Professional Documents

Culture Documents

Aalto EE Profile Toolbox 1/2013

Uploaded by

Aalto University Executive EducationCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aalto EE Profile Toolbox 1/2013

Uploaded by

Aalto University Executive EducationCopyright:

Available Formats

FRANKLY SPEAKING, THE GLOBAL MARKET IS NOT LOOKING

VERY GOOD AT THE MOMENT. The world is falling ever deeper into

debt. The United States, Japan and Europe are trying to reinvigo-

rate their economies to avoid an even bigger economic crash. Central

banks are printing money and nominal interest rates are close to zero.

Many developed countries are heavily indebted and the debts are ris-

ing by the month.

In times like these it doesnt pay to be passive. To the contrary,

if you have the right kind of investment portfolio, you may be able

to generate some great revenue, says Vesa Puttonen, Professor of

Finance at the Aalto University School of Business.

Exceptional times in the market mean exceptional opportunities:

it is now possible to accrue wealth in ways

other than through inheritance.

My advice at the moment would be

not to invest in treasury bonds. Revenues

are close to zero, countries are heavi-

ly indebted and when ination expecta-

tions rise so do interest rates, and that

decreases the value of treasury bonds,

says Puttonen.

He also emphasises the importance of

analyzing the content of each investment

asset. Dont buy just stocks.

Puttonen says that there are expen-

sive stocks and there are cheap stocks

and the same goes for real estate markets.

Real estate in Germany is a better invest-

ment just now than real estate in France

or Spain, he says.

T

E

X

T

:

S

A

T

U

R

LIFE IS

A RISKY

BUSINESS

Risky

times, good

investments

Fore more investment tips, check out

Puttonens latest book, Velka tikitt

hydy siit!, published in Finnish in

December 2012 by Aalto University

Executive Education.

www.aaltoee./en/shop

Fore more iinvestment i tips h che k ck out

We face crossroads every day with more and more options

to choose from. Find out where you are, decide the direction

and start making the moves. Risk equals potential.

1

23

You can use Toolbox materials at work or when giving

a presentation, link them to your blog or forward the

entire Toolbox to your colleagues. The background

ideas are available in a variety of web sources.

As slides:

www.slideshare.net/AaltoEE

In pdf format:

www.scribd.com/AaltoEE

The whole

magazine:

aaltoee./prole

Tips for

your

investment

portfolio

Find out

your nancial

risk tolerance

23

AALTO EE STARTED

PUBLISHING

its own series of

business books

and case studies

in 2012. The rst

book to come out

was on leadership

and management,

titled Johtajuuden

seitsemn synti

(The Seven Sins

of Management).

Currently, all

publications are in

Finnish only, but in

the future Aalto EE

will also be bringing

out works in English.

Before you start planning your

personal investment strategy,

you have to have an idea of your

risk tolerance.

By matching your portfolio risk to your personal

tolerance for risk, you can sleep at night without

stressing over your investments. Knowing your

risk tolerance and sticking to investments that

dont exceed it should keep you from total nan-

cial ruin.

Take this quiz and

nd out where you

stand:

njaes.rutgers.edu/

money/riskquiz/

anno nsrnun

iImo IriXvXIxrx

rrn mniiItn

nrxuII iInxrx

IsX nmuuosIus

1*5$,66'(0

4(+54(/<0

4:05+<

VESA PUTTONEN GIVES AN EXAMPLE

OF AN INVESTMENT PORTFOLIO

IN THE CURRENT MARKET SITUATION.

t Government bonds 0%

Low yields with high risk.

t Corporate bonds 20%

Relatively attractive yields, companies can

adjust their operations better than governments.

t Money market investments 10%

It is a good idea to keep some cash.

t Gold 10%

Gold does not have any cash ow and its price

is hard to predict. However, I would not dare

buy gold, so I would say 10%.

t Commodities 20%

When ination begins to rise, raw material

prices will go up.

t Equities 30%

Companies are more exible in adjusting their

operations than governments.International

American and European companies are strong

in general. Select the stocks carefully, do not

buy overpriced stocks.

t Real estate 10%

In Germany, for example, real estate prices are

relatively low at the moment.

The quiz was developed by

two personal nance pro-

fessors, Dr. Ruth Lytton at

Virginia Tech and Dr. John

Grable at Kansas State

University.

