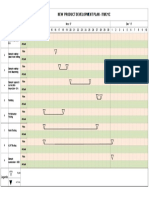

New Product Development Process

Process Stage

1. Internal Review

Inputs

Internal interview and review focusing on: corporate objectives

Outputs

Clear direction on research scope and expected outcomes

2. Market Screening

project objectives development rationale target markets market definition market segmentation SWOT pricing distribution unexploited technology sales Contribution to definition of likely future state

Desk and on site research in leading countries/markets covering: review of key trends and developments competitive environment

3. Product Screening

legislative and regulatory technology developments critical success factors Identify unique features and benefits relevant to NPD objectives

In-depth examination of market leading products, using desk research, on site and associates covering: product literature

�

4. Gap/Opportunity Analysis

product features targeting product linkage product positioning sales mechanisms sales channels promotional Definition of future opportunity and success factors for product development

Collate, review and distil information into a working summary document. Key headings to include: market projection(s)

current product strengths, weaknesses, opportunities and threats gap identification high value/unique features for incorporation prioritisation for future product development

5. Product Concept Generation

Using the working summary documents, develop outline product specifications against key criteria: market area utilities

Outline branded product propositions constructed in levels: Core: generic need that must be met/basic benefits Expected: minimal expectations beyond basic Augmented: offering over and above what customer is accustomed to and has in expectation terms

customer needs/values strategic fit with brand/progression achieving sustainable competitive advantage ability to deliver projected long-term market evolution

6.

Product Concept

Group/Depth Research to Test

Recommended product propositions

�Validation

and key success features for:

current product holding

perceived needs hierarchy purchase triggers evaluation criteria knowledge of area

Innovators Early Adopters Majority Laggards

attitude to providers current provider their brand/values relevance

response to product concepts evaluation of features/benefits likes/dislikes versus current products available strengths and weaknesses expectation of price/value

response to communication mechanism expectation of how/where to purchase level of advice/info/service expected Final product concepts ready for quantitative research

7. Product Interrogation

Taking the product specifications developed from the research findings, convene and facilitate a panel of experts to thoroughly probe for market saliency. Using authoritative sources (industry experts, journalists , players) in one or two interrogation sessions to: evaluate and refine the product concepts and targeting

�

/Competitor Benchmarking

develop revised/refined concepts for quantitative research

Benchmark against the major competitors products: mapping against competition

8. Full Segmentation Research

feature-by-feature comparison strengths, weaknesses potential USP/Positioning accept/reject option Quantification of target segments, including ranking of segments and definition of product and delivery specification

Covering the following areas: product options

9. Impact Assessment

delivery options target market characteristics target market needs

Detailed impact assessment for the new products and their delivery to the different segments. Outline: resource requirements

Resource and profitability impact assessment, including critical success factors

10. Business Case Development

investment requirements delivery requirements time-frames Approval of new product for development and launch

Business case for new product go: detailed product description

brand positioning communication programme detailed costings sales revenues projections capital costs