Professional Documents

Culture Documents

CMA Format Munjal Showa

Uploaded by

Mohit KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CMA Format Munjal Showa

Uploaded by

Mohit KumarCopyright:

Available Formats

ICICI Banking Corporation Ltd.

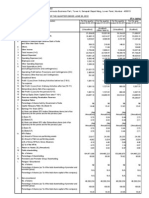

ASSESSMENT OF WORKING CAPITAL REQUIREMENTS FORM II - OPERATING STATEMENT Name: Amounts in Rs. Crore Last 2 Years Actuals Current Yr. Next Year (As per audited accounts) Estimates Projections 2009 2010 2011 2012 12 12 12 12

Year No.of months

1. Gross Sales i. ii. Domestic Sales Export Sales Total 2. Less Excise Duty 3. Net Sales (1 - 2) 4. % age rise (+) or fall (-) in net sales as compared to previous year (annualised ) 5. Cost of Sales i. Raw materials (including stores and other items used in the process of manufacture) a. b. ii. Imported Indigenous 7469.57 9698.42 11636.33 N/A 10609.75 730.59 9879.16 N/A 13884.14 990.88 12893.26 30.51% 16740.91 1172.09 15568.82 20.75% 10609.75 13884.14 16740.91

7469.57

9698.42

11636.33

Other Spares a. b. Imported Indigenous 412.11 347.76 421.46 584.59 230.76 9466.25 469.80 460.61 547.12 728.58 262.47 12167.00 520.65 541.01 665.47 869.20 272.29 14504.94

iii. iv. v. vi.

Power and Fuel Direct Labour (Factory wages & salaries) Other manufacturing expenses Depreciation

vii. Sub-total (i to vi)

viii. Add: Opening Stock-in-process Sub-total (vii + viii) ix. x. Deduct: Closing Stock-in-process Cost of Production 70.78 -70.78

70.78 9537.03 65.54 9471.50

65.54 12232.54 53.15 12179.39

53.15 14558.09 87.93 14470.17

1/3/2013

122611385.xls.ms_office (Form-II)

Page 1

ICICI Banking Corporation Ltd.

xi.

Add: Opening Stock of finished goods Sub-total (x + xi) -70.78 22.76 -93.54

22.76 9494.26 25.89 9468.37

25.89 12205.28 32.45 12172.83

32.45 14502.62 43.82 14458.80

xii. Deduct: Closing Stock of finished goods xiii. Sub-total (Total Cost of Sales)

6. Selling, general and administrative expenses 7. Sub-total (5 + 6) 8. Operating Profit before Interest (3 - 7) 9. Interest 10. Operating Profit after Interest (8 - 9) 11. i. Add: Other non-operating Income a. b. c. d. Interest Income Profits on sale of non-trade investments Profit on disposal of fixed assets Others 93.54 -93.54 93.54

80.85 9549.22 329.94 120.68 209.26

89.56 12262.39 630.87 91.40 539.47

115.81 14574.61 994.21 111.59 882.62

12.56 3.72

3.30 6.78 10.50

2.03 10.77

183.23 199.51

2.83 23.41

3.14 15.94

Sub-total (Income) ii. Deduct: Other non-operating expenses a. b. c. d. Director's Sitting Fees Payment to Statutory Auditors Provisions for doubtful debts Others

0.74

0.78 2.81 0.75

0.77 3.36

20.95 21.68 177.83 93.54 387.09 140.99 93.54 246.10

79.21 83.54 -60.13 479.34 139.16 340.18

35.45 39.57 -23.63 858.99 187.70 671.29

Sub-total (Expenses) iii. Net of other non-operating income / expenses [net of 11(i) & 11(ii)]

12. Profit before tax/loss [10 + 11(iii)] 13. Provision for taxes 14. Net Profit / Loss (12 -13) 15. a. b. Equity dividend paid-amount (Already paid + B.S. provision) Dividend Rate (% age)

16. Retained Profit (14 - 15) 17. Retained Profit / Net Profit (% age)

93.54 100.00%

246.10 100.00%

340.18 100.00%

671.29 100.00%

1/3/2013

122611385.xls.ms_office (Form-II)

Page 2

ICICI Banking Corporation Ltd.

