Professional Documents

Culture Documents

2-35-1357734401-2. Ijfm - A Comparative Study - D. Shreedevi

Uploaded by

AJAYOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2-35-1357734401-2. Ijfm - A Comparative Study - D. Shreedevi

Uploaded by

AJAYCopyright:

Available Formats

International Journal of Financial Management (IJFM) ISSN 2319-491X Vol.

2, Issue 1, Feb 2013, 13-20 IASET

A COMPARATIVE STUDY OF PUBLIC AND PRIVATE NON- LIFE INSURANCE COMPANIES IN INDIA

D. SHREEDEVI1 & D. MANIMEGALAI2

1

Associate Professor, Apollo Institute of Hospital Administration, Hyderabad, India Assistant Professor, Apollo Institute of Hospital Administration, Hyderabad, India

ABSTRACT

With the privatization of insurance, monopolistic competition of public sector insurance companies came to an end, giving wider opportunities to the customers to select their insurers as per their requirements. In todays hyper competitive environment, insurers are operating under shrinking premiums, growing customer expectations and tightening regulations which are narrowing their margins. Falling investment returns, tougher competition, rising operational costs, managing risks, supporting multiple distribution channels, complying with regulatory changes and shifting customer preferences are sticky areas any insurance company has to tread on, at any time. With the entry of private players, the competition is becoming intense. In this paper, an attempt is made to analyze the performance of public and private nonlife insurance companies in India.

KEYWORDS: Insurance Penetration, Insurance Density, Non- Life Insurance INTRODUCTION

The insurance industry today functions in a highly competitive environment, with increasing private participation and an expanding product portfolio. In this changing landscape, insurers have to invent ways to offer more value than ever before. The various components of non- life Insurance or general insurance are fire, marine, motor, engineering, health and aviation. Chart 1 shows the Insurance industry in India. There are 24 non-life insurance companies operating in India, of which four are under public sector, three standalone health insurers and the two specialized institutions.

Figure 1 The general insurance industry is estimated to grow by over 18 percent to reach a size of Rs 100,000 crore by 2015 and Rs. 2, 50,000 crore by 2020. The current size of the non-life industry is Rs. 58,344 crore growing at the rate of 23.16%. In terms of penetration general insurance in India is 0.60 percent of GDP against the world average of 2.14 percent. The huge market largely remains untapped in both rural and urban India as 70 percent of the population is still not touched by insurance companies.

14

D. Shreedevi & D. Manimegalai

OBJECTIVE

The objective of the present study is to compare the performance of public and private non-life insurance companies in terms of certain parameters.

HYPOTHESES

For the purpose of this study, the following null hypotheses are formed: There is no significant difference in the growth of number of new policies issued among public and private nonlife insurance companies There is no significant difference in the growth rate of gross direct premium income between public and private non-life insurance companies. There is no significant difference in the growth rate of net incurred claims among public and private non-life insurance companies.

RESEARCH METHODOLOGY

The data is basically secondary in nature collected from the annual reports of IRDA, from the various journals, research articles and websites. An attempt is made to analyse whether there is any significant difference in the growth of number of new policies, gross direct premium collected and net incurred claims among public and private non-life insurance companies or not. For this purpose, Mann-Whitney U- Test was applied. Mann-Whitney U Test is a nonparametric test. This test is used to determine whether two independent samples have been drawn from the same population.

PERIOD OF STUDY

The present study covers a period of 9 years from 2002-03 to 2010-11.

ANALYSIS OF THE DATA

Following the recommendations of the Malhotra Committee report, in 1999, the Insurance Regulatory and Development Authority (IRDA) was constituted as an autonomous body to regulate and develop the insurance industry. The IRDA was incorporated as a statutory body in April, 2000. The key objectives of the IRDA include promotion of competition so as to enhance customer satisfaction through increased consumer choice and lower premiums, while ensuring the financial security of the insurance market. The IRDA opened up the market in August 2000 with the invitation for application for registrations. Foreign companies were allowed ownership of up to 26%. In December, 2000, the subsidiaries of the General Insurance Corporation of India (GIC) were restructured as independent companies and at the same time GIC was converted into a national re-insurer. Table 1 shows the details of non-life insurance companies operating in India both in public and private sector. As on 31st March, 2011, 24 general insurance companies had been granted registration for carrying on non-life insurance business in the country. Of these, six are in public sector and the rest are in private sector. Of the private sector insurers, 3 have been granted registration to carry on operations in the health segment. Among the public sector companies, the four public sector insurance companies i.e., New India, national Insurance, Oriental Insurance, United India Insurance carry on multiline operations, there are two specialised insurance companies: one for credit insurance Export Credit Guarantee Corporation Ltd (ECGC) and the other for crop insurance Agriculture Insurance Company (AIC).