3

2

VIRTUALIZATION, CLOUD COMPUTING,

SOCIAL MEDIA, MOBILE DEVICES, THE

RISE OF EMERGING MARKETS, THE

FINANCIAL CRISIS, OFFSHORING

Information security faces many rapidly

accelerating challenges. In too many

companies, information security and risk management is

like putting out a re. There is a lack of long

term commitment, security management

and measuring, says Antti Herrala, Ernst

& Youngs IT Risk & Assurance Leader in

Finland.

However, it is often said that the weak-

est link in information security processes

is the human element. According to Ernst

& Youngs newly published 2012 Global

Information Security Survey, 37% of respondents think the

threat that has most increased their organizations risk ex-

posure is careless or unaware employees. In addition, the

number of real incidents caused by inadvertent employee

data loss has risen by 25% in the last year.

No matter how good and detailed information security

systems a company has, they can be destroyed in no time.

Herrala gives a few simple but vital guidelines that

everyone should follow in their workplace to minimize

the risk of information leaks:

t Read the companys information security policies and

guidelines.

t Put thought and eort into passwords. A password

on a Post-it is an absolute no-no.

t Work computers are for work use only. Do not, for

example, try to download any applications on to your

work computer. Have a separate computer for home

use.

t Be careful when sharing employer-related information

on social media. Inventive companies have social

media guidelines that show what work and employer-

related issues can and cannot be published on the

Internet.

4

5

Avoid being

the

weakest

link

IT PAYS OFF TO IMPROVE ONES

ABILITY TO FORECAST BETTER:

when something is predictable, it is

also designable.

There is a lot of data out there.

But what does it all mean? Random

patterns are not always meaningful,

claims statistician, political

forecaster and contributor to The

New York Times Magazine, Nate

Silver. Statistics are only as good as

the people who apply them.

According to Silvers recently

published book, The Signal and

the Noise, those who are good at

predicting have at least one thing in

common: they recognize that their

knowledge of the world is imperfect.

We take in much more

information than our brains can

process. Biases based on

expectations or self-interest

aect our analyses. The best

way to understand the world

is to take in new information

as it comes and rene your own

perceptions accordingly.

The Signal and the Noise:

Why So Many Predictions Fail

But Some Dont? (Penguin) was

named Amazons #1 Best Book

of 2012.

A book that

will teach you

how to forecast

and look to the

future better

25

Listen to

podcasts

CHECK OUT

www.startupcompass.com

Start-up founder,

predict your

success

WOULD YOU LIKE TO KNOW how your companys key

performance indicators stack up against your peers?

A benchmarking tool, Startup Compass,

combines scientic study of the way start-ups operate with

tools which help start-up founders improve their chances of

success.

Startup Compass enables start-ups and their founders to

evaluate their progress in relation to others in the eld and

support better decision-making.

It generates analyses that measure a start-ups key

performance indicators against other similar companies. This tool

quickly gives an in-depth review of the companys risk prole and

venture fundability.

BEHAVIOURAL ECONOMIST

DAN ARIELY has an interesting

weekly podcast called Arming

the Donkeys. These podcasts

are chats with researchers

in the social and natural

sciences. Short podcasts give

you fresh ideas and help you

make better decisions.

Why doesnt willpower work?

Are we more likely to cheat

after doing something good?

Why do we not save more?

How is it we keep fooling

ourselves? Listen and learn.

CHECK OUT

http://bit.ly/

danarielypodcast

6

7

8

8

Why do

you fail to

have a great

career?

YOU ARE NOT PURSUING YOUR PASSION,

answers Larry Smith, a Professor of Economics

at the University of Waterloo in Canada.

The most important thing in having a great

career is to nd your passion and follow it.

And passion is not the same as interesting.

You dont go to your loved one and say, marry me,

you are interesting!

Looking for passion (and a great career):

http://bit.ly/donotfail

CHECK OUT

You might also like

- The Long and the Short of It (International edition): A guide to finance and investment for normally intelligent people who aren’t in the industryFrom EverandThe Long and the Short of It (International edition): A guide to finance and investment for normally intelligent people who aren’t in the industryRating: 4.5 out of 5 stars4.5/5 (15)

- EMF BookSummary VolumeIII Digital 11072023 110020 AMDocument34 pagesEMF BookSummary VolumeIII Digital 11072023 110020 AMVaishnaviRavipatiNo ratings yet

- Millennial Money: How Young Investors Can Build a FortuneFrom EverandMillennial Money: How Young Investors Can Build a FortuneRating: 4.5 out of 5 stars4.5/5 (4)

- Investment Decision Research PapersDocument5 pagesInvestment Decision Research Papersjtxyihukg100% (1)

