Professional Documents

Culture Documents

CH 02 Case

Uploaded by

Leia Nada MarohombsarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 02 Case

Uploaded by

Leia Nada MarohombsarCopyright:

Available Formats

DLeon Inc.

, Part I

Financial Statements and Taxes

2-19 DONNA JAMISON, A 1997 GRADUATE OF THE UNIVERSITY OF FLORIDA WITH FOUR

YEARS OF BANKING EXPERIENCE, WAS RECENTLY BROUGHT IN AS ASSISTANT TO

THE CHAIRMAN OF THE BOARD OF DLEON INC., A SMALL FOOD PRODUCER THAT

OPERATES IN NORTH FLORIDA AND WHOSE SPECIALTY IS HIGH-QUALITY PECAN AND

OTHER NUT PRODUCTS SOLD IN THE SNACK-FOODS MARKET. DLEONS PRESIDENT,

AL WATKINS, DECIDED IN 2001 TO UNDERTAKE A MAJOR EXPANSION AND TO GO

NATIONAL IN COMPETITION WITH FRITO-LAY, EAGLE, AND OTHER MAJOR SNACK-

FOOD COMPANIES. WATKINS FELT THAT DLEONS PRODUCTS WERE OF A HIGHER

QUALITY THAN THE COMPETITIONS, THAT THIS QUALITY DIFFERENTIAL WOULD

ENABLE IT TO CHARGE A PREMIUM PRICE, AND THAT THE END RESULT WOULD BE

GREATLY INCREASED SALES, PROFITS, AND STOCK PRICE.

THE COMPANY DOUBLED ITS PLANT CAPACITY, OPENED NEW SALES OFFICES

OUTSIDE ITS HOME TERRITORY, AND LAUNCHED AN EXPENSIVE ADVERTISING

CAMPAIGN. DLEONS RESULTS WERE NOT SATISFACTORY, TO PUT IT MILDLY.

ITS BOARD OF DIRECTORS, WHICH CONSISTED OF ITS PRESIDENT AND VICE-

PRESIDENT PLUS ITS MAJOR STOCKHOLDERS (WHO WERE ALL LOCAL BUSINESS

PEOPLE), WAS MOST UPSET WHEN DIRECTORS LEARNED HOW THE EXPANSION WAS

GOING. SUPPLIERS WERE BEING PAID LATE AND WERE UNHAPPY, AND THE BANK

WAS COMPLAINING ABOUT THE DETERIORATING SITUATION AND THREATENING TO

CUT OFF CREDIT. AS A RESULT, WATKINS WAS INFORMED THAT CHANGES WOULD

HAVE TO BE MADE, AND QUICKLY, OR HE WOULD BE FIRED. ALSO, AT THE

BOARDS INSISTENCE DONNA JAMISON WAS BROUGHT IN AND GIVEN THE JOB OF

ASSISTANT TO FRED CAMPO, A RETIRED BANKER WHO WAS DLEONS CHAIRMAN AND

LARGEST STOCKHOLDER. CAMPO AGREED TO GIVE UP A FEW OF HIS GOLFING DAYS

AND TO HELP NURSE THE COMPANY BACK TO HEALTH, WITH JAMISONS HELP.

JAMISON BEGAN BY GATHERING THE FINANCIAL STATEMENTS AND OTHER DATA

GIVEN IN TABLES IC2-1, IC2-2, IC2-3, AND IC2-4. ASSUME THAT YOU ARE

JAMISONS ASSISTANT, AND YOU MUST HELP HER ANSWER THE FOLLOWING

QUESTIONS FOR CAMPO. (NOTE: WE WILL CONTINUE WITH THIS CASE IN

CHAPTER 3, AND YOU WILL FEEL MORE COMFORTABLE WITH THE ANALYSIS THERE,

BUT ANSWERING THESE QUESTIONS WILL HELP PREPARE YOU FOR CHAPTER 3.

PROVIDE CLEAR EXPLANATIONS, NOT JUST YES OR NO ANSWERS!)

