Professional Documents

Culture Documents

HW - RCBC Phoenix Dollar Fund UITF

Uploaded by

Mark Darrell Aricheta MendozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HW - RCBC Phoenix Dollar Fund UITF

Uploaded by

Mark Darrell Aricheta MendozaCopyright:

Available Formats

Eunice Cerdea Mark Darrell Mendoza

FINA402 Homework #2

June 17, 2013 FM4A

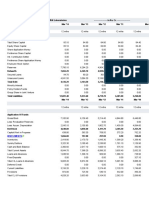

RCBC Phoenix Dollar Fund UITF Moderate in moneyness. Since RCBC Phoenix Dollar Fund UITF invests in short-term securities, they can be converted into cash in two (2) or three (3) years time. Also, since it is a type of UITF, buying and withdrawal is easy. Going to the bank and requesting for withdrawal would immediately transfer your funds to your settlement account.

1. Moneyness

P3.85B fixed rate issued. Based on our research, RCBC Phoenix Dollar Fund UITF had issued the first portion of its P3.85 billion in fixed rate and zero coupon Long Term 2. Divisibility and Negotiable Certificates of Time Deposit. Of the amount, P2.033 billion were from fixed rate Denomination and P1.817 billion were from zero coupon Long Term Negotiable Certificates of Time Deposit (LTNCDs). Low reversibility. It has a low reversibility because any fluctations or volatility of the RCBC Phoenix Dollar Fund UITF would be charged into the account of the investor. Thus, if fluctuation would be high, it could result to a lesser chance for the investor to get back his investment in cash. Maximum tenor of two (2) year. RCBC Phoenix Dollar Fund UITF invests in short term fixed income securities. Their minimum holding period is thirty (30) days. Moderately liquid. Ever since Unit Investment Trust Funds (UITFs) are launched, they show a positive increase in the financial market. The RCBC Phoenix Dollar Fund UITF is moderately liquid because for the past quarter, they showed a positive increase though fluctuations Not convertible. RCBC Phoenix Dollar Fund UITF cannot be converted to any other financial assets. Peso and Dollar Currency. Based on our research, the RCBC Dollar Fund UITF can be bought in peso or dollar. RCBC UITFs can be bought for a minimum of PhP 25,000 for peso currency or USD 1,000 for dollar currency.

3. Reversible

4. Term to Maturity

5. Liquidity

6. Convertibility

7. Currency

1.29 USD mutual fund Net Asset Value. On our research, the dividends of RCBC 8. Cash Flow and Phoenix Dollar Fund UITF are included in mutual fund Net Asset Value which has a Return value of 1.29 USD. It also shows that there is an additional 0.002% year dividend Predictability growth. Complex. RCBC Phoenix Dollar Fund UITF is complex because based on our research, they are not deposits or obligations and are not guaranteed, or insured of RCBC and any of its affiliates or subsidiaries. They are also not insured by the Philippine Deposit Insurance Company (PDIC). Thus, they are complex because they are exposed to market fluctuations and price volatility. The RCBC Phoenix Dollar Fund UITF is similar to the taxation terms of Common Trust Funds (CTF). Since they are both handled by the trust department of banks, they are not taxable entities and income paid to these funds is also not subject to income tax. The income of the common trust fund is subject to 20% final withholding tax upon distribution to the investors.

9. Complexity

10. Tax Status

You might also like

- Mendoza, Mark Darrell A. Fm3B Mrs. PorciunculaDocument1 pageMendoza, Mark Darrell A. Fm3B Mrs. PorciunculaMark Darrell Aricheta MendozaNo ratings yet

- Chapter 6Document26 pagesChapter 6Glen MangaliNo ratings yet

- HomeWork No.2 Financial Assets, Guidelines, ExampleDocument2 pagesHomeWork No.2 Financial Assets, Guidelines, ExampleMark Darrell Aricheta MendozaNo ratings yet

- HomeWork No.2 Financial Assets, Guidelines, ExampleDocument2 pagesHomeWork No.2 Financial Assets, Guidelines, ExampleMark Darrell Aricheta MendozaNo ratings yet

- BioDocument2 pagesBioMark Darrell Aricheta MendozaNo ratings yet

- Rizal in AteneoDocument36 pagesRizal in AteneoMark Darrell Aricheta Mendoza40% (5)

- HeroDocument10 pagesHeroMark Darrell Aricheta MendozaNo ratings yet

- Long Exam Part1 LETRANDocument1 pageLong Exam Part1 LETRANMark Darrell Aricheta MendozaNo ratings yet

- The First RomancesDocument14 pagesThe First RomancesMark Darrell Aricheta MendozaNo ratings yet

