Professional Documents

Culture Documents

RJ MMQ

Uploaded by

M Munir QureishiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RJ MMQ

Uploaded by

M Munir QureishiCopyright:

Available Formats

Reported Judgments by M Munir Qureshi Page 1 of 122

Muhammad Munir Qureshi

Judgments written as Member,

Income Tax Appellate Tribunal,

Lahore Bench,

Reported in the journals “TAXATION” and

“PAKISTAN TAX DIGEST”

Phone:

Fax:

Cell:

e-mail:

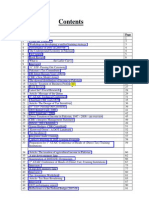

TABLE OF CONTENTS

Click Link to view Judgment.

Title Citation Remarks

01 Industrial Adhesives Vs IAC (2000) 82 Tax 105 (Trib) Books of Accounts- their appraisal by assessing officer explained.

Review of predecessors appellate order by successor in the garb of rectification

02 ACIT Vs Honda Breeze, Multan (2000) 82 Tax 117 (Trib)

not permissible.

Review of predecessors appellate order by successor in the garb of rectification

03 ACIT Vs Honda Breeze, Multan (2000) 82 Tax 96 (Trib)

not permissible.

Exemption u/s 118-D when rightly due, cannot be curtailed by concomitant

04 Samman Ghee Mill PVT Ltd Lhr Vs DCIT (2001) 83 Tax 35 (Trib)

charge u/s 80-D.

05 LandMark Lhr Vs IAC (2001) 83 Tax 71 (Trib) Exercise of revisionary jurisdiction u/s 17-B of W.T. Act 1963 explained.

06 New Qaiser Flour Mills, Lhr Vs IAC (2001) 84 Tax 77 (Trib) Exercise of jurisdiction u/s 66A of I.T.Ord’79 explained.

07 DCIT Vs Fatima Enterprizes, Multan (2001) 84 Tax 77 (Trib) Charge of C.A.T explained.

08

Haji M Hanif c/o Zohaib Jewellers Vs

(2001) 84 Tax 153 (Trib) Unexplained Investment u/s 13(1)(aa) & Exemption vide Clause 130-A of 2nd

ACIT Schedule to the I.T. Ord’79 explained.

Statutory provisions governing Wealth Tax Assessment under W.T. Act 1963

09 S.O.I.T. Vs Haji Maqsood Ahmad Butt Lhr (2001) 84 Tax 189 (Trib)

explained.

10 Paisa Akhbar Markaz Lhr Vs IAC (2002) 85 Tax 387 (Trib) When collective enterprise constitutes an AOP.

11 Mughal Steel Lhr Vs IAC (2002) 86 Tax 403 (Trib) Exercise of revisionary jurisdiction u/s 66A of I.T. Ord’79 explained.

12 Grey’s of Cambridge, Pak Ltd Sialkot. (2003) 87 Tax 8 (Trib) Exercise of revisionary jurisdiction u/s 66A of I.T. Ord’79 explained.

13 DCIT Vs Zaman Paper & Board Mills Ltd (2003) 87 Tax 303 (Trib) Deemed Income u/s 12(18) of I.T.Ord’79- how arises.

14 DCIT Vs Nisar Art Press PVT Ltd Lhr (2003) 87 Tax 241 (Trib) Exercise of option to opt out of presumptive tax regime explained.

15 Gojra Samundri Sugar Mills Ltd Lhr (2003) 88 Tax 21 (Trib) Unexplained investment u/s 13(1)(a) of I.T.Ord’79 explained.

16 Gojra Samundri Sugar Mills Ltd Lhr (2003) PTD TRIB 2547 Unexplained investment u/s 13(1)(a) of I.T.Ord’79 explained.

17 Dawood Hercules Chemicals Ltd Lhr (2003) 87 Tax 524 (Trib) Mischief of Section 12(9A) of I.T. Ord’79 explained.

18 Dawood Hercules Chemicals Ltd Lhr (2003) PTD TRIB 2499 Mischief of Section 12(9A) of I.T. Ord’79 explained

19 Ihsan Yousaf Textiles Pvt Ltd FSD (2003) 88 Tax 35 (Trib) Assessee in default u/s 52 of I.T. Ord’79 explained.

20 Ihsan Yousaf Textiles Pvt Ltd FSD (2003) PTD TRIB 2586 Assessee in default u/s 52 of I.T. Ord’79 explained

When properly substantiated assessee’s declared version required to be

21 Sadaqat Tanning Co Sahiwal Vs ITO (2003) PTD TRIB 1972

accepted.

(2003) 88 Tax 201 (Trib)

22 Nasreen Aftab Lhr Vs DCIT When reliance can be placed on ‘parallel case’ to discard regd sale deed.

(2004) 89 Tax 107 (Trib)

23 DCIT Vs M Farooq c/o Nirala Pvt Ltd Lhr (2003) 88 Tax 136 (Trib) Co-owners of immoveable property do not necessarily also constitute an AOP.

S.O.I.T. Vs M Burhan Khalid c/o M F

24 (2003) 88 Tax 316 (Trib) Ownership u/s 2(16) of W.T. Act 1963 explained.

Ellahi & Co Pvt Ltd Sialkot

S.O.I.T Vs Irfan Farooq c/o Prestige

25 (2004) 89 Tax 301 (Trib) Ownership of Immoveable Property under Wealth Tax Law explained.

Surgical Pvt Ltd Sialkot

(2004) 89 Tax 504 (Trib) Payment of penalty for infraction of law not admissible business expenditure u/s

26 En-Em Industries Ltd Lhr Vs CIT

(2004) 90 tax 282 (Trib) 23(1) of I.T.Ord’79- 66A action in order.

Excess Income over presumptive income- Extent of Credit- Rectification of main

27 Tetra Pak Pakistan Ltd Lhr Vs ITO (2004) 89 Tax 509 (Trib)

order not possible as no error found therein.

CIT (MTU) Lhr Vs M Naeem Goods When assessment order incurably defective annulment is in order & no law point

28 (2004) 90 Tax 36 (Trib)

Transport Lhr arises for reference to High Court.

CIT MTU Lhr Vs Faiq Qayyum Kashmir

29 (2004) 90 Tax 88 (Trib) Accounting treatment of Excise Duty explained.

Chemical Ind., Lhr

CIT MTU Lhr Vs Faiq Qayyum Kashmir

30 (2005) PTD TRIB 323 Accounting treatment of Excise Duty explained.

Chemical Ind., Lhr

Carry forward of accounting depreciation on fixed assets when intervening period

31 Bilal Fibres Ltd Lhr Vs CIT (2004) PTD TRIB 2777

falls in the presumptive tax regime- law explained.

CIT Multan Vs M Shahid c/o Madina Cold

32 (2004) 90 Tax 125 (Trib) Capital gain – How arises.

Storage Lhr

CIT BHP Zone Vs Aslam Sweet Merchant Exparte asstt finalized belatedly not illegal provided default on due date

33 (2004) 90 Tax 325 (Trib)

Multan Rd Lodhran established.

CIT BHP Zone Vs Aslam Sweet Merchant Exparte asstt finalized belatedly not illegal provided default on due date

34 (2005) PTD TRIB 211

Multan Rd Lodhran established.

35 CIT Sialkot Vs Shahid Javed Sialkot (2004) 90 Tax 344 (Trib) Assessee placed in presumptive tax regime cannot be burdened with addl

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 2 of 122

taxation.

Assessee placed in presumptive tax regime cannot be burdened with addl

36 CIT Sialkot Vs Shahid Javed Sialkot (2005) PTD TRIB 203

taxation

Irfan Farooq c/o Prestige Surgical Pvt Ltd

37 (2004) 90 Tax 346 (Trib) No error in main order [ (2004) 89 Tax 301 (Trib)] & same not rectifiable.

Sialkot Vs DCIT Sialkot

CIT MTU Lhr Vs M Naeem Good Multiple statutory Notices issued simultaneously under different provisions of

38 (2005) PTD TRIB 234

Transport Lhr statute cause serious prejudice to taxpayer.

i). Payment of Service Charges to Federal Bank by assessee on account of use

DCIT Circle-11 Zone-1 Lhr Vs Punjab of Credit Line is admissible expenditure u/s 23(1). ii) Looking to ambient

39 (2005) PTD TRIB 224

Prov Coop bank Lhr circumstances gain on sale of defaulters immoveable properties is a revenue gain

& not capital gain.