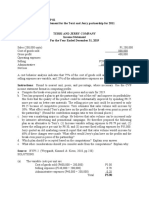

TABLE IC2-1. BALANCE SHEETS

2002 2001

ASSETS

CASH $ 7,282 $ 57,600

ACCOUNTS RECEIVABLE 632,160 351,200

INVENTORIES 1,287,360 715,200

TOTAL CURRENT ASSETS $1,926,802 $1,124,000

GROSS FIXED ASSETS 1,202,950 491,000

LESS ACCUMULATED DEPRECIATION 263,160 146,200

NET FIXED ASSETS $ 939,790 $ 344,800

TOTAL ASSETS $2,866,592 $1,468,800

LIABILITIES AND EQUITY

ACCOUNTS PAYABLE $ 524,160 $ 145,600

NOTES PAYABLE 636,808 200,000

ACCRUALS 489,600 136,000

TOTAL CURRENT LIABILITIES $1,650,568 $ 481,600

LONG-TERM DEBT 723,432 323,432

COMMON STOCK (100,000 SHARES) 460,000 460,000

RETAINED EARNINGS 32,592 203,768

TOTAL EQUITY $ 492,592 $ 663,768

TOTAL LIABILITIES AND EQUITY $2,866,592 $1,468,800

TABLE IC2-2. INCOME STATEMENTS

2002 2001

SALES $6,034,000 $3,432,000

COST OF GOODS SOLD 5,528,000 2,864,000

OTHER EXPENSES 519,988 358,672

TOTAL OPERATING COSTS

EXCLUDING DEPRECIATION AND AMORTIZATION $6,047,988 $3,222,672

EBITDA ($ 13,988) $ 209,328

DEPRECIATION AND AMORTIZATION 116,960 18,900

EBIT ($ 130,948) $ 190,428

INTEREST EXPENSE 136,012 43,828

EBT ($ 266,960) $ 146,600

TAXES (40%) (106,784)

a

58,640

NET INCOME ($ 160,176) $ 87,960

EPS ($1.602) $0.880

DPS $0.110 $0.220

BOOK VALUE PER SHARE $4.926 $6.638

STOCK PRICE $2.250 $8.500

SHARES OUTSTANDING 100,000 100,000

TAX RATE 40.00% 40.00%

LEASE PAYMENTS 40,000 40,000

SINKING FUND PAYMENTS 0 0

NOTE:

a

THE FIRM HAD SUFFICIENT TAXABLE INCOME IN 2000 AND 2001 TO OBTAIN ITS FULL TAX

REFUND IN 2002.

TABLE IC2-3. STATEMENT OF RETAINED EARNINGS, 2002

BALANCE OF RETAINED EARNINGS, 12/31/01 $203,768

ADD: NET INCOME, 2002 (160,176)

LESS: DIVIDENDS PAID (11,000)

BALANCE OF RETAINED EARNINGS, 12/31/02 $ 32,592

TABLE IC2-4. STATEMENT OF CASH FLOWS, 2002

OPERATING ACTIVITIES

NETINCOME ($160,176)

ADDITIONS (SOURCES OF CASH)

DEPRECIATION AND AMORTIZATION 116,960

INCREASE IN ACCOUNTS PAYABLE 378,560

INCREASE IN ACCRUALS 353,600

SUBTRACTIONS (USES OF CASH)

INCREASEIN ACCOUNTS RECEIVABLE (280,960)

INCREASEIN INVENTORIES (572,160)

NETCASH PROVIDED BY OPERATING ACTIVITIES ($164,176)

LONG-TERM INVESTING ACTIVITIES

CASHUSED TO ACQUIRE FIXED ASSETS ($711,950)

FINANCING ACTIVITIES

INCREASE IN NOTES PAYABLE $436,808

INCREASE IN LONG-TERM DEBT 400,000

PAYMENTOF CASH DIVIDENDS (11,000)

NET CASH PROVIDED BY FINANCING ACTIVITIES $825,808

SUM: NET DECREASE IN CASH ($ 50,318)

PLUS: CASH AT BEGINNING OF YEAR 57,600

CASH AT END OF YEAR $ 7,282

A. WHAT EFFECT DID THE EXPANSION HAVE ON SALES, NET OPERATING PROFIT

AFTER TAXES (NOPAT), NET OPERATING WORKING CAPITAL (NOWC), TOTAL

INVESTOR-SUPPLIED OPERATING CAPITAL, AND NET INCOME?

ANSWER: [S2-1 THROUGH S2-9 PROVIDE BACKGROUND INFORMATION. THEN SHOW S2-10

THROUGH S2-14 HERE.] SALES INCREASED BY $2,602,000.

NOPAT

02

= EBIT(1 - TAX RATE)

= (-$130,948)(0.6) = ($78,569).

NOPAT

01

= $190,428(0.6) = $114,257.

ANOPAT = ($78,569) - $114,257 = ($192,826).

NOPAT DECREASED BY $192,826.