- Rizal Law-1Document31 pagesRizal Law-1Mark Darrell Aricheta Mendoza75% (4)

- HistDocument1 pageHistMark Darrell Aricheta MendozaNo ratings yet

- The First RomancesDocument14 pagesThe First RomancesMark Darrell Aricheta MendozaNo ratings yet

- ProjectDocument4 pagesProjectMark Darrell Aricheta MendozaNo ratings yet

- American Policies in The PhilippinesDocument65 pagesAmerican Policies in The PhilippinesMark Darrell Aricheta Mendoza100% (9)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 3946 Mohamed Alameri ResumeDocument2 pages3946 Mohamed Alameri Resumeapi-413425549No ratings yet

- Securities Market (Basic) Module PDFDocument284 pagesSecurities Market (Basic) Module PDFAyush Pratap SinghNo ratings yet

- 315 STRGDocument4 pages315 STRGchetanvyas@No ratings yet

- Chapter5 Summary Financial Statement Analysis IIDocument9 pagesChapter5 Summary Financial Statement Analysis IIElvie Abulencia-BagsicNo ratings yet

- Living by Numbers Value Creation or Profit?: Case 2Document11 pagesLiving by Numbers Value Creation or Profit?: Case 2Logeswaran RajanNo ratings yet

- Test 1 Cheat SheetDocument3 pagesTest 1 Cheat SheetGabi FelicianoNo ratings yet

- Geojit AprilDocument52 pagesGeojit AprilSRI DHARANNo ratings yet

- Social Responsibility of BusinessDocument7 pagesSocial Responsibility of Businesskblitz83100% (1)

- Project Report On Capital StructureDocument96 pagesProject Report On Capital StructurePrince Satish Reddy50% (2)

- MBA 3rd Semester Investment Analysis Case StudiesDocument5 pagesMBA 3rd Semester Investment Analysis Case StudiesChandru ChanduNo ratings yet

- Quiz 1Document2 pagesQuiz 1Abdul Wajid Nazeer CheemaNo ratings yet

- List of BooksDocument4 pagesList of Booksavinash singhNo ratings yet

- MSN BalacesheetsDocument16 pagesMSN BalacesheetsnawazNo ratings yet

- SMBU How To Find and Trade Stocks in Play PDFDocument17 pagesSMBU How To Find and Trade Stocks in Play PDFkabhijit04100% (3)

- FM-financial Statement AnalysisDocument29 pagesFM-financial Statement AnalysisParamjit Sharma97% (32)

- (Cayman) Guide To Hedge Funds in The Cayman IslandsDocument29 pages(Cayman) Guide To Hedge Funds in The Cayman IslandsAlinRoscaNo ratings yet

- We're A Solutions CompanyDocument168 pagesWe're A Solutions CompanyAlexandru CorotchiNo ratings yet

- Hidayatullah National Law University Raipur (C.G)Document22 pagesHidayatullah National Law University Raipur (C.G)mukteshNo ratings yet

- Soal Chapter 4Document4 pagesSoal Chapter 4Cherry BlasoomNo ratings yet

- Company Analysis - Lonmin PLC - GB0031192486 - LMI LN EquityDocument8 pagesCompany Analysis - Lonmin PLC - GB0031192486 - LMI LN EquityQ.M.S Advisors LLCNo ratings yet

- Finance Case 2 CompletedDocument5 pagesFinance Case 2 CompletedAhmedMalik100% (1)

- Financial Analysis and ReportingDocument5 pagesFinancial Analysis and ReportingHoneyzelOmandamPonce100% (1)

- Project On Mutual Fund by WashimDocument152 pagesProject On Mutual Fund by Washimsonu alamNo ratings yet

- CF Berk DeMarzo Harford Chapter 13 Problem AnswerDocument9 pagesCF Berk DeMarzo Harford Chapter 13 Problem AnswerRachel Cheng0% (1)

- Chapter 11Document10 pagesChapter 11HusainiBachtiarNo ratings yet

- Candlestick Patterns Trading GuideDocument19 pagesCandlestick Patterns Trading GuideleylNo ratings yet

- Drago Indjic On Liquidity and Replicators at London Business SchoolDocument31 pagesDrago Indjic On Liquidity and Replicators at London Business SchoolDrago IndjicNo ratings yet

- Solnik & McLeavey - Global Investment 6th EdDocument5 pagesSolnik & McLeavey - Global Investment 6th Edhotmail13No ratings yet

- Market Structure InfographicDocument1 pageMarket Structure Infographicchris100% (1)

- 20180723163702-Samasta Microfinace IM 23.07.2018 PDFDocument105 pages20180723163702-Samasta Microfinace IM 23.07.2018 PDFSureshNo ratings yet