A Comparative Study of Public and Private Non- Life Insurance Companies in India

15

The potential and performance of the insurance sector is universally assessed with reference to two parameters, viz., Insurance Penetration and Insurance Density. Insurance penetration is defined as the ratio of premium underwritten in a given year to the Gross Domestic Product (GDP). Insurance density is defined as the ratio of premium underwritten in a given year to the total population (measured in USD). The insurance penetration was 2.32 per cent (Life: 1.77 per cent and Non-life: 0.55 per cent) in the year 2000 when the sector was opened up for private sector. It increased to 5.10 per cent in 2010 (Life: 4.40 per cent and Non-life: 0.70 per cent). The insurance density stood at USD 64.4 in 2010 (Life: USD 55.7 and Non-life: USD 8.7) from USD 9.9 in 2000 (Life: USD 7.6 and Non-life: USD 2.3). The non-life insurance sector witnessed significant growth of 8.1 per cent during 2010. Its performance is far better when compared to global non-life premium, which expanded by 2.1 per cent during the same period. The share of Indian non-life insurance premium in global non-life insurance premium increased slightly to 0.58 per cent, thereby improvising its global ranking to 19 th in comparison to 26th rank. Table 2 shows the details of market share of public and private non-life insurance companies for the years 2009-10 and 2010-11. . Among Public sector undertakings market leader and public sector giant New India Assurance stood with 16.75 per cent market share, followed by United India. In the private sector ICICI Lombard is the leader as far as market share is concerned. Till March 2009, private players were growing faster than their public sector counterparts, but after wards registered a low market share. Non-Life insurers contributed to the extent of only 5 per cent of total investments held by the insurance industry. The total investments of the sector, as on 31st March, 2011, stood at Rs. 82,520 crore. During 2010-

16

D. Shreedevi & D. Manimegalai

11, the net increase in investments was Rs. 16,148 crore (24.33 per cent growth over previous year), up from Rs. 66,372 crore in 2009-10. Table 2: Market Share of Public and Private Non- Life Insurance Companies (In per cent) Insurance Companies 2009-10 2010-11 Private Sector Royal Sundaram 2.67 2.71 Reliance General 6.04 3.98 IFFCO Tokio 4.22 4.18 TATA AIG General 2.53 2.79 Bajaj Allianz General 7.25 6.79 ICICI Lombard 9.81 10.2 Cholamandalam General 2.37 2.31 HDFC Ergo 2.69 3.35 Future Generali 1.10 1.45 Universal Sompo 0.51 0.68 Shriram General 1.18 1.81 Bharti AXA General 0.08 1.29 Raheja QBE 0.01 SBI General 0.08 L&T General 0.02 Public Sector United India 14.88 14.96 Oriental Insurance 13.53 12.48 National Insurance 13.41 14.15 New India Insurance 17.74 16.75 Total 100.00 100.00 Source: IRDA Annual Report 2010-11 Number of New Policies Issued During 2010-11the non-life insurers have issued 793 lakh new policies, out of which 506 lakh policies are issued by public sector and the private sector has issued 287 lakh policies. While public sector reported an increase of 16.52 percent (-3.84 percent in 2009-10) in the number of policies issued over the previous year, the private sector insurers reported a decline of 9.86 percent (19.44 percent increase in 2010-11) in the number of new policies issued. Overall the industry witnessed a 17.56 percent increase (0.64 percent in 2009-10) in the number of policies issued. Table 3 displays the details of number of new policies issued by public and private non-life insurance companies from 2002-03 to 2010-11. Table 3: Non-Life Insurers: Number of Policies Issued (Rs in Lakhs) Insurer Public Sector Private Sector TOTAL 2010-11 505.76 (16.52) 287.652 2009-10 434.04 (-3.84) 240.84 2008-09 451.37 (17.09) 219.23 2007-08 385.47 (13.47) 187.03 2006-07 339.72 (-19.48) 126.92 2005-06 421.93 (-5.47) 89.48 2004-05 446.34 (16.15) 51.45 2003-04 384.27 (-8.26) 32.99 (96.72) 417.26 (-4.21) 2002-03 418.85 16.77 435.62 -

