Professional Documents

Culture Documents

Critical ThinkingWords

Critical ThinkingWords

Uploaded by

Sel LiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Critical ThinkingWords

Critical ThinkingWords

Uploaded by

Sel LiCopyright:

Available Formats

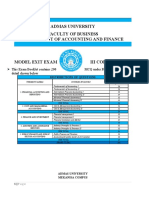

ACTL3003 Assignment: Credibility Theory

Selina Li

Part 1 Assumption 1 Units of Volume

Contract/ Time

1 2 3 4 Losses

Contract/ Time

1 2 0 0 0

2 2 0 0 0

3 3 0 0 0

4 4 0 0 3

5 6 0 0 3

6 6 0 3 2

7 8 0 4 2

8 5 0 2 2

9 6 9 3 2

10 6 11 2 3

1 2 3 4

1 0 0 0 0

2 1345 0 0 0

3 1846 0 0 0

4 10159 0 0 15016

5 7364 0 0 0

6 5972 0 5854 526

7 23524 0 6008 750

8 14976 0 1390 2436

9 10824 6344 1393 362

10 17601 10556 0 552

Intermediary Results

Contract (j)

48 20 14 17 1950.23 845.00 1046.07 1155.41 0.77 0.58 0.49 0.54

per unit of volume

1 2 3 4

1,803.65 1,040.65 1,181.35 1,227.70

4 10 99 1462.61

3014701.03 210085.74 2.39 1313.34

Assumption 2 Units of Volume

Contract/ Time

1 2 3 4 Losses

Contract/ Time

1 0 0 0 0

2 2 0 0 0

3 3 0 0 0

4 4 0 0 5

5 7 0 0 0

6 4 0 4 2

7 9 0 4 1

8 8 0 1 3

9 5 7 1 1

10 5 9 0 2

1 2 3 4

1 0 0 0 0

2 1345 0 0 0

3 1846 0 0 0

4 10159 0 0 15016

5 7364 0 0 0

6 5972 0 5854 526

7 23524 0 6008 750

8 14976 0 1390 2436

9 10824 6344 1393 362

10 17601 10556 0 552

Intermediary Results

Contract (j)

47 16 10 14 1991.72 1056.25 1464.50 1403.00 4 10 87 1664.34 0.82 0.60 0.49 0.57

per unit of volume

1 2 3 4

1,906.18 1,242.38 1,495.47 1,455.34 1493522.44 141660.96 2.48 1524.84

Part 2 Question 1 The underlying rationale of credibility theory is that the risk premium can be derived as a combination of the individual risk experience and the group risk experience. In the context of insurance, the premium can be expressed as a weighted average of the individual experience and the collective experience: ( ) The credibility level zj reflects how credible or trustworthy the experience of contract j is compared to that of the collective experience . A credibility level of one is suitable when there is large variation between contracts or the risk experience for contract j is sufficiently vast. In contrast, a credibility level of zero is suitable when contracts are homogenous. Under Approach 1, the zj values for each group were computed using the total exposure of each contract (wjsum), the average variance within each contract (s^2) and the variance between contracts (a). For all groups, s^2 and remain constant whereas total exposure changes. Higher total exposure results in higher zj values which is consistent with credibility theory since the credibility level approaches to one when the risk experience increases. Question 2: Compare results between Approaches 1 and 2 above. The difference between the intermediate results and credibility premiums of Approach 1 and 2 can be explained by the change in assumption for volume. In general, total units of exposure were greater than the total claims across all groups, resulting in higher wjt for Approach 1. The decline in volume also contributed to the higher lower weighted mean of outcomes (Xjt) for Approach 2. The variance within contracts and variance between contracts was also significantly different between both Approaches. This can be attributed to the increased dispersion of data in Approach 1 compared to that of Approach 2. In particular, contract 1 and 4 have units of exposure but not number of claims in certain time periods. The increased volume data and hence increased variability in Approach 1 contribute to s^2 and a, resulting in s^2 values and a values significantly greater than that of Approach 2. The changes in the intermediate results can all be linked to the changes to the credibility premiums. The higher the higher credibility level, higher collective mean and higher individual mean across all contracts for Assumption 2 has resulted in a greater Pcred for Approach 2 compared to the Pcred of Approach 1. Apart from the resulting data, the differences in the assumptions can also be examined. An implicit assumption of approach 1 is that it has a constant claims experience across all contracts. Hence, there is no incentive for individuals to manage their claims experience in Approach 1 than that of Approach 1. With Approach 1, there is no incentive to act in a more risk-adverse manner since the premium is just a measure of exposure (which could be number of contracts). Question 3 Contract 2 has credibility factors of 0.58 and 0.60 for Approach 1 and Approach 2 respectively. Despite the limited data, this suggests an emphasis on the risk experience of the contract rather than that of the collective mean. It can be argued that results of this model is not suitably appropriate since limited experience should have credibility weighting factors emphasized on the collective mean. On the other hand, the credibility model improves with time and hence should be used. A flaw to the model designed is that the time period used for all contracts is constant when only one contract had exposure in all ten time periods. This assumption could have contributed to the higher credibility levels determined. Nonetheless, even if the model was changed there is still considerable uncertainty with the group due to the limited risk experience. However, over time, this model will be able to become more accurate with greater input of data. The two approaches were also tested for homogeneity (using the F-test) and it was found that there was considerable heterogeneity in the data given. This gives more confidence that the credibility method used is suitable for both approaches. Hence, using credibility is justified and these unfavourable results should be only be used with considerable reasoning. However, there is confidence that the credibility model will improve with time.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Method Statement For Formworks, Rebars, Cast-In-Situ ConcreteDocument28 pagesMethod Statement For Formworks, Rebars, Cast-In-Situ ConcreteAzhar Ali87% (15)

