Professional Documents

Culture Documents

2007 H1 CS Q1 PDF

Uploaded by

panshanrenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2007 H1 CS Q1 PDF

Uploaded by

panshanrenCopyright:

Available Formats

H1 Economics 8816 Paper 1 Oct/Nov 2007 (a) (i) Summarize the two main features of the changes in international

visitor arrivals to ASEAN shown in the chart in Figure 1. [2] Overall there is an increase in international arrivals to ASEAN but there was a fall in 1998 and 2003 (ii) Explain possible reasons for these features. [4] Due to long term economic growth, household incomes have been increasing and as holiday abroad is a luxury good, demand increases by more than proportionately. However this upward trend is interrupted due to the Asian Financial Crisis and Sars which cause tourist arrivals to fall. During the Sars period, there was a greater deal of uncertainty and fear, as it was not known what cause the deadly infectious disease. The accompanying stringent screening measures also deter tourists from coming to ASEAN. (b) In the light of Extract 1, use supply and demand analysis to explain how you would expect the tsunami of December 2004 to have impacted upon world tourism. [6] price S2 S1

P1 P2 D2

D1

Right after the tsunami, the supply of world tourism fell as hotels, beaches and infrastructures all part of the tourist industry were destroyed. The demand fell too as there was less desire to visit the affected countries due to fear and uncertainty. The result was a fall in the volume of tourist activities. What happens to price depends on the extent of the fall in demand versus the fall in supply. In figure 1, the fall in demand is greater than the fall in supply, resulting in a fall in price as well as the volume of tourist activities.

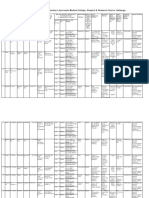

However, based on extract 1, tourism normally bounced back after a crisis. In this case, supply increases after the affected countries took measures to rebuild the tourist industry and demand too increases as affected countries launched campaigns to lure tourists and also tourists regain confidence to travel to these countries again. (c) (i) Explain one negative externality which is claimed to result from tourism. [2] A negative externality refers to the cost borne by the third party who is not directly involved in the production or consumption of the good. Some examples of negative externalities are the destruction to the natural environment, loss of traditions and pollution. As land is cleared for building roads and hotels, large areas of forest may be destroyed and the loss of vegetation could result in more frequent flooding and landslides. The third parties are the residents in the vicinity who may lose property, livestock and even lives whenever there is a landslide or flood and these are people who may not be related to the tourist industry at all. (ii) Discuss the case for and against imposing eco-tourist taxes. [8] Revenue/ cost a b MSC MPC

Q2 Q1

quantity

Before the imposition of eco-taxes, the equilibrium quantity of tourist activities is at OQ1 and at this level of output, producers and consumers maximize their benefits as they equate MPB with MPC but from the societys perspective there is over-consumption as the market fails to take into account marginal external cost ab, which means to say that the price does not fully reflect the true cost of production. At OQ1, MSC is greater than MSB and this gives rise to a deadweight loss equal to the shaded area. By imposing the eco-taxes, the MPC shifts upwards to MSC and now tourists have to pay a higher price equivalent to the MEC and this will reduce consumption to OQ2. Thus, eco-taxes are necessary to reduce welfare loss associated with negative externalities generated by tourists. However, the above analysis assumes that it is possible to determine the monetary value of the negative externality but it may be difficult to do so because the monetary value of things like loss of cultural traditions or the extent of the damage cause by floods and landslides is not easy to

compute. This can result in over or under- taxing the tourists in which case there will still be a welfare loss. An argument against the imposition of eco-taxes is that the higher price of a holiday would drive away tourists especially where there are other tourist attractions available. This could lead to increase in unemployment in the tourist industry as well as those industries that are indirectly related to tourism through the multiplier effect. This is especially significant for poor countries where tourism is the major source of income and employment. However, if the tax revenue is used for preservation of heritage sites, the protection of land for national parks, providing assistance to those who were displaced because of tourism then the welfare loss may be smaller as new jobs will be created and the unemployed can be absorbed into these projects.

Eco-taxes should only be imposed if the main tourist attraction has a fragile natural environment which can be destroyed by hordes of tourists and where the tax system is very well established. Besides, there are alternatives to imposing eco-taxes such as firmer rules and regulations governing land use, controlling the type of transport in the area to reduce damage from pollution etc. In conclusion, there is a need to strike a balance between the micro economic objective of efficient resource allocation and the macro objective of employment and income. Moderating the growth of tourism is necessary but there can be better alternatives to taxes alternatives that are less damaging to the economy than eco-taxes.