(19.44) (9.86) (17.21) (47.36) (41.85) (73.92) (55.96) 793.41 674.88 670.60 572.50 466.64 511.41 497.79 (17.56) (0.64) (17.13) (22.69) (-8.75) (2.74) (19.30) Note: Figure in bracket indicates the growth over the previous years in per cent Source: IRDA Annual reports

A Comparative Study of Public and Private Non- Life Insurance Companies in India

17

Gross Direct Premium Income of Non-Life Insurers The premium income of public insurers increased from year to year. It was Rs. 13,337 crore in the year 2003-04 and was increased to Rs. 25,152 crore in 2010-11. The growth rate was 4.77 percent 2004-05 and it was increased to 8.41 percent in 2006-07 and again it decreased to 3.52 percent in 2007-08. Compared to the previous year, it was increased by 21.84 percent in 2010-11. In private sector also there is a continual increase in the direct premium income during the years from 2003-04 to 2010-11. The premium underwritten by 15 private sector insurers (other than the insurers carrying on exclusively health insurance business) in 2010-11 was Rs. 17,425 crore as against 13,977 crore in 2009-10. It was Rs.2,257 crore in 2003-04 and was increased to Rs. 17,425 crore in 2010-11. The rate of growth of private sector also shows the fluctuating trend. The growth rate of growth was 55.36 percent in 2004-05 and recorded highest growth rate of 61.24 percent in 2006-07 and it was decreased to 24.67 percent in 2010-11. Table 4 displays the details of gross direct premium income by public and private non-life insurance companies from 2003-04 to 2010-11. Table 4: Gross Direct Premium Income in India of Non-Life Insurers (Rs in Lakh) Growth Rate in % 2003-04 1333708 2004-05 1397296 4.77 2005-06 1499706 7.33 2006-07 1625890 8.41 2007-08 1683184 3.52 2008-09 1803075 7.12 2009-10 2064345 14.49 2010-11 2515183 21.84 Source: IRDA Annual Reports Year Public Net Incurred Claims Table 5 indicates that in the case of the private insurers, the net incurred claims were Rs. 911.72 crore as against Rs.543.36 crore in 2003- 04. Overall, the incurred claims ratio was 51.16 per cent as against 50.97 in 2003-04. The net incurred claims of the non-life insurers stood at Rs. 29,536 crore in 2010-11 as against Rs.22,229 crore in 2009-10. The incurred claims exhibited an increase of 32.87 per cent during 2010-11. While the public sector insurers reported growth at 30.95 per cent in the incurred claims, while for private insurers it was 36.83 per cent. However, the overall the growth in incurred claims during 2010-11 is 32.87 per cent which was significantly higher than 12.74 per cent recorded during the previous year. Both public and private sectors have continuous increase in claims except for public sector in the year 200607 (-0.29 percent growth rate, which increased to 30.95 percent in 2010-11). Compared to public sector companies, the growth rate of net incurred claims of private non-life insurance companies was high. Table 5: Net Incurred Claims of Non-Life Insurers (Rs in Lakh) Growth Rate in % 2002-03 769114 2003-04 825330 7.31 2004-05 907540 9.96 2005-06 1056985 16.47 2006-07 1053875 -0.29 2007-08 1212481 15.05 2008-09 1363779 12.48 2009-10 1496723 9.75 2010-11 1959914 30.95 Source: IRDA Annual Reports Year Public Private 29225 54336 91172 154822 250289 424631 607967 726249 993731 Growth Rate in % 85.92 67.79 69.81 61.66 69.66 43.18 19.46 36.83 Private 225773 350764 536266 864657 1099189 1232108 1397700 1742463 Growth Rate in % 55.36 52.89 61.24 27.12 12.09 13.44 24.67

