Professional Documents

Culture Documents

5 Ways To Fund Your Child S College Education

Uploaded by

Chelaru PavelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 Ways To Fund Your Child S College Education

Uploaded by

Chelaru PavelCopyright:

Available Formats

Title: 5 Ways to Fund Your Child's College Education Word Count: 702 Summary: A degree level education is probably

the most expensive single cost in bringing up children today. Unless parents take action early the chances of their childre n graduating without substantial debt are minimal - that's if they can afford to go to college at all. Keywords: education savings plans, education savings, college education Article Body: Did you know that the cost of a 4 year degree program is around $20,000 dollars per year. The cost of a college education is probably the most expensive item in bringing up children today. When you take into account tuition fees, exam fees, living ex penses, accommodation, books and computers it's not surprising that the average cost of college education is over $20,000 per year and that's before the social side of college life. Today we live in a world where only the best educated and most prepared can succ eed. The Job market is probably the most crucial and competitive element of our society and having a college education and degree goes a long way towards succee ding in it. When our children are ready to enter the world of work it will be even more diff icult and a college education will be essential to succeed. Here are 5 ways to f und your child's college education. 1. The usual method of parental funding of college education is out of current i ncome, that is out of your weekly or monthly salary. Whilst this is the most common method of funding college education it is one tha t only the very rich or highly paid can afford to do with ease. Even if there ar e 2 salaries most families find it difficult and will require sacrifices, even m ore so if you have more than 1 child. At best most parents can only afford to co ntribute part of the costs of college education out of current income. Additiona l sources of income will be required. 2. Your child can work his or her way through college. Many students have to work whilst studying but many find the experience of juggl ing a job, lectures and a social life very difficult. Often the result is that s tudents drop out of college education, fail their exams or don't do as well as t hey could. 3. Your child may have the opportunity to take out student loans to fund their c ollege education. Today the vast majority of students are forced to take out student loans to fund all or part of their college education. Usually to subsidize parental contribut ions, student loans are the most common way of students funding their own colleg e education. Many students however, leave college with substantial debt and even

with interest rates at historically low levels today's students can expect to h ave to pay substantial monthly repayments for many years. 4. Your child may obtain a scholarship or be entitled to grants from either fede ral or local funds towards the cost of their college education. There are many sources of student scholarships or grants and with a bit of resea rch most students today can find some grant funding. These sources however canno t be guaranteed for the future. Whilst scholarships and grants do not have to be repaid and as such are preferable to loans they are not guaranteed or predictab le and therefore relying on them for our children is a risk. 5. Take out an education savings plan to fund college education. An education savings plan is a regular saving plan into which you and your child ren can contribute. The plans are administered by colleges or state authorities and can be taken out for any child including a newborn babies. Because of the ef fects of long term compound interest the earlier you take out your plan the easi er it will be and the lower your contributions will be. Because the funds are bu ilt up prior to going to college students do not have to rely on scholarships, g rants or loans and they can concentrate on their studies. There are a number of options to fund your child's college education but the onl y way funds can be guaranteed is by you taking out an education savings plan. Wi th the education savings plan you decide what you can invest and your child can also contribute to his or her college education. With luck scholarships and gran ts will still be available as will loans to top up if necessary. If your child d oes not go to college the fund can be cashed in. Taking out an education savings plan early will give your child the real opportu nity of a college education and the best prospects for a job when they leave col lege.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Social ResponsibilityDocument2 pagesCorporate Social ResponsibilityChelaru PavelNo ratings yet

- Concentrating Sunlight For EnergyDocument1 pageConcentrating Sunlight For EnergyChelaru PavelNo ratings yet

- Birds - The Peregrine FalconDocument1 pageBirds - The Peregrine FalconChelaru PavelNo ratings yet

- Asia Africa and Climate ModificationDocument2 pagesAsia Africa and Climate ModificationChelaru PavelNo ratings yet

- Climate Change What Is ItDocument1 pageClimate Change What Is ItChelaru PavelNo ratings yet

- Are We Humans Really The Masters of This PlanetDocument1 pageAre We Humans Really The Masters of This PlanetChelaru PavelNo ratings yet