FORM III - ANALYSIS OF BALANCE SHEET LIABILITIES Name: Amounts in Rs. Crore Last 2 Years Actuals Current Yr. Next Year (As per audited BS) Estimates Projections 2009 2010 2011 2012 12 12 12 12

Year No.of months

CURRENT LIABILITIES 1. Short-term borrowing from banks (including bills purchased, discounted & excess borrowing placed on repayment basis) i. ii. iii. From applicant bank From other banks (of which BP & BD) Sub-total [i + ii] (A) 2. Short term borrowings from others 3. Sundry Creditors (Trade) 4. Advance payments from customers / deposits from dealers 5. Provision for taxation 6. Dividend payable 7. Other statutory liabilities (due within 1 year) 8. Deposits / instalments of term loans / DPGs / debentures etc. (due within 1 year) 9. Other current liabilities & provisions (due within 1 year) - specify major items a. b. c. d. Interest Accrued Unpaid Dividend Others Provisions 497.66 4.44 2.85 327.54 162.83 1481.28 1941.50 46.57 283.77 228.59 9.00 3.14 28.56 187.90 2199.11 2253.33 49.51 320.48 204.64 7.91 3.56 11.24 181.94 2260.80 2460.80 0.33 0.19 0.19 983.29 1639.99 1685.98 460.22 54.22 200.00 460.22 54.22 200.00

Sub total [2 to 9] (B) 10. Total current liabilities [A + B]

1/3/2013

122611385.xls.ms_office (Form-III)

Page 3

ICICI Banking Corporation Ltd.

TERM LIABILITIES 11. Debentures (not maturing within 1 year) 12. Preference Shares (redeemable after 1 year) 13. Term loans (excluding instalments payable within 1 year) 14. Deferred Payment Credits (excluding instalments due within 1 year) 15. Term deposits (repayable after 1 year) 16. Other term liabilities 17. Total Term Liabilities [11 to 16] 18. Total Outside Liabilities [10 + 17] 1941.50 148.42 667.42 2920.75 148.50 359.59 2820.39 519.00 211.09

NET WORTH 19. Ordinary Share Capital 20. General Reserve 21. Revaluation Reserve 22. Other Reserves (excluding Provisions) 23. Surplus (+) or deficit (-) in Profit & Loss a/c 23. a. Others Share Premium Capital Redemption Reserve 24. Net Worth 25. TOTAL LIABILITIES [18 + 24] 1805.49 3746.99 2029.78 4950.53 2561.62 5382.01 79.99 1725.50 79.99 1949.79 79.99 2481.63

1/3/2013

122611385.xls.ms_office (Form-III)

Page 4

ICICI Banking Corporation Ltd.

FORM III - ANALYSIS OF BALANCE SHEET (Continued) ASSETS Name: Amounts in Rs. Crore Last 2 Years Actuals Current Yr. Next Year (As per audited BS) Estimates Projections 2009 2010 2011 2012 12 12 12 12 30.89 47.22 30.00

Year No.of months

CURRENT ASSETS 26. Cash and Bank Balances 27. Investments (other than long term) i. Govt. and other trustee securities ii. Fixed Deposits with banks 28. i. Receivables other than deferred & exports (incldg. bills purchased and discounted by banks) ii. Export receivables (incldg. bills purchased/discounted by banks) 29. Instalments of deferred receivables (due within 1 year) 30. Inventory: i. Raw materials (including stores and other items used in the process of manufacture) a. Imported b. Indigenous ii. Stocks-in-process iii. Finished goods iv. Other consumable spares a. Imported b. Indigenous 31. Advances to suppliers of raw materials and stores/spares 32. Advance payment of taxes 33. Other current assets (specify major items) a. Other Current Assets b. Prepaid Expenses c. Loans and Advances d. Security Deposit 34. Total Current Assets (26 to 33)

1429.93

1759.68

93.55

91.42

366.73

490.73

234.46 234.46 53.15 32.45 46.68 46.68 14.27 435.40 80.36 12.39 342.30 0.35 2277.22

294.79 294.79 87.93 43.82 64.20 64.20 17.67 439.42 85.97 14.95 338.16 0.35 2784.72

70.78 22.76

65.54 25.89

93.55

91.42

1/3/2013

122611385.xls.ms_office (Form-III)

Page 5

ICICI Banking Corporation Ltd.

