Professional Documents

Culture Documents

Calculate Loan Payments and Maximum Affordable Loan Amounts Using Excel's PMT and Goal Seek Functions

Uploaded by

Emdadul Haq RahulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculate Loan Payments and Maximum Affordable Loan Amounts Using Excel's PMT and Goal Seek Functions

Uploaded by

Emdadul Haq RahulCopyright:

Available Formats

Exercise-5 Using PMT (Payment function) PMT (payment) function is used to calculate Loan payment: Syntax:

=PMT(rate,nper,pv,fv,type)

Where,

Rate is the interest rate for the loan. Nper is the total number of payments for the loan (number of months) Pv is the present value; also known as the principal. Fv is the future value, or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (zero); that is, the future value of a loan is 0. Type is the number 0 (zero) or 1 and indicates when payments are due. 0 = at the end of the period (at the end of month/year) 1 = at the beginning of the period (at the beginning of the month/year)

**** note that rate and nper , both needs to be in monthly unit. Eg, if the rate=8% per annum and nper=30 months, then rate needs to converted to monthly interest rate by dividing by 12.

Example: 1. a) You want to buy a BMW worth $80000. Interest rate is 9% p.a. If you choose a loan payment period of 45 months calculate monthly installments.

b) If you choose to repay the loan at the beginning of each month calculate monthly installment. Solution: see Excel file Exercise-5 Solution.xls.

Molla E Majid, School of Business, NSU

Now solve the following problems in the same file: 2. You want to buy a flat worth TK1,20,00000. If the bank interest rate is 12% p.a. calculate monthly installment in order to pay off the loan in 25 years. 3. a) Calculate monthly repayment of a loan of TK 10,00000 taken over a period of 52 months at 11.5% annual interest rate. b) Recalculate the loan amount if you choose to repay the loan at the beginning of each month

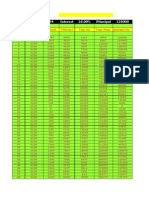

Goal Seek Goal seek solves formulas backward. Use Goal seek when you know the result you want but need to determine how much to change a single input to get that result. Problem 4 You want to take out a loan to buy a car. The interest rate for the Bank loan is 7% annually. Maximum payment you can afford is $300/month. The loan requires 20% down payment. What is the most expensive car you can afford if the repayment period is 2 years? Solution: To use goal seek enter the above data into an excel sheet as shown below. Cell B4 will return a zero value.

Molla E Majid, School of Business, NSU

Now, Select cell B4 (that contains the formula) and choose Data>What if analysis>goal seek The following Goal Seek window will appear Enter B4 in the Set Cell box. (because this cell contains the repayment formula) Enter To Value to -300 (this is the repayment amount and so a negative value) Enter B3 in By changing cell box as shown in the following figure. (as this cell will show you the result)

Click Ok. The following result will come up:

Molla E Majid, School of Business, NSU

The amount shown 6700.53 is just the loan amount that you can afford which is just 80% of the Price; the rest 20% needs to be paid as down payment). In order to calculate the Car price you need to use the following mathematical formula: Price of the Car = Loan / 80% = 6700.53/0.8 = 8375.66 Perform the above calculation in the same sheet as shown below

Molla E Majid, School of Business, NSU

Problem 5: You want to purchase a Sony Bravia LCD TV. The condition is you have to make a 30% down payment. The maximum amount you can afford as monthly installment is Tk 6000. Annual interest rate is 8.5% pa. What would be the price of the TV if you want to pay off the balance in 2 years?

Molla E Majid, School of Business, NSU

You might also like

- Bridgewater Associates Presentation (Updated)Document17 pagesBridgewater Associates Presentation (Updated)GHaj100% (3)

- FINA 2330 Assignment 5Document4 pagesFINA 2330 Assignment 5rebaNo ratings yet

- 8 - Interests CommissionsDocument46 pages8 - Interests Commissionsapi-267023512No ratings yet

- CFA Performance Evaluation Amp AttributionDocument38 pagesCFA Performance Evaluation Amp AttributionverashelleyNo ratings yet

- Activity 3 36 PointsDocument3 pagesActivity 3 36 PointsFatima AnsariNo ratings yet