- Chemicals That Mimic Hormones Explain Birth Defects and 8 Year-Olds Reaching PubertyDocument5 pagesChemicals That Mimic Hormones Explain Birth Defects and 8 Year-Olds Reaching PubertyChelaru PavelNo ratings yet

- Common Turtle SpeciesDocument3 pagesCommon Turtle SpeciesChelaru PavelNo ratings yet

- Climate Modification and VolcanoesDocument2 pagesClimate Modification and VolcanoesChelaru PavelNo ratings yet

- Bird-Watchers Flock To Florida BeachesDocument1 pageBird-Watchers Flock To Florida BeachesChelaru PavelNo ratings yet

- Bio PyramidDocument2 pagesBio PyramidChelaru PavelNo ratings yet

- Biomass Heating Your Home With CornDocument1 pageBiomass Heating Your Home With CornChelaru PavelNo ratings yet

- An Overview of Wind As An Energy SourceDocument2 pagesAn Overview of Wind As An Energy SourceChelaru PavelNo ratings yet

- Antarctica Is It Really in DangerDocument2 pagesAntarctica Is It Really in DangerChelaru PavelNo ratings yet

- A Really Intimate Look at Wind Turbines and Deciding What You Might Opt ForDocument2 pagesA Really Intimate Look at Wind Turbines and Deciding What You Might Opt ForChelaru PavelNo ratings yet

- Air Purifiers A Breath of Fresh AirDocument1 pageAir Purifiers A Breath of Fresh AirChelaru PavelNo ratings yet

- A Practical Solution To U.S. Energy Needs May ExistDocument1 pageA Practical Solution To U.S. Energy Needs May ExistChelaru PavelNo ratings yet

- Americans Get Serious About RecyclingDocument2 pagesAmericans Get Serious About RecyclingChelaru PavelNo ratings yet

- A Great LonelinessDocument3 pagesA Great LonelinessChelaru PavelNo ratings yet

- 13 SEER Earth Day Working Together To Improve The EnvironmentDocument1 page13 SEER Earth Day Working Together To Improve The EnvironmentChelaru PavelNo ratings yet

- Getting Your Bachelor S DegreeDocument1 pageGetting Your Bachelor S DegreeChelaru PavelNo ratings yet

- 5 Great Reasons To Harness Solar PowerDocument3 pages5 Great Reasons To Harness Solar PowerChelaru PavelNo ratings yet

- Fear of Publishing and What To Do About ItDocument2 pagesFear of Publishing and What To Do About ItChelaru PavelNo ratings yet

- Don T Touch It and Other Simple Nature-Friendly AdviceDocument2 pagesDon T Touch It and Other Simple Nature-Friendly AdviceChelaru PavelNo ratings yet

- Get It Out of Your Head and Into A Mind MapDocument2 pagesGet It Out of Your Head and Into A Mind MapChelaru PavelNo ratings yet

- Education PlansDocument2 pagesEducation PlansChelaru PavelNo ratings yet

- What You Must Know To Enter The University of Phoenix S School of Criminal JusticeDocument2 pagesWhat You Must Know To Enter The University of Phoenix S School of Criminal JusticeChelaru PavelNo ratings yet

- Federal Perkins LoanDocument1 pageFederal Perkins LoanChelaru PavelNo ratings yet

- Engineering and Its ImportanceDocument2 pagesEngineering and Its ImportanceChelaru PavelNo ratings yet

- Enrich Your Life With A MBA DegreeDocument2 pagesEnrich Your Life With A MBA DegreeChelaru PavelNo ratings yet

- Junayed - 19 39800 1Document11 pagesJunayed - 19 39800 1gurujeeNo ratings yet

- Laboratorio 1Document6 pagesLaboratorio 1Marlon DiazNo ratings yet

- Nutrition During PregnancyDocument8 pagesNutrition During PregnancyHalliahNo ratings yet

- Live Performance Award Ma000081 Pay GuideDocument48 pagesLive Performance Award Ma000081 Pay GuideDan LijndersNo ratings yet

