Professional Documents

Culture Documents

Depreciated Replacement Cost

Uploaded by

OdetteDormanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciated Replacement Cost

Uploaded by

OdetteDormanCopyright:

Available Formats

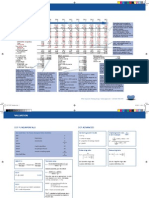

Calculation of NPV for the Head Leasehold Interest in Woodrow House with a target rate of return of 8.5%.

This will provide a investor bid price of 536,113

c)

Years 1-5 6 - 10 11 - 15 16 - 20 21 - 25 26 - 30 31 - 35 36 -40 41 -45 46 - 50 51 - 55 56 - 60 61 - 65 66 -70 71 - 75 76 -80 81 - 85 86 -90 91 -95 96 -100

Rent Receivable 633,000.00 682,499.97 735,870.78 793,415.14 855,459.41 922,355.48 994,482.76 1,072,250.32 1,156,099.22 1,246,505.02 1,343,980.47 1,449,078.40 1,562,394.88 1,684,572.59 1,816,304.49 1,958,337.68 2,111,477.73 2,276,593.18 2,454,620.49 2,646,569.35

growth in rent receivable in 5 yrs 682,500 735,871 793,415 855,459 922,355 994,483 1,072,250 1,156,099 1,246,505 1,343,980 1,449,078 1,562,395 1,684,573 1,816,304 1,958,338 2,111,478 2,276,593 2,454,620 2,646,569 2,853,528

rent payable is 8% of rent receivable 50,640.00 54,600.00 58,869.66 63,473.21 68,436.75 73,788.44 79,558.62 85,780.03 92,487.94 99,720.40 107,518.44 115,926.27 124,991.59 134,765.81 145,304.36 156,667.01 168,918.22 182,127.45 196,369.64 211,725.55

YP 5 yrs @ 8.5%

PV @ 8.5%

DCF

3.9406 1.00000000 199,554.11 3.9406 0.44228542 3.9406 0.29413989 3.9406 0.19561639 3.9406 0.13009378 3.9406 0.08651828 3.9406 0.05753858 3.9406 0.03826577 3.9406 0.02544848 3.9406 0.01692439 3.9406 0.01125549 3.9406 0.00748541 3.9406 0.00497814 3.9406 0.00331069 3.9406 0.00220176 3.9406 0.00146427 3.9406 0.00097381 3.9406 0.00064762 3.9406 0.00043070 3.9406 0.00028644 95,161.71 68,235.83 48,928.59 35,084.31 25,157.25 18,039.04 12,934.92 9,275.00 6,650.65 4,768.86 3,419.52 2,451.97 1,758.19 1,260.71 903.99 648.21 464.80 333.29 238.98

101 -105 106 - 110 111 - 115 116 -120 121 -125 126 infinity

2,853,528.43 3,076,671.50 3,317,264.14 3,576,670.87 3,856,362.96 4,157,926.69

3,076,672 3,317,264 3,576,671 3,856,363 4,157,927 4,483,072

228,282.27 246,133.72 265,381.13 286,133.67 308,509.04 332,634.13

3.9406 0.00019049 3.9406 0.00012669 3.9406 0.00008425 3.9406 0.00005603 3.9406 0.00003726 15.625 0.00003726 NPV

171.36 122.88 88.11 63.18 45.30 193.66 536,113

****Based on the yield of approximately 7% this will be use as the yearly growth ****rent payable is 8% of amount rent receivable. **** all risk yield as was calculated previously is 7.8199%

