Professional Documents

Culture Documents

Thesun 2009-07-14 Page16 Banks Need Clear Strategy To Ensure Viability PWC

Uploaded by

Impulsive collectorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thesun 2009-07-14 Page16 Banks Need Clear Strategy To Ensure Viability PWC

Uploaded by

Impulsive collectorCopyright:

Available Formats

16 theSun | TUESDAY JULY 14 2009

business

‘Dual currency

Banks need clear strategy Woods

investment

gaining

to ensure viability: PwC back

in the

spotlight

pg 29

momentum’

KUALA LUMPUR: OCBC Bank (Malay-

sia) Bhd sees vast growth potential in dual

currency investments (DCIs) as customers

KUALA LUMPUR: Banks, including including governance, risk and control, According to Soo Hoo, effecting real are more familiar with the short-term non-

those not impacted by the financial crisis, financial management, delivery, legal change across an organisation requires principal protected alternative investment

should have a clear strategy to ensure that and physical structures, and people and skill and dexterity, taking strategy and form.

they continue to be relevant in an evolving reward, Soo Hoo said. driving it while at the same time manag- OCBC Bank Premier Banking head Tye

financial market landscape, according to “Nothing less than a world-class ing current business risks and developing Su Leng said DCI was a boon to clients

PricewaterhouseCoopers (PwC). approach will suffice and the ability to individual components. conducting business transactions in alter-

“Banks need to act quickly to develop address all of these issues, in the correct “Putting them together in the right nate currency, particularly using foreign

comprehensive plans, first to stabilise order and to ensure that responses are way and delivering sustainable change is currency in the import-export business.

their businesses and then to move for- aligned will be of critical importance to the challenge which will set the winners “It also appeals to clients who have

ward,” said PwC Malaysia partner Soo survival,” he said. apart from the rest,” he said. – Bernama invested in properties and housing loans

Hoo Khoo Yean. in their alternate currencies and who have

“Typical reactions from the banking children pursuing tertiary education over-

industry to the current financial crisis seas,” she said in a statement.

have, understandably, been short term

in nature,” Soo Hoo said in a statement

yesterday.

EU to further develop projects Through DCI, customers’ investments

are made in one currency known as the

“base currency” to vie for higher interest

“However, even for the Malaysian

banks which remain relatively unscathed

from this downturn, there is no guarantee

with Malaysia rates, Tye said.

She said payment at maturity can either

be in the base currency or in another

that they will do well in the future, espe- KUALA LUMPUR: The European expected to be less between the partnerships with local small and agreed-upon currency at a pre-determined

cially with the recent liberalisation of the Union (EU) will further develop EU and Malaysia due to the global medium enterprises, especially in exchange rate set by the investor when the

financial sector,” he said. projects in the fisheries, services economic uncertainty,” he said environment and energy, natural transaction is entered into.

Against the expected keener competi- and forestry sectors with the re- after a briefing on the EU-East resources or forestry, agriculture “With tenures of between two weeks

tion, Malaysian banks needed to review spective local ministries to boost Asean Growth Area (EAGA) Busi- and aquaculture, and ecotourism. and a month, the DCI is a viable option

their current business model for sustain- trade with Malaysia. ness and Technology Partnership According to Rumbo, EU firms for investors looking to make short-term

ability in the long term, Soo Hoo said. EU-Malaysia cooperation here. should emulate Malaysia’s move investments,” she said.

“The risk is that taking a short-term programme manager Pablo Igle- Rumbo said the trade deficit of diversifying its businesses and Tye said OCBC Bank offered a wide

view can undermine the longer term vi- sias Rumbo said yesteray total with Malaysia is also expected exports to cushion the impact of range of currency pairs for clients to choose

ability of the business. Banks are highly trade between both parties may to continue as the EU has always the current economic difficulties. from to suit their investment preferences.

complicated structures and the tempta- decline slightly this year from €28 been a top export destination. “We hope that in this trying “Our clients find the structured product

tion for a quick fix can divert them from billion (RM137.2 billion) recorded He hoped that with the times, EU firms will look at appealing and many use it for their chil-

doing the ‘right thing’,” he said. last year. EU-EAGA partnership, more geographical areas not ventured dren’s overseas education,” she said.