NOWC

02

=

|

.

|

\

|

+

|

.

|

\

|

+ + ACCRUALS

PAYABLE

ACCOUNTS

S INVENTORIE

RECEIVABLE

ACCOUNTS

CASH

= ($7,282 + $632,160 + $1,287,360) - ($524,160 + $489,600)

= $913,042.

NOWC

01

= ($57,600 + $351,200 + $715,200) - ($145,600 + $136,000)

= $842,400.

ANOWC = $913,042 - $842,400 = $70,642.

NET OPERATING WORKING CAPITAL INCREASED BY $70,642.

OC

02

= NET OPERATING WORKING CAPITAL + NET PLANT AND EQUIPMENT

= $913,042 + $939,790 = $1,852,832.

OC

01

= $842,400 + $344,800 = $1,187,200.

AOC = $1,852,832 - $1,187,200 = $665,632.

TOTAL INVESTOR-SUPPLIED OPERATING CAPITAL INCREASED SUBSTANTIALLY BY

$665,632 FROM 2001 TO 2002.

NI

02

NI

01

= ($160,176) - $87,960 = ($248,136).

THERE WAS A BIG DROP, -$248,136, IN NET INCOME DURING 2002.

B. WHAT EFFECT DID THE COMPANYS EXPANSION HAVE ON ITS NET CASH FLOW,

OPERATING CASH FLOW, AND FREE CASH FLOW?

ANSWER: [SHOW S2-15 AND S2-16 HERE.]

NCF

02

= NI + DEP AND AMORT = ($160,176) + $116,960 = ($43,216).

NCF

01

= $87,960 + $18,900 = $106,860.

OCF

02

= EBIT(1 - T) + DEP AND AMORT = (-$130,948)(0.6) + $116,960

= $38,391.

OCF

01

= ($190,428)(0.6) + $18,900 = $133,157.

FCF

02

= NOPAT - NET INVESTMENT IN OPERATING CAPITAL

= (-$78,569) - ($1,852,832 - $1,187,200)

= (-$78,569) - $665,632 = ($744,201).

NCF IS NEGATIVE IN 2002, BUT IT WAS POSITIVE IN 2001. OCF IS POSITIVE

IN 2002, BUT IT DECREASED BY OVER 70 PERCENT FROM ITS 2001 LEVEL.

FREE CASH FLOW WAS -$744,201 IN 2002.

C. JAMISON ALSO HAS ASKED YOU TO ESTIMATE DLEONS EVA. SHE ESTIMATES

THAT THE AFTER-TAX COST OF CAPITAL WAS 10 PERCENT IN 2001 AND

13 PERCENT IN 2002.

ANSWER: [SHOW S2-17 THROUGH S2-19 HERE.]

EVA

02

= EBIT(1 - T) - AFTER-TAX COST OF OPERATING CAPITAL

= (-$130,948)(0.6) - ($1,852,832)(0.13)

= ($319,437).

EVA

01

= EBIT(1 - T) - AFTER-TAX COST OF OPERATING CAPITAL

= ($190,428)(0.6) - ($1,187,200)(0.10)

= ($4,463).

IN 2001, EVA WAS SLIGHTLY NEGATIVE; HOWEVER IN 2002 EVA WAS

SIGNIFICANTLY NEGATIVE.

D. LOOKING AT DLEONS STOCK PRICE TODAY, WOULD YOU CONCLUDE THAT THE

EXPANSION INCREASED OR DECREASED MVA?

ANSWER: [SHOW S2-20 HERE.] DURING THE LAST YEAR, STOCK PRICE HAS DECREASED BY

OVER 73 PERCENT, THUS ONE WOULD CONCLUDE THAT THE EXPANSION HAS

DECREASED MVA.

E. DLEON PURCHASES MATERIALS ON 30-DAY TERMS, MEANING THAT IT IS

SUPPOSED TO PAY FOR PURCHASES WITHIN 30 DAYS OF RECEIPT. JUDGING FROM

ITS 2002 BALANCE SHEET, DO YOU THINK DLEON PAYS SUPPLIERS ON TIME?

EXPLAIN.

IF NOT, WHAT PROBLEMS MIGHT THIS LEAD TO?

ANSWER: [SHOW S2-21 HERE.] DLEON PROBABLY DOES NOT PAY ITS SUPPLIERS ON TIME

JUDGING FROM THE FACT THAT ITS ACCOUNTS PAYABLES BALANCE INCREASED BY

260 PERCENT FROM THE PAST YEAR, WHILE SALES INCREASED BY ONLY 76

PERCENT. COMPANY RECORDS WOULD SHOW IF THEY PAID SUPPLIERS ON TIME.

