Professional Documents

Culture Documents

Calculating NTA of A Company

Uploaded by

Vanson TanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculating NTA of A Company

Uploaded by

Vanson TanCopyright:

Available Formats

The Big Question Behind NTA

When buying stocks at a discount to NTA, it's important to assess what the firms NTA consists of, that it's not over-stated, and that there are no contingent claims on the assets.

The proposed management buyout of NatSteel Ltd's assets at a deep discount to its net tangible assets (NTA) has ignited market debate as to the fairness of the deal. This week, lets look at what goes into NTA in general. And specifically, what NatSteels NTA consists of. Well also discuss why some stocks trade below their NTA and others many times above. Just some quick statistics. Almost 40 per cent of the 370 stocks listed on the Singapore Exchange are trading below their NTA, while 56 stocks trade two times above their NTA. We'll discuss briefly if there are justifications for these share prices relative to NTA. First, the definition. A companys NTA is its total assets minus intangible asset and total liabilities. Technically, its what would be left over for shareholders if the firm were to sell all its tangible assets at the prices recorded in its books and repay all its debts. The question, of course, is how accurately the book values of the assets reflect their market value.

In accounting, the key principles used to identify and value assets are historical cost and conservatism. Under the historical cost principle, assets are recorded at their original cost. Conservatism, meanwhile, requires that asset values be revised downward if fair value is less than the cost. These two principles ensure that managements estimate of a firm's resources is not overstated. As a result, asset values reported on the balance sheet can be normally considered the lower boundary of the value of future benefits. But we are not living in normal times. In the past few years, the emergence of various technologies has revolutionized the way we do business. The roles played by layers of middlemen have been reduced. In addition, the entry of China into the global marketplace has expanded the worlds production capacity significantly. Chinas low cost base has put a dampener on product prices worldwide. This has been compounded by weak demand as a result of anaemic economies. So a plant that cost $100 million to build two years ago may not be worth even $50 million if the price of the products it makes has plunged 50 per cent. This has been the case for NatSteel. Due to capacity glut, steel prices have declined to a 20-year low. Steel producers around the world have gone bankrupt and many more are bleeding, including NatSteel. In such a scenario, the fall in the market value of the fixed assets is faster than the accounting depreciation. Thus, conservatism requires that a company write down the net book value of the assets. Meanwhile, stocks or inventories carried by the company may not be sold at even cost-price. So a write-down in inventory is also required. If the write-down carried out by management is less than the fall in the market value of the assets, then NTA will be over-stated and the share price will trade below the NTA per share.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Discounted Cash Flow Valuation ExampleDocument3 pagesDiscounted Cash Flow Valuation ExampleVanson TanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Singapore Insider Trading NewsDocument2 pagesSingapore Insider Trading NewsVanson TanNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Human Error Stock MarketDocument3 pagesHuman Error Stock MarketVanson TanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Winning Hedge Fund Strategies ExplainedDocument3 pagesWinning Hedge Fund Strategies ExplainedVanson TanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sustainability of ROEDocument2 pagesSustainability of ROEVanson TanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Increase Odds With Low Price To Book RatioDocument3 pagesIncrease Odds With Low Price To Book RatioVanson TanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Finding Undervalued StocksDocument3 pagesFinding Undervalued StocksVanson TanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Benefits of Insider Trading To Financial MarketsDocument2 pagesBenefits of Insider Trading To Financial MarketsVanson TanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Overconfidence in Abilities To Buy StocksDocument3 pagesOverconfidence in Abilities To Buy StocksVanson TanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Hedge Fund Definition SimpleDocument3 pagesHedge Fund Definition SimpleVanson TanNo ratings yet

- Best Singapore Price Earnings Ratio StocksDocument3 pagesBest Singapore Price Earnings Ratio StocksVanson TanNo ratings yet

- Does Stock Market OverreactDocument2 pagesDoes Stock Market OverreactVanson TanNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- What Does A Low Price To Book Ratio MeanDocument2 pagesWhat Does A Low Price To Book Ratio MeanVanson TanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Low Price To Book Ratio For Singapore StocksDocument2 pagesLow Price To Book Ratio For Singapore StocksVanson TanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Calculating NTA of A CompanyDocument2 pagesCalculating NTA of A CompanyVanson TanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Intangible Assets On Balance Sheet ExampleDocument3 pagesIntangible Assets On Balance Sheet ExampleVanson TanNo ratings yet

- Natsteel Holdings Asset ValueDocument2 pagesNatsteel Holdings Asset ValueVanson TanNo ratings yet