To ensure future success, banking “This year, trade volume is EU firms will consider forming before,” he said. – Bernama In fact, due to the current market vola-

strategy must get the fundamentals right, tility and slowdown in unit trust products,

Tye said the shine seemed to be upon

foreign currencies as a viable alternative

US gaming tycoon says Asian dreams intact for investors.

With a minimum RM250,000 investment

and no annual management fees or sales

charged imposed, the DCI is currently

SINGAPORE: It has been a chal- himself as a “gut variety, plain (RM7.1 billion) needed to com- materials and labour, issues that available at most OCBC Bank branches and

lenging year for Sheldon Adelson, vanilla entrepreneur.” plete the projects, he said. are beyond his control, he said. Premier Banking Centres nationwide, she

but the bullish 75-year-old US Adelson has invested heavily “We are shooting for a restart A US$5.5-billion (RM19.53 added. – Bernama

casino tycoon is confident he has in Asia in recent years, mainly in of the Macau project before the billion) casino and convention

enough aces up his sleeve to revive Macau, where a pre-crisis gaming end of this year,” said Adelson, complex, Marina Bay Sands, is

stalled projects in Asia.

The construction of new

casinos in Macau and Singapore

boom saw the former Portuguese

colony overtake Las Vegas in

terms of overall revenue.

chairman of Las Vegas Sands.

The delayed projects are part of

the company’s ambitious US$12-

now targeted to open in either

January or February 2010,

instead of end-2009

Bank Islam

has been delayed after the global

financial crisis hit both economies

hard and Adelson’s company Las

One industry analyst said

Adelson may have taken huge

risks in pursuing his Asian

billion (RM42.6 billion) building

plan in Macau on a reclaimed strip

of land known as Cotai Strip.

as originally

planned.

- AFP

brings down

Vegas Sands ran into funding

problems.

Once ranked the third wealthi-

expansion – but it might pay off

eventually.

“There is no question that the

Squeezed by the global credit

crunch, Las Vegas Sands an-

nounced in November that work

NPLs

est American by Forbes Magazine company has for quite some time on sites five and six on the Cotai KUALA LUMPUR: Bank Islam Malaysia

until the meltdown wiped out a taken a very strategically aggres- Strip would be stopped until Bhd says it has brought down its non-per-

substantial chunk of his fortune, sive approach to the Asian market financial market conditions im- forming loans (NPLs) rate to a single digit for

he was forced to inject US$1 bil- place,” said Jonathan Galaviz, a proved. the financial year ended June 30, compared

lion (RM3.55 billion) of his own partner with Nevada-based con- Sites five and six include an with 14-15% the previous year.

money into Las Vegas Sands. sultancy Globalysis. 1,800-room Sheraton hotel and However, its general manager of con-

But the self-made billionaire “Yet at the same time, one has three casinos. sumer banking division, Khairul Kamaru-

says the experience accumulated to have respect for that because The Vegas firm was din did not disclose the actual figure.

since he first went into business as the Asian market place is going to also forced to fire up The management will announce the

a 12-year-old will help him put his be the growth place for the next to 11,000 mainly figure during the company’s year-end an-

gaming empire back on a winning 10-20 years.” construction staff nouncement which is normally around

streak, and industry analysts are Adelson said he was aiming as work ground August or September, he told reporters

giving him decent odds. to restart the stalled projects in to a halt on the after a price-giving ceremony here for the

“I intend to rain on critics’ Macau later this year once Las projects.

parade,” Adelson told a Singa- Vegas Sands completes a fund- Like in Macau, winners of the bank’s first Al-Awfar Savings

pore news conference last week raising exercise for US$3.5 billion Adelson’s Singa- and Investment Account-i draw.

in reference to bleak economic (RM12.43 billion). pore project has Khairul said the bank achieved the lower

forecasts. A sale or public listing of the also run into NPLs rate by being more aggressive and

“If we are in the down portion Macau assets are among the op- delays and cost focused in its tasks. “We focus on recovery

AFPPIX

now, we can look forward to go- tions being explored to raise the overruns due work and at the same time we focus on our

ing back (up),” he said, describing money, including US$2 billion to shortages of business growth.”