(d)

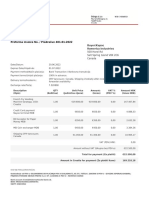

How would you assess the macroeconomic impact on an economy of a change in tourism demand worldwide? [8] I can assess the macroeconomic impact of a change in tourism demand worldwide by observing the changes to the unemployment rate, inflation rate, economic growth rate and the state of its balance of payments. As most economies aim for full employment, stable prices, sustain economic growth and healthy balance of payments, changes in these economic variables will reflect whether the changes in tourism demand will have positive or negative impacts on the economy. I shall now look at how tourism demand affects the economy. Tourism demand affects a countrys net exports as expenditure by tourists is classified under export of goods and services. It will also have an impact on

domestic investment as the building of hotels and tourist attractions such as Singapores integrated resort is in response to greater tourist arrivals. I shall consider a fall in tourism demand. First of all, this fall in demand would mean that a countrys export of goods and services would fall. With fewer tourists, hotels and shops will experience a fall in demand for their goods and services. If the fall in exports is great, the country will have a current account deficit. This will be the first indicator that the macro economy is adversely affected. As net exports is a component of aggregate demand, its fall will lead to a multiple fall in income as not only is the tourist industry such as hotels, restaurants, transport companies, tourist attractions affected, other industries are also affected. Face with lower demand firms may lay off workers to cut costs. The rising unemployment would mean that there is less income to buy other goods and services. Other industries such as food, retailing, clothing, entertainment would be badly hit as well. This is called the multiplier effect. So the next indicators, the unemployment rate and the GDP will fall. This is illustrated in figure 1 below. The leftward shift of GPL AS

P1 P2

AD2 AD1

Y1 Y2

real NY

AD1 to AD2 causes income to fall from Y1 to Y2. Prices too will increase as the rise in AD will slowly exhaust the available unemployed resources and output cannot rise faster enough to satisfy the higher demand. This will be reflected by higher inflation rates. To what extent a fall in tourism demand worldwide would affect a country in the above manner would depend very much on how dependent a country is on the tourist industry. A small country like the Maldives is very much more affected than say Japan because revenue from tourism takes up a big proportion of net exports whereas for Japan, there are many items, both consumer and capital goods, that constitute her exports. So Japans current account would not go into a deficit even if tourism demand falls.

Even if net exports fall, whether AD will fall or not would depend on whether other components of demand such as C and G are increasing. If the government is embarking on an industrialization drive by spending more on infrastructure and education, AD may still increase. Again even if AD falls, the extent income falls will depend on the size of the multiplier. If both mps and mpt are high, the impact on the changes in income will be smaller. As for employment, tourism is highly labour intensive and so a downturn in this industry will cause unemployment to increase substantially. Overall whether the economys unemployment rate will rise will depend on how important is tourism to the economy. As for the rate of inflation, the analysis above assumes that AS is constant. But if a country has been adopting supply side policies to increase productive capacity, the adverse impact on price levels can be reduced. Or in the case of a small open economy, an appreciation of the domestic currency to government intervention may also dampen inflation. In conclusion, how a fall in tourism demand would affect an economy would depend on many other factors such as how important tourism is to the country, whether the other components of AD are changing and whether AS is changing as well. More information about the economy must be available before one is able to assess the impact of falling tourism demand on an economy.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Cash Memo FormatDocument6 pagesCash Memo FormatPPP67% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

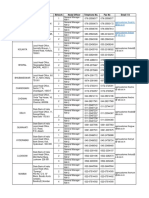

- 2009 H1 CS Q1Document4 pages2009 H1 CS Q1panshanren100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- A Pricing Strategy For A Recycling Industry: Scrap TiresDocument9 pagesA Pricing Strategy For A Recycling Industry: Scrap TiresBen GuhmanNo ratings yet

- 9701 w10 Ms 22Document6 pages9701 w10 Ms 22panshanrenNo ratings yet

- 9808 2012Document8 pages9808 2012panshanrenNo ratings yet

- 9701 w10 QP 23Document12 pages9701 w10 QP 23panshanrenNo ratings yet

- 9810 2012Document10 pages9810 2012panshanrenNo ratings yet

- 9701 w10 QP 21Document12 pages9701 w10 QP 21panshanrenNo ratings yet

- Dutch For Beginners LongDocument33 pagesDutch For Beginners LongpanshanrenNo ratings yet

- 9701 w10 Ms 22Document6 pages9701 w10 Ms 22panshanrenNo ratings yet

- 9701 w10 QP 21Document12 pages9701 w10 QP 21panshanrenNo ratings yet

- University of Cambridge International Examinations General CertificateDocument12 pagesUniversity of Cambridge International Examinations General CertificateHubbak KhanNo ratings yet

- 2010 H1 CS Q2Document5 pages2010 H1 CS Q2panshanren100% (1)

- 2012-2 Admission GuidelinesDocument11 pages2012-2 Admission GuidelinespanshanrenNo ratings yet

- Latihan Soal Un SMP Mts 2012 Ipa BahasDocument1 pageLatihan Soal Un SMP Mts 2012 Ipa BahasElzan AgungNo ratings yet

- Kata Kunci Bhs IndonesiaDocument1 pageKata Kunci Bhs IndonesiaAlvin Fhay GhantaNo ratings yet

- 2011 H1 Prelim ModifiedDocument8 pages2011 H1 Prelim ModifiedpanshanrenNo ratings yet

- 2012 Ivy League StatementDocument1 page2012 Ivy League StatementpanshanrenNo ratings yet

- International Math Olympiad 2011Document2 pagesInternational Math Olympiad 2011Himansu MookherjeeNo ratings yet