40 DCIT Vs Safa Rice Mills Pvt Ltd Lhr (2005) PTD TRIB 309 Levy of penalty for failure to file C.A.T Return justified.

i. Return qualifying USAS is reqd to be processed u/s 59(1) & not 59A-

41 Sh Ahsan Ali ACM Lhr Vs IAC (2005) PTD TRIB 311 ii. When Return wrongly accepted u/s 59A & prejudice to revenue patent IAC’s

intervention u/s 66A justified.

i. Matter outside scope of rectification u/s 156. ii. Limitation u/s 156(4) not

42 Paisa Akhbar Markaz Lhr Vs ITO Lhr. (2005) PTD TRIB 1578

attracted. Iii. Applicable Law is the current law notified thru Finance Bill.

i. IAC’s intervention u/s 17-B of WTA not possible in the year when provision not

borne on Statute. Ii. When person holds clear title to immoveable property he

43 Munir Ahmad Khan Lhr Vs IAC Lhr (2005) PTD TRIB 1593 cannot claim to be ‘benamidar’ 7 not real owner on the basis of some indirect

evidence adduced by him. Iii. When asset concealed by person holding clear title

no claim for exemption under 2nd Schedule admissible.

i. Deducting Authority u/s 50(4) bound to deposit deducted tax in Treasury within

CIT Vs Flying Board & Paper Products

44 (2005) PTD TRIB 1602 stipulated timeframe. Ii. Orders u/s 52 of I.T.Ord’79 may be passed separately for

Lhr.

different time frames falling in the same asstt period.

i. Limitation u/s 17(A)(1)(a) of WTA explained- ii. Revision of W.T. return must be

45 Mst Safia Abida Multan Vs WTO Multan (2005) PTD TRIB 1708

corroborated by material on record.

Return properly qualified USAS reqd to be accepted and no arbitrary

46 Sahib Jee Lhr Vs IAC (2005) PTD TRIB 1676

disqualifications invented by IAC on Inspection of record of any avail u/s 66A.

i. No limitation of time laid down in law for action u/s 52 of I.T.Ord’79. ii

47 Monnoo Industries Ltd Lhr Vs DCIT (2005) PTD TRIB 1562 Examination of books of accounts not condition precedent for invoking provisions

of Section 52.

DB competent to declare judgment of another DB as ‘per incuriam’ provided the

48 Faisal Weaving Pvt Ltd Vs CIT (2005) 92 Tax 33 (Trib)

facts / law so justify.

When factual position / legal position not properly appreciated by 1st appellate

49 IAC Vs Rana Textile Mills Pvt Ltd Lhr (2005) 92 Tax 41 (Trib)

authority remand back in order.

50 IAC Vs Rana Textile Mills Pvt Ltd Lhr (2005) PTD TRIB 2151 IAC Vs Rana Textile Mills Pvt Ltd Lhr

51 Ashfaq Bros ACM Lhr Vs DCIT (2005) 92 Tax 103 (Trib) Mischief of Section 12(18) of I.T.Ord’79 explained.

M Ashraf Sukhera prop Q-Tech Issue of multiple statutory notices simultaneously under different provisions of the

52 (2006) 93 Tax 99 (Trib)

Computers Lhr Vs DCIT statute not approved.

i. Income attributable to a particular source reqd to be substantiated.

Saifullah Iron Merchant Jalalpur Bhattian

53 (2006) 93 Tax 101 (Trib) ii. Valid contract between two genuine parties reqd to be bonafide, arms length &

Vs DCIT

transparent.

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 3 of 122

((2000) 82 TAX 105 (Trib.)J

[ THE INCOME TAX APPELLATE TRIBUNAL, LAHORE BENCH, LAI-IORE]

Back to TOC

Present: M. Munir Qureshi, Accountant Member and Khawaja Farooq Saeed,

Judicial Member.

I.T.A. Nos. 2447/LB and 2448/LB of 1992-93, 9958/LB of 1993-94 and

5609/LB of 1995 (Assessment years 1990-91 to 1993-94),

decided on 23-5-2000.

Department

Income Tax Ordinance, 1979 cXXl of 1979) - Section 13 - Rejection of accounts - Upholding by C.l.T. (A) - Validity - Maintenance of record

and checking by Excise/Sales Tax Authorities - Rudiments of difference in requirement of type of records to be determined for purposes of

sa/es tax and for purposes of determination of total income - Range and scope of examination of tax payers account by assessing officer

and examination of Excise/Sales Tax Authorities - Manipulation of trading account - Effect of - Opportunity of being heard - Question of fact

- Application of G.P. rate of 35%

- Justification of - Whether Assessing officer’s examination of a tax payer’s account had much wider range and scope than the examination

of Excise/Sales Tax Authorities in the context of le of excise duty/sales tax - Held yes - Whether reasonable opportunity had invariably

been given to the assessee to submit its books of accounts and necessas’y supporting documentation - Held yes - Whether Assessing

officer had not drawn adverse inference behind the back of assessee - Held yes - Whether accounts maintained by assessee-company

were specially tailored to the requirements of Excise/Sales Tax Authorities and were deficient for purposes of determination of total income

by Income Tax Officer - Held yes - Whether looking to the type and range of products manufactured by assessee and its privileged position

in market, application of G.P. rate of 35% was fair and reasonable - Held yes

Assessing officer’s examination of at taxpayer’s accounts has a much

wider range and scope then the examination of Excise/sales Tax Authorities

in the context of levy of Excise Duty/Sales Tax. [ 111 JA.

The appellant-company had itself disclosed “other income” in the assessment years 1988-89 & 1989-90 but such ‘other income’ has not

been disclosed in the assessment years 1990-91 to 1992-93. Such ‘other income’ is relateable to income realized as a result of sale of

waste. The only logical conclusion from the company’s non-declaration of other income’ in 1990-91 to 1993-94, therefore, would be that

the company has managed to reduce waste to ‘nil’ which of-course is incredible and totally implausible as no manufacturing facility, no

matter how efficiently managed, can chieve 100% efficiency and reduce wastage to zero. [ 113 ]B.

Assessee

Versus

106 TAXATION [ 82

Close scrutiny of the assessment record, including order sheets from 1990-91 to 1993-94, show that reasonable opportunity has invariably

been given to the appellant to submit its books-of-accounts and necessary supporting documentation before the assessing officer. [ 113 ]

C.

However, it is the CIT(Appeal’s observation, duly recorded in the appellate orders, that the appellant failed to avail of this opportunity and

did not produce the company’s books-of-accounts and related documentation before him at appellate stage to rebut the assessiAg officer’s

observations recorded In the assessment orders that were the subject-matter of appeal.

[ 113-114 ID.

We find that Nnecessary opportunity’, as envisaged in law has inf act been

given to the appellant and the assessing officer has not drawn adverse

inference ‘behind the back’ of the appellant. [ 114 JE.

As already explained above, the accounts maintained by appellant- company are specifically tailored to the requirements of Excise/Sales

Tax Authorities and are deficient for purposes of determination of total income by the Income Tax Officer. The appellant-company Is a

manufacturing concern and is expected to maintain daily production record showing utilization of raw- material inputs viz-a-viz achieved

production. It is not understandable as to why the appellant-company has not produced such record before the assessing officer. [ 115 ]F.

The GP rate usually applied in the case of a manufacturer’s products comparable to the products manufactured by the appellant, ranges

between 30 to 40%. The department has been applying GP rate of 35% uniformly and such application has been confirmed by the CIT, (A)

and ITAT. Looking to the type and range of products manufactured by the appellant (self-adhesive PVC, BOPP, Kraft Paper Tapes,

Neoprene Resins and industrial Glues) and the fact that it uses state of the art; imported technology and high-quality raw-material inputs

with a high import component, and taking into account the ready demand for its finished products and its privileged position in the market,

application of GP rate at 35% is fair and reasonable. Hence maintained.

[ 116 ]G.

Cases referred to:

(1967) PTD 205 and (1981) PTD’213.

Muhammad Akbar, F.C.A., for the Appellant.

Mrs. Ta/at A/ta!, D.R., for the Respondent.

Date of hearing: 13-4-2000.

ORDER

[ Order was passed by M. Munir Qureshi, Accountant Member.] -

The appellant, a Public Limited company, engaged in the manufacture and

2000] APPL TRIBUNAL [ No. 2447/LB of 1992-93] 107

sale of Adhesive Tapes tiled writ petition before the Honourable Lahore High Court against appeals decided by the Income Tax Appellate

Tribunal for the assessment years 1990-91 to 1993-94 vide ITA No. 2447/LB of 1992-93 (Assessment year 1990-91), ITA No. 2448/LB of

1992-93 (Assessment year 1991 -92), hA No. 9958/LB of 1993-94 (Assessment year 1992-93) and ITA No.