Question #2 a) Using Trial and Error calculate the EV which would be achieved at the asking price? The calculation the Equivalent Yield will be done using the term and reversion method and then recalculated using the Trial and Error for completeness. The units let recently were all nearby were rented at approximately 1,050 per m; using this information we calculate the going market rent of the property located at #62 Queen Street to be 235,200 (8 x 28 x 1050). This property is being offered for sale for 2,000,000. Therefore giving an estimated yield of 11.76% (235,000 / 2,000,000) rounded to 12% since the calculation will be done manually. Therefore the equivalent yield that will be achieved would be: Calculate using T&R Terms: Current Rent YP years Reversion: Market Value YP years 10 @ 12% PV years 3 @ 12% 3 @ 11% 74,000 2.444 180,856 235,200 5.650 0.712 4.0228 946,162.56 1,127,018.56

Now using trial and error we will use 15% Terms: Current Rent YP years Reversion: Market Value YP years 10 @ 15% PV years 3 @ 15% 235,200 5.019 0.658 3.3025 776,748.47 957,604.47 Now using trial and error we will use 10% Terms: Current Rent YP years Reversion: Market Value YP years 10 @ 10% PV years 3 @ 10% 235,200 6.145 0.751 4.6149 1,085,424.48 1,269,462.48 Now using trial and error we will use 10.5% Terms: Current Rent YP years Reversion: Market Value YP years 10 @ 10.5% PV years 3 @ 10.5% 235,200 6.017 0.741 4.4586 1,048,662 1,231,109 74,000 2.4655 182,447 74,000 2.487 184,038 74,000 2.283 180,856

3 @ 15%

3 @ 10%

3 @ 10.5%

Therefore we can assume based on the above calculation that the equivalent yield using trial and error will be 10.5%.

b) The difference between Equivalent yield and Equated Yield An Equivalent yield is the relationship between the current rental income from the property and the present value of the capital value of the property. This is mostly used in a traditional valuation with an implicit growth rate that is it assumes that little or no growth exists. This is better known as the IRR of the cash flow from a property which is assume will increase to the estimated market value at the next rental review. An Equated yield is mostly used in a discounted cash flow valuation with an explicit assumption re growth, the discount rate or internal rate of return which when applied to the income expected over the life of the investment produces a present value that is equal to the capital outlay. It is the overall internal rate of return required by investors for investing in a particular property; this is computed from an income stream that has been adjusted for change. This rate is usually higher than the equivalent yield. Ex: Value a freehold shop in a prime location let at its market rent of 90,000 FRI. The lease is for 15 years with 5 years upward only rent reviews. Similar properties are selling on an ARY of 5.5% and an equated yield of 12%. Using Equivalent Yield: Rent YP perpetuity @5.5% However using Equated Yield: Current rent 5 YP @ 12% Market rent in five years time 90,000 x 1.412931 YP perpetuity @5.5% 18.1818 PV 5 years @ 12% .56742 90,000 3.6048 324,432 127,164

90,000 18.1818 1,636,362

10.3167 1,311,913 1,636,345 Although the equated yield is using a higher yield than the equivalent, the amounts is practically the same, this is because the equated yield is discounted to the presented value.

Question #3 Depreciated Replacement Cost (DRC) is a cost-based method of arriving at a value for assets which are normally never exposed to the open market. This type of valuation should only be used as a last resort, it should be used when there are no useful or evidence of recent market transactions due to the specialized nature of the asset. The specialized nature may occur due to the size of the property or the location of that property that is some buildings are designed to be used by Town Councils or public sector/healthcare/military workers, and are therefore quite unique and its simply not appropriate or possible to value it for a commercial use. These properties very rarely change hands and because of this, almost no comparable evidence is available. Under this approach, the present value of the remaining service potential of an asset is determined as the depreciated replacement cost of the asset. The replacement cost of an asset is the cost to replace the assets gross service potential. This cost is depreciated to reflect the asset in its used condition. An asset may be replaced either through reproduction (replication) of the existing asset or through replacement of its gross service potential. The depreciated replacement cost is measured as the reproduction or replacement cost of the asset, whichever is lower, less accumulated depreciation calculated on the basis of such cost, to reflect the already consumed or expired service potential of the asset. The replacement cost and reproduction cost of an asset are determined on an optimized basis. The rationale is that the entity would not replace or reproduce the asset with a like asset if the asset to be replaced or reproduced is an overdesigned or overcapacity asset. The determination of the replacement cost or reproduction cost of an asset on an optimized basis thus reflects the service potential required of the asset A typical examine of a specialized property is the new US Embassy built in Kingston Jamaica a few years ago which was build to accommodate employees and therefore has mainly offices but is situated at allocation that includes designed security features such as thick walls, bullet proof glazed glass and cost significantly more than a normal office building would but provides the occupants with additional security which cannot be replicated through the purchase of a normal office building. This type of building is likely to be treated as a specialized and therefore valued at DRC with full account taken of the actual cost of the additional features and requirements. In arriving at the DRC, we look at the following: Cost of constructing the building(s) (including fees) Plus: Cost of the land (including fees) Total Costs Less: Allowance for age and depreciation Depreciated Replacement Cost