18

D. Shreedevi & D. Manimegalai

RESULTS AND INTERPRETATION

In order to know whether there is any statistically significant difference in the growth rates of public and private non-life insurance companies in terms of the parameters like number of new policies issued, gross direct premium income and net incurred claims, Mann-Whitney-U-Test was used. For testing the null hypothesis, which is laid down, the U value was calculated. The results of Mann-Whitney-U- Test is given in table 6 Table 6: Results of Mann-Whitney - U- Test Hypotheses Ho1 Particulars Tabulated U Value 0.001 0.003 0.000 Result Rejected Rejected Rejected

Number of new policies issued Ho2 Gross Direct Premium income in India Ho3 Net incurred claims Source: Calculated Value

Ho1: The tabulated probability for n1 = 8, n2 = 8 and U = 4 is 0.001, which is less growth rates of number of new policies issued by public and private non-life insurance companies.

than 0.05 (5% level of

significance) hence, the null hypothesis framed for this study is rejected. That means there is a significant difference in the

Ho2: The tabulated probability for n1 = 7, n2 = 7 and U = 4 is 0.003, which is less than 0.05 (5% level of significance) hence, the null hypothesis framed for this study is rejected. That means there is a significant difference in the growth of gross direct premium income among public and private non-life insurance companies. Ho3: The tabulated probability for n1 = 8, n2 = 8 and U = 1 is 0.000, which is less than 0.05 (5 % level of significance) hence, the null hypothesis framed for this study is rejected. That means there is a significant difference in the growth of net incurred claims among public and private non-life insurers.

CONCLUSIONS

Comparatively public sectors firms have done well mostly because of their aggressive pricing and the retention of business. New India Assurance in PSU companies and ICICI Lombard in private companies will continue to hold the leadership position for the next few years. The Indian general insurance market is relatively underdeveloped. Compared to the other countries it is still at a budding stage, which indicates the potential opportunities available for the players. Higher disposable incomes, rising aspiration of the people and growing awareness about need for insurance are some of the factors that would continue to drive the growth of the insurance sector in India in the coming decade.

REFERENCES

1. Rao, V.S.K, Retail Products The Future of Non-Life Insurance. The Journal of Insurance Institute of India, Vol.No.1 Issue No.1 Oct-Dec, 2012 2. 3. 4. IRDA Annual Reports Handbook on Indian Insurance Statistics 2009-10 Sethu, P.V., Marketing Approach and Strategies of (non-life) General Insurance in the Current Competitive Market. The Insurance Times, Vol. XXXI No.9, Sept, 2011.

A Comparative Study of Public and Private Non- Life Insurance Companies in India

19

5.

Jagendra Kumar, This Fiscal may be deuce, for Private and Public Sector General Insurers, The Insurance Times, Vol. XXX No. 6, June, 2010

6.

Rana, J.K., The Ticketsize of General Insurance Market in India . The Insurance Times, Vol. XXXII No. 08, August, 2012.

7.

Vinay Verma, Efficiency and Effectiveness in Competitive Era in General Insurance Companies in Public SectorA Journey of from objectives to Results in 2012-13, The Insurance Times, Vol. XXXII No. 04, April, 2012.

8.

Shiv Narayana M, Forgotten Monies of the Non-Life Insurers. The Insurance Times, Vol. No.12, December, 2010.

9.

Guria, R.C., Downsizing of Global Economy- Threats as well as Opportunities to General Insurance Sector in India, The Insurance Times, Vol. XXIX No. 6, June, 2009.

10. Selva Kumar, M. and Vimal Priyan, J., A Comparative Study of Public and Private Life Insurance Companies in India. The Indian Journal of Commerce, Vol. 65, No.1, January-March 2012.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- IJLL - Use of The Figure of Al-Husayn in Contemporary Arabic Poetry - 1Document14 pagesIJLL - Use of The Figure of Al-Husayn in Contemporary Arabic Poetry - 1iaset123No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- IJSMM-A Study of The Linear Relationship Between Age and Cannabidiol - CBD - Awareness and UsageDocument12 pagesIJSMM-A Study of The Linear Relationship Between Age and Cannabidiol - CBD - Awareness and Usageiaset123No ratings yet