FIXED ASSETS 35. Gross Block (land, building, machinery, work-in-progress) 36. Depreciation to date 37. Net Block (35 - 36) OTHER NON-CURRENT ASSETS 38. Investments/book debts/advances/deposits which are not current assets i. a. Investments in subsidiary companies / affiliates b. Others ii. Advances to suppliers of capital goods and contractors iii. Deferred receivables (maturity exceeding 1 year) iv. Others a. Security Deposits b. Loans to Subsidiaries c. Receivables over 6 months d. Loan Given to Employees 39. Non-consumable stores and spares 40. Other non-current assets including dues from directors 41. Total Other Non-current Assets (38 to 40) 42. Intangible Assets (patents, good will, prelim.expenses, bad / doubtful debts not provided for, etc. 43. Total Assets (34+37+41+42) 44. Tangible Net Worth (24 - 42) 45. Net Working Capital (34 - 10) 46. Current Ratio (34 / 10) 47. Total OUTSIDE Liabilities / Tangible Net Worth (18 / 44) 48. Total TERM Liabilities / Tangible Net Worth (17 / 44) ADDITIONAL INFORMATION A. Arrears of depreciation B. Contingent Liabilities: i. Arrears of cumulative dividends ii. Gratuity liability not provided for iii. Disputed excise / customs / tax liabilities iv. Other liabilities not provided for

4085.24 1454.71 2630.52

4240.02 1678.49 2561.53

34.53

33.90

13.62

5.42

20.91 13.61

28.48 19.69

7.31

8.79

8.26 42.79

1.86 35.76

93.55 93.55 #DIV/0!

91.42 1805.49 -1850.08 0.05 1.08

4950.53 2029.78 23.89 1.01 1.44 0.33

5382.01 2561.62 323.92 1.13 1.10 0.14

1/3/2013

122611385.xls.ms_office (Form-III)

Page 6

ICICI Banking Corporation Ltd.

FORM IV COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES Name: Amounts in Rs. Crore Last Year Current Yr. Next Year Peak Norms Actuals Estimates Projections Requirement Year 2010 2011 2012 A. CURRENT ASSETS 1. Raw materials (incl. stores & other items used in the process of manufacture) a. Imported Month's Consumption b. Indigenous Month's Consumption 2. Other Consumable spares, excluding those included in 1 above a. Imported Month's Consumption b. Indigenous Month's Consumption 3. Stock-in-process Month's cost of production 4. Finished goods Month's cost of sales 5. Receivables other than export & deferred receivables (incl. bills purchased & discounted by bankers) Month's domestic sales: excluding deferred payment sales 6. Export receivables (incl. bills purchased and discounted) Month's export sales 7. Advances to suppliers of raw materials & stores / spares, consumables 8. Other current assets incl. cash & bank balances & deferred receivables due within one year Cash and Bank Balances Investments (other than long term): i. Govt. and other trustee securities ii. Fixed Deposits with banks Instalments of deferred receivables (due within 1 year) Advance payment of taxes Other current assets 9. Total Current Assets

(To agree with item 34 in Form III)

234.46 (0.29)

294.79 (0.30)

65.54 (0.08) 25.89 (0.03)

46.68 (1.19) 53.15 (0.05) 32.45 (0.03)

64.20 (1.48) 87.93 (0.07) 43.82 (0.04)

1429.93 (1.24)

1759.68 (1.26)

14.27

17.67

466.29 30.89

516.64 47.22 30.00

91.42

435.40 2277.22

439.42 2784.72

1/3/2013

122611385.xls.ms_office (Form-IV)

Page 7

ICICI Banking Corporation Ltd.