BY NOT PAYING SUPPLIERS ON TIME, DLEON IS STRAINING ITS RELATIONSHIP

WITH THEM. IF DLEON CONTINUES TO BE LATE, EVENTUALLY SUPPLIERS WILL

CUT THE COMPANY OFF AND PUT IT INTO BANKRUPTCY.

F. DLEON SPENDS MONEY FOR LABOR, MATERIALS, AND FIXED ASSETS

(DEPRECIATION) TO MAKE PRODUCTS, AND STILL MORE MONEY TO SELL THOSE

PRODUCTS. THEN, IT MAKES SALES THAT RESULT IN RECEIVABLES, WHICH

EVENTUALLY RESULT IN CASH INFLOWS. DOES IT APPEAR THAT DLEONS SALES

PRICE EXCEEDS ITS COSTS PER UNIT SOLD? HOW DOES THIS AFFECT THE CASH

BALANCE?

ANSWER: [SHOW S2-22 HERE.] IT DOES NOT APPEAR THE DLEONS SALES PRICE

EXCEEDS ITS COSTS PER UNIT SOLD AS INDICATED IN THE INCOME STATEMENT.

THE COMPANY IS SPENDING MORE CASH THAN IT IS TAKING IN AND, AS A

RESULT, THE CASH ACCOUNT BALANCE HAS DECREASED.

G. SUPPOSE DLEONS SALES MANAGER TOLD THE SALES STAFF TO START OFFERING

60-DAY CREDIT TERMS RATHER THAN THE 30-DAY TERMS NOW BEING OFFERED.

DLEONS COMPETITORS REACT BY OFFERING SIMILAR TERMS, SO SALES REMAIN

CONSTANT. WHAT EFFECT WOULD THIS HAVE ON THE CASH ACCOUNT? HOW WOULD

THE CASH ACCOUNT BE AFFECTED IF SALES DOUBLED AS A RESULT OF THE

CREDIT POLICY CHANGE?

ANSWER: [SHOW S2-23 HERE.] BY EXTENDING THE SALES CREDIT TERMS, IT WOULD TAKE

LONGER FOR DLEON TO RECEIVE ITS MONEY--ITS CASH ACCOUNT WOULD

DECREASE AND ITS ACCOUNTS RECEIVABLE WOULD BUILD UP. BECAUSE

COLLECTIONS WOULD SLOW, ACCOUNTS PAYABLE WOULD BUILD UP TOO.

INVENTORY WOULD HAVE TO BE BUILT UP AND POSSIBLY FIXED ASSETS TOO

BEFORE SALES COULD BE INCREASED. ACCOUNTS RECEIVABLE WOULD RISE AND

CASH WOULD DECLINE. MUCH LATER, WHEN COLLECTIONS INCREASED CASH WOULD

RISE. DLEON WOULD PROBABLY NEED TO BORROW OR SELL STOCK TO FINANCE

THE EXPANSION.

H. CAN YOU IMAGINE A SITUATION IN WHICH THE SALES PRICE EXCEEDS THE COST

OF PRODUCING AND SELLING A UNIT OF OUTPUT, YET A DRAMATIC INCREASE IN

SALES VOLUME CAUSES THE CASH BALANCE TO DECLINE?

ANSWER: THIS SITUATION IS LIKELY TO OCCUR AS SUGGESTED IN THE SECOND PART OF

THE ANSWER TO QUESTION G.

I. DID DLEON FINANCE ITS EXPANSION PROGRAM WITH INTERNALLY GENERATED

FUNDS (ADDITIONS TO RETAINED EARNINGS PLUS DEPRECIATION) OR WITH

EXTERNAL CAPITAL? HOW DOES THE CHOICE OF FINANCING AFFECT THE

COMPANYS FINANCIAL STRENGTH?

ANSWER: [SHOW S2-24 HERE.] DLEON FINANCED ITS EXPANSION WITH EXTERNAL

CAPITAL RATHER THAN INTERNALLY GENERATED FUNDS. IN PARTICULAR, DLEON

ISSUED LONG-TERM DEBT RATHER THAN COMMON STOCK, WHICH REDUCED ITS

FINANCIAL STRENGTH AND FLEXIBILITY.

J. REFER TO TABLES IC2-2 AND IC2-4. SUPPOSE DLEON BROKE EVEN IN 2002 IN

THE SENSE THAT SALES REVENUES EQUALED TOTAL OPERATING COSTS PLUS

INTEREST CHARGES. WOULD THE ASSET EXPANSION HAVE CAUSED THE COMPANY

TO EXPERIENCE A CASH SHORTAGE THAT REQUIRED IT TO RAISE EXTERNAL

CAPITAL?