- IJLL - Development of Thought in John Keats' Series of Odes - 1Document4 pagesIJLL - Development of Thought in John Keats' Series of Odes - 1iaset123No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- IJLL - Exploring The Colonial Impact On Postcolonial Indian Society A Study of Kiran Desais Novel, The Inheritance of Los - 1Document6 pagesIJLL - Exploring The Colonial Impact On Postcolonial Indian Society A Study of Kiran Desais Novel, The Inheritance of Los - 1iaset123No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- IJLL - Adjuncts, Disjuncts and Conjuncts Nouns in English - 1Document8 pagesIJLL - Adjuncts, Disjuncts and Conjuncts Nouns in English - 1iaset123No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Ijll-Format-rituals and Ceremonies During The Chhalivan Festival of The Noctes of The Borduria Village A Hint at Using Folk Culture For Purposes of English Language LearningDocument6 pagesIjll-Format-rituals and Ceremonies During The Chhalivan Festival of The Noctes of The Borduria Village A Hint at Using Folk Culture For Purposes of English Language Learningiaset123No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 14-10-2022-1665733299-8-IJHSS-19. Reviewed - IJHSS - Conservation of Two Statues in The Temple of Mut in Luxor EgyptDocument10 pages14-10-2022-1665733299-8-IJHSS-19. Reviewed - IJHSS - Conservation of Two Statues in The Temple of Mut in Luxor Egyptiaset123No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 25-10-2022-1666691535-8-IJHSS-23. IJHSS - Effect of Read Along Application On Speaking and Reading Skills of English LanguageDocument8 pages25-10-2022-1666691535-8-IJHSS-23. IJHSS - Effect of Read Along Application On Speaking and Reading Skills of English Languageiaset123No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 17-12-2022-1671258231-8-Ijhss-25. Food As Natural Medicine Lifestyle, Knowledge, and Healthcare Practices of Indian Scheduled TribesDocument4 pages17-12-2022-1671258231-8-Ijhss-25. Food As Natural Medicine Lifestyle, Knowledge, and Healthcare Practices of Indian Scheduled Tribesiaset123No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 15-10-2022-1665819963-8-IJHSS-21.Knowledge and Attitude of The Beneficiaries Towards Activities of Baif Development Research FoundationDocument10 pages15-10-2022-1665819963-8-IJHSS-21.Knowledge and Attitude of The Beneficiaries Towards Activities of Baif Development Research Foundationiaset123No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- 22-10-2022-1666422924-8-IJHSS-22. IJHSS - Dara Shikoh and The Zamindars of Bihar During War of Succession - 1Document8 pages22-10-2022-1666422924-8-IJHSS-22. IJHSS - Dara Shikoh and The Zamindars of Bihar During War of Succession - 1iaset123No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 5.ijhss-7. Reviewed - Ijhss - Role of Youth in Decision Making of The Agricultural Activities in Devarakonda Block of Nalgonda DistrictDocument8 pages5.ijhss-7. Reviewed - Ijhss - Role of Youth in Decision Making of The Agricultural Activities in Devarakonda Block of Nalgonda Districtiaset123No ratings yet

- 15-11-2022-1668515243-8-IJHSS-24. Sustainability of The Acceleration in Edtech Growth Post COVID - 1 - 1 - 1Document14 pages15-11-2022-1668515243-8-IJHSS-24. Sustainability of The Acceleration in Edtech Growth Post COVID - 1 - 1 - 1iaset123No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 14-10-2022-1665748970-8-IJHSS-20. IJHSS - Women's Education - 1Document6 pages14-10-2022-1665748970-8-IJHSS-20. IJHSS - Women's Education - 1iaset123No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 9.IJHSS-11. Reviewed - IJHSS - Extent of Knowledge and Adoption Selected Cashew Production Technology Among Cashew GrowersDocument8 pages9.IJHSS-11. Reviewed - IJHSS - Extent of Knowledge and Adoption Selected Cashew Production Technology Among Cashew Growersiaset123No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 13.IJHSS-16. Reviewed - IJHSS-The Weapons of The Prophet Muhammad - Peace Be Upon Him - and It's Uses in InvasionsDocument16 pages13.IJHSS-16. Reviewed - IJHSS-The Weapons of The Prophet Muhammad - Peace Be Upon Him - and It's Uses in Invasionsiaset123No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- 13.IJHSS-17. IJHSS - Teaching Information Literacy To Undergraduate Students Tools Workshop, and Activity IdeasDocument12 pages13.IJHSS-17. IJHSS - Teaching Information Literacy To Undergraduate Students Tools Workshop, and Activity Ideasiaset123No ratings yet