FORM IV COMPARATIVE STATEMENT OF CURRENT ASSETS AND CURRENT LIABILITIES Name: Amounts in Rs. Crore Last Year Current Yr. Next Year Peak Norms Actuals Estimates Projections Requirement Year 2010 2011 2012 B. CURRENT LIABILITIES (Other than bank borrowings for working capital) 10. Creditors for purchase of raw materials, stores & consumable spares Month's purchases 11. Advances from customers 12. Statutory liabilities 13. Other current liabilities: Short term borrowings from others Provision for taxation Dividend payable Deposits / instalments of term loans / DPGs / debentures etc. (due within 1 year) Other current liabilities & provisions (due within 1 year) 14. Total (To agree with total B of Form-III)

983.29 (1.58)

1639.99 (1.98) 46.57 512.55 0.19

1685.98 (1.73) 49.51 525.31 0.19

497.99 0.33

283.77 497.66 1481.28 228.59 2199.11

320.48 204.64 2260.80

1/3/2013

122611385.xls.ms_office (Form-IV)

Page 8

I C I C I Banking Corporation Ltd.

FORM V COMPUTATION OF MAXIMUM PERMISSIBLE BANK FINANCE FOR WORKING CAPITAL Name: Amounts in Rs. Crore Last Year Current Yr. Next Year Peak Actuals Estimates Projections Requirement Year 2010 2011 2012 91.42 1481.28 -1389.86 -347.47 -1850.08 -1042.40 460.22 -1042.40 1502.62 2277.22 2199.11 78.11 19.53 23.89 58.58 54.22 54.22 2784.72 2260.80 523.92 130.98 323.92 392.94 200.00 200.00

First Method of Lending

1. Total Current Assets (Form-IV-9) 2. Other Current Liabilities (other than bank borrowings (Form-IV-14) 3. Working Capital Gap (WCG) (1-2) 4. Min. stipulated net working capital: (25% of WCG excluding export receivables) 5. Actual / Projected net working capital

(Form-III-45)

6. Item-3 minus Item-4 7. Item-3 minus Item-5 8. Max. permissible bank finance

(item-6 or 7, whichever is lower)

9. Excess borrowings representing shortfall in NWC (4 - 5)

Second Method of Lending 1. Total Current Assets (Form-IV-9) 2. Other Current Liabilities (other than bank borrowings (Form-IV-14) 3. Working Capital Gap (WCG) (1-2) 4. Min. stipulated net working capital: (25% of total Current Assets excluding export receivables) 5. Actual / Projected net working capital

(Form-III-45)

91.42 1481.28 -1389.86

2277.22 2199.11 78.11

2784.72 2260.80 523.92

22.86 -1850.08 -1412.72 460.22 -1412.72 1872.94

569.31 23.89 -491.20 54.22 -491.20 545.42

696.18 323.92 -172.26 200.00 -172.26 372.26

6. Item-3 minus Item-4 7. Item-3 minus Item-5 8. Max. permissible bank finance

(item-6 or 7, whichever is lower)

9. Excess borrowings representing shortfall in NWC (4 - 5)

1/3/2013

122611385.xls.ms_office (Form-V)

Page 9

ICICI Banking Corporation Ltd.

FORM VI FUNDS FLOW STATEMENT Name: Amounts in Rs. Crore Last Year Current Yr. Next Year Actuals Estimates Projections 2010 2011 2012

Year

1. SOURCES a. b. c. d. e. Net Profit Depreciation Increase in Capital Increase in Term Liabilities (including Public Deposits) Decrease in i. ii. f. g. Fixed Assets Other non-current Assets 1479.40 1805.49 2462.31 902.09 7.03 79.99 667.42 246.10 340.18 1454.71 671.29 223.77

Others TOTAL

2. USES a. b. c. Net loss Decrease in Term Liabilities (including Public Deposits) Increase in i. ii. d. e. f. Fixed Assets Other non-current Assets 4085.24 42.79 154.78 307.83

Dividend Payments Others TOTAL 115.89 4243.91 139.45 602.06

3. Long Term Surplus (+) / Deficit (-) [1-2]

1805.49

-1781.60

300.03

1/3/2013

122611385.xls.ms_office (Form-VI)

Page 10

ICICI Banking Corporation Ltd.