ANSWER: [SHOW S2-25 HERE.] EVEN IF DLEON HAD BROKEN EVEN IN 2002, THE FIRM

WOULD HAVE HAD TO FINANCE AN INCREASE IN ASSETS.

K. IF DLEON STARTED DEPRECIATING FIXED ASSETS OVER 7 YEARS RATHER THAN

10 YEARS, WOULD THAT AFFECT (1) THE PHYSICAL STOCK OF ASSETS, (2) THE

BALANCE SHEET ACCOUNT FOR FIXED ASSETS, (3) THE COMPANYS REPORTED NET

INCOME, AND (4) ITS CASH POSITION? ASSUME THE SAME DEPRECIATION

METHOD IS USED FOR STOCKHOLDER REPORTING AND FOR TAX CALCULATIONS, AND

THE ACCOUNTING CHANGE HAS NO EFFECT ON ASSETS PHYSICAL LIVES.

ANSWER: [SHOW S2-26 HERE.] THIS WOULD HAVE NO EFFECT ON THE PHYSICAL STOCK OF

THE ASSETS; HOWEVER, THE BALANCE SHEET ACCOUNT FOR NET FIXED ASSETS

WOULD DECLINE BECAUSE ACCUMULATED DEPRECIATION WOULD INCREASE DUE TO

DEPRECIATING ASSETS OVER 7 YEARS VERSUS 10 YEARS. BECAUSE

DEPRECIATION EXPENSE WOULD INCREASE, NET INCOME WOULD DECLINE.

FINALLY, THE FIRMS CASH POSITION WOULD INCREASE, BECAUSE ITS TAX

PAYMENTS WOULD BE REDUCED.

L. EXPLAIN HOW EARNINGS PER SHARE, DIVIDENDS PER SHARE, AND BOOK VALUE

PER SHARE ARE CALCULATED, AND WHAT THEY MEAN. WHY DOES THE MARKET

PRICE PER SHARE NOT EQUAL THE BOOK VALUE PER SHARE?

ANSWER: NET INCOME DIVIDED BY SHARES OUTSTANDING EQUALS EARNINGS PER SHARE.

DIVIDENDS DIVIDED BY SHARES OUTSTANDING EQUALS DIVIDENDS PER SHARE,

WHILE BOOK VALUE PER SHARE IS CALCULATED AS TOTAL COMMON EQUITY

DIVIDED BY SHARES OUTSTANDING.

MARKET PRICE PER SHARE DOES NOT EQUAL BOOK VALUE PER SHARE. THE

MARKET VALUE OF A STOCK REFLECTS FUTURE PROFITABILITY, WHILE BOOK

VALUE PER SHARE REPRESENTS HISTORICAL COST.

M. EXPLAIN BRIEFLY THE TAX TREATMENT OF (1) INTEREST AND DIVIDENDS PAID,

(2) INTEREST EARNED AND DIVIDENDS RECEIVED, (3) CAPITAL GAINS, AND (4)

TAX LOSS CARRY-BACK AND CARRY-FORWARD. HOW MIGHT EACH OF THESE ITEMS

IMPACT DLEONS TAXES?

ANSWER: [SHOW S2-27 THROUGH S2-30 HERE.] FOR A BUSINESS, INTEREST PAID IS

CONSIDERED AN EXPENSE AND IS PAID OUT OF PRE-TAX INCOME. THEREFORE,

INTEREST PAID IS TAX DEDUCTIBLE FOR BUSINESSES. FOR INDIVIDUALS,

INTEREST PAID IS GENERALLY NOT TAX DEDUCTIBLE, WITH THE NOTABLE

EXCEPTION BEING LIMITED TAX DEDUCTIBILITY ON HOME MORTGAGE INTEREST.

DIVIDENDS PAID BY A BUSINESS ARE PAID OUT OF AFTER-TAX INCOME.

INTEREST EARNED, WHETHER BY A BUSINESS OR INDIVIDUAL, IS TAXABLE

INCOME AND SUBJECT TO STANDARD INCOME TAXES, EXCEPT FOR SOME STATE AND

LOCAL GOVERNMENT DEBT INTEREST. DIVIDENDS RECEIVED ARE FULLY TAXED AS

ORDINARY INCOME FOR INDIVIDUALS, CREATING A DOUBLE TAXATION OF

DIVIDENDS. A PORTION OF DIVIDENDS RECEIVED BY CORPORATIONS IS TAX

EXCLUDABLE, IN ORDER TO AVOID TRIPLE TAXATION.