- 177 Undergraduate Scholarship Schedule 1203010504Document1 page177 Undergraduate Scholarship Schedule 1203010504panshanrenNo ratings yet

- 2009 H1 CS Q2Document9 pages2009 H1 CS Q2panshanrenNo ratings yet

- H1 (8816) '08 Case Study Question 1: TH THDocument5 pagesH1 (8816) '08 Case Study Question 1: TH THpanshanrenNo ratings yet

- 2008 H1 CS Q2Document5 pages2008 H1 CS Q2panshanrenNo ratings yet

- 178 - 6829680d TmuDocument14 pages178 - 6829680d TmupanshanrenNo ratings yet

- 2007 H1 CS Q2Document2 pages2007 H1 CS Q2panshanrenNo ratings yet

- Overview Tuition Fee 2011-2012Document1 pageOverview Tuition Fee 2011-2012panshanrenNo ratings yet

- 186 Undergraduate Scholarship Requirements 1203010504Document2 pages186 Undergraduate Scholarship Requirements 1203010504panshanrenNo ratings yet

- Fms Recycle CIE Study Awards MasseyDocument1 pageFms Recycle CIE Study Awards MasseypanshanrenNo ratings yet

- Application Form - Stenden University Bali 2011Document4 pagesApplication Form - Stenden University Bali 2011panshanrenNo ratings yet

- ML French Language LessonsDocument27 pagesML French Language LessonsAnesu MushateNo ratings yet

- REACTION PAPER Tree PlantingDocument13 pagesREACTION PAPER Tree PlantingErrol Tortola0% (1)

- Bio-Business Plan-Organic Baby FoodDocument10 pagesBio-Business Plan-Organic Baby FoodnavnaNo ratings yet

- Cik ListDocument8 pagesCik ListStaurt AttkinsNo ratings yet

- What Is A Cheque Truncation System?Document7 pagesWhat Is A Cheque Truncation System?PrramakrishnanRamaKrishnanNo ratings yet

- ClaudiaDocument3 pagesClaudiaclauecaniNo ratings yet

- Implement Sustainable Work Practices - Assessment TwoDocument22 pagesImplement Sustainable Work Practices - Assessment TwoRenee Passmore100% (1)

- Proforma Invoice: 15-Apr-2019 Dt. Our Ref - NoDocument6 pagesProforma Invoice: 15-Apr-2019 Dt. Our Ref - Norohit negiNo ratings yet

- Quiz 14 q1Document4 pagesQuiz 14 q1Максим НовакNo ratings yet

- Shri Hingulambika Education Society's Ayurvedic Medical College, Hospital & Research Centre, GulbargaDocument6 pagesShri Hingulambika Education Society's Ayurvedic Medical College, Hospital & Research Centre, GulbargaSahal ShaikhNo ratings yet

- Business Analysis of Auto IndusrtyDocument29 pagesBusiness Analysis of Auto IndusrtySaurabh Ambaselkar100% (1)

- X-runner empresa social de saneamiento alternativoDocument6 pagesX-runner empresa social de saneamiento alternativoCandy Wen Ticona PomaNo ratings yet

- Cgsi 2004Document29 pagesCgsi 2004Hargungeet SinghNo ratings yet

- Toyota Production SystemDocument32 pagesToyota Production SystemWawang SukmoroNo ratings yet

- The Story of PenangDocument2 pagesThe Story of Penangalbhome pcNo ratings yet

- Academic Studies On Social and Economic IssuesDocument240 pagesAcademic Studies On Social and Economic IssuesJavierNo ratings yet

- PaperDocument18 pagesPapermiel0805100% (1)

- 12 Eco Material EngDocument161 pages12 Eco Material EngYASHU SINGHNo ratings yet

- Admas University Eco101 PDFDocument2 pagesAdmas University Eco101 PDFhusseinNo ratings yet

- CSR Policy - Otis IndiaDocument7 pagesCSR Policy - Otis IndiaRakesh SharmaNo ratings yet

- TUI Environmental ReportDocument142 pagesTUI Environmental ReportvejzagicNo ratings yet

- MicroeconomicsDocument66 pagesMicroeconomicsAnanya GuptaNo ratings yet

- Student Handouts For BananaDocument8 pagesStudent Handouts For Bananaapi-271596792No ratings yet

- SBI local head office contact detailsDocument2 pagesSBI local head office contact detailsWeb SitesNo ratings yet

- T PVFrzu Mps 9 DLXDMBQ EQg X3 THH 5 Unf RGDocument2 pagesT PVFrzu Mps 9 DLXDMBQ EQg X3 THH 5 Unf RGDejan PekićNo ratings yet

- Wire Nail PmegpDocument4 pagesWire Nail PmegpTarun ChakrabortyNo ratings yet

- Lesson 2: Science and Technology in Different PeriodsDocument2 pagesLesson 2: Science and Technology in Different Periodssushicrate xxNo ratings yet

- 1368 2689 1 SMDocument22 pages1368 2689 1 SManon_832333674No ratings yet

- BAS Moldova Project ApplicationDocument2 pagesBAS Moldova Project ApplicationПавел МанжосNo ratings yet