- Elem. Reading PracticeDocument10 pagesElem. Reading PracticeElissa Janquil RussellNo ratings yet

- Bentel J408Document64 pagesBentel J408Bojan MarkovicNo ratings yet

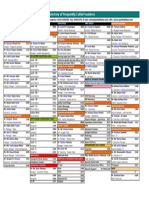

- Directory of Frequently Called Numbers: Maj. Sheikh RahmanDocument1 pageDirectory of Frequently Called Numbers: Maj. Sheikh RahmanEdward Ebb BonnoNo ratings yet

- Placenta Previa Case StudyDocument59 pagesPlacenta Previa Case StudySiergs Smith GervacioNo ratings yet

- Diagnostic and Statistical Manual of Mental Disorders: Distinction From ICD Pre-DSM-1 (1840-1949)Document25 pagesDiagnostic and Statistical Manual of Mental Disorders: Distinction From ICD Pre-DSM-1 (1840-1949)Unggul YudhaNo ratings yet

- Alternate Mekton Zeta Weapon CreationDocument7 pagesAlternate Mekton Zeta Weapon CreationJavi BuenoNo ratings yet

- Đề cương ôn tập tiếng anh 9Document28 pagesĐề cương ôn tập tiếng anh 9Nguyễn HoaNo ratings yet

- General Specifications: Detail ADocument1 pageGeneral Specifications: Detail AJeniel PascualNo ratings yet

- Practice of Epidemiology Performance of Floating Absolute RisksDocument4 pagesPractice of Epidemiology Performance of Floating Absolute RisksShreyaswi M KarthikNo ratings yet

- 559 Fault CodeDocument4 pages559 Fault Codeabdelbagi ibrahim100% (1)

- G10 Bio CellsDocument6 pagesG10 Bio CellsswacaneNo ratings yet

- Schneider Electric PowerPact H-, J-, and L-Frame Circuit Breakers PDFDocument3 pagesSchneider Electric PowerPact H-, J-, and L-Frame Circuit Breakers PDFAnonymous dH3DIEtzNo ratings yet

- Arp0108 2018Document75 pagesArp0108 2018justin.kochNo ratings yet

- Fluid Mechanics Sessional: Dhaka University of Engineering & Technology, GazipurDocument17 pagesFluid Mechanics Sessional: Dhaka University of Engineering & Technology, GazipurMd saydul islamNo ratings yet

- Heat Exchanger Sodium SilicateDocument2 pagesHeat Exchanger Sodium SilicateChristopher BrownNo ratings yet

- Study On Marketing Strategies of Fast Food Joints in IndiaDocument35 pagesStudy On Marketing Strategies of Fast Food Joints in IndiaNiveditaParaashar100% (1)

- Akshaya Trust NgoDocument24 pagesAkshaya Trust NgodushyantNo ratings yet

- WSO 2022 IB Working Conditions SurveyDocument42 pagesWSO 2022 IB Working Conditions SurveyPhạm Hồng HuếNo ratings yet

- Benefits and Limitations of Vojta ApproachDocument50 pagesBenefits and Limitations of Vojta ApproachAlice Teodorescu100% (3)

- Tugas B InggrisDocument9 pagesTugas B InggrisDellyna AlmaNo ratings yet

- Quality Control Plan Static EquipmentDocument1 pageQuality Control Plan Static EquipmentdhasdjNo ratings yet

- AZ ATTR Concept Test Clean SCREENERDocument9 pagesAZ ATTR Concept Test Clean SCREENEREdwin BennyNo ratings yet

- 50-Orthodontic Objectives in Orthognathic Surgery-State of The PDFDocument15 pages50-Orthodontic Objectives in Orthognathic Surgery-State of The PDFDeena A. AlshwairikhNo ratings yet

- Aplikasi Berbagai Jenis Media Dan ZPT Terhadap Aklimatisasi Anggrek VandaDocument15 pagesAplikasi Berbagai Jenis Media Dan ZPT Terhadap Aklimatisasi Anggrek VandaSihonoNo ratings yet

- Mabuhay Wedding Package2006Document3 pagesMabuhay Wedding Package2006Darwin Dionisio ClementeNo ratings yet