CAPITAL GAINS ARE DEFINED AS THE PROFITS FROM THE SALE OF AN ASSET

NOT USED IN THE NORMAL COURSE OF BUSINESS. FOR INDIVIDUALS, CAPITAL

GAINS ON ASSETS ARE TAXED AS ORDINARY INCOME IF HELD FOR LESS THAN A

YEAR, AND AT THE CAPITAL GAINS RATE IF HELD FOR MORE THAN A YEAR.

CORPORATIONS FACE SOMEWHAT DIFFERENT RULES. CAPITAL GAINS FOR

CORPORATIONS ARE TAXED AS ORDINARY INCOME. TAX LOSS CARRY-BACK AND

CARRY-FORWARD PROVISIONS ALLOW BUSINESSES TO USE A LOSS IN THE CURRENT

YEAR TO OFFSET PROFITS IN PRIOR YEARS (2 YEARS), AND IF LOSSES HAVENT

BEEN COMPLETELY OFFSET BY PAST PROFITS THEY CAN BE CARRIED FORWARD TO

OFFSET PROFITS IN THE FUTURE (20 YEARS).

DLEON PAID INTEREST EXPENSE OF $136,012 WHICH WAS USED TO FURTHER

LOWER ITS TAX LIABILITY RESULTING IN A TAX CREDIT OF $106,784 FOR A

NET LOSS OF -$160,176. HOWEVER, BECAUSE OF THE TAX LOSS CARRY-BACK

AND CARRY-FORWARD PROVISION DLEON WAS ABLE TO OBTAIN ITS FULL TAX

REFUND IN 2002 (AS THE FIRM HAD SUFFICIENT TAXABLE INCOME IN 2000 and

2001).

You might also like

- 770976ce9 - DLeon Part IDocument5 pages770976ce9 - DLeon Part IMuhammad sohailNo ratings yet

- NOPAT NOPAT2011 - NOPAT20010 (Note ' MeansDocument5 pagesNOPAT NOPAT2011 - NOPAT20010 (Note ' MeansBryan LluismaNo ratings yet

- Division Performance MeasurementDocument31 pagesDivision Performance MeasurementKetan DedhaNo ratings yet

- Written Assignment Unit 7Document5 pagesWritten Assignment Unit 7Gregory PilarNo ratings yet

- ACCT-UB 3 - Financial Statement Analysis Module 3 HomeworkDocument2 pagesACCT-UB 3 - Financial Statement Analysis Module 3 HomeworkpratheekNo ratings yet

- Managerial Accounting Chapter 8 & 9 SolutionsDocument8 pagesManagerial Accounting Chapter 8 & 9 SolutionsJotham NyanjeNo ratings yet

- 03 LeasingDocument16 pages03 Leasingnotes.mcpuNo ratings yet

- Activity-Based CostingDocument7 pagesActivity-Based CostingVlad BelyaevNo ratings yet

- CH 5 Security Market IndexesDocument12 pagesCH 5 Security Market IndexesMoin khanNo ratings yet

- Accounting For A Professional Service Business: The Combination JournalDocument33 pagesAccounting For A Professional Service Business: The Combination Journallovelyn seseNo ratings yet

- Financial AnalysisDocument22 pagesFinancial Analysisnomaan khanNo ratings yet

- Carlos Hilado Memorial State College: College of Business Management and AccountancyDocument14 pagesCarlos Hilado Memorial State College: College of Business Management and AccountancyMa.Cristina JulatonNo ratings yet

- Microdrive Case SolutionDocument3 pagesMicrodrive Case SolutionKING KARTHIKNo ratings yet

- Chapter 14Document9 pagesChapter 14Kimberly LimNo ratings yet

- Hansen AISE TB - Ch17Document39 pagesHansen AISE TB - Ch17clothing shoptalkNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingJenny Dela Cruz100% (1)

- OLYMPUS CAUGHT IN THE ACT (A Case Study)Document25 pagesOLYMPUS CAUGHT IN THE ACT (A Case Study)StephannieArreolaNo ratings yet

- Chapter 11 PDFDocument66 pagesChapter 11 PDFSyed Atiq TurabiNo ratings yet

- CPA Firm Involved AdelphiaDocument2 pagesCPA Firm Involved AdelphiaHenny FaustaNo ratings yet