- Cognitive Engagement StyleDocument19 pagesCognitive Engagement StylesnsclarkNo ratings yet

- Master of Business Administration: MOS Marketing of ServicesDocument31 pagesMaster of Business Administration: MOS Marketing of ServicesTrần Hoàng TrinhNo ratings yet

- EncodersDocument8 pagesEncoderssuresh mariappanNo ratings yet

- HersheysfailureDocument3 pagesHersheysfailureirenesarange6No ratings yet

- CE On Events After The Reporting PeriodDocument2 pagesCE On Events After The Reporting PeriodalyssaNo ratings yet

- PPE MatrixDocument2 pagesPPE MatrixDhaval DobariyaNo ratings yet

- Notes From Nowhere (Editors) - We Are Everywhere - The Irresistible Rise of Global Anti-Capitalism-Verso (2003)Document526 pagesNotes From Nowhere (Editors) - We Are Everywhere - The Irresistible Rise of Global Anti-Capitalism-Verso (2003)Maryam SamirNo ratings yet

- Struktur Sel ProkariotDocument101 pagesStruktur Sel ProkariotRizkalNo ratings yet

- Arizona State University Mail - Team 15 Ogl 355 Module 1 Team Project Choosing An Organization and Team ExpectationsDocument3 pagesArizona State University Mail - Team 15 Ogl 355 Module 1 Team Project Choosing An Organization and Team Expectationsapi-513937876No ratings yet

- Lecture 2b - The Radar EquationDocument13 pagesLecture 2b - The Radar EquationSatishNo ratings yet

- JAYSON Feasibility 3 PDFDocument68 pagesJAYSON Feasibility 3 PDFReyes Je AnNo ratings yet

- Ic Engines and Gas TurbineDocument3 pagesIc Engines and Gas TurbineLippin PaulyNo ratings yet

- EstimationDocument15 pagesEstimationnoor bashaNo ratings yet

- All QuestionDocument37 pagesAll QuestionOUSMAN SEIDNo ratings yet

- True English Translation of A Business Permission Letter Which The Original Is in BengaliDocument3 pagesTrue English Translation of A Business Permission Letter Which The Original Is in Bengalifahim527433No ratings yet

- BMW CAR m5 E34Document8 pagesBMW CAR m5 E34Gonzalo PerazaNo ratings yet

- Current Event Lesson PlanDocument3 pagesCurrent Event Lesson Planapi-550211632No ratings yet

- Fequently Asked Questions (Faqs) On FcraDocument10 pagesFequently Asked Questions (Faqs) On FcraJATEENKAPADIA123No ratings yet

- Physics Sample Paper 10 - 231221 - 091030Document19 pagesPhysics Sample Paper 10 - 231221 - 091030derexax756No ratings yet

- Taperla, NANOTECHNOLOGY Week 10 - 11Document4 pagesTaperla, NANOTECHNOLOGY Week 10 - 11kevin cagud PhillipNo ratings yet

- Technical Specification MBGDocument5 pagesTechnical Specification MBGM RikoNo ratings yet

- Paroc Pro Roof Slab 20 Kpa: Product DatasheetDocument2 pagesParoc Pro Roof Slab 20 Kpa: Product Datasheetcarlos martinezNo ratings yet

- A Low-Power 60-GHz CMOS Transceiver For WiGig Applications PDFDocument2 pagesA Low-Power 60-GHz CMOS Transceiver For WiGig Applications PDFdanial_1234No ratings yet

- RHRP8120 D PDFDocument5 pagesRHRP8120 D PDFgameel alabsiNo ratings yet

- Open Ended Lab For Soil MechanicsDocument27 pagesOpen Ended Lab For Soil Mechanicsعثمان محيب احمدNo ratings yet

- Debug 1214Document3 pagesDebug 1214RedyNo ratings yet

- Hobart D-300 ManualDocument12 pagesHobart D-300 ManualMichaella Ben-AriNo ratings yet

- COMP2121: Microprocessors and Interfacing: Lecture 25: Serial Input/Output (II)Document10 pagesCOMP2121: Microprocessors and Interfacing: Lecture 25: Serial Input/Output (II)SebaNo ratings yet