Adelson ... I intend to rain on critics’ parade. On Al-Awfar Savings and Investment

Account-i, he said the bank had successfully

registered 40,990 new accounts, totalling

Proton moves to strengthen export market RM145.8 million in worth as at end of

June.

KUALA LUMPUR: Proton Holdings Bhd has taken benefit from the economies of scale, quality and more aggressive export strategy for Proton,” said “Eighty per cent of the RM145.8 million

further steps to ensure its overall export plans capability transfer, the company said. managing director Datuk Syed Zainal Abidin Syed are saving accounts, while the remaining

and strategies are aligned with those of its inter- The markets were chosen for their pre-existing Mohamed Tahir. 20% registered for investment,” he added.

national importers and distributors. trade and culture linkages with Malaysia and Pro- “Staying competitive and our ability to sustain The bank, which earlier projected to

In line with this, the national carmaker held ton leveraged on this to reduce its cost in making requires for our export operations to operate achieve RM300 million in saving accounts

a two-day International Distributor Conference further inroads, it said in a statement yesterday. differently and if need be, drastic changes will by end of the year, is now confident of

that ended last Friday, where it not only shared The strategy also identified several key be made to ensure growth in Proton’s business achieving the target by September.

updates and details but also held dialogue ses- regional centres, namely China and Iran, for the abroad,” he said. “We have been seeing an overwhelming

sions to gather feedback on various operational establishment of completely knocked down (CKD) According to Syed Zainal Abidin, the national response since we launched it in March this

issues abroad. operations which allowed Proton to serve its carmaker wants to ensure that its international year,” he said.

Emphasis was on high growth regional customers in the region more effectively. importers and distributors are on the same page Customers are entitled to win cash prizes

markets, namely Asean, China, India and Middle “The current environment clearly indicates when it comes to Proton’s moving forward strat- up to RM100,000 every three months when

East-North Africa (MENA), where Proton is able to that the challenges ahead would demand for a egy. – Bernama they sign up with the Al-Awfar Savings and

Investment Account-i. – Bernama

You might also like

- Paper 5Document15 pagesPaper 5Dushyant SharmaNo ratings yet

- Note On The Asset Management IndustryDocument16 pagesNote On The Asset Management IndustryBenj DanaoNo ratings yet

- Poster Template SeptemberDocument1 pagePoster Template SeptemberAhmed usamaNo ratings yet

- Marketing and Investment Banking II RelationshipsDocument12 pagesMarketing and Investment Banking II RelationshipsAliElkhatebNo ratings yet

- VIR Interview 1680574800Document1 pageVIR Interview 1680574800thuytien19581955No ratings yet

- Pengaruh Nilai Pelanggan, Inovasi Produk Dan Kualitas Layanan Terhadap Loyalitas Nasabah Bank Muamalat Indonesia Cabang MadiunDocument16 pagesPengaruh Nilai Pelanggan, Inovasi Produk Dan Kualitas Layanan Terhadap Loyalitas Nasabah Bank Muamalat Indonesia Cabang MadiunIntan putri rengganisNo ratings yet

- Investing in The Backbone of Emerging MarketsDocument12 pagesInvesting in The Backbone of Emerging MarketsMoin Uddin AhmedNo ratings yet

- Government Securities Market Development The Indonesia CaseDocument31 pagesGovernment Securities Market Development The Indonesia CaseADBI EventsNo ratings yet

