Professional Documents

Culture Documents

cs29 2013

Uploaded by

stephin k jOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

cs29 2013

Uploaded by

stephin k jCopyright:

Available Formats

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)] GOVERNMENT OF INDIA MINISTRY OF FINANCE

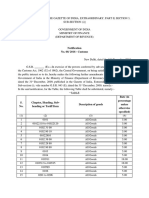

(DEPARTMENT OF REVENUE) Notification No. 29 / 2013-Customs New Delhi, the 16th May, 2013 G.S.R. 316 (E).- In exercise of the powers conferred by sub-section (1) of section 25 of the Customs Act, 1962 (52 of 1962), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby makes the following amendments in each of the notifications of the Government of India in the Ministry of Finance (Department of Revenue) specified in column (2) of the Table below, in the manner specified in the corresponding entry in column (3) of the said Table, namely :Table Sl. No. (1) 1. Notification number and date (2) 92/2009-Customs,dated the 11th September, 2009 [Vide number G.S.R. 658 (E), dated the 11th September, 2009] 93/2009-Customs,dated the 11th September, 2009 [Vide number G.S.R. 659 (E), dated the 11th September, 2009] 95/2009-Customs,dated the 11th September, 2009 [Vide number G.S.R. 661(E), dated the 11th September, 2009] Amendments (3) In the said notification, in the opening paragraph, in condition (ii), for the words, figures and letters notification No. 29 of 2012 Central Excise, dated the 9th July, 2012,, the words, figures and letters notification Nos. 29 of 2012 - Central Excise, dated the 9th July, 2012 and 7 of 2013 -Service Tax, dated the 18th April, 2013, shall be substituted. In the said notification, in the opening paragraph, in condition (ii), for the words, figures and letters notification No. 30 of 2012 Central Excise, dated the 9th July, 2012,, the words, figures and letters notification Nos. 30 of 2012 - Central Excise, dated the 9th July, 2012 and 6 of 2013-Service Tax, dated the 18th April, 2013, shall be substituted; In the said notification, in the opening paragraph, in condition (i), for the words, figures and letters notification No. 32 of 2012 Central Excise, dated the 9th July, 2012,, the words, figures and letters notification Nos. 32 of 2012 - Central Excise, dated the 9th July, 2012 and 8 of 2013-Service Tax, dated the 18th April, 2013, shall be substituted. In the said notification, in the opening paragraph, for condition (2), the following condition shall be substituted, namely:-

2.

3.

4.

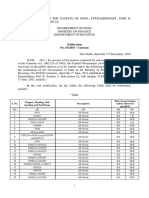

104/2009-Customs,dated the 14th September, 2009 [Vide number G.S.R. 674 (E), dated the (2) that the said scrip has not been issued in violation of the 14th September, 2009] condition contained in the sub-paragraph (5) of paragraph 2 of notification No.101 of 2009 Customs, dated the 11th September, 2009 or sub-paragraph (4) of paragraph 2 of

notification No.102 of 2009 Customs, dated the 11th September, 2009 or the second proviso to sub-paragraph (1) of paragraph 2 of notification No. 05 of 2013 Customs, dated the 18th February, 2013 or sub-paragraph (3) of paragraph 2 of notification No. 22 of 2013 Customs, dated the 18th April, 2013 or first proviso to sub-paragraph (1) of paragraph 2 of notification No. 23 of 2013-Customs, dated the 18th April, 2013, as the case may be;. 5. 23/2013-Customs, dated the 18th April, 2013, vide number G.S.R. 249 (E), dated the 18th April, 2013. In the said notification, in paragraph 2, in condition (16), for the words made under this exemption, the words, figures and letters made under this exemption and the debits made under the notification No. 14 of 2013 - Central Excise, dated the 18th April, 2013, shall be substituted. [F.No.605/10/2013-DBK]

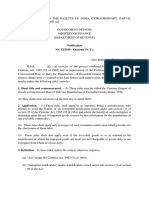

(Sanjay Kumar) Under Secretary to the Government of India Note: (i) The principal notification number 92/2009-Customs, dated the 11th September, 2009 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.658 (E), dated the 11th September, 2009 and was last amended by notification No. 20/2013Customs, dated the 3rd April, 2013 published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R.203 (E), dated the 3rd April, 2013. (ii) The principal notification number 93/2009-Customs, dated the 11th September, 2009 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 659 (E), dated the 11th September, 2009 and was last amended by notification No. 20/2013-Customs, dated the 3rd April, 2013 published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i) vide number G.S.R.203 (E), dated the 3rd April, 2013. (iii) The principal notification number 95/2009-Customs, dated the 11th September, 2009 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 661(E), dated the 11th September, 2009 was last amended by notification No. 20/2013-Customs, dated the 3rd April, 2013 published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i) vide number G.S.R.203 (E), dated the 3rd April, 2013. (iv) The principal notification number 104/2009-Customs, dated the 14th September, 2009 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 674 (E), dated the 14th September, 2009 was last amended by notification No. 24/2013-Customs, dated the 18th April, 2013 published in the Gazette of India, Extraordinary, Part II, Section 3, Subsection (i) vide number G.S.R.250 (E), dated the 18th April, 2013. (v) The principal notification number 23/2013-Customs, dated the 18th April, 2013 was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 249 (E), dated the 18th April, 2013.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jNo ratings yet