- CH 15 PDFDocument7 pagesCH 15 PDFYohanaNo ratings yet

- BF Assign1Document3 pagesBF Assign1Mian Shawal67% (3)

- EVA Investment Center Hilton Chapter 13Document62 pagesEVA Investment Center Hilton Chapter 13Riedy RiandaniNo ratings yet

- Chapter 15Document34 pagesChapter 15IstikharohNo ratings yet

- Kuliah III Case of Time Value of MoneyDocument27 pagesKuliah III Case of Time Value of MoneyMathilda UllyNo ratings yet

- Internal Test - 2 - FSA - QuestionDocument3 pagesInternal Test - 2 - FSA - QuestionSandeep Choudhary40% (5)

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Answers - Chapter 2 Vol 2 RvsedDocument13 pagesAnswers - Chapter 2 Vol 2 Rvsedjamflox100% (3)

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Assignment 2Document2 pagesAssignment 2Shaina Santiago AlejoNo ratings yet

- Artistic Woodcrafting Inc.Document10 pagesArtistic Woodcrafting Inc.Irish June Tayag0% (1)

- Management Accounting Group 4 AssignmentDocument5 pagesManagement Accounting Group 4 AssignmentpfungwaNo ratings yet

- Chapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument5 pagesChapter 7. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- Example of Investment Analysis Paper PDFDocument24 pagesExample of Investment Analysis Paper PDFYoga Nurrahman AchfahaniNo ratings yet

- 2-Capital Budgeting TechniquesDocument31 pages2-Capital Budgeting TechniquesSafdar BNC cjk IqbalNo ratings yet

- Risk and Rates of ReturnDocument16 pagesRisk and Rates of ReturnSally Goodwill100% (1)

- Can One Size Fits AllDocument8 pagesCan One Size Fits AllAngelica B. PatagNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- Special Decision MakingDocument3 pagesSpecial Decision Makingsandesh tamrakarNo ratings yet

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahNo ratings yet

- Assignment 5Document3 pagesAssignment 5Hilkiah MusNo ratings yet

- Easy Company Financial PositionDocument2 pagesEasy Company Financial PositionSheila May SantosNo ratings yet

- Case Study 01Document3 pagesCase Study 01BILL GRANT ORETANo ratings yet

- AssignmentDocument7 pagesAssignmentMona VimlaNo ratings yet

- Chapter No. 06 The Risk and Term Structure of Interest RatesDocument4 pagesChapter No. 06 The Risk and Term Structure of Interest RatesMuhammad FarhanNo ratings yet

- Cagayan State University - AndrewsDocument4 pagesCagayan State University - AndrewsWynie AreolaNo ratings yet

- Strategic Management CH-4Document9 pagesStrategic Management CH-4padmNo ratings yet

- Chapter 7 Materials Controlling and CostingDocument43 pagesChapter 7 Materials Controlling and CostingNabiha Awan100% (1)

- 6 Organizational Innovations: Total Quality Management Just-In-Time Production System PDFDocument5 pages6 Organizational Innovations: Total Quality Management Just-In-Time Production System PDFAryan LeeNo ratings yet

- This Study Resource Was: Using Your Judgment 2-4Document4 pagesThis Study Resource Was: Using Your Judgment 2-4Cherry Mae Garay PamulaganNo ratings yet

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Mapping Compensation StrategiesDocument4 pagesMapping Compensation StrategiesMarc Allan100% (1)

- Written Assignment Unit 2 Fin MGTDocument2 pagesWritten Assignment Unit 2 Fin MGTSalifu J TurayNo ratings yet

- Magerial Economics Ms 09Document271 pagesMagerial Economics Ms 09smartsatish100% (1)

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoNo ratings yet

- Nestle-Organizational Behaviour With Refrence To 17 PointsDocument9 pagesNestle-Organizational Behaviour With Refrence To 17 PointsKhaWaja HamMadNo ratings yet

- Managerial QuizDocument5 pagesManagerial QuizThuy Ngan NguyenNo ratings yet

- Chapter 8Document17 pagesChapter 8Jamaica DavidNo ratings yet

- MBF5207201004 Strategic Financial ManagementDocument5 pagesMBF5207201004 Strategic Financial ManagementtawandaNo ratings yet

- INTEGRATIVE PROBLEM 2-17 and Solution For ReviewDocument11 pagesINTEGRATIVE PROBLEM 2-17 and Solution For ReviewNoor NabiNo ratings yet

- Homework #1 - Ratio AnalysisDocument9 pagesHomework #1 - Ratio Analysisfgdsafds100% (1)