The inconsistently of the calculation of the DRC method used by valuators is always in question and there are several approaches that can be used which provides different results therefore challenges the consistency of methodology and outcome sought.

Strength of the DRC method: - It the best method to use when the asset being valued is considered to be a specialized asset. - This calculation is considered as one of the easiest method to use. Disadvantages of the DRC method: - The formula to calculate the DRC required obsolescence however this can be over or under stated as it depends on the valuator. - It neglects the difference between cost and value namely that one property might be cheaper than another but generate a much higher net income. This is because it works on the basis of a building or propertys value being the same as cost (which in most cases is a flawed concept, as cost is a fairly definite sum, whereas value is not). - This approach may not provide a useful indication of value if the benefits inherent in the appraised property are not replaced by the available replacement for which the cost is estimated. - It relies on other valuation methods to derive the value of land, therefore making it impossible to stand on its own. There is a high degree of inconsistency in the use of the DRC methodology, this inconsistency in approach is comparing one year with the next as a variation in the value of the property may result, not because of shifts in market values, but because of the different approaches to the component parts of the valuation used by valuers. Of particular concern was the variation in approach to the valuation of land, the costing of replacement buildings, the depreciation of the buildings to reflect age and obsolescence and the degree of involvement of the instructing client.

Question#4 Explain Valuation approach taken, factors that influence value and improvement needed to improve value: A Public House is a premise that is licensed to sell alcoholic beverages to customers for consumption on the premise. The valuation of the public house is based on its annual rental value which is determined by an analysis of the actual rent of the property or in this case comparative properties, we will use the profit earning ability that exist or anticipated by prospective buyers. Valuation of Public House When we look at the value of the property we take into consideration the following:

Actual Building

The size, availability of space, the state of repairs needed and the specific facilities such as the kitchen size, parking area, garden and any likely view if any exits. A buyer normally assess the opportunity for the business to grow beyond what it is now, that is, what would occur if they employ a new chef and recreate the menu, what impact would this have on sales. The fact that a three bedroom currently exist upstairs which would be vacated when the property is sold, could the buyer convert the property into a bed and breakfast by letting those rooms or the possibility of increasing the size of the property to cater to more persons. The increase of the building will depend on the size or any restrictions that exist on that property. Location

The fact that this public is located at the edge of the town this could prove to be a negative as well as a positive. Location will interact with business performance to some extent. For instance, the prices for food, drinks and room hire will generally be less as you move away from town and go into the rural area which is the typical stereotype of quaint villages with loyal locals and passing trade from passer bys. Performance

Overall profit is, of course, the major indicator of value. But other aspects can positively affect value. For instance, a high volume of customers is of value, even if the current owner is not especially profitable, as it provides the new buyer with a good customer base to work with. Other more intangible aspects can also sometimes help, such as having a good reputation, being well known in the area or having some level of exclusivity. Being this far from town it does not seem to have a good reputation especially since the owner thinks employing a chef is not important and therefore the buyer might need to build their own customer base. Actions needed In order for the owner to generate a great price for his property he might want to examine the property for any minor repairs that will add value to the building such as a fresh coat of paint, increase the revenue gain from the pub by employing a good chef which could impact current customers and through word of mouth draw additional customers to the pub, clean and upgrade the kitchen especially if nothing has been done over the last 35 years that the owner had the property.

