86 pagesTRAIN HighlightsJehugem BayawaNo ratings yet

- Aud Theo Explanation From 72-108Document11 pagesAud Theo Explanation From 72-108Rheu ReyesNo ratings yet

- Latin Words in Business Law Simplified Explanation - WPS OfficeDocument2 pagesLatin Words in Business Law Simplified Explanation - WPS OfficeRheu Reyes50% (2)

- ACCTG-206B-FIRST-PREBOARD Without AnswerDocument16 pagesACCTG-206B-FIRST-PREBOARD Without AnswerRheu ReyesNo ratings yet

- Learner Enrollment and Survey Form: Grade Level and School InformationDocument2 pagesLearner Enrollment and Survey Form: Grade Level and School InformationCyrus Emmanuel Casil100% (1)

- Accounting 204anfinal Exams Compilation Old NotesDocument1 pageAccounting 204anfinal Exams Compilation Old NotesRheu ReyesNo ratings yet

- Aud Theo Explanation From 72-108Document11 pagesAud Theo Explanation From 72-108Rheu ReyesNo ratings yet

- LIABILITIES and EQUITY ALASTOY BSA 2Document91 pagesLIABILITIES and EQUITY ALASTOY BSA 2JAY AUBREY PINEDANo ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Sales agency net income and cost of sales calculationDocument27 pagesSales agency net income and cost of sales calculationKandiz89% (9)

- Advanced Accounting 2:: Home Office, Branch and Agency - General ProceduresDocument37 pagesAdvanced Accounting 2:: Home Office, Branch and Agency - General ProceduresIzzy B94% (16)

- Government Accounting Final Examination With Answer and SolutionDocument13 pagesGovernment Accounting Final Examination With Answer and SolutionRheu Reyes100% (6)

- AuditingDocument5 pagesAuditingJona Mae Milla0% (1)

- These Notes Are Independence Day Gift : But First Let's Know What Is AMAZON?Document40 pagesThese Notes Are Independence Day Gift : But First Let's Know What Is AMAZON?muhammad faisalNo ratings yet

- Tunku Puteri Intan Safinaz School of Accountancy Bkal3063 Integrated Case Study FIRST SEMESTER 2020/2021 (A201)Document14 pagesTunku Puteri Intan Safinaz School of Accountancy Bkal3063 Integrated Case Study FIRST SEMESTER 2020/2021 (A201)Aisyah ArifinNo ratings yet

- SEO and The Evolution of The Customer Journey: Search: ResultsDocument28 pagesSEO and The Evolution of The Customer Journey: Search: ResultsIago MacedoNo ratings yet

- Helpful tips for nose bleedsDocument5 pagesHelpful tips for nose bleedsAisyahNo ratings yet

- Chapter 5Document25 pagesChapter 5Ayunda BungaNo ratings yet

- Business Model Canvas TemplateDocument2 pagesBusiness Model Canvas TemplateTaniyaNo ratings yet

- Report 1Document62 pagesReport 1Kiki KirthiNo ratings yet

- Business Plan TemplateDocument36 pagesBusiness Plan Templateusama juttNo ratings yet

- Assignment No: 3 Project Synopsis: Ecommerce SystemDocument3 pagesAssignment No: 3 Project Synopsis: Ecommerce SystemAnmol JainNo ratings yet

- Brand Sustainability and Brand DevelopmentDocument19 pagesBrand Sustainability and Brand Developmentnayeon imNo ratings yet

- Major Project - Stage 1 Ariel Detergent Report Class 2.1 - Group 1 - Principles of MarketingDocument25 pagesMajor Project - Stage 1 Ariel Detergent Report Class 2.1 - Group 1 - Principles of MarketingPhạm Ngọc Phương AnhNo ratings yet

- Kinh Tế Vi Mô Nhóm 4Document42 pagesKinh Tế Vi Mô Nhóm 411B701Hoàng AnNo ratings yet

- 100+ ChatGPT For Ecom MarketingDocument56 pages100+ ChatGPT For Ecom MarketingInstech Premier Sdn Bhd100% (3)

- Soal Bahasa InggirsDocument4 pagesSoal Bahasa Inggirsnurmalia ramadhonaNo ratings yet

- Introduction to Neuromarketing and Consumer NeuroscienceDocument2 pagesIntroduction to Neuromarketing and Consumer Neuroscienceamidou diarraNo ratings yet

- Assignment 2 (Vartika & Mahima)Document34 pagesAssignment 2 (Vartika & Mahima)Vartika VermaNo ratings yet

- Retail Management Assignment On "Branded Diamond Jewellery Retail Chains"Document8 pagesRetail Management Assignment On "Branded Diamond Jewellery Retail Chains"Pawan VintuNo ratings yet

- AquaDocument6 pagesAquaIndah SariwatiNo ratings yet

- Leasing and Hire-PurchaseDocument30 pagesLeasing and Hire-PurchaseDileep SinghNo ratings yet

- PT Mimpi Design: Company ProfileDocument5 pagesPT Mimpi Design: Company ProfileSyamNo ratings yet

- Campari q3 2023Document30 pagesCampari q3 2023Emanuele Gre'No ratings yet

- Mba 501-Quick Service Industry-FinalDocument16 pagesMba 501-Quick Service Industry-FinalMhild GandawaliNo ratings yet

- Achieving Strategic FitDocument18 pagesAchieving Strategic FitSewwandi LiyanaarachchiNo ratings yet

- Trident Principles for Business Flexibility and Brand BuildingDocument13 pagesTrident Principles for Business Flexibility and Brand BuildingMark KolibasNo ratings yet

- What's MoreDocument5 pagesWhat's MoreJade Payba50% (2)

- Fundamentals of Marketing Management PDFDocument6 pagesFundamentals of Marketing Management PDFAli RizviNo ratings yet

- Module 1Document12 pagesModule 1Donna Claire AngusNo ratings yet

- BSBMKG 501 Identify and Evaluate Marketing OpportunitiesDocument17 pagesBSBMKG 501 Identify and Evaluate Marketing Opportunitiesbabluanand100% (1)

- Sales Page Cheat Codes: How To Write The Perfect Sales Page (Even If You're Not A Copywriter)Document102 pagesSales Page Cheat Codes: How To Write The Perfect Sales Page (Even If You're Not A Copywriter)Mobile MentorNo ratings yet

- Mahardika PrimaDocument4 pagesMahardika PrimaMahardika PrimaNo ratings yet