- math108x_doc_CHECKPOINTloanDocument2 pagesmath108x_doc_CHECKPOINTloanHermann KpadonouNo ratings yet

- SolutionsDocument30 pagesSolutionsNitesh AgrawalNo ratings yet

- Example: PMT (Rate, Nper, PV, FV, Type)Document2 pagesExample: PMT (Rate, Nper, PV, FV, Type)chkhurramNo ratings yet

- Project 2Document5 pagesProject 2api-246579738No ratings yet

- Week 6Document7 pagesWeek 6Phil OdendronNo ratings yet

- Using Solver For Financial PlanningDocument4 pagesUsing Solver For Financial PlanningAmna JupićNo ratings yet

- Present - Future ValueDocument15 pagesPresent - Future ValueMadeleine EricaNo ratings yet

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedThùy LêNo ratings yet

- Excel PMT Function ExplainedDocument4 pagesExcel PMT Function ExplainedSuryaNo ratings yet

- Instructions For Using Excel PowerDocument3 pagesInstructions For Using Excel PowerAbhijit NairNo ratings yet

- M1050mortgagelab 1Document5 pagesM1050mortgagelab 1api-302779278No ratings yet

- Car LoanDocument8 pagesCar Loanapi-449855520No ratings yet

- Final MortgageDocument5 pagesFinal Mortgageapi-301270815No ratings yet

- SpringDocument12 pagesSpringEmma Zhang0% (2)

- UGBA 183 Berkeley Midterm Spring 2018Document7 pagesUGBA 183 Berkeley Midterm Spring 2018summerhousing2019100% (1)

- Session 18-Financial FunctionsDocument4 pagesSession 18-Financial Functionsking coNo ratings yet

- Financial Functions in Excel: by Varma PradeepDocument38 pagesFinancial Functions in Excel: by Varma PradeepZEEL SATVARANo ratings yet

- Fin630 GBD 2024 by Pin and MuhammadDocument4 pagesFin630 GBD 2024 by Pin and MuhammadMohammadihsan NoorNo ratings yet

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedSiêng Năng NèNo ratings yet

- Mortgage CalculatorDocument4 pagesMortgage Calculatorapi-246390576No ratings yet

- Logarithms and Car PaymentsDocument8 pagesLogarithms and Car Paymentsapi-264152935No ratings yet

- TVM Exercises Time Value of MoneyDocument4 pagesTVM Exercises Time Value of MoneyIvan CarreñoNo ratings yet

- Question and Answer - 47Document31 pagesQuestion and Answer - 47acc-expert0% (1)

- MBAA AbdullahDocument4 pagesMBAA AbdullahHelplineNo ratings yet

- Minimum Monthly Investment for Dream CarDocument4 pagesMinimum Monthly Investment for Dream CarTruong CaiNo ratings yet

- Microsoft Excel As A Financial Calculator Part IIDocument8 pagesMicrosoft Excel As A Financial Calculator Part IIbenjah2No ratings yet

- Simplify Financial Life - Calculate Your Home Loan Installments Using MS Excel - The Economic TimesDocument3 pagesSimplify Financial Life - Calculate Your Home Loan Installments Using MS Excel - The Economic TimeskarunagaranNo ratings yet

- Fixed Rate Mortgage Homework ProblemsDocument2 pagesFixed Rate Mortgage Homework ProblemscjNo ratings yet

- Business Mathematics: For LearnersDocument12 pagesBusiness Mathematics: For LearnersJet Rollorata BacangNo ratings yet

- Math 1050 Mortgage Project: Show Work HereDocument5 pagesMath 1050 Mortgage Project: Show Work Hereapi-302479969No ratings yet

- Solution Manual For Financial Analysis With Microsoft Excel 6th EditionDocument27 pagesSolution Manual For Financial Analysis With Microsoft Excel 6th EditionTiffanyFowlercftzi100% (41)

- Mortgage LabDocument11 pagesMortgage Labapi-437742945No ratings yet

- Amortization: ObjectivesDocument10 pagesAmortization: ObjectivesLara Lewis AchillesNo ratings yet

