Professional Documents

Culture Documents

A Guide To The Slowdown

Uploaded by

shishir50Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Guide To The Slowdown

Uploaded by

shishir50Copyright:

Available Formats

A guide to the slowdown

Latest data show that India's economic growth is set to slump to a 10-year low of 5% in 2012-13. HT looks at the interplay of forces behind the slowdown. What does the latest data tell us about the Indian economy? The latest data released by the Central Statistics Office (CSO) of the ministry of statistics and programme implementation (MOSPI) has forecast that India's economy will grow by 5% in 2012-13, the slowest since 2002-03 when the economy grew by 4%. How have prices pulled down growth? Whether daily groceries, or the occasional fine dining, or recurrent home loan EMIs, the economic downturn spells bad news for Indian households. It is eating into savings and squeezing family budgets. There are strong linkages between inflation, industrial slowdown, government deficit, employment and salary raises. Sharply rising food prices hit family budgets hard as the same amount of money now buys fewer goods. Besides food, clothing, medical care, education, travelling, communication, recreation, eating out and most services have turned dearer over the past 12 months. While food items turned more expensive on weather-induced supply shortages, manufactured output has also turned costlier. What about high borrowing costs? How does it affect the broader economy? In the last three years, home loan EMIs (equated monthly instalments) have steadily gone up. Since they cannot be curtailed, family budgets are squeezed by cutting down on regular expenses - even on items such as clothes and consumer durables. Higher prices and the need to find additional money for EMIs force cuts on purchases of televisions and cars. The resultant fall in demand have hit companies, hurting their revenues, already boxed in by rising input and borrowing costs. Many experts also say that adverse policy pronouncements by the government have hurt the prospects of the Indian economy. How? Policy pronouncements such as a retrospective tax on older corporate transactions such as the Vodafone-Hutch deal and uncertainty over general anti-avoidance rule (GAAR) had dented India's image as an investment hotspot, sparking fears among global investors.

As foreign investors, who say this would choke foreign investment into India, pull out from Indian equities, the rupee has slid. A fall in the rupee's value makes imported raw materials and overseas loans costlier, hitting companies further. How has costly borrowing hurt consumer purchases? Households putting off spending are warning signals of an economy-wide squeeze and the clearest indications of this downturn are available in a market or a mall. Automobile sales growth crawled to 4.6% during April to December 2012 versus 12.5% in the year-ago period, supporting the view that high inflation and interest rates are denting discretionary consumer spending. Latest GDP data has shown that private consumption is estimated to remain flat at 59.7% of GDP (at current prices) against 59.2% last year, implying people are putting off planned purchases due to high interest rates and costly products. A recent Reserve Bank of India (RBI) survey shows that high interest rates have dented consumer confidence. There has been a decline in the proportion of respondents reporting increase in current and future spending. From the borrowers' point of view, the proportion of respondents perceiving interest rate as high has increased, according to the RBI consumer confidence survey of households for October-December 2012. The survey, carried out among 5,259 urban households across Bengaluru, Chennai, Hyderabad, Kolkata, Mumbai and New Delhi, is a metric for assessing consumer sentiments. Last month, the RBI cut the repo rate - the key lending rate at which it gives out funds to banks by 0.25 percentage points to 7.75%, a first in 9 months. Data from 47 banks - accounting for about 95% of all loans - shows than "non-food credit", which includes retail loans for houses and cars, grew at a much slower 8.6% in April to December against 10.4% in the same period last year. What about investment? Tight monetary conditions and high inflation have hurt investment activity. Gross fixed capital formation, a proxy for investment activity, has slowed down to 29.9% of GDP (at current prices) against 30.6% last year.

Costly borrowings and inputs have dampened investments as firms defer capacity expansion, hurting job prospects. Firms have pruned wage bills, offering lower salary hikes that barely take care of rising prices. How would the slowdown affect the government's plans? Sluggish industrial growth has led to deceleration in the economy, resulting in slower GDP growth. Slow growth can hurt government's tax revenues that may force the government to borrow more to fund its activities. This can upset fiscal plans ahead of the budget. What steps can the government take to revive the economy? One of the surest ways to revive a sagging economy is to prompt households to spend more. In times of high prices, the best way to do this is to give more money to people via tax breaks. It's also critical to fast-track roads, ports, airports, and railways projects to create jobs, raise nonfarm incomes and catalyse large scale industrialisation. The 1,483-km long Delhi- Mumbai Industrial Corridor and a few other large-scale projects should be accorded the highest priority as they can potentially spin off into millions of jobs.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1 PBDocument14 pages1 PBSaepul HayatNo ratings yet