5069)/LB of 1995 (Assessment year 1993-94). In the cited consolidated orders of the hAT, dated 25-10-1997, the Tribunal has upheld

rejection of the Company’s accounts by the CIT(A) but accorded relief in the estimates of Turnover as under:

Asstt: year. Sales Sales Sales

declared. Estimated. reduced by

hAT,

1990-9 Rs. 86,67,224 95,00,000 92,00,000

1991-92 Rs. 1,53,51,037 1,65,00,000 1,60,00,000

1992-93 Rs. 72,64,599 1,25,00.000 80,00,000

1993-94 Rs. 79,87,583 1,35,00,000 90,00,000

As for cost of sales, the assessing officer had applied G.P. rate uniformally at 35% in the assessment years 1990-91 to 1993-94 except for

assessment year 1991 -92 in which the declared G. P. rate of 42.2% has been adopted. The declared and applied G. P. rates in 1990-91

to 1993-94 are summarized below:

Asstt: year. G. P. G. P. By ITAT.

declared applied

1990-91 14.24% 35% 35%

1991-92 42.2% 42.2% 35%

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 4 of 122

1992-93 Gross Loss 35% 35%

1993-94 24.19% 35% 35%

As regards add backs made against P&L account expenses claimed by the Company, the hAT had accorded relief to appellant by deleting

add backs made against Printing & Stationary and Entertainment, and had confirmed add backs made against Vehicle Running and

Charity & Donations in all the years. As for Postage, Telephone & Telegraph, the ITAT had fixed add back quantum at 15% of billed

amount. In the case of Repair & Maintenance for 1990-91 and 1991-92, the ITAT had restricted add back amount to As. 20,000/- and As.

50,000/- respectively and had confirmed add backs made for 1992-93 and

1993-94 as approved by CIT(A). In the case of Miscellaneous Expenses, add backs made in 1990-91 and 1991-92 had been deleted. In

the case of carriage expenses, the ITAT had confirmed add backs made for 1990-91 and 1991-92 and reduced the add back to As. 7,500/-

in 1992-93 and As. 10,000/- in 1993-

108 TAXATION [

94. In the case of Packing Material, add backs made for 1990-91 to 1993-94 had been confirmed.

The first appellate authority had upheld rejection of appellant’s accounts for the assessment years 1990-91 to 1993-94. The CIT(A) in his

orders for the assessment years 1990-91 and 1991-92 has upheld rejection with the following observation: NThe record protuced before

the officer was not produced before

me. Details of purchases and sales lying on records indicate unverlable addresses of parties whom it was not possible to contact.

Apparently, the assessee/appellant is represented by a Chartered accountant who ought to know his duties $ If complete addresses are

not furnished before the officer it Is not possible for him to put them to any verification whereas it cannot be said that in calling for details

no opportunity to prodl4ce that were complete in

• every respect was not provided.

In these circumstances, the first and foremost duty of

- representathies in appeal should be to appear with relevant records in rebuttal of the observations contained in the assessment orders.

Obviously, these appeal proceedings provide further opportunity in support of the income returned. Hence this opportunity, which lapses

by lathes that are attributable directly to the assessee and its representatives.

History in the case also indicates rejection of books and estimates of sales and applied rates in the past two years. G. P. applied at 35% is

based on history and estimated sales not excessive and In this view of the matter I decline to interfere particularly when the trading a/c

additions are under-cast as the declared profits were under-valued on a/c of miscellaneous sales of empty cartons treated as a direct

deduction from costs which is not an approved principle of accounting.

For assessment years 1992-93 and 1993-94, the CIT(A) has again upheld

rejection citing the position of accounts statedly maintained on the same lines

as in assessment years 1990-91 and 1991-92 when these had been rejected.

The appellant in writ petition filed before the Lahore High Court has argued that its accounts had been wrongly rejected by the Department

in the assessment years 1990-91 to 1993-94 and the said rejection of its accounts have been confirmed without any justification by the first

appellate authority and the Income Tax Appellate Tribunal.

The Honourable High court in disposing of appellant’s writ petition has

observed that the ITAT while determining the tax liability of the assessee has

not examined the principles on which that liability was determined.

2000] APPL. TRIBUNAL P.T.A. No. 2447/LB of 1992-93] 109

Accordingly, the decision of the Tribunal for the assessment years 1990-91 to 1993-94 has been set-aside and matter remitted back to the

ITAT for denovo decision with the specific direction that the reasons be given if the Tribunal does not accept the accounts furnished by the

Appellant.

The appeHant in arguing its case for acceptance of the Company’s accounts emphasized that the Company maintains a comprehensive

set of accounts with full supporting documentation and the Department had rio valid reasons to reject the same. It especially pointed out

that the goods manufactured by the appellant-company are subject to levy of sales tax and the prescribed records as per relevant Excise

Rules have been duly maintained and scrutinized by the Excise/Sales Tax Authorities. The said record comprising RG-I, RG-ll, AR-I, ACL

RI-I, RI-Ill are regularly maintained and scrutinized/checked by the Excise/Sales Tax Authorities. Such record according to the appellant

fully substantiates appellant’s declared version and there was, therefore, no cause for the assessing officer to discard appellant’s declared

version in each of the years under appeal.

The main thrust of appellant’s arguments in support of its contention that declared version be accepted is that the record maintained as per

prescribed Excise Rules Is sufficient to substantiate the final accounts of the Company submitted before the assessing officer alongwith

the Return of Income. We have given this matter our earnest consideration as it is of considerable significance in deciding the issue before

us. In our considered opinion, there is a fundamental difference in the requiremePt of types of record/accounts in the context of liability to

be determined for purposes of sales tax and for purposes of determination of total Income. In the case of determination of ability for

purposes of levy of sales tax, the Excise/Sales Tax Authorities are mainly concerned with monitoring production and evaluating average

sale rate. The Excise Authorities expect a minimum level of production to be achieved periodically and provided that level is achieved, the

Excise Authorities are generally satisfied with the results disclosed. The Excise Duty is paid with reference to achieved production and

sales tax is levied on the Turnover (i.e. manufactured goods that are disposed off in the market. If the Excise/Sales Tax Authorities are

satisfied that production of goods is correctly recorded and the average sale price disclosed is reasonable, then in their view of the matter

the available records as per the prescribed Excise Rules are sufficient and no further queries are considered necessary.

In the case of determination of total income, however, the range and scope of accounts/supporting documentation required is, in our

opinion, much wider. The assessing Officer is not simply concerned with the achieved level of production and the quantum of sales made

in the market. The assessing officer must go beyond actual physical production and examine purchases and incidental expenses thereon.

He must examine average purchase price in-depth and be satisfied that it is correctly disclosed and that

110 TAXATION [ 82

there is no under/over invoicing. Similarly, the sales are subjected to close scrutiny to see that there are no significant variations in sale

rate of the same commodity/goods and that the average sale rate is consistent with the bona fide price prevailing in the market. The cost of

sales is a matter of consequence for the assessing officer as the gross profit rate evolving expressed as a percentage is often referred to

while evaluating the declared trading results. The G.P. percentage is routinely cited by the assessing officer while framing an order of

assessment. This G. P. percentage is generally not accepted to change significantly from year to year, “other things remaining the same”

and further more, disclosed G. P. percentage is expected to be comparable with the G. P. percentage declared in other. similar cases.’