You might also like

- M&a Class Outline Short VersionDocument12 pagesM&a Class Outline Short Versionkenjiamma50% (2)

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Methods of DepreciationDocument12 pagesMethods of Depreciationamun din100% (1)

- Fine JudaicaDocument98 pagesFine JudaicaelkawpNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Johnson Tax Statement 10.22.18Document2 pagesJohnson Tax Statement 10.22.18Andrew KochNo ratings yet

- 9 Capital BudgetingDocument6 pages9 Capital BudgetingRavichandran SeenivasanNo ratings yet

- Assessing The Economic Impact of Transportation ProjectsDocument34 pagesAssessing The Economic Impact of Transportation ProjectsMiaNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- "Buying Behavior and Consumer Preferences in The Residential Real Estate Industry in Delhi NCR Region PDFDocument85 pages"Buying Behavior and Consumer Preferences in The Residential Real Estate Industry in Delhi NCR Region PDFPoshit Mittal64% (14)

- Environmental & Social Review Procedures ManualDocument78 pagesEnvironmental & Social Review Procedures ManualIFC SustainabilityNo ratings yet

- Cost APProachDocument40 pagesCost APProachMANNAVAN.T.N100% (1)

- 6184-7 SupbDocument17 pages6184-7 SupbLibyaFlowerNo ratings yet

- Chapter 2 - Plant AssetDocument8 pagesChapter 2 - Plant AssetMelkamu Dessie TamiruNo ratings yet

- 2-4 2005 Dec ADocument14 pages2-4 2005 Dec AnsarahnNo ratings yet

- Accounting For Depreciation Accounting For DepreciationDocument32 pagesAccounting For Depreciation Accounting For DepreciationKaranNo ratings yet

- Module 7: Replacement Analysis (Chap 9)Document35 pagesModule 7: Replacement Analysis (Chap 9)우마이라UmairahNo ratings yet

- FA 13 DepreciationDocument53 pagesFA 13 DepreciationStuti GargNo ratings yet

- Philippine School of Business Administration - PSBA ManilaDocument12 pagesPhilippine School of Business Administration - PSBA ManilaephraimNo ratings yet

- Lecture Note 5 - BSB315 - LIFE CYCLE COST CALCULATIONDocument24 pagesLecture Note 5 - BSB315 - LIFE CYCLE COST CALCULATIONnur sheNo ratings yet

- Capital Investment Analysis: Class Discussion QuestionsDocument44 pagesCapital Investment Analysis: Class Discussion QuestionsMoko ajaNo ratings yet

- Decision Tree Analysis and Expected Value CalculationsDocument11 pagesDecision Tree Analysis and Expected Value Calculationscatcat1122No ratings yet

- Accounting 1Document11 pagesAccounting 1yaqoob008No ratings yet

- Gross Fund Invests in Such Interest1Document5 pagesGross Fund Invests in Such Interest1Muha Mmed Jib RilNo ratings yet

- DepreciationDocument6 pagesDepreciationSYOUSUF45No ratings yet

- Accounting for Depreciation ExpenseDocument57 pagesAccounting for Depreciation ExpenseKashish Manish JariwalaNo ratings yet

- BMA Ch3.8 HLSL Investment - AppraisalDocument15 pagesBMA Ch3.8 HLSL Investment - AppraisalandreaNo ratings yet

- Methods of DepriciationDocument8 pagesMethods of DepriciationGurkirat TiwanaNo ratings yet

- Fa4e SM Ch08Document20 pagesFa4e SM Ch08michaelkwok1100% (1)