- FI Valuation DeckDocument28 pagesFI Valuation DeckoodidayooNo ratings yet

- 111-Article Text File-229-1-10-20180804 PDFDocument8 pages111-Article Text File-229-1-10-20180804 PDFAhsan ali riazNo ratings yet

- Marketing Practices of Public Sector Banks - 2Document4 pagesMarketing Practices of Public Sector Banks - 2nitinsule64No ratings yet

- Thesun 2009-02-20 Page16 F&N Confident of The FutureDocument1 pageThesun 2009-02-20 Page16 F&N Confident of The FutureImpulsive collectorNo ratings yet

- Bank's Capital Structure & Basle IIDocument8 pagesBank's Capital Structure & Basle IIsarkarankanNo ratings yet

- SME Financing: Need For A New Business ModelDocument6 pagesSME Financing: Need For A New Business ModelSha HussainNo ratings yet

- Managing The Great Transaction Banking Sea Change: Research ReportDocument4 pagesManaging The Great Transaction Banking Sea Change: Research Reportkoundinya99No ratings yet

- Post Finance Insurance q3 PeDocument8 pagesPost Finance Insurance q3 PeEngly PeouNo ratings yet

- Annual Report Bca 2016Document600 pagesAnnual Report Bca 2016Nabilah RamadhanNo ratings yet

- 2019 Security Bank Annual ReportDocument75 pages2019 Security Bank Annual ReportHannah Brynne UrreraNo ratings yet

- Article On Fund ManagementDocument8 pagesArticle On Fund ManagementLizaNo ratings yet

- Share Best Practices Booklet 2008Document32 pagesShare Best Practices Booklet 2008Noman KhosaNo ratings yet

- La Contribution Des Etablissements de Microfinance A L'inclusion Financiere en Zone Cemac - 3Document14 pagesLa Contribution Des Etablissements de Microfinance A L'inclusion Financiere en Zone Cemac - 3SALMANo ratings yet

- Swift Banks Whitepaper Correspondentbanking-1Document8 pagesSwift Banks Whitepaper Correspondentbanking-1habchiNo ratings yet

- Strategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirDocument24 pagesStrategic Management Journal - 2021 - Flammer - Strategic Management During The Financial Crisis How Firms Adjust TheirPragya patelNo ratings yet

- PWC Banking Industry Reform PDFDocument24 pagesPWC Banking Industry Reform PDFcontactbarathNo ratings yet

- Arthanomics IB NewsletterDocument8 pagesArthanomics IB NewsletterABHISHEK DALAL 23No ratings yet

- UniCredit and ReputationDocument21 pagesUniCredit and ReputationIoana MirceaNo ratings yet

- Role of Financial Capabilities in Harnessing Digital Mobile Payments For Enterprise SuccessDocument2 pagesRole of Financial Capabilities in Harnessing Digital Mobile Payments For Enterprise SuccesssuelaNo ratings yet

- Annual Report 2022Document646 pagesAnnual Report 2022Elham Mohammad Kashem (193011094)No ratings yet

- Global Annual Review 2009 PWCDocument62 pagesGlobal Annual Review 2009 PWCDeepesh SinghNo ratings yet

- Credit Derivatives BrochureDocument3 pagesCredit Derivatives BrochureAileen AraoNo ratings yet

- HBS Note On CommercialBankingDocument16 pagesHBS Note On CommercialBankingJatin SankarNo ratings yet

- Covid ImpactDocument43 pagesCovid Impactmichaele gobezieNo ratings yet

- SME Financing - An Industry PerspectiveDocument3 pagesSME Financing - An Industry PerspectiveArun KrishnanNo ratings yet

- FICO - What Do SME Needs From Their Banking Providers Post-Pandemic - 2022Document8 pagesFICO - What Do SME Needs From Their Banking Providers Post-Pandemic - 2022kangNo ratings yet