Variations in the 6. P. percentage are required to be closedly investigated and commented upon by the assessing officer and the assessee

is interrogated on the same and where no satIsfactory reasons are forth-coming for a G.P. percentage that is not upto the level expected

from the business then the prevailing market’ G. P. percentage is usually applied. The purchases and sales are also scrutInIzed to see

how far these are properly vouched and verifiable. Where purchases and/or sales are found to be not fully and properly vouched/verifiable,

then the possibility of rejection of declared version is considered. THE ASSESSING OFFICER MUST ALSO SEE THAT THE MANNER IN

WHICH THE ACCOUNTS ARE DRAWN UP CONFIRM TO STANDARD ACCOUNTING PRACTICES AND PROPERLY REFLECT

PROFITABILITY POSITION. This is a matter of considerable significance for the assessing officer because he has to rule out any

manipulation of trading results so as to arbitrarily achieve acceptable gross profit say by under Invoicing purchases or debiting the P&L

account with expenses that properly pertain to the trading account. Similarly, he must analyse sales made and see whether the sales

returned back to the seller for any reason have been reduced from the gross sales or not. He must also see whether any discounts allowed

by way of reduction of sales price have been given proper effect in the trading account and whether any tax-duty on sales made are

included in the sales disclosed. All these aspects have a direct bearing on the gross profit position. The gross profit percentage is one of

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 5 of 122

the essential parameters employed to appraise the operating results. Thus is a tax-payer is able to hood-wink the assessing officer by

manipulating the trading account he may arbitrarily achieve the required level of gross profit in its particular line of business. The assessing

officer is thus required to make lndepth examination of the debit and credit sides of the trading account to rule out any manipulation. The

tax-payer must facilitate the assessing officer in his endeavour to determine the tax-payer’s total income by maintaining accounts in a

manner that enable the assessing officer to correctly determine the tax payer gross and net profit in a given time frame. The tax-payer

must also be prepared to answer various queries regarding the running of the business, the production process employed, the waste

disclosed, the capacity utilization, the unit consumption of energy, the disposal of waste and resultant income

2000] APPL. TRIBUNAL [ No. 2447/LB of 1992-931 111

therefrom (etc). Even with regard to business expenses not directly debitable to the trading account but required to be charged to the P & L

account. documentation Is required to be produced to substantiate the expenses and the assessing officer Is required to examine the

documentation and the reasonableness of the expenditure claim In the context of the business transacted by the tax-payer. Thus were the

assessing officer is, say, of the opinion that a particular expenditure claim preferred (like for example expenses claimed for us of

telephone) contain a personal element then appropriate disallowance of the claim may be required to be made. The assessing officer may

also disallow an expenditure claim in its entirety If it is found that the expenditure has no proper nexus with the business transacted. The

assessing officer will also disallow expenditure that is found to be of a “capital nature” as only Revenue’ expenditure can be debited to the

P&L account. The credit side of the P & L account must also be looked into. Generally speaking income realized by a business that is not

directly relatable to the trading activities as such, is credited to the P & L account. Thus income realized by, say disposal of waste

material/packing material Is credited to the P&L account directly,. Similarly, other receipts/incomings not directly relatable to trading activity

are credited to the P & L account.

The examination of the balance-sheet is again a very significant requirement In the assessing officer’s appraisal of accounts. The assets

and liabilities sides of the balance-sheet require close scrutiny to ensure that whatever accretion/decretion is cited is properly explained.

Any unexplained accretion has to be looked into and evaluated in terms of express statutory stipulation. Such unexplained accretion can

be found to constitute “deemed income” and separately included in a tax-payer’s total income. Even where an accretion is explained, it can

sometimes have tax consequences, Thus where a loan is received otherwise then by crossed cheque beyond a stipulated threshhold, the

same Is to constitute tax-payer’s deemed Income u/s 12 (18). The valuation of stocks is also required to be made in a consistent manner

according to well-defined parameters.

As is obvious from what is stated above, the assessing officer’s

examination of at taxpayer’s accounts has a much wider range and scope A then the examination of Excise/sales Tax Authorities in the

context of levy of

Excise Duty/Sales Tax.

In the case of the appellant, examination of the assessment record

clearly establishes that (a) the appellant has consistently credited the

company’s purchase account in the ledger by the amount of sales proceeds

of containers/cartons in which raw-material is purchased. This has the

obvious effect of reducing purchases. Further more, the appellant-company has consistently credited sales with amounts realized as a

result of sale of

damaged/unuseable roles of PVC. The treatment so accorded by appellant company is squarely against established accounting norms as

it has the effect

e

112 TAXATION [ 82

of arbitrarily pitching up the company’s gross profit. Further more, such treatment by the appellant reduces its overall tax liability as the

amount realized from disposal of containers/cartons/damaged roles of PVC/other waste material, should property be credited directly to the

P & L account. By not doing so and by changing the trading account in the manner described above, the appellant-company has

deliberately’ year after year, arbitrarily manipulated gross profit and has avoided crediting the P&L account with realizations made from

sale of assorted materials described above. This has been done consciously and deliberately obviously to secure tax benefits that would

not have been available to the company had the company drawn up its final accounts according to established norms of accountancy.

Both purchases and sales of the company are not 100% open to verification. No doubt, the bulk of purchases made are imports and these

are of course satisfactorily documented. Nevertheless, a part of the purchases made by the company are of local origin. Thus in

assessment year 1990-91 against total purchases of Rs. 83,84, 313/- purchases of Rs. 11,38,325/- are local. Out of these local purchases

of As. 11,38,325/, purchases of As. 6,33,702/- (of toluene) have been made from PSO limited and are of-course open to verification.

However, other local purchases are not open to 100% verification and include purchases of paper core, cloth, local chemicals (etc). Similar

position obtains in the assessment year. 1991-92 to 1993-94 also. Again looking to sales, these two are not 100% open to verification and

instances of such sales not open to verification have been recorded in the assessment orders passed. The appellant has not been able to

satisfactorily rebut the assessing officer’s findings In this regard and the first appellate authority has specifically noted in the adjudication

made for the assessment years 1990-91 & 1991-92 that the appellant failed to produce books-of-accounts and supporting documentation

to counter the assessing officer’s observations regarding unverifiability of part of the purchases and sales.

The acid test for acceptance/rejection of .accounts in the context of determination of total income must be the suitability of such accounts

for purposes of determining the gross and net profits. As explained above, the appellant-company has arbitrarily manipulated its trading

account, year after year by under-casting purchases and over-casting sales and thereby artificially over reporting gross profits. That being

so, the company’s operating results have been rightly rejected by the assessing officer and confirmation of such rejection by the first

appellate authority is thus fully justified.

The company has not produced stock registers before the assessing officer and the order-sheets bear this out. The only stock record

produced is that maintained for Excise/Sales Tax Authorities. The qualitative and quantitative details required in the context of income tax

proceedings for purposes of determination of the company’s total income are lacking in this record. No doubt non-maintenance of stock

register aione cannot be made

2000] APPL. TRIBUNAL [ No. 2447/LB of 1992-93] 113

basis for rejection of account. Similarly, low citation of GP rate alone also may not necessarily lead to rejection of accounts. As pointed out

above, however, these are not the only deficiencies noted in appellant’s case and looked at in their totality, including the fact that the

appellant-company has, year after year under-cast purchases and over-cast sales, a case for rejection of accounts is clearly well-

established. It also needs to be especially noted that the appellant- company had itself disclosed Nother incomev in the assessment years

1988-89 & 1989-90 but such ‘other income’ has not been disclosed in the assessment years 1990-91 to 1992-93. Such ‘other income’ is

relateable to income realized as a result of sale of waste. The only logical conclusion from the company’s non-declaration of other income’

in 1990-91 to 1993-94, therefore, would be that the company has managed to reduce waste to ‘nil’ which of-course Is incredible and totally

implausible as no manufacturing facility, no matter how efficiently managed, can achieve 100% efficiency and reduce wastage to zero.

This too casts serious doubt on the veracity of the company’s accounts.

Coming now to the opportunity accorded to appellant to explain its

position before the assessing officer at assessment stage.

Close scrutiny of the assessment record, including order sheets from

1990-91 to 1993-94, show that reasonable opportunity has invariably been c given to the appellant to submit its books-of-accounts and

necessary

supporting documentation before the assessing officer. The books-of-account actually presented before the ITO consisted of cash book,

ledger, and vouchers. Daily production record and stock register (other than for excise/Sales tax purposes) was not produced. Besides,

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 6 of 122

import documents, salary sheets were made available. The order sheets make it clear that various aspects of the case were discussed

with the AR and details, where considered necessary, were called for. Thus is assessment year 1992-93 details regarding consumption of

units of electricity and sui gas consumed during the assessment year as well as in the preceding year were called for and taken on record.

Similarly in 1993-94 assessment year, details of share deposit money, sources of investment, and copies of the company’s minutes book

and resolutions were called for Adjournments requested by appellant were also allowed. Besides opportunity given by the assessing officer

to substantiate declared version with necessary accounts/related records, it is noted that the first appellate authority also while conducting

appeal proceedings for 1991-92 and 1992-93 assessment years, gave the appellant the opportunity to rebut the assessing officer’s

observations recorded in the assessment orders impugned before him by making specific reference to the company’s books of-accounts

and supporting documentation. However, it is the CIT(Appeal’s observation, duly recorded in the appellate orders, that the appellant failed

to

avail of this opportunity and did not produce the company’s books-of- D

114

TAXATION [

accounts and related documentation before him at appellate stage to rebut the assessing officer’s observations recorded in the

assessment orders that were the subject-matter of appeal.