4. Increase/decrease in current assets * (as per details given below) 5. Increase/decrease in current liabilities other than bank borrowings 6. Increase/decrease in working capital gap 7. Net Surplus / Deficit (-) [3-6] 8. Increase/decrease in bank borrowings 9. Increase/decrease in NET SALES

-2.13 1481.28 -1483.41 3288.90 460.22 N/A

2185.80 717.83 1467.97 -3249.57 -406.00 3014.10

507.50 61.69 445.81 -145.78 145.78 2675.56

* Break up of item-4 i. Increase/decrease in Raw Materials ii. Increase/decrease in Stocks-in-Process iii. Increase/decrease in Finished Goods iv. Increase/decrease in Receivables a) b) Domestic Export 46.68 -0.01 -2.13 480.56 2185.80 17.52 53.76 507.50 1429.93 329.75 -5.25 3.13 234.46 -12.39 6.56 60.33 34.78 11.37

v. Increase/decrease in Stores & Spares vi. Increase/decrease in other current assets TOTAL

1/3/2013

122611385.xls.ms_office (Form-VI)

Page 11

I C I C I Banking Corporation Ltd.

Key Indicators S. No For year ended / ending September 30, 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 Net Sales PBILDT PBT PAT Net Cash Accruals P B I L D T/ Net Sales (%) PAT/ Net Sales (%) Dividend/PAT (%) Gross Block Net Block Paid up Capital Tangible Networth (TNW) Group Invetsments Adjusted T N W LTD/TNW DFS/TNW TOL/TNW Current Assets Current Liabilities Net Working Capital Current Ratio 93.55 #DIV/0! #DIV/0! #DIV/0! #DIV/0! 93.55 1805.49 0.25 1.08 91.42 1941.50 -1850.08 0.05 -451.85 0.33 0.42 -6.46 2277.22 2253.33 23.89 1.01 2561.62 0.14 0.29 1.10 2784.72 2460.80 323.92 1.13 79.99 1805.49 4085.24 2630.52 79.99 -451.85 4240.02 2561.53 79.99 2561.62 93.54 93.54 93.54 93.54 #DIV/0! #DIV/0! 2009 Actual 2010 Actual 9879.16 #REF! 387.09 246.10 #REF! #REF! 2.49% 2011 Estimate 12893.26 833.21 479.34 340.18 602.65 6.46% 2.64% 2012 Projection 15568.82 1242.87 858.99 671.29 943.58 7.98% 4.31%

Other Indicators 22 23 24 R O C E (%) Interest Coverage Ratio DSCR 99.99% #DIV/0! -23.74% #REF! #REF! 20.84% 9.77 9.77 28.90% 11.35 3.20

Fund Flow Analysis Year Ended / Ending September 30, Long Term Sources Long Term uses Surplus/Deficit Surplus / Incremental build up of current assets (%) 1805.49 -2.28% 2010 1805.49 2011 2462.31 4243.91 -1781.60 2390.94% 2012 902.09 602.06 300.03 22.29%

1/3/2013

122611385.xls.ms_office (Financials)

Page 12

I C I C I Banking Corporation Ltd.

Pattern of TCA Funding 1999 Year ended / Ending 30 September Sundry Creditors Other Current Liabilities Bank Borrowings Long Term funds 100.00% 1075.57% 544.73% 503.41% -2023.71% 72.02% 24.55% 2.38% 1.05% 60.54% 20.64% 7.18% 11.63% 2000 2001 2002

1/3/2013

122611385.xls.ms_office (Financials)

Page 13

You might also like

- CMA DataDocument35 pagesCMA Dataashishy99No ratings yet

- Lead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital RequirementsDocument13 pagesLead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital Requirementsprateekm176123No ratings yet

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDocument16 pagesICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementbalajeenarendraNo ratings yet

- ICICI Bank Working Capital AnalysisDocument16 pagesICICI Bank Working Capital AnalysisPravin Namokar100% (1)

- Assessment of Working Capital Requirements Form Ii - Operating StatementDocument12 pagesAssessment of Working Capital Requirements Form Ii - Operating Statementsluniya88No ratings yet

- Year Ended/Ending On March 31 No - of Months: ActualDocument14 pagesYear Ended/Ending On March 31 No - of Months: ActualVinod JainNo ratings yet

- Cma Format For Bank-3Document40 pagesCma Format For Bank-3technocrat_vspNo ratings yet

- SHRI BHAWANI FINANCIAL DATADocument18 pagesSHRI BHAWANI FINANCIAL DATAAnurag GahlawatNo ratings yet