- Chapter 7 Asset Investment Decisions and Capital RationingDocument31 pagesChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNo ratings yet

- Calculating Project NPV and Investment ConsiderationsDocument14 pagesCalculating Project NPV and Investment ConsiderationsMaster's FameNo ratings yet

- University of Gloucestershire: MBA-1 (GROUP-D)Document10 pagesUniversity of Gloucestershire: MBA-1 (GROUP-D)Nikunj PatelNo ratings yet

- Answers F9Document11 pagesAnswers F9Orkhan GuliyevNo ratings yet

- DepreciationDocument5 pagesDepreciationAniket Paul ChoudhuryNo ratings yet

- 4Ch11 Financial AnalysiskDocument14 pages4Ch11 Financial AnalysiskJoshua EllisNo ratings yet

- Capital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Document8 pagesCapital Investment Appraisal: Basic Investment Appraisal (Does Not Take Into Account Time Value of Money)Imtiaz AhmedNo ratings yet

- Accounting 9th Edition Horngren Solution ManualDocument19 pagesAccounting 9th Edition Horngren Solution ManualAsa100% (1)

- Module 7.3Document10 pagesModule 7.3Althea mary kate MorenoNo ratings yet

- Mock 2 Section C.thapelo MolibeliDocument17 pagesMock 2 Section C.thapelo MolibeliLerato SelloNo ratings yet

- Modern MethodsDocument20 pagesModern MethodsBangalore BharathNo ratings yet

- Capital Budgeting: Satish SinghDocument21 pagesCapital Budgeting: Satish SinghSatish Singh ॐ100% (1)

- Investment Appraisal Relevant Cash Flows AnswersDocument8 pagesInvestment Appraisal Relevant Cash Flows AnswersdoannamphuocNo ratings yet

- Depre ContDocument31 pagesDepre ContBalu BalireddiNo ratings yet

- Financial Management Chapter 09 IM 10th EdDocument24 pagesFinancial Management Chapter 09 IM 10th EdDr Rushen SinghNo ratings yet

- Aset Tetap & Penyusutan Aset TetapDocument16 pagesAset Tetap & Penyusutan Aset Tetapnadila rahmahNo ratings yet

- Annuity (Continuous Compounding) and MARRDocument31 pagesAnnuity (Continuous Compounding) and MARRJordan Ronquillo100% (1)

- CH 6Document29 pagesCH 6Kasahun MekonnenNo ratings yet

- Topic 9Document18 pagesTopic 9SUREINTHARAAN A/L NATHAN / UPMNo ratings yet

- Depreciation 140513051242 Phpapp02Document22 pagesDepreciation 140513051242 Phpapp020612001No ratings yet

- D2 Equivalent Annual Costs and BenefitsDocument7 pagesD2 Equivalent Annual Costs and BenefitsTENGKU ANIS TENGKU YUSMANo ratings yet

- Lockheed Tri Star and Capital Budgeting Case Analysis: ProfessorDocument8 pagesLockheed Tri Star and Capital Budgeting Case Analysis: ProfessorlicservernoidaNo ratings yet

- Accounting o LevelsDocument6 pagesAccounting o LevelsHira KhanNo ratings yet

- Ce316 03Document27 pagesCe316 03Kelvin Kindice MapurisaNo ratings yet

- The Retail Supply Chain of House of Deblewis LTDDocument6 pagesThe Retail Supply Chain of House of Deblewis LTDShehryaar AhmedNo ratings yet

- DepreciationDocument7 pagesDepreciationSoumendra RoyNo ratings yet

- Financial Appraisal of ProjectDocument22 pagesFinancial Appraisal of ProjectMahmudur RahmanNo ratings yet

- Session 6-Cost of ProductionDocument54 pagesSession 6-Cost of ProductionShreyas DixitNo ratings yet

- Chap 5Document10 pagesChap 5khedira sami100% (1)