- UC3M - Grado Contabilidad y Finanzas - Matemáticas FinancierasDocument3 pagesUC3M - Grado Contabilidad y Finanzas - Matemáticas FinancierasMaria Elena SalgadoNo ratings yet

- Ifaa 2Document2 pagesIfaa 2GUDATA ABARANo ratings yet

- DS Chapter 7 [p203-213] Mortgage ModificationDocument11 pagesDS Chapter 7 [p203-213] Mortgage ModificationsandeepdevathiNo ratings yet

- Finacial Formulas: Case StudyDocument3 pagesFinacial Formulas: Case StudyNicu ScutaruNo ratings yet

- 13.1 MSE - Chapter 6 - Financial Formulas - Case Study PDFDocument3 pages13.1 MSE - Chapter 6 - Financial Formulas - Case Study PDFIacob ClaudiuNo ratings yet

- EMI CalculatorDocument6 pagesEMI CalculatorPhanindra Sarma100% (1)

- Use Goal Seek To Find The Result You Want by Adjusting An Input Value - ExcelDocument3 pagesUse Goal Seek To Find The Result You Want by Adjusting An Input Value - ExcelAmandeep PuniaNo ratings yet

- Banking, Inflation and Exchange Rates Notes and QuestionsDocument22 pagesBanking, Inflation and Exchange Rates Notes and QuestionsKelvinNo ratings yet

- 14th Week 2ndDocument49 pages14th Week 2nd조선관 Tony ChoNo ratings yet

- Math1050 - MortgagelabDocument5 pagesMath1050 - Mortgagelabapi-424955946No ratings yet

- Final ExamDocument7 pagesFinal ExamOnat PNo ratings yet

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDocument7 pagesFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manuallaylasaintbq83pu100% (27)

- FINM7401 Assignment Sem1 2020Document5 pagesFINM7401 Assignment Sem1 2020Abs PangaderNo ratings yet

- BUSINESS MATHEMATICS 2ND QUARTER 2nd WEEK LESSON Lesson Commission On Cash Basis, Installment Basis, Downpayment, Gross Balance, Current BalanceDocument12 pagesBUSINESS MATHEMATICS 2ND QUARTER 2nd WEEK LESSON Lesson Commission On Cash Basis, Installment Basis, Downpayment, Gross Balance, Current BalanceDearla Bitoon100% (1)

- FI 580 Final Exam XCLDocument28 pagesFI 580 Final Exam XCLjoannapsmith33No ratings yet

- Concept Check Quiz: First SessionDocument27 pagesConcept Check Quiz: First SessionMichael MillerNo ratings yet

- INDE PreviousDocument4 pagesINDE PreviousOrangeNo ratings yet

- Excel PMT FunctionDocument12 pagesExcel PMT FunctionsaketNo ratings yet

- Problem Sets 15 - 401 08Document72 pagesProblem Sets 15 - 401 08Muhammad GhazzianNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Solution: Net IncomeDocument4 pagesSolution: Net IncomeEmdadul Haq RahulNo ratings yet

- Ip TelephonyDocument24 pagesIp TelephonyMamatha RkNo ratings yet

- British American Tobacco BangladeshDocument4 pagesBritish American Tobacco BangladeshEmdadul Haq RahulNo ratings yet

- Affect of SmokingDocument3 pagesAffect of SmokingEmdadul Haq RahulNo ratings yet

- IP Internet TelephonyDocument36 pagesIP Internet TelephonyEmdadul Haq RahulNo ratings yet

- Ip Internet TelephonyDocument32 pagesIp Internet TelephonyRajashri BangeraNo ratings yet

- Exercise-1 PROPERTY FileDocument1 pageExercise-1 PROPERTY FileEmdadul Haq RahulNo ratings yet

- Executive Summary EMDAD 2003 FORMATDocument74 pagesExecutive Summary EMDAD 2003 FORMATEmdadul Haq RahulNo ratings yet

- Test Pass First Choice First Choice Result Second Choice Second Choice ResultDocument33 pagesTest Pass First Choice First Choice Result Second Choice Second Choice ResultEmdadul Haq RahulNo ratings yet