- Financing Small and Medium Enterprise: A Case Study of BASIC Bank LTDDocument20 pagesFinancing Small and Medium Enterprise: A Case Study of BASIC Bank LTDAhsan ali riazNo ratings yet

- UntitledDocument63 pagesUntitledEnock KapoteNo ratings yet

- Business Weekly 15032024Document16 pagesBusiness Weekly 15032024EffortNo ratings yet

- Annual Report 2017Document128 pagesAnnual Report 2017Kubra KhanNo ratings yet

- Ujjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Document10 pagesUjjivan Small Finance Bank LTD - Company Update - 120623 (1) - 12-06-2023 - 09Sanjeedeep Mishra , 315No ratings yet

- Bond Market Development in Bangladesh ADocument10 pagesBond Market Development in Bangladesh AA B M MoshiuddullahNo ratings yet

- Determinants of Bank Technical Efficiency Evidence From Rural and Community Banks in GhanaDocument16 pagesDeterminants of Bank Technical Efficiency Evidence From Rural and Community Banks in GhanaGetnet ZemeneNo ratings yet

- Investment BankingDocument80 pagesInvestment BankingVelankaniNo ratings yet

- Qatar Banking Perspective 2021 v2Document22 pagesQatar Banking Perspective 2021 v2ayoub abbarNo ratings yet

- Postgraduate - 19 September 2017Document4 pagesPostgraduate - 19 September 2017Times MediaNo ratings yet

- Pulse of Fintech h1 22Document62 pagesPulse of Fintech h1 22prokonektNo ratings yet

- Working Capital of Borrower-Bank of BarodaDocument82 pagesWorking Capital of Borrower-Bank of BarodaRaj KopadeNo ratings yet

- Tržište Kredita I Mali Biznis U Zemljama U Tranziciji - Studija Slu Aja Za SrbijuDocument10 pagesTržište Kredita I Mali Biznis U Zemljama U Tranziciji - Studija Slu Aja Za Srbijuhoxx82No ratings yet

- Chartered Mortgage AnalystDocument4 pagesChartered Mortgage AnalystKeith ParkerNo ratings yet

- CAPITALSTRUCTUREOFBANK IN GhanaDocument14 pagesCAPITALSTRUCTUREOFBANK IN Ghananle brunoNo ratings yet

- Impact of Liquidity On Profitability of Commercial Banks in NepalDocument14 pagesImpact of Liquidity On Profitability of Commercial Banks in Nepalybashreejana5No ratings yet

- Thesun 2009-04-21 Page16 PNB Offers 5Document1 pageThesun 2009-04-21 Page16 PNB Offers 5Impulsive collectorNo ratings yet

- Characteristics of Nigerian Deposit Money Banks and Their Financial OutcomeDocument8 pagesCharacteristics of Nigerian Deposit Money Banks and Their Financial OutcomeEditor IJTSRDNo ratings yet

- Credit Rating ArticleDocument2 pagesCredit Rating ArticleLaweesh KumarNo ratings yet

- Capital Buffer, Credit Standards and Financial Performance of Commercial Banks in KenyaDocument11 pagesCapital Buffer, Credit Standards and Financial Performance of Commercial Banks in KenyaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Tiob Launched Digital Membership Identification Cards: News FeaturesDocument5 pagesTiob Launched Digital Membership Identification Cards: News FeaturesArden Muhumuza KitomariNo ratings yet

- Indian Banks Building Resilient LeadershipDocument88 pagesIndian Banks Building Resilient Leadershiparul.btugNo ratings yet

- How Banks Can Build Their Future Workforce TodayDocument7 pagesHow Banks Can Build Their Future Workforce TodayalexNo ratings yet

- Asian Digital Challenger BankDocument37 pagesAsian Digital Challenger BankSubhro SenguptaNo ratings yet

- Ey How Banks Can Leverage Digital Innovation To Compete in The Fast Changing SMB Market v2Document17 pagesEy How Banks Can Leverage Digital Innovation To Compete in The Fast Changing SMB Market v2Prajapati BhavikMahendrabhaiNo ratings yet