- Name:: Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in RsDocument12 pagesName:: Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in RsprajeshguptaNo ratings yet

- Cma Format WcaDocument8 pagesCma Format Wcaabhishekbehal5012No ratings yet

- CMA FormatDocument14 pagesCMA FormatSuresh KumarNo ratings yet

- Year No - of MonthsDocument84 pagesYear No - of MonthsMatrudutta DasNo ratings yet

- Sud SudhaDocument27 pagesSud Sudhasudhak111No ratings yet

- Assessment of Working Capital Requirements: Form - I Particulars of Existing / Proposed Limits From The Banking SystemDocument12 pagesAssessment of Working Capital Requirements: Form - I Particulars of Existing / Proposed Limits From The Banking SystemsubbupisipatiNo ratings yet

- Cma With Cra For Bank ProjectionDocument31 pagesCma With Cra For Bank ProjectionMuthu SundarNo ratings yet

- SIDBI Financial Result DEC 2010 EnglishDocument2 pagesSIDBI Financial Result DEC 2010 EnglishSunil GuptaNo ratings yet

- Cma FormatDocument42 pagesCma FormatSekhar BethalaNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in Rs. LacsDocument20 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in Rs. LacsAnuj NijhonNo ratings yet

- Equity Research - Finance Modelling - NIFTY - SENSEX CompaniesDocument46 pagesEquity Research - Finance Modelling - NIFTY - SENSEX Companiesyash bajajNo ratings yet

- Cma Blank FormatDocument12 pagesCma Blank FormatManohar WaghelaNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Statement Date No. of MonthsDocument6 pagesStatement Date No. of MonthscallvkNo ratings yet

- WORKING CAPITAL ANALYSISDocument42 pagesWORKING CAPITAL ANALYSISkhajuriaonlineNo ratings yet

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Document16 pagesStandalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document2 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Cma FormatDocument14 pagesCma FormatMahesh ShindeNo ratings yet

- 2023-q1-consolidated-audit-report-enDocument61 pages2023-q1-consolidated-audit-report-enduyhuynhworkkNo ratings yet

- IPTC CMA Bank FormatDocument12 pagesIPTC CMA Bank FormatRadhesh BhootNo ratings yet

- Sushrut Yadav PGFB2156 IMDocument15 pagesSushrut Yadav PGFB2156 IMAgneesh DuttaNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Sample CMA DataDocument38 pagesSample CMA DatalinujoshyNo ratings yet

- Analysis of Apollo TiresDocument12 pagesAnalysis of Apollo TiresTathagat ChatterjeeNo ratings yet

- Reliance Industries Ltd. FY 2012 Profit and Loss StatementDocument10 pagesReliance Industries Ltd. FY 2012 Profit and Loss StatementJuhi BansalNo ratings yet

- Ισολογισμοσ Φυτοθρεπτικη Χρησησ 2012 EnDocument1 pageΙσολογισμοσ Φυτοθρεπτικη Χρησησ 2012 Env_tsoulosNo ratings yet

- Cma Data BlankDocument14 pagesCma Data BlankSonu NehraNo ratings yet

- Basic Accounts Ca1Document5 pagesBasic Accounts Ca1shivanigas morwaNo ratings yet

- Hyundai Motor Company 1q 2022 Consolidated FinalDocument61 pagesHyundai Motor Company 1q 2022 Consolidated FinalNitesh SinghNo ratings yet

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document1 pageStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Balance Sheet: Titan Industries LimitedDocument4 pagesBalance Sheet: Titan Industries LimitedShalini ShreyaNo ratings yet

- CMA FormatDocument23 pagesCMA FormatSumiti Goel100% (1)

- Hyundai Motor Company 2020 Interim Financial ReportDocument62 pagesHyundai Motor Company 2020 Interim Financial ReportshountyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Revenue, Expenses, Profit BreakdownDocument8 pagesRevenue, Expenses, Profit BreakdownArashdeep SinghNo ratings yet

- Statement of Finanacial Position (Annexure-B of The Format) (Rs. in '000)Document12 pagesStatement of Finanacial Position (Annexure-B of The Format) (Rs. in '000)saxenaNo ratings yet

- Cash Flow Statements - FinalDocument18 pagesCash Flow Statements - FinalAchal GuptaNo ratings yet

