Professional Documents

Culture Documents

VSA High Probability Trades

Uploaded by

David GordonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VSA High Probability Trades

Uploaded by

David GordonCopyright:

Available Formats

HIGH-PROBABILITY TRADES

March 2009 Todd Krueger

HIGH-PROBABILITY TRADES

For me, a successful trading strategy relies on trading from support/resistance (S/R) levels using Wyckoff candle volume analysis (WCVA) patterns. I realize numerous benefits from my trading plan when trading from valid support/resistance levels. By waiting for the trade to come to me, I eliminate the essential hallmark of the losing trader: overtrading. These S/R levels also allow me to accurately identify where to place my protective stop loss and usually keep me on the right side of the order flow.

BACKGROUND

WCVA is a zero-lag methodology that is used to identify price strength/weakness when it appears on the chart. A synergistic trading strategy is created when you combine S/R levels with WCVA patterns. [See the January 2009 article Follow the Smart $$] Technical analysis provides you with a multitude of methods to find valid S/R levels. The method I illustrate here occurs when an old area of price support is broken. You know that old support, once broken, becomes new resistance. See Figure 1 and note the red line drawn from the candle that created the initial support. To the right are circled areas where price respected the support line. Once price penetrates this level, you should wait patiently for it to rise as you monitor for signs of weakness using WCVA.

Because you expect price weakness at a resistance level, your market timing will be impeccable. At the arrow on the chart, note the candle formation and the greatly reduced trading volume. In WCVA terminology, this is known as a doji, or a demand-drying-up candle. It confirms that the smart money is withdrawing as the price moves up to this resistance level. Big traders are not buying, and without their buying support, the price will fall.

GETTING IN

Enter this short trade when price breaks 1 cent below the low of the doji. The placement of the stop loss is set just a few cents above the resistance line. In this example, the low of the doji is $19.12 and resistance is at $19.39, so your entry would be at $19.11 and your stop approximately at $19.41. By combining support/resistance levels with WCVA, you can use extremely tight stops with highprobability outcomes.

GETTING OUT

Scale out of 50 percent of your position at the first expected area of chart support, which is designated by the blue dashed line in Figure 1 around $18.42. Once this is hit, you will move the stop on your

remaining positions to just above the closing price of the doji candle and keep trailing the stop as price moves down, maximizing your profit.

You might also like

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- VSA High Probability TradesDocument3 pagesVSA High Probability TradesAnonymous L4GY7kq100% (1)

- Volume Spread AnalysisDocument3 pagesVolume Spread Analysisswifty4000No ratings yet

- Summary of John Bollinger's Bollinger on Bollinger BandsFrom EverandSummary of John Bollinger's Bollinger on Bollinger BandsRating: 3 out of 5 stars3/5 (1)

- My VSA NotesDocument1 pageMy VSA NotesSyed Muhammad Shahbaz100% (1)

- VSA Official Summary Part1Document38 pagesVSA Official Summary Part1Otc Scan100% (2)

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketFrom EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNo ratings yet

- Toms SlidesDocument113 pagesToms SlidesSeptimusScott100% (3)

- Support Resistance in VSADocument11 pagesSupport Resistance in VSAHarniazizi Mansor100% (1)

- Volume Spread Analysis (Part I) : A New Way To Look at MarketsDocument7 pagesVolume Spread Analysis (Part I) : A New Way To Look at MarketsDeepak Solanki100% (1)

- Summary of James F. Dalton, Eric T. Jones & Robert B. Dalton's Mind Over MarketsFrom EverandSummary of James F. Dalton, Eric T. Jones & Robert B. Dalton's Mind Over MarketsNo ratings yet

- Develop Your Fundamental Trading SkillDocument13 pagesDevelop Your Fundamental Trading SkillBigFatPillar100% (1)

- VSA ExplorationsDocument1 pageVSA ExplorationsashlogicNo ratings yet

- Volume Spread Analysis Karthik MararDocument32 pagesVolume Spread Analysis Karthik MararOmar CendronNo ratings yet

- Beat the Street: A Trader's Guide to Consistently Scoring in the MarketsFrom EverandBeat the Street: A Trader's Guide to Consistently Scoring in the MarketsRating: 2 out of 5 stars2/5 (2)

- Whyckoff MethodDocument14 pagesWhyckoff Methodngocleasing100% (3)

- Earl The Complete Volume Spread Analysis System ExplainedDocument7 pagesEarl The Complete Volume Spread Analysis System ExplainedSardar Amrik Singh MallNo ratings yet