- Coaching in OrganisationsDocument18 pagesCoaching in OrganisationsImpulsive collectorNo ratings yet

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDocument5 pagesIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorNo ratings yet

- Futuretrends in Leadership DevelopmentDocument36 pagesFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Global Talent 2021Document21 pagesGlobal Talent 2021rsrobinsuarezNo ratings yet

- Emotional or Transactional Engagement CIPD 2012Document36 pagesEmotional or Transactional Engagement CIPD 2012Impulsive collectorNo ratings yet

- HayGroup Job Measurement: An IntroductionDocument17 pagesHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- KPMG CEO StudyDocument32 pagesKPMG CEO StudyImpulsive collectorNo ratings yet

- Islamic Financial Services Act 2013Document177 pagesIslamic Financial Services Act 2013Impulsive collectorNo ratings yet

- Global Added Value of Flexible BenefitsDocument4 pagesGlobal Added Value of Flexible BenefitsImpulsive collectorNo ratings yet

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocument4 pagesHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- HayGroup Rewarding Malaysia July 2010Document8 pagesHayGroup Rewarding Malaysia July 2010Impulsive collectorNo ratings yet

- Developing An Enterprise Leadership MindsetDocument36 pagesDeveloping An Enterprise Leadership MindsetImpulsive collectorNo ratings yet

- Stanford Business Magazine 2013 AutumnDocument68 pagesStanford Business Magazine 2013 AutumnImpulsive collectorNo ratings yet

- Hay Group Guide Chart - Profile Method of Job EvaluationDocument27 pagesHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Flexible Working Good Business - How Small Firms Are Doing ItDocument20 pagesFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorNo ratings yet

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocument15 pagesHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNo ratings yet

- Managing Conflict at Work - A Guide For Line ManagersDocument22 pagesManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNo ratings yet

- Strategy+Business Magazine 2016 AutumnDocument132 pagesStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- 2012 Metrics and Analytics - Patterns of Use and ValueDocument19 pages2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorNo ratings yet

- Compensation Fundamentals - Towers WatsonDocument31 pagesCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Megatrends Report 2015Document56 pagesMegatrends Report 2015Cleverson TabajaraNo ratings yet

- Strategy+Business - Winter 2014Document108 pagesStrategy+Business - Winter 2014GustavoLopezGNo ratings yet

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocument117 pagesCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- HBR - HR Joins The Analytics RevolutionDocument12 pagesHBR - HR Joins The Analytics RevolutionImpulsive collectorNo ratings yet

- IBM - Using Workforce Analytics To Drive Business ResultsDocument24 pagesIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorNo ratings yet

- Talent Analytics and Big DataDocument28 pagesTalent Analytics and Big DataImpulsive collectorNo ratings yet

- 2016 Summer Strategy+business PDFDocument116 pages2016 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- 2015 Summer Strategy+business PDFDocument104 pages2015 Summer Strategy+business PDFImpulsive collectorNo ratings yet

- TalentoDocument28 pagesTalentogeopicNo ratings yet

- Deloitte Analytics Analytics Advantage Report 061913Document21 pagesDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNo ratings yet

- Case Problem Hanievon MerchandisingDocument20 pagesCase Problem Hanievon MerchandisingPrincessjane Largo100% (1)

- Quantitative Techniques & Data Interpretation: QA13CMATSP01Document4 pagesQuantitative Techniques & Data Interpretation: QA13CMATSP01Meenakshi SachdevNo ratings yet

- Finance ProjectDocument99 pagesFinance ProjectRaj Aaryan100% (1)

- Ai-1 RM2Document4 pagesAi-1 RM2SheenaNo ratings yet

- National Stock Exchange'S Certification in Financial Markets (NCFM)Document4 pagesNational Stock Exchange'S Certification in Financial Markets (NCFM)Saran BaskarNo ratings yet