Given the above narration of the factual position obtaining in this case regarding opportunities given to the appellant to substantiate

declared- version, we find that “necessary opportunity”, as envisaged in law has intact

been given to the appellant and the assessing officer has not drawn adverse E inference ‘behind the back’ of the appellant. The factual

position regarding

maintenance of accounts by the appellant wherein appellant has deducted the amount realized from sale of packing

material/cartons/drums from the over all purchases of the company and/the crediting of sales with amount realized on account of sale of

damaged of PVC roles is the admitted position and there is no dispute here

As explained above, this methodology adopted by the company does not constitute sound accounting practice and makes it problematic

for the assessing officer to arrive at the correct net profits position of the company. This defect by itself, therefore, is sufficient to warrant

rejection of the company accounts.

The Superior Judiciary in Pakistan has recognized that the assessing officer is invested with considerable authority in the matter of

rejection of books-of-accounts presented before him at assessment stage. In 1981 PTD 213, the Hon’ble Lahore High Court has held that

the Income Tax Officer is competent to reject books-of-accounts where the circumstantial evidence casts doubts on the accuracy and

reliability of the entries recorded therein and it is not necessary that the income Tax Officer cite specific defects or flaws in the account

books before he can reject him. The Hon’ble Supreme court of Pakistan in Miss Assia v. Income TaxAppellate Tribunal, has held: “The

Assessing Officer was not bound to rely on all the evidence

produced by the assessee in case he was not satisfied about it. He was entitled to reject the accounts believed by him to be false and

unreliable, although there may be no direct and definite evidence with him to prove their incorrectness. There is no rule of law compelling a

Judge to accept evidence, even though it IS uncontradicted, which he beleives to be a pack of lies, (in re: Baghat Halvai). In this

connection in Ganga Ram Balmokand v. Commissioner of Income Tax, Punjab it was held that the law does not impose any burden on the

income-tax authority to prove by positive evidence that the accounts are unreliable or that the figure at which they assess is the correct

figure. On the other hand, the question of the unrellabdity of accounts is a question of fact and primarily falls for the determination of the

Income Tax authorities alone. If, therefore, it is once decided by them that the accounts are fictitious or unreliable their finding cannot be

disturbed unless it is

2000] APPL. TRIBUNAL [ No. 2447/LB of 1992-93] 115

altogether capricious and injudicial. In matters like these a very wide discretion vests In the income tax authorities in view of the exigencies

of the case, and the control exerciseable on them Is very meagre. What alone has to be seen in such cases is whether the discretion has

been judicially exercised and if it is once found to be so exercised, no Court can interfere with the order N

(S.I.C)

As already explained above, the accounts maintained by appellant- company are specifically tailored to the requirements of Excise/Sales

Tax Authorities and are deficient for purposes of determination of total income by

the income Tax Officer. The appellant-company is a manufacturing concern F and Is expected to maintain daily production record showing

utilization of raw- material inputs viz-a-viz achieved prdduction. It is not understandable as to why the appellant-company has not produced

such record betore the assessing officer. This has been recognized by ITAT in ITA Nos. 2057, 2058 and 2059 of 1963-64 and STA Nos.

248, 249 and 250 of 1963-64 (Assessment Years 1956-57, 1957-58, 1958-59 and 1959-60) decided on 8-7-1966 wherein it has been held

that: “true that in a case of a dealer who purchases and sells goods as such without subjecting them to a manufacturing process the

absence of a stock register would not entail the rejection of the account version unless the profit rate disclosed is ridiculously low but the

same considerations do not apply in the case of a manufacturer who has got to maintain a manufacturing record without which the

correctness of production and consequently the declared sales cannot be vouchsafed. The plea of the assessee for the acceptance of

accounts is, therefore, unmerited and must fall;”

(S.l.C)

The importance of maintenance of a manufacturing account giving quantitative reconciliation in the case of a manufacturer has also been

recognized in case reported as (1967) PTD 205 wherein it has been held that even though accounts may have been maintained regularly

in the case of a manufacturer, absence of a manufacturing account giving quantitative reconciliation would entitle the Income Tax Officer to

reject the accounts and frame assessment according to his judgments.

Thus, in view of the peculiar manner in which the books-of-accounts have

been maintained and the final accounts of company drawn up, as discussed

above, we find that rejection of declared-version is justified.

In the matter of estimate of Turnover, we have examined the position of

sales declared by the appellant and the estimates made by the assessing

officer and relief given by the CIT(A) and Income Tax Appellate Tribunal.

t

116 TAXATION [

Looking to all pertinent aspects, we find that sales as reduced by ITAT to Rs.

92,00,000/- in 1990-91, Rs. 1,60,00,000/- in 1991-92, Rs. 80,00,000/- In 1992-

93 and Rs. 90,00,000/- in 1993-94 are fair and reasonable and call for no

interference. Hence maintained.

In the matter of application of GP rate, the ITAT has previously uniformally/approval GP rate at 35% when the appellant had been

declaring GP rate ranging between 5.74% to 42.2%. Scrutiny of the assessment orders shows that the GP rate of 35% is being applied in

this case since assessment year 1988-89. The appellant Is a manufacturer of high-quality Industrial adhesive tapes with a high raw-

materials Import component and appears to have a privileged position in this line of business in Pakistan. Keeping in mind the ready

demand for Its products, It Is In a position to charge good prices.

The GP rate usually applied in the case of a manufacturer’s products comparable to the products manufactured by the appellant, ranges

between 30 to 40%. The department has been applying GP rate of 35% uniformly and

such application has been confirmed by the CIT, (A) and ITAT. Looking to the G type and range of products manufactured by the appellant

(self-adhesive PVC, BOPP, Kraft Paper Tapes, Neoprene Resins and Industrial Glues) and the fact that it uses ‘state of the art; imported

technology and high-quality raw-material inputs with a high Import component, and taking into account the ready demand for Its finished

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 7 of 122

products and Its privileged position In the market, application of GP rate at 35% Is fair and reasonable. Hence maintained.

Add backs against expenses have been looked into and we find that

treatment as approved by the first appellate authority is reasonable and calls

for no interference.

Resultantly, the appeals for 1991-92 to 1993-94 are disposed off as

above.

Appeals disposed

of accordingly. Back to TOC

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 8 of 122

2000]

[ 82 TAX 117 (Trib.)]

[ THE INCOME TAX APPELLATE TRIBUNAL LAHORE BENCH, L.AHORE]

Back to TOC

Present: M. Munir Qureshi, Accountant Member and Kha wa/a Farooq Saeed,

Judicial Member.

LT.A. No. 4537/LB of 1999 (Assessment year 1995-96),

decided on 7-6-2000.

Department Versus Assessee

Income Tax Ordinance, 1979 (XXXI of 1979) - Sections 59, 62, read with Circular No. 5 of 1995 - Rectification of mistake - Order of C.l. T.

(A) rectified by successor C.!. T. (A) - Jurisdiction and scope - Assessee earning income from purchase and sale of used cars - Income de

entirely from commission received from sale of brand new vehicles - Change in nature of business, concealment of income and

suppression of receipts from commission - Observations of department - C.I. T. (A) rectified order of his predecessor and held that case

had already been finalized and D.C.I.T. had no jurisdiction to proceed u/s 62 - Challenge to - Selection of return for normal law assessment

- Validity - Jurisdiction of successor CJ.T. (A) to recti4’ the order of his predecessor - Qualification of return under the scheme

- Question of law - Whether successor C.!. T. (A) could disturb clear cut finding recorded by his predecessor with regard to disqualification

of assessee’s return under BBSAS - Held no - Whether it was open to department to select certain percentage of returns for normal law

assessment

- Held yes - Whether assessee fell in categoiy of “new tax payer” and its return could be taken up for normal law assessment - Held yes

The predecessor CIT(A) had already interpreted Circular No. 5 of 1995

and had explained that the assessee M/s. H.... B fall in the category of

“new taxpayers”. [ 125 ]A.

It was not open to the successor CIT(A) to disturb the clear-cut finding recorded by his predecessor with regard to dis-qualification of

assessee’s return under BBSAS especially when the successor ClT(A) could not show that his predecessor had wrongly cited pertinent

facts or had wrongly interpreted the relevant law/applicable circulars. [ 125 ]B.

The provisions of Section 65 would be applicable in the case of an “existing assessee” in terms of Circular No. 5 of 1995. In the case of a

“new taxpayer,” it is open to the Department to select a certain percentage of returns filed for normal law assessment. In the present case,

it has been shown that the assessee M/s. H.... B.... falls in the category of “new tax-payer and, therefore, its return could be taken up for

normal law assessment.

[ 126 Ic.