- Dollarlogic: A Six-Day Plan to Achieving Higher Investment Returns by Conquering RiskFrom EverandDollarlogic: A Six-Day Plan to Achieving Higher Investment Returns by Conquering RiskNo ratings yet

- Ten Principles of Personal FinanceDocument7 pagesTen Principles of Personal Financepichi pichiNo ratings yet

- Bloomberg BusinessweekDocument76 pagesBloomberg BusinessweekJosip DžolićNo ratings yet

- An Investment Primer for New Investors: A Step-By-Step Guide to Investment SuccessFrom EverandAn Investment Primer for New Investors: A Step-By-Step Guide to Investment SuccessNo ratings yet

- The Power of SimplicityDocument4 pagesThe Power of Simplicitysatoshi2010No ratings yet

- Investment Fraud: How Financial “Experts” Rip You Off And What To Do About It: Financial Freedom for Smart PeopleFrom EverandInvestment Fraud: How Financial “Experts” Rip You Off And What To Do About It: Financial Freedom for Smart PeopleNo ratings yet

- 1 Jan .... 4 ArticlesDocument10 pages1 Jan .... 4 Articlesnafa nuksanNo ratings yet

- Simply Invest: Naked Truths to Grow Your MoneyFrom EverandSimply Invest: Naked Truths to Grow Your MoneyRating: 5 out of 5 stars5/5 (1)

- InvestmentDocument342 pagesInvestmentJIGERNo ratings yet

- The Smooth Ride Portfolio: How Great Investors Protect and Grow Their Wealth...and You Can TooFrom EverandThe Smooth Ride Portfolio: How Great Investors Protect and Grow Their Wealth...and You Can TooNo ratings yet

- Quick Financial Literacy Guide: For Students by Students: June 2018Document18 pagesQuick Financial Literacy Guide: For Students by Students: June 2018lee binNo ratings yet

- Social Media Strategies for Investing: How Twitter and Crowdsourcing Tools Can Make You a Smarter InvestorFrom EverandSocial Media Strategies for Investing: How Twitter and Crowdsourcing Tools Can Make You a Smarter InvestorRating: 3 out of 5 stars3/5 (2)

- Quick Financial Literacy Guide Final DraftDocument18 pagesQuick Financial Literacy Guide Final DraftMian KashifNo ratings yet

- Rescue Your Money: How to Invest Your Money During these Tumultuous TimesFrom EverandRescue Your Money: How to Invest Your Money During these Tumultuous TimesRating: 4.5 out of 5 stars4.5/5 (5)

- Entrepreneurship and Risk Taking - Final PaperDocument13 pagesEntrepreneurship and Risk Taking - Final PaperAugustoNo ratings yet

- Dissertation InvestmentDocument8 pagesDissertation InvestmentWriteMyPaperForMeCheapSingapore100% (1)

- Multi-Asset Investing: A practical guide to modern portfolio managementFrom EverandMulti-Asset Investing: A practical guide to modern portfolio managementRating: 3 out of 5 stars3/5 (4)

- Moral Hazard ThesisDocument4 pagesMoral Hazard Thesisrebeccarogersbaltimore100% (1)

- The Gone Fishin' Portfolio (Review and Analysis of Green's Book)From EverandThe Gone Fishin' Portfolio (Review and Analysis of Green's Book)No ratings yet

- 9 Myths About EntrepreneursDocument4 pages9 Myths About EntrepreneursJayanta TulinNo ratings yet

- Value Investing in Growth Companies: How to Spot High Growth Businesses and Generate 40% to 400% Investment ReturnsFrom EverandValue Investing in Growth Companies: How to Spot High Growth Businesses and Generate 40% to 400% Investment ReturnsRating: 5 out of 5 stars5/5 (1)

- Finance and Investment Thesis TopicsDocument5 pagesFinance and Investment Thesis Topicsdnqjxbz2100% (2)

- Investing: Best and Simple Steps: Wise and Simple Steps to Increase Financial KnowledgeFrom EverandInvesting: Best and Simple Steps: Wise and Simple Steps to Increase Financial KnowledgeNo ratings yet

- 1 Learn To Earn 21042023 105748 AMDocument3 pages1 Learn To Earn 21042023 105748 AMmrumar7850No ratings yet

- Start-ups: A toolkit for entrepreneursFrom EverandStart-ups: A toolkit for entrepreneursBCS, The Chartered Institute for ITNo ratings yet