- Lease Income NarrativeDocument14 pagesLease Income Narrativegreg_jkNo ratings yet

- Case Study 4Document4 pagesCase Study 4Nenad MazicNo ratings yet

- ME482 M6 Ktunotes - inDocument20 pagesME482 M6 Ktunotes - injas nazarNo ratings yet

- They Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?Document5 pagesThey Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?bekza_159No ratings yet

- Depreciation MethodDocument67 pagesDepreciation MethodSherwin Mosomos100% (1)

- Ise 307Document56 pagesIse 307Hussain Ali Al-HarthiNo ratings yet

- 6.3 Applying Annual-Worth Analysis 6.3.1 Benefits of AE AnalysisDocument6 pages6.3 Applying Annual-Worth Analysis 6.3.1 Benefits of AE Analysisshintya nadaNo ratings yet

- IM Chapter 6 and 7Document48 pagesIM Chapter 6 and 7Kasahun MekonnenNo ratings yet

- Cma Final DT AmendmentsDocument40 pagesCma Final DT AmendmentsRaj KumarNo ratings yet

- DepEd Seeks New School Sites to Address CongestionDocument33 pagesDepEd Seeks New School Sites to Address CongestionRichie SalubreNo ratings yet

- Minority DiscountDocument31 pagesMinority DiscountTergel NyamlkhagvaNo ratings yet

- Government Accounting Chapter 6Document33 pagesGovernment Accounting Chapter 6Charlagne LacreNo ratings yet

- SMSHB 2003Document278 pagesSMSHB 2003MfaneloNo ratings yet

- E&C MQP Answerkey SpecDocument21 pagesE&C MQP Answerkey SpecNisamNo ratings yet

- Sineedge ConsultingDocument20 pagesSineedge Consultingssr68No ratings yet

- Market Approach To ValuationDocument46 pagesMarket Approach To Valuation054 Modi Tanvi100% (1)

- Differences Between Public Goods and Private GoodsDocument16 pagesDifferences Between Public Goods and Private GoodsGetu WeyessaNo ratings yet

- City Assessor'S Office: Organizational ChartDocument2 pagesCity Assessor'S Office: Organizational ChartJohn Paulo RodriguezNo ratings yet

- AES2 Indepependent Business Valuation EngagementsDocument10 pagesAES2 Indepependent Business Valuation EngagementshnmjzhviNo ratings yet

- Standardization of Bid EvaluationDocument9 pagesStandardization of Bid Evaluationomoba solaNo ratings yet

- Chapter 3Document16 pagesChapter 3Much. Irvan FahrurroziNo ratings yet

- House Property - IllustrationDocument10 pagesHouse Property - IllustrationAnirban ThakurNo ratings yet

- Hawes V Dean (2014) NSWCA 380Document41 pagesHawes V Dean (2014) NSWCA 380Osprey SkeerNo ratings yet

- Dissertation Topics in Construction Quantity SurveyingDocument8 pagesDissertation Topics in Construction Quantity SurveyingWriteMyPhilosophyPaperCanadaNo ratings yet

- IBBI Examination QuestionsDocument2 pagesIBBI Examination QuestionsMurthy BabuNo ratings yet

- .Za-Uploads-Files-July 2011 Agent Magazine PDFDocument40 pages.Za-Uploads-Files-July 2011 Agent Magazine PDFArdiansyah PermanaNo ratings yet

- Valuations & Business Modelling: Study MaterialDocument486 pagesValuations & Business Modelling: Study Materialashika chourasiaNo ratings yet

- Project Appraisal Guidelines 2009Document6 pagesProject Appraisal Guidelines 2009nareshbansal130No ratings yet

- Republic Vs Lichauco - SalesDocument29 pagesRepublic Vs Lichauco - SalesJonathan PacaldoNo ratings yet

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiNo ratings yet

- Who Is ValuerDocument30 pagesWho Is ValuerHanis ZulNo ratings yet