- VSA Distribution2Document17 pagesVSA Distribution2ehayy100% (1)

- WyckoffDocument2 pagesWyckoffHafezan Omar100% (1)

- Reversal Patterns: Part 1Document16 pagesReversal Patterns: Part 1Oxford Capital Strategies LtdNo ratings yet

- What Is Volume Spread Analysis (Vsa) ?Document4 pagesWhat Is Volume Spread Analysis (Vsa) ?JayaAdityan100% (1)

- VSA Official Summary Part 2Document46 pagesVSA Official Summary Part 2Yuan Chin Soh100% (3)

- Volume Spread Analysis ExamplesDocument55 pagesVolume Spread Analysis Examplesthinkscripter82% (11)

- Importance of Volume in Stock TradingDocument24 pagesImportance of Volume in Stock TradingMuhammad Mubasher Rafique100% (2)

- Volume Spread Analysis by Kartik MararDocument47 pagesVolume Spread Analysis by Kartik MararNam Chun Tsang100% (3)

- SLAprv TOCDocument33 pagesSLAprv TOCpjwillis100% (1)

- 34 PNF 5Document4 pages34 PNF 5ACasey101100% (1)

- The ABCs of VSA TrendsDocument19 pagesThe ABCs of VSA TrendsMorris PoonNo ratings yet

- Volume Spread AnalysisDocument4 pagesVolume Spread AnalysisMuhammad SohailNo ratings yet

- Vsa Basics From MTMDocument32 pagesVsa Basics From MTMHafeezah Ausar100% (3)

- Rediscover The Lost Art of Chart Reading Using VSADocument6 pagesRediscover The Lost Art of Chart Reading Using VSADavid Gordon100% (1)

- VSACheat SheetDocument1 pageVSACheat SheetAdrian Traveller100% (1)

- SMART Trader Color Codes: Absorption VolumeDocument1 pageSMART Trader Color Codes: Absorption VolumeAhmed AmmarNo ratings yet

- VSA PrinciplesDocument4 pagesVSA PrinciplesCryptoFX82% (11)

- Vsa Wa PapdfDocument29 pagesVsa Wa PapdfAhmad Azwar Amaladi100% (1)

- Leibovit Volume Reversal PDFDocument6 pagesLeibovit Volume Reversal PDFfad finityNo ratings yet

- Vsa PDFDocument7 pagesVsa PDFGerrard50% (2)

- The ABC's of VSA Accumulation Part IDocument18 pagesThe ABC's of VSA Accumulation Part IThích Chánh Nghiệp100% (1)

- Bar by BarDocument5 pagesBar by Barpuneeth_ss3804No ratings yet

- He Market Bar by BarDocument49 pagesHe Market Bar by BarSalomé100% (8)

- Follow The Smart Money VSADocument10 pagesFollow The Smart Money VSADavid Gordon100% (2)

- Wyckoff VolumeDocument6 pagesWyckoff VolumeMarcianopro183% (6)

- Accumulation Distribution Volume 2Document6 pagesAccumulation Distribution Volume 2analyst_anil1450% (2)

- Session1 PDFDocument104 pagesSession1 PDFpravin020282100% (1)

- Wave SetupsDocument15 pagesWave SetupsRhino382100% (9)

- Todd Krueger ArticlesDocument27 pagesTodd Krueger ArticlesCryptoFX100% (11)

- VSA Cheat SheetDocument1 pageVSA Cheat Sheetne30n250% (2)

- Price Volume Analysis & Wyckkoff MethodDocument56 pagesPrice Volume Analysis & Wyckkoff MethodKalfy Warsp100% (3)

- Wyckoff Price and Market StructuresDocument2 pagesWyckoff Price and Market StructuresSeo Soon Yi100% (10)

- VSA Short Note BY Ali ChowdhuryDocument6 pagesVSA Short Note BY Ali ChowdhuryUpasara Wulung100% (3)

- Wyckoff Part 01Document8 pagesWyckoff Part 01Eyad QarqashNo ratings yet

- Evans Echoes PDFDocument4 pagesEvans Echoes PDFJay Sagar50% (2)

- Volume Price AnalysisDocument18 pagesVolume Price AnalysisSha BondNo ratings yet

- SonicR Secrets Ir Forex FilosophyDocument17 pagesSonicR Secrets Ir Forex FilosophyDavid GordonNo ratings yet