- The Unofficial Guide To Investment Banking Issued by Contents OvervDocument36 pagesThe Unofficial Guide To Investment Banking Issued by Contents OvervEgon Dragon100% (1)

- Millionaires Simple Guide to Big Money and Wealth Building For BeginnersFrom EverandMillionaires Simple Guide to Big Money and Wealth Building For BeginnersNo ratings yet

- 7 Components of Entrepreneurial MindsetDocument5 pages7 Components of Entrepreneurial Mindsetlaarni joy conaderaNo ratings yet

- IS YOUR ACCOUNTANT AN IDIOT?: "The beginning of happiness may be hidden in doubling your Accountant's fees"From EverandIS YOUR ACCOUNTANT AN IDIOT?: "The beginning of happiness may be hidden in doubling your Accountant's fees"No ratings yet

- Behavioral Finance Dissertation TopicsDocument4 pagesBehavioral Finance Dissertation Topicsrecalthyli1986100% (1)

- The Illiterate Investor: Simple Strategies to Invest in the Stock MarketFrom EverandThe Illiterate Investor: Simple Strategies to Invest in the Stock MarketNo ratings yet

- 7 Ways To Begin Living Smarter: Build and Protect Your Wealth With Agora FinancialDocument9 pages7 Ways To Begin Living Smarter: Build and Protect Your Wealth With Agora FinancialTim LaneNo ratings yet

- Making Lemonade: A Bright View on Investing, on Financial Markets, and on the EconomyFrom EverandMaking Lemonade: A Bright View on Investing, on Financial Markets, and on the EconomyNo ratings yet

- Finance Term Paper IdeasDocument8 pagesFinance Term Paper Ideasc5q1thnj100% (1)

- 3 Steps to Investment Success: How to Obtain the Returns, While Controlling RiskFrom Everand3 Steps to Investment Success: How to Obtain the Returns, While Controlling RiskNo ratings yet

- Research Paper Topics On International FinanceDocument4 pagesResearch Paper Topics On International Financegz8pjezc100% (1)

- Dissertation Systemic RiskDocument6 pagesDissertation Systemic RiskCustomCollegePapersAnnArbor100% (1)

- Ramy Ahmed - Reasons For Business DiscontinuationDocument10 pagesRamy Ahmed - Reasons For Business Discontinuationرامي أبو الفتوحNo ratings yet

- Behavioral Traps and Innovation PDFDocument13 pagesBehavioral Traps and Innovation PDFAgam Reddy MNo ratings yet

- THE BLUEPRINT TO INTELLIGENT INVESTORS: VOLUME 2 STOCK AND SHARES TRADING, HOW TO BECOME A MILLIONAIRE AND PRIVATE PLACEMENT PROGRAMSFrom EverandTHE BLUEPRINT TO INTELLIGENT INVESTORS: VOLUME 2 STOCK AND SHARES TRADING, HOW TO BECOME A MILLIONAIRE AND PRIVATE PLACEMENT PROGRAMSNo ratings yet

- Value Investing A Value Investor S Journe Neely J Lukas PDFDocument1,814 pagesValue Investing A Value Investor S Journe Neely J Lukas PDFYash Kanda80% (5)

- Summary of I Will Teach You To Be Rich: by Ramit Sethi | Includes AnalysisFrom EverandSummary of I Will Teach You To Be Rich: by Ramit Sethi | Includes AnalysisRating: 4 out of 5 stars4/5 (5)

- Finance Term Paper TopicsDocument7 pagesFinance Term Paper Topicsaflsktofz100% (1)

- Guide To Stock Picking Strategies: Personal Finance Stock MarketDocument33 pagesGuide To Stock Picking Strategies: Personal Finance Stock Marketapi-19771937No ratings yet

- 7 Principles For The Perfect Portfolio' From A Top MIT Economist - MIT SloanDocument5 pages7 Principles For The Perfect Portfolio' From A Top MIT Economist - MIT SloanLouis Martin0% (1)

- Target Date Series Research Paper 2014Document4 pagesTarget Date Series Research Paper 2014egyey4bp100% (1)

- The Boring Secret To Getting RichDocument9 pagesThe Boring Secret To Getting RichJose Guzman100% (1)

- EifrigDocument15 pagesEifrigHNmaichoi100% (1)

- Beginner Mistakes: How To Avoid ThemDocument8 pagesBeginner Mistakes: How To Avoid Themambasyapare1No ratings yet

- 10 Things Start-Ups Won't Tell You - WSJDocument5 pages10 Things Start-Ups Won't Tell You - WSJJorge Del CarmenNo ratings yet