- CH 07Document12 pagesCH 07Mustakkima Afreen Mouly100% (1)

- Dave Landry Trailing StopsDocument6 pagesDave Landry Trailing Stopsdebbie_shoemaker100% (1)

- Investment Banking Cheatsheet Bloomberg TerminalDocument2 pagesInvestment Banking Cheatsheet Bloomberg TerminalAmuyGnop100% (2)

- (MB0053) International Business ManagementDocument14 pages(MB0053) International Business ManagementAjay KumarNo ratings yet

- Portfolio Risk & ReturnDocument37 pagesPortfolio Risk & ReturnAnonymous100% (1)

- Library BooksDocument10 pagesLibrary BookssakthikaviNo ratings yet

- 4 0 Continuation Patterns, Validating and Negating CPS, When ToDocument10 pages4 0 Continuation Patterns, Validating and Negating CPS, When ToVăn Thắng HoàngNo ratings yet

- Simple InterestDocument69 pagesSimple InterestValiant Darma100% (1)

- CORFISER SMI Fund Puesto 66 de 3,017 Fondos Segun Bloomberg Ranking May 2013Document1 pageCORFISER SMI Fund Puesto 66 de 3,017 Fondos Segun Bloomberg Ranking May 2013Finser GroupNo ratings yet

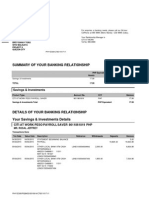

- Summary of Your Banking Relationship: Savings & InvestmentsDocument3 pagesSummary of Your Banking Relationship: Savings & InvestmentsJeffreyNo ratings yet

- Sharekhan Satisfaction LevelDocument116 pagesSharekhan Satisfaction LevelamericaspaydayloansNo ratings yet

- The Effect of Myopia and Loss Aversion On Risk TakingDocument16 pagesThe Effect of Myopia and Loss Aversion On Risk TakingbboyvnNo ratings yet

- SAP FI Transaction Code List 1Document10 pagesSAP FI Transaction Code List 1akhilsahu2004No ratings yet

- Problem Set: Exchange Rates: International EconomicsDocument16 pagesProblem Set: Exchange Rates: International EconomicsLucia Yuste MoreiraNo ratings yet

- Using Multiple MADocument7 pagesUsing Multiple MABock Dharma100% (2)

- Role of Rbi in Indian Banking SystemDocument31 pagesRole of Rbi in Indian Banking SystemAbhishek GolechhaNo ratings yet

- An Investigation Into The Effects of Monetary Intervention On Financial MarketsDocument6 pagesAn Investigation Into The Effects of Monetary Intervention On Financial MarketsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Study On Customer Satisfaction Towards Online Share Trading With Special Reference To India InfolineDocument65 pagesA Study On Customer Satisfaction Towards Online Share Trading With Special Reference To India InfolineAshima BhatiaNo ratings yet

- 118.2 - Illustrative Examples - IFRS15 Part 2Document2 pages118.2 - Illustrative Examples - IFRS15 Part 2Ian De DiosNo ratings yet

- Dvanced Orporate Inance: Derivatives and Hedging RiskDocument29 pagesDvanced Orporate Inance: Derivatives and Hedging RiskMohamed A FarahNo ratings yet

- Student Loan BankFraudDocument34 pagesStudent Loan BankFraudSalaam Bey®100% (18)

- The Collected Wisdom of Seth KlarmanDocument11 pagesThe Collected Wisdom of Seth KlarmanSantangel's Review93% (15)

- Venture Capital Class 4 SDDocument25 pagesVenture Capital Class 4 SDMary Williams100% (1)

- Efficient Market HypothesisDocument40 pagesEfficient Market HypothesisZia Ur RehmanNo ratings yet

- Chapter 5 - Financial MarketsDocument9 pagesChapter 5 - Financial MarketsThuyển ThuyểnNo ratings yet