- Exercise 6Document3 pagesExercise 6Emdadul Haq RahulNo ratings yet

- Ip Internet TelephonyDocument32 pagesIp Internet TelephonyRajashri BangeraNo ratings yet

- Ip Internet TelephonyDocument32 pagesIp Internet TelephonyRajashri BangeraNo ratings yet

- Affect of SmokingDocument3 pagesAffect of SmokingEmdadul Haq RahulNo ratings yet

- British American Tobacco BangladeshDocument4 pagesBritish American Tobacco BangladeshEmdadul Haq RahulNo ratings yet

- Questionnaire MainDocument3 pagesQuestionnaire Maingautham100% (1)

- Forex Trading JournalDocument36 pagesForex Trading JournalAmit VermaNo ratings yet

- Understanding The T-Bond Tables in The WSJDocument2 pagesUnderstanding The T-Bond Tables in The WSJkwstisx2450No ratings yet

- Loan CalculatorDocument47 pagesLoan CalculatorgoodthoughtsNo ratings yet

- Fresh MarketDocument17 pagesFresh MarketJafeth AgueroNo ratings yet

- Unit 2Document52 pagesUnit 2RajasekaranArunaNo ratings yet

- Macro Economics AssignmentDocument2 pagesMacro Economics AssignmentAmit SonkawadeNo ratings yet

- Recueil D'exercices Corrigés de MicroéconomieDocument73 pagesRecueil D'exercices Corrigés de MicroéconomieHa YouNo ratings yet

- Job Order Costing Seatwork - 2Document2 pagesJob Order Costing Seatwork - 2Akira Marantal ValdezNo ratings yet

- Aggregate FunctionsDocument7 pagesAggregate Functionspauljose007No ratings yet

- Comparison Between Managerial Economics and Traditional EconomicsDocument2 pagesComparison Between Managerial Economics and Traditional EconomicsAamir KhanNo ratings yet

- EVM Gold CardDocument1 pageEVM Gold Cardwalmart007No ratings yet

- MEISTER - Smile Modeling in The LIBOR Market ModelDocument166 pagesMEISTER - Smile Modeling in The LIBOR Market ModelLameuneNo ratings yet

- Engle 1982Document22 pagesEngle 1982dougmatos100% (1)

- Jam MarketDocument22 pagesJam MarketDina Ismail KamalNo ratings yet

- Basic Cost Planning & Cost EstimateDocument22 pagesBasic Cost Planning & Cost EstimateDilip Kumar100% (1)

- MWG FlashcardsDocument47 pagesMWG FlashcardsSky ShepheredNo ratings yet

- Advanced MacroeconomicsDocument3 pagesAdvanced MacroeconomicsKai Qi LeeNo ratings yet

- Chapter 6Document30 pagesChapter 6calebrmanNo ratings yet

- Rice ECO501 LecturesDocument172 pagesRice ECO501 LecturesIu ManNo ratings yet

- Evaluating PCDocument12 pagesEvaluating PCNigel YeoNo ratings yet

- EOQ and Inflation UncertaintyDocument8 pagesEOQ and Inflation UncertaintyLivia MarsaNo ratings yet

- α t α t α α t α t α t β t αβ α t α=1,... ,N tDocument18 pagesα t α t α α t α t α t β t αβ α t α=1,... ,N tMichael ChiuNo ratings yet

- Outside Lands Economic Impact Report - Executive SummaryDocument3 pagesOutside Lands Economic Impact Report - Executive SummaryOcean Beach BulletinNo ratings yet

- Chap 10Document43 pagesChap 10Ryan SukrawanNo ratings yet

- 3 Aggregate Demand and SupplyDocument34 pages3 Aggregate Demand and SupplySaiPraneethNo ratings yet

- Assignment 1Document2 pagesAssignment 1rianbe33% (3)

- Kalman Filter and Economic ApplicationsDocument15 pagesKalman Filter and Economic ApplicationsrogeliochcNo ratings yet

![DS Chapter 7 [p203-213] Mortgage Modification](https://imgv2-2-f.scribdassets.com/img/document/722938219/149x198/6e25b2fd88/1713111601?v=1)