- Thesis Subjects International BusinessDocument7 pagesThesis Subjects International Businesselizabethtemburubellevue100% (2)

- When The Secret Sauce FailsDocument1 pageWhen The Secret Sauce FailsAalto University Executive EducationNo ratings yet

- Aalto EE Profile 3 2012 - The Taboos of LeadershipDocument2 pagesAalto EE Profile 3 2012 - The Taboos of LeadershipAalto University Executive EducationNo ratings yet

- Aalto EE Profile Toolbox 2 2012Document4 pagesAalto EE Profile Toolbox 2 2012Aalto University Executive EducationNo ratings yet

- Aalto EE Profile Toolbox 3 2012Document4 pagesAalto EE Profile Toolbox 3 2012Aalto University Executive EducationNo ratings yet

- Aalto EE Profile Toolbox 03 2011Document4 pagesAalto EE Profile Toolbox 03 2011Aalto University Executive EducationNo ratings yet

- Aalto EE Profile Toolbox 01 2012Document4 pagesAalto EE Profile Toolbox 01 2012Aalto University Executive EducationNo ratings yet

- Aalto EE Profile 1 2011 ToolboxDocument2 pagesAalto EE Profile 1 2011 ToolboxAalto University Executive EducationNo ratings yet

- Profile ToolboxDocument2 pagesProfile ToolboxAalto University Executive EducationNo ratings yet

- Aalto EE Profile ToolboxDocument4 pagesAalto EE Profile ToolboxAalto University Executive EducationNo ratings yet

- Aalto EE Profile ToolboxDocument4 pagesAalto EE Profile ToolboxAalto University Executive EducationNo ratings yet

- Beats Non ExclusiveDocument2 pagesBeats Non ExclusiveCentral mind State100% (1)

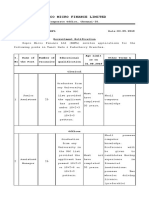

- Repco Micro Finance Limited: Corporate Office, Chennai-35Document4 pagesRepco Micro Finance Limited: Corporate Office, Chennai-35Abaraj IthanNo ratings yet

- Bca 201612Document78 pagesBca 201612tugayyoungNo ratings yet

- Paul Sonkin Investment StrategyDocument20 pagesPaul Sonkin Investment StrategyCanadianValueNo ratings yet

- LSB Building, Rizal St. Legazpi CityDocument5 pagesLSB Building, Rizal St. Legazpi Cityhey heyNo ratings yet

- Essay Test 2021 (Practice Test)Document3 pagesEssay Test 2021 (Practice Test)Philani HadebeNo ratings yet

- Process Planning & Cost Estimation - Department of Mechanical EngineeringDocument12 pagesProcess Planning & Cost Estimation - Department of Mechanical EngineeringRoji C SajiNo ratings yet

- 2670 La Tierra Street, Pasadena - SOLDDocument8 pages2670 La Tierra Street, Pasadena - SOLDJohn AlleNo ratings yet

- Continuous Casting Investments at USX Corporation: Group 9Document5 pagesContinuous Casting Investments at USX Corporation: Group 9Kartik NarayanaNo ratings yet

- E. Bryan - The Records and Info Management Profession - View From Within The Jamaica Public Service (ACARM Newsletter)Document8 pagesE. Bryan - The Records and Info Management Profession - View From Within The Jamaica Public Service (ACARM Newsletter)Emerson O. St. G. BryanNo ratings yet

- Unilever: AssignmentDocument8 pagesUnilever: AssignmentVishal RajNo ratings yet

- Pemasaran Produk PerikananDocument12 pagesPemasaran Produk Perikananunang17No ratings yet

- G.R. No. 85141 Filipino Merchants V CADocument5 pagesG.R. No. 85141 Filipino Merchants V CAJo ParagguaNo ratings yet

- Department of Labor: 2005 05 27 17 FLSA ShiftsDocument2 pagesDepartment of Labor: 2005 05 27 17 FLSA ShiftsUSA_DepartmentOfLaborNo ratings yet

- DoD Risk MGT Guide v7 Interim Dec2014Document100 pagesDoD Risk MGT Guide v7 Interim Dec2014Bre TroNo ratings yet

- Packaging and Labeling DecisionsDocument11 pagesPackaging and Labeling DecisionsAnonymous UpDFk5iANo ratings yet

- Melissa Schilling: Strategic Management of Technological InnovationDocument25 pagesMelissa Schilling: Strategic Management of Technological Innovation143himabinduNo ratings yet