- MRT Mrte MRTFDocument24 pagesMRT Mrte MRTFJonathan MoraNo ratings yet

- Elastic Modulus SFRCDocument9 pagesElastic Modulus SFRCRatul ChopraNo ratings yet

- ACIS - Auditing Computer Information SystemDocument10 pagesACIS - Auditing Computer Information SystemErwin Labayog MedinaNo ratings yet

- RENCANA KERJA Serious Inspeksi#3 Maret-April 2019Document2 pagesRENCANA KERJA Serious Inspeksi#3 Maret-April 2019Nur Ali SaidNo ratings yet

- Activity Description Predecessor Time (Days) Activity Description Predecessor ADocument4 pagesActivity Description Predecessor Time (Days) Activity Description Predecessor AAlvin LuisaNo ratings yet

- Danby Dac5088m User ManualDocument12 pagesDanby Dac5088m User ManualElla MariaNo ratings yet

- XgxyDocument22 pagesXgxyLïkïth RäjNo ratings yet

- Cryo EnginesDocument6 pagesCryo EnginesgdoninaNo ratings yet

- Manufacturing StrategyDocument31 pagesManufacturing Strategyrajendra1pansare0% (1)

- Oracle FND User APIsDocument4 pagesOracle FND User APIsBick KyyNo ratings yet

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Document4 pagesEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNo ratings yet

- Functions of Commercial Banks: Primary and Secondary FunctionsDocument3 pagesFunctions of Commercial Banks: Primary and Secondary FunctionsPavan Kumar SuralaNo ratings yet

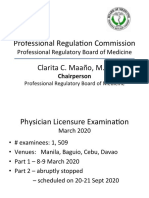

- Professional Regula/on Commission: Clarita C. Maaño, M.DDocument31 pagesProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartNo ratings yet

- Ts Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFDocument308 pagesTs Us Global Products Accesories Supplies New Docs Accessories Supplies Catalog916cma - PDFSRMPR CRMNo ratings yet

- Hager Pricelist May 2014Document64 pagesHager Pricelist May 2014rajinipre-1No ratings yet

- The Electricity Act - 2003Document84 pagesThe Electricity Act - 2003Anshul PandeyNo ratings yet

- CLAT 2014 Previous Year Question Paper Answer KeyDocument41 pagesCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuNo ratings yet

- Javascript Applications Nodejs React MongodbDocument452 pagesJavascript Applications Nodejs React MongodbFrancisco Miguel Estrada PastorNo ratings yet

- HealthInsuranceCertificate-Group CPGDHAB303500662021Document2 pagesHealthInsuranceCertificate-Group CPGDHAB303500662021Ruban JebaduraiNo ratings yet

- Process States in Operating SystemDocument4 pagesProcess States in Operating SystemKushal Roy ChowdhuryNo ratings yet

- CHAPTER 3 Social Responsibility and EthicsDocument54 pagesCHAPTER 3 Social Responsibility and EthicsSantiya Subramaniam100% (4)

- BMA Recital Hall Booking FormDocument2 pagesBMA Recital Hall Booking FormPaul Michael BakerNo ratings yet

- A Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Document73 pagesA Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Os MNo ratings yet

- State Immunity Cases With Case DigestsDocument37 pagesState Immunity Cases With Case DigestsStephanie Dawn Sibi Gok-ong100% (4)

- Doas - MotorcycleDocument2 pagesDoas - MotorcycleNaojNo ratings yet

- Cabling and Connection System PDFDocument16 pagesCabling and Connection System PDFLyndryl ProvidoNo ratings yet

- Convention On The Rights of Persons With Disabilities: United NationsDocument13 pagesConvention On The Rights of Persons With Disabilities: United NationssofiabloemNo ratings yet

- Perkins 20 Kva (404D-22G)Document2 pagesPerkins 20 Kva (404D-22G)RavaelNo ratings yet

- Cdi 2 Traffic Management and Accident InvestigationDocument22 pagesCdi 2 Traffic Management and Accident InvestigationCasanaan Romer BryleNo ratings yet