- 11.IJHSS-13. Reviewed - IJHSS - ALIZAN Integration To Issue Linkages Tools 28 July 2022Document16 pages11.IJHSS-13. Reviewed - IJHSS - ALIZAN Integration To Issue Linkages Tools 28 July 2022iaset123No ratings yet

- 12.ijhss-Ijhss-09!08!22the Shift From "Sacred" To "Secular" FamilyDocument8 pages12.ijhss-Ijhss-09!08!22the Shift From "Sacred" To "Secular" Familyiaset123No ratings yet

- 24-08-2022-1661330777-8-Ijhss-Ijhss-17-08-22-A Study On Consumer's BehaviorDocument6 pages24-08-2022-1661330777-8-Ijhss-Ijhss-17-08-22-A Study On Consumer's Behavioriaset123No ratings yet

- 7.ijhss-10. Reviewed - Ijhss - A Study On Involvement of Tribal Youth in Different Agriculture Practices in Koriya District of Chhattisgarh-FftDocument8 pages7.ijhss-10. Reviewed - Ijhss - A Study On Involvement of Tribal Youth in Different Agriculture Practices in Koriya District of Chhattisgarh-Fftiaset123No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A 13. Ijhss - An Analysis of Knowledge of Women About Agro-FtDocument6 pagesA 13. Ijhss - An Analysis of Knowledge of Women About Agro-Ftiaset123No ratings yet

- IJHSS - Impact of Jal Bhagirathi Foundation Intensive Watershed Development Project On - 1Document8 pagesIJHSS - Impact of Jal Bhagirathi Foundation Intensive Watershed Development Project On - 1iaset123No ratings yet

- A 13. Ijhss - An Analysis of Knowledge of Women About Agro-FtDocument6 pagesA 13. Ijhss - An Analysis of Knowledge of Women About Agro-Ftiaset123No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 11.IJHSS-13. Reviewed - IJHSS - ALIZAN Integration To Issue Linkages Tools 28 July 2022Document16 pages11.IJHSS-13. Reviewed - IJHSS - ALIZAN Integration To Issue Linkages Tools 28 July 2022iaset123No ratings yet

- 3.IJHSS-2. Reviewed - IJHSS - Reactions To Frustration of Adolescent BoysDocument6 pages3.IJHSS-2. Reviewed - IJHSS - Reactions To Frustration of Adolescent Boysiaset123No ratings yet

- Knowledge and Attitude Towards The Existing Livelihood Systems of Tribal Farmers in Ananthagiri Mandal of Visakhapatnam DistrictDocument8 pagesKnowledge and Attitude Towards The Existing Livelihood Systems of Tribal Farmers in Ananthagiri Mandal of Visakhapatnam Districtiaset123No ratings yet

- 15-07-2022-1657864454-8-IJGMP-1. IJGMP - Study On The Density of Phytoplankton's and Zooplankton's of Bichhiya River WaterDocument22 pages15-07-2022-1657864454-8-IJGMP-1. IJGMP - Study On The Density of Phytoplankton's and Zooplankton's of Bichhiya River Wateriaset123No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Reactions To Frustration of Adolescent Girls: Chokchimsa. Wegara R. Marak, Dr. Anshu & Dr. Anjali MathurDocument6 pagesReactions To Frustration of Adolescent Girls: Chokchimsa. Wegara R. Marak, Dr. Anshu & Dr. Anjali Mathuriaset123No ratings yet

- 1.IJHSS - Reactions To Frustration of Adolescents Across GenderDocument6 pages1.IJHSS - Reactions To Frustration of Adolescents Across Genderiaset123No ratings yet