- Employment Application Form - Ver2 (1) .0Document7 pagesEmployment Application Form - Ver2 (1) .0ranjithsutariNo ratings yet

- Repayment LetterDocument3 pagesRepayment Lettersunil kr verma100% (1)

- Overview of The Front Office DepartmentDocument2 pagesOverview of The Front Office DepartmentReina100% (3)

- ISAGANI Vs ROYAL-position Paper 1Document5 pagesISAGANI Vs ROYAL-position Paper 1Gerald HernandezNo ratings yet

- W5 - Culturing Corporate EntrepreneurshipDocument33 pagesW5 - Culturing Corporate EntrepreneurshipIlya Faqihah Binti Baderul Sham C20A1529No ratings yet

- SCM SummaryDocument47 pagesSCM SummaryEmanuelle BakuluNo ratings yet

- Logistics Distribution TescoDocument10 pagesLogistics Distribution TescoSanchit GuptaNo ratings yet

- Sap Pa LISTDocument281 pagesSap Pa LISTdaniel22% (9)

- Nail Making Business Project ReportDocument4 pagesNail Making Business Project ReportBrian KiruiNo ratings yet

- Project Proposal On BuildingDocument5 pagesProject Proposal On BuildinghawiNo ratings yet

- MC Donald's in Saudi ArabiaDocument15 pagesMC Donald's in Saudi ArabiaSravan SakkhariNo ratings yet

- Listing Presentation Scripts: Sitting Down at The Table (Via Zoom)Document5 pagesListing Presentation Scripts: Sitting Down at The Table (Via Zoom)kang hyo minNo ratings yet

- Check Book Register: Account InfoDocument3 pagesCheck Book Register: Account InfodlkfaNo ratings yet

- Scary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldFrom EverandScary Smart: The Future of Artificial Intelligence and How You Can Save Our WorldRating: 4.5 out of 5 stars4.5/5 (55)

- Designing Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeFrom EverandDesigning Your Life by Bill Burnett, Dave Evans - Book Summary: How to Build a Well-Lived, Joyful LifeRating: 4.5 out of 5 stars4.5/5 (62)

- Steal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeFrom EverandSteal the Show: From Speeches to Job Interviews to Deal-Closing Pitches, How to Guarantee a Standing Ovation for All the Performances in Your LifeRating: 4.5 out of 5 stars4.5/5 (39)

- Generative AI: The Insights You Need from Harvard Business ReviewFrom EverandGenerative AI: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (2)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyFrom EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyRating: 4 out of 5 stars4/5 (51)

- The 7 Habits of Highly Effective People: The Infographics EditionFrom EverandThe 7 Habits of Highly Effective People: The Infographics EditionRating: 4 out of 5 stars4/5 (2475)

- The 30 Day MBA: Your Fast Track Guide to Business SuccessFrom EverandThe 30 Day MBA: Your Fast Track Guide to Business SuccessRating: 4.5 out of 5 stars4.5/5 (19)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- AI Superpowers: China, Silicon Valley, and the New World OrderFrom EverandAI Superpowers: China, Silicon Valley, and the New World OrderRating: 4.5 out of 5 stars4.5/5 (398)

- The Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldFrom EverandThe Master Algorithm: How the Quest for the Ultimate Learning Machine Will Remake Our WorldRating: 4.5 out of 5 stars4.5/5 (107)

- Summary: 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur by Ryan Daniel Moran: Key Takeaways, Summary & AnalysisFrom EverandSummary: 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure Entrepreneur by Ryan Daniel Moran: Key Takeaways, Summary & AnalysisRating: 5 out of 5 stars5/5 (2)

- An Ugly Truth: Inside Facebook's Battle for DominationFrom EverandAn Ugly Truth: Inside Facebook's Battle for DominationRating: 4 out of 5 stars4/5 (33)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- From Paycheck to Purpose: The Clear Path to Doing Work You LoveFrom EverandFrom Paycheck to Purpose: The Clear Path to Doing Work You LoveRating: 4.5 out of 5 stars4.5/5 (39)

- The First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterFrom EverandThe First 90 Days: Proven Strategies for Getting Up to Speed Faster and SmarterRating: 4.5 out of 5 stars4.5/5 (122)

- Start.: Punch Fear in the Face, Escape Average, and Do Work That MattersFrom EverandStart.: Punch Fear in the Face, Escape Average, and Do Work That MattersRating: 4.5 out of 5 stars4.5/5 (56)