118 TAXATION [ 82

Statutory notices u/s 61 of the Income Tax Ordinance were issued to the assessee on 10-12-1995, 21-12-1995, and 10-12-1996 and the

assessee’s then AR, Mr. Hadi, FCA, did appear in compliance before the assessing officer and was duly confronted with the department’s

finding regarding ineligibility of assessee’s case under BBSAS for 1995-96. [ 127 ]D.

CIT(A)’s finding that assessment stood finalized u/s 59 (4) as no order had been passed by 30-6-1996 is wholly misconceived as the

assessee had already been advised weli before 30-6-1996 that his return for the year did not qualify under BBSAS and notices u/s 61 had

been issued and served and case discussed with the then AR. (page 128 JE.

The successor CIT(A) has virtually re-Interpretated statutory provisions, including BBSAS provisions for 1995-96, after a firm finding on the

issues had been duly recorded by his predecessor in office. The successor CIT(A) had no authority under the law to record a different

finding on the same cited facts and in fact the successor CIT(A) has not even marshalled facts properly but rather has distorted the factual

position by omitting all references to action u/s 61 before 30-6-1996 and subsequent interaction between the department and the assessee

on various pertinent aspects as well as the fact the departmen had continued to requisition information having a bearing on the

computation of assessee’s total Income, before as well as after 30-6-1996. (page 128 ] F.

Sha hid Zaheer, D.R., for the Appellant.

TalatJaved, F.C.A., for the Respondent.

Date of hearing: 3-6-2000.

ORDER

[ Order was passed by M. Munir Qureshi, Accountant Member.1 - This is an appeal by Revenue against order of the CIT(A), dated 14-4-1

999 in which the first appellate authority has rectified the order of his predecessor and has held that the order passed by the predecessor

CIT(A) was defective insofar as no adjudication had been made with regard to Ground No. 1.

Briefly stated, the facts in this case are that the assessee, an AOP, filed Return under BBSAS for 1995-96 declaring Total Income of Rs.

1,04,775/- on 30-8-1995. On scrutiny of the Return, the DCII found that (a) the assessee had changed its nature of business from

purchase and sale of “used” cars of assorted brands to exclusive sale of new, Honda brand automobiles supplied by H.... A.... C (Pakistan)

L In the computation appended with the Return filed, the income declared related entirely to commission earned from HACPL on sale of its

brand new vehicles and no income whatsoever had been declared from purchase and sale of used automobiles. This was seen by the

DCIT as a qualitative charge in the nature of business as in the past the assessee had declared income from sale of “used” motor vehicles

only. Furthermore, the status of the assessee though still that of an AOP, also

I

2000] APPL TRIBUNAL [ Nos. 4537/LB of 1999) 119

recorded a change insofar as the previous AOP having three Members known M...... by the name of MA... S...... S.... R NIN 04-03-

0808359 (Mr. M.... A , Mr. A H and Mst. N H ) stood enlarged with the induction of new members so that the total strength of the new AOP

known by the name of H B was of six members.

Besides the above, the DCIT also found that the gross commission receipts from HACPL’ declared by M/s. H B for assessment year 1994-

95 amountIng to Rs. 37,12,457/- was not consistent with the Information furnished by HACPL showing gross commission disbursed to

assessee amounting to Rs. 65,69,013/-. Prima fade, the assessee appeared to have concealed/suppressed commission receipts from

HACPL.

In view of the fact that the assessee having changed its nature of its business and furthermore, the assessee having

concealed/suppressed gross commissioner receipts from HACPL. the DCIT found the assessee to be ineligible under the BBSAS for 1995-

96. Statutory notices u/s 61 of the Ord., were then issued on 10-12-1995 and duly served on the assessee on 14-12-

.1995. In compliance, Mr. M. A. Hadi, chartered accountant/AR appeared before the assessing officer and discussed various aspects of

the case. Statutory notices u/s 61 were subsequently also issued on 21-12-1995 and

10-02-1996.

The assessee’s AR challenged the selection of Return filed for 1995-96 under BBSAS for normal law assessment on the Ground that the

said Return’ duly qualified for acceptance under BBSAS. The AR was confronted with the findings made by DCIT regarding status of the

assessee and concealment/suppression of gross commission receipts. The AR contested DCIT’s findings and denied any change in the

nature of business/status of the assessee. As regrades, the alleged concealment of gross commission receipts, the AR explained that the

assessee did not maintained any regular accounts and the alleged discrepancy in gross commission receipts referred to by the DCIT was

In fact due to cash basis recording receipts adopted by the assessee as against the accrual basis adopted by the Principal (HACPL).

The DCII further found that besides commission earned by the assessee from HACPL on H vehicles, the assessee had also made

independent purchases of brand new Honda motor vehicles of some 205 cars during the period relevant to assessment year 1995-96. The

assessee’s earnings on such independent purchase of motor cars was also found to have been conceaIed. When confronted on the

matter, the assessee’s AR explained that the assessee was required by HACPL to purchase motor vehicles independently from those

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 9 of 122

supplied by HACPL for show-room disp(a purposes and it was for this reason that the assessee had made purchases on own account of

Honda Motor vehicles besides the Honda vehicles supplies on commission basis by

HACPL

120 TAXATION [ 82

After discussion of the case with the assessee’s A.R. and after examining the assessee’s response on various findings confronted, the

DCII found that (a) M/s. H... B... fell in the category of a “new assessee” and furthermore, that M/s. H... B... had actually

concealed/suppressed gross commission receipts from HACPL and the explanations given were wholly unsatisfactory. The DCIT held that

for the reasons aforementioned, the assessee’s case fell in the definition of Nnew assessee”. 1 on account of furnishing inaccurate

particulars of its income, its return for 1995-96 fell outside the purview of BBSAS in terms of para 6 of Circular No. 5 of 1995.

After recording finding, as above, the DCIT proceeded to frame

assessment under normal law and determined total income at Rs. 49,55,162/-

computed as under:

Net Income as per P & LA/c Rs. 1,04,775/-

Add Difference In

Commission Receipts

disclosed by Assessee

and intimated by HACPL. As. 28,56,356/-

Additions out of P&L A/C.

Total B. F. As. 29,61,131/-

Financial Charges.

As. 14,42,247/-

(Claimed disallowed In

entirety as found not relevant

to assessee’s business) Rs. 14,42,247/-

Sales and Marketing

Claimed Rs. 6,64,954/-, added back

Rs. 3,32,477. Rs. 3,32,477

Administrative Expenses.

Claimed Rs. 15,00,482/-

added back As. 2,19,307/- Rs. 2.19,30Th

As. 49,55,162/-

The order of assessment is dated 4-6-1998 and the DCIT has issued

notice u/s 116 for furnishing of inaccurate particulars of income.

In appeal before the first appellate authority, the assessee reiterated its claim for acceptance under BBSAS. The CIT(A) examined the

case in-depth and found that the assessee’s claim under BBSAS was wholly misconceived as the DCIT had rightly come to the conclusion

that the assessee’s case fell in the category of “new tax-payer” as the “nature of business” of the newly

Back to TOC

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 10 of 122

[ 82 TAX 96 (Trib.)1

[ THE INCOME TAX APPELLATE TRIBUNAL, LAHORE BENCH, LAHORE]

Back to TOC

Present M. Munir Qureshi, Accountant Member and Khawaja Farooq Saeed, Judicial Member.

I.T.A. No. 4538/LB of 1999 (Assessment year 1996-97),

decided on 20-6-2000.,

Department Versus .. Assessee

Income Tax Ordinance 1979 (XXXI of 1979) - Section 156 Rectification of mistake -‘Application for - Acceptance,by’ (Successor) C.!. T (A)-

Validity - Assessee an. AOP deriving income as dealer of cars - Filed return for assessment year 1996-97 under BBSAS - Non acceptance

by Assessing Officer on ground of concealment and suppression of commission receipts - Addition u/s 13 - Order set aside by predecessor

C.I.T (A) for want of proper show cause notice, also for not allowing extent/on oft/me as requested by assessee - Application ‘for

rectification of ‘order was accepted by the successor C.I.T. (A) who concluded that his predecessor had failed to make proper adjudication

regarding autcmatlc finalization of assessment u/s 59(4) and allowed return under BBSAS - Appeal against - Jurisdiction of (successor)

C.I.T. (A) to rectify order of his predecessor - Question of law - Interpretation - Scope and application of - Whether scope of section 156

could be enlarged perforce to permit wholesale review of predecessor C I. T. (A) ‘a order - Held nO - Whether action of successor C.!. T.