- CH 05Document37 pagesCH 05Janna KarapetyanNo ratings yet

- CitikeyDocument54 pagesCitikeyJacob PochinNo ratings yet

- Typeform Invoice BTLWMgTYQCPq91RjvDocument1 pageTypeform Invoice BTLWMgTYQCPq91RjvAakash vermaNo ratings yet

- L.C.Gupta Committee PurposeDocument3 pagesL.C.Gupta Committee PurposeAbhishek Kumar SinghNo ratings yet

- 84 UCin LRev 327Document23 pages84 UCin LRev 327Shashwat BaranwalNo ratings yet

- Affiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Document20 pagesAffiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Endubai SuryawanshiNo ratings yet

- AshZjxFuEemP8Qpm209XvA Rewiring-Trade-FinanceDocument5 pagesAshZjxFuEemP8Qpm209XvA Rewiring-Trade-Financezvishavane zvishNo ratings yet

- Perla - Econ 201 Chapter 1 - 4Document111 pagesPerla - Econ 201 Chapter 1 - 4Nana NsiahNo ratings yet

- Approved Sponsorship LetterDocument2 pagesApproved Sponsorship LetterFelix Raphael MintuNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fundamentals of Business Law PDFDocument358 pagesFundamentals of Business Law PDFmikiyo90% (10)

- Management Case Study Submission Guidelines - (Shuvo - Britterbaire@ymail - Com)Document7 pagesManagement Case Study Submission Guidelines - (Shuvo - Britterbaire@ymail - Com)Shuvo Sultana HasanNo ratings yet

- Sue PisciottaDocument3 pagesSue PisciottaSubhadip Das SarmaNo ratings yet

- Social Compact SummaryDocument5 pagesSocial Compact SummaryAlisa OngNo ratings yet

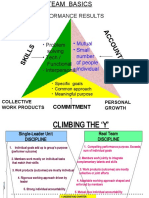

- Team BasicsDocument3 pagesTeam BasicsSoumya Jyoti BhattacharyaNo ratings yet

- Teaching PowerPoint Slides - Chapter 16Document36 pagesTeaching PowerPoint Slides - Chapter 16Seo ChangBinNo ratings yet

- Strother v. 3464920 Canada Inc.Document2 pagesStrother v. 3464920 Canada Inc.Alice JiangNo ratings yet

- Coti GIW Rep 26x28LSA PDFDocument3 pagesCoti GIW Rep 26x28LSA PDFjohan diazNo ratings yet

- ISO-TS 16949 Practice TestDocument18 pagesISO-TS 16949 Practice TestManan Bakshi100% (1)

- Vansh Course Prospectous 12 Feb 2021Document8 pagesVansh Course Prospectous 12 Feb 2021Komal S.No ratings yet

- Understanding The Leadership Spectrum - Developing The SkillsDocument46 pagesUnderstanding The Leadership Spectrum - Developing The SkillsSam PoliasNo ratings yet

- f1 Kaplan Kit CompressDocument236 pagesf1 Kaplan Kit CompressRomaan AliNo ratings yet

- AGROVETDocument37 pagesAGROVETcaroprinters01No ratings yet

- Hilton Hotels - Brand Differentiation Through Customer RelationshipDocument11 pagesHilton Hotels - Brand Differentiation Through Customer RelationshipYash Pratap SinghNo ratings yet

- Essentials of College and University AccountingDocument121 pagesEssentials of College and University AccountingLith CloNo ratings yet

- Math 2nd Grading 1st SummativeDocument4 pagesMath 2nd Grading 1st SummativeAubrey Gay SarabosquezNo ratings yet

- Ebook Business Law and The Regulation of Business 11Th Edition Mann Test Bank Full Chapter PDFDocument37 pagesEbook Business Law and The Regulation of Business 11Th Edition Mann Test Bank Full Chapter PDFelizabethclarkrigzatobmc100% (10)

- Money Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDocument6 pagesMoney Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDhivya APNo ratings yet

- Indicated in Syllabus: See Only Footnote #1: (2) Albano V. ReyesDocument1 pageIndicated in Syllabus: See Only Footnote #1: (2) Albano V. ReyesJul A.No ratings yet

- Branding-Bottled WaterDocument29 pagesBranding-Bottled Watern4b33l100% (1)

- Evike Order 3939175Document3 pagesEvike Order 3939175Carlos CrisostomoNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (89)