- Cma AFSDocument14 pagesCma AFSvijayNo ratings yet

- Assessment of Working Capital Requirements Form AnalysisDocument16 pagesAssessment of Working Capital Requirements Form AnalysisRaghavendra Kulkarni40% (5)

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Accounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Document1 pageAccounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Jatin GuptaNo ratings yet

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sample ProposalDocument22 pagesSample Proposalbrynzky100% (1)

- Brekeke Tutorial DialplanDocument22 pagesBrekeke Tutorial DialplanMiruna MocanuNo ratings yet

- Case 1 UpdatedDocument2 pagesCase 1 UpdatedSelshei Cristobal-Omar50% (2)

- Falk Series C, E, F, G, J, P, Q, S, Y Gear Drives - Service ManualDocument4 pagesFalk Series C, E, F, G, J, P, Q, S, Y Gear Drives - Service ManualJorge Iván Carbajal100% (1)

- Filing For ExtensionDocument5 pagesFiling For ExtensionTexas WatchdogNo ratings yet

- MT Dbp-hcp-1000 Series ManualDocument54 pagesMT Dbp-hcp-1000 Series ManualNguyễn Thế PhongNo ratings yet

- KemmyDocument22 pagesKemmyKemi HamzatNo ratings yet

- Welcome To All of You..: Nilima DasDocument16 pagesWelcome To All of You..: Nilima DasSteven GarciaNo ratings yet

- Food Delivery App ProjectDocument3 pagesFood Delivery App ProjectJaanvi Singh RajputNo ratings yet

- Fitch BNG Bank N.V. 2019-08-13Document10 pagesFitch BNG Bank N.V. 2019-08-13Suranga FernandoNo ratings yet

- Motion For New TrialDocument3 pagesMotion For New TrialKM MacNo ratings yet

- Fund Flow StatementDocument17 pagesFund Flow StatementPrithikaNo ratings yet

- Cqi-8 LpaDocument32 pagesCqi-8 LpaMonica AvanuNo ratings yet

- Pete 3036Document31 pagesPete 3036SeanNo ratings yet

- PG SweetPotatoDocument28 pagesPG SweetPotatoBebo Gomez BruNo ratings yet

- SAPI S7dotNet InstructionsDocument9 pagesSAPI S7dotNet InstructionsEnrico Chicco PaluzzanoNo ratings yet

- 2023 Congressional Baseball Sponsorship PackagesDocument2 pages2023 Congressional Baseball Sponsorship PackagesSpencer BrownNo ratings yet

- TOtal Quality ControlDocument54 pagesTOtal Quality ControlSAMGPRONo ratings yet

- Final Exams in Civil Procedure, May 28, 2020 (1) .OdtDocument1 pageFinal Exams in Civil Procedure, May 28, 2020 (1) .OdtHazel BayanoNo ratings yet

- Manual Mfm383a SelecDocument4 pagesManual Mfm383a SelecPhương NguyênNo ratings yet

- Exam PaperDocument2 pagesExam PapersanggariNo ratings yet

- Buses and PortsDocument3 pagesBuses and PortsHuma Rashid80% (5)

- Assign Controlling Areas and Company Codes for Optimal Cost AccountingDocument4 pagesAssign Controlling Areas and Company Codes for Optimal Cost Accountingatsc68No ratings yet

- Topic 2Document9 pagesTopic 2swathi thotaNo ratings yet

- Business Finance Week 2 2Document14 pagesBusiness Finance Week 2 2Phoebe Rafunsel Sumbongan Juyad100% (1)

- Global Bicycle Market - Growth, Trends, and Forecast (2020 - 2025) PDFDocument169 pagesGlobal Bicycle Market - Growth, Trends, and Forecast (2020 - 2025) PDFNicholas Chia100% (2)

- JokeDocument164 pagesJoketarinitwrNo ratings yet

- 5 Schedule Timetable FLIFODocument8 pages5 Schedule Timetable FLIFOAlba FernándezNo ratings yet

- Bank TellerDocument3 pagesBank Tellerapi-3701112No ratings yet

- Dollar ReportDocument26 pagesDollar ReportNirati AroraNo ratings yet