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jNo ratings yet

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jNo ratings yet

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jNo ratings yet

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jNo ratings yet

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Document1 pageDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jNo ratings yet

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jNo ratings yet

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jNo ratings yet

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jNo ratings yet

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Document3 pagesDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 617 NP BookletDocument77 pages617 NP BookletDexie Cabañelez ManahanNo ratings yet

- Bank Interview QuestionsDocument8 pagesBank Interview Questionsfyod100% (1)

- Annexure - VI Deed of Hypothecation (To Be Executed On Non Judicial Stamp Paper of Appropriate Value)Document3 pagesAnnexure - VI Deed of Hypothecation (To Be Executed On Non Judicial Stamp Paper of Appropriate Value)Deepesh MittalNo ratings yet

- Nature of International BusinessDocument19 pagesNature of International BusinessRodric MarbaniangNo ratings yet

- Intel 5 ForcesDocument2 pagesIntel 5 ForcesNik100% (1)

- Statement 20231030161033Document6 pagesStatement 20231030161033kreetika kumariNo ratings yet

- KONTRAK KERJA 2 BahasaDocument12 pagesKONTRAK KERJA 2 BahasaStanley RusliNo ratings yet

- Correct Answers Ch. 26Document15 pagesCorrect Answers Ch. 26Hannah Michele MooreNo ratings yet

- Inflation AccountingDocument9 pagesInflation AccountingyasheshgaglaniNo ratings yet

- Income CertificateDocument1 pageIncome CertificatedeepakbadimundaNo ratings yet

- Greenberg-Megaworld Demand LetterDocument2 pagesGreenberg-Megaworld Demand LetterLilian RoqueNo ratings yet

- Five Year PlanDocument5 pagesFive Year PlanrakshaksinghaiNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisDemi Jamie LaygoNo ratings yet

- Levels ReactingDocument17 pagesLevels Reactingvlad_adrian_775% (8)

- Sample Fryer Rabbit Budget PDFDocument2 pagesSample Fryer Rabbit Budget PDFGrace NacionalNo ratings yet

- Lean Remediation - Azimuth1Document1 pageLean Remediation - Azimuth1Jason DaltonNo ratings yet

- Industrialisation in RajasthanDocument4 pagesIndustrialisation in RajasthanEditor IJTSRDNo ratings yet

- Special Economic ZoneDocument7 pagesSpecial Economic ZoneAnonymous cRMw8feac8No ratings yet

- ENG - (Press Release) PermataBank and Kredivo Team Up For Rp1 Trillion Credit LineDocument2 pagesENG - (Press Release) PermataBank and Kredivo Team Up For Rp1 Trillion Credit LineTubagus Aditya NugrahaNo ratings yet

- Learning From Michael BurryDocument20 pagesLearning From Michael Burrymchallis100% (7)

- ToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...Document14 pagesToC - Smart Hospitality Market - Global Industry Analysis, Size, Share, Gr...PalawanBaliNo ratings yet

- QM - Chapter 4 (MCQ'S)Document15 pagesQM - Chapter 4 (MCQ'S)arslanNo ratings yet

- Chapter 8Document52 pagesChapter 8EffeNo ratings yet

- Dear Nanay: How This Story of A Little Girl and Her OFW Mother Came To Be, by Zarah GagatigaDocument3 pagesDear Nanay: How This Story of A Little Girl and Her OFW Mother Came To Be, by Zarah GagatigaMarkchester Cerezo100% (1)

- Black and Gold Gala - On WebDocument1 pageBlack and Gold Gala - On Webapi-670861250No ratings yet

- What Are The Difference Between Governme PDFDocument2 pagesWhat Are The Difference Between Governme PDFIndira IndiraNo ratings yet

- Democracy in Pakistan Hopes and HurdlesDocument3 pagesDemocracy in Pakistan Hopes and HurdlesAftab Ahmed100% (1)

- Steger Cooper ReadingGuideDocument2 pagesSteger Cooper ReadingGuideRicardo DíazNo ratings yet

- Economic System and BusinessDocument51 pagesEconomic System and BusinessJoseph SathyanNo ratings yet

- Suture ManufacturerDocument7 pagesSuture ManufacturerVishal ThakkarNo ratings yet