(A) in invoking provision of section 156 to rectify order of his predecessor in office was illegal and without jurisdiction - Held Yes

The scope of Section 156. While It is arguable that u/s 156 it might have been possible for the successor C(T(A) to find that assessee’s

Return for

2000] APPL. TRIBUNAL [ No. 4538/LB OF 1999j 97

1996-97 stood accepted/assessed u/s 59(4) on 30-6-1997. However, the scope’of Section 1.56 cannot be enlarged perforce to permit

wholesale review of predecessor CIT(A) order. Thus by making such Wholesale review of his predecessor CIT(A). order the

successor .CIT(A) undoubtedly exceeded his

jurisdiction. [ 103’]A. .. . -

The action of the successor CIT(A) in invoking the provisions of section 156 to rectify the order of.his predecessor in office Is found to be

Illegal for the reason. that the predecessor In office has recorded firm findings after discussing exhaustively all pertinent aspects and these

findings are not open to Review by successor CIT(A). That being so, the, appellant was required to file formal appeal against the appellate

order of (predecessor) CIT(A) rather than, move a rectification application before successor. CIT(A). As successor .CIT(A) had no

jurisdiction in.Iaw to take action u/s 156 in the manner done by him In the present ase, we, therefore, annul the order of successor CIT(A)

and.restore the order of predecessor CIT(A). [ 104 38.

Cases referred to:

(1996 PTD Trib. 1117); (AIR 1987 SC 1160) and (AIR 1972 Mad. 309).

Shahid Zaher, DR.; for the Appellant.

Ta/at Javed, F.C.A., for the Respondent.

Date of hearing: 3-6-2000. , .. . .

ORDER

(The Order was passed by M. Munir Qureshi, Accountant Member.J - This Is an appeal by revenue directed against order of CIT(A), dated

14-4-1999 In which.. the first appellate authority has urectifiedn u/s 156 of the Ord., the adjudication made by his predecessor in office vide

order dated 12-11-1998.

2. The departmental contention is that the(successor) C had no jurisdiction In law to rectify order passed by. this predecessor In office.

Further more,: it is also the departmental case that . the (successor) CIT(A) had no justification in law to hold that no formal order of

assessment having been passed till 30-6-1997, Return filed for assessment year .1996-97 under BBSAS was deemed have been finalized

u/s 59 on that date.

3 Briefly stated, the facts in the case are that the appellant an AOP denying

income ‘as dealer of H. A.... C.... P... L...(HACPL) filed Return for 1996-97

under BBSAS declaring tOtal income at Rs. 460,495/- comprising gross comrnl receipts from HACPL/amounting to Rs. 8157170/- against

which expenses had been charged aggregating Rs.76,96,675/-. The Return filed was accompanied by trading, profit & loss account,

computation chart and personal accounts of members of AOP. The Return so filed was not accepted by the assessing officer under

BBSAS on account of (a), concealment property purchased by AOP vide No. 63-A.... A.... M.... comprising commercial

98 “

TAXATION

[ 82

immovable property (land) measuring 5 kanal at 63-A.... R.... M.... having a registered value of Rs. 25,00,000/- and (b). suppression of

commission receipts from HACPL The said property has not been cited either in the statement of affairs of AOP or in the indMdual wealth

tax Return of any of the Members of AOP. Such concealment was found to automatically oust the appellant’s claim for assessment under

BBSAS in view of the provisions of Self Assessment Scheme announced for 1996-97 Para-2 (h) of Circular No. 4 of 1996 dated 1-7-1996).

4. Besides, the concealment of property purchased by AOP, discussed above, the appellant also statedly suppressed commission receipts

amounting to Rs. 67,05,114/- (The actual commission receipts by appellant AOP from HACPL aggregates Rs. 148,62,284/-). The

information regarding comrq receipts was formally requisitioned from HACPL and duly submitted to the assessing officer and a finding of

suppression of commission receipts has been recorded by the assessing officer after examining the details furnished by HACPL regarding

commission disbursed to the appellant.

5. The factum of concealment detected in appellant’s case was duly confronted to appellant through statutory notices issued u/s 61 & 62 of

the ord. Detailed discussions were made with the appellant’s AR. s M/s M.A. Hadi, FCA and Mr. Talat Javed, FCA.

6. When formally confronted on the matter, the appellant had no plausible explanation to offer regarding non-disclosure of commercial

property purchased by the appellant/AOP at A.... R.... M.... and, the under statement of gross commission receipts. The appellant sought

extention in time for filing of reply In the matter pertaining to disclosure of land purchased by the appellant bearing No. 63, A.... A.... M.....

The assessing officer interpreted this “as delaying tactics” deliberately adopted in the face of irrefutable evidence to the effect that the

appellant/AOP had infact purchased valuable property at 63- A.... R.... M...., the market value of which property was much higher than that

disclosed in the registered deed executed on 9-10-1995 for Rs. 25,00,000/-. Local enquiries, were got conducted by assessing officer and

these confirmed that the bona fide market value of the cited property ranged between Rs. 22,00,000/- to Rs: 25,00,000/- per Kanal. The

assessing officer also found that the appellant had made payment through 2 cheques bearing No’s. 257202 and 257203 both dated 9-10-

1995, amounting to Rs. 86,00,000/- and As. 25,00,000/- respectively drawn on Plantinum Commercial Bank Limited, H B M The assessing

officer further found that the face of the two cheques bears the following remarks:-

“for purchase of land at

63-A.... R.... M....

7. As stated above, the appellant AOP has neither cited this land at 63-A.... A , in the statement of affairs of AOP annexed with the Return

of income

-a

2000] APPL TRIBUNAL [ No. 4538/LB OF 1999] 99

filed nor in the individual wealth, tax Returns of any of the Members of the AOP. In the balance sheet of AOP as on 30-6-1 996 also, there

is no mention of the land in question.

8. In view of the definite, unequivocal and irrefutable evidence regarding purchase of 5 Kanal commercial land at 63-A.... R.... M.... by the

appellant/AOP, the assessing officer recorded a firm finding to the effect that (a) the appellant AOP had concealed purchase of cited land

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 11 of 122

and (b) under stated bona fide market value of the said land. The market value of cited land has been appraised at Rs. 1,11,00,000/- and it

has been established, as discussed above, that the appellant/AOP had made payment In that amount also. Consequently, the difference

between declared value of As. 25,00,000/- and market value of Rs. 1,11,00,000/- amounting to Rs. 86,00,000/- has been brought to tax u/s

13 (1) (d) while the admitted purchase price as per registered deed amounting to Rs. 25,00,000/- has been brought to tax u/s 13 (1) (c).

9. In the matter of suppression of commission income when formally confronted on the matter, the appellant avoided making a direct

response and instead submitted various explanations. Basically, the appellant argued that the apparent discrepancy in commission

receipts as disclosed by the assessee and as Intimated by HACPL was due to the fact that accounts were drawn up and maintained in a

different manner by the two parties involved. The appellant under took to reconcile the discrepancy and file a reconciled statement before

the assessing officer. However, that was not done. On the other hand the assessing officer found that the appellant’s account maintained

In the HACPL ledger showed that HACPL had credited appellant’s account on a month-wise basis from July, 1995 to June, 1996 so that

the total credits as on 3t 996 aggregated Rs. 318480600/-. The scrutiny of appellant’s ledger account as maintained by HACPI Indicated

that the appellant, besides earing commission income from HACPL had also purchased and sold H A.... C.... on ‘OWfl account’: When

confronted on the matter, the appellant explained that it was H A.... policy that its dealers purchase Honda cars on own account as well as

for ‘display purpose’ in the show room. However, the appellant’s explanation was not found plausible by the assessing officer as the

appellant was found to have purchased 426 cars during the year and the assessing officer concluded that such a large number of cars

could not have been purchased merely for display purposes.

10. The assessing officer found that the appellant/AOP is not declaring any Income/from purchase and sale of motor vehIcles on own

account and only

disclosing commission income earned from HACPL on supplies of vehicles booked by customers, consequently, the assessing officer

when evaluating the appellant’s claim on account of financial charges during the year aggregating Rs. 3789906/- on account of running

finance facility with plantinurn Commercial Bank Ltd. (40 Million) decided to curtail admissibility of

100 TAXATION [

cited financial charges by 50% as the loan facility from bank was not being utilized fully for transacting the admitted business of the AOP.

Rather Part of the loan facility was being diverted towards purchase of motor vehicles on account against which no Income has been

disclosed by the appellant in Return filed.

11. Other items of expenditure have also been looked into by the assessing officer and add backs made against salary, entertainment,

vehicle running, telephone, donation, car repairs, medical aid, carriage, charity, sales and Marketing & gifts commission paid to other

parties claimed at Rs. 8,86.000/- had been disallowed In its entirety as this was found to be totally unverifiable. The appellant then filed

appeal before CIT (A) who adjudicated the appeal filed for 1996-97 vide order dated 12-11-1998.