- Module 3 Debt ManagementDocument33 pagesModule 3 Debt ManagementJane BañaresNo ratings yet

- Rural Marketing FMCG Product Hindustan Unilever Limited: Master of Business Administration (MBA) Session 2019-20Document6 pagesRural Marketing FMCG Product Hindustan Unilever Limited: Master of Business Administration (MBA) Session 2019-20Amit SinghNo ratings yet

- Long Quiz BSA 1st Yr 2023 2024Document10 pagesLong Quiz BSA 1st Yr 2023 2024Kenneth Del RosarioNo ratings yet

- Thesis Aquaculture)Document88 pagesThesis Aquaculture)Eric Hammond100% (1)

- Retirement and SeparationsDocument18 pagesRetirement and SeparationsRuben GhaleNo ratings yet

- 4 Commissioner - of - Internal - Revenue - v. - Court - ofDocument8 pages4 Commissioner - of - Internal - Revenue - v. - Court - ofClaire SantosNo ratings yet

- Agreement FormatDocument5 pagesAgreement Formatpurshottam hunsigiNo ratings yet

- Group3-Case Study-7c5Document31 pagesGroup3-Case Study-7c5NoorNabilaNo ratings yet

- KRF ProgramDocument15 pagesKRF ProgramVlado SusacNo ratings yet

- Fund DisbursementDocument33 pagesFund DisbursementNawal AbdulgaforNo ratings yet

- Lesson 3:: Total Quality Management PrincipleDocument17 pagesLesson 3:: Total Quality Management PrincipleJolina CabardoNo ratings yet

- PDF Ministry 2011eng PDFDocument154 pagesPDF Ministry 2011eng PDFEugene TanNo ratings yet

- Financial DerivativesDocument2 pagesFinancial Derivativesviveksharma51No ratings yet

- Factors Affecting Customer Satisfaction in The Fast Food Restaurants of KathmanduDocument11 pagesFactors Affecting Customer Satisfaction in The Fast Food Restaurants of KathmanduRoshanNo ratings yet

- IRS Form 3520 Annual Return To ReportDocument6 pagesIRS Form 3520 Annual Return To ReportFAQMD2No ratings yet

- How To Add Money To Your Investment A/cDocument2 pagesHow To Add Money To Your Investment A/cNarendra VinchurkarNo ratings yet

- Marketing Offering & Brand ManagementDocument33 pagesMarketing Offering & Brand ManagementTom jerryNo ratings yet

- Foundations of Engineering EconomyDocument62 pagesFoundations of Engineering EconomyMuhammad AmmarNo ratings yet

- Ate Mapa PrintDocument10 pagesAte Mapa PrintchosNo ratings yet

- BDADocument9 pagesBDAEmaan SalmanNo ratings yet

- Research Paper AlibabaDocument8 pagesResearch Paper Alibabacwzobjbkf100% (1)

- Sheet 2Document21 pagesSheet 2yehyaNo ratings yet

- Nikita: Thanks For Choosing Swiggy, Nikita! Here Are Your Order Details: Delivery ToDocument2 pagesNikita: Thanks For Choosing Swiggy, Nikita! Here Are Your Order Details: Delivery ToAkash MadhwaniNo ratings yet

- Aswath Damodaran - Technology ValuationDocument115 pagesAswath Damodaran - Technology Valuationpappu.subscription100% (1)

- Dan Mcclure Owns A Thriving Independent Bookstore in Artsy NewDocument1 pageDan Mcclure Owns A Thriving Independent Bookstore in Artsy NewAmit Pandey0% (1)

- Chapter 7: The Basics of Simple Interest (Time & Money) : Value (Or Equivalent Value)Document4 pagesChapter 7: The Basics of Simple Interest (Time & Money) : Value (Or Equivalent Value)Ahmad RahhalNo ratings yet

- AER Presentation On RAB MultiplesDocument18 pagesAER Presentation On RAB MultiplesKGNo ratings yet

- Tata SteelDocument15 pagesTata SteelanwaritmNo ratings yet

- Bill-Cum-Notice: Dial Toll Free 1912 For Bill & Supply ComplaintsDocument1 pageBill-Cum-Notice: Dial Toll Free 1912 For Bill & Supply Complaintsshekhar.mnnitNo ratings yet

- Instructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) Article Instructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) ArticleDocument2 pagesInstructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) Article Instructions: Find, Read and Attach An Opinion-Editorial (Op-Ed) ArticleAriell EmraduraNo ratings yet