- Maximum Net Asset Value Test ExampleDocument2 pagesMaximum Net Asset Value Test ExampleVanson TanNo ratings yet

- Correlation Hedge Fund StrategiesDocument2 pagesCorrelation Hedge Fund StrategiesVanson TanNo ratings yet

- Negative Correlation Reduce Portfolio RiskDocument2 pagesNegative Correlation Reduce Portfolio RiskVanson TanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Equity Risk Premium FormulaDocument3 pagesEquity Risk Premium FormulaVanson TanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Red Flags in Accounting AnalysisDocument3 pagesRed Flags in Accounting AnalysisVanson Tan100% (1)

- Equity Risk Premium EffectivenessDocument3 pagesEquity Risk Premium EffectivenessVanson TanNo ratings yet

- When To Pile Money in StocksDocument5 pagesWhen To Pile Money in StocksVanson TanNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Project Management Assignment 2Document11 pagesProject Management Assignment 2Melissa Paul75% (8)

- The Cochran Firm Fraud Failed in CA Fed. CourtDocument13 pagesThe Cochran Firm Fraud Failed in CA Fed. CourtMary NealNo ratings yet

- PsychographicsDocument12 pagesPsychographicsirenek100% (2)

- 09 - Chapter 2 PDFDocument40 pages09 - Chapter 2 PDFKiran PatelNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

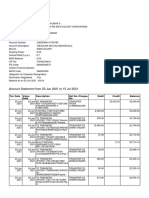

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- Session 5Document2 pagesSession 5Angelia SimbolonNo ratings yet

- Bid Doc ZESCO06614 Mumbwa Sanje Reinforcement July 2014 FinalDocument374 pagesBid Doc ZESCO06614 Mumbwa Sanje Reinforcement July 2014 FinalmatshonaNo ratings yet

- SGI Monthly Newsletter Title Under 40 CharactersDocument13 pagesSGI Monthly Newsletter Title Under 40 Charactersgj4uNo ratings yet

- Whitepaper - State of Construction TechnologyDocument16 pagesWhitepaper - State of Construction TechnologyRicardo FigueiraNo ratings yet

- Global Marketing Test Bank ReviewDocument31 pagesGlobal Marketing Test Bank ReviewbabykintexNo ratings yet

- BharatBenz FINALDocument40 pagesBharatBenz FINALarunendu100% (1)

- Authors LibraryDocument1,128 pagesAuthors Libraryauthoritybonus75% (12)

- Annex D Internship Contract AgreementDocument7 pagesAnnex D Internship Contract AgreementCamille ValdezNo ratings yet

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- HP-Cisco Alliance Strategy ChallengesDocument6 pagesHP-Cisco Alliance Strategy ChallengesSAHIL100% (1)

- En (1119)Document1 pageEn (1119)reacharunkNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bangalore University SullabusDocument35 pagesBangalore University SullabusJayaJayashNo ratings yet

- Key Differences Between Islamic and Conventional BankingDocument2 pagesKey Differences Between Islamic and Conventional BankingNoor Hafizah0% (2)

- Case Study 1Document9 pagesCase Study 1kalpana0210No ratings yet

- 21PGDM177 - I&E AssignmentDocument6 pages21PGDM177 - I&E AssignmentShreya GuptaNo ratings yet

- B&O Annual Report 2015-16Document136 pagesB&O Annual Report 2015-16anon_595151453No ratings yet

- Nike's Winning Ways-Hill and Jones 8e Case StudyDocument16 pagesNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- SS ISO 9004-2018 - PreviewDocument12 pagesSS ISO 9004-2018 - PreviewKit ChanNo ratings yet

- G.R. No. 161759, July 02, 2014Document9 pagesG.R. No. 161759, July 02, 2014Elaine Villafuerte AchayNo ratings yet

- Model LOC Model LOC: CeltronDocument3 pagesModel LOC Model LOC: CeltronmhemaraNo ratings yet

- LPP Mod 2Document27 pagesLPP Mod 2ganusabhahit7No ratings yet

- Microsoft® Azure™ SQL Database Step by Step PDFDocument48 pagesMicrosoft® Azure™ SQL Database Step by Step PDFmtamilmaniNo ratings yet

- ARCHITECTURAL INTERNSHIP ReportDocument41 pagesARCHITECTURAL INTERNSHIP ReportsinafikebekeleNo ratings yet

- Updated Case Westover ElectricalDocument8 pagesUpdated Case Westover ElectricalRalph Adrian MielNo ratings yet

- Problem Solving (Part 2)Document126 pagesProblem Solving (Part 2)royal mimingNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)