12. Before the CIT (A), the appellant submitted, as per grounds of appeal filed, that the assessment as made u/s 62 vide order dated 4-6-

1998 was of no àonsequence as the appellant cases was deemed to have been finalized u/s 59 (4) under BBSAS on 30-6-1997, no order

having been passed by that date and appellant’s return not having been found ineligible for processing under BBSAS. The appellant

further contended that additions made u/s 13 had been made behind the back of the appellant/AOP and notices issued u/s 13 (2) were

allegedly never brought to the notice of and of the Members of the AOP. The appellant denied concealment of 5 Kanals land at 63-A.... R

and submitted that the payment for cited land had been made through AOP’s bank account which was proof that there had been no

concealment. The appellant also submitted that acquisition of cited land had not been made declared formally in the statements annexed

with the Return filed for 1996-97, as there was statedly no such requirement under BBSAS for 1996-97. Similaily, with regard to alleged

suppression of commission income, the appellant contended that there had been no suppression and the apparent discrepancy was the

result of different accounting methods of HACPL and appellant/AOP. The appellant contested the assessing officer finding to the effect that

the appellant had purchased and sold H.... A... cars on own account besides commission income earned on supplies of such vehicles by

HACPL Add backs against P & L expenses claimed were also contested including curtailment of financial charges by 50%.

13. The first appellate authority (predecessor) after making appraisal of AOP’s affairs, recorded a firm finding to the effect that the

appellant/AOP having concealed purchase of property No. 63-A.... A.... M.... and having suppressed commission income earned

amounting to As. 6705114/- from HACPL In the period relevant to assessment year 1996-97, the Return filed under BBSAS stood

disqualified and in the presence of the disquaiifications arising from concealment of cited land and suppression of commission receipts,

there could be no question of acceptance of Return under BBSAS/59 (1), finalization of assessment or under deeming provisions of

Back to TOC

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 12 of 122

BEFORE THE INCOME TAX APPELLATE TRIBUNAL,LHR BENCH,LHR

Back to TOC

RA No. 293/LB/2001

(Assessment Year 1995-96)

NTN: 21-05-0019623

Late Haji Muhammad Hanif C/o Zohaib Jewellers, Lahore Applicant

Versus

CIT/WT, Zone-C, Lahore. Respondent

Applicant by : Mian Aashiq Hussain,ADV.

Respondent by : Mr. Anwar-ul-Haq,DR.

Date of hearing : 25-07-2001

Date of order : 27-07-2001

ORDER

This Reference Application by an individual member of an AOP, formulates the following questions of law statedly arising out of the

Tribunal’s order bearing ITA No.4279/LB/2000 (Assessment year 1995-96) dated 24.1.2001:-

1. Whether the learned Tribunal was justified to uphold the addition u/s 13(1)(aa) at Rs.1,32,66,600 without

considering the material fact that the ample accumulated resources to finance the purchase of gold?

2. Whether the learned Tribunal was justified to ignore documentary evidence without any verification? After finding that

applicant imported 3000 Tolas of gold, whether the Tribunal was justified to uphold application of Section 13(1)(aa)

instead of specific provisions of Section 80(C)?

3. Whether the Tribunal was justified to presume that revised returns indicate that original returns must have been filed

before issuance of notice u/s 61 of the Ordinance?

4. Whether the Tribunal was justified to rely upon irrelevant assertions of AAC, neither taken up in grounds of appeal nor

argued at the time of hearing of the appeal?

5. Whether explanation u/s 13supported by documentary evidence could be rejected without disclosing any basis thereof in a

notice u/s 62 of the Ordinance?”

2. The facts in this case, interalia, are that the assessee is a returning expatriate Pakistani who in the period relevant to assessment

year 1995-96 brought with him 3000 tolas gold bars from theUAE valuing Rs.1,32,66,600 admittedly by way of “PERSONAL BAGGAGE”

and on which he paid Rs.2,65,322 as duty to the Custom Authorities at the Airport. On examination of applicant/appellant’s Income Tax

Return for 1995-96, the assessing officer found that the necessary resources to finance the cited acquisition of gold by the assessee were

not evident; he accordingly issued a show cause notice u/s 13 of the Income Tax Ordinance, 1979. In response, the assessee did not

specifically identify the resources employed to purchase the 3000 tolas gold bars and instead took the plea that the said gold had been

brought into Pakistan as “Personal Baggage” and was thus exempt being personal baggage item. The assessee specifically advised the

assessing officer that the gold had not been “imported” by him into Pakistan. The assessing officer duly considered assessee’s reply and

found the same to be wholly unsatisfactory insofar “as the sources of investment” had not been identified by the assessee. Before the

assessing officer, the assessee had also taken the plea that vide Clause 130A of the Second Schedule to the Income Tax Ordinance, the

income of a returning expatriate enjoyed statutory exemption. That contention was also considered and the assessing officer found that

the assessee could not be absolved from explaining the sources of investment involved in the purchase of 3000 tolas bars by him. He

accordingly made addition u/s 13 (1) (aa) amounting to Rs.1,32,66,600. Before the first appellate authority, the assessee reiterated that

the assessee could not be interrogated with regard to the purchase of gold bars cited Supra in view of alleged statutory exemption

available for returning expatriate both by way of personal baggage exemption and also vide clause 130-A of the Second Schedule to the

Income Tax Ordinance. The assessee’s contentions were rejected by the first appellate authority. Before the Tribunal, the assessee again

argued his case on the same lines as before and the arguments did not find favour and the AAC’s order was maintained.

3. The assessee then filed a Miscellaneous Application for rectification of the Tribunal’s order bearing ITA No.4279/LB/2000 dated

24.1.2001 and now adopted a different stance and argued that the gold in question had actually been “imported“ by him into Pakistan and

such import was covered u/s 80-C of the Ordinance as it fell in the presumptive tax regime. It was argued that payment of duty on the gold

brought as Personal Baggage was akin to payment of tax u/s 50(5). The assessee’s contention was looked into and found to be

misconceived as the gold in question was admittedly brought as personal baggage item and duty duly paid to the custom authorities.

4. The D.R. has pointed out that under the law there is no way that the applicant can circumvent the fundamental requirement of

offering explanation in specific terms regarding the sources of investment involved as the assessee first purchased the gold and then

brought it into Pakistan. The D.R. pointed out that even if it be accepted that this is a case of “regular import” of gold into Pakistan, that

would not absolve the assessee from the separate requirement of explaining the sources of investment when called upon to do so by the

assessing officer and when the sources are not identified then formal cognizance is bound to be taken u/s 13(1)(aa) as the law clearly

provides. The D.R. emphasized that the provisions of Section 80-C are not an alternate to the provisions of Section 13(1)(aa) as the

assessee is trying to make out in the Reference Application. The A.R of applicant kept on harping on the theme that the case was covered

u/s 80-C & the duty paid at airport when the gold was brought into Pakistan and declared as personal baggage item is akin to tax paid u/s

50(5) & constituted full and final discharge of applicant’s liability and no further tax can be demanded u/s 13(1)(aa). The A.R. said that

even the Tribunal in its cited order No.4279/LB/2000 dated 24.1.2001 had referred to ‘import’ of gold by the applicant. It was pointed out to

the AR that the Tribunal had only clarified that, in its “broad connotation”, the act of bringing anything into Pakistan may be seen as an

‘import’. However, that did not mean that this ‘broad connotation’ of the term ‘import’ is the same as its “strict connotation” where an item

is formally imported into Pakistan after opening letter of Credit (L/C) and Bill of entry duly made out at Port stage and tax charged u/s 50

mhtml:file://C:\Documents and Settings\maq\Desktop\RJ_MMQ.mht 2/13/2009

Reported Judgments by M Munir Qureshi Page 13 of 122

(5). However, the AR kept on taking refuge behind a purely semantic analysis and insisted that the gold in question had been imported into

Pakistan and was therefore placed in the presumptive tax regime u/s 80-C and hence enjoyed blanket immunity from all interrogation.

5. We have heard both sides and have examined the available record and our findings are recorded hereunder:-

1. Question No.1 as formulated above has been looked into. After due consideration, we find that the availability of resources to

finance purchase of cited gold bars is a question of fact. The Tribunal had held vide order referred to Supra that since actual

availability of sources to meet purchase of 3000 ‘tolas’ gold bars by the applicant /appellant had not been established , therefore,

recourse to the provisions of section 13(1) (aa) was justified. The applicant has not submitted any evidence whatsoever of (i)