- The RSI Scalping StrategyDocument30 pagesThe RSI Scalping StrategyDavid Gordon83% (23)

- Gavin Holmes - Trading in The Shadow of Smart Money Vol 2 2011Document182 pagesGavin Holmes - Trading in The Shadow of Smart Money Vol 2 2011David Gordon89% (9)

- Rediscover The Lost Art of Chart Reading Using VSADocument6 pagesRediscover The Lost Art of Chart Reading Using VSADavid Gordon100% (1)

- Follow The Smart Money VSADocument10 pagesFollow The Smart Money VSADavid Gordon100% (2)

- Frozen in Analysis ParalysisDocument8 pagesFrozen in Analysis ParalysisAhmad Azwar AmaladiNo ratings yet

- Donner Company 2Document6 pagesDonner Company 2Nuno Saraiva0% (1)

- Direct Mail Success SecretsDocument0 pagesDirect Mail Success SecretsunpinkpantherNo ratings yet

- StartUp India - Case AnalysisDocument3 pagesStartUp India - Case AnalysisIrshad AzeezNo ratings yet

- Corporate FinanceDocument11 pagesCorporate Financemishu082002100% (2)

- Avro RJ General Data Brochure PDFDocument66 pagesAvro RJ General Data Brochure PDFMonica Enin100% (2)

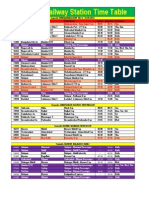

- Solapur Railway Station Time TableDocument2 pagesSolapur Railway Station Time TableAndrea Lopez33% (3)

- English Listening MaterialsDocument3 pagesEnglish Listening MaterialsVita NovitasariNo ratings yet

- Closure in Valuation: Estimating Terminal Value: Problem 1Document3 pagesClosure in Valuation: Estimating Terminal Value: Problem 1Silviu TrebuianNo ratings yet

- Brand Licensing PDFDocument3 pagesBrand Licensing PDFalberto micheliniNo ratings yet

- MudraDocument19 pagesMudraManoj MawaleNo ratings yet

- EnglishtoMath##1Document8 pagesEnglishtoMath##1zubairNo ratings yet

- A. The Importance of Capital BudgetingDocument16 pagesA. The Importance of Capital BudgetingManish ChaturvediNo ratings yet

- Antwoordblad Instaptoets EngelsDocument4 pagesAntwoordblad Instaptoets EngelskadpoortNo ratings yet

- Best Practices in Hotel Financial ManagementDocument3 pagesBest Practices in Hotel Financial ManagementDhruv BansalNo ratings yet

- Tourism PolicyDocument6 pagesTourism Policylanoox0% (1)

- Respond To Business OpportunitiesDocument21 pagesRespond To Business OpportunitiesRissabelle CoscaNo ratings yet

- Capital StructureDocument44 pagesCapital Structure26155152No ratings yet

- Tennis Ball Activity - Diminishing Returns - Notes - 3Document1 pageTennis Ball Activity - Diminishing Returns - Notes - 3Raghvi AryaNo ratings yet

- Cash Flows From Operating ActivitiesDocument5 pagesCash Flows From Operating ActivitiesIrfan MansoorNo ratings yet

- ElectiveDocument5 pagesElectiveMarkNo ratings yet

- Gat PreparationDocument21 pagesGat PreparationHAFIZ IMRAN AKHTERNo ratings yet

- Sap MM Standard Business ProcessesDocument65 pagesSap MM Standard Business ProcessesDipak BanerjeeNo ratings yet

- Market Share AnalysisDocument3 pagesMarket Share AnalysisLawal Musibaudeem ObafemiNo ratings yet

- Business Level StrategyDocument28 pagesBusiness Level StrategyMohammad Raihanul HasanNo ratings yet

- IOW Casting Company NPV Excel SolutionDocument15 pagesIOW Casting Company NPV Excel Solutionalka murarka100% (1)

- PricelistDocument3 pagesPricelist4 fruit companyNo ratings yet

- Fundraising Blueprint Plan TemplateDocument3 pagesFundraising Blueprint Plan Templateoxade21No ratings yet

- Diebold Case StudyDocument2 pagesDiebold Case StudySagnik Debnath67% (3)

- 5-Minute Chocolate Balls PDFDocument10 pages5-Minute Chocolate Balls PDFDiana ArunNo ratings yet

- Spisak Parfema NEWDocument1 pageSpisak Parfema NEWDouglas CoxNo ratings yet